UnitedPips Review 2026

Established in 2016 and registered in Saint Lucia, UnitedPips is an offshore broker offering CFD trading on forex, metals, and cryptocurrencies.

This UnitedPips review, led by British traders and industry experts, evaluates its features, reliability, and trading experience to assess its suitability for UK traders.

Our Take

- UnitedPips offers leverage up to 1:1000, which can appeal to Brits looking to maximise their potential returns with a smaller capital investment. However, it’s higher risk than the 1:30 limit imposed by the UK’s FCA for retail traders.

- UnitedPips is not regulated by the UK’s Financial Conduct Authority (FCA), which means it lacks the investor protection and oversight that come with top-tier regulation.

- There’s a narrow selection of trading instruments, mainly limited to forex, precious metals, and cryptocurrencies. Unlike competitors such as IG, it does not offer a broader range, such as stocks or ETFs.

- The broker offers commission-free trading across its accounts, which is attractive if you are looking to reduce costs. However, spreads can still be wide based on our tests, especially on lower-tier accounts.

- UnitedPips lacks comprehensive educational content, which can disadvantage beginners. There are no video tutorials, courses, or webinars to help traders improve their skills.

- UnitedPips offers a mobile-optimised version of its desktop platform, UniTrader, allowing you to access your accounts on the go. However, it’s not a fully dedicated mobile app available in app stores, limiting its functionality.

Is UnitedPips Regulated In The UK?

UnitedPips is not regulated by the UK’s Financial Conduct Authority (FCA), meaning the broker does not adhere to the strict investor protection measures it enforces.

FCA-regulated brokers must segregate client funds and participate in the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000 in case of broker insolvency.

UnitedPips lacks these protections, making it a higher-risk option for UK traders. Instead, the broker is registered offshore in Saint Vincent and the Grenadines and operates under the International Financial Services Authentication (IFSA).

While IFSA provides a basic level of oversight, it does not offer a compensation scheme to protect client funds. Negative balance protection helps limit trading losses, but without FSCS coverage, you face more significant financial risk in the event of the broker’s insolvency.

Accounts

Live Accounts

UnitedPips provides three account types, each requiring a higher minimum deposit to access tighter spreads.

- The Standard account has a $10 (GBP equivalent) minimum deposit, spreads starting from 2.0 pips, and leverage up to 1:1000. You can open positions as small as 0.01 lots, with a maximum trade size of 1 lot. The margin call is 60%, and the stop-out level is 30%.

- The Premium account requires a $2,000 (GBP equivalent) deposit and offers spreads from 1.5 pips and leverage up to 1:500. The minimum lot size remains 0.01, but the maximum increases to 10 lots. The margin call level is lowered to 50%, while the stop-out remains at 30%.

- The VIP account demands a sizeable $10,000 (GBP equivalent) deposit and provides the tightest spreads from 0.7 pips, but leverage is capped at 1:200. Lot sizes range from 0.01 to 100 lots, with a 30% margin call and a 10% stop-out level.

UnitedPips could improve its offering by introducing a zero-spread account, a feature available with brokers like IC Markets and Pepperstone, which would appeal more to active traders.

However, the broker distinguishes itself by offering swap-free accounts to all traders rather than restricting them to those following Sharia law.

Demo Account

UnitedPips provides a demo trading account where I can practice trading in a simulated environment without risking real money.

A standout feature is the unlimited time frame for using the demo account. This allows me to refine my strategies at my own pace, something brokers rarely offer.

This makes it particularly advantageous for beginners aiming to familiarise themselves with forex trading and platform tools before transitioning to live accounts.

To get started, register on the UnitedPips website. You’ll then gain quick access to your client dashboard, which allows you to explore and trade all available instruments risk-free.

Funding Options

Deposits

UnitedPips provides various deposit options, including debit card and credit card, PayPal, Perfect Money, and cryptocurrencies like Bitcoin, Ethereum, and USDT. Crypto deposits receive a 5-10% bonus, which helps cover exchange fees.

The minimum deposit is $50 (GBP equivalent) for PayPal and bank cards and $10 (GBP equivalent) for cryptocurrencies.

From my experience, deposits are processed instantly, allowing me to start trading without delays.

While UnitedPips does not charge deposit fees, external fees of around 5-10% can apply, mainly when using e-wallets, crypto exchanges, or converting currencies.

One drawback for UK traders is that UnitedPips only supports USD as a base account currency.

This means deposits and withdrawals in GBP are subject to conversion fees, adding unnecessary costs. Expanding currency options to include GBP accounts would make transactions more cost-effective for traders in the UK.

Additionally, the broker lacks support for bank wire transfers and popular e-wallets like Skrill, limiting flexibility for funding accounts.

Another improvement would be introducing lower and more consistent minimum deposits across account types, making trading more accessible. Some brokers like Axi even have no minimum deposit amount.

Withdrawals

Withdrawal methods match the deposit options, but fees and minimum amounts vary by payment method.

In my experience, PayPal withdrawals are processed within 1 to 72 hours, while cryptocurrency withdrawals are quicker at up to 24 hours. Credit/debit card withdrawals can take up to 5 business days.

While withdrawals are free, external fees like conversion costs may apply, especially when withdrawing in GBP. PayPal and crypto withdrawals may incur up to 5-10% in fees, depending on the method and network conditions.

The minimum withdrawal is $50 (GBP equivalent) for PayPal and bank cards and $5 (GBP equivalent) for cryptocurrencies. Withdrawals must be made using the same method as the deposit, and account verification is required.

Processing happens Monday through Friday, and all requests are reviewed by the finance department. Keep in mind possible conversion fees and longer processing times for some methods.

Market Access

Trading with UnitedPips feels restrictive due to its limited selection of CFDs, making it less appealing for experienced traders looking for diverse assets.

The forex library includes just over 40 major, minor, and exotic currency pairs.

Precious metals like gold, silver, platinum, and palladium are available, providing some diversification outside of forex.

Cryptocurrency trading is supported with Bitcoin, Ethereum, Ripple, and Litecoin assets.

Compared to brokers like Blackbull Markets, which provide access to over 26,000 instruments, UnitedPips feels underwhelming. The absence of stocks, indices, ETFs and options makes it less competitive for traders seeking a broader portfolio.

Unlike platforms like eToro, which offer copy trading and interest on idle funds, UnitedPips lacks features for passive investors, further limiting its appeal beyond high-risk, short-term trading.

Leverage

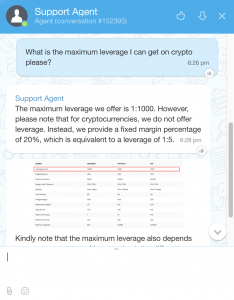

UnitedPips offers flexible leverage, up to 1:1000 for Standard accounts. However, Premium and VIP accounts have lower maximum leverage of 1:500 and 1:200, respectively.

Unlike FCA-regulated brokers, which are limited to 1:30 leverage for retail traders, UnitedPips can offer much higher levels since it operates offshore.

Having said that, UnitedPips does not offer leverage for cryptocurrencies. Instead, it provides a fixed margin percentage of 20%, equivalent to a leverage of 1:5.

Considering the margin percentage, for example, if the price of BTC is $90,000, you would need $18,000 to open one lot of BTC/USD. To open a mini lot, you would need $1,800; for a micro lot, it would cost $180.

I can conveniently adjust leverage settings in my client area, but increasing leverage may require additional approval.

Pricing

UnitedPips employs a straightforward, commission-free pricing model across its three account types.

Fixed spreads offer a degree of price certainty but vary depending on the account tier.

For instance, the Standard account features spreads starting from 2.0 pips on major currency pairs like EUR/USD, while the Premium account offers spreads from 1.5 pips, and the VIP account provides spreads as low as 0.7 pips for the same pair.

UnitedPips’ spreads are competitive, especially as many other brokers also charge commissions in addition to spreads, which can increase trading costs.

UnitedPips’ commission-free structure simplifies cost calculations and can be advantageous if you prefer a clear understanding of your expenses.

Additionally, UnitedPips offers a swap-free trading environment across all account types, eliminating overnight fees for swing trades.

Trading Platform

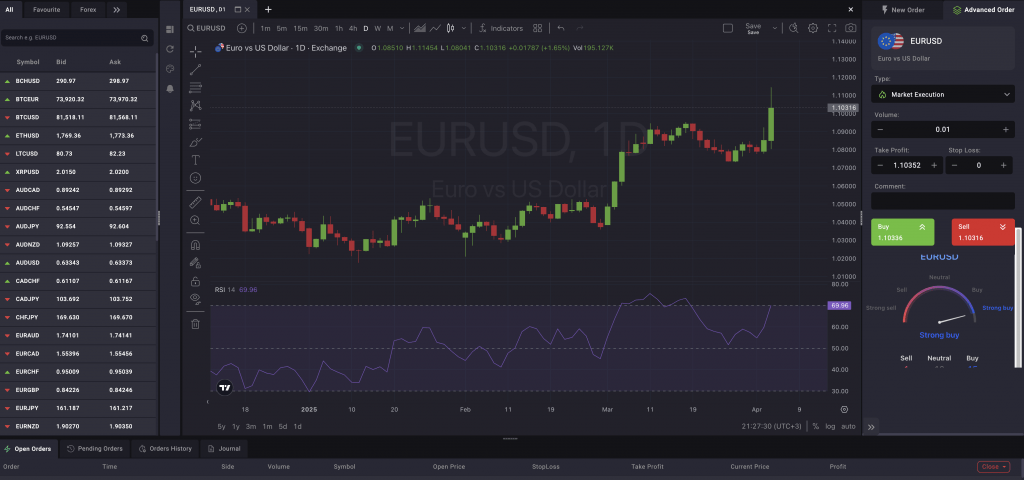

UnitedPips’ trading platform, UniTrader, is a simplified, branded version of TradingView. It offers a familiar interface with basic charting tools and technical indicators.

However, it lacks several features that make TradingView popular, such as customisable indicators, social trading options, and access to community resources for sharing strategies.

The platform’s user-friendly design makes it easy to navigate through instruments, set price alerts, create watchlists, and manage open positions.

I select the instrument from the list to place a trade, set my position size, and choose between a market or limit order. The order execution is quick and seamless.

Adding indicators to a chart is just as easy – I open the chart for the selected instrument, click on the indicators section, and choose from basic tools like moving averages and RSI.

The platform supports basic order types like market, limit, and stop orders. Still, it lacks advanced order types such as trailing stops, “move stop loss to break even,” partial exits, and OCO (one-cancels-the-other) orders, which are helpful for more advanced strategies.

For active traders like me who prefer platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader, UnitedPips can feel limiting since it only offers UniTrader. These third-party platforms typically provide more indicators, customisation options, and automated trading features.

Competitors like Pepperstone offer a wider selection of platforms, including proprietary terminals, giving you more flexibility.

Automated trading is also limited due to the absence of VPS services, which are essential for fast, stable connections, and you can’t integrate third-party tools into your trading setup.

Extra Tools

UnitedPips lacks dedicated educational content – no tutorials, courses, or webinars – which makes it much harder for beginners to get started.

This is frustrating, especially compared to platforms like Interactive Brokers, which offer extensive learning resources like video lessons, live webinars, and structured courses covering technical analysis, risk management, and trading strategies.

Although the broker offers basic market research and in-house analysis, it does not offer real-time news feeds, an economic calendar, or third-party trading signals.

This means I have to rely mostly on my analysis or seek information elsewhere, which puts me at a disadvantage compared to brokers who provide in-depth market insights and trading ideas.

Customer Service

UnitedPips offers solid customer service, though it’s not without room for improvement.

The 24/7 live chat is usually quick to respond, resolving questions about withdrawals or platform features within minutes.

However, there have been times when I’ve been handed off to a new representative mid-chat due to shift changes, which can be irritating and disrupt the support process.

Still, the team is generally clear and patient and stays on the chat until all my questions are answered.

The support options are basic, with email and phone support for UK traders. However, unlike brokers such as FXTM, there’s no call-back feature or multilingual support.

For a better overall experience, UnitedPips should consider adding more communication channels like WhatsApp and Telegram and active social media support.

Expanding the FAQ section and correcting spelling errors in the glossary would also enhance professionalism and accessibility.

Bottom Line

UK traders should carefully weigh the pros and cons of using UnitedPips.

While it offers high leverage, commission-free trading, and a variety of deposit options, it lacks FCA regulation, which means less investor protection.

Additionally, UnitedPips doesn’t provide strong educational resources, market research, or third-party signals, which could make it harder for beginners to succeed.

While customer support is responsive, the lack of multiple communication channels and multilingual support is a drawback.

If you’re experienced and comfortable with the risks of trading with an offshore broker, UnitedPips could be a viable option. However, if strong regulation and comprehensive resources are important to you, it might be better to look for an FCA-regulated broker.

FAQ

Can You Invest In GBP With UnitedPips?

UnitedPips does not support GBP as a base currency for trading accounts. The primary currency for accounts is USD, meaning UK traders must convert their GBP into USD when making deposits or withdrawals.

If you plan to trade in GBP, you must know potential conversion costs when depositing funds or when profits are withdrawn. Brokers like IG or ActivTrades may be better suited if you are looking for GBP-based accounts.

Is UnitedPips Safe For UK Traders?

UnitedPips may not be the safest option for UK traders since it isn’t regulated by the Financial Conduct Authority (FCA).

Instead, it operates under the International Financial Services Authentication (IFSA) in Saint Vincent and the Grenadines, offering limited investor protection.

Traders miss protections like the Financial Services Compensation Scheme (FSCS) without FCA oversight.

Does UnitedPips Offer A Mobile Trading App?

UnitedPips supports its proprietary UniTrader platform on mobile devices but is not a dedicated mobile app available on app stores. Instead, it’s a mobile-optimised version of the desktop platform, offering a similar experience for smartphone/tablet trading.

While it provides essential trading features, it lacks the full functionality and convenience of a third-party mobile app like MetaTrader, cTrader, or TradingView.

Can You Invest In Cryptocurrency With UnitedPips In The UK?

Yes, you can invest in cryptocurrency with UnitedPips in the UK. The broker offers a range of popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin.

However, due to crypto’s volatility, leverage is capped at 1:5, which limits the size of positions compared to other asset classes.

Article Sources

International Financial Services Authentication (IFSA)

Top 3 UnitedPips Alternatives

These brokers are the most similar to UnitedPips:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- XTB - Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

- Fusion Markets - Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

UnitedPips Feature Comparison

| UnitedPips | Pepperstone | XTB | Fusion Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4.8 | 4.8 | 4.6 |

| Markets | CFDs, Forex, Precious Metals, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Minimum Deposit | $10 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | IFSA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, KNF, DFSA, FSC | ASIC, VFSC, FSA |

| Education | No | Yes | Yes | No |

| Platforms | - | MT4, MT5, cTrader | - | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:500 |

| Visit | 72% of retail investor accounts lose money when trading CFDs |

70% of accounts lose money when trading CFDs with this provider. |

||

| Review | UnitedPips Review |

Pepperstone Review |

XTB Review |

Fusion Markets Review |

Trading Instruments Comparison

| UnitedPips | Pepperstone | XTB | Fusion Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | No | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | No | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

UnitedPips vs Other Brokers

Compare UnitedPips with any other broker by selecting the other broker below.

|

|

UnitedPips is #18 in our rankings of CFD brokers. |

| Top 3 alternatives to UnitedPips |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Demo Account | Yes |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Regulated By | IFSA |

| Leverage | 1:1000 |

| Mobile Apps | Web Access Only |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Debit Card, PayPal, Perfect Money |

| Copy Trading | No |

| Islamic Account | Yes |

| Commodities | Gold, Palladium, Platinum, Silver |

| CFD FTSE Spread | NA |

| CFD GBPUSD Spread | 1.3 |

| CFD Oil Spread | NA |

| CFD Stocks Spread | NA |

| GBPUSD Spread | 1.3 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.1 |

| Assets | 40+ |

| Crypto Coins | BTC, ETH, LTC, XRP |

| Crypto Spreads | 500 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |