Best Brokers With No Minimum Deposit 2026

Brokers with no minimum deposit make it easy to test forex, CFD and other markets without risking too much capital. We’ve pinpointed the top UK brokers with no minimum deposit, ideal for beginners getting started.

Top UK Brokers With Low Minimum Deposits

-

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

FXCC, a well-established brokerage since 2010, offers cost-effective online trading. Registered in Nevis and regulated by CySEC, it is distinguished by its ECN conditions and absence of a minimum deposit requirement. The account opening process is efficient, taking under five minutes.

Instruments Regulator Platforms CFDs, Forex, Indices, Commodities, Crypto CySEC MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

Ingot Brokers, established in 2006, is a well-regulated brokerage firm. It provides opportunities for CFD trading on over 1,000 instruments, encompassing forex, stocks, indices, commodities, and cryptocurrencies. The firm supports both MetaTrader 4 and MetaTrader 5 platforms, offering account options with raw spreads as well as commission-free trades.

Instruments Regulator Platforms CFDs, Commodities, Stocks, Indices, ETFs, Forex, Cryptocurrencies ASIC, FSCA, JSC, FSA, CMA MT4, MT5 Min. Deposit Min. Trade Leverage $10 0.01 Lots 1:500 -

PrimeXBT is a multi-asset platform providing leveraged trading across forex, indices, commodities, and cryptocurrencies. Established in 2018, it now boasts over 1 million users from upwards of 150 countries. Offering copy trading, low commissions, and no minimum deposit, this broker is a favoured choice for those new to crypto trading.

Instruments Regulator Platforms CFDs, Cryptos, Forex, Indices, Commodities, Futures Own Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:1000 -

Established in 2008, NordFX is an offshore CFD brokerage catering to over 1.7 million clients across 190 countries. It provides trading opportunities in forex, stocks, commodities, indices, and cryptocurrencies. Traders use the MT4 and MT5 platforms, benefiting from zero spreads and minimal commissions. The company offers significant leverage of up to 1:1000, with initial deposits starting at just $10.

Instruments Regulator Platforms Forex, CFDs, indices, commodities, cryptos, stocks FSC (Mauritius), FSA (Seychelles) MT4, MT5 Min. Deposit Min. Trade Leverage $10 $1 1:1000

Safety Comparison

Compare how safe the Best Brokers With No Minimum Deposit 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ | |

| Ingot Brokers | ✘ | ✔ | ✘ | ✔ | |

| PrimeXBT | ✘ | ✔ | ✘ | ✔ | |

| NordFX | ✘ | ✘ | ✘ | ✘ |

Payments Comparison

Compare which popular payment methods the Best Brokers With No Minimum Deposit 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Ingot Brokers | ✘ | ✔ | ✔ | ✔ | ✔ | ✘ |

| PrimeXBT | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| NordFX | ✘ | ✘ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With No Minimum Deposit 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| FXCC | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ | ||

| Ingot Brokers | iOS & Android | ✘ | ||

| PrimeXBT | iOS & Android | ✘ | ||

| NordFX | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With No Minimum Deposit 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| FXCC | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots | ||

| Ingot Brokers | ✔ | $10 | 0.01 Lots | ||

| PrimeXBT | ✔ | $0 | 0.01 Lots | ||

| NordFX | ✔ | $10 | $1 |

Advanced Trading Comparison

Do the Best Brokers With No Minimum Deposit 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| Ingot Brokers | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 | ✘ | ✘ | ✘ | ✘ |

| PrimeXBT | ✔ | ✘ | 1:1000 | ✘ | ✘ | ✔ | ✘ |

| NordFX | Expert Advisors (EAs) on MetaTrader | ✘ | 1:1000 | ✔ | ✘ | ✘ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With No Minimum Deposit 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| FXCC | |||||||||

| Trade Nation | |||||||||

| Fusion Markets | |||||||||

| Ingot Brokers | |||||||||

| PrimeXBT | |||||||||

| NordFX |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

Cons

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

Our Take On FXCC

"FXCC remains a top choice for forex traders, offering over 70 currency pairs, very tight spreads from 0.0 pips in tests, and high leverage up to 1:500 with the ECN XL account."

Pros

- There are no limitations on short-term trading techniques such as trading and scalping.

- FXCC offers competitive and transparent ECN spreads starting from 0.0 pips, with no commissions. This makes it one of the most cost-effective forex brokers available.

- FXCC is a trusted and licensed broker under the regulation of CySEC, a leading European authority ensuring excellent safeguarding standards.

Cons

- Unaware traders might face steep withdrawal fees, such as a notable $45 for bank transfers.

- The range of research tools, such as Trading Central and Autochartist, is quite limited. Leading platforms in this category, like IG, offer more advanced features.

- The variety of currency pairs surpasses most options, but the choice of other assets is limited. Notably, stocks are absent.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Global traders can use accounts in various currencies.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- Fusion Markets consistently impresses traders with its competitive pricing, featuring tight spreads and lower-than-average commissions. These cost-effective options are particularly attractive to those engaging in frequent trading.

- Fusion Markets provides algo traders with a sponsored VPS and offers a 25% discount for choosing the NYC Servers VPS for MT4 or cTrader.

- Fusion Markets provides exceptional support, characterised by rapid, friendly, and efficient responses. Unlike other platforms, it doesn't utilise automated chatbots, ensuring traders experience a seamless interaction.

Cons

- Fusion Market falls short compared to competitors like IG in education, offering few guides and live video sessions for enhancing trader skills.

- Unlike AvaTrade, there is no specialised trading platform or app tailored for beginners, which is a significant disadvantage.

- The broker stands out with its extensive selection of currency pairs, surpassing most competitors. However, its alternative investment options are merely average, lacking stock CFDs outside the US.

Our Take On Ingot Brokers

"Ingot Brokers is ideal for traders seeking a straightforward broker offering various instruments. Experienced traders will value the advanced MT5 platform, but beginners might find the educational resources lacking."

Pros

- Traders have access to the top-tier MT4 and MT5 platforms. Together, these platforms provide numerous advanced technical indicators and charting tools, facilitating comprehensive analysis.

- Ingot Brokers is regulated by multiple authorities, including ASIC, a leading regulatory body.

- The modest minimum deposit of $100 and the absence of commission fees are attractive to novice traders.

Cons

- The broker's educational resources and market research lag behind most competitors.

- The ECN account provides a more limited range of assets compared to other account types.

- The selection of over 30 currency pairs falls short of the industry standard and may not meet the needs of dedicated forex traders.

Our Take On PrimeXBT

"PrimeXBT suits aspiring traders interested in crypto derivatives and traditional markets such as forex and indices, all accessible via a user-friendly, web-based platform. The copy trading feature is perfect for passive traders, offering 5-star ratings and performance charts to identify suitable traders."

Pros

- The online platform and app cater to traders, offering advanced charts, a customisable interface, and multiple order options like one-cancels-the-other (OCO).

- Trading fees for crypto futures contracts are quite competitive, with maker fees at 0.01% and taker fees at 0.02%.

- PrimeXBT has introduced new trading options with the addition of tokens such as 1Inch, Aave, and Injective for exchange and investment.

Cons

- PrimeXBT operates widely in the crypto sector but without approval from a recognised regulator, significantly increasing the risk for retail traders.

- Despite enhancements, the range of approximately 100 instruments lags significantly behind competitors, such as OKX, which offers over 400 assets.

- The absence of integration with established platforms such as MT4 restricts traders accustomed to the globally popular forex software.

Our Take On NordFX

"NordFX offers competitive conditions solely for top-tier accounts, ideal for seasoned traders pursuing zero-spread trading via MetaTrader. The minimum deposit is $100 for MT4 and $200 for MT5."

Pros

- A wide array of trading tools enhances the trading environment, such as VPS hosting, calculators, live signals, and an economic calendar.

- The user-friendly trading service might attract novice or advancing traders, requiring only a £100 initial deposit to begin.

- NordFX has enhanced its offerings by introducing Pro accounts, which utilise spread-only pricing. Additionally, Zero accounts now provide spreads starting from 0.0 on popular assets such as EUR/USD.

Cons

- The absence of robust regulatory oversight at NordFX raises concerns. Clients face limited protection, with no negative balance safeguards and no segregated accounts.

- NordFX offers a limited market range, featuring just approximately 100 instruments. The selection of shares is especially sparse, with only about 20 available.

- While NordFX provides competitive pricing with its Zero accounts, it lags behind more cost-effective brokers such as IC Markets. Conversely, its Pro accounts come with some of the highest spreads in the market, starting from 10 pips.

How Investing.co.uk Chose The Best Brokers For Low Minimum Deposits

To create this ranking, we began by recording the minimum deposit requirements for every broker we review.

These figures are tracked and updated regularly, as broker policies can change – Interactive Brokers, for example, has significantly reduced its minimum deposit over the years, now requiring a $0 minimum.

Brokers were then ranked starting with those offering no minimum deposit, followed by those with the lowest deposit thresholds.

This list was overlaid with our overall broker ratings, which are based on more than 200 individual data points collected across eight core categories, including fees, UK regulation, support, and more.

Our ratings are informed by direct, hands-on testing by our UK-based research team, made up of active traders and industry experts with years of market experience.

What Is A Minimum Deposit?

A minimum deposit is the smallest amount required to open a trading account. In the UK, growing competition—especially among discount brokers like XTB and Pepperstone—has led to lower or no minimum deposit requirements, making it easier for new traders to get started.

This is excellent news for UK investors, who can now trade forex, stocks, commodities, CFDs, and even crypto without needing thousands upfront.

Many of these brokers also offer small trade sizes, from just 0.01 lots, helping beginners manage risk while gaining real market experience.

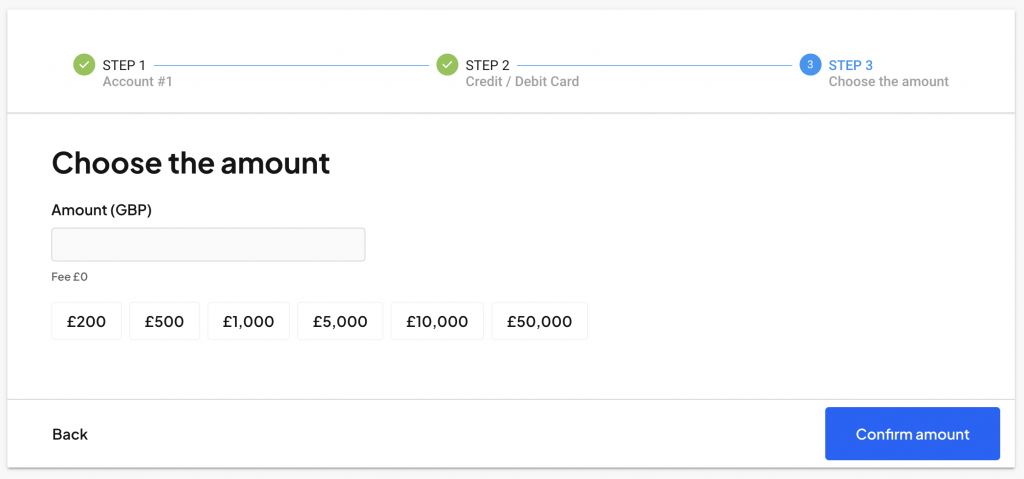

The deposit funds page at FCA-regulated Pepperstone

Pros Of Low Deposit Brokers

Trading with brokers that have no minimum deposit offers several key advantages, especially for new and budget-conscious UK investors:

- Affordable Entry Point: Brokers with low or no minimum deposit requirements are ideal for quick access to popular financial products without a large upfront investment. On a budget, you can begin trading markets like the FTSE 100, GBP/USD, or UK-listed stocks, and gradually build your capital over time.

- Access to a Range of Markets: Most low-deposit brokers we’ve tested offer exposure to various assets, including CFDs on UK and global stocks, major forex pairs like EUR/USD, cryptocurrencies, and commodities like gold and oil. This allows you to explore strategies and asset classes without committing significant funds.

- Great for Beginners: Low-deposit brokers offer a safer starting point if you’re new to trading. You can begin with small amounts and only risk what you’re comfortable losing, making learning the ropes easier and gaining experience without high financial pressure.

Starting out, I didn’t have much capital, so finding a broker with no minimum deposit let me practise in real markets without the pressure of risking a big sum. It was the perfect way to build confidence step by step.

Cons Of Low Deposit Brokers

Choosing a broker with no minimum deposit might seem like an easy win, but it’s also important to weigh the potential downsides:

- Risk of Scams and Unregulated Brokers: The promise of zero deposit, often combined with low fees and generous bonuses can be tempting, but we’ve witnessed fraudulent or substandard brokers using this tactic. You should always ensure your chosen platform is regulated by the Financial Conduct Authority (FCA). No deposit brokers like IG, CMC Markets and City Index are FCA-authorised and adhere to strict standards, offering greater peace of mind. It’s also wise to check for additional protections such as negative balance protection and FSCS protection.

- Hidden or Higher Fees: While skipping a minimum deposit sounds cost-effective, we’ve discovered some brokers compensate for it with alternative charges. These can include high spreads, withdrawal fees, inactivity penalties, or steep commissions. For example, a no-minimum broker might charge more per trade or apply monthly account fees, especially on less frequently traded UK assets like AIM-listed stocks or certain ETFs.

- Limited Tools and Features: Some no deposit brokers keep starting requirements low by offering a basic platform. This means fewer advanced features like integrated platform tools, real-time Level 2 data for UK equities, or smart order routing. While this may suit new traders, more experienced investors might find the lack of premium tools restrictive.

- False Sense of Security for Beginners: The low entry barrier sometimes encourages novice traders to jump in too quickly. New investors may underestimate the risks, lured by aggressive marketing or the comfort of low stakes, without fully understanding trading costs or strategy.

When I first started investing with a no-minimum deposit broker, I quickly realised that the low entry point came with higher spreads and fewer tools. This taught me to look beyond the sign-up offer and really investigate the platform’s features and fees.

What To Look For In A Low Deposit Broker

While selecting a broker with a low or zero minimum deposit can be appealing, it’s equally important to consider these five key factors that may affect your long-term trading success:

1. Trade Size

When selecting a broker with a low or no minimum deposit, it’s crucial to check the minimum trade size it offers. Investing large sums might not be feasible or practical for beginners, especially if you’re still learning the ropes.

Choosing a broker that allows for smaller lot sizes helps manage risk and will enable you to practice trading without exposing yourself to significant losses. Brokers that offer micro accounts (0.01 lots) are often the best choice for newcomers.

2. Training & Tools

Take time to explore what each broker offers beyond just the deposit requirements. Choosing a platform with strong educational resources and trading tools can make a big difference, especially in the early stages.

CMC Markets, a well-known FCA-regulated broker with a low entry threshold, provides valuable extras like a comprehensive trading glossary, market insights, and beginner-friendly tutorials. These resources can help new traders build confidence and improve decision-making.

Features like copy trading and professional-grade charting are worth considering for those interested in more advanced tools. Axi, for example, is a top-rated broker with no minimum deposit. It offers access to social trading platforms and robust technical analysis tools, ideal if you want to learn from others or refine your strategies.

3. Accessibility

Before signing up, ensure the broker accepts UK clients — whether you’re based in London, Birmingham, Edinburgh, or anywhere else in the country. Not all platforms operate in the UK, so it’s important to confirm they’re open to UK residents and ideally regulated by the FCA.

It’s also worth checking that the broker supports the markets you’re most interested in. For example, suppose your focus is on forex trading. In that case, several FCA-regulated brokers with low or no minimum deposits, such as CMC Markets, offer access to major currency pairs like GBP/USD.

On the other hand, if you’re aiming to invest in US tech stocks listed on the Nasdaq, platforms like eToro allow UK investors to trade these equities with a low minimum deposit and no commission.

4. Platform

Top brokers with no minimum deposit often provide access to high-quality trading platforms and mobile apps, making it easy to manage trades from virtually anywhere. If you want flexibility, most offer user-friendly apps compatible with iOS and Android mobile devices, ideal for monitoring positions on the move.

Meanwhile, if you want to take a more active or technical approach, you can use powerful desktop platforms like MT4, MT5, cTrader, and TradingView. These are widely supported by low deposit brokers such as Pepperstone and Axi and include features like advanced charting, custom indicators, and algorithmic trading tools.

5. Deposits & Withdrawals

If you prefer certain payment methods that are popular in the UK like PayPal, a debit card, or bank transfers, it’s important to check that your chosen broker supports them. Many brokers offer a range of deposit and withdrawal options, but not all accept every method or bank.

Leading UK brokers with low minimum deposits, such as XTB, typically support major payment providers and accept bank transfers from UK institutions like Barclays, Lloyds and NatWest.

It’s wise to review any daily withdrawal limits, processing times, and potential fees to avoid surprises when accessing your funds.

Bottom Line

Whether you’re looking to trade forex, invest in UK stocks, explore gold markets, or even try your hand at options trading, choosing a broker with no minimum deposit can be a smart way to begin, particularly for newcomers.

These platforms offer a low-risk market entry without requiring a significant upfront commitment.

That said, it’s essential to do your homework. Ensure the broker is FCA-regulated, review all the terms and conditions, and pay close attention to fees and trading conditions.

When chosen carefully, a low or no-minimum deposit broker can provide an accessible and secure starting point for UK retail investors.

See our list of recommended no deposit trading brokers to start trading today.

FAQ

Which Trading Broker Has The Lowest Deposit?

Some brokers allow UK investors to open an account with as little as £0, removing one of the most significant barriers to entry.

Trusted platforms such as ActivTrades and XTB offer no minimum deposit, making them attractive options for beginners or those looking to start small without compromising platform quality or regulatory oversight.

Can I Trust A Broker With A Low Minimum Deposit?

While many brokers with low or no minimum deposit requirements are reputable, UK investors should still prioritise platforms authorised and regulated by the FCA. This ensures your funds are protected and the broker operates under strict standards.

It’s also important to watch out for hidden fees and be especially cautious of suspicious ads or pop-ups promoting “no deposit” trading accounts on casino apps, gambling websites, or mobile games. These are often linked to unregulated or scam brokers. Always verify the broker’s credentials before signing up.