Best Time To Trade In The UK

For short-term traders in particular, when you trade can have a significant impact on how profitable a trade or series of trades may be. This guide uncovers the best time to trade in the UK, considering market opening hours, liquidity and volatility. We also look at optimum trading times for different assets and strategies, from day trading forex, crypto, gold and crude oil to longer-term stock and futures investing.

Best 3 Brokers in the UK

Best Time Of The Day To Trade

As a general rule, periods with high volume and liquidity offer the best trading opportunities with the lowest fees. This tends to be just after a trading session has opened.

The reason for high volumes at the opening and closing of a session is partly due to activity in other major trading hubs. The opening of the UK session, for example, overlaps with the end of the Tokyo session whilst the close overlaps with the US session.

Of course, trading session opening and closing times will vary somewhat depending on the market, but most UK forex and stock markets open at 08:00 and run through to 16:00 GMT.

Importantly, the first fifteen minutes of the market opening is often the most volatile with retail investors and institutional traders looking to capitalise on overnight price movements. But whilst tighter spreads provide opportunities for greater returns, volatility, and in turn risk, is also greater.

Towards the close of the day, volatility once again increases. Especially between 15:00 and 16:00 GMT, with many traders looking to close out positions before the session closes. The end of the day also overlaps the US trading day so trading volumes increase.

Note, for traders looking for stability, the middle of the day is often the most suitable trading window.

Best Time Of The Week To Trade

Buy

There is little evidence to support the argument that a certain day of the week is likely to be more profitable than another over the long term. Despite this, many believe that the beginning of the week is the most opportunistic. This has led to the coining of the terms the Weekend effect or the Monday effect.

The thought behind this is that the general momentum of the market on Monday morning will follow the trajectory it was on when the markets closed on Friday afternoon. So, if it was trending up, it will likely continue in that vein.

Others argue that markets sometimes trend down on Monday which can lead to lower returns. This can make Monday a good day to snap up potentially undervalued stocks.

Novice traders should note that the beginning of the week tends to experience higher volatility. Activity tends to stabilise in the middle of the week before it increases again before the weekend.

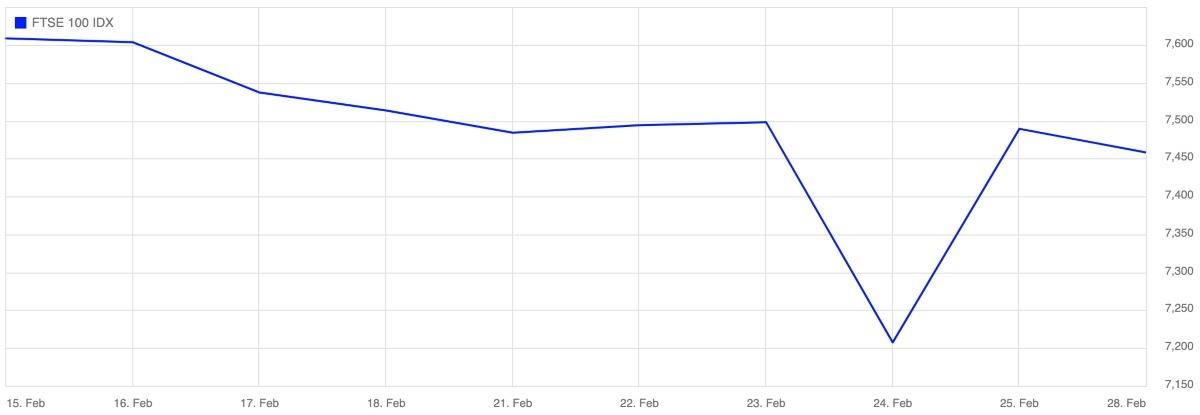

That being said, major geopolitical events can have a large and sudden impact on the market and its prices. For example, when Russia invaded Ukraine on Thursday 24 February 2022, the FTSE 100 fell 3.8% by the close as investors sold riskier global assets. So, disruption can occur at any time which is why it is important to stay abreast of breaking news.

FTSE 100 February 2022

Sell

If you are interested in short-selling, many traders argue that Friday is a good time to take a position. If Monday’s markets are likely to trend downwards then the reverse is true for the end of the week.

Whether it is because weekend movements have not yet been priced into the market, or weekend optimism, many feel that Fridays give rise to higher prices. This could make Friday a good day to sell, and hopefully for a better price than would be seen on Monday.

Best Months To Trade

Autumn has traditionally seen some of the biggest lows for stocks. The Great Depression and Black Monday both took place around this time. For this reason, some argue that September and October are traditionally good times to sell.

Institutional investors are also wrapping up Q3 positions around this time which may further contribute to lows.

‘Sell in May and go away’ is an old expression that was derived from wealthy investors leaving London in the summer months and therefore unable to monitor their positions. The departure led to a slump in activity, picking up again in the autumn upon their return. Whilst there is little evidence to support this in the modern day, trends in some markets indicate that activity does still trend down over the summer.

Public holidays will also have an impact. Often activity quietens down during the festive period and picks up again in the New Year.

Best Time To Trade Forex

There are two windows that typically offer the most opportunity when trading forex in the UK. These are when the UK trading window overlaps with the US and Tokyo. The UK/US overlap can see particularly high trading volumes as well as volatility.

- New York/London (13:00 – 16:00) – Over 70% of trades are made when the US/London markets overlap. The high liquidity allows for tighter spreads.

- London/Tokyo (08:00 – 09:00) – Although Tokyo is a smaller market than the US, the short market overlap can still make for lucrative trading. First thing in the morning is also popular due to the fact that news or movements that have taken place overnight are factored into prices.

This is true for most GBP pairs in the UK, whether you are speculating on GBP/USD or GBP/JPY.

Best Time To Trade Stocks

Similar to forex, the best time of day to trade stocks is often the first couple of hours of the market opening. The reason being that significant market news is factored into prices first thing in the morning, which means that opportunities to capitalise on volatility are typically highest when the trading session starts.

As the day progresses, trading volumes and volatility tend to level out.

Note, different stock markets will open at different times. For example, in the UK you can trade the FTSE 100 from 08:00, the New York Stock Exchange from 14:30 and the DAX 40 from 08:00.

Best Time To Trade Crypto

Cryptocurrencies are one of the few assets that can be traded 24/7. Crypto markets do not tend to close so traders enjoy greater flexibility over the weekends, for example.

With that said, most crypto trades are still placed within the 08:00 – 16:00 window. As a result, this is when retail traders can usually get the tightest spreads and lowest fees.

When To Trade Checklist

Whilst macro factors should be considered, there are also things closer to home that can have an impact on trading profitability. Before you start trading, there are a few basic things to check:

- Are the markets open? As a general rule, periods with higher trade volumes offer the most favourable trading conditions. This tends to fall during standard market operating hours. For most markets, this will be Monday to Friday, although instruments such as cryptos are available 24/7.

- Has there been a major news announcement? The immediate aftermath of major global and domestic events often brings about periods of high volatility. Whilst volatility may present opportunity, risks are higher. For new traders especially, it may be best to let things settle before opening positions.

- Are you prepared? Before executing a trade, ensure you have done the research you need to make an informed decision. Have you researched the asset? Do you have a strategy in place? What external factors do you need to consider?

When Not To Trade

If any of the conditions outlined above have not been met, or at least considered, then it may be best to hold off. Underestimating risks, or failing to do your due diligence, can lead to large losses.

If you are new to online trading or exploring a new market or instrument, proceed carefully. You do not necessarily need to trade in the most volatile windows when starting out. Alternatively, practice strategies on demo accounts to get a feel for market dynamics. Also ensure you have a risk management strategy in place.

Bottom Line On The Best Time To Trade In The UK

There is no equation that can determine the ‘best time to trade’ in the UK for binary options, volatility indices or any other instrument. Instead, there are a number of criteria that can be used to evaluate how favourable the conditions of a particular day or time of day might be. This includes volume, volatility, and in turn, fees and risk.

However, traders should note that this will not look the same for everyone. What works for one trader will not necessarily work for another. This is because the right time to trade is dependent on a number of factors including strategy, risk appetite, capital requirements and instrument.

FAQs

What Time Does Trading Start In The UK?

Trading in the UK traditionally starts at 08:00 and closes at 16:00 GMT, Monday through Friday. This is the period when UK stocks and currencies are typically traded in the highest volumes in line with respective market operating hours.

Can You Trade Stocks In The UK Over The Weekend?

Most major markets will close on Friday afternoon through to Sunday, including the London Stock Exchange. Some brokers may offer extended hours but these can be inaccessible to many traders. Your best bet is to stick to Monday – Friday.

What Days Should You Not Trade In The UK?

As a general rule, any time the markets are shut. This includes weekends and public holidays. The best brokers will publish details of market closures and upcoming holidays on their website or on their trading platform. With that said, cryptos are available for trading over the weekend.

What’s The Best Time To Trade Currency Pairs In The UK?

Generally speaking, the best times to trade forex are when major trading zones overlap. In the UK, this is 13:00 – 16:00 when the UK/US markets overlap. There is also a small overlap with Tokyo between 08:00 and 09:00 which seeks another spike.

What Is The Worst Day Of The Week For Trading?

Strictly speaking, there is no ‘worst day for trading’. With that said, festive periods often see the largest percentage losses. Also avoid the weekends when traditional markets are closed unless you want to speculate on cryptos which are open 24/7.