Best Brokers For Under 18s

As the rise of ‘finfluencers’ grows on social media like TikTok, more under-18s are interested in investing. Many parents also aim to secure their children’s financial future by setting up investment accounts on their behalf. Yet with traditional trading accounts unavailable to minors, Junior Individual Savings Accounts are often the choice vehicle.

Discover the best brokers for under 18s. Every platform has been personally tested by our experts and provides legitimate ways to get involved in the financial markets for young investors.

Investing is high-risk. Under 18s should only use regulated investment products with adequate supervision. Pursuing financial education and consulting an investment advisor is recommended.

Best Brokers With Investment Products For Minors

-

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50

Safety Comparison

Compare how safe the Best Brokers For Under 18s are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers For Under 18s support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers For Under 18s at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ |

Beginners Comparison

Are the Best Brokers For Under 18s good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 |

Advanced Trading Comparison

Do the Best Brokers For Under 18s offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers For Under 18s.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers |

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

How We Chose The Best Brokers

To create our list of the best trading platforms for under-18s, we:

- Leveraged our database of around 300 brokers accepting UK clients

- Pinpointed those with Junior Individual Savings Accounts (JISAs)

- Ranked them by their rating, blending hard data with our testing observations

What To Consider When Selecting A Broker For Under-18s

Look For Tailored Investment Vehicles

Peer-generated investment advice often recommends that under-18s start trading by opening accounts under their parents’ names. However, this loophole in the system encourages a risky start to the investment journey.

Instead, we recommend selecting a broker that offers investment vehicles specifically designed for under-18s, where the beneficiaries of the investments are children themselves.

In the UK, this typically means a Junior ISA (Individual Savings Accounts).

Junior ISAs are tax-free vehicles, i.e. you do not pay tax on returns. Parents can invest up to £9,000 per year into a stocks and shares or cash account. The child can control the account from the age of 16 and can withdraw from the age of 18.

Look For A Range Of Investment Opportunities

You may be looking for wide exposure to financial markets, ensuring diverse opportunities. That’s why we’ve selected brokers that offer Stocks and Share JISAs, not just cash JISAs.

Our recommended brokers offer a range of ETFs, funds and investment trusts, ideally with a comparable range to adult ISAs.

- Interactive Investor offers its extensive range of over 40,000 investments to JISA clients, including their curated lists of ‘Quick Start Funds’, selected in partnership with MorningStar, for their low fees, plus the II Super 60 and ACE 40 lists, chosen using ii’s in-house methodology.

- Interactive Brokers’ JISA also allows you to invest in a slightly reduced list of ‘qualifying investments’ including shares, securities issued by companies, recognised UCITS, and depositories. Whilst this does not mirror the adult investment opportunities, IBKR has one of the most extensive ranges of assets I’ve seen in the industry.

In contrast, Vanguard did not make our list, as it offers only 86 Vanguard-owned funds, of which only 13 are UK-focused, potentially making it less attractive to British investors.

Look For Trusted Brokers

Only invest through trusted brokers, with the best sign that a firm can be trusted being a license from the Financial Conduct Authority (FCA).

The FCA helps protect retail investors from harm, with safeguards like compensation under the Financial Services Compensation Scheme (FSCS) which means that should your brokerage go into liquidation, your investments are protected up to a value of £85,000.

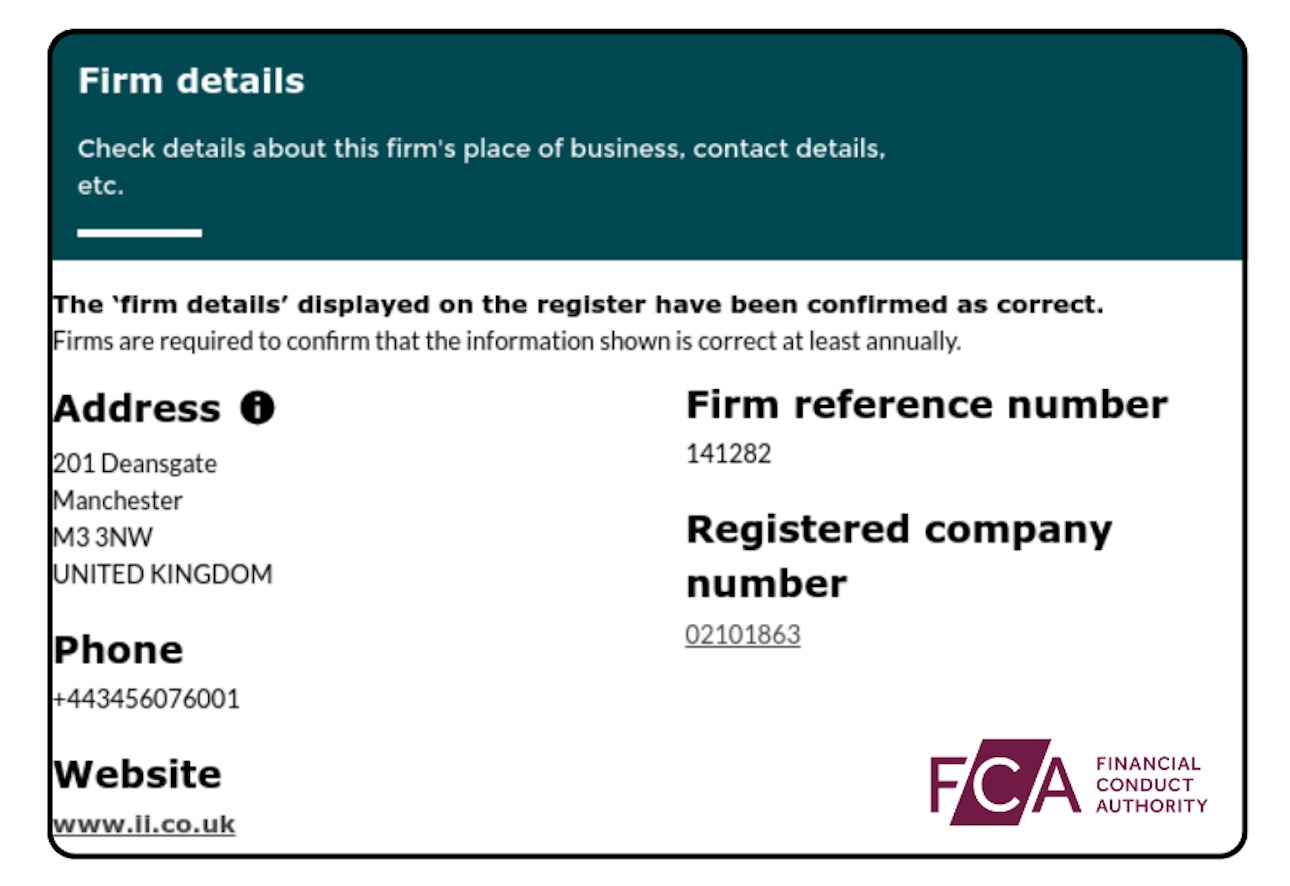

For each broker recommended, we confirmed they are an authorised financial services provider on the FCA’s Financial Services Register. For example, you can see Interactive Investor’s details below.

Interactive Investor – FCA License

We also consider the length of service as a key metric for trustworthiness, with established companies more likely to be well-run with a good reputation.

- Interactive Investor is a Manchester-based broker with almost 30 years in the industry and a stellar reputation.

- Interactive Brokers (IBKR) is US-based with over 45 years in the industry and the confidence of our experts.

Look For Resources For Kids To Learn About Investing

The best brokers for under 18s provide educational resources to support the investment journey. Our recommended brokers cater to teen learning, rather than those just helping parents understand the JISA vehicle.

- Interactive Investor has a wealth of knowledge designed specifically for helping under-18s learn about investing. I’ve been particularly impressed with its section of their Knowledge Centre called ‘Finance for Kids’ with articles such as ‘How To Teach Your Bored Teenager About Investing’ covering topics within the teen-o-sphere such as Tiktok finfluencer’s motivations and the infamous Dogecoin, plus ‘Three investment Ideas For Junior ISAs’.

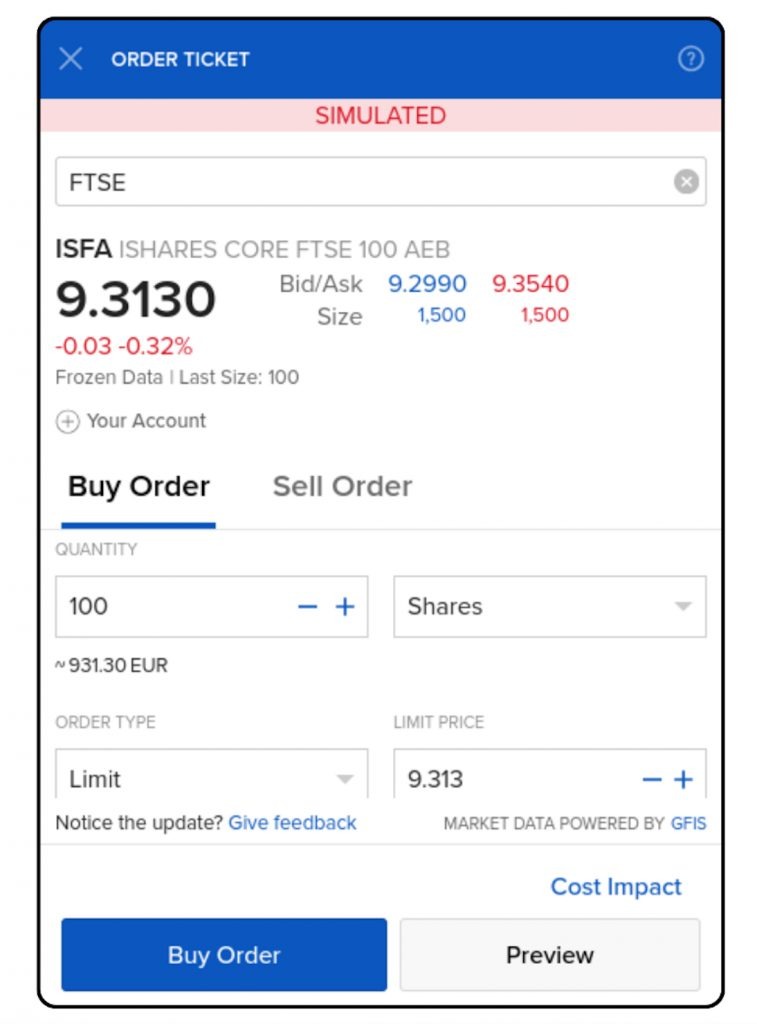

- Interactive Brokers goes even further, allowing teens to open a ‘Paper Trading’ account via their Student Trading Lab. Young investors can start trading with virtual money on their Trader Work Station (TWS) and mobile app. I’ve used this and it can teach you about a wide variety of assets and strategies, including those not available within the JISA.

On the other end of the scale, alternative JISA provider Fidelity, offers nothing in the way of teen-focused financial literacy or education – a missed opportunity.

IBKR – Student Trading Lab

Look For A Simple Pricing Structure

Select a low-cost broker with a simple fee structure. A straightforward JISA charging model allows 16-year-olds (who at that point can control their JISAs themselves) to start managing their finances.

- Interactive Investor does just that. It charges a monthly fee for their JISA of £11.99 for their Investor Plan which allows free regular investing plus one extra trade per month. As many children as needed can be added to this plan. Alternatively, there’s the Super Investment Plan which allows two free extra trades per month and costs £19.99. Extra trades are charged at £3.99.

- Interactive Brokers is also low-cost. There is a £1 minimum activity fee and you’ll receive one free withdrawal per month after which they’ll be charged at £7 per withdrawal. However, IBKR charges a commission on the purchase of shares. This is a trickier structure to grapple with, as shares and ETFs are charged differently, and depend on the volume of shares traded, plus whether they’re a fixed or tiered charging model. If parents are trying to allow kids to learn about investing, this complex fee structure may feel overwhelming.

Look For An Accessible Minimum Investment

Brokers usually require a minimum deposit and/or investment for both one-off and regular payments. It’s important to consider if this suits your planned investment schedule and budget.

- Interactive Investor allows free regular deposits starting at just £25 per month.

- Interactive Brokers allows subscription investing as low as £1 per month.

Some competitors that didn’t make our list include Charles Stanley and Vanguard which require a steeper minimum of £50 and £100 per month respectively.

FAQ

Which Is The Best UK Broker For Minors?

Interactive Investor is our highest-rated UK broker with investment products for minors following testing.

Its Junior Individual Savings Account (ISA) account provides access to a staggering 40,000 markets, there are flexible pricing plans, it’s FCA-regulated, and it has one of the slickest apps I’ve used.

Can Under-18s Invest In The Stock Market?

Under 18s are not permitted to hold stocks and shares in the UK. However, they can invest in the stock market via a Junior ISA, an investment vehicle opened by parents that allows up to £9k per year to be invested in cash, or stocks and shares.

At 18, the ownership of the fund transfers to the child, and they are permitted to continue investing themselves, or withdraw.

What Is The Minimum Investment For A Junior ISA?

The minimum monthly deposit varies by broker. Interactive Brokers, for example, requires a monthly subscription of just £1. However, Vanguard requires a £100 minimum, which may not be achievable for some budget investors.

It’s important to consider your planned deposit schedule when picking a broker.

Article Sources

Financial Conduct Authority (FCA)