Brokers With Trailing Stop Loss

Brokers with trailing stop loss help investors take advantage of an asset’s growth while still providing a safety net in the case of a trade not working out. Alongside the take profit order, trailing stop loss orders are one of the most popular methods of managing risk.

This guide to trading with trailing stop losses will explain how they work, their pros and cons, plus how to set up a trailing stop loss order. We also list top UK brokers with trailing stop loss.

Brokers With Trailing Stop Loss

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Tickmill is a worldwide broker regulated by respected authorities like CySEC and FCA. It has attracted hundreds of thousands of traders, executing over 530 million trades. Its edge lies in sophisticated tools, informative resources, and competitive fees.

Instruments Regulator Platforms Forex, CFDs, stocks, indices, commodities, cryptocurrencies, futures, options, bonds FCA, CySEC, FSA, DFSA, FSCA Tickmill Webtrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:1000 -

Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro)

Safety Comparison

Compare how safe the Brokers With Trailing Stop Loss are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Tickmill | ✔ | ✘ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Brokers With Trailing Stop Loss support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Tickmill | ✔ | ✘ | ✘ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Brokers With Trailing Stop Loss at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Tickmill | ✔ | ✘ | ||

| FXPro | iOS & Android | ✘ |

Beginners Comparison

Are the Brokers With Trailing Stop Loss good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Tickmill | ✔ | $100 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Brokers With Trailing Stop Loss offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Tickmill | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✘ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Brokers With Trailing Stop Loss.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Forex.com | |||||||||

| Vantage FX | |||||||||

| Tickmill | |||||||||

| FXPro |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- The trading firm provides narrow spreads and a clear pricing structure.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- The broker recently expanded its range of CFDs, offering more trading opportunities.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- Vantage has enhanced its trading tools for experienced traders, introducing AutoFibo EA to pinpoint potential market reversals.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On Tickmill

"Tickmill stands out for traders, particularly with the Raw account, offering nearly no pip spreads and exceptionally swift order execution."

Pros

- Drawing from our trading experience, Tickmill consistently executes orders rapidly—averaging around 59 milliseconds—with minimal slippage or requotes. This reliability ensures traders can trust their entry and exit prices without delay, safeguarding against potential costs in fast markets.

- Tickmill holds licences from regulators such as the FCA and CySEC, ensuring tangible advantages. Client funds are segregated in secure accounts, and negative balance protection is in place. This guarantees you won't owe more than your deposit, offering reassurance during market fluctuations.

- With the Raw Spread account, spreads are remarkably tight, occasionally reaching zero pips, complemented by a clear per-trade commission. This arrangement minimises trading costs, offering a crucial benefit for frequent trades and eliminating hidden fees that erode profits.

Cons

- If you prefer cTrader's interface and advanced order options, you won't find them here. Tickmill utilises MetaTrader 4 and 5, TradingView, and its own platform but lacks cTrader. This may hinder those who depend on cTrader's features or tools like cTrader Copy.

- Tickmill's demo accounts exclude certain platforms, including its proprietary one, complicating strategy practice. This limitation poses challenges for testing skills comprehensively, particularly with newer Tickmill tools, before engaging in live trading.

- Tickmill targets forex pairs, select stock CFDs, indices, and limited commodities. If you prefer trading across diverse asset classes like cryptocurrencies or a wider array of stocks, options here are restricted versus brokers offering thousands of instruments.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

Cons

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

What Is A Trailing Stop Loss?

A stop loss order is a risk management tool that helps to limit the total loss and therefore risk associated with a trade. It is an automated order that triggers the closing of a contract when an asset’s value reaches a certain amount. This amount is called the stop price.

A trailing stop loss is a type of stop loss order that allows the stop price to change so that investors can secure profits if the market moves in their favour. For instance, if you open a long CFD trade and the asset increases in value immediately after you open the contract, the stop price will follow the increase. If the asset then declines in value and hits the trailing stop price, the investor will have secured a greater return than if they had used a normal stop loss order.

Brokers with trailing stop loss allow their clients to determine the trailing distance either using a percentage or a fixed amount. For example, the trailing stop loss could be 10% away from the market price or £10 away.

How Does It Work?

Let’s look at an example of how a trailing stop loss could work…

The current value of Barclays stock listed on the London Stock Exchange is 161 GBP. Let’s say you open a buy contract with a trailing stop loss at a 5% decrease, which at open is 152.95 GBP. After the contract opening, BARC.L initially increased to 173 GBP but is now worth 140 GBP.

If you had used a normal stop loss order, you would have made a loss of 8.05 GBP (161 GBP – 152.95 GBP). However, with

a trailing stop loss, the stop price would have increased to 164.35 GBP (173 GBP x .95) following the initial market growth. Meaning when the stock price declined again, the new limit would be triggered and you would return a profit of 3.35 GBP (161 GBP – 164.35 GBP).

In this example, the profit and loss in each instance are not large but they show how a trailing stop loss can be beneficial, especially compared to normal stop loss orders.

Pros Of Brokers With Trailing Stop Losses

Brokers with trailing stop loss orders can help limit your risk exposure, especially when trading on margin with products such as CFDs. Leverage increases your trade size meaning any profits and losses are multiplied. If 1:10 leverage had been used in the example above, the returns would be 33.5 GBP (10 x 3.35 GBP), rather than 3.35 GBP.

Incorporating a trailing stop loss order essentially helps to protect you against large losses on leveraged trades, while providing the flexibility to generate returns if the market moves in your favour.

Additional Risk Management Measures

Brokers with trailing stop loss usually also offer other orders such as take profit. A take profit order works in a similar way to a stop loss such that when an asset’s value reaches a certain price, the contract is automatically closed. These can be used alongside trailing stop loss orders to help secure profit from a winning position.

In the Barclays stock example above, if a take profit order had been placed at 170 GBP, the position would have been closed on the initial rise and a 9 GBP profit would have been returned (170 GBP – 161 GBP).

You can also use risk management techniques such as the 1% rule and portfolio diversification. The 1% rule says that you should only invest 1% of your total capital on a single trade so that an individual loss is not too damaging.

Diversifying your portfolio means spreading your money across several investments and assets. Doing this will mean there will be less impact on your entire portfolio if one or two trades go wrong.

Both of these strategies can mean that huge profits in a short space of time are less likely, but long-term, more consistent success is possible with reduced risk exposure.

For more tips on risk management techniques, check out our guide.

How To Set Up A Trailing Stop Loss Order

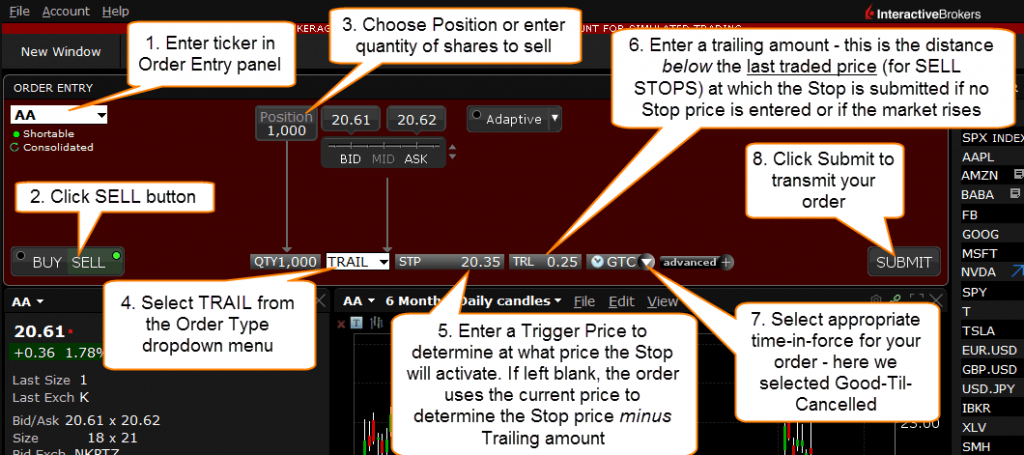

It is an easy process to add a trailing stop loss to your trade. This step-by-step guide is for Interactive Brokers but other trading platforms with trailing stop loss orders follow a similar method either through a mobile app or desktop terminal.

- Log in to your account and open the trading platform

- Select the asset you want to trade from the drop-down menu and create your order

- Select ‘TRAIL’ from the order type menu

- Input the amount or percentage for the trailing stop loss order. Note that this is the most recent traded value minus the amount or percentage

- Select the time limit for the trail order. If you wanted, you can enable the trailing stop loss order to apply for only a few hours

- Confirm the order

Using trailing stop loss orders on Interactive Brokers

Trailing Stop Loss Tips

When using brokers with trailing stop loss, you need to plan out where the initial stop price should be. To do this, consider both daily and longer-term volatility. If you put the stop price really close then the stop loss order could be triggered too early due to typical hourly fluctuations. If you put the stop price too far away then the stop order may not be triggered until you have incurred a large loss.

Additionally, you should not just open a trade with a trailing stop loss order and ignore it until the contract closes. You need to monitor the trade to check the asset’s performance as the market could see growth and you could reset the stop price even higher, or vice versa for a short position. It may be worthwhile setting up a notification algorithm such that you receive an alert if the asset’s value reaches a certain amount, prompting a stop price change.

Implementing trailing stop loss orders can be difficult as it requires market knowledge to recognise what the best starting stop prices are. An ideal way to get experience is through a demo account. Many brokers with trailing stop loss allow their customers to register for a paper trading account where they can invest simulated funds in a risk-free environment.

Once you have gained enough experience with trailing stop loss orders and other risk management techniques, you can move on to live trading.

Comparing Brokers With Trailing Stop Loss

To help you choose the best brokers with trailing stop loss, consider the following factors:

Trading Platform

The trading platform that brokers with trailing stop loss use will have a large impact on your trading experience. You will use these platforms to execute trades, monitor positions and complete any technical analysis, so it is important to find a high-quality platform.

Some brokers such as Admiral Markets use the world-leading MetaTrader4 (MT4) and MetaTrader 5 (MT5) platforms. Others, such as eToro, provide proprietary platforms.

Regulation

Trade with a broker licensed by the Financial Conduct Authority (FCA). As the UK’s financial regulatory authority, it mandates that licensed brokers must guarantee negative balance protection for all retail clients. This acts akin to a stop loss order so that you will never make a loss in excess of what you have deposited into your brokerage account.

Pricing

Reliable brokers with trailing stop loss will be clear about their prices including spreads, account subscription charges, deposit and withdrawal fees, and any trading commissions.

Keep in mind that any fees will eat away at your profits, so try to find competitively priced brokers that still offer a good service.

Often, if brokers advertise themselves as “free” or there is no trading commission, the quoted spreads will be wider than average.

Ratings & Reviews

You can read customer reviews and ratings to get an idea of how good or bad a broker with trailing stop loss is. This is how you can find out if the broker charges hidden fees or if there are frequent reliability and outage issues.

Reviews can be found on websites and trading forums such as Reddit, Facebook, Discord and Quora. Alternatively, we have reviewed and compared the top brokers with stop loss orders here.

Deposits & Withdrawals

The best brokers will have several options for transferring capital between your bank and trading accounts. Look for methods such as debit/credit cards and e-payments such as PayPal and Neteller.

Also, if you are new to trading, choose a platform with low or no minimum deposit and withdrawal requirements. For example, Pepperstone imposes no minimum deposit or withdrawal limit, making it one of the more affordable brokers with trailing stops.

Customer Support

Choose a broker with trailing stop loss orders that is contactable throughout the week with fast responses. For example, via live chat on the website, over the phone or through email.

Note that if your trailing stop loss did not work, it may be due to orders not processing after hours. Charles Schwab, for example, does not process stop loss orders during pre-market or post-market trading.

Bottom Line On Brokers With Trailing Stop Losses

So, is using trailing stop loss a good idea? It certainly can be. Trailing stop loss and take profit orders can help lock in profits while providing a flexible risk management tool that tracks your position when the market moves in your favour.

Use this guide to set up a trailing stop loss. And see our list of the best brokers with stop losses to find the right platform.

FAQs

Should I Use A Stop Loss Or Trailing Stop Loss Order?

Both stop loss and trailing stop loss orders are viable ways of reducing your risk exposure. A normal stop loss order is easier to understand and implement, however, a trailing stop loss offers the benefit of following positive market movements. To help you determine which is better out of the stop loss and trailing stop loss, you can practise with a paper trading account.

Is It A Good Or Bad Idea To Use Brokers With Trailing Stop Loss?

It can be an excellent idea to use brokers with trailing stop loss orders. It can be difficult to figure out how to best set up a trailing stop loss order but once you have learned how to identify the right initial stop price, it is an invaluable risk management tool.

What Are The Best Strategies To Use With Brokers With Trailing Stop?

When day trading with brokers with trailing stop losses, there are several strategies you can adopt. For example, a hedge, arbitrage or scalping strategy are all viable options. It is hard to say which of these is the best as that is dependent upon a trader’s financial goals and trading styles. A good idea would be to register a demo account and try out different strategies until you find a system you are comfortable with.

Will Using Brokers With Trailing Stop Loss Remove Risk Altogether?

No – because all trades carry a degree of risk. Using a broker with trailing stop losses may reduce your exposure, but you can still lose money. With that in mind, only risk what you can afford to lose.

Where Can I Learn More About Brokers With Trailing Stops?

Many of the best brokers have education sections with FAQs for beginners where you can have definitions and trading concepts explained. Brokers with trailing stop loss orders also often provide step-by-step videos to guide you through deciding how to execute a trade with a stop loss and how long a stop loss needs to last.