Best Brokers For Beginners In The UK 2026

Starting your investment journey can feel overwhelming—especially with so many trading platforms and brokers competing for your attention.

In this guide, we’ll highlight the best brokers for new investors, helping you take your first confident steps into the world of investing.

Best Brokers For Beginners UK

-

In our tests, Pepperstone aided beginners with a low minimum deposit, responsive 24/5 support, and free demo accounts. Educational resources featured webinars, trading guides, and strategy tutorials. Execution was swift, with intuitive MT4, MT5, and cTrader platforms. Access to forex, indices, commodities, and crypto enabled new traders to practise and develop skills in a secure, low-risk setting.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our tests, XTB served novices with a minimal deposit requirement, prompt support, and complimentary demo accounts. Educational materials featured videos, webinars, and comprehensive trading guides. The xStation platform provided user-friendly tools and risk management options. Access to forex, indices, commodities, and cryptocurrencies enabled new traders to learn and practise in a safe, affordable setting.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In our analysis, IG offered user-friendly trading with comprehensive educational materials, such as webinars, guides, and demo accounts. Customer service was responsive through chat and phone. Execution proved reliable, allowing beginners access to forex, stocks, indices, and commodities with intuitive platforms and risk management tools, making IG a good fit for novice traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

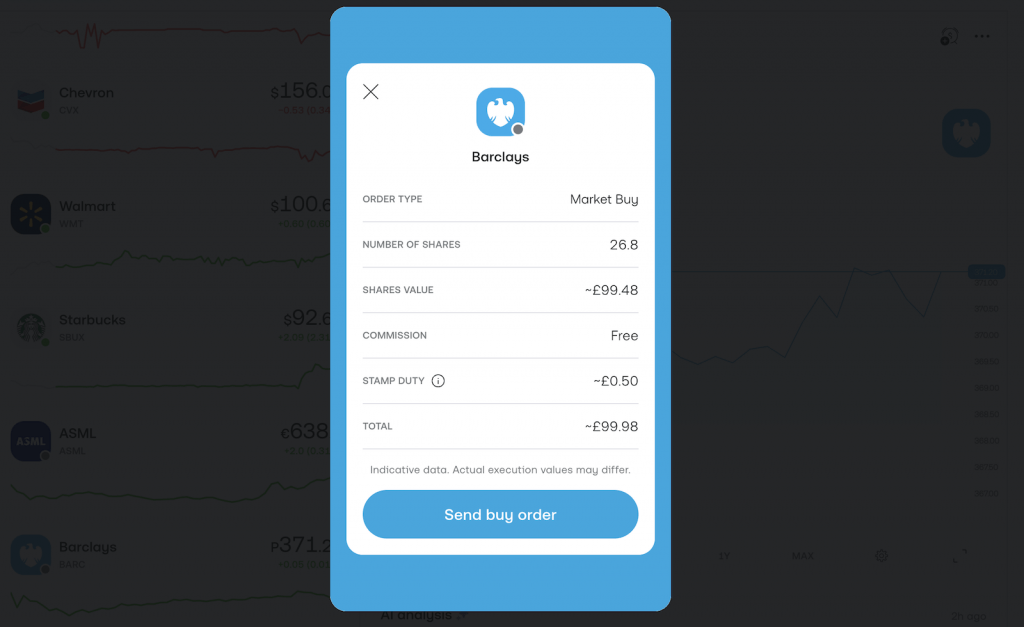

In our recent tests, eToro assisted novices with a minimal deposit requirement, efficient 24/5 support, and complimentary demo accounts. Educational tools featured webinars, trading manuals, and importantly, social trading elements for peer learning. Executions were dependable, while access to stocks, ETFs, forex, and crypto offered a low-risk setting for new traders to practise and gain confidence.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

InstaForex aids novices with a low minimum deposit, 24/7 responsive support, and free demo accounts. It offers tutorials, webinars, and daily market analysis as educational resources. Execution on MT4 and MT5 is solid, offering traders access to forex, indices, commodities, and crypto for practising low-risk trading strategies.

Instruments Regulator Platforms Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures BVI FSC MT4, MT5 Min. Deposit Min. Trade Leverage $1 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) 1:30 for retail clients, 1:500 for professional

Safety Comparison

Compare how safe the Best Brokers For Beginners In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| InstaForex | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers For Beginners In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| InstaForex | ✘ | ✘ | ✘ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers For Beginners In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| InstaForex | iOS and Android + browser based platform | ✘ |

Beginners Comparison

Are the Best Brokers For Beginners In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| eToro | ✔ | $50 | $10 | ||

| InstaForex | ✔ | $1 | 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) |

Advanced Trading Comparison

Do the Best Brokers For Beginners In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| InstaForex | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 for retail clients, 1:500 for professional | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers For Beginners In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| eToro | |||||||||

| InstaForex |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

Cons

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- The web platform and mobile app receive higher user reviews and app rankings compared to leading competitors like AvaTrade.

- eToro now offers accounts in EUR and GBP, with recent additions of BTC and ETH payment options. This reduces conversion costs and delivers a tailored trading experience.

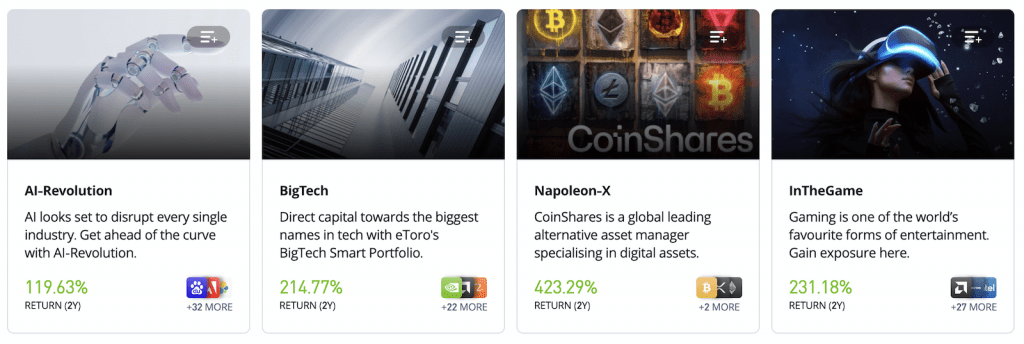

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

Cons

- There are no assured stop-loss orders, which could be a valuable risk management tool for novice traders.

- The only significant contact option, besides the in-platform live chat, is limited.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

Our Take On InstaForex

"InstaForex remains a leading forex broker, offering more currency options than most competitors. Tight spreads and low minimum deposits ensure accessibility for traders of all levels, particularly those accustomed to the MT4 and MT5 platforms."

Pros

- The broker is an excellent choice for dedicated forex traders, offering over 100 currency pairs and competitive spreads starting at 0.0 pips. Additionally, it provides a top-tier collection of forex market resources.

- The broker is beginner-friendly, offering low minimum deposits and commission-free trading.

- InstaForex provides an excellent trading environment, utilising the robust MT4 and MT5 platforms. These platforms come equipped with numerous technical analysis tools, automation features, and various order types.

Cons

- The broker's website and client portal seem outdated, making navigation challenging for beginners.

- Customer support is offered exclusively in English, Czech, Polish, and Slovak.

- The broker exclusively offers trading instruments as CFDs.

How To Compare Brokers For Beginners

With so many online brokers competing for attention, choosing the right platform can feel overwhelming. The best options for beginners, however, tend to share a few key qualities:

Account Fees & Trading Costs

It’s common for beginners to be drawn in by the promise of ‘commission-free investing‘, only to discover later that currency conversion fees or wider spreads eat into returns. For example, buying US stocks through some UK brokers can quietly cost an extra 1% or more per trade. Over a year of monthly investing, this can add up to more than the headline savings on commission.

Platform Usability

Many new investors start with platforms that initially seem exciting but quickly become overwhelming due to flashing charts and endless menus. A simple, intuitive dashboard reduces mistakes and makes it easier to focus on long-term investing. Those who start on complex trading-style platforms often find themselves distracted by tools they don’t understand or need.

Finding the right broker as a beginner often comes down to more than fees—it’s about clarity, support, and confidence. Hands-on experience shows that a platform that feels intuitive and transparent makes learning the markets far less intimidating.

Investment Choice

A broad menu of investments sounds ideal, but too much choice can lead to ‘analysis paralysis.’ Beginners often end up sticking to familiar UK shares or a single ETF simply because the platform doesn’t guide them well. Brokers that highlight starter-friendly funds or provide model portfolios often help new investors make more confident first choices.

Educational Resources

Good educational support goes beyond articles buried in a help centre. Some platforms provide structured learning modules, quizzes, or video explainers that gradually build knowledge. Without this, many beginners rely on social media advice or forums—sometimes picking up risky habits before even understanding the basics of diversification.

Learn trading skills from beginner to advanced with IG’s interactive courses

Customer Support

When withdrawals get delayed or an order doesn’t execute, waiting days for a reply can be stressful. Many new investors discover too late that their broker relies heavily on chatbots with little real support. Platforms with quick access to human help during market hours can provide peace of mind at critical moments.

Copy Trading & Social Investing

Copy trading feels like a safety net at first—simply follow someone experienced and learn by watching. But many discover that the most-followed traders often use high-risk strategies that look good in the short term but swing wildly over time. The most useful platforms are those that display each trader’s risk score, portfolio breakdown, and past drawdowns, so beginners can learn responsibly instead of blindly following.

Mirror experienced investors with eToro’s copy trading portfolios

Safety & Regulation

Discovering later that a broker isn’t FCA-regulated can be an expensive lesson. FSCS protection and segregated client funds aren’t just technical jargon—they’re the line between recovering your money in a worst-case scenario and losing it altogether. Beginners who research this early tend to avoid costly mistakes.

Fractional Shares & Minimum Deposits

Fractional shares often make the difference between investing £20 a week in big names like Amazon or being locked out until more cash is available. However, some brokers only allow fractions through riskier CFD products, leaving beginners confused about what they own. Direct fractional ownership is safer and keeps things simpler for first-time investors.

Invest in expensive stocks with small amounts using Trading 212’s fractional shares

Mobile App vs Desktop

Starting with just a mobile app is convenient, but it can hide the limitations of a platform. Many beginners only realise later that they can’t set advanced orders, export statements easily, or access research tools from mobile alone. Platforms that sync seamlessly between mobile and desktop provide a smoother learning curve and better long-term usability.

Demo Accounts

A demo account is one of the most underrated beginner tools. Practising with virtual money allows new investors to place trades, explore order types, and get comfortable with a platform’s features without risking real capital. Using a demo first often reveals whether a platform feels intuitive or overly complex, and highlights risky habits—like overtrading—before real money is committed. The absence of a demo option means the first mistakes are likely to come with actual losses, making it harder to learn safely.

Practising on a demo account before investing real money revealed exactly how trades behave and where mistakes happen. Experiencing it firsthand made my initial live trades far less stressful and much more manageable.

Hidden Features & Future-Proofing

Many beginners choose a broker solely on fees, only to regret it when they later want access to international markets, better research tools, or tax wrappers. Moving investments to a new platform can trigger capital gains tax or involve weeks of delays. Starting with a broker that can grow with you—offering both beginner simplicity and advanced tools—saves frustration down the road.

Bottom Line

Choosing the best broker for beginners in the UK isn’t about chasing the lowest fees or the flashiest features—it’s about finding a platform that balances cost, usability, safety, and long-term flexibility.

The best brokers help new investors learn as they go, offer accessible entry points like fractional shares or demo accounts, and provide reassurance through strong regulation and reliable support.

With the right choice at the start, beginners can focus less on the mechanics of trading and more on building the confidence and habits that lead to long-term investing success.