Tax On Investments In The UK

British investors need to understand the latest tax rules that govern different types of trading and investing activities in the UK. The contributions that are often payable to HM Revenue and Customs (HMRC) can take a large bite out of an investor’s returns.

This guide will unpack the different taxes that apply to various types of UK investments, from short-term trading products to longer-term investing vehicles. Our experts also explain how to reduce (or even eliminate) payments to the taxman through certain financial products.

Quick Introduction

- UK rules governing Income Tax and Capital Gains Tax can differ wildly across asset classes and investment horizons.

- Tax rules change regularly, so UK investors should keep up to date with developments from HMRC to maximise their returns.

- Tax-efficient Individual Savings Accounts (ISAs) and Self-Invested Personal Pensions (SIPPs) can reduce an individual’s tax liabilities, though these products limit how much you can invest and some come with withdrawal rules.

- The best brokers and trading platforms in the UK offer user-friendly tax reporting tools that make it straightforward to calculate how much you owe.

Best Brokers With Tax Reporting Tools

-

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Founded in 1989, CMC Markets is a reputable broker publicly listed on the London Stock Exchange. It holds authorisation from top-tier regulators such as the FCA, ASIC, and CIRO. The brokerage, which has received multiple awards, boasts a global membership exceeding one million traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA Web, MT4, TradingView Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Tax On Investments In The UK are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| CMC Markets | ✔ | ✔ | ✔ | ✔ |

Payments Comparison

Compare which popular payment methods the Tax On Investments In The UK support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| CMC Markets | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Tax On Investments In The UK at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| CMC Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Tax On Investments In The UK good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro | ✔ | $50 | $10 | ||

| CMC Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Tax On Investments In The UK offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| CMC Markets | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Tax On Investments In The UK.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| eToro | |||||||||

| CMC Markets |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- The entry requirements for eToro Club have been reduced. For $4.99 monthly, members enjoy 18 benefits, including a debit card that converts purchases into stocks with a 4% share return.

- There is an extensive online training academy offering a range of accessible resources, from concise articles to detailed courses.

- The web platform and mobile app receive higher user reviews and app rankings compared to leading competitors like AvaTrade.

Cons

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The only significant contact option, besides the in-platform live chat, is limited.

Our Take On CMC Markets

"Equipped with advanced charts and a broad array of tradable CFDs, including an unmatched selection of currencies and bespoke indices, CMC Markets offers an excellent online platform for traders at any level."

Pros

- The brokerage excels with an extensive array of valuable resources, such as pattern recognition scanners, webinars, tutorials, news feeds, and research from reputable sources like Morningstar.

- CMC Markets has introduced an AI News feature. This leverages AI to highlight and summarise market stories instead of executing trades, suggesting the future direction of broker research tools.

- CMC Markets is well-regulated by respected financial authorities, ensuring a secure and reliable trading environment. It upholds a strong reputation, providing traders with confidence.

Cons

- Trading stock CFDs comes with a relatively high commission, particularly when compared to low-cost brokers such as IC Markets.

- Although there have been improvements, the online platform still needs further refinement to match the user-friendly trading experience offered by competitors such as IG.

- CMC provides a robust range of assets; however, it does not support trading actual stocks, and UK clients are unable to trade cryptocurrencies.

Stocks

The returns that investors make on owning stocks can come in two forms: capital gains, where the value of a stock rises over time; and dividend income, where the business returns surplus cash via shareholder payouts.

Both of these forms of returns are taxed differently.

In the case of dividends, the taxman will treat these in the same way they would a salary. In other words, Income Tax is applied on any amount that:

- Exceeds a person’s Personal Allowance, and

- Falls outside an individual’s yearly Dividend Allowance

The annual dividend allowance has fallen sharply in recent years. It sat at £1,000 for the 2023/2024 tax year, before dropping to £500 in 2024/2025.

The amount of tax someone pays on their dividend income depends on what Income Tax band they fall within:

- 8.75% for basic rate taxpayers

- 33.75% for higher rate taxpayers

- 39.35% for additional rate taxpayers

Capital Gains Tax is applicable on any profits an investor makes by selling a share for more than they paid for it. However, individuals could enjoy an annual allowance of £6,000 before they had to start making tax payments in the 2023/2024 tax year. This fell to £3,000 in 2024/2025.

For those in the basic income tax band, Capital Gains Tax on profit that does not take the holder into a higher income tax bracket is charged at 10%. The rate moves to 20% if this higher tax bracket is breached.

Let’s say I’m an employed, basic-rate taxpayer who has made £450 in dividends and £7,000 in capital gains in the 2023/2024 tax year. Under the rules, I’ll pay nothing in Income Tax but £100 in Capital Gains Tax.

Bonds

Any gains that investors make by trading in bonds are subject to Capital Gains Tax. As with shares, dealers in these debt instruments can also make use of an annual capital gains allowance to reduce or eliminate any tax liabilities.

Bonds issued by the UK government, known as gilts, are not subject to Capital Gains Tax, however. Corporate bonds purchased directly from the issuer and issued in pounds are also exempt, provided that they are considered ‘qualifying corporate bonds’ by HMRC.

Income from bonds – including on gilts – is also subject to Income Tax, regardless of whether the security was bought directly from the issuer or through a bond fund. Again, an investor can use their Personal Allowance to reduce or remove any outstanding tax.

Contracts for Difference (CFDs) and Spread Bets

These financial derivatives function in a similar way, but they are treated very differently by HMRC, in part due to their short-term, speculative nature.

CFDs are classified as a financial instrument and, as a result, Capital Gains Tax is applied to profits made beyond the annual allowance. Any losses incurred by a trader can also be used to offset tax.

Spread betting is considered a form of gambling, meaning that Capital Gains Tax does not apply. However, any losses can also not be used to offset tax due from other sources of income.

Furthermore, if a spread better is deemed to be making a living from spread betting, Income Tax is due on any proceeds above the Personal Allowance.

Cash Savings

Many Brits turn to savings accounts in addition to traditional trading and investing products, especially when interest rates are favourable.

Most individuals have three allowances they can utilise before they have to pay any tax on cash savings. These are:

- The Personal Allowance

- The Starting Rate

- The Personal Savings Allowance

Individuals can earn interest tax-free if their Personal Allowance has not been used up on wages, pensions, or other sources of income. The size of the Personal Allowance is dependent upon which tax band they sit in (i.e. whether you are a basic, higher, or additional rate taxpayer).

UK citizens also get a Starting Rate of £5,000, although those who earn over £17,570 or more in other income are not eligible for this. For those who earn below this amount, every £1 of other income above their Personal Allowance reduces the savings starting rate by £1.

Finally, the Personal Savings Allowance allows someone to earn a certain amount of interest before tax is due. This stands at £1,000 for basic rate taxpayers, and £500 for higher rate taxpayers. Unfortunately, additional rate taxpayers receive zero tax relief.

Let’s say I’m a basic rate taxpayer who earned wages of £17,000 in the last tax year and savings interest of £300. My wages use up the first £12,570 of my Personal Allowance, while the remaining £4,430 reduces my savings starting rate by the same amount. This pulls my savings starting rate to £570, which means I do not need to pay tax on the £300 interest I earned.

Tax-Efficient ‘Wrappers’

In recent decades, UK governments have created and refined special tax ‘wrappers’ to encourage people to save and invest for retirement. These are known as the Individual Savings Account (ISA) and the Self-Invested Personal Pension (SIPP).

As their names imply, the ISA is designed to provide tax breaks on personal savings, while the SIPP provides a tax-efficient approach to pension saving.

ISAs

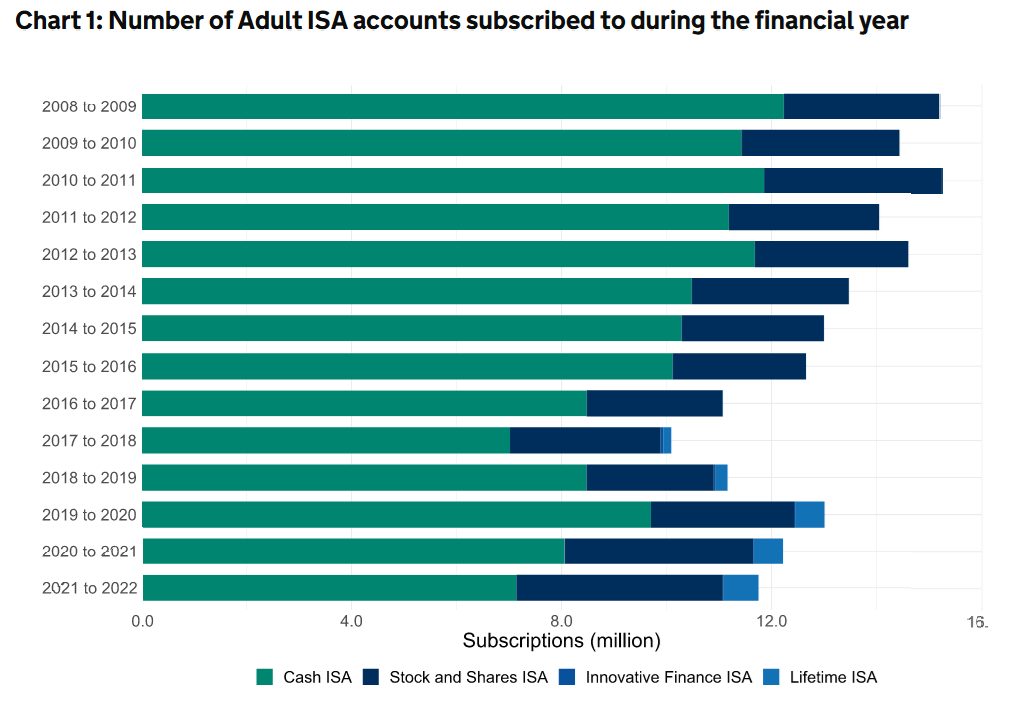

These hugely popular savings vehicles have been going strong since 1999. They allow individuals to save or invest up to £20,000 in each tax year – except for the Lifetime ISA – without having to pay a penny in Income Tax or Capital Gains Tax.

There is also no Inheritance Tax to pay on an ISA if the spouse or civil partner of the deceased is the beneficiary.

These products may not be suitable if you wish to make regular withdrawals. The general rule is that when you draw money from my ISA, you cannot replace it within the same tax year without using up more of my annual allowance.

Brits can split their annual allowance across a wide variety of different ISAs. These are:

Cash ISAs

These are cash savings accounts where interest is free from any tax liability. Some products may offer restrictions on withdrawals and investment rates. Investors can get better interest rates if they agree to lock their cash up for a fixed period.

Within this category, investors can also choose from a ‘flexible’ and ‘not flexible’ ISA. With flexible ISAs, any money withdrawn and returned in the same tax year does not count towards the £20,000 subscription limit. This can provide a huge advantage compared with other ISAs.

Stocks and Shares ISAs

These products are available for the over-18s and are used primarily by investors to buy British and international equities. However, they can also be used to purchase a wide range of securities including exchange-traded funds (ETFs), unit trusts, investment funds, and corporate and government bonds.

One downside to holding investments in a Stocks and Shares ISA is that, while profits are not taxed, any losses sustained on investments held within the ISA cannot be used to offset Capital Gains Tax due on non-ISA investments.

The UK government is currently exploring the introduction of a ‘British ISA.’ This will have an annual allowance of £25,000, and be intended for investment in domestic assets only.

Lifetime ISAs

These accounts can be used to hold the same assets as Cash ISAs and Stocks and Shares ISAs. The beauty here is that, for every £4 I invest, the government will add £1 to my pot.

Lifetime ISAs are designed to help people build a nest egg for retirement, or to buy their first home (subject to certain restrictions). They can only be opened by those who are aged between 18 and 40, and individuals can only pay into them up to the age of 50.

Critically, investors can only invest up to £4,000 in one of these ISAs each year. Furthermore, withdrawals made before the account holder hits 60 are subject to a 25% penalty, unless the drawdown is used to buy a first home or the holder is terminally ill. This can mean that an individual gets back less than they invested.

Let’s say I choose to draw down £10,000, a sum comprising £8,000 of my own money and £2,000 in government top-ups. In this case, I would only be reimbursed £7,500. This is because of a £2,500 penalty I’d be obligated to pay (£10,000 x 25%).

Innovative Finance ISAs

Rolled out in 2016, these are one of the more recent introductions to the ISA suite. They provide investors aged 18 and over with exposure to peer-to-peer lending and crowdfunding investments, and from April 2024 also allowed individuals to invest in Long-Term Asset Funds (LTAFs) and open-ended property funds.

Investing in IFISAs is chiefly suitable for experienced investors who are happy to accept high levels of risk for the potential of greater returns. Peer-to-peer financing can be a dicey endeavour, and several IFISA providers have collapsed in recent years, leaving investors out of pocket.

IFISA platforms are not covered by the Financial Services Compensation Scheme (FSCS), which covers the first £85,000 that an investor loses when a financial services provider goes bust.

Source: HM Revenue & Customs

Junior ISAs

The final type of ISA is designed for under 18s and allows children to save cash or invest in stocks and shares. Parents or guardians can open and then manage the account, but the money belongs to the child.

The child can take control of the account at the age of 16, but they cannot withdraw any funds until they reach 18. The annual allowance for Junior ISAs stands at £9,000.

SIPPs

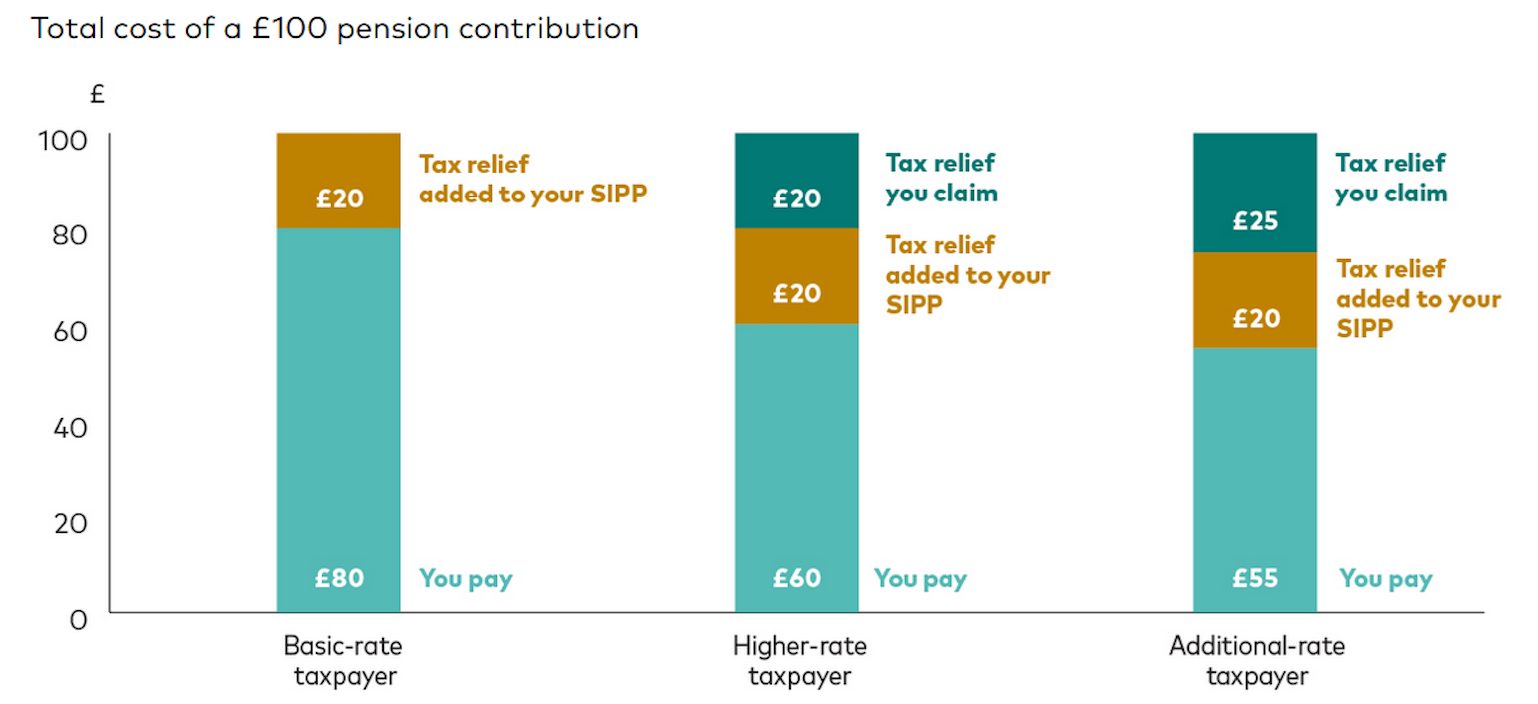

As with ISAs, SIPPs protect investors from having their capital gains and income eroded by the tax man. And just like the Lifetime ISA, investors get a 20p top-up from the government for every 80p they invest in one of these pension products.

SIPPs are especially popular with individuals who pay higher levels of tax. Higher-rate taxpayers get a 40% government top-up rather than the 20% described above. For additional rate taxpayers, the figure moves to 45%.

The 20% tax relief is paid straight into a person’s pension account weeks after they make their contribution. Higher and additional rate taxpayers will claim their extra 20% and 25% respectively through self-assessment. Tax relief rates for people in Scotland differ slightly.

Source: Vanguard

Let’s say I’m a higher-rate taxpayer who invests £8,000 in my SIPP over the tax year. At this level, the government will pay another £2,000 at source, and another £2,000 later on when I complete my self-assessment. This will give me total pot of £12,000 for the period.

SIPPs are also well-liked because of the wide range of investments that they can hold. Stocks, bonds, commodities, investment trusts, ETFs, and certain categories of property and land can all be bought with one of these tax wrappers. Alternatively, they can just be used to save cash.

Typically speaking, individuals can invest 100% of their gross earnings into one of these products each year, up to a maximum of £60,000. This annual limit pertains to all pensions an individual holds, however, and applies to their personal contributions as well as any that an employer or third party makes.

Those who are unemployed can also make SIPP contributions. These are subject to an upper limit of £3,600 a year, which includes 20% tax relief.

Individuals who have unused pension allowances in any of the previous three tax years can carry these forward into the current year. So for the 2023/2024 tax year, someone could potentially have invested a total of £180,000 (£60,000 for that year, and 3 x £40,000 for the prior three years when the annual allowance was lower).

Anyone under the age of 75 can invest in a SIPP. But unlike with an ISA, I’d have to wait until the age of 55 until I can draw down my money. This is due to rise to 57 in 2028.

As with Junior ISAs, parents can also open one of these products for their children.

Before investing in a SIPP, it’s important to consider whether you may need access to any funds before hitting this age milestone.

Unlike with ISAs, investors must pay the taxman when they make drawdowns from a SIPP. Typically speaking, only 25% of each cash withdrawal from one of these pensions will be tax-free. The rest is subject to tax.

If a SIPP holder dies before the age of 75, they can bequeath their assets to any beneficiary without having to pay Inheritance Tax. This is provided that any funds are transferred within two years of the holder’s death.

This differs from an ISA, where only a spouse or civil partner enjoys such tax relief. However, standard Inheritance Tax rules apply to the SIPP holdings of anyone who died after 75.

Bottom Line

The tax-sheltering qualities of ISAs and SIPPs mean that it often makes sense to put all eligible investments into these types of accounts, using as much of the annual allowance as possible.

There are some exceptions to this rule. Let’s say that I can get a better interest rate on a standard savings account than on a Cash ISA. I may be better off maxing out my Personal Savings Allowance (of £1,000 or £500) before turning to that Cash ISA.

As I’ve discovered myself, it may be a good idea to consult a financial advisor to formulate the most cost-effective way to make your money work for you based on your personal circumstances.

Article Sources

Individual Savings Accounts (ISA) – GOV.UK

Individual Savings Accounts (ISAs) – Low Incomes Tax Reform Group

Autumn Statement 2023 – HM Treasury

Junior Individual Savings Accounts (ISA) – GOV.UK

Commentary for Annual savings statistics: June 2023 – HM Revenue & Customs

SIPP allowances and pension tax-relief explained – Vanguard

Tax relief on pension contributions – Scottish Public Pensions Agency

Tax on savings interest – GOV.UK

Income Tax rates and Personal Allowances – GOV.UK

Capital gains tax on bonds – interactive investor

Capital Gains Manual – HM Revenue and Customs

How are spread bets and CFDs taxed in the UK? – IG Group