UK Brokers With The Best Demo Trading Competitions 2026

Looking to sharpen your trading skills without risking a penny? Demo trading competitions offer a risk-free arena to test strategies, build confidence, and even win real prizes.

Whether you’re a budding investor or a seasoned trader fine-tuning your edge, the best demo trading competitions combine education with excitement—making them a smart step before committing real capital.

Best Demo Trading Competition Brokers

-

During our assessments, Vantage’s demo contests frequently provided access to cash prizes over $10,000. Registration was effortless, with authentic trading conditions, such as tight spreads from 0.0 pips and rapid execution on MT4/MT5 and ProTrader. Real-time leaderboard updates ensured competitions closely reflected live markets, fostering competitive strategy and timing.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

When exploring FxPro’s demo trading competitions, we noted that they offered fewer events compared to some competitors. However, they provided solid prize pools and easy entry. Trading conditions closely mirrored live environments, with spreads starting at 1.2 pips on MT4/MT5 and cTrader, and no commission. Execution speed stood out, offering a realistic and low-risk platform to competitively test strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

FXCM's demo contests had limited slots, yet offered highly competitive prizes, often in the thousands. Participation was straightforward, with trading on Trading Station and MT4, featuring spreads from 1.3 pips. Execution speed and slippage closely replicated live accounts, ensuring a realistic and tested setting.

Instruments Regulator Platforms Forex, Stock CFDs, Commodities CFDs, Crypto CFDs FCA, CySEC, ASIC, FSCA, BaFin, CIRO Trading Station, MT4, TradingView, Quantower Min. Deposit Min. Trade Leverage $50 Variable 1:400 -

During our Axi test, trading tournaments were infrequent but excellently organised, offering cash prizes and straightforward registration. Trading took place on MT4 with raw spreads from 0.0 pips and a $7 round-turn commission per lot. Execution mimicked live conditions—low latency, realistic slippage, and sufficient volatility for strategy testing under pressure.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In our review of CMC Markets' trading competitions, we discovered free entry with cash prizes reaching $1,400. Entrants got a $10,000 virtual account, with contests on MT4/MT5. Competitive spreads and execution mimicked live markets, ensuring a realistic trading experience.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 2005, FXOpen is a well-regulated broker that has drawn over one million traders. Tailored for active trading, it offers a diverse range of over 700 markets. The platform facilitates high-frequency trading, scalping, and various algorithmic strategies through the use of expert advisors (EAs).

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs FCA, CySEC, FC TickTrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (EU, UK), 1:1000 (Global) -

In our evaluations, NordFX’s demo competitions occurred monthly with prize pools reaching $3,000. Entry was swift, and trades were conducted on MT4 with spreads starting at 0.9 pips. Market conditions closely mirrored live situations, including slippage during volatile periods. The structure encouraged both consistent strategies and risk-taking, providing a robust testing environment.

Instruments Regulator Platforms Forex, CFDs, indices, commodities, cryptos, stocks FSC (Mauritius), FSA (Seychelles) MT4, MT5 Min. Deposit Min. Trade Leverage $10 $1 1:1000

Safety Comparison

Compare how safe the UK Brokers With The Best Demo Trading Competitions 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| FXCM | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ | |

| NordFX | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the UK Brokers With The Best Demo Trading Competitions 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| FXCM | ✔ | ✔ | ✔ | ✘ | ✘ | ✔ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| NordFX | ✘ | ✘ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the UK Brokers With The Best Demo Trading Competitions 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Vantage FX | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| FXCM | iOS and Android | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ | ||

| FXOpen | iOS & Android | ✘ | ||

| NordFX | iOS & Android | ✘ |

Beginners Comparison

Are the UK Brokers With The Best Demo Trading Competitions 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| FXCM | ✔ | $50 | Variable | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots | ||

| NordFX | ✔ | $10 | $1 |

Advanced Trading Comparison

Do the UK Brokers With The Best Demo Trading Competitions 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| FXCM | - | ✘ | 1:400 | ✘ | ✔ | ✘ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| NordFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:1000 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the UK Brokers With The Best Demo Trading Competitions 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Vantage FX | |||||||||

| FXPro | |||||||||

| FXCM | |||||||||

| Axi | |||||||||

| CMC Markets | |||||||||

| FXOpen | |||||||||

| NordFX |

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- The broker recently expanded its range of CFDs, offering more trading opportunities.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

Our Take On FXCM

"FXCM remains a leading choice for traders using automated strategies, offering four robust platforms, strategy backtesting, and algorithmic trading via APIs. It is also ideal for active traders, providing discounted spreads and minimal to zero commissions on popular assets."

Pros

- The proprietary Trading Station platform is an excellent option for traders seeking a comprehensive tool for their short-term and automated strategies.

- In addition to its four charting platforms, FXCM provides a superior selection of specialist software for seasoned traders, featuring QuantConnect, AgenaTrader, and Sierra Chart.

- Traders have access to premium tools such as a market scanner, forex signals, and research from the third-party site eFXPlus.

Cons

- The live chat support is often sluggish and inconsistent when compared to leading competitors.

- While FXCM primarily caters to seasoned traders, the absence of managed accounts is unfortunate.

- There are no retail account options available for traders, and Cent/Micro account alternatives are also absent.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

- Axi provides an excellent MT4 experience, enhanced by the NextGen plug-in for sophisticated order management and analytics, with low execution latency around 30ms.

Cons

- Axi lags by solely providing MT4, while competitors have upgraded to MT5, cTrader, TradingView, and bespoke platforms, delivering a smoother user experience with enhanced tools.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets has introduced an AI News feature. This leverages AI to highlight and summarise market stories instead of executing trades, suggesting the future direction of broker research tools.

- The CMC web platform offers an exceptional user experience with sophisticated charting tools for trading and customisable options, suitable for both novice and seasoned traders. It supports MT4 but not MT5, and TradingView will be available from 2025.

- The brokerage excels with an extensive array of valuable resources, such as pattern recognition scanners, webinars, tutorials, news feeds, and research from reputable sources like Morningstar.

Cons

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

Cons

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

Our Take On NordFX

"NordFX offers competitive conditions solely for top-tier accounts, ideal for seasoned traders pursuing zero-spread trading via MetaTrader. The minimum deposit is $100 for MT4 and $200 for MT5."

Pros

- NordFX has enhanced its charting tools for seasoned traders by incorporating MT5 alongside MT4, offering quicker, multi-threaded processing.

- NordFX has enhanced its offerings by introducing Pro accounts, which utilise spread-only pricing. Additionally, Zero accounts now provide spreads starting from 0.0 on popular assets such as EUR/USD.

- The user-friendly trading service might attract novice or advancing traders, requiring only a £100 initial deposit to begin.

Cons

- NordFX offers a limited market range, featuring just approximately 100 instruments. The selection of shares is especially sparse, with only about 20 available.

- The absence of robust regulatory oversight at NordFX raises concerns. Clients face limited protection, with no negative balance safeguards and no segregated accounts.

- While NordFX provides competitive pricing with its Zero accounts, it lags behind more cost-effective brokers such as IC Markets. Conversely, its Pro accounts come with some of the highest spreads in the market, starting from 10 pips.

How Investing.co.uk Chose The Best Demo Trading Contests

Our research team reviewed the demo trading competitions offered by each shortlisted broker, assessing prize formats, entry requirements, and competition rules.

We then ranked providers by their overall ratings, revealing the best demo trading contests available in the UK.

How To Pick A Demo Trading Contest

Clear & Transparent Rules

These define how performance is measured – whether by total return, risk-adjusted return, or consistency – so you need to have a clear idea of them before a contest kicks off.

Without clear criteria, aggressive, high-risk trading may be unfairly rewarded over a disciplined strategy, skewing the learning experience for beginners. The reputable brokers we evaluated often outline their scoring systems and monitor accounts to prevent abuse, such as using loopholes or exploiting demo-specific bugs. Transparent competitions build trust and ensure a fair environment where skills—not exploits—determine the winner.

Charting Platform

A high-quality trading platform such as MetaTrader 4 or TradingView allows you to learn and execute trades efficiently using real-world tools. Features like advanced charting, technical indicators, and flexible order types (e.g. stop-loss, trailing stops) help simulate the full trading experience.

The demo environment must mirror the live platform closely so you can build skills that transfer directly to live trading. A clunky or limited demo platform may lead to poor habits or misjudged strategies that wouldn’t hold up in fundamental markets.

- FXCM‘s superb range of platforms includes MT4 and TradingView as well as its own proprietary forex and CFD platform, Trading Station.

Markets

Market access and instrument variety let you explore different asset classes—such as forex, stocks, indices, commodities, or even crypto—and find what suits your trading style. For UK-based traders, access to FTSE 100 stocks, GBP currency pairs, or UK-listed ETFs can make the experience more relevant and practical.

Some brokers offer a broad range of markets in their demo competitions, allowing you to diversify strategies and understand how different instruments react to news, volatility, and liquidity in real time. This exposure is key to developing well-rounded trading skills.

- The 10,000+ instruments available from CMC Markets includes more than 300 forex pairs, which remains far beyond the range available from most forex brokers and provides huge scope for innovative strategies and unique opportunities in demo competitions.

Leverage

Understanding leverage and risk settings helps you to avoid reckless trading habits that won’t translate well to live markets. Some competitions we looked at offer fixed high leverage to boost returns quickly, but this doesn’t reflect FCA-regulated live account limits—for example, 1:30 for major forex pairs.

A good broker designs demo environments with realistic margin requirements and risk controls, helping you develop proper risk management skills such as position sizing and stop-loss discipline. Choosing a competition with sensible leverage settings ensures your learning experience mirrors actual trading conditions.

- FxPro is transparent about its provision of leverage, which includes the FCA-mandated 1:30 for UK retail clients and a much higher rate for pros.

Prizes

Prize structure and payout terms determine both the value and accessibility of your potential reward. Some brokerages offer cash prizes, funded trading accounts, or trading credits, but it’s important to check for conditions—like withdrawal restrictions, minimum trading volume, or account verification steps.

For example, a $500 prize might be locked behind a live account deposit. Reliable brokers clearly outline these terms, helping you avoid surprises and focus on competitions that offer transparent, attainable incentives.

Competition Frequency

The frequency and availability of demo trading competitions offer multiple chances to practice, learn from mistakes, and refine strategies over time. Some brokers run competitions monthly or even weekly, while others host only one-off events with limited entry windows.

Regular access helps you stay engaged, improve consistency, and build long-term trading habits without the pressure of a single high-stakes event.

In my early trading days, I learned more from a well-structured demo competition than from any textbook—but only after switching to a broker that treated the demo like a real market, not a game.The right platform teaches you discipline, not just how to chase a leaderboard.

Regulation

FCA regulation is a key indicator of trust and security for demo trading competitions in the UK. Regulated brokers must adhere to strict rules around client fund segregation, transparent pricing, and fair competition practices—reducing the risk of platform manipulation or unfair scoring.

For example, an FCA-regulated broker is required to hold your data securely and ensure the demo environment closely mirrors real-market conditions. This not only protects your experience during the competition but also provides a smoother, more credible transition if you later choose to open a live account.

- Vantage FX is FCA-regulated and runs regular demo competitions with cash prizes that can reach $10,000.

What Is A Demo Trading Competition?

A demo trading competition is a simulated trading event where participants compete using virtual funds provided by the broker.

The goal is typically to achieve the highest return within a set timeframe—ranging from a few days to several weeks—though some contests also consider factors like trade frequency or effective risk control.

These competitions are usually hosted by online brokers such as CloseOption, CMC Markets, and Axi to help attract new clients and keep current users engaged.

For beginner traders, they offer a risk-free environment to experiment with strategies, learn platform features, and gain hands-on experience in live market conditions—without the stress of losing real money.

Participants can usually trade a wide range of instruments, including forex, stocks, indices and commodities, depending on the platform.

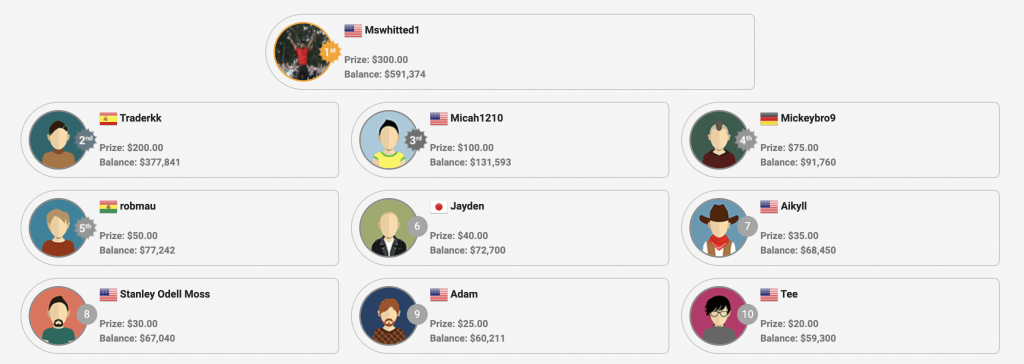

While the trading is virtual, the rewards are often real. Top performers may win cash prizes, bonus trading credits, or access to funded trading accounts.

CloseOption offers a top prize of $1,000 for 20 winners every week

Pros Of Demo Trading Competitions

- Risk-free skill development: Demo trading competitions allow new traders to execute positions using virtual capital while interacting with live market data—learning key mechanics like order types (e.g., stop-loss, limit orders), margin usage, and position sizing. This makes it an ideal environment for testing strategies without the downside of real financial loss.

- Performance under realistic stress: Competitions introduce time limits, leaderboards, and peer comparison, which simulate market pressure and emotional volatility. This helps beginners experience how psychology—such as fear of missing out (FOMO) or revenge trading—can impact decision-making, a critical but often overlooked element of successful trading.

- Prizes & broker perks: Beyond virtual learning, some brokers often reward top performers with cash, trading credits, or access to funded trading programs. This creates a pathway for disciplined traders to transition from demo to live environments with reduced capital risk, while also gaining visibility with proprietary trading firms or mentorship programs.

Cons Of Demo Trading Competitions

- Unrealistic risk-taking behaviour: Since participants trade with virtual money, there’s a tendency to take excessive risks—like overleveraging or ignoring stop-losses—to climb leaderboards quickly. This behaviour can create bad habits that don’t translate well to real-money trading, where capital preservation is crucial.

- Psychological disconnect from real trading: While competitions simulate market pressure, they can’t fully replicate the emotional weight of losing real money. As a result, you might perform well in a demo setting but struggle with discipline, hesitation, or anxiety when transitioning to live accounts.

- Short-term focus over long-term strategy: Most demo competitions reward high returns within a short period, often favouring aggressive, high-frequency strategies. This can skew your perception of success, discouraging the more sustainable practices of long-term planning, consistent risk management, and compounding.

One thing I didn’t expect to matter—but did—was how often the competitions ran. With a broker offering regular monthly contests, I could treat each one like a trading season, review my mistakes, and come back sharper. Consistency in opportunities helped build consistency in my strategy.

Bottom Line

Demo trading competitions offer a valuable, risk-free way to build trading skills, test strategies, and compete for real rewards.

The best brokers with demo trading competitions combine realistic trading conditions with transparent rules, fair scoring systems, and accessible prize structures.

Choosing a trusted, FCA-regulated platform with recurring competitions and quality tools ensures both a safe learning environment and a more authentic trading experience.