Best Brokers With LAMM Accounts In The UK 2026

LAMM (Lot Allocation Management Module) brokers allow investors to allocate funds to professional traders who manage sub-accounts on their behalf.

We’ve tested and highlighted the top UK brokers with LAMM accounts after evaluating money managers’ track records, the fees involved, and the level of control and risk.

Best LAMM Brokers In The UK

-

IronFX, established in 2010, is a highly regulated broker specialising in forex and CFDs. This acclaimed company provides access to over 500 markets for more than 1.5 million clients in 180 countries. Traders benefit from multiple account options with competitive rates via the MT4 platform, alongside 24/5 customer support available in 30 languages.

Instruments Regulator Platforms Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) CySEC, FCA, FSCA, BMA / Bermuda MT4, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM)

Safety Comparison

Compare how safe the Best Brokers With LAMM Accounts In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| IronFX | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With LAMM Accounts In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| IronFX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With LAMM Accounts In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| IronFX | Android, iOS, WebTrader | ✘ |

Beginners Comparison

Are the Best Brokers With LAMM Accounts In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| IronFX | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With LAMM Accounts In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| IronFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With LAMM Accounts In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| IronFX |

Our Take On IronFX

"IronFX is ideal for seasoned forex traders seeking fixed or floating spreads. Offering over 80 currency options, it surpasses many competitors and provides excellent forex market research tools."

Pros

- IronFX offers both fixed and floating spread accounts, appealing to novices and seasoned traders alike.

- Traders gain access to the renowned Trading Central research tool, featuring automated AI analytics and round-the-clock support.

- The broker regularly hosts trading competitions with cash rewards and provides welcome bonuses for new clients.

Cons

- It is unfortunate that the broker lacks advanced software options like MT5 or TradingView, restricting choice for seasoned traders.

- In comparison to top brokers, IronFX provides a limited range of share CFDs.

- Commissions in zero-spread accounts begin at £13.50 per lot, almost twice the industry standard.

How Investing.co.uk Chose The Best LAMM Brokers

We reviewed brokers that offer Lot Allocation Management Module (LAMM) accounts, enabling traders to follow and allocate trades from strategy managers. Our team tested each platform to evaluate ease of use, copy-trading functionality, and overall trading experience.

We then ranked the brokers by overall ratings, combining our hands-on experience with verified data points such as account allocation features, fees, and platform tools, to highlight the best choices for trading with LAMM.

What To Look For In A LAMM Account Provider

Money Managers

Consider the qualifications and track record of the professional traders who will be managing the sub-accounts in the LAMM program. Look for traders who have a proven track record of success, a transparent trading history, and a strategy that aligns with your investment goals and risk tolerance.

Specific metrics to consider are average weekly returns, risk ratings, total number of investors, total capital invested, and the length of time the professional trader has been operating.

Minimum Investment

Check the minimum investment requirements for the LAMM program, as well as any other requirements or restrictions on opening and maintaining a LAMM account.

Fees & Costs

Look for LAMM brokers that offer transparent and competitive costs, including any performance fees charged by the professional traders managing the sub-accounts.

Also look for any hidden fees, such as deposit or withdrawal charges, that may impact your returns.

Regulation

Make sure LAMM brokers are regulated by a reputable body in the jurisdiction where they operate – in the UK the top brokers with LAMM accounts will be licensed by the FCA.

This provides assurance that the brokerage is following best practices and operating in a transparent and fair manner.

Customer Service

The top brokers with LAMM accounts offer responsive customer support, including access to contact channels like phone, email, and live chat.

Providers should also have a comprehensive FAQ section and educational resources to help you learn more about LAMM accounts and how they work.

What Is A LAMM Account?

A LAMM account is a type of managed trading profile typically used in forex. LAMM brokers allow traders to allocate a number of lots to be invested, with returns dependent on the multiple of lots.

The basic premise is that each account owner will receive a standard lot when the professional trader purchases a standard lot. With that said, the client retains control over their account and can adjust the number of lots allocated.

The profits and losses for each sub-account are in proportion to the number of lots invested.

LAMM accounts are often used by investors who wish to diversify their trading portfolio or to benefit from the expertise of professional traders. LAMM account holders typically have a large amount of trading capital.

How LAMM Accounts Work

- The investor opens a LAMM account with a supporting broker and selects the number of lots to invest.

- The investor identifies one or more professional traders to manage their sub-account. The trader can choose this based on their trading style, risk tolerance, and other factors.

- The investor and professional trader(s) agree on the strategy to be used. This includes trade types, trade frequency, risk management parameters, and maximum drawdown limits.

- The professional trader(s) execute trades that are reflected in the respective sub-accounts. The profits and losses generated by the sub-account are based on the actions taken in the manager’s main account.

- The client retains control over their trading account and can adjust the number of lots allocated. The trader can also add or remove professional traders as needed.

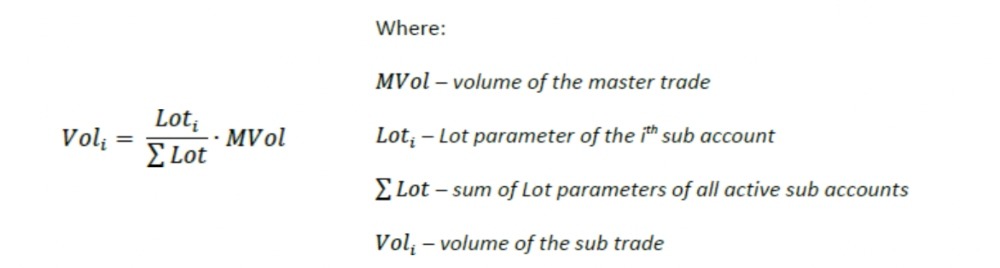

FxPro Lot Allocation Method

Pros Of Using A LAMM Account

- Diversification: By allocating funds to multiple accounts managed by different traders, LAMM accounts allow investors to diversify their portfolios with different leverages and reduce overall risk.

- Professional Management: Investors benefit from the expertise of professional traders who have a track record of success in a specific market, such as forex. This may result in higher returns than a trader might achieve alone.

- Transparency: Brokers with LAMM accounts generally provide high transparency from our tests, allowing investors to monitor the performance of trades executed by professional traders, often in real time.

- Lower Costs: LAMM accounts often have lower costs than traditional managed accounts, as traders typically pay a performance fee to money managers rather than a fixed management fee – this will either be a percentage or flat rate.

- Flexibility: Investors retain control over their LAMM account and can adjust the lot allocations and add or remove money managers at any time.

Cons Of Using A LAMM Account

- Control: While investors keep overall control of their LAMM account, they delegate some control to the professional traders managing the sub-accounts. Traders should carefully select and monitor the performance of each money manager.

- Risk: Like any investment, LAMM accounts involve risk. The performance of the sub-accounts can vary significantly based on market conditions, the skill of the professional traders, and other factors.

- Performance Fees: Professional traders managing LAMM sub-accounts typically charge a performance fee based on the profits generated in the sub-account. While this fee structure may be lower than traditional managed accounts, investors must still factor in these fees when evaluating the potential returns.

- Limited Customisation: While traders can allocate funds to different accounts with different strategies, they may have limited ability to customise the specific parameters. Investors often have to work with the approach agreed upon by the professional trader.

- Liquidity: Investors may not be able to withdraw funds immediately. Review the terms and conditions of LAMM brokers to understand restrictions on liquidity.

LAMM Vs MAM & PAMM

LAMM, PAMM, and MAM accounts are different types of managed investment solutions that allow investors to allocate their funds to profiles managed by professional traders or money managers.

LAMM accounts are the precursor to PAMM accounts. But while Lot Allocation Management Module accounts assign funds based on the number of lots, Percent Allocation Management Module accounts assign funds based on the client’s allocation percentage.

The method of investing is similar across LAMM and PAMM – the trader connects their account to the manager’s who then trades with their own funds. The trades made by the manager will be automatically copied into the client’s account.

Multi-Account Manager (MAM) accounts can be thought of as a cross between PAMM and LAMM. They use the percentage allocation approach of PAMM while also giving money managers the flexibility to change the level of risk and distribute capital.

For example, managers can make trades in fixed lots, whereby they can decide the lot size and leverage level for sub-investors based on their account balance and risk appetite.

Bottom Line

Brokers with LAMM accounts offer several benefits, such as diversification, professional management, and flexibility, but they also have drawbacks, including potential losses and fees.

Make sure you consider the performance of money managers before assigning lots, considering their average weekly or monthly returns, the number of other investors, and their risk level. Also check the minimum investment requirement and management fees.

To find a suitable provider, see our list of the best UK brokers with LAMM accounts.

FAQ

What Is The Minimum Investment For A LAMM Account?

The minimum investment required varies between brokers with LAMM accounts, ranging from a few hundred pounds to thousands.

How Do I Choose The Best Professional Traders For My LAMM Account?

The top LAMM brokers rank traders across several metrics, including overall profitability, average returns over a set period, the total number of investors, the total amount of funds invested, plus the length of time the money manager has been active.

How Much Control Will I Have Over My LAMM Account?

As the investor, you can choose the number of lots allocated to the money manager. You can also add or remove professional traders at agreed intervals or in real time.