Best Award-Winning Brokers in the UK 2026

Online trading can feel like a minefield, with an ever-growing list of brokers to choose from. That’s why narrowing your search to award-winning brokers in 2026 could help you get it right first time. Forex, CFD and crypto platforms with accolades for their UK customer service, mobile apps, or bonuses, can all help set you up for success.

We’ve explained what to look for in an award-winning broker below, as well as highlighting the most prestigious industry accolades alongside the brands claiming the top prizes.

Top UK Brokers with Awards

-

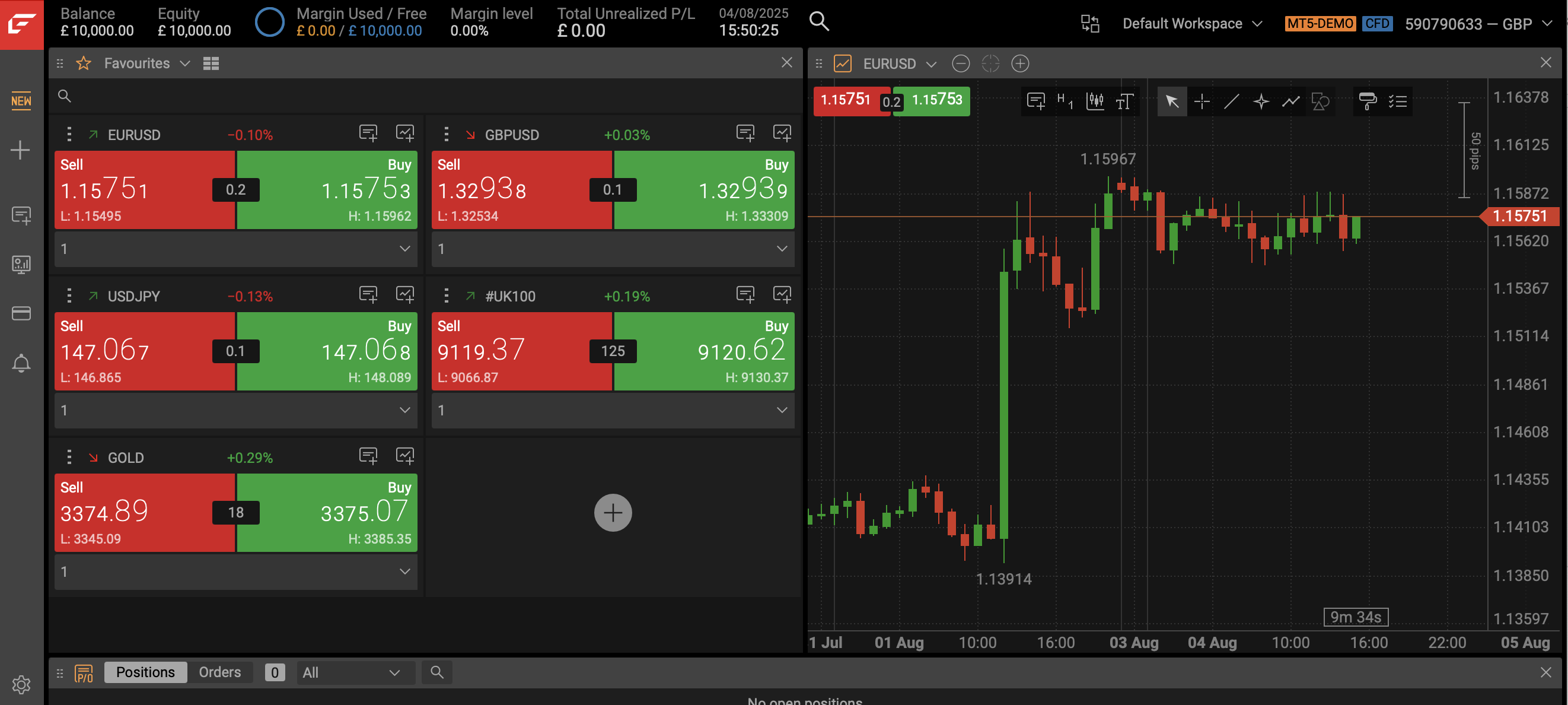

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Awards- Best Overall Broker - DayTrading.com 2025

- Best Forex Broker Runner Up - DayTrading.com 2025

- Best Trading App Runner Up - DayTrading.com 2025

- Best MT4/MT5 Broker Runner Up - DayTrading.com 2025

- Best TradingView Broker Runner Up - DayTrading.com 2025

- Best Forex Broker - DayTrading.com 2024

- Best Overall Broker - DayTrading.com 2023

- Best Trading App - DayTrading.com 2022

- Best Forex Broker - DayTrading.com 2021

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Awards- Best Forex Broker for Beginners 2022

- Best Customer Service 2021

- Best Forex Broker for Low Costs 2021

- Best Mobile App for Investing 2020

- #1 EMEA Bloomberg spot for FX accuracy in Q2 of 2020 and Q3 of 2018

- Best Polish Forex Broker 2019

- Best Execution Broker 2019

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Awards- Best Customer Service 2022 - Online Money Awards

- Best Spread Betting Provider 2022 - Online Money Awards

- Best Platform for the Active Trader 2022 - ADVFN International Financial Awards

- Best Multi Platform Provider 2022 - ADVFN International Financial Awards

- Best Finance App 2022 - ADVFN International Financial Awards

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Awards- Best US Broker 2025 - DayTrading.com

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Awards- Best TradingView Broker 2025 - DayTrading.com

- Best Cryptocurrency Broker 2025 - DayTrading.com

- Best Overall Broker 2024 - DayTrading.com

- Best Cryptocurrency Broker 2024 - DayTrading.com

- Best Forex Broker 2023 - DayTrading.com

- Best Cryptocurrency Broker 2023 - DayTrading.com

- Best MT4/MT5 Broker 2022 - DayTrading.com

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

eToro is a leading multi-asset platform providing trading services across numerous CFDs, stocks, and cryptocurrencies. Since its 2007 inception, it has attracted millions of traders worldwide. It operates with authorisation from top regulators such as the FCA and CySEC. Its social trading feature is especially well-regarded. Crypto investments are high-risk and possibly unsuitable for retail investors. There's a potential to lose all invested capital. Familiarise yourself with the risks. 61% of retail CFD accounts incur losses.

Awards- Best Crypto Broker Runner Up 2025 - DayTrading.com

- Best Cryptocurrency Trading Platform 2022 - Finder

- Education Materials/Program 2022 - Investment Trends

- Best Copy Trading Platform 2021 - Ultimate Fintech Awards

- Best Multi-Asset Trading Platform 2021 - Ultimate Fintech Awards

- Best Stockbroker 2021 - Ultimate Fintech Awards

- Best Social Trading Platform 2019 - ADVFN International Financial Awards

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Awards- Most Trusted Broker Global - International Business Magazine Award 2025

- Best Global Broker - Ultimate Fintech Awards LATAM 2025

- Best Forex Affiliate Program - Global Brand Awards 2025

- Best CFD Broker Global - Global Brands Magazine 2024

- Best Trade Execution - Global Forex Awards 2023

- Best Multi-Asset Broker Global - Global Business and Finance Magazine 2023

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting FCA, ASIC, FSCA, VFSC ProTrader, MT4, MT5, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $50 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Award-Winning Brokers in the UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Award-Winning Brokers in the UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Award-Winning Brokers in the UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| eToro | iOS & Android | ✘ | ||

| Vantage FX | iOS & Android | ✘ |

Beginners Comparison

Are the Best Award-Winning Brokers in the UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Award-Winning Brokers in the UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Award-Winning Brokers in the UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| eToro | |||||||||

| Vantage FX |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- Setting up an XTB account is straightforward and fully online, requiring only a few minutes. This simplicity eases new traders into the world of trading.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- As a seasoned broker, IG adheres to stringent regulatory standards across various regions, ensuring significant trust.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- While initially targeting seasoned traders, IBKR has recently widened its appeal by eliminating its $10,000 minimum deposit requirement.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- eToro is a globally recognised brand, operating under top-tier international regulations. It boasts a community of over 25 million users.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The only significant contact option, besides the in-platform live chat, is limited.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- Hedging and scalping strategies are fully permitted without any short-term restrictions.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

How To Chose An Award-Winning Broker

The retail trading space is an increasingly competitive environment, with high demand encouraging brokers to reduce fees and refine products to capture the growing market.

But whilst better trading conditions is good news for investors, it can make identifying the best brokers challenging. That’s why opting for award-winning brokers is a quick and easy way to home in on the best options. Picking from a list of the top brokers that have already been vetted and praised for their innovation or FX trading services, for example, is a good way to get started on the right foot.

Year after year, we find that the top awards go to brokers that perform well in these areas:

Trust

The best brokers go out of their way to prove their credentials to investors, and we’ve found that firms that maintain strong regulatory oversight year on year tend to also maintain high standards across the board.

Several of the award-winning brokers on our list hold licenses from the Financial Conduct Authority (FCA) and other trusted global regulators.

- IG Index has proven itself as a reliable broker over decades serving clients since it was founded in 1974. Today it’s one of the UK’s most trusted brokers and regularly picks up awards including the Online Money Awards’ top prize for spread betting brokers.

Fees

The highest-rated brokers don’t necessarily charge premium fees – in fact, we’ve found that many award-winning brokers also lead the way with the most competitive pricing.

The most important fees I usually look for are the average spread plus any commissions on the specific assets you want to trade – remember that brokers tend to quote the minimum spread on popular instruments like the EUR/USD forex pair, but niche assets like exotic forex pairs or crypto tokens will often have big variations in pricing among different brokers.

- FXCC remains a leading low-cost broker thanks to an STP and ECN execution model that allows for razor-thin spreads from 0.0 pips and commission-free trading – a model that’s netted it awards from MENA Forex Show Awards, World Finance Magazine and the Global Finance & Banking Awards.

Charting Platforms & Tools

Access to strong charting platforms is one of our top criteria for a solid broker, and we also highly recommend those that provide access to high-quality trading tools for no extra fee.

FxPro’s award-winning browser-based platform, FxPro Edge

- FxPro‘s proprietary platform continues to impress industry influencers like Investors Chronicle & Financial Times, which awarded it as the ‘Broker With The Best Trading Platform’. It also supports classic third-party options including MetaTrader 4, MetaTrader 5 and cTrader, giving traders a huge amount of flexibility.

Customer Service

It’s easy to overlook the importance of customer service until run into a problem while trading and you realise how crucial fast, knowledgeable and professional assistance can be.

That’s why we highly rate brokers that invest in their customer service departments, and we’re not alone – many of the most influential industry awards include categories for customer service.

- XTB has regularly topped our charts in several areas including customer service, and its high-quality 24/6 customer service via phone, email and live chat netted it DayTrading.com’s ‘Best Customer Service’ award.

Account Options

Our top award-winning brokers usually have account options that suit a wide range of traders – for example, we like brokers that have a low barrier of entry with a low or no minimum deposit, and we also highly rate those that accommodate Muslim traders via swap-free accounts.

- Pepperstone remains one of our most prolific award-winning brokers, netting awards year after year and not least for its inclusive account options with no minimum deposit and swap-free trading allowing almost anyone to dive in and start trading.

Trusted Industry Awards

DayTrading.com

DayTrading.com is a leading international guide that offers comprehensive reviews of brokers from all over the world. They have their finger on the pulse when it comes to what makes traders tick and with years of experience in the financial markets, they’re one of the most trusted trading resources online.

DayTrading.com’s annual broker awards are an excellent place to find the number one options in several categories, from the best forex and crypto brokers in 2026 to the best trading apps and the top providers for MT4 & MT5 traders.

Global Forex Awards

For UK FX traders, the Global Forex Awards is another reputable source of credible brokers. Traders vote on award-winning brokers in the forex trading space with prizes handed out each year across several categories, from the best technology to leading education and low-cost investing.

Because voting is public, it’s an excellent way to get recommendations from fellow investors.

World Finance

World Finance is another trusted resource that hands out awards to the best brokers across multiple categories. They regularly rank the best CFD providers, the brokerages offering the most competitive conditions, and the platforms with high trust ratings.