FXOpen Review 2026

FXOpen is an FCA-regulated STP and ECN brokerage. The firm offers multi-asset trading opportunities on the MT4, MT5, TradingView, and proprietary TickTrader platforms. With a minimum deposit of £300, educational resources, and tight spreads, it offers accessible investments for both beginners and experienced traders.

But how does FXOpen stack up to alternative brokers in the UK? To answer this question, our review will cover how to open an account and login, payment methods, platform downloads, market access, fees, and more. Find out if our experts recommend trading with FXOpen.

FXOpen is an excellent all-round broker for UK traders, with FCA regulation, 4 platforms and apps, plus a choice of pricing models to suit different investors and trading strategies.

Company History & Overview

FXOpen UK is a London-based, forex and CFD broker. Established in 2005, the brokerage offers 600+ instruments including currency pairs, commodities, global indices, and more.

The ECN model provides direct access to interbank market prices, with no dealing desk intervention. This means fast executions and deep liquidity.

UK investors also benefit from the stringent rules set by the Financial Conduct Authority (FCA) with up to £85,000 available in compensation from the FSCS.

Markets & Instruments

FXOpen offers UK investors 600+ assets. This is notably less than some competitors, but it does still provide most retail investors with ample trading opportunities.

Clients can trade:

- ETFs – Trade 33 exchange-traded funds on the TickTrader terminal

- Currency Pairs – Trade 50+ major and minor forex pairs including GBP/USD and EUR/GBP

- Indices – Invest in 10 of the world’s largest stock indices such as the FTSE 100 and the Europe 50

- Commodities – Speculate on the price of precious metals and energies including Natural Gas and Gold

- US Shares – Trade some of the largest US company stocks via CFDs. Firms include Apple, Facebook, Netflix, and Nike

Note, cryptocurrency trading including Bitcoin, is available to professional traders only.

Platforms

FXOpen offers a wider range of platforms than most competitors. Four platforms are available; a proprietary platform named TickTrader, MetaTrader 4, MetaTrader 5, and TradingView.

Retail investors can download all terminals to desktop devices, and use them as mobile-compatible apps or as web solutions via major browsers.

The platforms are suitable for investors of all experience levels, though MT4 and TradingView are the easiest to get started with for beginners.

TickTrader

TickTrader is FXOpen’s bespoke trading platform. Day traders can access 1200+ tools including heatmaps, level 2 data, and strategy backtesting.

Other features include:

- Custom EAs

- Trading history logs

- Algo-based strategies

- 30+ technical indicators

- Intuitive charting package

- VPS and API integration

- Integrated economic calendar

- One or double-click trading mode

- Trade alert system with custom notifications

- Nine advanced order types such as Market, Stop, Hidden, and Iceberg, plus settings for volume units, stop levels, and slippage

The all-in-one terminal does feel slightly busy however, so our experts recommend spending some time in the demo environment before investing funds.

Note, TickTrader does not have a Mac-compatible download option.

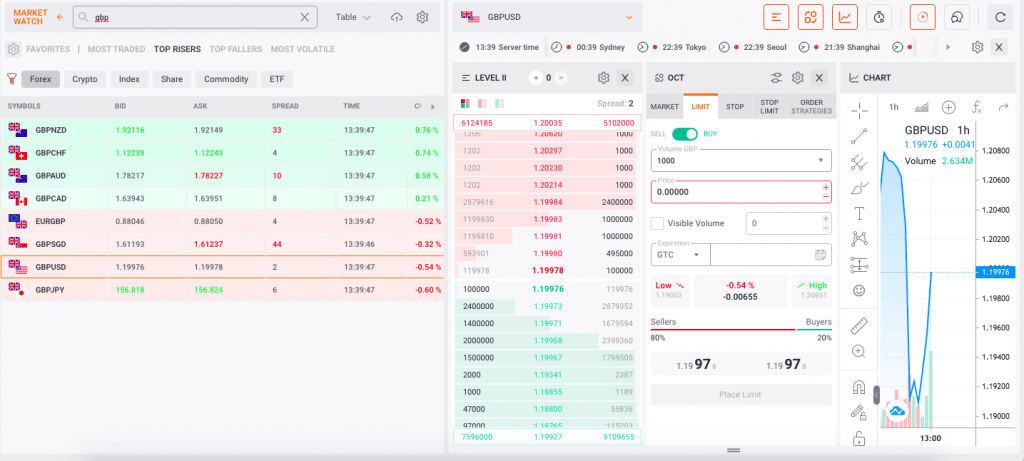

How To Use The Platform

To view instrument specifications and pricing data, click on the desired symbol in the Market Watch window. Review pricing data, customise charts, and analyse instruments with technical indicators. All other windows will automatically refresh to show the relevant information for the selected symbol.

In the image below, the order window is the third from the left. Here you can add the details of the order including order type (Market, Limit, Stop or Stop Limit).

TickTrader

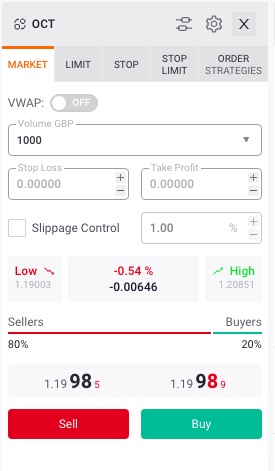

Placing A Market Order

- Click on the instrument from the Market Depth window

- Select the ‘Market’ icon on the order window

- Choose the order volume in GBP

- Add Stop Loss/Take Profit risk parameters

- If desired, change the default slippage value by selecting the tick box and entering the new value

- Select ‘Buy’ or ‘Sell’ to confirm the order

New Order

Note, VWAP allows investors to view the best pricing based on order volumes.

TradingView

FXOpen also has partnered with TradingView, a globally established charting and social network platform. The terminal is free for UK FXOpen customers.

The interface supports highly intuitive charts with custom indicators to help investors make informed trading decisions. It is slightly more limited vs the TickTrader terminal in terms of supported order types, however. Traders can access Market, Stop, Limit, and Stop-Limit orders vs the nine order types available on the broker’s proprietary platform.

Other features include:

- 8 million + custom scripts

- Performance replay option

- 50+ integrated drawing tools

- Hundreds of pre-built studies

- Asset heatmaps with key statistics

- Pine Script™ programming language

- Custom price, indicator, and strategy alerts

- 12 chart types including Kagi and Point & Figure

- Discover and publish ideas via the social forum function

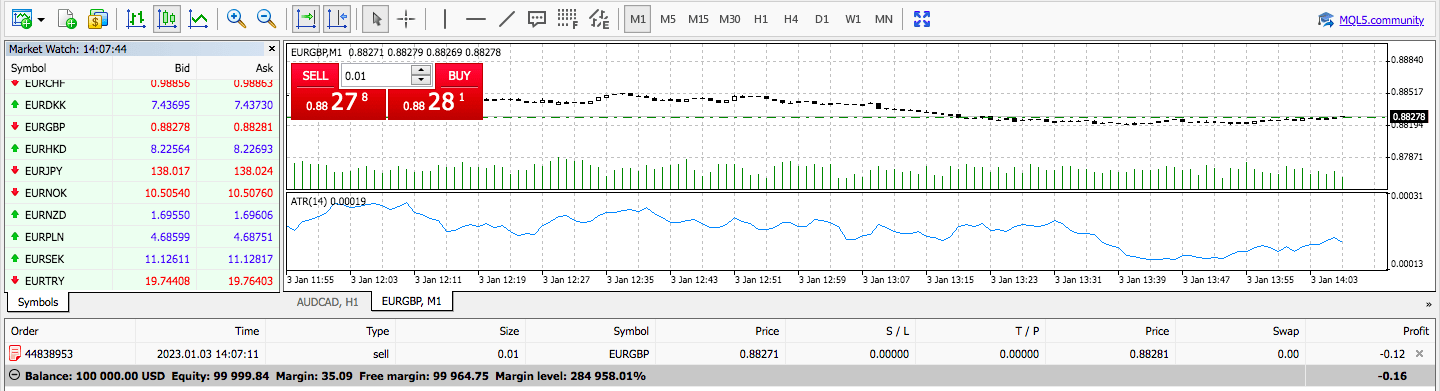

MetaTrader 4

FXOpen was the first broker to offer access to interbank liquidity and ECN trading via the MT4 platform. Although the platform is renowned for forex trading, traders can access all instruments.

The MetaTrader 4 platform supports three order types (Market, Stop, and Limit). Other features include:

- One-click trading

- Access to Expert Advisors (EAs)

- Review charts across nine timeframes

- Use 24 analytical objects including Fibonacci and Elliot Wave

- 30+ in-built technical indicators including Bollinger Bands and RSI

MetaTrader 4

MetaTrader 5

MetaTrader 5 is the latest trading platform developed by MetaQuotes.

The terminal is best suited to experienced traders and offers features such as trading robots, fundamental analysis tools, and technical signals. But while it offers more features, many investors, particularly beginners, still prefer the simplicity of MT4.

Unlike its predecessor, MT5 offers an integrated economic calendar and six pending order types. Other features include:

- 44 analytical objects

- One-click trading

- Access to Expert Advisors (EAs)

- Hedging and netting permitted

- Review charts and graphs across 21 timeframes

- Automated trading features with the MQL5 programming language

- 38+ in-built technical indicators including moving average and CCI arrows

Fees & Charges

Trading fees are competitive and vary by account type.

The STP profile offers commission-free investing, with all costs integrated within spreads. The ECN account, on the other hand, provides direct pricing from liquidity providers, and so, a commission fee applies.

It is also worth considering the £10 monthly inactivity fee for dormant profiles after six months and overnight swap charges for positions held overnight.

ECN Account

High-volume traders or those with a significant account balance are rewarded with cheaper commission fees.

Retail traders with an account balance of less than £1000 will incur a £3.50 commission per lot for forex trades. Those with a balance of over £250,000 will benefit from reduced commissions of just £1.50 per lot.

This is a similar story across all instruments. A commission per side of 0.0075% applies to traders with an account balance of less than £1000 for index CFDs versus 0.005% for individuals with more than £25,000.

STP Account

When using FXOpen’s straight-through processing account, we were offered tight, floating spreads. This included 0.2 pips on the GBP/USD currency pair and 0.3 pips on the EUR/GBP pair. The live spread on the FTSE 100 index was offered at 0.8 pips.

These are competitive rates, making FXOpen a good option for active traders looking to keep costs down.

FXOpen Mobile App

Our experts were pleased to see that all trading platforms are available as mobile-compatible apps. This includes downloads for iOS and Android smartphones and tablet devices.

The applications can be used to stay up to date with market fluctuations and price changes while on the go. All platforms enable users to place trades, manage account details and view analysis in smaller-screen visuals.

However, it’s worth noting that the MetaTrader mobile terminals offer reduced tools and functionality. Conducting technical analysis is also much harder on a smaller, mobile or tablet screen.

Payment Methods

Deposits

FXOpen offers a modest selection of payment methods. UK investors can make deposits via bank wire transfer, credit/debit card, and instant bank payments.

Although these payment solutions are suitable for the majority of traders, it is a shame there are no e-wallet solutions such as Skrill, Neteller, or PayPal. There are also no cryptocurrency payment options, which many brokers now accept.

On a more positive note, FXOpen does not charge any deposit fees, though minimum and maximum limits apply. This includes a minimum deposit of £300 for bank wire transfers and £10 for credit/debit cards.

How To Deposit Via Bank Wire Transfer

- Log in to the FXOpen client portal

- Select ‘Add Funds’ from the top menu and then ‘Wire Transfer’

- Complete the deposit form including details of the currency (e.g. GBP), amount, and bank-registered country (e.g. UK)

- Select ‘Next’

- Download or print the proof of payment invoice

Withdrawals

Retail traders can request withdrawals via the same payment methods.

There are no fees for withdrawals made in GBP though a minimum limit of £30 applies for bank wire transfers and £10 for credit/debit cards and instant bank payments.

Withdrawal requests made before noon (GMT) will be processed the same day though the time taken for funds to be returned varies by method. Card withdrawals can take between two to five working days and bank wire transfers between one and three days. This is fairly standard among UK brokers.

To view the payment status and transaction history, select the account number in the left of the client portal dashboard.

Account Types

FXOpen offers two live accounts; ECN and STP. The main difference is the order execution models and associated trading conditions.

With the ECN account, traders benefit from raw prices, direct from liquidity providers. The STP account, on the other hand, is more suitable for beginners thanks to the commission-free, spread-based fee structure.

Retail investors can open trading accounts in GBP, USD, or EUR denominations.

ECN Account

- £300 minimum deposit

- Raw floating spreads from 0 pips

- Commission from £1.50 per 1 lot

- 0.01 lot minimum transaction size

- Instruments; currencies, commodity CFDs, index CFDs, share CFDs

STP Account

- Floating spreads

- Commission-free

- £300 minimum deposit

- 0.01 lot minimum transaction size

- Instruments; currencies and metal CFDs only

Note, FXOpen also offers swap-free Islamic accounts which are compliant with Sharia law for Muslim investors.

How To Register For A Real Account

New users can open an FXOpen trading account in a few minutes.

- Click on the ‘Visit’ button at the top of this review and on the broker’s website

- Select the country of residence from the drop-down menu

- Click ‘Begin Application’

- Complete the form with an email address and contact number

- Upload identity verification including proof of address

- Once verified, new users will receive a username and password to the registered email address

- Log in to the client portal

- Deposit funds and start investing

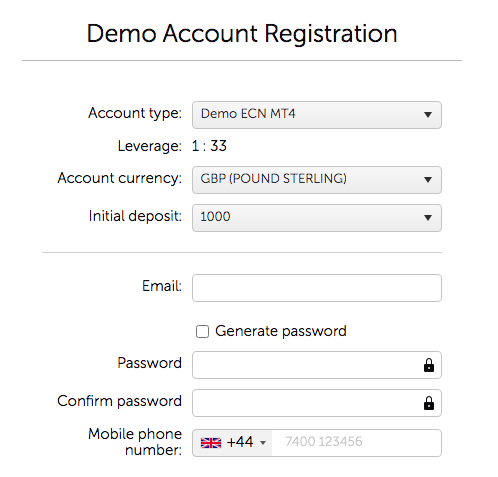

FXOpen Demo Account

FXOpen offers demo trading profiles for all platforms and account types. Although this is pretty standard for all major players in the market, it is a good way for beginners to get comfortable with the features and functions of the terminals.

Trade risk-free with virtual funds. Retail investors can practice trading via the STP or ECN execution model.

How To Open A Demo Account

- From the broker’s main webpage, select the ‘Demo Account’ icon

- In the drop-down menu, choose the platform, account currency, and amount of virtual funds

- Add an email address and phone number

- Create a password or use the random password generator

- Once registered, log in to the client portal using the credentials

Account Registration

Note, investors can open additional demo accounts from within the client dashboard.

Bonuses & Promos

The FXOpen UK entity does not offer bonus rewards or financial incentives due to ESMA regulations. As a result, British traders are not able to use a no-deposit bonus, promotion codes, a free welcome bonus, or participate in live account contests. There are a few historical bonus promotions run by the broker, but these were not available to residents of the UK.

While this may be disappointing for some prospective traders, this is fairly standard among reputable UK brokers. Instead, FXOpen offers a decent range of trading tools and additional features, outlined in more detail below.

Note, always check terms and conditions before opting in to a bonus.

UK Regulation

The company is registered in the United Kingdom under the trading name FXOpen Ltd, reference number 07273392. FXOpen is regulated by the Financial Conduct Authority (FCA), FRN 579202.

This is a highly regarded financial authority, with strict compliance protocols. The broker segregates client funds in top-tier UK banks and provides negative balance protection.

Additionally, UK residents benefit from access to FSCS compensation in the case of business failure. This includes protection up to £85,000.

Overall, the FCA oversight is a reassuring sign that FXOpen is a legitimate and trustworthy online broker.

Leverage Review

As an FCA-regulated broker, FXOpen cannot offer leverage above 1:30. This is significantly lower vs offshore global entities such as IC Markets (offering leverage up to 1:500) and FXTM (offering leverage up to 1:2000)

Designed to protect clients against significant losses, the maximum margin can be changed and used on major forex pairs. FXOpen UK offers the following leverage on other assets:

- Minor & Emerging Forex Pairs – 1:20

- Commodities – Up to 1:20

- Indices – 1:20

- Shares – 1:5

- Cryptocurrencies – 1:2

Both accounts have a 100% margin call and a 50% stop-out level.

Extra Tools & Features

FXOpen ranks highly in terms of the additional trading tools available. This includes margin and pip value calculators and currency converters.

The educational content is also decent. There are specific articles suitable for beginners, plus advanced strategies for more experienced investors.

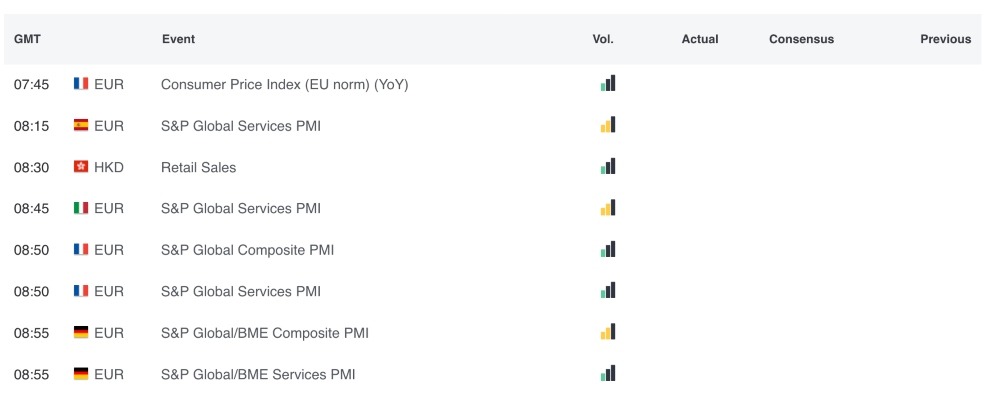

The broker also offers an economic calendar and daily market news with analytics by instrument and forex insights.

Economic Calendar

Plugin

The broker offers a one-click trading & Level 2 plugin for free download. The tool gives traders access to the best possible pricing, with single-click execution. The high speed and improved accuracy function provide five levels of market depth.

How To Install The One Click Trading & Level 2 Plugin

- Register for an FXOpen account

- Download or open the platform suitable for ECN trading

- Open the download window via the broker’s website (trading>platforms>trader’s tools)

- In the first screen select ‘Next’

- Review and accept the terms and conditions

- In the ‘Destination Window’, select the MT4 platform

- Click ‘Install’ and ‘Finish’ once the download is complete

FXOpen Trading Hours

Opening hours vary between instruments. Indices such as the FTSE 100 can be traded on the FXOpen platform between 1 AM and 12 AM Monday to Friday. US shares are available to UK traders between 16:35 and 23:25 (GMT).

The market opening hours and reflected UK timezone is reflected within the trading platform.

Customer Service

FXOpen customer support is available 8 AM to 6 PM (GMT), Monday to Friday. Help options include an email address, phone number, and live chat service. When we used the live chat function, we received a response within one minute.

An in-depth FAQ section/online help centre is also available via the broker’s website. There are plenty of user guides including step-by-step articles with responses to withdrawal problems and trading account registration support.

Contact details:

- Phone – +442035191224

- Email – support@fxopen.co.uk

- HQ Address – 80 Coleman Street, London, EC2R 5BJ

- Live Chat – Icon located bottom right of the broker’s website

Client Security

While using FXOpen, we felt assured of the security features in place. From the initial sign-in to making a local deposit and trading, the broker secures all transactions with industry-standard security protocols.

The brand uses top-tier encryption technologies to secure all information transmissions including 128-bit encryption and TLS with keys larger than 2048-bit. In addition, users can implement two-factor authentication (2FA) and one-time passwords (OTP).

In line with its FCA license, the broker also adheres to AML and KYC requirements.

Should You Trade With FXOpen?

FXOpen should certainly be a contender when it comes to a safe, UK-based trading firm. The choice of pricing models suits different traders and strategies, while the FCA regulatory oversight is a good sign that the brokerage is trustworthy. The breadth of additional tools and market insights are also excellent benefits.

The only major drawbacks are the lack of copy trading and the modest range of assets, including no cryptos, vs alternative brands. Overall though, FXOpen is an excellent option for UK traders.

FAQs

Is FXOpen A Good Broker?

Our 2026 expert review confirmed that FXOpen is a good all-round broker. The brand offers a range of instruments, a choice of pricing models, and four trading platforms and investing apps. It also offers competitive pricing and reliable customer support.

Is FXOpen A Safe Broker?

FXOpen is a relatively secure broker. The brokerage is regulated by the Financial Conduct Authority (FCA) and offers negative balance protection and segregated client funds in top-tier banks. Additionally, investors benefit from access to FSCS compensation in the event of broker insolvency.

Can I Practise Trading On An FXOpen Demo Account?

Yes – FXOpen offers an STP and ECN demo server. Retail investors can practise trading on all platforms including MT4 and TickTrader.

Does FXOpen Offer Good Trading Platform Choices?

Yes – FXOpen offers four trading platform options. This includes globally renowned MT4, MT5, and TradingView. The broker also provides a bespoke proprietary terminal named TickTrader.

All platforms are available for free download to desktop devices, available with webtrader compatibility, and have mobile trading apps.

How Much Do I Need To Deposit To Start Trading With FXOpen?

FXOpen UK clients must deposit £300 to get started on either the ECN or STP account types. Although this shouldn’t put the brand out of reach for all investors, it is slightly higher vs alternative brokers such as FXPro.

Top 3 FXOpen Alternatives

These brokers are the most similar to FXOpen:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- FXPro - Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

FXOpen Feature Comparison

| FXOpen | Pepperstone | Swissquote | FXPro | |

|---|---|---|---|---|

| Rating | 3.7 | 4.8 | 4 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Minimum Deposit | $100 | $0 | $1,000 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, FC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, CySEC, FSCA, SCB, FSA |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 (EU, UK), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 71.9% of retail investor accounts lose money when trading CFDs |

|||

| Review | FXOpen Review |

Pepperstone Review |

Swissquote Review |

FXPro Review |

Trading Instruments Comparison

| FXOpen | Pepperstone | Swissquote | FXPro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | No |

FXOpen vs Other Brokers

Compare FXOpen with any other broker by selecting the other broker below.

Popular FXOpen comparisons:

|

|

FXOpen is #24 in our rankings of CFD brokers. |

| Top 3 alternatives to FXOpen |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs |

| Demo Account | Yes |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, FC |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:30 (EU, UK), 1:1000 (Global) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ADVcash, Credit Card, Debit Card, FasaPay, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Gold, Natural Gas, Oil, Silver |

| CFD FTSE Spread | 0.7 |

| CFD GBPUSD Spread | 0.4 |

| CFD Oil Spread | 0.04 |

| CFD Stocks Spread | 0.40 (Apple) |

| GBPUSD Spread | 0.4 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.5 |

| Assets | 50+ |

| Crypto Coins | BCH, BTC, DSH, EOS, ETC, ETH, IOT, LTC, NEO, XMR, XRP |

| Crypto Spreads | 9.0 (BTC) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |