Top UK Brokers With The Most Clients 2026

Brokers with the most clients are generally considered the most reputable and reliable, as proven by their large, longstanding user base. We’ve rounded up the UK brokers with the most traders – all tested and rated by our experienced traders.

Top UK Brokers With The Most Traders

-

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Number of clients: 38,000,000

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Founded in 2008 and based in Israel, Plus500 is a leading brokerage with over 25 million registered traders across more than 50 countries. It focuses on CFD trading, offering a user-friendly proprietary platform and mobile app. The company provides competitive spreads and does not impose commissions or charges for deposits or withdrawals. Plus500 stands out as a highly trusted broker, licensed by respected authorities such as the FCA, ASIC, and CySEC.

Number of clients: 32,000,000

Instruments Regulator Platforms CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA WebTrader, App Min. Deposit Min. Trade Leverage $100 Variable Yes -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Number of clients: 5,000,000

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30 -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Number of clients: 3,500,000

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

IronFX, established in 2010, is a highly regulated broker specialising in forex and CFDs. This acclaimed company provides access to over 500 markets for more than 1.5 million clients in 180 countries. Traders benefit from multiple account options with competitive rates via the MT4 platform, alongside 24/5 customer support available in 30 languages.

Number of clients: 1,500,000

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Number of clients: 1,000,000

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 2005, FXOpen is a well-regulated broker that has drawn over one million traders. Tailored for active trading, it offers a diverse range of over 700 markets. The platform facilitates high-frequency trading, scalping, and various algorithmic strategies through the use of expert advisors (EAs).

Number of clients: 1,000,000

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto, ETFs FCA, CySEC, FC TickTrader, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (EU, UK), 1:1000 (Global)

Safety Comparison

Compare how safe the Top UK Brokers With The Most Clients 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Plus500 | ✔ | ✔ | ✔ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| IronFX | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXOpen | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Top UK Brokers With The Most Clients 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Plus500 | ✔ | ✔ | ✔ | ✘ | ✔ | ✔ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXOpen | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Top UK Brokers With The Most Clients 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| eToro | iOS & Android | ✘ | ||

| Plus500 | iOS, Android & Windows | ✘ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| IronFX | Android, iOS, WebTrader | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXOpen | iOS & Android | ✘ |

Beginners Comparison

Are the Top UK Brokers With The Most Clients 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| eToro | ✔ | $50 | $10 | ||

| Plus500 | ✔ | $100 | Variable | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| IronFX | ✔ | $100 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXOpen | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Top UK Brokers With The Most Clients 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Plus500 | ✘ | ✘ | ✔ | ✘ | ✔ | ✘ | ✘ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXOpen | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (EU, UK), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Top UK Brokers With The Most Clients 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| eToro | |||||||||

| Plus500 | |||||||||

| Vantage FX | |||||||||

| Interactive Brokers | |||||||||

| IronFX | |||||||||

| XTB | |||||||||

| FXOpen |

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- There is an extensive online training academy offering a range of accessible resources, from concise articles to detailed courses.

- In 2025, eToro enhanced its trading experience by incorporating insights from over 10 million Stocktwits users, enabling better assessment of market sentiment.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On Plus500

"Plus500 provides a seamless experience for traders with its CFD platform, featuring a sleek design and interactive charting. However, its research tools are basic, fees are higher than the most economical brokers, and its educational resources could be improved."

Pros

- The customer support team consistently delivers reliable support around the clock through email, live chat, and WhatsApp.

- Plus500 has expanded its range of short-term trading instruments by adding VIX options, which feature increased volatility. Additionally, it has extended trading hours for seven stock CFDs.

- The broker provides low-commission trading across varied markets, reducing extra fees and attracting seasoned traders.

Cons

- Plus500's omission of MetaTrader and cTrader charting tools may deter seasoned traders seeking familiar platforms.

- Algorithmic trading and scalping are not available, potentially deterring certain traders.

- Educational resources are not as extensive as leading brokers such as eToro, which affects beginners' ability to learn quickly.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

Cons

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- Traders gain access to the renowned Trading Central research tool, featuring automated AI analytics and round-the-clock support.

- IronFX is a well-established firm regulated by respected authorities such as the CySEC, FCA, and FSCA.

- IronFX offers both fixed and floating spread accounts, appealing to novices and seasoned traders alike.

Cons

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

Cons

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On FXOpen

"FXOpen is perfect for high-volume traders, providing swift execution via its ECN system, spreads starting at 0 pips, and reduced commissions as low as $1.50 per lot."

Pros

- FXOpen significantly cut FX spreads by over 40% in 2022. In 2023, they launched commission-free index trading. These changes make trading more economical for traders.

- FXOpen integrated TradingView in 2022 and enhanced its TickTrader platform in 2024. This upgrade delivers Level 2 pricing, over 1,200 trading instruments, and sophisticated order options. The platform appeals to both seasoned and high-frequency traders.

- In 2024, FXOpen simplified its account options. Traders now benefit from ECN accounts with raw spreads starting at 0.0 pips. The platform offers rapid execution and reduced commissions for those with high trading volumes, enhancing user experience.

Cons

- Even with an expanded asset portfolio, FXOpen provides a more limited selection of global stocks, commodities, and cryptocurrencies compared to the leading firm BlackBull. This results in fewer diverse trading opportunities for traders.

- Though FXOpen remains a trusted broker with authorizations from the FCA and CySEC, it lost its ASIC license in 2024 due to 'serious concerns.' Consequently, it no longer accepts traders from Australia.

- FXOpen's educational resources are quite limited, with a scarcity of courses and webinars commonly available at brokers such as IG. This deficiency may deter novice traders looking to enhance their understanding.

How Investing.co.uk Chose The Brokers With The Most Clients

We research and frequently monitor the client numbers of important brokers in the UK to maintain an up-to-date list of the most popular firms.

To ensure our data is fresh and accurate, our experts:

- Investigate and review the number of clients of each broker where possible as part of our review process

- Check publicly available data

- Contact brokerage firms directly to verify figures

Why Size Isn’t Everything

The brokers on our list serve huge numbers of clients, but that’s an effect rather than the cause of their success. These firms do so well because they get these fundamental factors right:

Regulation

Most investors prefer to work with a broker that’s overseen by a strong regulatory body like the UK’s Financial Conduct Authority (FCA) and we suggest you to do the same.

The FCA imposes strict conditions on firms to obtain a license, and they require frequent financial submissions to ensure continued compliance.

Clients of FCA-regulated firms can be assured that their funds will be held separately from business accounts and that they will not lose more than their account balance in bad trades, among other protections.

Up to £85,000 of their funds will also be insured against business insolvency in the Financial Services Compensation Scheme.

Track Record

Trading with a broker that has a long and clean track record in the industry provides assurance that your funds are in safe hands.

Another benefit is that established firms have experience in the industry and need to know what traders want in order to stay competitive, so they often provide a more enjoyable trading experience with competitive pricing and attractive features.

Stock Exchange Listing

Choose a broker that’s listed on a major stock exchange and you’ll have the added assurance that this firm runs its business transparently with frequent financial reports.

For example, companies that are listed on the London Stock Exchange must first meet the exchange’s stringent inclusion criteria and then must comply with regulatory rules and undergo monitoring.

Tools & Features

Brokers that serve large customer bases usually have the resources to provide extra tools and features, so you should be able to find a broker that caters to your own investing style.

Some of our favourites include integrated research tools, auto-trading, social trading and sentiment analysis.

I’ve come to appreciate social trading as a very useful feature, especially for newer traders. Apart from the popularity of copy trading, social investing also allows you to read experienced traders’ ideas and to engage in discussions.While it’s important to do your own research and not to blindly trust other people’s analysis, this can be a really useful way to learn about markets and to find out what is trending.

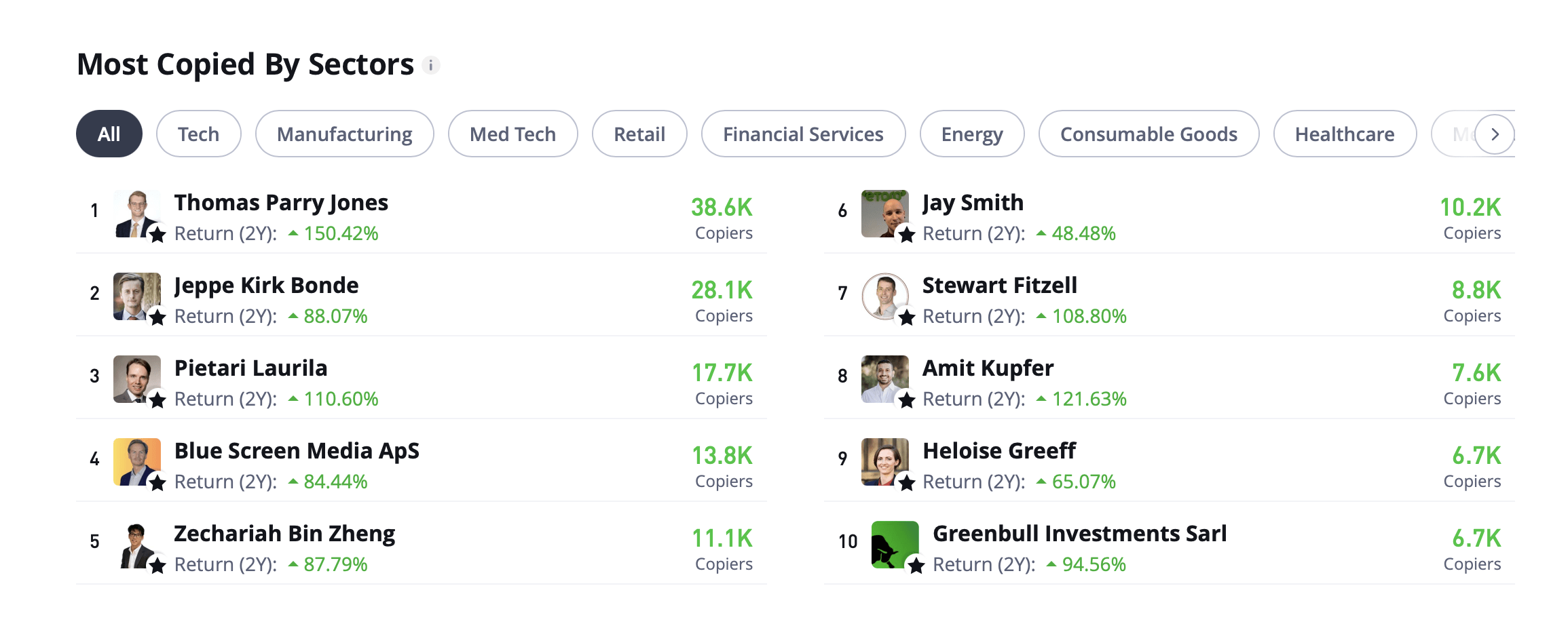

eToro’s copy trading platform

Pros Of Trading With Large Brokers

- Reputation – If someone does a job well, you are more likely to recommend them to a friend. The same goes for trading brokers. Often, a firm’s client base has, to some extent, been built by happy customers recommending the broker to their peers.

- Regulation – Normally, the UK brokers with the most clients are regulated by the FCA from our research. We recommend opting for a regulated brokerage where possible as they generally provide clients with a greater degree of protection than their unregulated counterparts.

- Professionalism – Larger trading brokers tend to have more established processes and ways of interacting with clients. They are more likely to have a reliable customer support team, a complaints management process and experienced staff. All of these are factors that contribute to a more professional client experience.

- Flexibility – We have seen some of the most flexible accounts, fee structures and payment methods offered by some of the largest brokers. These firms have the resources and know-how to integrate additional flexibility into their platforms and apps, catering to a wide range of trading styles and needs.

Bottom Line

UK investors have several good options when looking at brokers with a large client base. Our team have found that some of the biggest brokers offer a premium, reliable and secure trading experience, while being able to cater to a range of trading strategies, interests and experience levels.

It is worth noting, however, that the size of a broker’s client base is not the only factor to consider when choosing a brand. Platforms, tools, instruments, fee structure, regulation and security should not be overlooked. Ultimately though, size can often be a good indication of reputation.

To get started, jump to our list of the biggest trading brokers.

FAQ

Are Brokers With More Clients Better?

Brokers with the most clients are not necessarily better than those with fewer active users. However, a large client base tends to be an indication that a broker is trustworthy.

There are, of course, other factors to consider when choosing a brokerage, including UK regulations, platforms, tools and pricing.