Best Brokers With APIs In The UK 2026

In today’s fast-moving markets, savvy investors don’t just trade—they build. Whether you’re automating strategies, backtesting ideas, or integrating with custom dashboards, having access to a powerful broker application programming interface (API) can give you a serious edge.

We break down the top UK brokers with APIs so that you can take control of your investments with speed, precision, and tech-driven insight.

Top Brokers With API Access

-

When we evaluated Pepperstone's FIX and cTrader Open API in trading simulations, execution latency consistently remained at around 30 ms, even during volatility peaks. Razor account spreads started at 0.0 pips, plus approximately $7 per lot, keeping trading costs minimal. Deep ECN liquidity and Smart Trader tools improved order execution, making it perfect for algorithmic traders.

Instruments Regulator Platforms CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

In testing, BlackBull Markets' FIX API showed outstanding performance with execution speeds averaging below 75 milliseconds, outperforming the industry standard of 130 milliseconds. Their ECN infrastructure utilises the NY4 Equinix data centre, ensuring extensive liquidity and tight spreads starting at 0.0 pips plus a $2 commission per lot. This is beneficial for algorithmic traders and high-frequency strategies.

Instruments Regulator Platforms CFDs, Stocks, Indices, Commodities, Futures, Crypto FMA, FSA BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:500 -

IG’s REST API delivered dependable order execution with moderate delays during our tests, making it suitable for automated strategies but not for ultra-low-latency requirements. The API provides advanced market data and order types, with competitive spreads, particularly on major indices and forex pairs.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

FOREX.com's REST API proved dependable for automation, offering average execution speeds near 20 ms, with most trades executed in under a second, perfect for algorithmic strategies. Raw-pricing accounts had spreads dropping to about 0.2 pips, with a $7 commission per 100k. Lightstreamer streaming support works but is less refined than competitor endpoints.

Instruments Regulator Platforms Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA WebTrader, Mobile, MT4, MT5, TradingView Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 -

FxPro’s FIX and cTrader APIs ensure rapid order execution, averaging 11–14 ms even during high volatility. Over 80% of orders achieve mid-price, reducing slippage. Spreads on cTrader begin at 0.3 pips, with co‑located VPS hosting at LD4 London decreasing latency, perfect for algorithmic strategies.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting FCA, CySEC, FSCA, SCB, FSA FxPro Edge, MT4, MT5, cTrader, AutoChartist, TradingCentral, DupliTrade, Quantower Min. Deposit Min. Trade Leverage $100 0.01 Lots 1:30 (Retail), 1:500 (Pro) -

Testing showed BitMEX's FIX API adds latency, acting as a layer over the REST API. Although the WebSocket API provides real-time data efficiently, it sometimes falters during high volatility, hinting at possible overloads. To achieve optimal performance, position your server in AWS EU-West-1, aligning with BitMEX's server location for the quickest connection.

Instruments Regulator Platforms Crypto Republic of Seychelles BitMEX Web Platform, AlgoTrader, TradingView, Quantower Min. Deposit Min. Trade Leverage $0.01 Variable -

In our Axi API tests, execution latency averaged 110 milliseconds, fitting for trading but possibly limiting high-frequency traders. They offer tight spreads, from 0.0 pips on Pro accounts, and a free VPS for low-latency trading. However, Axi's sole use of MetaTrader 4 may not attract users searching for more advanced platforms.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, Crypto FCA, ASIC, FMA, DFSA, SVGFSA Axi Copy Trading, MT4, AutoChartist Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30

Safety Comparison

Compare how safe the Best Brokers With APIs In The UK 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| BlackBull Markets | ✘ | ✔ | ✘ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✘ | |

| FXPro | ✔ | ✔ | ✘ | ✔ | |

| BitMEX | ✘ | ✘ | ✘ | ✘ | |

| Axi | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With APIs In The UK 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BlackBull Markets | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| FXPro | ✔ | ✘ | ✔ | ✔ | ✔ | ✘ |

| BitMEX | ✘ | ✘ | ✘ | ✘ | ✘ | ✘ |

| Axi | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With APIs In The UK 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| BlackBull Markets | iOS & Android | ✘ | ||

| IG | iOS & Android | ✔ | ||

| Forex.com | iOS & Android | ✘ | ||

| FXPro | iOS & Android | ✘ | ||

| BitMEX | iOS & Android | ✘ | ||

| Axi | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With APIs In The UK 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| BlackBull Markets | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| FXPro | ✔ | $100 | 0.01 Lots | ||

| BitMEX | ✔ | $0.01 | Variable | ||

| Axi | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With APIs In The UK 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| BlackBull Markets | Expert Advisors (EAs) on MetaTrader, cTrader Automate | ✘ | 1:500 | ✔ | ✔ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| FXPro | Expert Advisors (EAs) on MetaTrader, cBots on cTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✔ | ✔ | ✘ |

| BitMEX | BitMEX Market Maker, BotVS, and via API | ✘ | - | ✘ | ✘ | ✘ | ✘ |

| Axi | Expert Advisors (EAs) on MetaTrader, Myfxbook | ✔ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With APIs In The UK 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| BlackBull Markets | |||||||||

| IG | |||||||||

| Forex.com | |||||||||

| FXPro | |||||||||

| BitMEX | |||||||||

| Axi |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone's demo accounts expire after 30 days, which may not provide sufficient time to explore various platforms and evaluate trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On BlackBull Markets

"Following the upgrade to Equinix servers in New York, London, and Tokyo, BlackBull has reduced latency, making it a clear choice for stock CFD trading using ECN pricing."

Pros

- BlackBull provides three ECN-powered accounts—Standard, Prime, and Institutional—to cater to traders of all experience levels, from novices to seasoned professionals. The variety of account types allows for flexible options tailored to individual trading needs and available capital.

- BlackBull provides everything a trader needs: execution speeds under 100ms, leverage as high as 1:500, and competitive spreads starting at 0.0 pips.

- BlackBulls's research excels, particularly in the daily 'Trading Opportunities' articles. These publications simplify complex market dynamics into clear insights, enabling traders to effectively capitalise on emerging trends.

Cons

- Unlike many leading brokers, BlackBull imposes a bothersome $5 fee for withdrawals. This charge can reduce the overall cost-effectiveness, particularly for traders who regularly transfer funds.

- Despite an expanding range of over 26,000 assets, including new additions to Asia Pacific indices, their offerings are primarily equities. The selection of currency pairs and indices remains average.

- Despite enhancements such as webinars and tutorials in the Education Hub, our review indicates that the courses still require greater emphasis on elucidating broader economic factors affecting prices.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

Cons

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- Although FOREX.com has expanded its range of instruments, its product offering is confined to forex and CFDs. Consequently, there are no investment options for actual stocks, ETFs, or cryptocurrencies.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On FXPro

"FxPro is an excellent choice for traders, offering swift execution speeds under 12ms, reduced fees since 2022, and outstanding charting platforms like MT4, MT5, cTrader, and FxPro Edge."

Pros

- FxPro provides four dependable charting platforms, including the user-friendly FxPro Edge. It features more than 50 indicators, 7 types of charts, and 15 different timeframes.

- FxPro's Wallet is a notable feature enabling traders to securely manage their funds. It ensures additional protection and ease by separating unused funds from active trading accounts.

- FxPro uses a 'No Dealing Desk' (NDD) model for swift and transparent order execution, usually within 12 milliseconds, making it well-suited for short-term trading strategies.

Cons

- FxPro, with its $10M funded demo account and expanding Knowledge Hub, mainly caters to experienced traders. Beginners might find its account and fee structure challenging to understand.

- There are no passive investment options such as copy trading or interest on cash. While traders might not find these essential, competitors like eToro, which accommodate both active and passive investors, offer more extensive services.

- FxPro offers customer support five days a week around the clock, accessible via various platforms, and the service quality is reliable based on tests. However, the absence of weekend support can be a drawback for traders requiring help beyond standard market times.

Our Take On BitMEX

"Traders interested in a wide selection of crypto derivatives will find BitMEX appealing, especially with its Perpetual Contracts. Additionally, the 100x leverage on Bitcoin exceeds that of many other platforms."

Pros

- The BMEX token offers up to 15% discounts on trading fees and other exclusive benefits when staked.

- The broker ensures exceptional security by employing a mix of hot and cold wallets alongside advanced encryption for managing cryptographic keys.

- The specialised crypto platform is more efficient than other multi-asset terminals.

Cons

- BitMEX operates as an offshore company and lacks regulation by any reputable authority, which is typical for crypto brokers.

- Only Bitcoin is allowed for cost-free withdrawals.

- BitMEX primarily caters to active traders, offering limited tools and features for beginners.

Our Take On Axi

"Axi excels for forex trading on MetaTrader 4 with over 70 currency pairs, MT4 NextGen features, and tight spreads starting at 0.2 pips on the Pro account."

Pros

- Based on our tests, Axi's new trading app is highly intuitive. It offers practical filtering options to align strategies with individual risk preferences.

- Experienced traders are invited to join the Axi Select funded trader programme via the broker's international branch. This scheme offers up to $1 million in capital with the benefit of a 90% profit share.

- Axi Academy offers a wealth of educational resources, from free eBooks and video tutorials to interactive quizzes. These are particularly beneficial for novice traders.

Cons

- Axi retains our confidence. However, recent issues with ASIC and FMA require it to maintain a secure environment and comply with licensing standards.

- Although Axi delivers excellent performance, its support is not available 24/7. This unavailability can be inconvenient for traders operating in different time zones or requiring help beyond regular trading hours.

- Axi lags by solely providing MT4, while competitors have upgraded to MT5, cTrader, TradingView, and bespoke platforms, delivering a smoother user experience with enhanced tools.

How We Selected The Top Brokers For APIs

Our UK-based team shortlisted regulated brokers offering API access and conducted hands-on tests. We evaluated brokers’ APIs for ease of integration, data reliability, execution, and available documentation.

Each broker was rated and ranked based on performance, considering not just API access but the full trading experience.

How To Choose A Broker With API Access

- Real-time market data access enables your trading algorithms to see and react to price changes as they occur. Without live data, your trades might be based on outdated information, leading to poor timing and missed opportunities. For example, suppose you’re using an API to place trades automatically. In that case, delays of even a few seconds can make a significant difference—especially in fast-moving markets like forex or cryptocurrency.

- Order execution and management through an API allows your trading system to place, update, and cancel orders automatically based on real-time market conditions. This means you can respond instantly to price movements without manual input. For example, you can program a stop-loss to trigger the moment a price drops to a certain level, or adjust a limit order as the market shifts. Reliable order management ensures your trades are accurate, fast, and aligned with your strategy—which is especially important when trading at scale or in volatile markets.

- Historical data availability allows you to backtest your trading strategies, meaning you can see how they would have performed in the past before risking real money. Through an API, you can access price history, volume, and other market indicators to test and refine your approach. Without historical data, you’re guessing whether your strategy will work. Technically, it also helps you train models or simulations if you’re exploring more advanced algorithmic trading.

- Security and authentication protect your trading account and personal data when using a broker’s API. Methods like API keys or OAuth ensure that only you—or trusted applications you approve—can access your account and place trades. Without strong security, your account could be vulnerable to hacking or unauthorised trades. These protocols help verify identities and encrypt communication between your software and the broker, keeping your investments safe in an online environment.

- A sandbox or testing environment lets you try out your trading strategies and code without risking real money. It’s a safe space where you can send orders, access market data, and simulate trades just like in the real market—but without any financial consequences. This helps you catch bugs and refine your algorithms before going live, reducing the chance of costly mistakes once you start trading with actual funds.

- Cost and limits matter because many broker APIs charge fees or impose restrictions on how often you can make requests, known as rate limits. If you exceed these limits, your API access might be slowed down or temporarily blocked, which can disrupt your trading strategies. Some brokers also offer different access levels, where advanced features or higher usage come with extra costs. Understanding these technical details helps you choose an API that fits your budget and trading style without unexpected interruptions or fees.

- Good documentation and developer support make it easier to understand and use a broker’s API correctly. Clear guides, examples, and troubleshooting help you build and test your trading tools without getting stuck. Well-written documentation explains how to connect, send orders, and handle data securely, reducing errors and saving time. Strong support means you can get help quickly if something goes wrong, making your trading experience smoother and more confident.

When I first started automating trades, I realised a good broker API isn’t just a bonus—it’s the backbone. If the connection’s unreliable or the docs are a mess, even the best strategy can fall apart.

What Is A Broker API?

A broker API (Application Programming Interface) is a set of tools that lets you connect directly to a trading platform using code.

Instead of placing trades manually through a website or app, you can use an API to automate buying and selling, access real-time market data, or track your portfolio.

You’ll need to understand the different API endpoints—like market data and order management—so you can build trading systems that execute trades and track your portfolio seamlessly in real time.

This is especially useful for building custom trading strategies, backtesting ideas, or integrating with tools like Python, Excel, or dashboards.

For beginners, it opens the door to more advanced, hands-off investing—but it does require some basic programming knowledge.

Why Use A Broker API?

APIs enable the execution of trading strategies that would be too slow or complex to implement manually. Because markets move quickly, using an API helps you and your broker react faster to changes and take advantage of opportunities in real time.

For example, if you’re interested in a broker that allows high-frequency trading—where positions are opened and closed within seconds—you’ll need an algorithm and fast technology to make it work. These strategies rely on making numerous quick, small trades, and APIs are essential for executing them smoothly.

APIs are also helpful for everyday trading. They enable you to connect directly to a wide range of financial markets, including stocks, forex, commodities, and cryptocurrencies, making trading faster and more efficient overall.

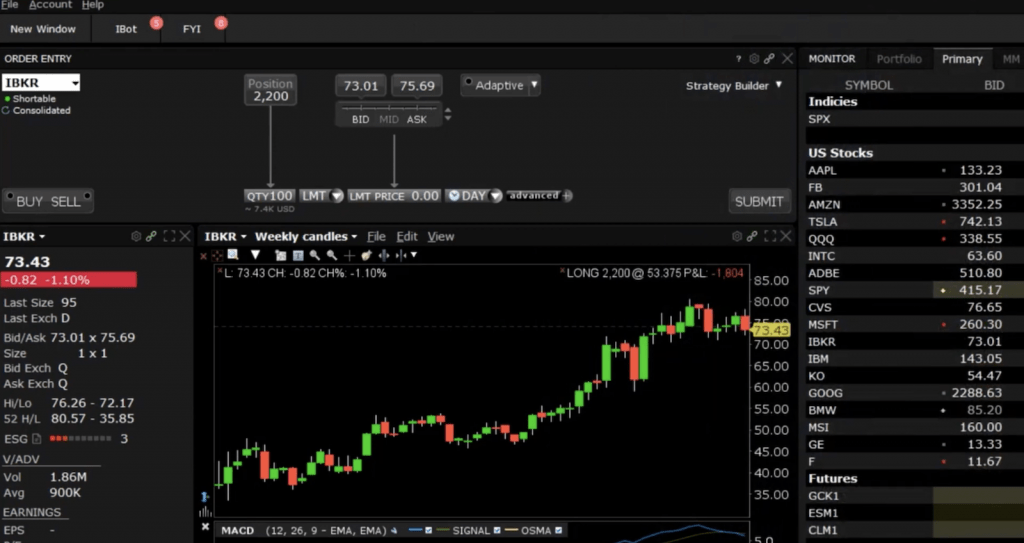

Clients with funded accounts can use IBKR’s TWS API

Pros Of APIs For Trading

- Automation of trading strategies: Broker APIs let you automate your trades based on predefined rules, so you don’t have to watch the markets all day. This means you can run strategies 24/7—including entry, exit, stop-loss, and rebalancing—without manual input.

- Faster execution & real-time access: APIs allow for lightning-fast trade execution and direct access to live market data. This speed is crucial when markets move quickly, enabling you to react instantly to price changes and capitalise on short-term opportunities.

- Customisation & flexibility: With an API, you can build your trading tools, dashboards, or alerts tailored to your needs. Whether you’re using Python, Excel, or third-party platforms, APIs give you the freedom to trade your way, not just through a broker’s default app.

Cons Of APIs For Trading

- Requires technical knowledge: To use a broker API effectively, you’ll need at least basic programming skills (usually in Python or JavaScript). This can be a steep learning curve for beginners who aren’t familiar with coding or software tools.

- Risk of costly mistakes: If your code has errors or your trading logic isn’t carefully tested, you could place unwanted trades, lose money quickly, or even violate trading rules. A small bug can lead to big losses if not caught in time.

- Limited support & documentation: Not all brokers provide detailed, beginner-friendly documentation or support based on our tests. Some APIs are designed with professional developers in mind, which can make setup, troubleshooting, and integration more difficult for casual traders.

For me, the right broker API isn’t just about speed or data—it’s about how smoothly I can turn my code into live trades without second-guessing every connection or workaround. That trust in the tools makes all the difference.

Bottom Line

Brokers offering API access bring significant advantages, making them increasingly essential for traders, especially in fast-paced markets like forex.

APIs enable smoother, faster, and more efficient trading by allowing direct communication between your trading system and the broker’s platform.

However, leveraging these tools effectively does require some programming skills. If you’re new to coding, it’s a good idea to learn the basics first to avoid costly mistakes and make the most of what APIs have to offer.

Building this foundation will enable you to trade more confidently and fully leverage automated strategies.

To get started, turn to our selection of the best UK brokers for APIs.