Best Professional Trading Accounts in the UK 2026

Professional trading accounts offer higher leverage with fewer regulatory protections for eligible investors. This guide explains how to become an elective professional client, in line with FCA requirements. We’ve also pinpointed the best pro trading accounts in the UK.

Top Brokers With Professional Trading Accounts

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Spreadex, regulated by the FCA, provides spread betting across 10,000+ CFD instruments, including 60 forex pairs. Traders have the option to engage in short-term positions on sporting events as well. With a history exceeding 20 years, the company has earned numerous accolades.

Instruments Regulator Platforms Forex, CFDs, Indices, Commodities, Stocks, Crypto, Bonds, Interest Rates, ETFs, Options, Spread Betting FCA Spreadex Platform, TradingView, AutoChartist Min. Deposit Min. Trade Leverage £0 £0.01 1:30 -

Founded in 2007, Axi is a forex and CFD broker operating under multiple regulations. Over the years, it has enhanced the trading experience by broadening its stock offerings, upgrading the Axi Academy, and launching a proprietary copy trading app.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1983, City Index is a prestigious broker, now under the Nasdaq-listed StoneX Group. It excels in forex, CFDs, and spread betting. With access to over 13,500 instruments, City Index provides a dynamic Web Trader platform, exceptional educational materials, and round-the-clock support five days a week, ensuring a thorough trading experience.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting FCA, ASIC, CySEC, MAS Web Trader, MT4, TradingView, TradingCentral Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Professional Trading Accounts in the UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Spreadex | ✔ | ✔ | ✘ | ✔ | |

| Axi | ✔ | ✔ | ✘ | ✔ | |

| City Index | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Professional Trading Accounts in the UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Spreadex | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| City Index | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Professional Trading Accounts in the UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| FXPro | iOS & Android | ✘ | ||

| Spreadex | iOS & Android | ✘ | ||

| Axi | iOS & Android | ✘ | ||

| City Index | iOS & Android | ✘ |

Beginners Comparison

Are the Best Professional Trading Accounts in the UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Spreadex | ✘ | £0 | £0.01 | ||

| Axi | ✔ | $0 | 0.01 Lots | ||

| City Index | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Professional Trading Accounts in the UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Spreadex | ✘ | ✔ | 1:30 | ✘ | ✘ | ✔ | ✔ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| City Index | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 | ✘ | ✔ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Professional Trading Accounts in the UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| FXPro | |||||||||

| Spreadex | |||||||||

| Axi | |||||||||

| City Index |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

Our Take On Spreadex

"Spreadex attracts UK traders keen on spread betting in financial markets and traditional sports wagers. It offers low fees for short trades, and spread bet profits are tax-free. With a robust charting platform and no minimum deposit, it's easy to begin."

Pros

- There are appealing new account promotions, such as double the odds and matched betting offers.

- Spreadex offers UK traders the chance to earn tax-free profits via spread betting.

- The broker provides a user-friendly custom charting platform and mobile application.

Cons

- Third-party e-wallets are not permitted.

- Limited customer support may lead to delays in resolving issues.

- There is no support for expert advisors or trading bots.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

Cons

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Even with the expansion of stock CFDs in the US, UK, and EU markets, its range still falls short compared to companies like BlackBull, which provide thousands of equities for varied trading opportunities.

Our Take On City Index

"City Index suits active traders perfectly, offering rapid execution speeds averaging 20ms and a customisable web platform with over 90 technical indicators. Its educational resources are exceptional. For UK traders interested in spread betting on 8,500+ instruments tax-free, City Index is an excellent option."

Pros

- City Index offers access to over 13,500 markets, including forex, indices, shares, commodities, bonds, ETFs, and interest rates. The platform's inclusion of niche markets such as interest rates provides traders with unique opportunities not commonly available on other platforms.

- City Index is under the regulation of leading authorities, such as the FCA in the UK, ASIC in Australia, and MAS in Singapore. Its parent company, StoneX Group Inc., is publicly listed, which enhances its credibility.

- City Index offers adaptable trading platforms suited to every expertise level. For newcomers, the Web Trader platform is straightforward and user-friendly. For more in-depth analysis and automated features, MetaTrader 4 (MT4) and TradingView are supported, providing a comprehensive trading experience for all traders.

Cons

- City Index does not offer an Islamic account with swap-free conditions, making it less attractive to Muslim traders than brokers such as Eightcap and Pepperstone.

- Unlike brokers like AvaTrade and BlackBull, City Index lacks options for passive trading, such as social copy trading or real ownership of stocks and ETFs. This limitation may reduce its appeal to traders seeking a more hands-off approach.

- Although many brokers, such as eToro, have broadened their crypto offerings, City Index restricts its clients to crypto CFDs. This limited selection may not meet the needs of traders seeking a wider variety of altcoins.

What Is A Professional Trading Account?

A professional trading account is offered to investors who meet certain requirements, including experience in the finance sector, a minimum portfolio size, and the placement of large trades in the last 12 months.

These profiles provide several advantages over standard trading accounts, from higher leverage and lower margin rates to competitive fees, dedicated account managers and support for out-of-hours trade execution.

However, a professional trading setup often lacks various protection measures, with no negative balance protection, limited money segregation requirements, and a greater assumption that clients will understand the risks associated with certain trading products.

Ultimately, professional trading accounts are only suitable for individuals with previous or current experience in financial services.

How To Get A Professional Trading Account

In the UK, the requirements for the professional trader designation are set by the Financial Conduct Authority (FCA).

Elective Professional Status

The elective professional trader status is obtained based on previous experience and available capital rather than formal trading certifications.

The FCA requires brokers to ensure elective professional clients meet at least two of the following definitions:

- Has placed 40 trades of significant size within the last year on relevant markets – ideally at an average frequency of 10 per quarter over the previous four quarters.

- Has a total cash and financial instruments portfolio of £500,000 or more – excluding company pensions, property and other non-financial investments.

- Has worked or currently works in the financial sector in a professional trading or associated role – with specific knowledge of the type of instruments available on the trading account.

Make An Application

If these conditions are met, you must put in writing your request to be treated as a professional client, giving evidence that the minimum requirements are met and stating your intentions to trade on specific markets, such as commodities or forex.

If this is satisfactory, the firm will reply to your written request with a full breakdown of the professional trading setup. The FCA requires this to include “a clear written warning of the protections and investor compensation rights the client may lose”.

The next correspondence from your side must be an acknowledgement of the implications and risks of losing such protections.

Open An Account

Once the legal and regulatory formalities are complete, finish any further verification and deposit funds into the account.

At this stage, a personal account manager may become involved, guiding you through the remainder of the process and helping you navigate your new broker.

Institutional Professional Status

Another way to gain a professional trading setup is to trade on behalf of a regulated or authorised entity. Qualifying companies include:

- Pension funds

- Local authorities

- Investment firms

- Insurance companies

- Commodity derivatives dealers

Hedge funds that meet capital requirements can also qualify as professional clients, as can local and regional banks.

This list is not exhaustive, and several other types of financial institutions meet the FCA criteria for per se professional clients.

Advantages Of Pro Trading Accounts

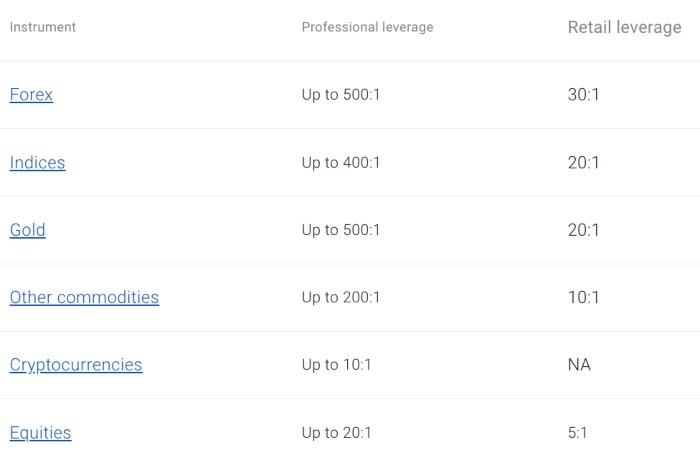

- Higher Leverage – The FCA caps the leverage available to regular traders at 1:30. However, professional clients can access higher leverage of up to 1:500.

- Exclusive Markets – Some markets, such as swaps or complex derivatives, may only be accessible to professional investors through select brokerages. Moreover, brokers that offer professional trading accounts may take bespoke trading requests on behalf of professional or institutional clients.

- Rebates & Lower Fees – One way brokers try to entice professional traders and their significant capital to their platforms is through lower fees and rebates. Some pro trading brokers may even offer zero fees for maker transactions.

- Bespoke Support – Many brokers offer personal account managers to help professional traders manage their profiles. These dedicated support staff are more knowledgeable and available than traditional customer service representatives and often proactively monitor accounts or pass on bespoke trades to a dealing desk.

Disadvantages Of Pro Trading Accounts

- Stringent Eligibility Criteria – Pro trading accounts are limited to those working on behalf of institutions or working in relevant jobs in the financial sector. There is no formal trading certification that allows investors to qualify for this type of account. In addition, there are significant capital requirements.

- Lack Of Protection – Several protections available to retail investors, such as negative balance protection and automatic stop-outs are not provided to professional clients. This makes trading with a professional account riskier.

How To Compare Brokers With Professional Trading Accounts

Instruments & Markets

Ensure that the brokerage offers the specific markets and instruments that you wish to trade, or has the ability to execute bespoke trades if that is a facility you require.

Note, specialised brokers may require prospective clients to have specific experience in their market to register for a pro trading account.

Trading Platforms

Professional traders may need multi-asset platforms with complex analysis tools, sophisticated order types, and support for deep market data.

Check if the broker supports your preferred platform, or offers API access so you can use your own trading programs and algorithms.

Leverage & Margin

In addition to offering high leverage, the best brokers with professional trading accounts offer low margin rates on products like CFDs and spread betting.

Pepperstone Professional Trader Leverage

Fees & Commissions

Professional traders may need to shop around to find the lowest fees and commissions. With high-volume and high-capital trades, finding the best deal can have a significant impact on profits. Some brokers also offer fee rebates.

Alternatively, see our list of professional trading accounts with competitive fees.

Further Considerations

Professional Trader Tax

Investors may want to consult with a qualified tax professional. Activity in a professional trading account may be classified as self-employed or business income.

This means that professional trader tax may be in line with regular income tax rather than speculative or capital gains tax.

Extended Hours

Professional traders may have access to after trading hours, depending on the broker and the market being traded.

This can provide additional opportunities for profits, but it also carries additional risks, such as increased volatility and lower liquidity.

Bottom Line On Professional Trading Accounts

While the hurdles to qualifying for a professional trading account in the UK are significant, benefits such as lower fees, higher leverage and extended trading hours are attractive. This said, professional trader status is not all positive, as investors may lose protections such as negative balance protection and automated stop-out levels.

See our ranking of the best pro trading accounts to find a suitable provider.

FAQ

What Is A Pro Trading Account?

A professional trading account is an account designed for experienced investors that have or currently work in professional trading jobs. It offers advantages such as higher leverage and lower fees compared to standard trading accounts. On the downside, elective professional status comes with fewer regulatory protections, including no negative balance protection.

What Are The Professional Trading Account Requirements In The UK?

For brokers and investors based in the UK, the FCA requires investors to have professional experience in a finance role (minimum one year), a significant existing portfolio of trading products (minimum £500,000), and a demonstrable record of high volume transactions in the last four quarters (minimum 10 per quarter).

Can A Person Have 2 Trading Accounts – Pro And Retail?

It is possible for an investor to have a combination of trading accounts, including both retail and professional trading setups. However, a professional trader using a retail account may still be liable for professional trader tax implications.