ETX Capital Review 2024

|

|

ETX Capital is #97 in our rankings of CFD brokers. |

| ETX Capital Facts & Figures |

|---|

ETX Capital were a London-based, FCA regulated broker offering tight spreads across a wide range of markets. |

| Instruments | CFDs, Forex, Stocks, Cryptos |

|---|---|

| Demo Account | Yes |

| Min. Deposit | £250 |

| Mobile Apps | iOS and Android |

| Payments | |

| Min. Trade | £1 |

| Regulated By | FCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Leverage | 1:30 |

| FTSE Spread | 1 pt |

| GBPUSD Spread | 0.9 |

| Oil Spread | 0.06 pips |

| Stocks Spread | From 0.5% |

| GBPUSD Spread | 0.9 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 0.9 |

| Assets | 65+ |

| Stocks | ETX Capital offer stock trading on over 5000+ assets from 20 countries. Spreads are as tight as 0.2% and the firm are FCA regulated |

| Cryptocurrency | Trade 5 cryptocurrencies, and BTC against USD, GBP or EUR. Margin is tiered from 50% |

| Coins |

|

| Spreads | BTC Market Spread + 10, ETH Market spread + 8 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Spreadbetting | ETX Capital offer 5000+ markets with ultra tight spreads for tax free spread betting. The TraderPro platform is delivered on mobile too, and includes price alerts. |

ETX Capital are a London based broker. They provide traders multiple ways to trade. Primarily a spread betting, Forex and CFD (Contracts for Difference) specialist. Read our full review here.

They provide an excellent trading platform. As a UK based CFD broker, they are fully regulated by the Financial Conduct Authority (FCA) Number 124721. At present, the firm offer trading with some of the tightest spreads on the market.

ETX described in their own words; “We believe that ETX Capital offers traders a wide variety of benefits that many of our competitors may find hard to match.”

In our opinion however, traders, particularly in the UK, are better served with alternative brokers who can offer a more reliable service, more features and a broader range of markets.

Trading Platform

ETX Capital operate several specific platforms, each with it’s own login. There is a binary platform, the TraderPro platform, and the MT4 (MetaTrader4) integration. The first thing of note is that it is closed entirely while global markets are closed – there are no virtual markets to entice clients to over trade. Forex trading remains open with the markets of course. Trading availability reflects the trading hours of the asset

The left hand side of the trading platform is the asset and options list. ETX provide the usual mix of assets – Forex, Indices, Commodities and Stock. The lists are extensive, with all major FX pairs covered, such as EURUSD and GBPUSD etc. Popular assets such as gold and oil can be added to favourites lists for ease.

Best Alternatives to ETX Capital

-

AvaTrade's 1250+ leveraged CFD products span a wide range of asset classes including stocks, indices, commodities, bonds, crypto, and ETFs. You can speculate on underlying assets in the broker’s feature-rich web and mobile platforms with market-leading research tools to help discover opportunities.

-

XTB offers a huge selection of more than 2,100 CFDs spanning forex, indices, commodities, stocks, ETFs, and cryptos (location-dependant). Leverage up to 1:30 is available in the EU and UK, while global clients and pro traders can access up to 1:500. XTB stands out for its CFD trading resources and tutorials to assist traders in developing short-term trading strategies.

-

CMC lets you trade CFDs on 12,000+ assets across currencies, indices, commodities, shares, ETFs and treasuries. Spreads are relatively tight, there are no hidden fees and the industry-leading MetaTrader 4 platform is also supported for leveraged trading. Year after year, CMC shines as one of the best CFD brokers in the market.

-

Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area.

-

FXCC offers a narrow range of CFDs beyond forex with a limited selection of metals, energies, indices and cryptos. However, it stands out with its high leverage up to 1:500, which will serve experienced traders looking to maximize their buying power while speculating on rising and falling prices.

-

Trade CFDs on Spreadex's diverse list of instruments with leverage up to 1:30 and highly competitive spreads. While this broker's USP is spread betting, the excellent trading terms and range of markets makes it an equally good choice for CFD trading.

-

Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

-

Over 8,000 CFDs are offered on a vast array of instruments, encompassing stocks, indices, forex, and commodities. Moreover, the TWS platform lends itself to seasoned traders, offering a comprehensive selection of over 100 order types and algorithms, alongside premium market data sourced from reputable sources such as Reuters and Dow Jones.

-

You gain access to over 2,250 CFDs, available for trading 24/5 across popular markets such as forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and advanced bridge technology, IC Markets ensures optimal conditions for scalpers, hedgers, and algo traders alike.

-

Traders can speculate on leveraged CFDs with zero commissions, spanning popular markets including currencies, equities and commodities. Additionally, the MetaTrader platforms collectively offer dozens of advanced technical indicators built for short-term strategies.

-

Trade 5,000+ CFDs from a single account with no hidden fees and free live market data. The suite of markets is impressive vs alternatives, including access to shares, indices, commodities and bonds.

-

DNA Markets offers a small suite of 250 CFDs covering stocks, indices, forex, commodities and cryptos, providing opportunities to speculate on rising and falling prices. There are no restrictions on strategies with leverage up to 1:30 (Australia) or 1:500 (rest of world).

-

With the ability to take both long and short positions on 5,500+ CFDs across forex, stocks, indices, commodities, and cryptocurrencies, FOREX.com excels. Its exclusive Web Trader platform offers an excellent trading experience, equipped with over 80 technical indicators and average execution speeds of just 20 milliseconds, ensuring an optimal environment for serious traders.

-

You can trade CFDs on over 3,000 assets and access rich market data through the integrated TradingView charts. There are also comprehensive free learning tools available for beginners via the eToro Academy, including dedicated CFD trading courses and guides.

-

RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

-

You can trade CFDs across a range of diverse markets with flexible account types and leverage up to 1:1000. With access to both MT4 and MT5, traders can execute multiple short-term CFD trading strategies using the dozens of pre-integrated technical indicators and graphical objects.

-

LQDFX offers a modest collection of CFDs covering currencies, metals, stocks, indices, commodities and cryptos. The 50+ technical indicators and drawing tools pre-included in MT4 will facilitate both short-term and long-term strategies.

-

Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

-

IG offers a huge selection of 17,000+ CFDs, providing more trading opportunities than most CFD brokers. Traders can go long or short on popular markets like stocks, currencies, commodities and cryptos, while custom price alerts and the IG Academy continue to enhance the trading experience.

-

BlackBull Markets CFDs are offered on forex, stocks, indices, commodities and cryptos with tight spreads and high leverage. The ECN accounts offer fast execution and low slippage, and the broker provides traders with plenty of extra tools and features plus 24/7 customer support.

-

Traders can speculate on 1000+ financial markets with high leverage up to 1:500. You can bet on rising and falling prices in currencies, commodities, indices, shares, and more without owning the underlying asset. With the comprehensive choice of CFD trading platforms, users can also switch between desktop, web and mobile for a seamless trading experience.

-

FxPro offers thousands of CFDs on forex, commodities, indices, shares and futures. The broker's analysis and charting capabilities continue to stand as some of the best in the industry, with Trading Central integration, advanced order types and access to custom indicators.

-

Plus500 presents commission-free CFDs encompassing a vast array of markets, spanning currencies, stocks, indices, and commodities. You can engage in long or short positions on popular assets, benefiting from adaptable leverage without encountering any concealed fees.

-

You can go long or short on a range of CFDs covering forex, commodities, shares, indices and cryptos. High leverage up to 1:500 is available for experienced traders in some locations, whilst beginners will appreciate access to micro-lots. There are no restrictions on short-term trading strategies using CFDs.

-

You can trade 275+ CFD instruments covering equities, currencies, commodities, indices and cryptocurrencies. The broker offers flexible trading software and account options, plus access to the unique dealCancellation risk management tool, which is ideal for beginners.

-

Access highly leveraged CFDs across forex, commodities, indices, stocks and bonds with 24/5 customer support. Build a diverse portfolio with hundreds of CFD assets.

-

CFDs are available on forex, stocks, indices, metals, oil and cryptos, with support on MT4 and MT5. Execution speeds are also decent, averaging 0.5 seconds, though there is also a VPS service facilitating 24/7 connectivity for algo strategies.

-

CFDs are available on forex, indices, commodities and cryptos, although the range of 100+ instruments is limited compared to alternatives such as Quotex with 400+. Leverage is available up to 1:500 but the $250 minimum deposit is noticeably higher than competitors.

-

Markets.com offers a strong variety of CFD products, not only covering popular asset classes but also more interesting markets such as IPOs and Bonds. The low fees and educational resources will appeal to beginners, whilst seasoned CFD traders will appreciate the feature-rich charting platforms.

-

Axi offers 220+ products covering forex, shares, commodities, indices and cryptos. Spreads on EUR/USD come in at around 0.2 pips in the Pro account and 1.1 pips in the Standard account. These are competitive and aligned with equivalent accounts at leading low-cost brokers like Pepperstone.

-

The broker offers a small range of 100+ CFD instruments spanning key markets, with high leverage up to 1:500. Pricing is reasonable, with round turn commissions coming in at $6 alongside tight spreads. Multiple short-term strategies are also permitted, including hedging and scalping.

-

VT Markets offers over 1000+ CFDs spanning currencies, stocks, indices, ETFs and commodities. The MetaTrader charting platforms provide dozens of technical tools alongside integrated market analysis resources and zero restrictions on short-term trading strategies.

-

My tests uncovered around 100 CFD products covering forex, indices, commodities and cryptos. Leverage is available up to 1:400 and it’s good to see that scalping, hedging and EA strategies are permitted.

-

PrimeXBT offers CFDs across four asset classes with very high leverage up to 1:1000. Beginners can also take advantage of the broker’s useful technical analysis guides and CFD education, plus 24/7 in-platform support via live chat.

-

Traders can access CFDs across forex, indices, commodities and stocks. There are no restrictions on short-term strategies, which is good news for scalpers and algo traders. There’s also an excellent range of free tools on offer, including a custom price ticker.

-

FXTrading offers CFDs on a wide range of assets, including forex, stocks, commodities, indices and cryptocurrencies. Commodities include a selection of softs as well as metals and energies, and the eight indices offered include the US30, US500 and UK100. Flexible leverage is available with excellent risk management tools.

-

ThinkMarkets continues to offer an excellent range of around 3500 CFD instruments covering forex, indices, stocks and commodities. Leverage is available up to 1:30 in the EU and UK, while global clients can access up to 1:500.

-

M4Markets offers CFD trading across forex, stocks, indices, commodities and cryptocurrencies. Traders can access powerful charting platforms with multiple order types and built-in indicators. There’s also a good selection of data-driven analysis tools supplied by reputable provider, Acuity.

-

SuperForex offers CFDs on a good range of assets, though it only really shines when it comes to forex, thanks to its very diverse list. On the other hand, the significant leverage available on most assets increases profit potential, though traders will need to watch out for spreads, which compare poorly to some competitors.

-

Access over 2,000 CFDs across diverse markets including indices, commodities and bonds. There is also premium daily analysis and strategy resources for savvy traders.

-

Trade 400+ CFDs on forex, stocks, commodities, indices and cryptocurrencies with the choice of commission-free or raw-spread accounts with transparent fees. Speculate on rising and falling prices with no hidden charges.

-

IronFX’s asset list of 300+ instruments covers forex, stocks, commodities and index CFDs. Maximum leverage from 1:30 to 1:1000 is available depending on account location. Traders can access superb technical analysis features, including 30 pre-integrated indicators and 9 charting time frames.

-

Ingot Brokers offers CFD trading on 1000+ instruments including stocks, commodities and cryptocurrencies. The MT4 and MT5 platforms offer comprehensive features for active CFD traders, including multiple order types and pre-integrated technical tools.

-

You can trade a range of CFD instruments across forex, shares, indices and commodities. There’s an excellent selection of platforms for traders, including TradingView and MT4, plus additional tools for experienced algo traders including API solutions.

-

You can trade hundreds of CFDs on major asset classes including currencies, shares and futures. Spreads are not overly competitive starting at 0.9 pips, although the $50 minimum deposit and zero commissions will allow active traders to keep their costs down.

-

Dukascopy offers highly leveraged CFDs with rates up to 1:200. A wide selection of asset classes are available, including currencies, equities, commodities, ETFs and cryptos. Spreads are also tight starting from 0.1 pips and traders get 24/7 support.

-

Trade CFDs on forex, stocks, indices, commodities and cryptos with high leverage up to 1:500 on the no-commission ClassiQ account. The raw spread account options have low commissions from $4 round-turn and offer lower maximum of leverage of 1:200 or 1:400, which is still competitive.

-

Trade CFDs on forex, indices, metals, oil and cryptocurrencies with high leverage up to 1:500 and competitive spreads, with the choice between zero commission or raw spreads.

-

Videforex CFDs are available on forex, indices, cryptocurrencies and commodities with up to 1:500 leverage and tight spreads from near zero. CFDs incur a commission fee of 1%–2.5% and up to 5% for leveraged trades.

-

Rock Global offers low-price CFDs on forex, shares, indices and commodities. The broker charges zero-commission trading on commodities and indices, and zero-spread, commission-only trading on shares. Leverage varies by instrument with 1:200 available on indices and 1:10 on blue-chip stocks.

-

FXTM’s CFD offering spans 250+ forex, stocks, commodities and indices, plus crypto CFDs at the global entity. Leverage up to 1:30 is available from the CySEC-regulated branch, though highly seasoned traders can also access massive 1:2000 rates from the global entity.

-

You can trade a competitive range of CFDs encompassing crypto, indices, energies and metals, with very high leverage up to 1:1000. ECN pricing is available, with spreads from 0.0 pips and low commissions from $2.50. A Cent account is also available for those on a smaller budget.

-

CFDs are available on a breadth of underlying assets, including stocks, indices, commodities, forex and cryptos. High leverage up to 1:500 is available alongside a 0.01 minimum lot size and award-winning software. For the tightest spreads from 0 pips, opt for the Premium account.

-

Trade CFDs on forex, indices, stocks, commodities and cryptocurrencies with leverage up to 1:3000. Swap-free trading is available, and all account types trade with competitive spreads and are commission-free except the Go Pro account, which charges a $7 round-turn commission.

-

CFDs are available on popular asset classes with a competitive $1 minimum deposit. The MT5 integration will allow serious short-term traders to utilize the vast library of technical tools, bots and indicators, but the lack of any CFD trading education puts the broker behind many alternatives.

-

Focus Option offers CFD trading through an intuitive mobile app, with 300+ tradeable instruments spanning forex, cryptocurrencies, commodities, shares and indices. Leverage ranges from 1:20 to 1:50 and spreads are variable, starting from 1 pip, with no commission.

-

Trade CFDs on forex, stocks, metals, energies, indices, cryptos and dollar futures. Sage FX offers tight spreads and high leverage on all instruments from 1:100 to 1:500.

-

Access thousands of CFDs with competitive pricing and leverage up to 1:500. A range of asset classes are available, including currencies, shares, indices, metals and commodities. CFDs can be traded on the market-leading MetaTrader platforms.

-

PU Prime offers CFD trading on hundreds of shares, as well as indices, commodities, bonds and cryptocurrencies. The leverage available varies by asset, and spreads also vary greatly between instruments and account types with the tightest near zero and the widest in the hundreds of pips. Stock, index, commodity and bond CFDs are traded on the leading MT4 platform.

-

SimpleFX stands out with highly leveraged trading options up to 1:1000 covering popular asset classes, including stocks, indices, currencies and commodities. Additionally, the social community serves as an excellent resource for gathering CFD strategy tips and short-term trading ideas.

-

Errante customers can trade stocks, indices, commodities and cryptocurrencies with leveraged CFDs. The level of leverage available depends on regulatory oversight, with 1:30 the maximum allowed in the EU though this varies by asset.

-

CFDs are available on hundreds of markets including forex, indices, shares and commodities. Traders can go long or short with reliable trading tools, excellent market research and transparent pricing.

-

Swissquote offers spot, forward and synthetic contracts on a breadth of markets, including stocks, indices, bonds and commodities. The pricing model is transparent with no hidden fees. Clients can diversify portfolios and hedge risk with low margin requirements.

-

Trade CFDs on forex, stocks, metals, energies, cryptos and indices with high leverage up to 1:1000 on major currency pairs, 1:200 on metals, 1:100 on indices, 1:33 on stocks and energies, and 1:5 on cryptocurrencies. The range of 200+ instruments is not the biggest on the market, but the variety of asset classes provides flexible trading options for most traders.

-

FP Markets' CFD trading covers a range of markets, including 10,000+ equities, indices, commodities, cryptocurrencies and ETFs. Spreads are tight and traders get fast execution speeds.

-

Core Spreads offers CFD trading on 40 forex pairs plus 13 commodities, including metals and energies, and 13 global stock indices including the UK100 and US30. CFDs are traded through the MT4 platform with leverage up to 1:30 in line with UK regulations.

-

Anzo Capital clients can use MetaTrader 4 and MetaTrader 5 to trade CFDs on stocks, equity indices, crude oil and precious metals with competitive price levels.

-

HYCM traders can access CFDs on a range of stocks, indices, commodities and ETFs with floating spreads and maximum leverage varying by instrument. Clients also have a choice between two industry-leading platforms.

-

Global Prime offers CFD trading opportunities on 150+ global markets including forex, indices, commodities, cryptocurrencies and bonds. Spreads are tight with a raw ECN account available starting from zero.

-

Fortrade's list of leveraged CFDs covers a wide range of asset classes including forex, stocks, bonds, indices, commodities and cryptocurrencies. Traders can access leverage up to 1:30 and will trade with zero commission, fast execution and low latency on MetaTrader 4 or the bespoke platform.

-

Traders have the opportunity to engage in CFD trading across a broad spectrum of assets, including currency pairs, stocks, commodities, bullion (gold and silver), indices, and cryptocurrencies. Experienced traders can access high leverage up to 1:1000 in certain jurisdictions. However, a notable downside is the restriction of scalping strategies which may deter experienced traders.

-

FXOpen offers CFDs on multiple assets including forex, stocks, commodities, indices, cryptocurrencies and ETFs. Leverage and spreads vary by instrument, with spreads starting from zero and fast order execution.

-

Libertex's list of CFDs covers a decent range of tradeable underlying assets, but there isn't much depth with only around 250 in total. Leverage up to 1:30 for retail clients is available in accordance with CySEC regulations, and traders can choose between three excellent trading platforms. Best of all are the tight spreads available on all markets and the zero commissions on investments in stocks.

-

Trade CFDs on forex, stocks, indices, commodities, ETFs, bonds and cryptocurrencies with variable leverage up to 1:30. The broker provides great value to traders with six free trades per day on US, UK and European stocks, tight spreads on forex and low commissions on ETFs.

-

Trade CFDs on a broad range of asset classes including forex, energies, precious metals, company shares, indices and cryptos. The excellent trade execution and opportunity to trade with direct market access pricing sets this broker apart from rivals.

-

Trade CFDs on forex, stocks, commodities and indices with tight spreads and leverage limited to the FCA-sanctioned maximum of 1:30. Infinox traders benefit from lightning-fast execution speeds and a choice between STP and ECN pricing, making this a flexible option for beginner and serious traders.

-

Trade CFDs on 75+ instruments, including forex, energies, metals, and indices with variable leverage up to 1:500 on major pairs, 1:200 on minors and exotics and 1:100 on commodities and energies.

-

OspreyFX offers leveraged CFDs on forex, commodities, stocks, cryptos and indices. Deep liquidity is available from 50+ providers with a competitive ECN account that will suit active trading strategies, including scalping.

-

Trade a decent range of markets via CFDs, with commissions of $6 per lot. There is also a reasonable $10 minimum deposit and 24/7 customer support for new traders.

-

Trade all markets via CFDs, with retail leverage up to 1:30. With the RStocks Trader account, clients can access over 12,000 CFDs with algorithmic analysis tools and intuitive charts.

-

AdroFx offers a most selection of around 100 CFDs on stocks, cryptos, indices and commodities. Its appeal lies in the high leverage up to 1:500 which you can't find in heavily regulated jurisdictions and the commission-free pricing model which will serve beginners. You can speculate on both rising and falling prices from the same product with CFDs.

-

Trade flexible CFDs on forex, commodities, indices and cryptos with tight spreads, fast execution, micro-lot trading and leverage up to 1:500. There are also no restrictions on trading strategies.

-

EZ Invest offers leveraged CFDs on popular asset classes, including forex, stocks, indices and commodities. Execution speeds are decent but a large deposit is needed for the best pricing conditions.

-

Trade 8,900+ CFDs spanning forex, stocks, indices, commodities, options and bonds with powerful tools and signals.

-

Access a modest range of CFD instruments across key markets, including indices and commodities. Clients can trade directly from charts with high leverage up to 1:500 and customisable time intervals.

-

You can speculate on popular financial assets covering forex, commodities, indices, metals and bonds. You can get started with $0 minimum deposit, making the broker a good pick for beginners. There’s also over 130 technical indicators available collectively in the MT4 and OANDA Trade platforms.

-

Trade CFDs on 100+ instruments from popular asset classes. Leverage up to 1:200 is available on precious metals, while stocks, indices and energies can access 1:20 max leverage and 1:10 for commodities. On the negative side, the depth of assets is limited vs other CFD brokers.

-

With CFDs on 20+ Polish and 30+ US stocks, as well as energies and seven global stock indices covering US, UK, European, Australian and Japanese markets, Just2Trade offers a superb selection of global assets.

-

You can take positions on a range of popular trading markets including forex, stocks, energies and metals. Leverage is high at 1:500 and live spreads can be viewed in the web-accessible platform and app.

-

World Forex's leveraged CFDs are available on a modest suite of 100+ instruments, including stocks, commodities and forex. Very high leverage up to 1:1000 is available for account balances up to $1000, with lower levels available to accounts with higher balances.

-

Trade commission-free CFDs on 3000+ instruments from forex, stock and commodities markets with volumes starting from 0.1 lots, a low minimum deposit of $10 and tight floating spreads. The selection of CFDs beats most competitors.

-

Trade CFDs on forex, commodities, indices and crypto assets. With spreads from 0 pips and generous incentives and bonus offers setting Vault Markets apart from competitors, this Namibian broker will appeal to aspiring traders.

-

Trade CFDs on forex, stocks, indices, energies and metals with fast execution and variable leverage. Spreads are tight and commission-free trading is available on some assets.

-

Trade 200+ CFDs with leverage up to 1:1000 on a powerful proprietary platform. Asset classes include stocks, forex and crypto with ECN execution. You can bet on rising and falling prices with leveraged CFDs.

-

Trade CFDs on an array of assets with ultra-low spreads

-

Engage in leveraged CFD trading across a wide array of instruments, encompassing forex, stocks, commodities, and indices. Yet while the selection of asset classes is satisfactory, the charting software and floating spreads for short-term traders fall behind that of competitors.

-

Trade leveraged CFDs in a range of financial markets.

On certain binary option types (‘Long term’ for example), the asset lists will shorten as not all markets are available across all option types.

On each platform, once the option and asset have been selected, the price graph will update on the right of the screen. From here, the specifics of each trade can be set. So on binary, the expiry can be adjusted, with incremental expiries available, plus ‘end-of-day’ expiry times. Trade size is above the price chart. Where possible, the platform is the same whether trading via MT4, forex on Trader Pro, or binaries.

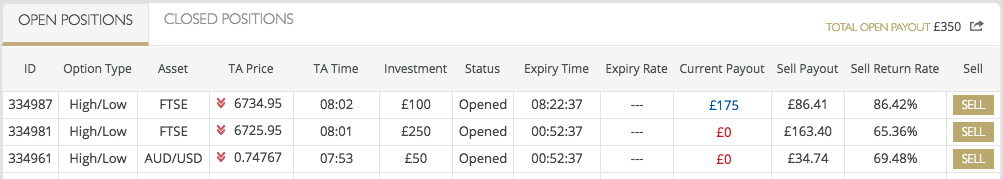

The Call and Put buttons are clear, with the strike price illustrated between the buttons. Once highlighted, trader simply click on ‘Invest’ to confirm the trade. Once open, a trade will appear in the ‘Open Positions’ screen below the trading platform. The price graph will also show the current status of the trade, with a colour sensitive profit or loss figure.

In the Open positions window, traders can close certain trades. Binaries offer a ‘Sell’ price, where CFD trades can be closed at any time. The open trades window does show immediately the cost of each trade – though spreads at ETX a very competitive.

In the Open positions window, traders can close certain trades. Binaries offer a ‘Sell’ price, where CFD trades can be closed at any time. The open trades window does show immediately the cost of each trade – though spreads at ETX a very competitive.

Fees for overnight charges or rollover costs are low relative to rival firms. Full lists can be found on the ETX website.

Demo Accounts

ETX Capital have demo accounts for the binary options, cfd and Forex platforms. The TraderPro and MT4 platforms each have a separate demo account login as each has subtle differences. These accounts allow traders to check the platform, make sure it suits them and check that all the assets they need are available. It is also a vital educational tool for beginners. The demo accounts are free and do not need a deposit.

Trader choice

CFD

ETX offer a full range of assets to trade via contracts for difference. These include stock and commodity assets, including bitcoin. Levels of gearing or leverage can be selected, ensuring traders can manage their own risk. Stop losses and stop limits can also be used across a range of trades to further control risk and ensure that margin call never comes.

Binary Options

As well as more traditional options, ETX Capital also offer the ‘Spread High/Low’ which at present, is unique to them;

- High/Low – The traditional binary – will the asset price be higher or lower than the current strike price at expiry?

- Short Term – The same concept as High/Low but these options have very short expiry times. At ETX, they are generally 60 second or 2 minute expiries.

- One Touch – ETX provide both high and low ‘touch’ prices. These finish ‘in the money’ immediately if the price level is reached or surpassed. The is no ‘No touch’ option however. Volatility therefore plays a key role.

- Spread High/Low – Unique to ETX Capital, these options have strike prices slightly above, or below the actual current price level. Beyond that, they behave just as a standard High/Low option. The difference is that the payout on the spread option is 100% – ETX can do this because their “spread” is covered by moving the strike price. It is a nice innovation, which some traders will enjoy.

- Long Term – Again, the trades behave as a standard High/Low, but these have longer expiry times. At ETX, these are generally the end of the month (the end of the last trading session of the calendar month).

The range of assets is excellent and the option types are good – some additional expiry times within the long term range, and perhaps adding Ladder or boundary options, would mean ETX compete with the very best for trading choice.

Forex

The ETX capital forex platform is offered with it’s own demo account. It follows the same look and feel as elsewhere on the site. Spot FX trading is possible across the full range of major and minor pairs, from the ever popular EURUSD, to things like the Swiss franc (CHF) or Japanese Yen.

The spread on leading pairs is as good as anything in the industry, and this has seen many traders swap their old broker for ETX.

ETX Capital Mobile App

The mobile app has been separated from the CFD trading app, to focus purely on binaries. Available for Android (v3.0.0 and up) and iOS (iPhone and iPad app), the application delivers the same look and feel as the website, and all of the functionality. All assets and trade types are on offer from the mobile platform, as are trade history and account management features.

The binary mobile app is available free to all ETX customers, as are the CFD and forex apps. The download is quick and simple, and traders can login and trade quickly.

Payout

Payouts at ETX can reach 100%. This is due to the ‘Spread High/Low’ option, where the profit margin of the broker is built into the strike price “spread”. They can therefore afford to pay 100% on in the money trades. Elsewhere, payout are generally 75% or 80% – where assets are more popular, the payouts tend to be higher. The levels are certainly very competitive. Payouts will always vary based on the asset and expiry time, but ETX certainly tend to be at the higher level in comparison with rivals, and the ‘Spread High/Low’ trades give them an eye-catching headline payout.

ETX Spreads

Withdrawal and Deposit Options

As a broker that is regulated by the FCA, ETX Capital have strict controls on deposit and withdrawal methods, and this in turn, ensures greater protection for the trader when they add funds.

There is a £100 minimum deposit requirement at ETX, though you must have sufficient funds in your account to open trades. The amount required will depend on the asset, and expiry.

Deposits can be made via debit or credit card but these must be in the name of the individual (not a commercial card for example). Wire bank transfers are accepted, again they must be in the same name as the individual on the trading account. Deposits can be made via exactly the same options over the mobile apps. ETX accept deposits in a broad range of currencies, including GBP, USD, EUR, ZAR, SGD, SEK, RON, PLN, NOK, JPY, HRK, HKD, DKK, CZK, CHF, CAD, AUD.

Other payment methods include popular e-wallets such as Neteller, Skrill and Paypal.

Withdrawals are a positive at ETX. There is no minimum withdrawal. Bank transfers should be process in 2 or 3 days – withdrawals to a debit or credit card will take a day longer. There no fees for withdrawals – unless traders make of 5 requests in a single calendar month. Any withdrawals over 5 within a month will incur a £10 charge.

There is also a £15 charge per month for ‘dormant’ accounts. An account is deemed dormant if there are funds in it, but no trades have been placed over 120 days. The dormant account charge is explained in full in the ETX trading terms and conditions.

Other Features

ETX offer a broad range of additional benefits and Services:

- MT4 Platform – A great platform for advanced traders and technical analysis investors. Seamless integration on this popular platform.

- Huge Range Of Markets

- Tight Spreads – ETX offer some very competitive spreads compared to rival CFD and Forex brokers.

- Training Materials – Including webinars, which are very popular among users, and very helpful.

- Excellent Reputation – ETX generate very few complaints, and enjoy high satisfaction ratings from their user base.

- ETX Capital TV – Trading news, video commentary and features on the ETX entertainment channel.

- International – ETX are a growing brand globally, seeing rapid expansion in South Africa, Australia, Spain, Germany, India and Indonesia

Compare ETX Capital with Other Brokers

These brokers are the most similar to ETX Capital:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

ETX Capital Feature Comparison

| ETX Capital | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4.9 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | £250 | $100 | $0 | $0 |

| Minimum Trade | £1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5 | - | MT4 |

| Leverage | 1:30 | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | ||||

| Review | ETX Capital Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| ETX Capital | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | Yes | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

ETX Capital vs Other Brokers

Compare ETX Capital with any other broker by selecting the other broker below.

Popular ETX Capital comparisons: