InstaForex Review 2026

InstaForex is a global broker well-known for its welcome bonuses and trading promotions. UK traders can take positions on 300+ instruments through the MT4 and MT5 platforms, plus a proprietary WebTrader. This InstaForex review will cover how to deposit to a live account and place a trade. Our experts also evaluate the account types, minimum deposits, client cabinet features, login security, market access, and fees.

InstaForex offers a range of welcome bonuses and trading contests to new and existing users. The $1 minimum deposit and free demo account will also appeal to beginners. On the downside, the broker is not regulated by the FCA and some traders have reported withdrawal problems.

Company History & Overview

InstaForex is a CFD and forex broker established in 2007 by the InstaFintech group. Millions of traders have opened an account with the firm in the last 15+ years, including aspiring investors in the UK.

The company is regulated by the British Virgin Islands Financial Services Commission (BVI FSC). InstaForex does not hold a license with the UK Financial Conduct Authority (FCA), however, the firm segregates traders’ funds from company money.

Customers can access 1:500 leverage, forex copy trading, and 24/7 customer support.

Markets & Instruments

InstaForex offers a competitive range of 300+ assets spanning:

- Stocks – 200+ company shares such as Johnson & Johnson, Pfizer Inc, JPMorgan Chase and Nike

- Indices – 10 leading stock indices including the FTSE 100, STOXX 50 and CAC 40

- Forex Pairs – 100+ major, minor and exotic currency pairs including GBP/JPY, EUR/GBP, and EUR/USD

- InstaFutures – 2 currency futures; EUR/USD month and EUR/USD week

- Commodities – 3 precious metals and 7 energies including natural gas, crude oil, and gold. Alternatively trade futures contracts on agriculture, metals, and softs

Fees & Charges

While using InstaForex, we found spreads are the most competitive with the Eurica account, which offers spreads from 0 pips plus a £3 commission. In contrast, spreads on the Standard and MT5 accounts are about 3 pips, though we were offered the GBP/JPY at 7 pips.

Trading fees also vary depending on the instrument. Stocks, for example, come with a charge of 0.1% while InstaFutures have a 0.01 tick fee.

Other charges to take into account include a £5 monthly fee after six months of no account activity, plus swap fees for positions kept open overnight. In addition, UK traders may have to pay conversion fees because the broker does not offer a GBP trading account.

InstaForex Leverage

As an offshore brokerage, InstaForex can offer much higher leverage than many FCA-regulated brokers, such as CMC Markets. Traders can access flexible leverage up to 1:500 (Pro), 1:30 (Retail), while all accounts have a 30% margin call and a 10% stop-out level.

But while leverage is a useful tool to increase potential returns, losses are also magnified. As a result, make sure you apply suitable risk management parameters.

Platforms

InstaForex offers UK traders three primary platforms; MetaTrader 4, MetaTrader 5, and a proprietary WebTrader.

You can download MT4 and MT5 to desktop devices or open the terminal via major web browsers.

WebTrader

When we used InstaForex, we felt the WebTrader solution was the best fit for beginners. No software download is required and users can open and close trades with a few clicks.

Traders also benefit from tick charts, full trading history, market news stream, custom favourites list, synchronisation with the broker’s other platforms, plus a choice of three layouts (Dashboard, Classic, Chart).

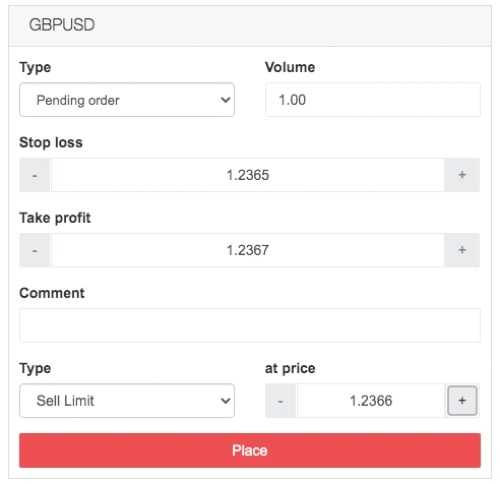

How To Place A Trade

- Search for a symbol in the navigation bar or your favourites list

- Select ‘Buy’ or ‘Sell’ to open up the order window

- Choose ‘Instant Execution’ or ‘Pending Order’ from the dropdown menu

- Input the position size

- Use the ‘+’ or ‘-‘ icons to toggle between Stop Loss and Take Profit levels

- Add a comment (optional)

- Select ‘Buy’ or ‘Sell’

Note, all open/closed orders are displayed towards the bottom of the platform interface.

MT4 & MT5

InstaForex also offers the popular MetaTrader 4 and MetaTrader 5 platforms. These familiar terminals offer one-click trading, custom charting toolkits, integrated technical indicators for analysis, plus the capability to design, build, and deploy automated trading strategies.

MT5 is the best fit for experienced traders, with 21 timeframes (9 available on MT4), 44 analytical objects (21 available on MT4), and six pending order types (4 available on MT4). MT5 also offers Level II pricing, an integrated economic calendar, plus strategy backtesting.

Note, the MultiTerminal service is also compatible with MT4, allowing clients to manage several trading accounts at once. Traders can also access the FastTrader solution. The browser-based terminal can be used to make tick trades with 6-digit quotes and an intuitive look and feel.

Mobile App

InstaForex supports multiple mobile applications making trading on the go a seamless experience.

Users can download the proprietary MobileTrader app to iOS and Android (APK) devices. This all-in-one solution allows clients to manage accounts, open and close positions, analyse the markets, and access live news streams.

There are also other mobile solutions, including separate applications for the client area (IFX Client), copy trading (ForexCopy), education (Forex Courses), and more. On the downside, the number of apps is bordering on overwhelming and may confuse new traders.

The MetaTrader 4 and MetaTrader 5 terminals are also both available as mobile-compatible apps. However at the time of writing, both applications are only available to download on Android devices due to Apple App Store restrictions.

Payment Methods

Deposits

InstaForex has a low minimum deposit of £1 which will appeal to beginners.

UK traders can fund accounts using credit and debit cards, wire transfers, plus cryptos such as Bitcoin. Wire transfer deposits can take up to four days while payments made by bank cards are usually processed within 24 hours and cryptocurrency payments take three hours. Deposits and withdrawals are processed by the broker between 8 AM and 5 PM (UTC+00) Monday to Friday.

There is no charge to make a deposit, however, third-party bank charges may apply.

How To Make A Deposit

- Log in to the InstaForex client cabinet

- Select ‘Financial Operations’ from the menu on the left and then ‘Deposit Money’

- Click on the respective payment method logo from the list

- Enter the payment details, including the deposit value

- Click ‘Submit’

Note, you will be unable to make a payment until you have completed the account verification process.

Withdrawals

Clients must withdraw back to the original payment method and in the same currency.

Similar to deposits, the broker does not charge any commission fees, though banking fees may apply. Withdrawal timelines vary between payment systems. For instance, wire transfers can take up to four working days while bank card withdrawals can take up to six business days.

For any withdrawal delays or problems, you can contact the InstaForex customer support team using the details further below.

Demo Account

InstaForex offers a free demo account, similar to competitors.

Users can practise trading on all 300 instruments under real market conditions. Clients can load a demo account with up to $1,500,000 in virtual funds and practise trading risk-free. On the downside, demo profiles are only available in USD, EUR, or RUB, not GBP.

InstaForex also regularly runs demo trading contests and promotions. As well as a good way to get to grips with trading platforms, they can be an effective way to improve trading skills and win prizes.

How To Open A Demo Account

- Click on the ‘Open Demo Account’ logo on the broker’s homepage

- Complete the online registration form

- Click ‘Open An Account’

- Demo account login credentials will be displayed on the next screen

- Download MetaTrader or log in to the web terminal

- Start trading

Bonuses & Promotions

InstaForex stands out for its wide range of welcome bonuses and trading promotions. Depending on current availability, offers can include a 30% to 100% welcome deposit bonus, a demo contest, and monthly participation in a deposit rebate scheme.

When we registered for a new live account, we were offered a 100% deposit bonus on our first payment and a 55% reward for every deposit thereafter. There were also competitions for luxury items such as cars and electronics for traders who deposit at least £1000. You can opt into bonuses and promotions when adding funds to your live profile or via the ‘Campaign’ area.

Importantly, always review bonus terms and conditions before getting started. There are often minimum volume requirements that have to be satisfied before you can request profit withdrawal. For instance, some of the broker’s promotional deals require a 6x turnover of the value of the bonus.

UK Regulation

Instant Trading Ltd is authorised and regulated by the British Virgin Islands Financial Services Commission (BVI FSC), license number SIBA/L/14/1082.

Although it is good to see some regulatory oversight, this is an offshore entity, with relaxed joining stipulations and limited business control. UK traders should be aware that this licensing is not top-tier, and customer safeguarding may not be as prominent as seen by FCA-regulated brokers. Negative balance protection is also not offered to UK traders.

Fortunately, our experts did find measures in place to reduce transactions involved in financial crime. This means investors must comply with anti-money laundering identification protocols to receive access to the full suite of trading services. Additionally, the broker uses segregated accounts.

InstaForex Account Types

InstaForex offers four account types with a minimum deposit requirement of just £1. These profiles are categorised into either Standard or Eurica, which offer different pricing models. Trading conditions are the same between the relevant Standard and Eurica accounts except for the pricing models. This includes leverage up to 1:000, instant order execution, and a maximum trade size of 10,000 lots.

It is a shame that GBP is not accepted as an account base currency; EUR or USD is available only.

Standard Accounts

Both Standard accounts (Insta.Standard and Cent.Standard) offer commission-free trading. Instead, all fees are generated through spreads.

The Cent.Standard profile is best-suited for novice investors. The broker accepts a minimum trade size of 0.0001 lots but still adheres to the trading terms of the Insta.Standard profile. Smaller trade sizes essentially mean less risk for traders starting out.

Eurica Accounts

The Eurica accounts (Insta.Eurica and Cent.Eurica) offer competitive spreads from 0 pips with an average 0.03% to 0.07% commission, suitable for active traders. Similar to the Cent.Standard, clients can also trade a minimum of 0.0001 lots on the Cent.Eurica account.

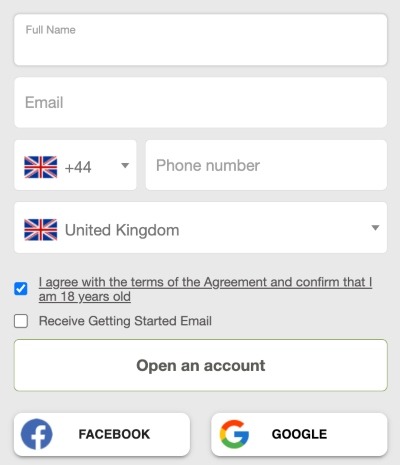

How To Open A Live Account

When we used InstaForex, our experts registered for an account in less than three minutes.

- Click on the ‘Visit’ button at the top or bottom of this InstaForex review

- Enter basic personal details or use your Facebook or Google account details to autofill

- Select ‘Open Account’ or ‘Register’

- Verify your new profile with a code sent to the registered email address

- Client area login credentials will be displayed on the next screen

- Input your new login details to access the client area and start trading

You do not need to provide identity verification at the sign-up stage, this can be added later.

Extra Tools

VPS

InstaForex offers high-speed virtual private server (VPS) connectivity. The server provides 24/7 market monitoring and trading without delays or interruptions. Prices range from $4 per month to $17 per month depending on your account balance and server type.

To subscribe:

- Log in to the client cabinet

- Select ‘Company Services’ from the menu on the left and then ‘VPS Service’

- Review the VPS server options (RAM 1024, 2048, or 3072)

- Select ‘Order’

- Confirm the price

- A username and password to access the IP address will be sent to your registered email

- Connect to the server and log in to the trading platform

Note, the VPS runs on Windows OS devices only.

Education

Our experts were impressed with the wealth of educational content, particularly for beginners. The website hosts a variety of video tutorials, key term glossaries, online training courses, and a full knowledge base of articles and resources.

For more experienced investors, there are daily market insights from over 30 forex analysts, news reports, technical overviews, and forecasts. Dividend calculators and profit & loss forecasting tools can also help with trading decisions. In addition, InstaForex TV has several interviews, trade breakdowns, and strategic guidance.

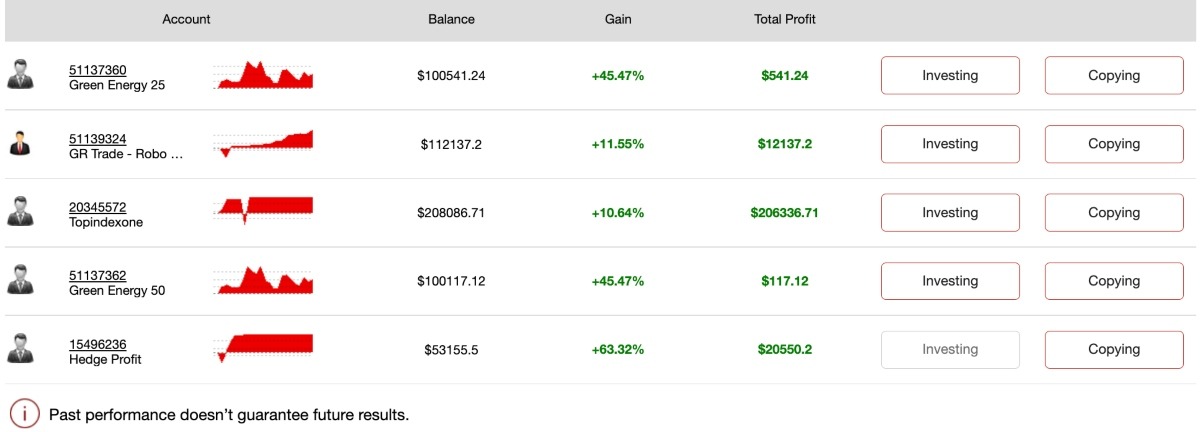

ForexCopy

UK traders benefit from access to the broker’s copy trading terminal; ForexCopy. It allows users to duplicate the orders of ‘professional’ traders whilst remaining in full control of funds. The tool is fully customisable meaning you can manually stop, pause or restart copying with the click of a button.

While using InstaForex, we were pleased with the low minimum deposit requirement of just £10 to get started.

Copy Traders

Opening Hours

InstaForex trading sessions are between Sunday 22:00 (GMT) to Friday 22:00 (GMT). Specific trading hours within this will vary depending on the market and instrument.

There is no weekend trading and public holidays may also affect opening hours.

Customer Support

InstaForex offers reliable customer support, available around the clock in 17 languages. This includes live chat through Skype and Telegram.

It is disappointing that there is no publicly available telephone contact number, however, you can request a call-back. There is also a comprehensive help centre with plenty of FAQs.

- Email – support@mail.instaforex.com

- Live Chat – Logo found in the bottom right of the broker’s website

- Call Back – Requests can be made via the support section of the official website

Client Safety

InstaForex provides a range of client security features. This includes text message authorisation for withdrawal requests. Two-factor authentication (2FA) can also be enabled when logging in to trading platforms. In addition, you can view the IP addresses that access your account so you can monitor client area logins.

All personal information is transmitted via SSL secure technology.

Should You Trade With InstaForex?

InstaForex has several positives. This includes 24/7 customer support, copy trading, access to 300+ instruments, plus a choice of third-party or proprietary terminals.

Having said that, the lack of FCA regulation is disappointing. There is also no negative balance protection and some of the broker’s bonuses come with tough volume requirements.

FAQs

Is InstaForex A Good Choice For UK Traders?

InstaForex does have some good points going for it; a range of account types and platforms, responsive customer support, educational content, and 300+ instruments. However, the lack of FCA regulation and licensing may deter UK traders.

Is InstaForex A Safe Broker?

InstaForex is regulated offshore by the British Virgin Islands Financial Services Commission (BVI SVG). The company does not offer negative balance protection or provide access to compensation schemes in the case of business failure. These are notable drawbacks for UK traders.

Does InstaForex Offer A Good Range Of Payment Methods?

UK investors can deposit to a live InstaForex account using bank wire transfer, credit/debit card, and cryptocurrency. The broker does not charge any commission fees. The minimum deposit requirement of just £1 is also ideal for beginners.

Can I Test InstaForex?

Yes, InstaForex offers a fully functional demo account on all trading platforms. You can practise trading risk-free with up to £1.5 million in virtual funds. Prospective traders can register for a demo account in a few minutes on the broker’s official website.

Does InstaForex Offer A Welcome Bonus?

Yes, InstaForex regularly offers financial rewards and bonus incentives. Previous deals have included a £500 new account startup bonus and a £1500 welcome login bonus.

Review bonus terms and conditions before signing up as withdrawal restrictions may apply.

Top 3 InstaForex Alternatives

These brokers are the most similar to InstaForex:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- IG - Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

- Vantage FX - Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

InstaForex Feature Comparison

| InstaForex | Pepperstone | IG | Vantage FX | |

|---|---|---|---|---|

| Rating | 3.2 | 4.8 | 4.5 | 4.7 |

| Markets | Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Minimum Deposit | $1 | $0 | $0 | $50 |

| Minimum Trade | 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | BVI FSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA | FCA, ASIC, FSCA, VFSC |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4 | MT4, MT5 |

| Leverage | 1:30 for retail clients, 1:500 for professional | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 71.9% of retail investor accounts lose money when trading CFDs |

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

||

| Review | InstaForex Review |

Pepperstone Review |

IG Review |

Vantage FX Review |

Trading Instruments Comparison

| InstaForex | Pepperstone | IG | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | No |

| Futures | Yes | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

InstaForex vs Other Brokers

Compare InstaForex with any other broker by selecting the other broker below.

Popular InstaForex comparisons:

|

|

InstaForex is #56 in our rankings of CFD brokers. |

| Top 3 alternatives to InstaForex |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Currencies, Cryptocurrencies, Stocks, Indices, Metals, Oil and Gas, Commodity Futures and InstaFutures |

| Demo Account | Yes |

| Minimum Deposit | $1 |

| Minimum Trade | 0.10 of the lot (0.0001 of market lot for Cent.Standard and Cent.Eurica) |

| Regulated By | BVI FSC |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:30 for retail clients, 1:500 for professional |

| Mobile Apps | iOS and Android + browser based platform |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Bank cards, Bitcoin, Litecoin, Tether, Ethereum, Skrill, Neteller, PayCo, AstroPay, WebMoney, and Local Banking & Transfer Solutions. |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities | Cocoa, Coffee, Copper, Cotton, Gasoline, Gold, Livestock, Natural Gas, Oil, Orange Juice, Palladium, Platinum, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | Fixed |

| CFD GBPUSD Spread | Av. Floating 0.6 pips |

| CFD Oil Spread | Fixed |

| CFD Stocks Spread | 0.1% |

| GBPUSD Spread | 0.6 |

| EURUSD Spread | 0.2 |

| GBPEUR Spread | 0.5 |

| Assets | 1000+ |

| Currency Indices | USD |