Best Brokers With Managed Trading Accounts In The UK 2026

Looking to grow your wealth without the day-to-day hassle of managing your investments? Managed accounts could be your answer.

We’ve rounded up the best brokers offering managed accounts in the UK—so you can invest smarter, with confidence.

Top Brokers With Managed Accounts

-

Testing Pepperstone's MAM and Social Trading platforms revealed excellent transparency, real-time reports, and flexible account allocation. Managers customised strategies with precise lot distribution. The admin tools were top-tier. Razor account spreads averaged 0.2–0.4 pips on major pairs, with a $3.50 commission per lot.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IG’s managed accounts accessed through approved third-party managers, rather than an internal PAMM/MAM system, offer excellent transparency. Monitoring performance, reporting, and trade analytics is straightforward. Average spreads on major currency pairs were 0.6–0.8 pips without additional commissions.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Our assessment found Trade Nation lacking a native managed account feature. Yet, third-party links enabled simple mirroring configurations. The main platform ensured good transparency and reporting, though personalization and admin controls were missing. Major pairs had fixed spreads of 1 pip, with no commission or performance charges.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA TN Trader, MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

IBKR’s managed accounts offer unparalleled transparency with detailed reports, trade analyses, and compliance-ready statements. Personalisation excels through adaptable fees, diverse allocation models, and robust risk controls. The administrative tools are top-tier. Major currency spreads average 0.1–0.3 pips, with tiered commissions from $2 per lot.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Testing eToro’s managed trading account (CopyTrader) revealed impressive transparency, featuring real-time statistics, risk scores, and portfolio details. Although strategy customization was minimal, the setup was smooth. Reports were auto-generated and detailed. There was flexibility in changing traders anytime. Major spreads averaged 1 pip with no administrative or performance fees.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

In our analysis, FxPro's PAMM/MAM platforms provided excellent transparency with detailed performance data and risk statistics. Lot allocation and profit-sharing were highly adaptable. Reports were comprehensive and easy to use. Administrative tools functioned efficiently. Spreads on major pairs averaged 0.6–0.8 pips, with commissions from $4 per lot.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our recent tests, Fusion Markets' managed account solution offered excellent transparency and clear reporting, featuring detailed trade statistics and live performance updates. Allocation models were adaptable, though customisation depended on the manager's configuration. Administration was seamless. Spreads averaged 0.2-0.4 pips on major currencies, with a commission of just $2.25 per lot.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500

Safety Comparison

Compare how safe the Best Brokers With Managed Trading Accounts In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Managed Trading Accounts In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Managed Trading Accounts In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Managed Trading Accounts In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro | ✔ | $50 | $10 | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Managed Trading Accounts In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Managed Trading Accounts In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| eToro | |||||||||

| FXPro | |||||||||

| Fusion Markets |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Beginners benefit from a modest initial deposit.

- Global traders can use accounts in various currencies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- The web platform and mobile app receive higher user reviews and app rankings compared to leading competitors like AvaTrade.

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- The trading app provides a top-tier social environment featuring an engaging feed and community chat, which we enjoy using.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The only significant contact option, besides the in-platform live chat, is limited.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

Cons

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- The market analysis tools, Market Buzz and Analyst Views, are excellent for identifying opportunities and are seamlessly incorporated into the client dashboard.

- Fusion Markets provides algo traders with a sponsored VPS and offers a 25% discount for choosing the NYC Servers VPS for MT4 or cTrader.

- The selection of charting platforms and social trading features is outstanding. Options like MT4, MT5, cTrader, and the newer TradingView meet diverse trader preferences.

Cons

- The broker stands out with its extensive selection of currency pairs, surpassing most competitors. However, its alternative investment options are merely average, lacking stock CFDs outside the US.

- Unlike AvaTrade, there is no specialised trading platform or app tailored for beginners, which is a significant disadvantage.

- Fusion Market falls short compared to competitors like IG in education, offering few guides and live video sessions for enhancing trader skills.

How Investing.co.uk Chose The Best Managed Account Brokers

To identify the best managed account brokers for UK investors, we conducted hands-on tests of each broker’s managed account tools.

We assessed platforms across key areas including transparency, customisation options, reporting quality, and administration tools. We also recorded objective data such as spread averages, commission structures, and real-time performance visibility.

Crucially, our team focused on features that matter most to UK traders—such as regulatory clarity, ease of use, and platform flexibility—and ranked each broker based on its overall ratings.

How To Choose A Broker With Managed Trading Accounts

- Minimum investment amounts determine how much capital you need to start investing with a managed account, which can impact your ability to diversify effectively. A higher minimum might limit access for beginners or those with smaller portfolios, while a lower minimum allows more flexibility but may come with fewer personalised services. Understanding these thresholds helps you strike a balance between affordability and the potential benefits of professional management, ensuring you choose an account that aligns with your financial capacity and goals.

- Fee structure and transparency directly affect your net returns—management fees, performance fees, and transaction costs can quietly erode your investment over time. Transparent brokers disclose all charges upfront, allowing you to assess whether you’re getting value for the service provided. Understanding what you’re paying—and why—helps avoid hidden costs and ensures your portfolio’s growth isn’t undermined by excessive or unclear fees.

- Investment strategy and asset selection determine how your money is allocated across various markets, sectors, and asset classes, directly influencing risk, return, and long-term performance. A well-structured strategy aligns with your financial goals and risk tolerance, while thoughtful asset selection ensures proper diversification to manage volatility. Choosing a managed account with a straightforward, disciplined investment approach helps avoid emotional decision-making and keeps your portfolio on track, even during market uncertainty.

- Performance history, while not a guarantee of future results, provides valuable insight into how a managed account has performed across different market conditions. It helps you assess the consistency and risk-adjusted returns of the investment strategy, rather than just looking at headline gains. Reviewing past performance—especially over multiple years—can reveal how well a manager navigates volatility and whether their approach aligns with your long-term expectations.

- Reporting tools and customer service provide transparency, control, and guidance throughout your investment journey. Clear, regular reports help you track performance, fees, and portfolio changes, while analytical tools can enhance your understanding of risk exposure and asset allocation. Responsive customer service is especially valuable—offering guidance, resolving issues, and helping you make informed decisions as your financial goals evolve.

- Regulation by the Financial Conduct Authority (FCA) ensures that brokers meet strict standards for financial stability, transparency, and client protection, reducing the risk of fraud or mismanagement. Additionally, the Financial Services Compensation Scheme (FSCS) offers a safety net by compensating investors up to £85,000 if a broker fails, protecting your funds from insolvency risks. These safeguards provide essential peace of mind, ensuring your money is held securely and your investments are managed within a trusted, well-regulated framework.

Handing over my portfolio to a managed account took some getting used to, as it meant trusting someone else with my investments.However, it brought greater consistency and discipline, allowing me to focus more on my long-term goals rather than reacting to every market fluctuation.

What Are Managed Trading Accounts?

A managed trading account is an investment account overseen by a professional portfolio manager who makes trading decisions on your behalf.

Unlike DIY investing, where you pick and manage your assets, managed accounts offer a hands-off approach—tailoring a portfolio to your goals, risk tolerance, and investment horizon.

Before choosing a managed trading account, clearly define your investment goals and risk tolerance. Understanding how professional managers tailor strategies to your needs will help you decide if a hands-off, expert-driven approach aligns with your financial priorities.

Managers utilise research, market analysis, and structured strategies to actively buy and sell assets, such as stocks, bonds, or ETFs.

These accounts are typically discretionary, meaning the manager can act without needing your approval for each trade, though this service comes with management fees.

J.P. Morgan, for example, offers managed accounts alongside managed ETFs and mutual fund portfolios. J.P. Morgan’s managed accounts have a higher minimum investment amount of £50,000 compared to £1,000 for a mutual fund managed account.

However, if you’re looking for a more accessible entry point, IG‘s Smart Portfolios require a minimum investment of just £500.

The benefits of managed accounts over alternatives include tax benefits, portfolio customisation, and direct ownership of securities.

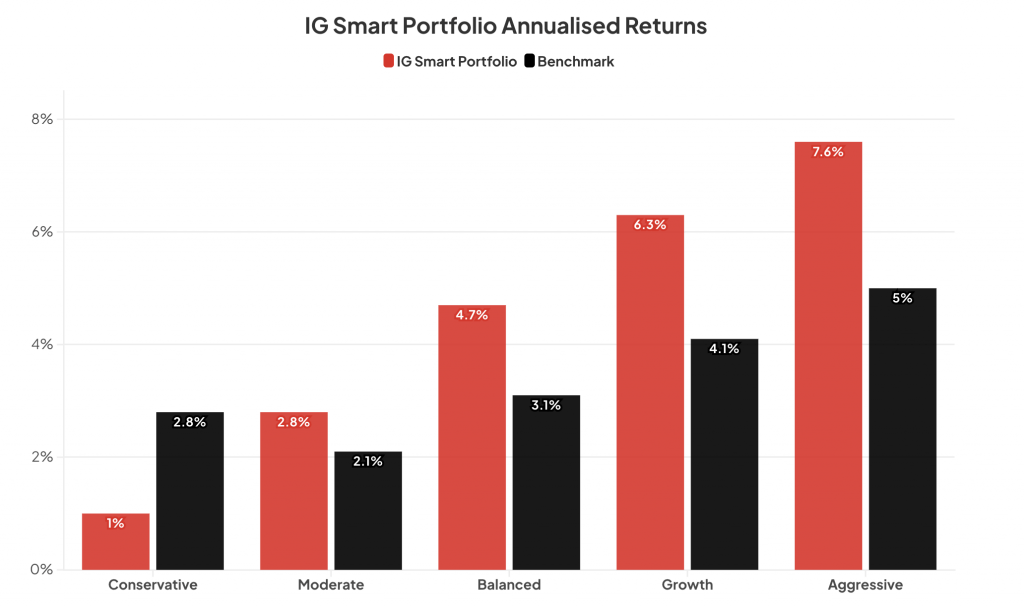

Annual returns for IG Smart Portfolios since their launch in February 2017

Who Should Consider A Managed Trading Account?

A managed trading account is best suited for investors who want market exposure but lack the time, expertise, or confidence to manage investments.

This includes busy professionals, high-net-worth individuals, and beginners who prefer personalised, expert-led strategies over DIY decision-making.

It’s also a strong option for those with long-term goals, such as retirement, income generation, or capital preservation, where disciplined management and risk control are key.

If you value structured portfolios, active oversight, and tax-efficient investing through vehicles like ISAs or SIPPs, a managed account could offer both peace of mind and performance potential.

Pros Of Managed Trading Accounts

- Professional management: Your portfolio is actively managed by qualified experts who utilise data-driven strategies, risk analysis, and market research to make informed decisions, thereby helping to reduce emotional bias and common investor mistakes.

- Personalised strategy: Managed accounts are tailored to your specific goals, risk tolerance, and time horizon, offering a level of customisation we don’t typically see with robo-advisors or off-the-shelf investment products.

- Time efficiency & convenience: With portfolio construction, rebalancing, and ongoing monitoring handled for you, managed accounts free up time while ensuring your investments stay aligned with your long-term objectives—beneficial within tax-efficient wrappers like ISAs or SIPPs.

Cons Of Managed Trading Accounts

- Higher fees: Managed trading accounts often charge annual management fees (typically 0.5–2.0% of assets), which can erode returns over time, especially when compared to low-cost DIY or passive investment options.

- Limited control: Because the manager makes decisions, you relinquish day-to-day control over trades and asset selection, which may not suit investors who prefer to be hands-on or respond directly to market events.

- Performance isn’t guaranteed: Even with professional oversight, managed accounts are still subject to market risks, and past performance doesn’t ensure future results—meaning you could still experience losses despite expert management.

What I’ve appreciated most about using a managed trading account isn’t just the professional oversight—it’s the clarity that comes with regular reports and structured reviews.While it’s not hands-on, it transforms investing into a more focused, goal-oriented process, eliminating the need to track every market move.

Bottom Line

Managed trading accounts provide a hands-off investing experience, allowing professionals to make trading decisions aligned with your financial goals and risk tolerance.

Unlike self-directed investing, these accounts rely on expert strategies and ongoing oversight, making them ideal if you want guidance or lack the time to manage your portfolios.

When choosing the best broker with managed trading accounts in the UK, look for FCA regulation, transparent fees, suitable minimum investment amounts, and a solid investment strategy.

Strong past performance, helpful reporting tools, and responsive customer service can also significantly impact your long-term experience and success.