Best Brokers With Pre-Market Trading In The UK 2026

Looking to get ahead of the UK and global markets? Pre-market trading gives you an edge by allowing you to react to overnight news, earnings reports, and global events before the regular session begins.

We reveal the best pre-market brokers that let you trade before the bell rings.

Top Brokers That Let You Trade Before The Market Opens

-

In our analysis, Interactive Brokers provided extensive trading hours from 08:00 to 02:00 (GMT) for U.S. stocks. Liquidity remained strong for popular stocks, with spreads increasing only by 0.3–0.5 pips. Stop-loss and limit orders executed accurately. Ultra-low commissions (beginning at $0.005/share) made it perfect for traders operating during extended hours.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In our tests, IG provided extended hours for trading key U.S. stocks and indices from 09:00 to 01:00 (GMT). Post-market spreads widened slightly (usually 0.5 to 1 pip). Stop-loss and limit orders worked well, even during low liquidity. We were impressed by the lack of additional commission on most extended-hours trades.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

During our testing of eToro's extended hours, U.S. equities were tradable from 09:00 to 01:00 (GMT). Post-market, spreads increased up to 1 pip, yet limit and stop-loss orders executed precisely. Liquidity for popular shares stayed robust. Zero commissions on shares helped mitigate overnight spread increases.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

During our review of Spreadex, trading was accessible from 09:00 to 01:00 (GMT) on major U.S. stocks and indices. Spreads increased significantly, reaching up to 1.2 pips, during low-liquidity times. Despite this, stop-loss and limit orders were precise. Commission-free trading offset the impact of wider spreads after regular market hours.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView, AutoChartist Min. Deposit Min. Trade Leverage £0 £0.01 1:30 -

During our City Index test, trading on major U.S. shares and indices was available from 09:00 to 01:00 (GMT). Spreads increased by 0.6–1 pip after regular hours, yet order execution stayed stable. Stop-loss and limit orders were dependable, with no additional fees during off-peak sessions.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

CMC Markets offered extended trading hours on US stocks and indices from 09:00 to 01:00 (GMT). Spreads widened slightly to around 0.5–0.9 pips post-market close, but order execution remained steady. Stop-loss and limit orders were triggered precisely. Commission-free equity CFDs enabled accessible, cost-efficient off-hours trading.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In tests, Saxo offered extended trading hours from 08:00 to 02:00 (GMT) for U.S. equities and indices. Blue-chip liquidity remained robust, with spreads widening by 0.4–0.7 pips outside core hours. Stop-loss and limit orders were executed accurately. Commissions starting at $1 per trade provided added value.

Instruments Regulator Platforms Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, options, warrants, bonds, ETFs DFSA, MAS, FCA, SFC, FINMA, AMF, CONSOB TradingView, ProRealTime Min. Deposit Min. Trade Leverage £500 Vary by asset 1:30

Safety Comparison

Compare how safe the Best Brokers With Pre-Market Trading In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Spreadex | ✔ | ✔ | ✘ | ✔ | |

| City Index | ✔ | ✔ | ✔ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ | |

| Saxo | ✔ | ✘ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Pre-Market Trading In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Spreadex | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| City Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Saxo | ✔ | ✘ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Pre-Market Trading In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| Spreadex | iOS & Android | ✘ | ||

| City Index | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ | ||

| Saxo | SaxoTraderGo (iOS, Android, Windows) | ✘ |

Beginners Comparison

Are the Best Brokers With Pre-Market Trading In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Spreadex | ✘ | £0 | £0.01 | ||

| City Index | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots | ||

| Saxo | ✔ | £500 | Vary by asset |

Advanced Trading Comparison

Do the Best Brokers With Pre-Market Trading In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Spreadex | ✘ | ✔ | 1:30 | ✘ | ✘ | ✔ | ✔ |

| City Index | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✘ | ✔ | ✔ | ✔ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

| Saxo | - | ✘ | 1:30 | ✘ | ✘ | ✘ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Pre-Market Trading In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| IG | |||||||||

| eToro | |||||||||

| Spreadex | |||||||||

| City Index | |||||||||

| CMC Markets | |||||||||

| Saxo |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

- eToro secured second place in DayTrading.com's 'Best Crypto Broker' for 2025, offering a vast selection of tokens, dependable service, and competitive fees.

- The entry requirements for eToro Club have been reduced. For $4.99 monthly, members enjoy 18 benefits, including a debit card that converts purchases into stocks with a 4% share return.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The only significant contact option, besides the in-platform live chat, is limited.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Spreadex

"Spreadex attracts UK traders keen on spread betting in financial markets and traditional sports wagers. It offers low fees for short trades, and spread bet profits are tax-free. With a robust charting platform and no minimum deposit, it's easy to begin."

Pros

- There is a superb selection of instruments and trading vehicles for short-term traders.

- Spreadex has added trading signals to its desktop platform, using Autochartist to deliver real-time, pattern-based insights. These insights assist traders in spotting potential opportunities.

- Traders can place wagers on sporting events directly through their brokerage accounts.

Cons

- The absence of a demo account may dishearten potential clients wishing to evaluate Spreadex's offerings.

- The proprietary terminal does not offer the detailed charting capabilities found in platforms such as MT4 and MT5.

- There is no support for expert advisors or trading bots.

Our Take On City Index

"City Index suits active traders perfectly, offering rapid execution speeds averaging 20ms and a customisable web platform with over 90 technical indicators. Its educational resources are exceptional. For UK traders interested in spread betting on 8,500+ instruments tax-free, City Index is an excellent option."

Pros

- City Index has significantly improved the trading experience. In 2024, they introduced Performance Analytics, providing insights into trades and discipline. The revamped mobile app now includes integrated market research and swipe-access news.

- City Index is under the regulation of leading authorities, such as the FCA in the UK, ASIC in Australia, and MAS in Singapore. Its parent company, StoneX Group Inc., is publicly listed, which enhances its credibility.

- City Index offers adaptable trading platforms suited to every expertise level. For newcomers, the Web Trader platform is straightforward and user-friendly. For more in-depth analysis and automated features, MetaTrader 4 (MT4) and TradingView are supported, providing a comprehensive trading experience for all traders.

Cons

- Although many brokers, such as eToro, have broadened their crypto offerings, City Index restricts its clients to crypto CFDs. This limited selection may not meet the needs of traders seeking a wider variety of altcoins.

- City Index does not offer an Islamic account with swap-free conditions, making it less attractive to Muslim traders than brokers such as Eightcap and Pepperstone.

- Unlike brokers like AvaTrade and BlackBull, City Index lacks options for passive trading, such as social copy trading or real ownership of stocks and ETFs. This limitation may reduce its appeal to traders seeking a more hands-off approach.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- We've upgraded the 'Assets & Markets' rating due to frequent product enhancements in early 2025. These include extended trading hours for US stocks and the introduction of new share CFDs.

- CMC provides competitive pricing with narrow spreads and low trading fees, except for stock CFDs. The Alpha and Price+ programmes offer additional benefits for active traders, including discounts on spreads of up to 40%.

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

Cons

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

Our Take On Saxo

"Saxo suits active traders and high-volume investors, providing unmatched instrument variety, premium research, and fee rebates. With 190 currency pairs offering tight spreads, it excels for forex traders."

Pros

- The ISA account offers easy access and flexibility, as it incurs neither entry nor exit fees.

- Elite research centre offering specialised market analysis and exclusive forecasts, including 'Outrageous Predictions'.

- Access to advanced external analysis tools, such as TradingView and Updata, is available.

Cons

- A subscription is necessary to access Level 2 pricing.

- Clients from certain regions, such as the US and Belgium, are not accepted.

- Trading accounts require substantial financial investment.

How Investing.co.uk Chose The Top Brokers For Pre-Market Trading

To identify the top UK brokers for pre-market trading, we examined various platforms available to UK traders.

Our UK-based team evaluated how each platform handled off-hours trading conditions, focusing on access to key markets like US equities, execution reliability, and real trading costs.

We monitored how spreads behaved during quieter periods, tested stop-loss and limit order performance, and noted any issues with platform stability or hidden fees. We then ranked brokers by their overall ratings.

How To Pick A Broker With Pre-Market Trading

- Not all brokers offer the same pre-market windows, so these hours directly impact your ability to react to news and price movements. For example, while the London Stock Exchange (LSE) pre-market typically opens at 07:00 (GMT), some brokers like IG also provide access to US pre-market trading from 09:00 (GMT), allowing you to engage with global markets before they officially open. Without the proper access, you could miss key volatility or price gaps—especially during earnings season or major economic events. It’s important to confirm not just the hours offered, but also whether they cover both UK and international markets relevant to your trading strategy.

- The types of assets available during pre-market hours can significantly affect your trading opportunities and strategy. Some brokers offer limited access to major UK equities or indices, such as the FTSE 100. In contrast, others, like CMC Markets, allow trading in ETFs during extended hours. If you’re looking to diversify or hedge using different asset classes, your broker must support them outside regular trading times. For example, forex markets operate 24/5, making them ideal for pre-market moves, but not all platforms offer full integration with other asset types before 08:00 (GMT).

- Pay attention to order types and execution quality in pre-market trading because liquidity is lower and prices can move quickly. Brokers that support limit and stop orders during pre-market hours—like Interactive Brokers—allow you to control entry and exit points more precisely, reducing the risk of slippage. Market orders can be risky in this environment, as wide bid-ask spreads may lead to unfavourable fills. Reliable execution speed is also essential, as delays of even a few seconds can lead to missed opportunities or poor pricing when volatility spikes after unexpected news. Always check if your broker’s order types and infrastructure are fully functional before the main session.

- Spreads, commissions, and fees can be significantly higher during pre-market hours. Due to lower liquidity, spreads often widen, meaning you may buy at a higher price and sell at a lower one, impacting profitability—especially for short-term trades. Some brokers may also apply different commission structures or minimum trade sizes during extended hours. Additionally, platform fees or inactivity charges can erode returns over time if you’re not trading regularly. It’s important to compare total costs—not just advertised spreads—when evaluating brokers for pre-market access.

- Platform tools and features can make a massive difference in pre-market trading because the market moves fast and with less transparency. Tools like pre-market scanners help identify early movers, while Level 2 data shows real-time order book depth—critical for spotting support and resistance in thin markets. Brokers like IG offer integrated news feeds, which can alert you to breaking headlines that drive price action before 08:00 (GMT). Accessing these features on both desktop and mobile ensures you can monitor and react from anywhere, but not all platforms offer full functionality outside regular hours. Without these tools, you’re essentially trading blind in a less predictable market.

- Account type requirements matter because not all brokers offer pre-market access to standard retail accounts. Some may restrict full pre-market functionality—such as advanced order types or access to specific markets—to professional or premium-tier clients, often requiring higher account balances or trading experience. This means that beginner investors may face limitations on what and when they can trade, even if the platform advertises pre-market features. Always check if pre-market access is included with your account level, or if it requires meeting specific funding thresholds or eligibility criteria under FCA rules.

In my own early-hours trading, I found that a broker’s pre-market offering isn’t just about having access—it’s about how reliably that access performs.A smooth execution at 07:05 (GMT) can make the most of a good setup, while even a slight delay or platform issue can turn a decent trade into a missed opportunity.

What Is Pre-Market Trading?

Pre-market trading in the UK, typically running from 07:00 to 08:00 (GMT) and before the LSE opens, lets you get early exposure across multiple asset classes—not just equities.

During this window, you can access select stocks, ETFs, and indices like the FTSE 100 and DAX, depending on the broker. Forex pairs can be traded 24 hours a day midweek and typically start on Sunday evening. On the other hand, cryptocurrency exchanges such as Coinbase, are open 24/7.

Activity tends to be lighter, with lower liquidity and wider spreads, so that price moves can be more volatile.

Platforms like IG, City Index, and Interactive Brokers offer varying levels of pre-market access, often catering more to experienced traders or those using professional-grade accounts.

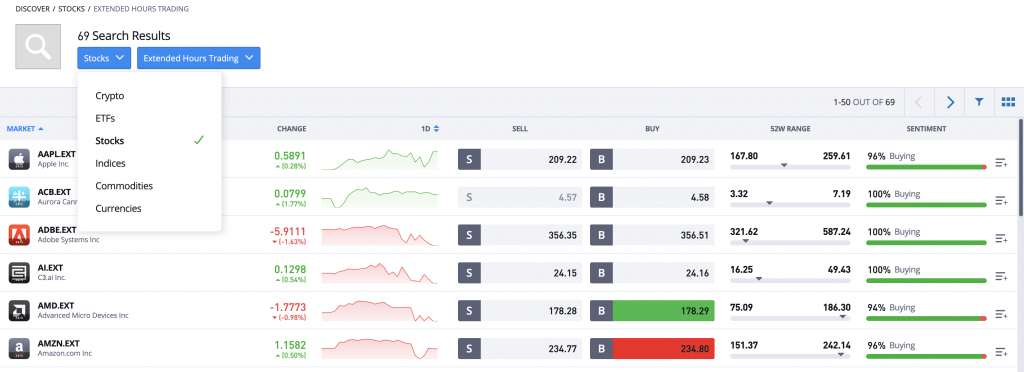

eToro offers extended hours trading on select US stocks for early market access

Pros Of Pre-Market Trading

- Early reaction to news: Pre-market trading lets you respond to key announcements—like earnings reports, economic indicators (e.g. CPI or interest rate decisions), or geopolitical developments—that are often released outside regular trading hours. This is particularly useful for UK traders dealing with international stocks or assets influenced by Asian and US markets. Reacting early can help you manage risk or take advantage of momentum before institutional volume floods in at 08:00 (GMT).

- Potential price advantage: Because markets can open with sharp price gaps, pre-market trading offers a chance to enter or exit positions at potentially more favourable prices. For example, if a company issues strong earnings at 07:00 (GMT), in the pre-market, you can buy shares before the full market demand drives the price higher. This can be especially effective when using limit orders to control entry levels in low-volume conditions.

- Flexible risk management: Pre-market access allows you to make strategic decisions outside the regular session—such as adjusting stop-loss orders, scaling into positions, or hedging exposure through index futures or ETFs. For example, if overseas events impact sentiment overnight, you can reduce risk before the LSE opens. This flexibility is valuable for managing portfolios with tighter risk controls or diversified across global assets.

Cons Of Pre-Market Trading

- Lower liquidity: Pre-market sessions typically have far fewer participants than regular trading hours, resulting in thinner order books. This means fewer buyers and sellers, which can make it harder to execute trades at your desired price—especially for less liquid UK equities or ETFs. Slippage is more common, and larger orders may move the market, making it difficult to enter or exit positions efficiently.

- Wider spreads & volatility: Reduced liquidity leads to wider bid-ask spreads, which increase trading costs—particularly for retail traders. Prices can swing more sharply in response to news, even on light volume, making it harder to distinguish real price action from noise. Limit orders help to avoid paying significantly more (or receiving less) than expected.

- Limited access & functionality: Not all brokers offer full pre-market access across all asset classes. For example, many UK platforms restrict pre-market trading to professional accounts or only allow trading in major FTSE stocks and indices. Additionally, tools like trailing stops or advanced charting features may not function reliably during off-market hours, limiting your ability to trade effectively.

At first, I didn’t think tools like Level 2 data or live news feeds were that important—but after missing a key move during a quiet pre-market session, I realised how valuable they are for spotting early signals.The right features don’t guarantee success, but they improve your odds in those low-liquidity hours.

Bottom Line

Pre-market trading offers you the chance to react early to news and global market movements, potentially gaining a strategic edge before the LSE opens.

However, it comes with unique challenges like lower liquidity and wider spreads, making the choice of broker crucial.

Selecting the best broker with pre-market trading means considering factors such as pre-market hours, asset availability, order types, fees, and account requirements to ensure you can trade efficiently and confidently during these extended hours.