Best Cardano (ADA) Brokers And Exchanges In 2026

Cardano (ticker ADA) is one of the most interesting decentralised finance (DeFi) projects out there, doing away with the proof-of-work standard in favour of a clever proof-of-stake scheme that manages to remain decentralised and secure at a small fraction of the energy requirement of Bitcoin and similar cryptocurrencies.

Jump into our pick of the best brokers to trade Cardano (ADA) – tested by experienced crypto traders and industry experts in the UK.

Best Cardano Brokers

-

Traders can engage in crypto speculation with commissions starting at 0.05% and leverage reaching 1:200. Furthermore, the broker enhances its services by launching Crypto Futures with 101 new tokens in 2025 and hosting trading contests with tangible rewards.

Crypto Coins- BTC

- LTC

- ETH

- XRP

- EOS

- ADA

- DOT

- SOL

- UNI

- LINK

- DOGE

- BNB

- ICP

- SAND

- more

Crypto Spread Crypto Lending Platforms 0.05% BTC, 0.05% ETH No Own Crypto Staking Minimum Deposit Regulator No $0 -

IC Markets provides a range of over 20 cryptocurrencies for trading through CFDs, featuring less common tokens like Avalanche, Kusama, and Uniswap. Traders can enjoy commission-free transactions and experienced individuals can utilise high leverage up to 1:200 via the MetaTrader platforms.

Crypto Coins- BTC

- BCH

- DOT

- DSH

- EMC

- EOS

- ETH

- LNK

- LTC

- NMC

- PPC

- XLM

- XRP

- ADA

- BNB

- DOG

- UNI

- XTZ

Crypto Spread Crypto Lending Platforms BTC 42.036 No MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Crypto Staking Minimum Deposit Regulator No $200 ASIC, CySEC, CMA, FSA -

OKX provides an excellent range of over 400 tokens, such as Bitcoin and Ripple. Traders can engage in buying and selling tokens or engage in crypto trading on margin through derivatives like perpetual swaps, options, and futures. The platform is distinguished by its competitive fees, wide token selection, and rapid transaction processing.

Crypto Coins- BTC

- XCH

- ETH

- OKB

- OKT

- LTC

- DOT

- ADA

- DOGE

- XRP

- USDT

- ICP

- BCH

- LINK

- XLM

- ETC

- MATIC

- THETA

- UNI

- TRX

- EOS

- FIL

- XMR

- NEO

- USDC

- AAVE

- SHIB

- LUNA

- KSM

- BSC

Crypto Spread Crypto Lending Platforms Variable Yes AlgoTrader, Quantower Crypto Staking Minimum Deposit Regulator No 10 USDT VARA -

XTB provides a robust array of over 50 cryptocurrencies, featuring competitive spreads beginning at 0.22% on Bitcoin and leverage up to 1:5. The xStation platform facilitates trading with pairs like ETH/BTC and DSH/BTC. Traders can operate round-the-clock in a secure and transparent cryptocurrency trading environment.

Crypto Coins- ADA

- BTC

- BCH

- DSH

- EOS

- ETH

- IOTA

- LTC

- NEO

- XRP

- XLM

- TRX

- XEM

- XLM

- XMR

- DOGE

- BNB

- LINK

- UNI

- DOT

- XTZ

Crypto Spread Crypto Lending Platforms 0.22% No xStation Crypto Staking Minimum Deposit Regulator No $0 FCA, CySEC, KNF, DFSA, FSC -

IG offers a growing selection of over 55 crypto CFDs and digital assets for buying, selling and storing. It also stands out with its crypto index, which tracks the value of the top 10 digital currencies by market cap and provides a holistic way to speculate on the value of the crypto market. Its crypto offering was also bolstered in the UK after it secured a digital asset license from the FCA, providing trading and investing on popular crypto coins in a regulated setting.

Crypto Coins- BTC

- ETH

- SOL

- XRP

- BCH

- ADA

- TIA

- LINK

- EOS

- HBAR

- ICP

- LTC

- NEAR

- NEO

- ONDO

- PEPE

- DOT

- POL

- SHIB

- XLM

- SUI

- TRX

- TON

- UNI

- DOGE

- AAVE

- APT

- ARB

- AVAX

- CRYPTO10

Crypto Spread Crypto Lending Platforms Variable No Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Crypto Staking Minimum Deposit Regulator No $0 FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA -

BitMEX provides an exceptionally competitive environment for crypto trading, offering low-cost $1 contracts and leverage up to 100:1. Its unique platform delivers advanced trading tools, featuring a customisable order book, a depth chart, and numerous technical indicators.

Crypto Coins- BCH

- BTC

- ETH

- LTC

- XRP

- TRON

- EOS

- XMR

- ADA

- DOGE

- BNB

- DOT

- SOL

- SHIB

- AVAX

- GAL

- NEAR

- SUSHI

- AXS

Crypto Spread Crypto Lending Platforms -0.01% maker, 0.075% taker No BitMEX Web Platform, AlgoTrader, TradingView, Quantower Crypto Staking Minimum Deposit Regulator Yes $0.01 Republic of Seychelles -

You have the opportunity to trade over 20 leading cryptocurrencies with leverage up to 1:200, available every day of the week. Direct transactions of assets such as Bitcoin and Ethereum are not supported. The range of tokens is narrower compared to Eightcap, which received our 'Best Crypto Broker' accolade for its offering of more than 100 crypto derivatives.

Crypto Coins- BTC

- ETH

- DSH

- LTC

- BCH

- XRP

- EOS

- EMC

- NMC

- PPC

- DOT

- XLM

- LINK

- DOGE

- XTZ

- UNI

- ADA

- BNB

- AVAX

- LUNA

- MATIC

- GLMR

- KSM

Crypto Spread Crypto Lending Platforms Floating No MT4, MT5, cTrader, AutoChartist, TradingCentral Crypto Staking Minimum Deposit Regulator No $200 FSC

Safety Comparison

Compare how safe the Best Cardano (ADA) Brokers And Exchanges In 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| PrimeXBT | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| OKX | ✘ | ✘ | ✘ | ✘ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| BitMEX | ✘ | ✘ | ✘ | ✘ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Cardano (ADA) Brokers And Exchanges In 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| OKX | ✔ | ✘ | ✔ | ✘ | ✘ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| BitMEX | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Cardano (ADA) Brokers And Exchanges In 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| PrimeXBT | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| OKX | Android & iOS | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| BitMEX | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ |

Beginners Comparison

Are the Best Cardano (ADA) Brokers And Exchanges In 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| OKX | ✔ | 10 USDT | Variable | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| BitMEX | ✔ | $0.01 | Variable | ||

| IC Trading | ✔ | $200 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Cardano (ADA) Brokers And Exchanges In 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| PrimeXBT | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| OKX | ✔ | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| BitMEX | BitMEX Market Maker, BotVS, and via API | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Cardano (ADA) Brokers And Exchanges In 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| PrimeXBT | |||||||||

| IC Markets | |||||||||

| OKX | |||||||||

| XTB | |||||||||

| IG | |||||||||

| BitMEX | |||||||||

| IC Trading |

Our Take On PrimeXBT

"PrimeXBT suits aspiring traders interested in crypto derivatives and traditional markets such as forex and indices, all accessible via a user-friendly, web-based platform. The copy trading feature is perfect for passive traders, offering 5-star ratings and performance charts to identify suitable traders."

Pros

- In 2025, PrimeXBT significantly expanded its Crypto Futures offerings with over 100 tokens, including AI, NFTs, Metaverse, and Layer 1 & 2 assets.

- Trading fees for crypto futures contracts are quite competitive, with maker fees at 0.01% and taker fees at 0.02%.

- Round-the-clock customer support, accessible through live chat, demonstrated outstanding performance during testing. Additionally, the comprehensive help centre offers ideal self-assistance resources.

Cons

- Despite enhancements, the range of approximately 100 instruments lags significantly behind competitors, such as OKX, which offers over 400 assets.

- The absence of integration with established platforms such as MT4 restricts traders accustomed to the globally popular forex software.

- PrimeXBT operates widely in the crypto sector but without approval from a recognised regulator, significantly increasing the risk for retail traders.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

Cons

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

Our Take On OKX

"OKX is ideal for traders seeking new crypto projects and emerging coins. They can utilise the platform's copy trading feature and automated bots."

Pros

- Active traders benefit from competitive rates, with maker fees starting at 0.02% and taker fees at 0.05%.

- OKX enjoys a strong reputation, serving 20 million clients worldwide and holding a licence from the Dubai Virtual Assets Regulatory Authority.

- A vast array of blockchain products is available, featuring DeFi services, NFTs, and games, along with over 400 established and emerging cryptocurrencies.

Cons

- The broker's platform and features might feel intricate for beginners.

- The firm has minimal regulatory oversight, which is typical for crypto brokers.

- Testing revealed that customer support quality varied.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG is amongst the best in terms of its range of instruments, which includes stocks, forex, indices, commodities, and cryptocurrencies, plus added US-listed futures and options as well as an AI Index, providing diversification opportunities.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On BitMEX

"Traders interested in a wide selection of crypto derivatives will find BitMEX appealing, especially with its Perpetual Contracts. Additionally, the 100x leverage on Bitcoin exceeds that of many other platforms."

Pros

- The broker ensures exceptional security by employing a mix of hot and cold wallets alongside advanced encryption for managing cryptographic keys.

- The BMEX token offers up to 15% discounts on trading fees and other exclusive benefits when staked.

- BitMEX consistently provides a wealth of free market insights, alongside trading guides and community platforms on Discord, Telegram, and additional channels.

Cons

- Only Bitcoin is allowed for cost-free withdrawals.

- Withdrawals are processed only at a designated time each day.

- The broker faced legal action from US regulators, resulting in fines.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

- IC Trading provides exceptional flexibility, allowing traders to open as many as 10 live accounts and 20 demo accounts. This enables the management of distinct profiles for various activities, including manual and algorithmic trading.

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

Cons

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- Unlike IC Markets, IC Trading lacks support for social trading via the IC Social app or the ZuluTrade platform.

How Investing.co.uk Chose The Best Cardano Brokers

We reviewed brokers that provide reliable access to Cardano (ADA) trading. Our team tested each platform to evaluate ease of use, execution quality, and the range of crypto trading tools.

We then ranked the brokers by overall ratings, combining our hands-on experience with verified data points such as ADA availability, fees, spreads, and account features, to highlight the best choices for trading Cardano.

What To Look For In An ADA Broker Or Exchange

Trust

Reliability is always our highest priority when reviewing brokers, and this should be your top criteria when selecting one, too.

Since Cardano is a popular cryptocurrency, it’s available on numerous crypto exchanges and brokers, but be careful: the loosely regulated world of crypto trading carries more risk than most other assets.

Crypto exchanges often provide more assets to trade with ADA and tighter spreads, but they can be more risky, since they are not typically licensed by the UK’s Financial Conduct Authority (FCA) or other respected international bodies in the same way as traditional crypto brokers, meaning there is less regulatory oversight.

In 2022, the collapse of one of the largest crypto exchanges of the time, FTX, showed how even the largest exchanges can carry high risk.

Fortunately, you can trade ADA via FCA-regulated brokers, providing a more secure option.

- eToro is one of the world’s largest trading broker brands with an entity that’s regulated by the FCA, providing UK investors with protections including segregated client funds and £85,000 of insured capital under the Financial Services Compensation Scheme (FSCS).

Charting Platform

The best charting platforms allow traders to evaluate price history, identify entry points and execute trades from one screen, and this can be hugely helpful when trading a volatile crypto token like Cardano.

Since ADA and similar tokens often experience large price swings in a short time frame, a clunky interface can kill your chances at profit so you want a fast and responsive platform with powerful integrated tools and indicators.

Old favourites like MetaTrader 4 are still supported by most brokers, but these are starting to show their age and newer platforms like TradingView are now firm favourites among our team.

You’ll also find many exchanges in particular offer their own proprietary platforms, and these can be excellent options as they’re geared specifically toward crypto trading.

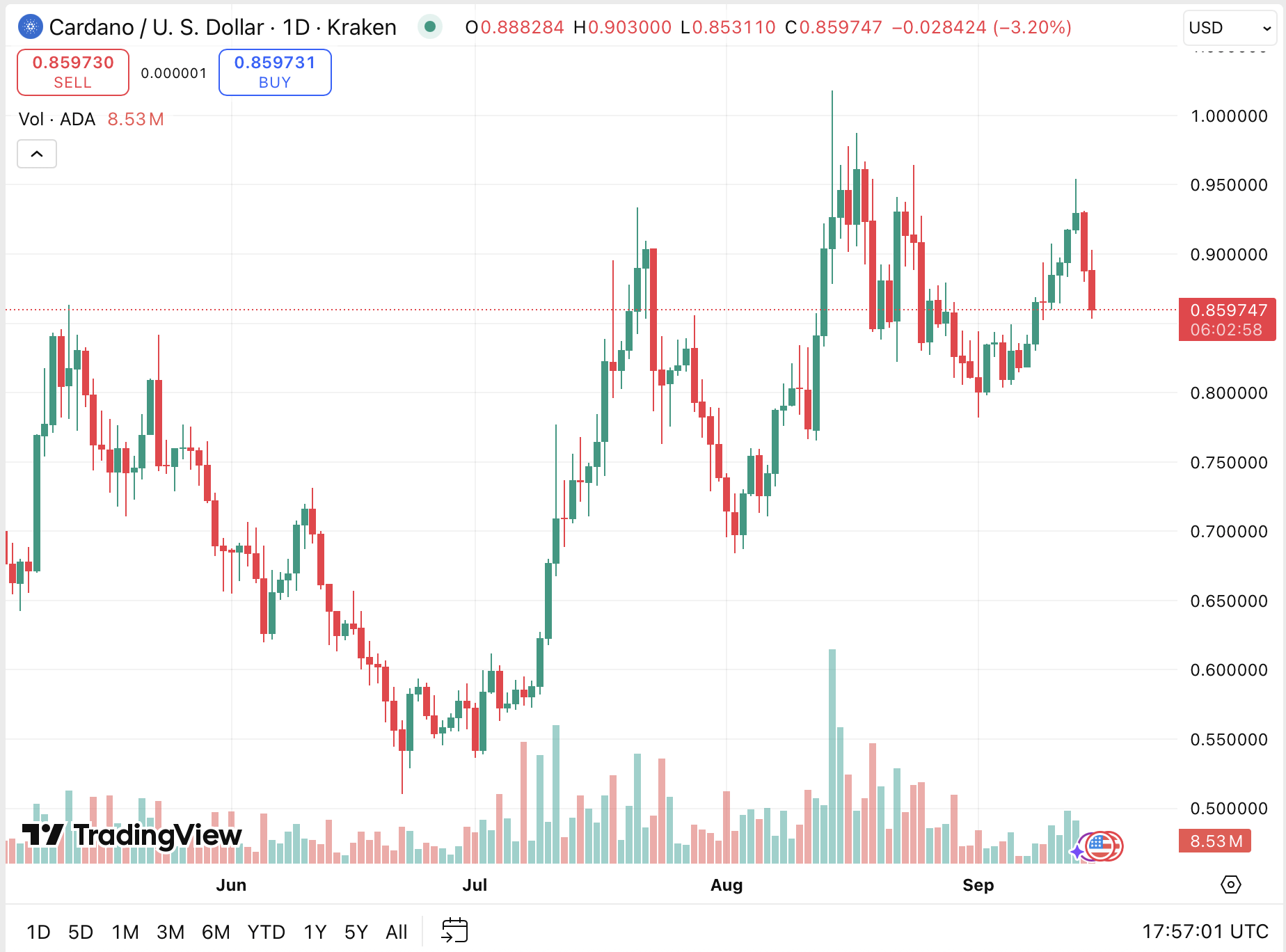

Trading Cardano on TradingView

Always make use of a demo account before signing up with a broker or exchange as these let you test-drive the charting platform before investing any of your money.

- IC Markets‘ superb selection of platforms – with MT4, MT5, cTrader and TradingView – remains one of the best of any Cardano broker, especially when combined with the ultra-fast execution and low ECN pricing.

Pricing

Choose a Cardano broker with tight spreads and low commissions or you’ll find that fees quickly slice away your trading profits.

You’ll usually find that crypto brokers charge a variable spread, sometimes in addition to a flat commission fee.

Crypto exchanges often charge ‘maker/taker’ fees, with lower spreads awarded to market makers who set limit orders and higher spreads to ‘takers’ who place market orders. These are usually discounted at increased trading volumes.

- BitMEX‘s transparent pricing structure makes this crypto exchange one of the most competitive places to trade ADA and other tokens, ranging from 0.05% maker/taker to 0.0150%/0.0320% for the highest-volume traders.

Leverage

Trading with leverage allows you to boost the size of your position using borrowed funds, and it can be a very useful tool for experienced trader with high risk tolerance.

However, the increased position size also greatly increases risk as losses are magnified, and these can mount very quickly when trading a highly volatile instrument like Cardano.

There’s a reason FCA has banned brokers from providing leveraged crypto trading to retail traders in the UK, while other regulators have capped leveraged trading at 1:2. If you’re an inexperienced trader, you should avoid leveraged Cardano trading and stick to less volatile assets.

- For experienced traders who have got to grips with leveraged trading, BlackBull is an offshore option with competitive fees and leverage up to 1:5 on crypto pairs.

DeFi Account Options

Crypto tokens like Cardano are attractive to many investors because of the flexibility they provide as decentralised finance (DeFi) instruments, so you may wish to find an exchange that supports these features.

You may want to look for crypto exchanges that support features like staking or yield farming to earn interest on your ADA tokens.

- Kraken is an established crypto exchange that allows users to earn a high interest rate by staking their ADA tokens, as well as earning rewards by holding crypto tokens.

What Is Cardano?

Cardano is an interesting blockchain platform that uses an Ouroboros proof-of-stake technology backed up by peer-reviewed research. This allows it to maintain similar decentralisation and security standards to other blockchains and cryptos without requiring the energy usage of a small country.

The founder of Cardano, Input Output Hong Kong, released Cardano in 2017 and have since seen it grow massively.

The Cardano network is a flexible and advanced blockchain that provides a strong foundation for application development and technological advancement. As with other blockchains, Cardano has a native token that supports local transactions, called Ada (ADA).

How Cardano Works

Proof Of Stake Vs Proof Of Work

Despite its fame, Bitcoin has received a fair amount of bad press, thanks to its massive energy usage. The reason for this is the proof-of-work philosophy that its blockchain is built on.

Bitcoin, along with almost every other cryptocurrency except Cardano, maintains its security by producing additional blocks through the solution of massive, unique computational problems.

Ada is built on an entirely different philosophy called proof-of-stake. Rather than solving big problems to prove the validity of a transaction, Cardano’s blocks are produced by selecting participants to generate new blocks.

The selection process uses a cryptographic algorithm called a verifiable randomness function (VRF) that assesses the size of the stakes that different participants, called stake pools, have in the blockchain. Staking rewards participants with some of the Ada that is produced with the new block.

The benefits of proof-of-stake are so clear, especially given the current climate crisis, that its popularity is rising massively. The first proof-of-stake blockchain project, Peercoin, combined both consensus mechanisms to improve the fairness of the mining system and reduce the energy requirements.

Ethereum, the world’s second-largest cryptocurrency, has also noticed the potential of proof-of-stake and is currently implementing upgrades to move away from proof-of-work.

Environmental Benefits

The approach taken by Cardano to validate transactions and produce new blocks is significantly less damaging to the environment than other cryptocurrencies.

This is because it doesn’t take a massive amount of computational power to create a new block, it simply requires staking some capital. This allows the network to run with an energy efficiency four million times larger than Bitcoin.

How To Start Trading Cardano

Brokers Vs Exchanges

Before you can begin trading Cardano (Ada), you need to decide whether you want to invest by owning some or simply speculate on its price movements.

For those looking to own the crypto and get directly involved with the blockchain, contributing to its demand and development, an exchange allows you to buy and hold the coin itself. When selecting an exchange, pay attention to its security, trustworthiness and fee structures.

If you wish to speculate on the price movements of Ada or the success of the Cardano platform, then you need a suitable broker. The quality of crypto brokers can vary massively, so be sure to do your research. Some of the most important things to look out for are FCA regulation, fee structure, security and trading platform.

Be aware when trading with an exchange that these are not covered by the same regulatory framework as FCA-licensed brokers, so you won’t have the same protections.We advise beginner traders to stick with regulated brokers, though serious crypto traders will often prefer a dedicated crypto exchange.

Set Up a Digital Wallet

If you have opted to become an owner of Cardano’s Ada, then you will need a digital wallet (e-wallet) to hold the asset.

When selecting a wallet, the most important thing to factor in is security. While people store physical money in safes and bank vaults, relying on physical walls and locks to keep money safe, digital assets sit in an online wallet protected by digital programming. If someone hacks your wallet, your money can all disappear, so finding a trustworthy wallet provider is imperative.

A common solution to this issue is to hold the Ada on a hardware wallet, which is a hard drive or SSD that stores the crypto much like a digital wallet, but that can be removed from a computer. Some of the most popular hardware wallets are the Ledger Nano X, S and the CoolWallet S, all of which support Cardano staking.

Start Trading Cardano

Once set up with a broker or exchange and wallet, you can begin trading Cardano. Investors can simply buy some Ada and store it in their wallet, possibly using it for transactions or staking some in a stake pool for a financial reward.

Speculators can start analysing the price movements of Cardano, using day trading strategies or patterns to inform trades. Alternatively, traders can look at new events and research the market to decide for themselves whether the price may rise or fall.

Bottom Line

Cardano has generated a lot of buzz, and with its impressive energy efficiency and strong historic bull runs you have an encouraging blockchain system that promises to keep improving off the back of peer-reviewed academic research.

To some, this may be enough to begin investing, but you should always be careful when risking your capital. Do as much research as you can to understand Ada and its future potential, be wary of online guides promising specific price movements and always follow robust risk management strategies.

To get started, check out our list of the top Cardano trading platforms.

Cryptoassets are highly volatile and many are unregulated in the UK. No consumer protection. Tax on profits may apply.