Best Brokers With Commission-Free Trading 2026

Commission-free trading brings a clear benefit to investors of lower trading and management fees, but not every broker measures up from our tests. Dig into our selection of the best brokers with zero commission investing in 2026.

Top Commission-Free Trading Brokers

-

XTB offers zero commission on real stocks and ETFs for monthly turnovers up to €100,000. Beyond this, a 0.2% fee applies, with a minimum of €10, plus a 0.5% FX conversion if the currency differs. Precise charges are shown before ordering. For active traders valuing clarity and dependability, XTB's transparent model simplifies managing short-term fees.

Instruments Regulator Platforms CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs FCA, CySEC, KNF, DFSA, FSC xStation Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 -

In our evaluation of IG, we found consistently competitive spreads across various products in select regions and accounts, without hidden charges. The transparency of costs across all instruments was notable; fees are always clear and upfront. Additionally, beginners benefit from exceptional educational resources, like the IG Academy.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:30 (Retail), 1:222 (Pro) -

Interactive Brokers provides commission-free trading for certain products, with a small per-share fee outside these plans, meaning costs aren't entirely zero. However, transactions align with shown prices, offering predictable expenses. Competitive spreads and transparency ensure no hidden costs, unlike many competitors.

Instruments Regulator Platforms Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies, CFDs FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower Min. Deposit Min. Trade Leverage $0 $100 1:50 -

In certain areas, eToro provides zero commissions on self-directed US stocks and options. Our practical experience showed that other fees, such as spreads, are clearly presented before trades, ensuring upfront cost clarity. This transparency benefits both casual and active traders by eliminating uncertainty and simplifying trading.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, ETFs, Smart Portfolios, Commodities, Futures, Crypto, NFTs FCA, ASIC, CySEC, FSA, FSRA, MFSA, CNMV, AMF eToro Web, CopyTrader, TradingCentral Min. Deposit Min. Trade Leverage $50 $10 1:30 -

FXCC provides commission-free trading on forex, equities, commodities, indices, and crypto via its ECN XL account. In addition to zero commissions, there’s no minimum deposit requirement. Traders can access the MetaTrader suite, ideal for those aiming to limit key costs to spreads and rollover charges.

Instruments Regulator Platforms CFDs, Forex, Stocks, Indices, Metals, Energies, Crypto CySEC, MISA MT4, MT5 Min. Deposit Min. Trade Leverage $0 0.01 Lots 1:1000

Safety Comparison

Compare how safe the Best Brokers With Commission-Free Trading 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| eToro | ✔ | ✔ | ✘ | ✔ | |

| FXCC | ✘ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Brokers With Commission-Free Trading 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| eToro | ✔ | ✔ | ✘ | ✔ | ✔ | ✘ |

| FXCC | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Brokers With Commission-Free Trading 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro | iOS & Android | ✘ | ||

| FXCC | iOS & Android | ✘ |

Beginners Comparison

Are the Best Brokers With Commission-Free Trading 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro | ✔ | $50 | $10 | ||

| FXCC | ✔ | $0 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Brokers With Commission-Free Trading 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| eToro | Automate your trades via CopyTrader - follow profitable traders. Open and close trades automatically when they do. | ✘ | 1:30 | ✘ | ✔ | ✘ | ✔ |

| FXCC | Expert Advisors (EAs) on MetaTrader | ✘ | 1:1000 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Brokers With Commission-Free Trading 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| XTB | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| eToro | |||||||||

| FXCC |

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

- IG secured a crypto asset license from the FCA, enabling its return to the UK market. It now offers buying, selling, and storage services for over 55 digital tokens with fees starting at 1.49%, all under FCA regulation.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On eToro

"eToro's social trading platform excels with its outstanding user experience and lively community chat, aiding beginners in spotting opportunities. It offers competitive fees on numerous CFDs and real stocks, alongside exceptional rewards for seasoned strategists."

Pros

- Utilising TradingView, the charts provide robust tools for technical analysis, featuring nine chart types and more than 100 indicators.

- Diverse investment portfolios are accessible, encompassing traditional markets, technology, cryptocurrency, and beyond for traders.

- eToro has launched automated crypto staking, offering a pathway to passive income. However, Ethereum requires users to opt in.

Cons

- The minimum withdrawal is set at $30, accompanied by a $5 fee. This may impact traders with limited funds, particularly those just starting out.

- The absence of extra charting platforms such as MT4 may deter experienced traders who rely on external software.

- The only significant contact option, besides the in-platform live chat, is limited.

Our Take On FXCC

"FXCC remains an outstanding choice for traders, offering over 70 currency pairs, ultra-tight spreads starting at 0.0 pips, leverage up to 1:1000 for ECN XL accounts, and a free VPS for eligible clients."

Pros

- FXCC's ECN XL account caters to active traders, offering 0.0 spreads with no commission. It also meets our benchmark for execution speed.

- Customer support remains reliant on human agents, delivering live chat responses in under three minutes during our tests. The knowledgeable representatives provide a refreshing alternative to the often frustrating AI chatbots more commonly used by brokers.

- FXCC offers algo traders a competitive edge with free VPS for eligible users and the capability to create or purchase EAs on MetaTrader.

Cons

- FXCC's offshore entity is regulated by MISA, not CySEC, and faces minimal oversight. It may lack protections such as investor compensation if the broker goes insolvent.

- FXCC imposes high withdrawal fees on numerous payment methods, such as $45 for bank transfers and a 2% charge on cryptocurrency transactions. This may reduce the returns for traders who frequently withdraw funds.

- While FXCC has expanded its market offerings to include US, European, and Asian stocks, its selection of metals and energies is limited, and soft commodities are absent.

How Investing.co.uk Chose The Best Brokers For Commission-Free Investing

We confirmed that every broker on our list truly offers commission-free trading, contacting support teams where needed to verify details.

From there, we sorted providers using our overall ratings – built from more than 200 data points and in-house testing by our team of experienced traders and analysts.

What To Look For In A No Commission Trading Broker

There is no singular ‘best’ commission-free trading broker for all investors. Everyone is looking to trade with different amounts, in different assets, and with different experience levels.

Check our list of the important considerations to help you find the right zero-commission broker for you:

Other Fees

While you may be looking at commission-free brokers, this does not mean there won’t be any charges. The most significant fees you’re likely to come up against are spreads – the difference between the price to buy and sell an asset – as you’ll have to cough this up each time you open or close a position.

It’s worth noting that commission-free brokers tend to have larger spreads, and these can add up if you frequently open and close trades. However, we’ve been impressed lately to find many brokers offering no commissions and spreads well below 1 pip on popular assets.

Brokers also often place fees in other parts of their service to enable them to offer zero-commission trading, from deposit/withdrawal charges and overnight financing costs to fees for premium trading tools.

- FXCC is a rare example of a no-commission broker that offers ECN pricing and ultra-tight spreads from 0 pips on its standard account type. It’s also one of the most accessible brokers, with no minimum deposit fee and zero funding fees.

Regulation & Security

The Financial Conduct Authority (FCA) is the UK’s financial services and market regulator. As such, if you are looking to trade from the UK then finding brokers with commission-free investing that hold a license with the FCA is important.

These brokers will adhere to the rules and regulations set by the FCA to protect you, the investor, from financial malpractice, including:

- Mandatory negative balance protection ensures investors can’t lose more money than they have in their accounts

- Segregated accounts keep clients’ and business funds separate

- Up to £85,000 of each client’s funds is insured against business failure under the Financial Services Compensation Scheme (FSCS)

- Regular financial reports and audits compel brokers to maintain high standards to hold onto their licences.

- IG is not just an FCA-regulated broker – it’s won recognition as one of the most secure and reliable brokers over decades in the business since it was established in 1974; its listing on the London Stock Exchange adds another layer of security as it must meet the exchange’s strict standards.

Platform & Mobile Investing

The platform is where traders place orders, so it’s one of the most important considerations when you choose a no-commission broker.

Most brokers we’ve tested provide well-established platforms such as cTrader, MetaTrader 4 or MetaTrader 5, but newer platforms like TradingView have been making in-roads, and many brokers also offer proprietary platforms that are typically more user-friendly and accessible.

Another key consideration is the mobile app – increasingly the favoured way of accessing markets nowadays – and we favour brokers that provide a fast and easy way to access markets on the move without sacrificing features or charting power.

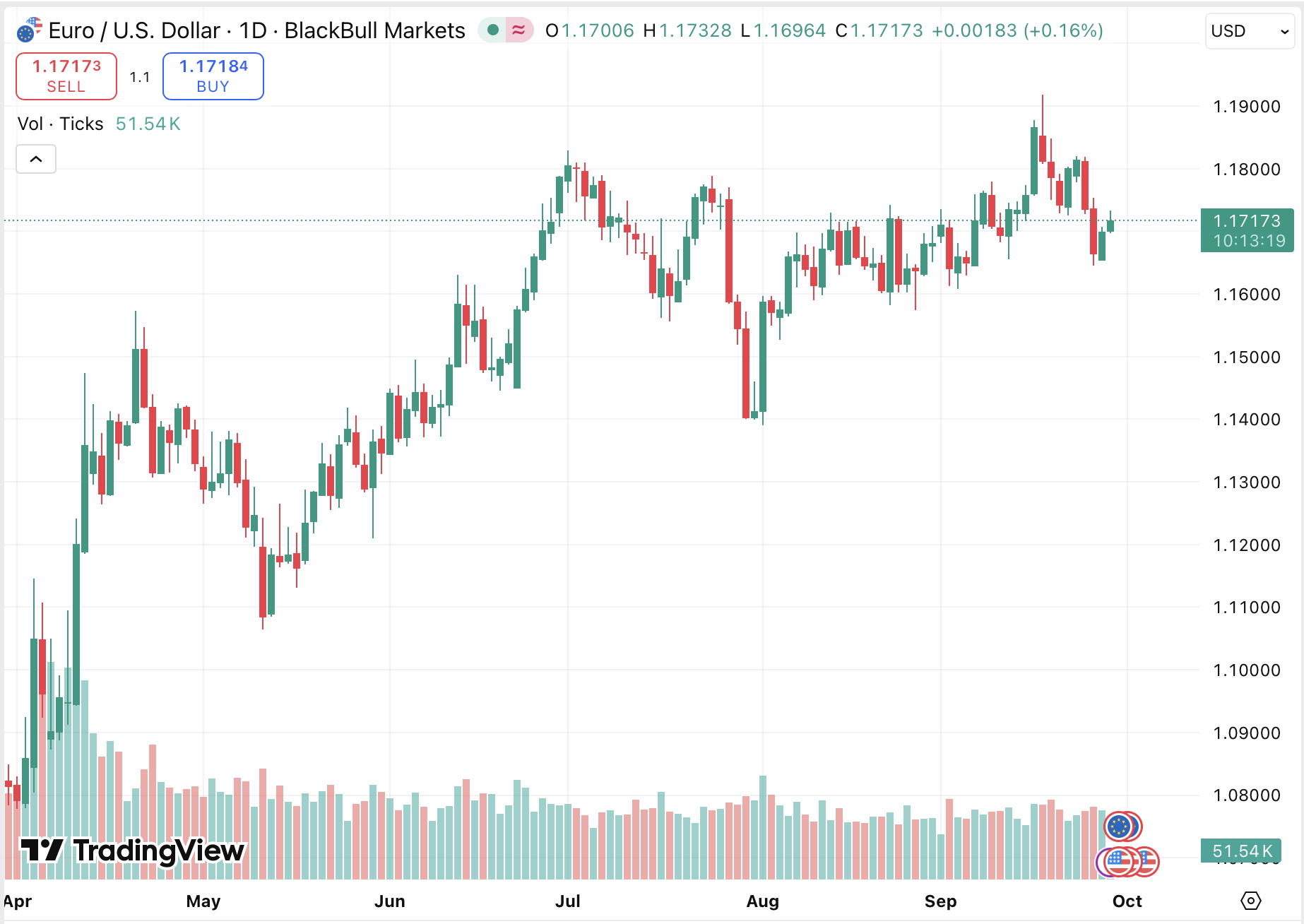

EUR/USD pair on TradingView via BlackBull Markets

Sign up with a demo account before you invest any money with a broker – this is the best way to try out the platform and see if it suits your needs.

- BlackBull provides a superb selection of trading platforms on its no-commission standard account, with traders able to choose between MT4, MT5, cTrader and TradingView, as well as accessing proprietary copy trading and investing platforms.

Assets

Brokers with commission-free investing provide access to different exchanges. Typically, brokers with no commission will offer access to fewer assets than those that charge a commission.

It is also worth noting that within the available assets, some brokers may only offer commission-free trading on a portion of them, for instance UK and US shares.

- Pepperstone offers competitive and, importantly, transparent commission-free pricing, with all of the costs for its various account types disclosed up front, and low no-commission spreads on assets like indices and gold as well as the usual FX pairs.

Research & Education

Informed decisions lead to greater chances of making profits, so you should find a broker that provides strong research tools and educational resources.

Some brokers with commission-free investing also increasingly offer social platforms that allow correspondence and interaction between users. This allows for the sharing of thoughts and predictions on stock or market movements, as well as the freedom to discuss with experienced investors.

Along with this, it is common for brokers with social platforms to offer copy trading, allowing traders to ‘copy’ other investors’ portfolios, strategies and positions. This can be a bonus for beginner investors or those looking to trade without much time for research and study.

- IC Markets provides a full suite of research tools and additional features, with traders able to access video and text tutorials, plus research webinars, a blog, trading calendars and calculators, as well as third-party tools including copy trading.

Currency

Not all licensed brokers regulated by the FCA use GBP as their portfolio currency. For example, eToro uses USD as the base currency, so if you deposit money, it will automatically convert to USD with a foreign-exchange fee.

If you plan to trade on foreign exchanges and platforms then it is worth considering each broker’s conversion fees.

Bear in mind that it’s sometimes an advantage to be able to hold foreign currencies in your trading account. If you want to trade US stocks or ETFs, for example, you’ll need US dollars since this is the currency they’re traded in.Being able to transfer in and hold various currencies can spare you from hefty conversion fees as you often get a better rate yourself via online services like Skrill.

- Interactive Brokers is the most flexible commission-free broker out there for account currency options, as it allows you to buy and sell currencies in its platform that you can then use to trade a dizzying array of assets across hundreds of global exchanges.

What Is Commission-Free Trading?

Brokers typically apply a fee when investors place a trade. This is usually a flat fee on every buy or sell order, though it can also be a percentage of the order.

At online brokers in the UK, this charge generally ranges from £1 to upwards of £10. In essence, the commission is the cost of making a trade.

Brokers with commission-free investing allow traders to place orders without such fees. This is particularly beneficial to those with less capital as flat commission fees can amount to a notable percentage of an investor’s overall trading portfolio.

Commission Vs Spread

A commission fee is different to the spread. Commissions are added on top when opening or closing a position. The spread is the difference between the bid and ask prices of a security, such as a FTSE-listed stock.

Typically, the bid price (the price you pay to buy a stock from a broker) is a little higher than the market value of the asset, and the ask price (the price the broker pays you when you sell the stock) is a little lower than the market value of the asset.

When opening and closing a position, the broker will pocket the difference between the actual market prices and the quoted prices.

How Do Brokers With Zero Commission Make Money?

But if brokers aren’t making money from commissions and offer low spreads, then how do they continue to operate? Brokerages incur a range of overheads and administrative fees for providing trading services, so they look to other channels to generate revenue…

Hidden Costs & Limitations

As mentioned, zero-commission traders will almost always make their money by charging a wider spread than brokers that do charge a commission.

Some brokers with commission-free investing also apply other charges such as deposit/withdrawal fees or extra charges to access data and research tools.

Brokers may also only offer zero-commission trading on some assets, such as OTC stocks, while forex and cryptos, for example, incur a commission. Alternatively, you may only be able to trade commission-free for a set number of orders each month. Or it may be limited by the size of the order.

Payment For Order Flow

There are other options for brokers to make money as well, such as Payment For Order Flow (PFOF). This is where brokers route client orders to market makers for execution, in return for a fee.

The Financial Conduct Authority (FCA) has banned this in the United Kingdom, to protect investors from conflicts of interest between clients and brokers. However, offshore brokers may still use this system, so you should be careful to investigate the system they use for orders.

Pros & Cons Of Using A Broker With No Commission Investing

Pros

- Zero-commissions can allow for cheaper portfolio diversification

- No restrictions on trading strategy or hedge systems

- Simplified and streamlined trading platforms

- Greater potential profit margins

- Lower minimum deposits

- Beginner-friendly

Cons

- Limited resources & research

- Access to fewer markets

- Wider bid-ask spreads

- Potentially hidden fees

Bottom Line

Zero-commission trading has taken off and the benefits are clear: cheaper buy and sell orders allow for greater profit margins and portfolio diversification.

Typically designed for newer investors, the trading platforms offered by zero-commission brokers are normally more streamlined, accessible, and user-friendly, though you may find you pay a wider spread or some hidden costs as a tradeoff.

Use our list of the best brokers for commission-free investing to get started.