Best Brokers With No Inactivity Fees 2026

Brokers with no inactivity fees don’t charge for periods of zero trading activity, making them well-suited to casual investors. This contrasts with most brokerages that generally charge a monthly fee after three or more months of no trading, catching out beginners.

Dig into our list of the top UK brokers that don’t charge for inactivity.

Top Brokers With No Inactivity Fee

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto ASIC, CySEC, CMA, FSA MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $200 0.01 Lots 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) -

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Instruments Regulator Platforms Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) FCA, ASIC, FSCA, SCB, FSA MT4 Min. Deposit Min. Trade Leverage $0 0.1 Lots 1:500 (entity dependent) -

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities ASIC, FCA, CySEC, SCB MT4, MT5, TradingView Min. Deposit Min. Trade Leverage £100 0.01 Lots 1:30 -

Fusion Markets, an online broker since 2017, operates under the regulation of ASIC, VFSC, and FSA. Renowned for offering cost-effective forex and CFD trading, it provides various account options and copy trading solutions to suit diverse trading needs. New clients can begin trading with a simple three-step registration process.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto ASIC, VFSC, FSA MT4, MT5, cTrader, TradingView, DupliTrade Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

BlackBull, a New Zealand-based CFD broker, offers a wide range of trading options across more than 26,000 instruments. Following a 2023 rebrand, it boasts a contemporary design and provides advanced trading tools along with ultra-fast execution speeds, averaging 20ms.

Instruments Regulator Platforms CFDs, Stocks, Indices, Commodities, Futures, Crypto FMA, FSA BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500

Safety Comparison

Compare how safe the Best Brokers With No Inactivity Fees 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| IC Markets | ✘ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Fusion Markets | ✘ | ✔ | ✘ | ✔ | |

| BlackBull Markets | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With No Inactivity Fees 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| IC Markets | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Fusion Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| BlackBull Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With No Inactivity Fees 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ | ||

| Fusion Markets | iOS & Android | ✘ | ||

| BlackBull Markets | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With No Inactivity Fees 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Fusion Markets | ✔ | $0 | 0.01 Lots | ||

| BlackBull Markets | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With No Inactivity Fees 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Fusion Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✘ | 1:500 | ✔ | ✘ | ✔ | ✘ |

| BlackBull Markets | Expert Advisors (EAs) on MetaTrader, cTrader Automate | ✘ | 1:500 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With No Inactivity Fees 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| IC Markets | |||||||||

| Interactive Brokers | |||||||||

| Trade Nation | |||||||||

| Eightcap | |||||||||

| Fusion Markets | |||||||||

| BlackBull Markets |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

Our Take On IC Markets

"IC Markets provides excellent pricing, swift execution, and easy deposits. With cutting-edge charting tools like TradingView and the Raw Trader Plus account, it continues to be a preferred option for intermediate and advanced traders."

Pros

- Access over 2,250 CFDs across diverse markets like forex, commodities, indices, shares, bonds, and cryptocurrencies. This variety enables traders to employ diversified strategies.

- As a well-regulated and reputable broker, IC Markets focuses on client safety and transparency to provide a dependable global trading experience.

- In 2025, IC Markets earned DayTrading.com's accolade for 'Best MT4/MT5 Broker' due to its top-tier MetaTrader integration. This achievement highlights the broker's continuous refinement over the years to enhance the platform experience.

Cons

- Interest is not paid on idle cash, a feature gaining popularity with alternatives such as Interactive Brokers.

- Although there are four top-tier third-party platforms available, the absence of in-house software or a trading app tailored for novice traders is notable.

- Certain withdrawal methods incur fees, including a $20 charge for wire transfers. These costs can reduce profits, particularly with frequent withdrawals.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- A wide range of third-party research subscriptions, both free and paid, are available for traders. Additionally, by subscribing to Toggle AI, traders can receive commission rebates from IBKR.

Cons

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- The trading firm provides narrow spreads and a clear pricing structure.

- Trade Nation, a highly regarded and well-regulated broker, was formerly known as Core Spreads.

- Global traders can use accounts in various currencies.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

Our Take On Fusion Markets

"Fusion Markets offers forex traders competitive pricing with minimal spreads, low commissions, and new TradingView integration. It is an excellent choice, especially for Australian traders, given its base and regulation by ASIC."

Pros

- The selection of charting platforms and social trading features is outstanding. Options like MT4, MT5, cTrader, and the newer TradingView meet diverse trader preferences.

- Fusion Markets consistently impresses traders with its competitive pricing, featuring tight spreads and lower-than-average commissions. These cost-effective options are particularly attractive to those engaging in frequent trading.

- With an average execution speed of approximately 37 milliseconds, traders can secure optimal prices more effectively, outpacing many competitors in rapidly changing markets.

Cons

- The demo account, lasting only 30 days, is limited in its effectiveness as a trading tool when used with a live account.

- Traders from outside Australia need to register with loosely regulated international firms that offer limited protection, lacking both safeguards and negative balance protection.

- The broker stands out with its extensive selection of currency pairs, surpassing most competitors. However, its alternative investment options are merely average, lacking stock CFDs outside the US.

Our Take On BlackBull Markets

"Following the upgrade to Equinix servers in New York, London, and Tokyo, BlackBull has reduced latency, making it a clear choice for stock CFD trading using ECN pricing."

Pros

- BlackBull provides everything a trader needs: execution speeds under 100ms, leverage as high as 1:500, and competitive spreads starting at 0.0 pips.

- BlackBulls's research excels, particularly in the daily 'Trading Opportunities' articles. These publications simplify complex market dynamics into clear insights, enabling traders to effectively capitalise on emerging trends.

- BlackBull provides three ECN-powered accounts—Standard, Prime, and Institutional—to cater to traders of all experience levels, from novices to seasoned professionals. The variety of account types allows for flexible options tailored to individual trading needs and available capital.

Cons

- Unlike many leading brokers, BlackBull imposes a bothersome $5 fee for withdrawals. This charge can reduce the overall cost-effectiveness, particularly for traders who regularly transfer funds.

- Despite enhancements such as webinars and tutorials in the Education Hub, our review indicates that the courses still require greater emphasis on elucidating broader economic factors affecting prices.

- BlackBull does not offer its own trading platform, instead utilising MetaTrader, cTrader, and TradingView. Although these platforms are highly regarded, some brokers, such as eToro, provide proprietary platforms with distinct features that cater well to novice traders.

How Investing.co.uk Chose The Top No Inactivity Fee Brokers

Our team reviewed account terms and conditions in detail and, where necessary, contacted customer support directly to confirm that no inactivity or dormancy fees are charged.

Platforms were rated higher if they combined clear, fee-free account policies with transparent pricing, reliable platforms, and strong customer protection measures, with overall ratings ultimately used to sort providers.

What To Look For In A Broker With Zero Inactivity Fees

Trust

The most important criteria when we review any broker is that it is reliable – otherwise, you risk losing your money to scams or business failure even if your trades are successful.

- Pepperstone is regulated by seven trusted financial bodies, including the UK’s Financial Conduct Authority (FCA). With a great choice of trading platforms provided, spanning MT4, MT5, cTrader and TradingView, and both CFDs and spread bets on popular markets with no minimum deposit, this is a great choice for traders seeking a trustworthy broker with no inactivity fees.

Fees

Aside from the inactivity fee, you need to look for a broker with low trading fees as these will chip away at your profits over time.

Avoid brokers that apply hidden fees such as charges for data, deposits and withdrawals as these affect your bottom line in the same way as inactivity fees.

- IC Markets has been a leading low-cost broker for years, thanks spreads starting at zero pips with a $3.5 commission per lot per side on its Raw Spread account and spreads from 0.6 pips on its commission-free Standard option. There are no deposits or withdrawal fees, no inactivity fees, and traders have fee-free access to top platforms plus third-party trading tools like ZuluTrade.

Markets

Choose a broker with a wide range of markets and you’ll have so many trading opportunities you may never need to worry about an inactivity fee!

We usually prefer brokers with access to 40+ forex pairs including all of the majors, plus global stocks, indices and commodities.

Having additional instruments like cryptocurrencies, ETFs and bonds adds even more depth and is a huge bonus for traders.

- Interactive Brokers is one of the best UK brokers with no inactivity fees for advanced traders because of its huge range of assets, which includes stocks from every region in the world plus forex, CFDs, cryptocurrencies, indices, bonds, options, ETFs, warrants and more.

Charting Platforms

The charting platform is your window onto markets and an indispensable tool for planning and executing trades, so you should make sure your broker provides one that you’re happy with.

Our experts have found that most brokers support the classic MT4 and MT5 platforms, and these have everything you need to access markets.

However, after decades these are finally starting to show their age, and many brokers now offer newer and more streamlined platforms such as TradingView, which has the advantage of integrated social media and research feeds.

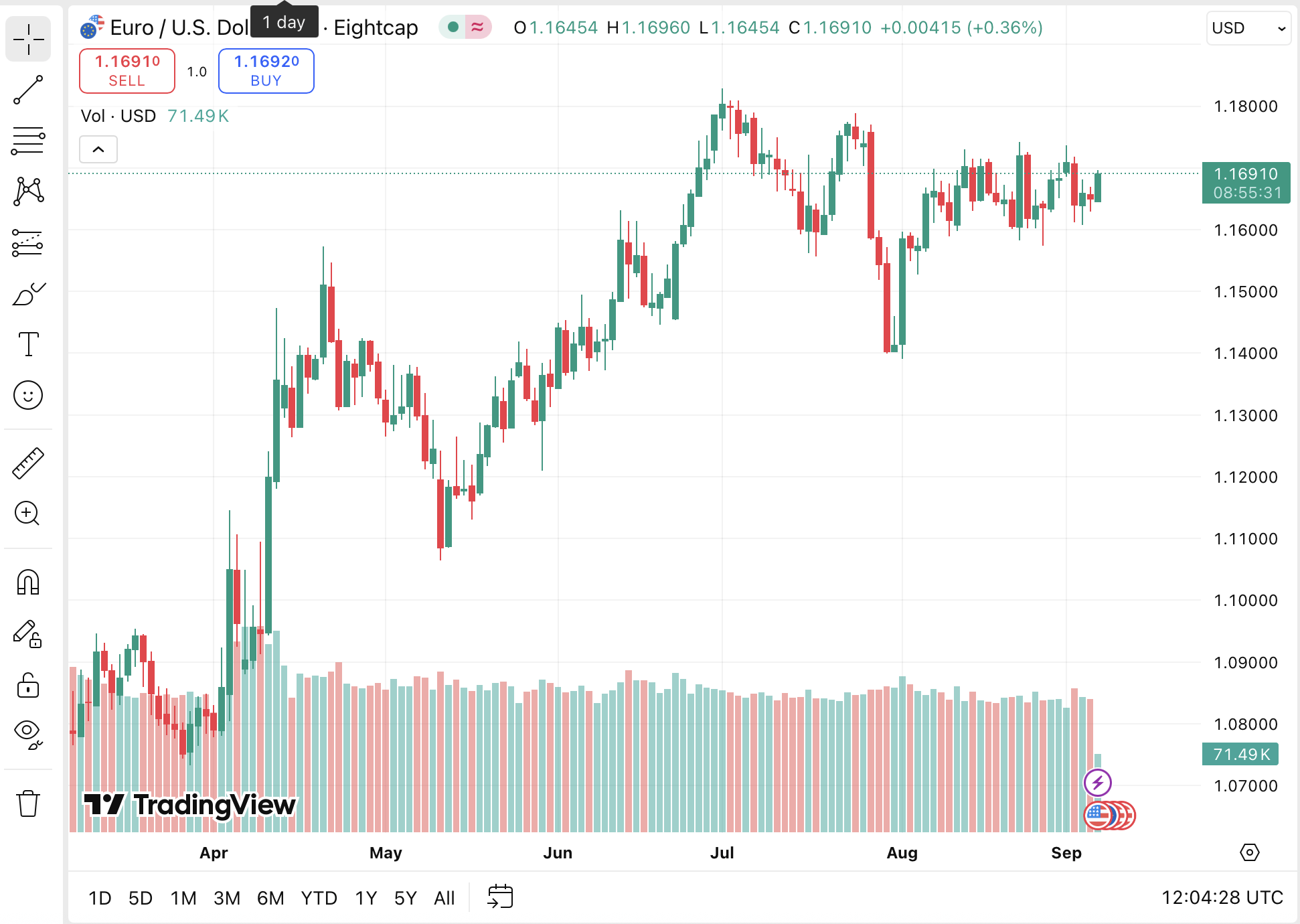

Eightcap’s EURUSD pair on TradingView

Some brokers have different asset lists on different platforms or generally work better with one platform than another, even if they support both. I find that an easy way to get a feeling for how a platform works with a particular broker is to use a demo trading account.

- Eightcap remains a great choice for UK traders looking for flexible platform options, with access to MT4, MT5 and TradingView. It’s also one of the most competitive when it comes to fees, with no charges for inactivity, account management or deposits/withdrawals, and a fair pricing structure with $7 round-turn per lot commissions.

Account Options

You need to be able to fund your account quickly and affordably, so you should choose a broker that has account options that suit you.

Other things to consider include whether the broker offers a swap-free account if your religious beliefs prohibit interest.

The best brokers with no inactivity fees offer flexible accounts and accept diverse payment methods, with digital options supported as well as card and wire transfers.

- XTB‘s account options are still among the best of any broker with no inactivity fee, with payment methods including card, wire transfer and e-wallets including PayPal. There’s no minimum deposit, allowing almost anyone to set up an account easily, and the swap-free account is suitable for Muslim traders.

What Is An Inactivity Fee In Trading?

As the name suggests, an inactivity fee is a charge levied on trading accounts that haven’t been active for a period. The length of that period and the size of the fee varies between online brokers. The fee itself is normally charged monthly and can range from $5 to $50+ from our tests.

The terms and conditions of account inactivity fees also vary. For example, we’ve seen some brokers charge if you haven’t placed a trade or if you have no open positions, while others simply require you to log into your account to avoid a fee.

Ultimately, for part-time investors and beginners, brokers with no inactivity fees are a sensible way to avoid hidden charges and non-trading costs.

Bottom Line

Inactivity fees are charged by most forex, stock and CFD brokers in the UK. Fortunately, there remain many excellent alternatives with no such charge, making them ideal for beginners and part-time investors.

To find the right provider for your needs, use our list of the top brokers with no inactivity fees.

FAQ

Can I Avoid Trading Inactivity Fees?

Yes – the easiest thing to do is to sign up with brokers with zero inactivity fees. Alternatively, you can avoid the charge on some platforms by simply logging into your trading account every couple of months.

With that said, it’s worth checking their terms and conditions because some brokers require that you open and close a real-money trade to avoid the charge.

Is It Legal For Trading Brokers To Charge Inactivity Fees?

Yes – it is legal for brokers to charge fees on inactive accounts. The charge is typically used to cover the costs of maintaining a live account. Yet reputable brokers should make clear any non-trading fees in their pricing schedule.

Firms that fail to disclose inactivity fees and other non-trading charges at the registration stage should be avoided.