DNA Markets Review 2024

|

|

DNA Markets is #13 in our rankings of CFD brokers. |

| Top 3 alternatives to DNA Markets |

| DNA Markets Facts & Figures |

|---|

DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Trading App |

Our initial disappointment with DNA Markets’ lack of a proprietary mobile app was quickly overshadowed by the impressive functionality of the MT4 and MT5 mobile apps. These platforms deliver a seamless trading experience akin to their desktop counterparts, with smooth charting and customizable features optimized for mobile use. The addition of push notifications and plentiful daily news accessible directly from your phone ensures you’re kept in the loop with key market updates. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Signal Start |

| Islamic Account | No |

| Commodities |

|

| CFDs | DNA Markets offers a recently enhanced suite of 800+ CFDs covering stocks, indices, forex, commodities and cryptos, providing opportunities to speculate on rising and falling prices. There are no restrictions on strategies with leverage up to 1:30 (Australia) or 1:500 (rest of world). |

| Leverage | 1:500 |

| FTSE Spread | 1.7 |

| GBPUSD Spread | 1.0 |

| Oil Spread | 1.5 |

| Stocks Spread | 1.0 cent + $0.02 per share, per side (Apple) |

| Forex | DNA Markets continues to deliver an excellent environment for forex traders with 50+ currency pairs and low spreads from 0.0 pips on the EUR/USD during tests. The MetaTrader 4 platform, available on desktop, web and mobile, was also designed specifically for forex trading. |

| GBPUSD Spread | 1.0 |

| EURUSD Spread | 1.0 |

| GBPEUR Spread | 1.0 |

| Assets | 50+ |

| Currency Indices |

|

| Stocks | You can trade 585+ US, European and Australian stocks including Google and Apple, alongside major indices like the S&P 500, FTSE 100 and VIX. That said, the breadth of shares is narrow compared to alternatives like CMC Markets with its 10,000+ shares. |

| Cryptocurrency | You can trade a strong range of 120+ cryptos 24/7, surpassing alternatives like Vantage with its 40+ tokens. That said, the spread from 170 on Bitcoin is significantly higher than the cheapest crypto brokers. |

| Coins |

|

| Spreads | $28 (Bitcoin) |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

DNA Markets offers over 800 CFDs on the MT4 and MT5 platforms. This DNA Markets review will evaluate the offering for UK traders, from the availability of GBP accounts and FCA regulation to the quality of the platforms, tools and pricing.

Our Take

- DNA Markets is best suited to short-term traders and algo traders familiar with the MetaTrader software.

- The Standard account is geared towards newer traders with commission-free trading, while the Raw account will serve experienced traders looking for tight spreads from 0.0 pips.

- UK traders are catered for with a GBP account and an affordable £100 minimum deposit, but the lack of FCA oversight reduces its trust score, especially compared to category leaders like Plus500.

- Signal Start is the only notable trading tool at DNA Markets, with a threadbare selection of research features and educational content to support aspiring traders, especially compared to IG.

Is DNA Markets Regulated In The UK?

DNA Markets is not regulated by the Financial Conduct Authority (FCA). This means British traders won’t receive access to the Financial Services Compensation Scheme (FSCS), which insures client funds up to £85,000.

Instead, UK traders will need to sign up with the weakly-regulated offshore entity, Focus Markets LLC, which is based in St Vincent and the Grenadines.

This will allow you to access leverage up to 1:500 – significantly more than the 1:30 available at FCA-regulated brokers. However, it also limits your recourse options in the event of disputes.

eToro is an excellent alternative if you want an FCA-regulated broker. Our British experts have been trading at eToro for years with no issues and praise the secure trading environment.

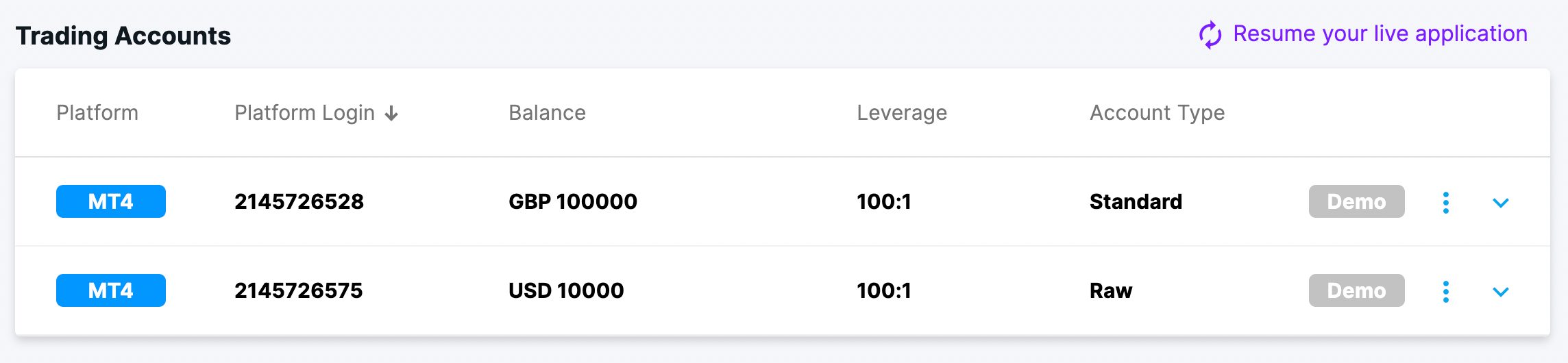

Accounts

Live Accounts

The account structure at DNA Markets is straightforward: Raw or Standard.

The Standard account will serve beginners looking for price simplicity. Spreads start from 1.0 pip with zero commissions.

The Raw account is best for experienced traders, scalpers and high-volume traders. Spreads range from 0.0 pips to 0.3 pips, with a $3 commission per side.

The £100 minimum deposit for both accounts will be affordable for most retail traders, even if it’s higher than firms like Pepperstone with no minimum.

There’s also a strong selection of 7 base currencies to choose from, including GBP, helping British traders deposit, fund and withdraw without hefty conversion fees.

I can’t fault the registration process at DNA Markets – it only took me a few minutes after pressing ‘Open Account’. I had to provide basic contact details and verify my ID before making a deposit.

Demo Account

You can also open a demo account to practice trading within MT4 or MT5.

The sign-up process for simulator mode is equally straightforward – simply follow the same steps to open a live account from the website, followed by a few clicks within the dashboard to activate a demo profile.

I appreciated that I could select the demo balance, leverage and choose between Raw or Standard, giving me a good feel for the different trading conditions at DNA Markets.

Funding

DNA Markets provides an excellent range of secure deposit solutions, with over 10 methods including debit/credit cards, bank wire, cryptos and e-wallets such as Skrill and Neteller.

The broker doesn’t charge any fees on deposits or withdrawals, though I discovered third-party transaction fees may apply on some methods.

Most transfers are processed instantly for deposits and withdrawals, though there is a lead time of up to 5 business days for bank wire withdrawals.

Market Access

DNA Markets offers a diverse investment offering with over 800 CFDs spanning forex, stocks, indices, commodities and cryptocurrencies.

Notably for British investors, there’s a good selection of UK share CFDs, including BP and Lloyds Banking Group, among 585+ other global shares.

Overall, it’s encouraging to see that DNA Markets has recently boosted its CFD offering for short-term traders, though it doesn’t yet provide longer-term investing products like real shares, bonds or ETFs.

IG is an excellent alternative here, with over 17,000 instruments spanning short- and long-term trading products. IG also supports spread betting, which provides a tax-free way to make short-term bets on financial markets in the UK and beyond.

Leverage

Since UK clients will be onboarded via the offshore entity, the maximum leverage available is 1:500, significantly amplifying gains and losses.

DNA Markets has a 80% margin call and a 50% stop-out level, whereby the broker will start closing out your positions.

I learned that DNA Markets do NOT provide negative balance protection in the UK. This means you can lose more than your deposit and increases the risk of trading with leverage.

Pricing

DNA Markets offers competitive pricing.

During testing, average spreads on the EUR/USD came in at around 1.1 pips using the Standard account, and around 0.2 pips in the Raw account. This compares well to alternatives like Vantage but trails the cheapest UK brokers, notably IC Markets.

Commissions in the Raw account are also competitive. At $3 per side, they are lower than UK brokers like Pepperstone, which charges $3.50 per side.

Where DNA Markets really shines is its non-trading fees. There are no deposit or withdrawal charges and unlike many competitors, including Plus500, there are no inactivity fees, making it an attractive option for casual traders.

Trading Platforms

DNA Markets provides leading third-party trading platforms: MetaTrader 4 and MetaTrader 5. These excel for experienced traders looking for advanced charting tools and algo trading, but they sport an old design that I don’t enjoy using.

Also, the lack of a proprietary platform built with beginners in mind is a serious drawback, especially compared to category leaders like AvaTrade, which provides in-house software alongside the MetaTrader suite.

The MetaTrader platforms each offer dozens of technical indicators and drawing tools, plus 9 timeframes in MT4 and 21 timeframes in MT5. I recommend MT4 for newer traders and forex traders, while MT5 offers more advanced features and was designed for multi-asset trading. That said, the similarities between both platforms make them easy to transition between.

MetaTrader users also benefit from a huge marketplace for indicators and charting tools, plus automated trading capabilities via Expert Advisors (EAs).

The other neat feature I rate at DNA Markets is its copy trading solution, Signal Start. This a paid subscription which works seamlessly alongside MT4 or MT5 to deliver daily forex signals.

Mobile Apps

DNA Markets doesn’t offer its own trading platform, another drawback against alternatives like AvaTrade.

While you can log in to the client portal through a mobile or tablet browser, there’s no iOS or Android app for a complete mobile trading experience.

On a positive note, MT4 and MT5 can both be downloaded from the App Store or Google Play. The apps are ideal for traders who prefer to trade on the go but don’t want to compromise on functionality, with mobile-optimised charts and a fast, stable trading environment.

Extra Tools

DNA Markets performs poorly when it comes to additional tools to enhance the trading experience, often a differentiator between an average broker and an excellent broker.

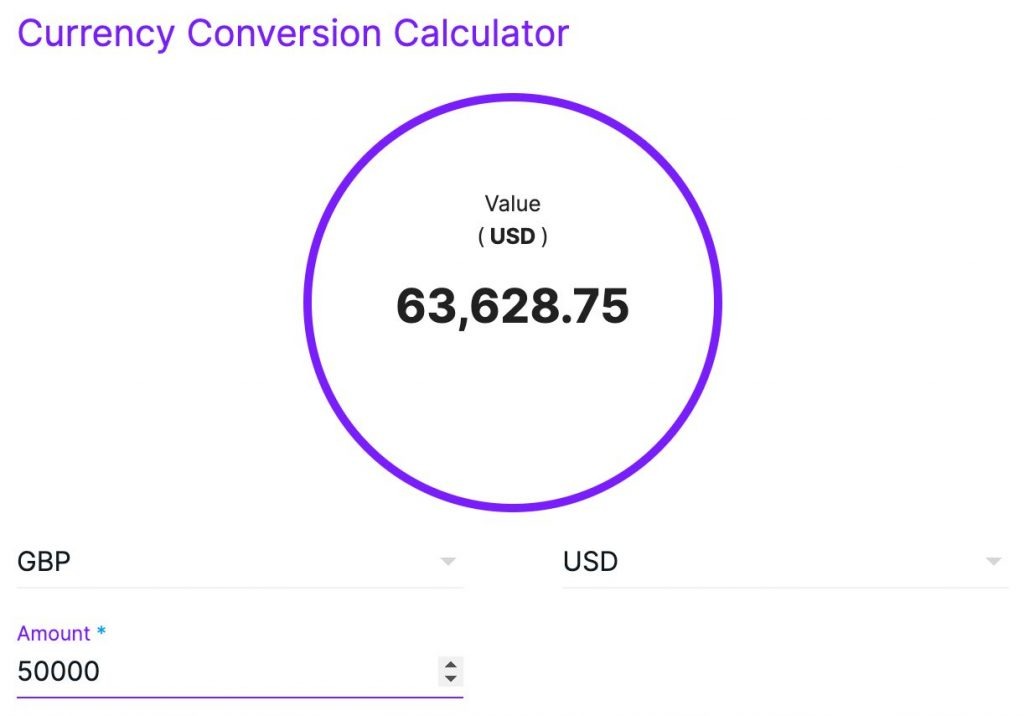

There are just a few calculators (margin, profit, pip, currency conversion) and Signal Start.

I’ve been surprised to find no economic calendar, which is provided by most leading brokers, including IG, and can help you track events that could impact the markets.

There are also zero insights from in-house analysts or news feeds from reputable sources like Reuters, meaning many traders will need to turn to third-party tools, providing an incomplete trading experience.

The lack of educational materials for beginners is also very disappointing. To compete with category leaders like eToro I’d like to see a training academy with articles, videos and live analysis that takes into account different experience levels and strategies.

Customer Service

Customer support at DNA Markets is good but response times trail the most reliable UK brokers, notably XTB.

Following multiple tests, the best way to reach the broker is via live chat, which is available 24/5 and usually offers responses within 5 minutes.

There’s also an email address and telephone line available:

- Email: support@dnamarkets.com

- Telephone: 02070825200

Should You Invest With DNA Markets?

If you are familiar with the MetaTrader platforms and want to make short-term trades with high leverage up to 1:500 in return for limited safeguards (no FCA regulation or negative balance protection), then DNA Markets could be worth considering.

However, DNA Markets seriously trails the best brokers in the UK in critical areas, notably regulation, research, education and mobile trading.

Despite some improvements, it also offers a mediocre investment offering with limited products for longer-term traders.

FAQ

Is DNA Markets Good For UK Traders?

DNA Markets is an average choice for UK traders. Despite a GBP account and UK-friendly payment methods, the broker isn’t regulated by the FCA and doesn’t provide access to British stocks.

Is DNA Markets Regulated By The FCA?

DNA Markets is not regulated by the UK Financial Conduct Authority (FCA). Instead, it holds a license with the Australian Securities & Investments Commission (ASIC).

Can You Trade In GBP With DNA Markets?

Yes, DNA Markets offers a trading account denominated in GBP, alongside a handful of other currencies, including USD and EUR.

Article Sources

DNA Markets – Australian Securities & Investments Commission License

Top 3 DNA Markets Alternatives

These brokers are the most similar to DNA Markets:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

DNA Markets Feature Comparison

| DNA Markets | Pepperstone | IC Markets | Fusion Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4.8 | 4.8 | 4.5 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $0 | $200 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | ASIC, VFSC, FSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:500 |

| Visit | 74-89 % of retail investor accounts lose money when trading CFDs |

|||

| Review | DNA Markets Review |

Pepperstone Review |

IC Markets Review |

Fusion Markets Review |

Trading Instruments Comparison

| DNA Markets | Pepperstone | IC Markets | Fusion Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | Yes | No |

DNA Markets vs Other Brokers

Compare DNA Markets with any other broker by selecting the other broker below.

Popular DNA Markets comparisons: