Grand Capital Review 2026

Grand Capital is an online broker that offers more than 500 assets, some of the most popular platforms and a range of account types to suit different traders’ needs. In this review, we evaluate the broker’s fees, funding options, bonuses and more. Our team share their key findings after testing Grand Capital.

Our Take

- Over 500 instruments are available covering forex, stocks, indices, commodities and cryptos

- The broker has more than 15 industry awards and thousands of global clients

- Industry-leading trading platforms are supported including MT4 and MT5

- The sign-up process is straightforward, taking just a few minutes

- The copy trading platform will appeal to hands-off traders

- Grand Capital is not regulated by the UK FCA

Market Access

A stand-out feature for out team is that Grand Capital offers more than 500 CFDs, covering forex, stocks, indices, commodities, and cryptocurrencies.

We are reassured to see that Grand Capital offers the most popular financial markets, with a particularly strong suite of currency pairs. On the negative side, the selection of commodities is fairly narrow. eToro, for example, offers 25 commodity products.

You can trade:

- Metals – Seven spot metals, including gold, silver and platinum

- Stocks – More than 70 major US and EU stocks, including eBay, Microsoft and BMW

- Forex – Over 50 currency pairs, including majors, minors and exotics like GBP/USD, USD/MXN and EUR/ZAR

- Energies – The broker supports trading in two oil commodities, WTI US Oil and Brent UK Oil

- Indices – 11 popular indices, covering some of the world’s largest markets, such as the FTSE 100, Nikkei 225, S&P 500 and CAC 40

- Cryptocurrencies – The most popular cryptocurrencies are supported, each paired with various fiat currencies to produce over 60 instruments, including BTC/USD, ETH/GBP and LTC/EUR

Fees

While using the broker, we found that Grand Capital charges a range of trading and non-trading fees. In general, we found these to be relatively high, with wide spreads and high commission rates compared to other brokers, such as Plus500 and CMC Markets.

The cheapest spreads can be found with the MT5, ECN Prime and Crypto accounts, all starting at 0.4 pips. All other accounts have spreads starting from 1.0 pips, which is higher than we are used to. Commission rates also vary by account type as detailed below, though all accounts are more expensive than we would like to see. The Micro account does not charge any commission.

Standard

- Forex: £0

- ETFs: 0.1%

- CFDs: £11 – £12

- US Stocks: 0.1%

MT5

- ETFs: 0.1%

- Cryptos: 0.5%

- USA, Euro, Russia & Asia CFDs: 0.1%

- Forex, Metals, Indices & Energies: £4 – £8

ECN Prime

- ETFs: 0.1%

- Indices: £5

- US Stocks: 0.1%

- Euro Stocks: 0.1%

- Forex, Metals & Energies: £4

Swap Free

- Forex: £8

- Metals: £8

- Bonds: £43

- Indices: £23

- Energies: £35

- US & Russian Stocks: 0.1%

Crypto

- Cryptocurrencies: 0.5%

While we appreciate that there is a commission-free account type available, we think the overall fees are generally quite high, especially with the Swap Free account, which has expensive spreads and very high commission fees. We struggled to turn meaningful profits with so much reward taken at every step.

Overall, our team is disappointed with the pricing at Grand Capital.

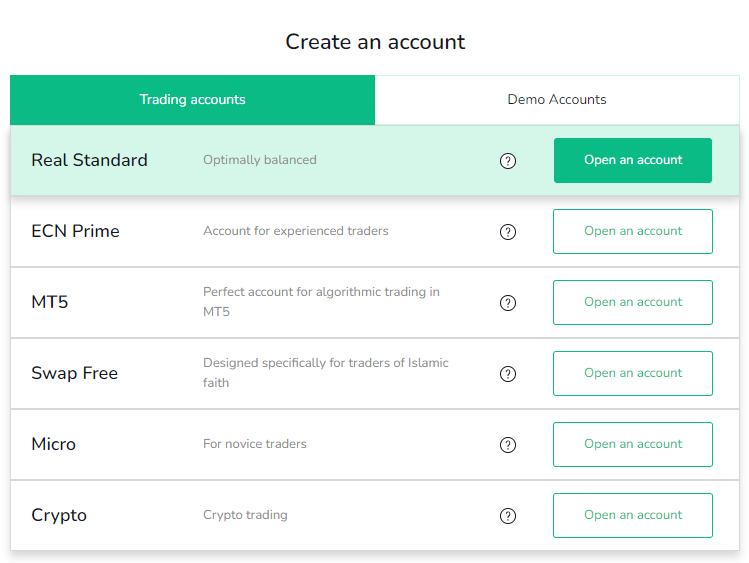

Accounts

Grand Capital offers six account types, each suiting different strategies, risk levels and investors. We confirmed that all accounts offer the MetaTrader 4 trading platform, apart from the MT5 account, which offers the MetaTrader 5 platform but limits deposits to USD.

Overall, we were impressed by the range of account types available. These accounts sufficiently covered the needs of most investment styles when we trialled them, with account types ideal for lower-stake, newer traders and the ECN Prime account for higher-volume, experienced traders. The Swap Free account provides an Islamic, Sharia-compliant option as well.

Unfortunately, we must highlight the limitations for UK investors in terms of account base currencies and instrument restrictions. Many firms like XTB maintain UK accessibility on all accounts.

Standard

- Assets: 330

- Leverage: Up to 1:500

- Minimum Deposit: £78

- Minimum Size: 0.01 lots

- Execution: Market Execution

- Margin Call / Stop Out: 100% / 40%

- Base Currency: GBP, USD, EUR, JPY, RUB, GOLD, mBTC, mETH

MT5

- Assets: 400+

- Base Currency: USD

- Minimum Deposit: £78

- Minimum Size: 0.01 lots

- Execution: Market Execution

- Leverage: Up to 1:100 (floating)

- Margin Call / Stop Out: 100% / 80%

Micro

- Assets: 66

- Leverage: Up to 1:500

- Minimum Deposit: £8

- Minimum Size: 0.01 lots

- Execution: Market Execution

- Margin Call / Stop Out: 100% / 40%

- Base Currency: GBP, USD, ERU, JPY, RUB, GOLD, mBTC, mETH

ECN Prime

- Assets: 38

- Base Currency: USD

- Minimum Size: 0.01 lots

- Minimum Deposit: £390

- Execution: Market Execution

- Leverage: Up to 1:100 (floating)

- Margin Call / Stop Out: 100% / 80%

Swap Free

- Assets: 150+

- Base Currency: USD

- Leverage: Up to 1:500

- Minimum Deposit: £78

- Minimum Size: 0.01 lots

- Execution: Market Execution

- Margin Call / Stop Out: 100% / 40%

Crypto

- Assets: 68

- Leverage: Up to 1:5

- Base Currency: USD

- Minimum Deposit: £78

- Minimum Size: 0.01 lots

- Execution: Market Execution

- Margin Call / Stop Out: 100% / 80%

Additional Account Types

Grand Capital offers two investment services, which are accounts for longer-term investments. These accounts are the Copytrading and Investment Portfolio accounts.

We found it easy to copy the trades of other, established speculators within the Copytrading account. We were given a decent selection of traders to copy and found that all of Grand Capital’s assets were available, alongside the ability to diversify risk across different traders in one account. We particularly rate that you can set your own profits and loss limits and copying ratios. The minimum deposit for this account is £78.

The Investment Portfolio account allowed us to invest in blue-chip companies to customise their portfolios and diversify for lower risk levels. The portfolios are designed for periods of one to six months, formed every month from the work of the broker’s in-house analysts and investors. Clients can choose which and how many portfolios to invest in and can pull their money out whenever it suits them. The minimum deposit for this account type is £780.

How To Open An Account With Grand Capital

I have tested hundreds of brokers and Grand Capital offers a quick and seamless sign-up process.

- Fill in login details (email address, name, phone number) and click Registration

- This will open an account in the Grand Capital client portal (Private Office)

- Choose which account type you would like to open

- Choose the leverage and currency for the account and hit Create

- You will then be supplied with your login details

- Activate your account and fill in the KYC verification details from the account portal to deposit funds and start trading

Account Registration Window

Funding Options

Grand Capital offers a strong range of funding methods and reimburses the deposit fees for many of these methods, which made funding our accounts quite cheap.

However, we were very disappointed to see that none of the supported methods, apart from international bank cards, support GBP as a fiat currency. As such, UK traders may need to pay a foreign conversion rato to deposit, which can vary by bank/method.

Details for the popular, internationally supported payment methods are given below:

- Bank Cards – GBP, EUR, USD – Deposits from 15 minutes – 0% deposit fee

- Astropay – USD – Deposits from 15 minutes – Withdrawals up to 3 business days – 0% deposit fee – 0.5% withdrawal fee

- PayLivre – USD – Deposits from 15 minutes – Withdrawals up to 3 business days – 0% deposit fee – 1.5% withdrawal fee

- Fasapay – USD, IDR – Deposits from 15 minutes – Withdrawals up to 3 business days – 0% deposit fee – 1% withdrawal fee

- PayRedeem – USD, EUR – Deposits from 15 minutes – Withdrawals up to 3 business days – 0% deposit fee – 6% withdrawal fee

- Perfect Money – USD, EUR – Deposits from 15 minutes – Withdrawals up to 3 business days – 0.5% deposit fee – 0.5% withdrawal fee

- Crypto Wallets – BTC, ETH, USDT – Deposits up to 1 business day – Withdrawals up to 3 business days – Fees determined by blockchain

Overall, we are disappointed by the lack of transfer options available in GBP. While the currency is available as a base for accounts, the broker only supports one GBP funding method, potentially incurring charges for every UK investor that wishes to open an account.

UK Regulation

Grand Capital is a member of the Financial Commission, an external dispute resolution body. This overseer is an international, independent entity untied to any country.

Our experts note that this has both benefits and costs. It is beneficial that FinaCom oversees far fewer brokers than traditional regulators, so each firm is watched more closely and disputes are cleared more quickly. Furthermore, brokers willingly choose to be overseen by FinaCom, perhaps making it more likely that they will follow the rules and regulations set out by the agency.

However, we have found that there may be a conflict of interest as the brokers pay FinaCom for the regulation, possibly making them biased towards the brokerage in disputes. Also, the overseer does not have the legal power that traditional regulators like the FCA have when a firm breaks the law. This is why we always recommend FCA-regulated firms to UK investors.

FinaCom provides a compensation scheme to retail investors, with Grand Capital being a Category A broker. This means that clients have access to up to £17,000 in compensation. Grand Capital is also a member of Serenity, protecting the security of user funds, guaranteeing withdrawals and resolving disputes.

Overall, we cannot be too confident in the strength of this broker’s regulation. We recommend that all users stay wary as investing with brokers that are not regulated by top overseers like the FCA can lead to financial detriment. There are many leading brokers whose services we preferred and that are regulated by the FCA, such as Pepperstone and IC Markets.

Trading Platforms

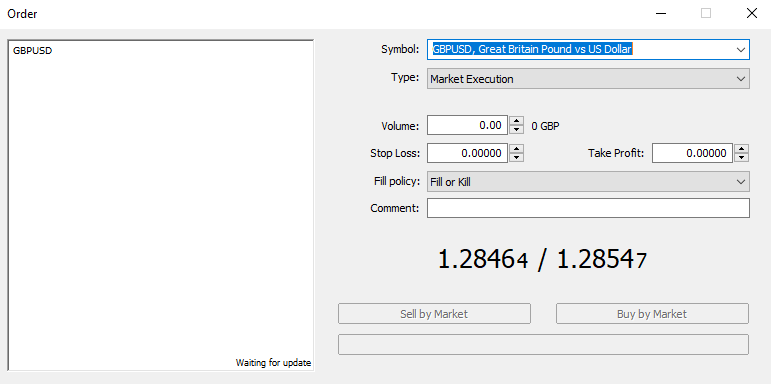

Grand Capital provided access to three trading platforms across its account types: MetaTrader 4, MetaTrader 5 and WebTrader.

MT4 and MT5 are some of the most popular online trading platforms, offering a wide range of technical tools, customisability and features. We found that the WebTrader successfully emulates the tools of MT4 and MT5, though it is accessible solely online through a web browser.

MetaTrader

The two MetaTrader platforms are similar, featuring the same general look and feel that we and many online traders have become accustomed to. The major differences come with the out-of-the-box features. MetaTrader 5 boasts more built-in tools, while MetaTrader 4’s popularity ensures that it has the largest range of additional add-on tools.

Built-in features include:

- Mobile trading applications

- 4 and 6 order types, respectively

- 9 and 21 time frames, respectively

- 31 and 44 graphical objects, respectively

- Automated trading through Expert Advisors

- 30 and 38 built-in technical indicators, respectively

- Programming languages (MQL4 and MQL5, respectively)

Both platforms can be downloaded from the Grand Capital website. Traders can download desktop versions for Windows and Mac computers or mobile versions for Android and iOS devices. Grand Capital also supports the web version of MetaTrader 4.

MetaTrader 5

WebTrader

The WebTrader is an online-only trading platform built by the broker to function like MetaTrader 4 but purely from your browser. This means that users can access the platform from any browser, including from mobile devices. The platform comes with the same indicators as MetaTrader 4 and we were pleased to see that we could sync our accounts across both platforms with ease.

WebTrader

The platform is accessible from the Grand Capital website.

How To Place A Trade With Grand Capital

- Log into your chosen trading platform

- Choose which asset you would like to trade and open its chart

- Perform your analysis to find the best time to trade

- Open the order window (MetaTrader) or click the chosen asset in the instrument list (WebTrader)

- Input the details of your trade (volume, etc.) and click Buy or Sell to place your order

MT5 Order Placement Window

Mobile App

Both MetaTrader 4 and 5 have downloadable mobile applications available on iOS and Android devices. These apps provide many of the same features as their desktop counterparts, allowing traders to chart asset prices, perform technical analysis and place trades on the go. These applications are perfect for those often on the move and looking to take advantage of market fluctuations at any time of day.

The WebTrader can also be accessed through mobile devices on their web browsers. We found that the experience is the same as that available on larger devices, though the smaller screen may be a disadvantage.

Leverage

We were pleased to see that Grand Capital supports leveraged trading on all its account types, with competitively high maximum limits for all account types.

The highest available leverage rate is 1:500, available on the Standard, Micro and Swap Free accounts. While these are not the highest rate limits out there, our team found them plenty sufficient to magnify any profit returns without taking on copious amounts of risk. The margin call for these accounts is at 100% and the stop-out is at 40%.

For those okay with taking on less risk, we found that rates of up to 1:100 are available on the MT5 and ECN Prime accounts, although these are both floating leverage limits. The margin call for these accounts is at 100% and the stop-out is at 80%.

The Crypto account only supports leverage of up to 1:5, with a 100% margin call and 80% stop out.

Demo Account

Our team were impressed to see that all clients can open one of three free demo accounts with Grand Capital, the Standard, ECN Prime and MT5 accounts.

When opening a demo account, users can select their leverage limit, initial deposit and base currency. These demo accounts let investors practise using the broker’s trading platforms without risking real capital. Clients can use them to become accustomed to the broker’s trading conditions and fee structures, as well as test new trading strategies.

Demo accounts can be opened in the same way live accounts are opened, available in the client portal.

Bonus Deals

Grand Capital prides itself on its bonus offers. In the past, the broker has offered a wide range of offers, including no-deposit welcome bonuses, interest on deposits, sign up deals, trading volume bonus offers and instrument-specific bonuses.

Our experts were offered a 40% deposit bonus running at the firm. This promotion is available to all Grand Capital clients with Standard or Swap Free accounts. The bonus is available on each deposit, although the maximum bonus amount cannot exceed £15,500. The 40% provided is not withdrawable right away but profits made from investing with it are freely withdrawable. Every lot traded makes £2 of the bonus amount withdrawable. Users can receive this bonus by requesting it from the Private Office or contacting their personal manager.

The broker also hosts regular trading tournaments, with cash prizes available for the top performers. We have found these demo contests to be a great way to inject some fun, excitement and real cash prizes into what can otherwise be a stressful experience, speculating on the financial markets.

The contest is free to enter and is available to all active Grand Capital clients with at least £8 in their account and at least one position in their trading history. The Grand Capital Cup is held monthly, lasting 24 hours and rewarding the top four traders with cash prizes of up to £390. The top trader is also given Professional trader status. The competition takes place on a demo account with a £8,000 starting balance. Competitors invest in currency pairs and metals over 24 hours to raise their account value as much as possible.

Grand Capital also offers a Payback scheme for active traders. This is a loyalty program that rewards those that open new positions every day. These are cash payments deposited into your account for investing on consecutive days. The bonus starts at six days of consecutive trading, with an increase at 16 and 31 days. Each client starts at the Newbie rank, earning no payback, with each milestone day raising you to the next rank. The following ranks are Bronze, Silver and Gold. At Bronze, you earn £0.40 for 1 lot. At Silver, you earn £0.80 for 1 lot and at Gold, you earn £1.20.

We think that the bonuses and promotions offered are better than most comparable brokers. However, some other firms run multiple promotions at once, which was not the case when our experts reviewed Grand Capital.

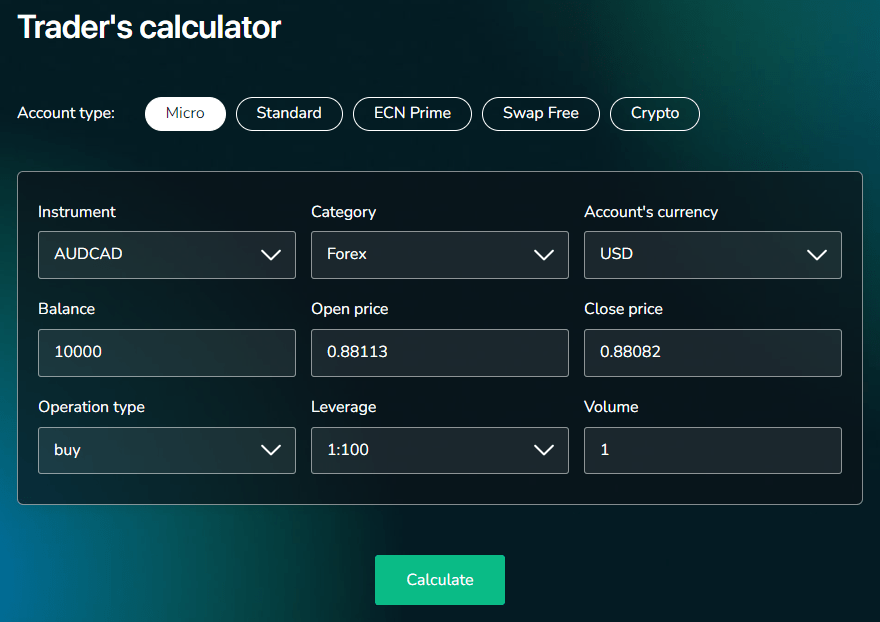

Extra Tools & Features

Our team made use of several additional tools provided by Grand Capital. These include market analysis reports, market insights, daily reviews, economic calendars and trading ideas.

The market analysis reports, market news insights, daily reviews and trading ideas predominantly cover analyses of different assets or product classes. As well as technical analysis of the asset’s price movements, these reports also look at external and fundamental factors, like GDP, interest rates, employment data, inflation and company financial reports to form opinions on market movement. Our experts were impressed by the detail of these reports, covering a wide range of factors to produce a strong analysis.

In the blog on the broker’s website, we read several educational articles clearly published to help newer traders successfully enter the world of investing. These articles cover a range of topics, including key tips and different simple and advanced speculation strategies. Unfortunately, we think the overall number and breadth of the educational articles is lacking, not providing enough for new traders to confidently and successfully learn enough to safely capitalise on the financial markets.

An economic calendar is also available on the Grand Capital website, covering the upcoming economic events relevant to speculators. We also found that the broker provides what it calls the Trader’s Calculator, calculating the profit of positions for each of the offered account types. This is a useful and specialised profit calculator. We were disappointed to find the lack of additional calculators or platform add-ons that many other brokers provide.

Trader’s Calculator

Overall, our opinion is that the extra tools provided by the firm are great for those that do not have the time or know-how to perform analysis themselves.

However, we think that newer traders will have trouble learning the basics of how to trade with Grand Capital. For example, eToro has a comprehensive, step-by-step education section that builds a strong foundation of theory and understanding with which to attack the markets.

Company History

Grand Capital is an international broker that was founded in 2006. The group is based in Seychelles and has been regulated by FinaCom since 2016. The brokerage has amassed an impressive 750,000 clients from 190 different countries, with customer service available 24/7 in 15 different languages.

Grand Capital has won 18 awards throughout the years. These include the “Top Investment Service Provider Africa 2020” by the Kenyan Association of Traders, the “Best Broker in Europe 2015” by ForexStars and the “Best ECN Broker of the Year” in 2015 at the Forex Expo.

Customer Service

We were very pleased to see that Grand Capital offers 24/7 customer support through its online chat window. This window connects you to one of the broker’s support professionals at any time of the day, any day of the year. We also found a phone number and several email addresses that users can contact if they need more specific support:

- Customer Interaction – support@grandcapital.net – Monday to Friday 06:00 to 18:00 GMT

- Analytics – analyst@grandcapital.net – Monday to Friday 07:00 to 17:00 GMT

- HR – hr@grandcapital.net – Monday to Friday 07:00 to 16:00 (GMT)

- Phone Number – +97 143 118 117

Our experts found that Grand Capital was responsive, friendly and helpful when we contacted the firm via multiple avenues. The broker responded through the online chat within minutes of our queries and our emails were responded to within an hour.

Security

The MetaTrader platforms are secure trading platforms that encrypt information to ensure trades are not hijacked or redirected.

However, we our research uncovered some negative reviews. Moreover, we could find limited provision of additional security measures in place, such as segregated bank accounts.

Trading Hours

The trading hours for each asset vary depending on when the underlying markets are open. For example, forex assets can be traded 24/5, while US stocks are only available when the US markets are open (14:30-21:00 GMT for NYSE). However, our review found that cryptocurrencies are available 24/7 because of their decentralised nature.

Trading holidays and details of changing opening times are all provided on the Grand Capital blog.

Should You Trade With Grand Capital?

Grand Capital offers a fairly strong selection of assets, two top trading platforms and various account types to suit every trader’s needs. The investment options for traders also help this broker appeal to a larger crowd, as do the demo competitions and deposit bonuses.

However, our experts note that the firm is not overseen by a reputable regulator like the FCA. Furthermore, UK traders may have trouble depositing funds because of the broker’s lack of GBP deposit methods, despite the option for GBP as a base currency. The trading fees charged by the broker are also comparatively high.

FAQs

Should UK Traders Invest With Grand Capital?

Grand Capital offers GBP as a base currency for some of its account types. However, the brokerage does not support any GBP deposit options, potentially making it difficult for UK traders to deposit and withdraw funds. Furthermore, the regulation of the broker is not particularly strict, especially when compared to that of the UK’s FCA.

Are Grand Capital’s Trading Platforms Good?

Grand Capital offers three trading platforms, MetaTrader 4, MetaTrader 5 and a WebTrader. The MetaTrader platforms are some of the most popular online trading platforms, used by countless investors across the world. The platforms are powerful, providing clients with ample tools to perform analysis and make profits. The WebTrader is designed to sync with MetaTrader 4, providing similar technical analysis capabilities.

Can Traders Make Profit Investing With Grand Capital?

Traders can make a profit on invested capital with Grand Capital, though it takes a lot of research, practice and testing to find a strong strategy that you can implement to make consistent returns. Moreover, the firm charges relatively high fees, making this more difficult than with alternative brokers.

Article Sources

Top 3 Grand Capital Alternatives

These brokers are the most similar to Grand Capital:

- World Forex - World Forex is an offshore broker based in St Vincent and the Grenadines. It provides commission-free trading with a minimum deposit of $1 and leverage up to 1:1000. Digital contracts are available, offering an easy method for novices to speculate on popular financial markets.

- AZAforex - Founded in 2016, AZAforex operates as an offshore broker enabling trading across more than 235 international financial markets. Traders can engage through binary options, with potential payouts reaching 90%. The broker offers three distinct accounts—Start, Pro, and VIP—each with exclusive features. All account types grant access to the Mobius Trader 7 platform, which has received performance enhancements over time.

- Videforex - Introduced in 2017, Videforex provides trading opportunities across stocks, indices, cryptocurrencies, forex, and commodities through binary options and CFDs. The platform, alongside its mobile app and copy trading features, is intuitive and caters to novice and occasional traders. Additionally, its market analysis tools and trading contests offer valuable avenues for honing trading skills.

Grand Capital Feature Comparison

| Grand Capital | World Forex | AZAforex | Videforex | |

|---|---|---|---|---|

| Rating | 3.9 | 4 | 3.4 | 3.5 |

| Markets | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Minimum Deposit | $10 | $1 | $1 | $250 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFDs) | 0.0001 Lots | $0.01 |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FinaCom | SVGFSA | - | - |

| Education | No | No | No | No |

| Platforms | MT4, MT5 | MT4, MT5 | - | - |

| Leverage | 1:500 | 1:1000 | 1:1000 | 1:2000 |

| Visit | ||||

| Review | Grand Capital Review |

World Forex Review |

AZAforex Review |

Videforex Review |

Trading Instruments Comparison

| Grand Capital | World Forex | AZAforex | Videforex | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | No |

| Corn | Yes | No | No | No |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | Yes | No | No | No |

| Bonds | Yes | No | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | No | No |

Grand Capital vs Other Brokers

Compare Grand Capital with any other broker by selecting the other broker below.

Popular Grand Capital comparisons:

|

|

Grand Capital is #6 in our rankings of binary options brokers. |

| Top 3 alternatives to Grand Capital |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Shares, Energies, Metals, Cryptocurrencies, Binary Options |

| Demo Account | Yes |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Regulated By | FinaCom |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:500 |

| Mobile Apps | Yes |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | ADVcash, AstroPay, Credit Card, Debit Card, FasaPay, Neteller, PayRedeem, Perfect Money, Western Union, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Yes |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Copper, Corn, Cotton, Gold, Natural Gas, Oil, Orange Juice, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | From 1 pip (Standard) |

| CFD GBPUSD Spread | From 1 pip (Standard) |

| CFD Oil Spread | From 1 pip (Standard) |

| CFD Stocks Spread | From 1 pip (Standard) |

| GBPUSD Spread | From 1 pip (Standard) |

| EURUSD Spread | From 1 pip (Standard) |

| GBPEUR Spread | From 1 pip (Standard) |

| Assets | 50+ |

| Crypto Coins | BAT, BCH, BNB, BTC, DSH, EOS, ETC, ETH, IOT, LTC, NEO, OMG, TRX, XLM, XMR, ZEC |

| Crypto Spreads | From 0.4 pips |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Expiry Times | 1 minute - 48 hours |

| Payout Percent | 86% |

| Ladder Options | No |

| Boundary Options | No |