Best Brokers With Micro Accounts In The UK 2026

For UK traders looking to start small but think big, micro accounts offer a low-barrier entry to the markets without sacrificing serious trading potential.

But success starts with the right broker. We reveal the top UK brokers offering micro accounts that combine competitive costs, reliable platforms, and trustworthy regulation.

Top Micro Account Brokers

-

In our tests, Pepperstone's micro account offered extremely tight spreads starting at 0.0 pips and swift execution in under 40ms, with no minimum deposit. Trading over 1,200 CFDs came with no inactivity fees. With low commissions ($3.50 per lot) and advanced charting tools, small-sized trading was both cost-efficient and highly responsive.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In our evaluations, XTB's Standard and Pro accounts facilitated micro-lot trading without a minimum deposit. The Standard account offers spreads from 0.5 pips, while the Pro account starts at 0.1 pips, with commissions on the Pro account at $3.5 per side. The broker supported MT4/MT5, providing a robust selection of instruments such as forex, stocks, ETFs, and indices.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

Our tests showed FXCC's ECN XL account supports micro-lot trading from a $0 deposit, featuring spreads from 0.0 pips and no commissions. Execution was quick, and there were no inactivity fees. The platform is compatible with MT4/MT5, providing various instruments like forex, metals, energies, and indices.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

During our evaluation of IC Markets, trading with micro-lots provided raw spreads starting at 0.0 pips with a $3.50 per lot commission and execution speeds under 35 ms. There is no minimum deposit required, access to over 2,250 CFD instruments, and no fees for inactivity, making it cost-effective for small trades. Active traders benefited from depth-of-market data and minimal slippage.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

In our recent tests, IC Trading allowed micro-lot sizes, starting at 0.01 lots (around 1,000 units), with ultra-low raw spreads beginning at 0.0 pips and a $7 round-turn fee for Raw accounts. Standard accounts feature 0.8 pips with no commission. Execution on NY4 servers was under a second. We noted no inactivity fees, adaptable lot sizing, ample liquidity, complimentary VPS for active traders, and straightforward hedging and account management.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures FSC MT4, MT5, cTrader, AutoChartist, TradingCentral Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:500 -

Eightcap suits beginners by requiring only a $100 minimum deposit for micro accounts, offering quick 24/5 support, and providing free demo accounts. It also offers webinars, trading guides, and tutorials as educational resources. With access to forex, indices, commodities, and crypto, it helps novice traders test strategies in a secure, cost-effective setting, fostering confidence with micro lots.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

In recent tests, Fusion Markets' micro-lot accounts demanded only a $1 deposit. Spreads were minimal, starting at 0.0 pips, plus $0.045 per micro lot. Execution was swift with no inactivity charges, and MT4/MT5/TradingView/cTrader provided excellent tools, perfect for budget-focused traders.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500

Safety Comparison

Compare how safe the Best Brokers With Micro Accounts In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| IC Trading | ✘ | ✘ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Micro Accounts In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| IC Trading | ✔ | ✔ | ✔ | ✔ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Micro Accounts In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| IC Trading | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Micro Accounts In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| IC Trading | ✔ | $200 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Micro Accounts In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| IC Trading | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Micro Accounts In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| FXCC | |||||||||

| IC Markets | |||||||||

| IC Trading | |||||||||

| Eightcap | |||||||||

| Fusion Markets |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- There are no deposit fees other than standard cryptocurrency mining charges, which benefits active traders.

- FXCC has introduced MT5, which in our evaluations, mirrored the trading conditions of MT4 by offering swift execution, improved charting, and market depth tools.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

Cons

- While the MetaTrader suite excels in technical analysis, its outdated design detracts from the overall trading experience, particularly when contrasted with contemporary platforms such as TradingView.

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- IC Markets provides reliable 24/5 support, especially for account and funding queries, drawing from direct experience.

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

Cons

- IC Markets provides metals and cryptocurrencies for trading through CFDs, though the selection is narrower compared to brokers such as eToro. This limits opportunities for traders focused on these asset classes.

- Interest is not paid on idle cash, a feature gaining popularity with alternatives such as Interactive Brokers.

- The tutorials, webinars, and educational resources require enhancement, lagging behind competitors such as CMC Markets, which diminishes their appeal to novice traders.

Our Take On IC Trading

"IC Trading offers an ideal environment, featuring top-tier execution speeds of around 40 milliseconds, extensive liquidity, and advanced charting tools, perfect for scalpers, traders, and algorithmic traders."

Pros

- The streamlined digital account setup allows traders to commence trading swiftly, eliminating lengthy paperwork. Testing shows the process takes mere minutes.

- IC Trading offers top-tier spreads, with some major currency pairs like EUR/USD featuring spreads as low as 0.0 pips, making it an excellent choice for traders.

- Trading Central and Autochartist provide valuable technical analysis and actionable ideas. These tools are readily available within the account area or on the cTrader platform.

Cons

- Although IC Trading operates under the reputable IC Markets group, it is licensed by the FSC in Mauritius, a regulator known for its limited financial transparency and lack of robust safeguards.

- The educational materials require significant enhancement unless accessed via the IC Markets website. This limitation is particularly disadvantageous for beginners seeking a thorough learning experience, especially when compared to industry leaders such as eToro.

- Customer support was inadequate during testing, with multiple live chat attempts going unanswered and emails ignored. This raises significant concerns regarding their capacity to manage urgent trading issues.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- With spreads starting at 0 pips, minimal commission charges, and leverage up to 1:500 for select clients, Eightcap delivers affordable and flexible trading opportunities. These conditions suit various strategies, such as trading and scalping.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- With an average execution speed of approximately 37 milliseconds, traders can secure optimal prices more effectively, outpacing many competitors in rapidly changing markets.

- Fusion Markets consistently impresses traders with its competitive pricing, featuring tight spreads and lower-than-average commissions. These cost-effective options are particularly attractive to those engaging in frequent trading.

- Fusion Markets provides algo traders with a sponsored VPS and offers a 25% discount for choosing the NYC Servers VPS for MT4 or cTrader.

Cons

- Traders from outside Australia need to register with loosely regulated international firms that offer limited protection, lacking both safeguards and negative balance protection.

- Unlike AvaTrade, there is no specialised trading platform or app tailored for beginners, which is a significant disadvantage.

- The demo account, lasting only 30 days, is limited in its effectiveness as a trading tool when used with a live account.

How Investing.co.uk Chose The Best Brokers with Micro Accounts

We blended 200+ data points with hands-on trading to assess brokers offering micro accounts. Our analysis covered spreads, execution quality, account flexibility, and platform usability – all crucial for traders who prefer smaller lot sizes and tighter risk control.

Brokers were then ranked by overall ratings, ensuring our top picks deliver the best balance of cost, reliability, and accessibility for UK traders.

What To Look For In A Broker With A Micro Account

- FCA regulation & investor protection: Ensure the broker is authorised and regulated by the UK’s Financial Conduct Authority (FCA). This not only enforces strict conduct and capital requirements but also gives you access to the Financial Services Compensation Scheme (FSCS) for up to £85,000 if the broker fails. Unregulated or offshore entities may offer higher leverage or bonuses, but they sacrifice UK-level safeguards.

- Trade execution speed & reliability: In forex and CFDs, execution latency can mean the difference between profit and slippage. Look for brokers with low-latency order routing, ideally under 100ms, and transparent reporting on execution quality. For micro accounts, consistent fills matter as much as spreads, especially when testing short-term strategies.

- Spreads, commissions & hidden costs: Micro accounts can appear cheap, but wide spreads or high overnight swap rates can eat into returns. Compare all-in trading costs, including conversion fees for GBP deposits/withdrawals and inactivity charges, which are common with smaller accounts.

- Leverage & margin requirements: Under FCA rules, leverage on major FX pairs is capped at 1:30, but some brokers offer lower ratios on micro accounts to limit risk. Assess whether the leverage provided aligns with your risk tolerance and strategy, and check for margin call and stop-out levels that could prematurely close trades.

- Range of instruments: A good micro account shouldn’t limit you to a token handful of FX pairs. Look for a broker that offers CFDs on indices, commodities, and possibly stocks—allowing you to diversify strategies without opening multiple accounts.

- Platform quality & usability: Whether it’s MetaTrader 5, cTrader, TradingView, or a proprietary broker platform, ensure the interface supports granular lot sizing (down to 0.01 lots) and offers robust charting, order types, and risk management tools. The ability to backtest and run Expert Advisors (EAs) can be valuable for refining strategies.

- Funding, withdrawals & account flexibility: Check deposit/withdrawal speed, fees, and methods—instant GBP deposits via Faster Payments can keep you agile. Also, consider whether the broker allows easy scaling from micro to standard accounts, so you can increase position size without changing platforms or disrupting your trading history.

Starting with a micro account taught me that small trades expose every flaw in my strategy—and a platform with slow execution or hidden fees can turn a promising test into a costly mistake.Choosing a broker isn’t just about cost—it’s about reliability, transparency, and tools that let you trade confidently while still thinking small.

What Is A Micro Account?

A micro trading account is a brokerage account that allows you to trade in very small contract sizes—typically 1/100th of a standard lot in forex—so each pip movement represents a fraction of the risk.

This means you can test strategies, manage exposure, and gain real-market experience with minimal capital outlay, often from as little as £50–£100.

While micro accounts reduce the financial impact of losses, they don’t eliminate market risk, and low entry costs can tempt overtrading—making discipline and position sizing just as important as with larger accounts.

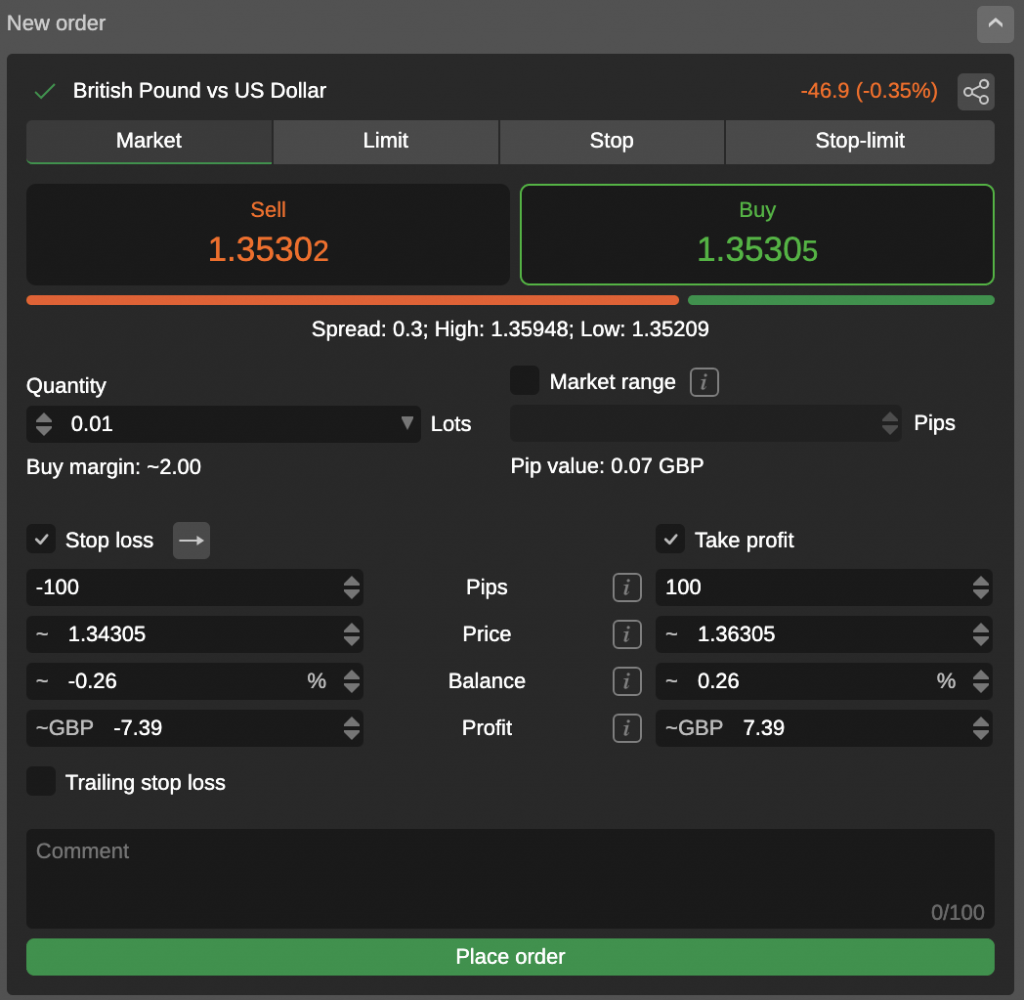

Trading on a micro account allows for precise, low-risk trading

How Does A Micro Account Work?

Imagine the GBP/USD exchange rate is sitting at 1.2100 and then climbs to 1.2165—a movement of 65 pips.

In a standard forex account, controlling one standard lot (100,000 units) would net you around $650 in gross profit before fees. With a micro account, where you trade just 1,000 units, that same move would earn roughly $6.50.

Now flip the scenario: if the rate drops from 1.2100 to 1.2090—a 10-pip decline—you’d be down about $100 on a standard lot, but only around $1 on a micro lot.

This scaling isn’t just about smaller gains—it’s a risk management tool. Micro accounts let you test strategies and ride out market fluctuations without committing large sums, making them ideal for learning price behaviour, refining discipline, and avoiding the psychological pressure that often leads to costly mistakes in early trading.

How Does Leverage Work With A Micro Account?

Many brokers offering micro accounts also provide access to leverage, or ‘trading on margin.’

This allows you to control a position larger than your deposited capital by borrowing funds from the broker, with the borrowed amount repaid at the close of the trade, along with any applicable charges.

Leverage magnifies both profits and losses, so while it can make small market moves more rewarding, it also increases the risk of quickly eroding your capital.

Using the earlier GBP/USD example, a 1:5 leverage ratio would turn a £6.50 gain into £32.50 (5 × £6.50). However, in the losing scenario, your £1 loss would expand to £5.

Now consider the FCA’s maximum allowed leverage for major currency pairs—1:30. The same £6.50 profit would swell to £195 (30 × £6.50), but the £1 loss would also balloon to £30. At this level, even minor price swings can have a significant impact on your balance.

The key takeaway is that leverage is a double-edged sword—it can accelerate account growth, but it can also deplete funds just as fast. Sensible use of position sizing, stop-loss orders, and an understanding of FCA margin requirements can help keep that risk in check.

Trading with a micro account forces you to confront risk in its purest form—every pip matters, but losses are manageable.It’s here I learned that discipline beats size: no amount of leverage or low spreads can replace a well-planned strategy and the patience to stick to it.

Bottom Line

Finding the best broker with a micro account is about balancing opportunity with protection.

A good broker should combine regulatory security, fair trading costs, reliable execution, and the flexibility to trade in small lot sizes without unnecessary restrictions.

While micro accounts minimise capital risk, the broker’s platform quality, leverage options, and transparency will determine how effectively you can learn, test, and grow.

Ultimately, the best choice is one that supports your trading goals today while allowing you to scale up when you’re ready.