Best Brokers With Guaranteed Stop Loss Orders

Brokers with guaranteed stop loss orders provide a beginner-friendly risk management tool. For a premium, investors can specify a price at which a trade will be closed, regardless of volatility and slippage. In this tutorial, we explain how a guaranteed stop loss works with a detailed example. We also look at their pros and cons, conditions, and list the top UK brokers with guaranteed stop loss orders in 2026.

Top 10 UK Brokers With Guaranteed Stop Loss

-

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Founded in 2008 and based in Israel, Plus500 is a leading brokerage with over 25 million registered traders across more than 50 countries. It focuses on CFD trading, offering a user-friendly proprietary platform and mobile app. The company provides competitive spreads and does not impose commissions or charges for deposits or withdrawals. Plus500 stands out as a highly trusted broker, licensed by respected authorities such as the FCA, ASIC, and CySEC.

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, EFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable Yes -

Founded in 1983, City Index is a prestigious broker, now under the Nasdaq-listed StoneX Group. It excels in forex, CFDs, and spread betting. With access to over 13,500 instruments, City Index provides a dynamic Web Trader platform, exceptional educational materials, and round-the-clock support five days a week, ensuring a thorough trading experience.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Best Brokers With Guaranteed Stop Loss Orders are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| City Index | ✔ | ✔ | ✔ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Guaranteed Stop Loss Orders support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| City Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Guaranteed Stop Loss Orders at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| City Index | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Guaranteed Stop Loss Orders good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Plus500 | ✔ | $100 | Variable | ||

| City Index | ✔ | $0 | 0.01 Lots | ||

| CMC Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Guaranteed Stop Loss Orders offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| City Index | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✘ | ✔ | ✔ | ✔ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Guaranteed Stop Loss Orders.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| IG | |||||||||

| Plus500 | |||||||||

| City Index | |||||||||

| CMC Markets |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- Plus500 has expanded its range of short-term trading instruments by adding VIX options, which feature increased volatility. Additionally, it has extended trading hours for seven stock CFDs.

- The customer support team consistently delivers reliable support around the clock through email, live chat, and WhatsApp.

- The broker provides low-commission trading across varied markets, reducing extra fees and attracting seasoned traders.

Cons

- Educational resources are not as extensive as leading brokers such as eToro, which affects beginners' ability to learn quickly.

- Algorithmic trading and scalping are not available, potentially deterring certain traders.

- Compared to competitors like IG, Plus500 offers limited research and analysis tools.

Our Take On City Index

"City Index suits active traders perfectly, offering rapid execution speeds averaging 20ms and a customisable web platform with over 90 technical indicators. Its educational resources are exceptional. For UK traders interested in spread betting on 8,500+ instruments tax-free, City Index is an excellent option."

Pros

- City Index offers access to over 13,500 markets, including forex, indices, shares, commodities, bonds, ETFs, and interest rates. The platform's inclusion of niche markets such as interest rates provides traders with unique opportunities not commonly available on other platforms.

- City Index has significantly improved the trading experience. In 2024, they introduced Performance Analytics, providing insights into trades and discipline. The revamped mobile app now includes integrated market research and swipe-access news.

- City Index is under the regulation of leading authorities, such as the FCA in the UK, ASIC in Australia, and MAS in Singapore. Its parent company, StoneX Group Inc., is publicly listed, which enhances its credibility.

Cons

- City Index does not offer an Islamic account with swap-free conditions, making it less attractive to Muslim traders than brokers such as Eightcap and Pepperstone.

- Unlike brokers like AvaTrade and BlackBull, City Index lacks options for passive trading, such as social copy trading or real ownership of stocks and ETFs. This limitation may reduce its appeal to traders seeking a more hands-off approach.

- Although many brokers, such as eToro, have broadened their crypto offerings, City Index restricts its clients to crypto CFDs. This limited selection may not meet the needs of traders seeking a wider variety of altcoins.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

- We've upgraded the 'Assets & Markets' rating due to frequent product enhancements in early 2025. These include extended trading hours for US stocks and the introduction of new share CFDs.

- The brokerage excels with an extensive array of valuable resources, such as pattern recognition scanners, webinars, tutorials, news feeds, and research from reputable sources like Morningstar.

Cons

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- A monthly inactivity charge of $10 is imposed after a year's inactivity, potentially discouraging occasional traders.

How A Guaranteed Stop Loss Works

A guaranteed stop loss order (GSLO) is a common risk management tool offered by leading trading brokers. Most platforms allow traders to set up a regular stop loss to limit losses if the market moves against them. However in highly volatile markets, prices can swing substantially, causing a discrepancy between the price the trade was requested and the price at which it is executed. This is known as slippage or gapping.

Fortunately, brokers with guaranteed stop loss orders offer a solution. For a fee, traders can specify a price at which a trade will be executed, regardless of any slippage. So GSLOs help traders limit risk exposure when trading in volatile markets, such as commodities, forex or cryptocurrencies.

Example

Let’s assume you want to go long on Barclays stock (BARC), which is currently valued at £165.00.

You buy 100 shares and intend to hold the position for several days. Your total position size is £16,500 (100 x £165).

However, from your research, you believe that market developments may lead to a period of significant volatility, which could result in slippage. With this in mind, you set a guaranteed stop loss order at £160.00 to limit your potential losses.

The GSLO fee is calculated as the premium rate x number of units, which in this case, is £2 x 100 = £200.

Following unexpected geopolitical events and a bleak economic outlook, the value of Barclays stock suddenly falls to £155.00.

Using a regular stop loss, the trade would be closed at the new price (£155), meaning a loss of £1000 (£16,500 – (100 x £155)).

However, with a guaranteed stop loss, the trade would have been closed at £160, meaning a loss of £300 (£16,500 – (100 x £160) – £200)).

Note, most brokers with guaranteed stop loss orders only charge a fee if the GSLO is actually triggered.

How To Set Up A Guaranteed Stop Loss

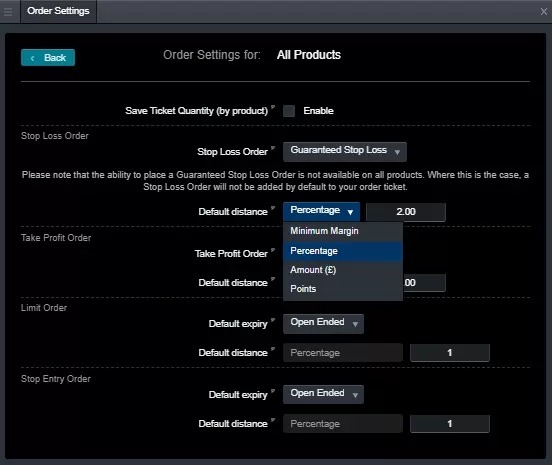

When setting up a regular stop loss on a trading platform, many brokers make it easy to upgrade it to a guaranteed stop loss. At CMC Markets, for example, in the order settings window, clients can choose the type of stop loss order from a drop-down list.

Traders can then set the distance/level of the guaranteed stop loss. This is normally displayed in pips/points or a percentage. There is also usually a minimum distance from the existing market price that the GSLO can be set.

Importantly, guaranteed stop losses can only be set during trading hours. With that said, you may be able to move the GSLO further away from the current market price outside of standard trading hours.

Setting Up A GSLO On CMC Markets

Setting Up Notes & Tips:

- Most brokers do not let you apply a GSLO to an existing/open position

- The GLSO premium is usually displayed on the order screen and is not charged unless it is triggered

- Make sure you have enough capital in your account to cover any increase in margin exposure if you modify your guaranteed stop loss

Advantages & Disadvantages Of Guaranteed Stop Losses

Pros

- Easy to understand and use

- Limits losses in volatile markets

- Protects against slippage and gapping

- Beginner-friendly risk management tool

- There is a long list of UK-regulated brokers with stop loss orders

- The GSLO premium is normally only charged if the stop loss is triggered

Cons

- Brokers usually charge a fee, known as the GSLO premium

- In many cases, regular stop losses will suffice, which are also cheaper

How To Choose Brokers With Guaranteed Stop Losses

Whilst guaranteed stop loss orders are a useful risk management tool, they are not the only option or consideration when choosing an online brokerage. Also look at the following:

Trading Platform

One of the most important factors is the platform(s) a broker offers. This is the interface investors use to navigate the markets, manage their trades, and control their accounts. Some of the most popular options are MetaTrader 4 (MT4) and MetaTrader 5 (MT5), though many brokers with guaranteed stop loss orders also offer a proprietary terminal.

A useful tip is to open a free demo account to test a broker’s platform before committing capital. You can also use a paper trading profile to explore a firm’s suite of risk management alerts and tools.

Fees & Charges

Brokers will have different GSLO premium rates. The fee can vary depending on the market, for example, forex vs commodities vs cryptocurrencies.

When picking a broker with guaranteed stop loss. it’s also worth comparing any spreads, commissions, hedge and overnight fees. In addition, there may be bank deposit and withdrawal charges to factor in. Finally, some brokers offer premium analysis tools and pattern recognition technology in return for a fee.

Consider the full list of trading and non-trading fees to find the best low-cost provider.

Education & Research

For beginners, in particular, it can be worth signing up with a brokerage that offers a good selection of educational materials. Some firms offer dedicated training academies for novice investors. Topics can include how to use risk management tools, such as guaranteed stop loss orders, plus insights into specific markets.

Social trading tools can also be an effective way to learn from seasoned investors.

Assets & Products

Brokers with guaranteed stop loss orders offer access to different markets and products. Do you want to speculate on the LSE or FTSE? Perhaps you want to take positions on foreign stocks listed on the NYSE or NASDAQ? Some firms also specialise in forex trading, offering a long list of currency pairs with the GBP.

Note, most UK-regulated brokers cap leverage to 1:30 on derivatives like CFDs.

Bottom Line On Brokers With Guaranteed Stop Loss

Brokers with guaranteed stop loss offer a user-friendly risk management tool that can protect traders from large losses in highly volatile markets. A GSLO essentially protects against slippage, ensuring a trade will always be executed at the pre-determined price. Some platforms charge when you open a guaranteed stop loss order, but many brokers only charge if the GSLO is triggered. Use our guide above to add a guaranteed stop loss to your next trade.

See our list of the best UK brokers with guaranteed stop loss orders to start trading.

FAQs

What Is A Guaranteed Stop Loss?

A guaranteed stop loss order (GSLO) is a straightforward risk management tool that instructs a broker to automatically close a position at a specified price. It is used to protect against high volatility and gapping, where the price fluctuates significantly without stopping at a level in between. Guaranteed stop loss orders can be used on a range of markets, from forex to stocks, oil, gold and silver.

What Is The Difference Between A Guaranteed Stop Loss And A Regular Stop Loss?

Regular stop losses will close a position at the price level you have specified most of the time. However, during periods of high volatility, slippage can occur whereby the price moves between the time you request a trade and when the trade is executed, which can lead to larger losses. This can be mitigated by using a guaranteed stop loss. This will guarantee that the trade will be executed at the pre-determined price, regardless of any slippage. The caveat is that brokers with guaranteed stop losses usually charge a fee, known as a premium.

What Are GSLO Premium Rates?

The premium rate will determine the fee you pay to exercise a guaranteed stop loss. Brokers with guaranteed stop losses charge different fees, however, many platforms use the following formula: (premium rate x number of units).

What Is The Best Broker With Guaranteed Stop Loss Orders?

There is no universally “best” broker. Each brokerage is different, offering its own risk management tools, market access, spreads and commission, plus trading platforms and investing apps. With that said, we have compiled a list of the top UK brokers with guaranteed stop losses.

When Should I Use A Guaranteed Stop Loss?

Using a guaranteed stop loss too frequently can lead to large fees and a regular stop loss can work effectively in many cases. With that in mind, brokers with guaranteed stop losses are best used during periods of high volatility when slippage and gapping could occur. One example of this could be when prices shift between market close and market open over the weekend.