XM Review 2024

|

|

XM is #10 in our rankings of CFD brokers. |

| Top 3 alternatives to XM |

| XM Facts & Figures |

|---|

XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures |

| Demo Account | Yes |

| Min. Deposit | $5 |

| Mobile Apps | iOS, Android & Windows |

| Trading App |

XM offer a mobile app for both Android and iOS that has been specifically tailored to each platform, maximizing the functionality of both. The app delivers the MT4 and MT5 software on the move, with full access to the broker’s 1000+ instruments. Where they shine is their dependability with minimal glitches and delays during testing. The built-in news, trading journal and push notifications also ensure you have everything you need to trade from your hand. |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | ASIC, CySEC, DFSA, FSC, FSCA, CNMV, AMF |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Traders can speculate on leveraged CFDs with zero commissions, spanning popular markets including currencies, equities and commodities. Additionally, the MetaTrader platforms collectively offer dozens of advanced technical indicators built for short-term strategies. |

| Leverage | 1:30 |

| FTSE Spread | 1.5 pts |

| GBPUSD Spread | 1.9 |

| Oil Spread | 0.03 |

| Stocks Spread | 0.002 |

| Forex | XM offers ultra low spreads across a wide range of forex assets with no re-quotes or hidden charges. Over 50 currency pairs are available, which is above the market average and is in line with one of our top award-winners, AvaTrade. |

| GBPUSD Spread | 1.9 |

| EURUSD Spread | 1.6 |

| GBPEUR Spread | 1.8 |

| Assets | 55+ |

| Currency Indices |

|

| Stocks | You can trade hundreds of shares in major markets, including the US, UK, Europe and Asia. Commissions are as low as $1 per transaction while fractional shares reduce the entry barrier for beginners. There's also a dedicated stock market analysis section on the broker's website. |

XM is a MetaTrader broker with a strong offering for UK traders, including 1,000+ assets and superb research. In this XM review, we evaluate every area you should consider before opening an account, drawing on our personal experience testing the platforms.

Our Take

- XM is not regulated by the FCA, but is authorized by 2 top-tier regulators (ASIC and CySEC) and provides negative balance protection.

- XM delivers for short- and long-term traders of all levels, with CFDs, Forex, Turbo Stocks, a stand-alone Shares account, plus copy trading.

- The XM App offers a superb mobile trading experience with notable improvements in 2023, including technical summaries and research.

- MT4 and MT5 are great for charting, but the lack of a beginner-friendly proprietary platform is a key drawback against brokers like AvaTrade.

- While support is available via phone, email and live chat, there is no UK presence and the quality is poor following tests, especially next to XTB.

Is XM Regulated In The UK?

XM is not regulated by the Financial Conduct Authority (FCA) in the UK. Instead, British traders will sign up through XM Global, which is registered offshore with the Financial Services Commission (FSC) of Belize.

Though this may appeal to investors looking for high leverage up to 1:1000, it remains a notable drawback as the FSC is not a respected regulator.

It also means UK clients won’t get up to £85,000 through the Financial Services Compensation Scheme (FSCS) in the case of broker insolvency – a safeguard available if you use an FCA-regulated broker like Plus500.

Weighing the positives, the XM Group is regulated by the respected Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC), boosting the brand’s trust score.

Additionally, XM provides negative balance protection, meaning you can’t lose more than your balance while trading.

Accounts

Live Accounts

UK traders can choose from four accounts: Micro, Standard, XM Ultra Low, or Shares.

In the Micro account, the standard lot size equates to 1,000 units of the base currency (0.1 lots), differing from the Standard account where 1 lot comprises 100,000 units (0.01 lots), as is typical for most forex trading accounts. This makes the Micro account suitable for newer investors looking to trade in smaller volumes.

The Ultra Low account will suit active traders looking for tighter spreads, starting from 0.6 pips compared to the 1.0 pip in the Micro and Standard accounts.

However, what will be missing for some experienced traders is an account with raw spreads from 0.0 and low commissions. Although available in other jurisdictions, UK clients of XM have no such option. IC Markets is a great option if you want this.

The minimum deposit is $5 for all account types, catering to budget traders, with the exception of the Shares account which requires $10,000 but offers real stock trading. Islamic accounts are also available and can be requested in the member’s area.

All accounts accept deposits in various base currencies, notably GBP, except for the Shares account which is available in USD only.

If you’re looking for a Share dealing account denominated in GBP, IG is an excellent alternative for British traders.

Demo Account

XM provides free demo accounts on MT4 and MT5. To access a demo account, simply open the platform like you would for a live account.

It’s worth noting that demo accounts have no expiration and can be created anytime, which is a major advantage against competitors who impose time limits to rush you into funding a live account.

Bonuses

UK clients can access several bonus deals and promotions at XM. During our last round of testing, we were offered a £20 bonus upon registration, with no deposit required.

There are also some deposit bonuses available, including a 50% bonus up to $500 and a 20% bonus up to $4,500.

Other ways to earn include XM’s loyalty program, as well as a range of demo and real competitions with cash prizes and no entry fees.

Funding Options

XM provides an excellent range of secure and cost-effective funding options for British traders. These include wire transfers, Visa and Mastercard credit/debit cards, as well as popular e-wallets like Apple Pay, Google Pay, Skrill, and Neteller.

I’ve found that e-wallets offer the quickest processing times, with funds typically available for trading within a few minutes.

As a UK trader, I also appreciate XM’s offering of multiple base currencies, notably GBP. This facilitates easy account management and trading in the British Pound, whilst also eliminating any conversion costs.

You can withdraw amounts as low as $5, with no maximum limit, providing flexibility for newer traders.

Withdrawal times are reasonable based on tests, usually ranging from 2 to 5 days.

Market Access

XM offers a commendable suite of over 1,000 instruments catering to a range of trading strategies.

Key strengths are the above-average selection of currency pairs and equity indices, plus the bespoke ‘Turbo Stocks’, which will serve short-term traders looking for high leverage.

However, the choice of metals and shares is subpar, seriously trailing category leaders like Blackbull Markets and CMC Markets, which offer 26,000+ and 12,000+ instruments respectively, providing superior trading opportunities for serious investors.

UK traders can access the following markets at XM:

- Forex – 50+ currency pairs including a mixture of majors, crosses and exotics. Notable pairs include the EUR/GBP, GBP/USD and GBP/JPY.

- Stock CFDs – Contracts for difference on over 1,200 global stocks from 17 jurisdictions including the UK. ‘Turbo Stocks’ consist of 7 popular underlying share CFDs with daily expiration times and very high leverage.

- Shares – Invest in 90+ shares from UK, US and German markets, including major British companies such as Tesco, EasyJet and Shell.

- Indices – Trade cash CFDs on 20 indices, plus 10 futures CFDs, including the FTSE (UK100), NASDAQ (US100) and DAX (GER30).

- Commodities – Trade futures on 8 commodities including high-grade copper, corn and coffee.

- Energies – Trade futures CFDs on oil and natural gas.

- Metals – Trade CFDs on gold and silver.

XM doesn’t offer ETFs – a popular instrument with long-term investors. eToro is an excellent alternative here, with over 500 global ETFs, including UK favourites such as the iShares Core FTSE 100 UCITS ETF and the iShares UK Property UCITS ETF.

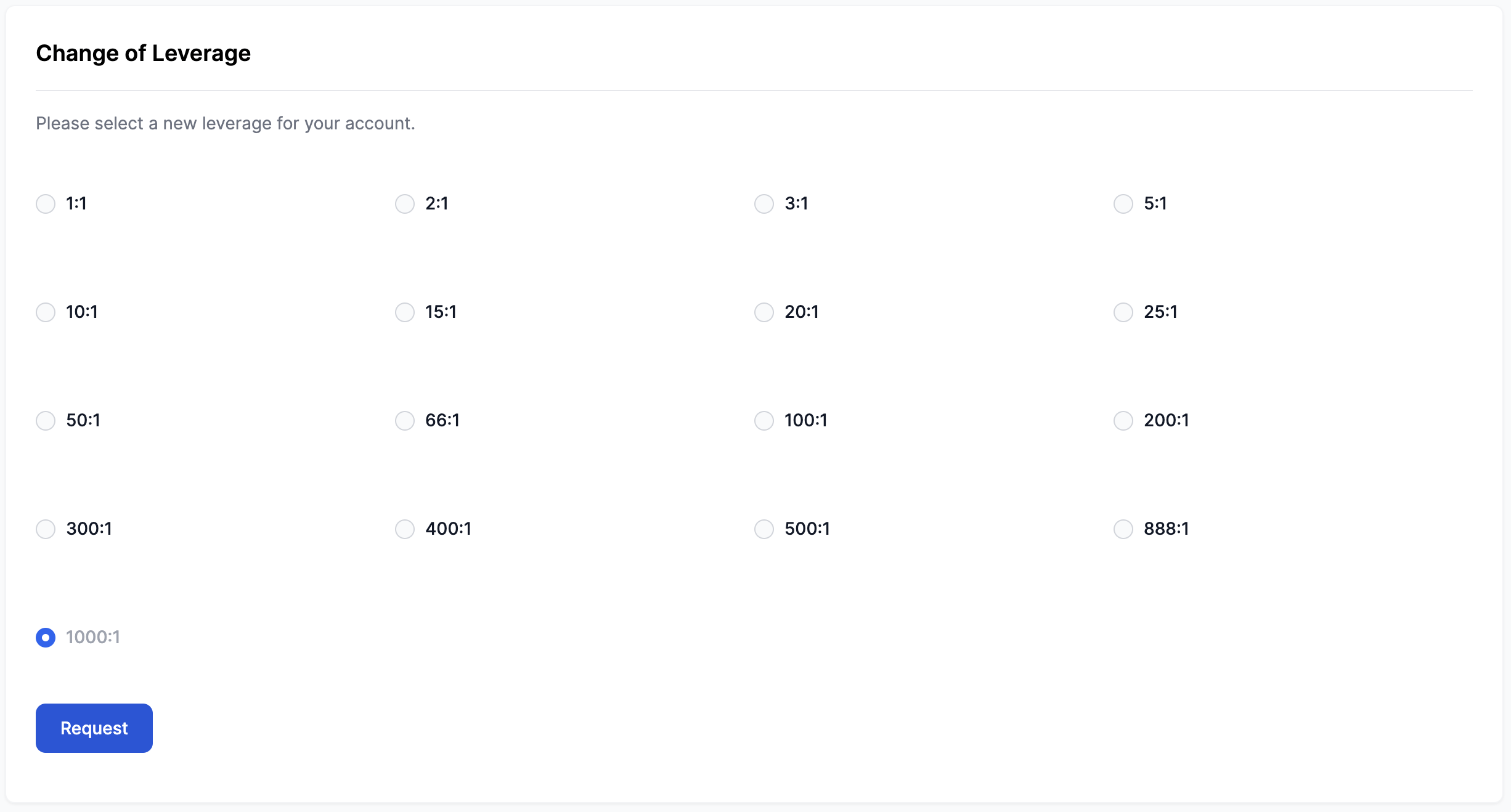

Leverage

XM offers leveraged trading from 1:1 to 1:1000, which is significantly higher than FCA-regulated brokers that can’t offer beyond 1:30 to retail investors.

This could be a major selling point for UK traders, however it’s vital to be aware that leveraged trading can significantly increase the risk of large losses, especially for inexperienced investors.

XM also employs a dynamic model for leverage, meaning that the highest leverage is typically only available on lower amounts of below $40,000.

The broker imposes a margin call at 50% and a stop-out level of 20%.

Flexible Leverage

Pricing

XM provides competitive trading fees. These differ based on the asset class and account type, with commission-free trading offered on Micro, Standard and Ultra Low accounts.

Floating spreads start from 0.6 pips for GBP/USD in the Ultra Low account and from 1.9 pips in the Micro and Standard accounts.

These are reasonable but not the lowest we’ve seen. AvaTrade, for example, offers a minimum spread of 1.3 pips for the same pair in its Standard account.

XM does not impose hidden fees, but you should note that overnight positions may incur rollover interest. This applies solely to cash instruments and does not affect futures. The exact amount charged varies based on the position held, such as long or short.

I’ve been pleased to find that XM does not charge deposit or withdrawal fees, and for international wire transfers exceeding $200, third-party bank charges are reimbursed.

For casual investors, it’s important to note a $10 monthly fee applies after 90 days of inactivity.

Trading Platforms

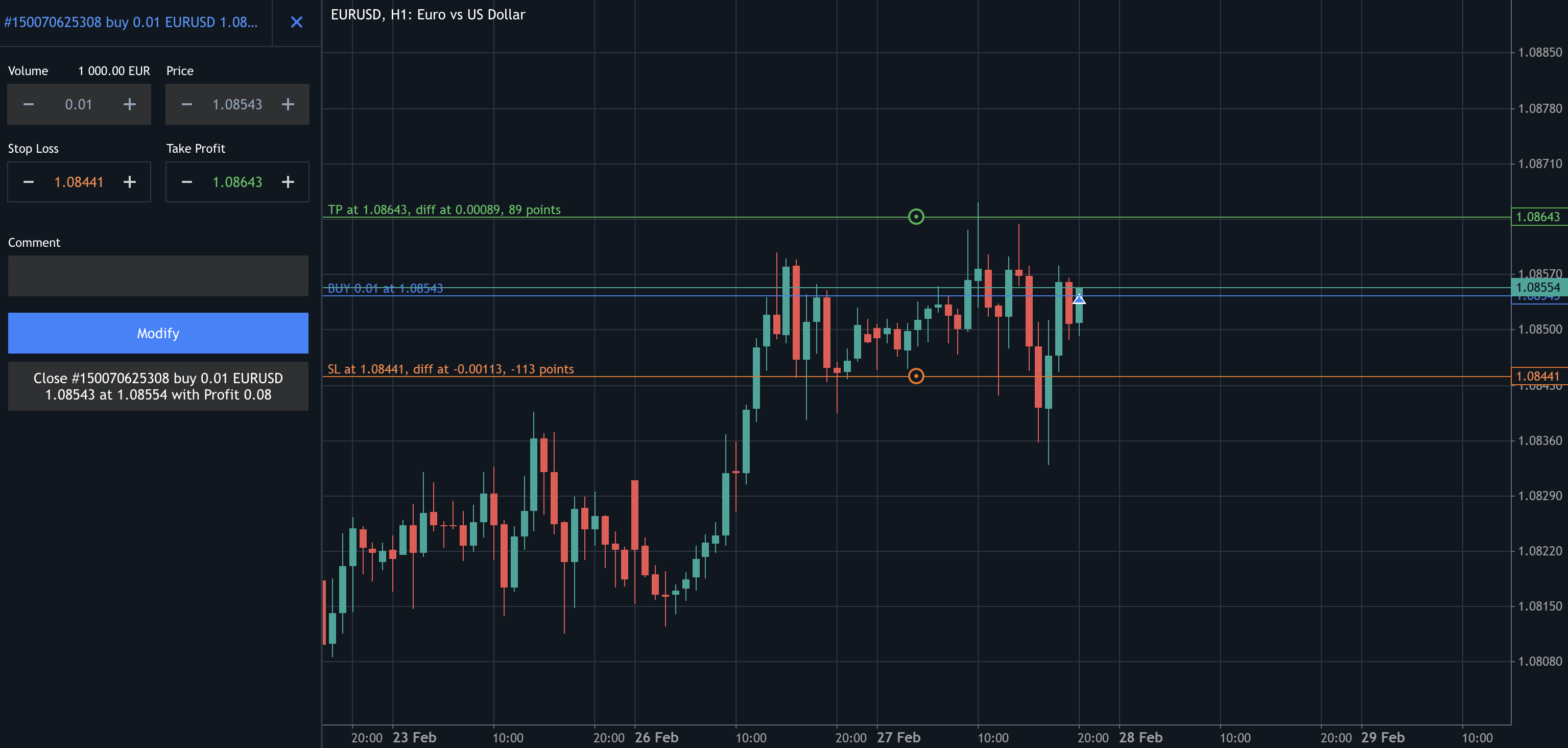

XM offers the market-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are available to download on desktop devices or can be accessed directly through web browsers.

MT4 and MT5 excel for their robust tools and versatility, catering to multi-asset trading. That said, their interfaces will feel outdated to newcomers and make for a less enjoyable trading experience in my opinion.

I would also have liked to see a proprietary solution offered to beginners who may prefer a cleaner, easier-to-navigate option, available at our top-rated UK broker, AvaTrade.

Trading Platform

Nonetheless, I’ve been impressed with the wide array of indicators and drawing tools, and experienced investors in particular will appreciate the 80+ included in MT5.

There are also various charting styles and timeframes, as well as support for numerous order types, providing important risk management parameters.

Additionally, you can automate your strategies using Expert Advisors (EAs) and scripts, or subscribe to copy trading strategies and competitions.

Mobile Apps

XM is a superb choice if you want to trade on the go. Alongside the fully optimised MT4 and MT5 mobile apps there’s also the proprietary XM App, delivering a complete trading package.

The XM App connects seamlessly to your MT4 or MT5 account, whilst providing convenient access to your account management settings and funding options.

I was also pleased to see XM improve its trading app in 2023, introducing a wider selection of enhanced features, notably news, technical analysis and market research, ensuring a more complete mobile trading experience.

Extra Tools

XM continues to offer an impressive range of supplementary resources, even rivalling category leaders like eToro.

I particularly rate the news channel, which continuously streams Reuters articles and helps me stay informed about the latest market developments.

Other standout features include free forex signals, webinars, podcasts, an economic calendar, platform tutorials, proprietary technical indicators, VPS hosting, and YouTube-hosted videos. There’s even video-hosted market commentary via XM TV, further enriching the overall trading experience.

Technical Analysis and XM TV

For technical analysis support, the platform provides a variety of blog articles to help you generate trade ideas.

The all-in-one calculator on the broker’s main site is also great for evaluating various metrics, including pip value, swaps, and required margin.

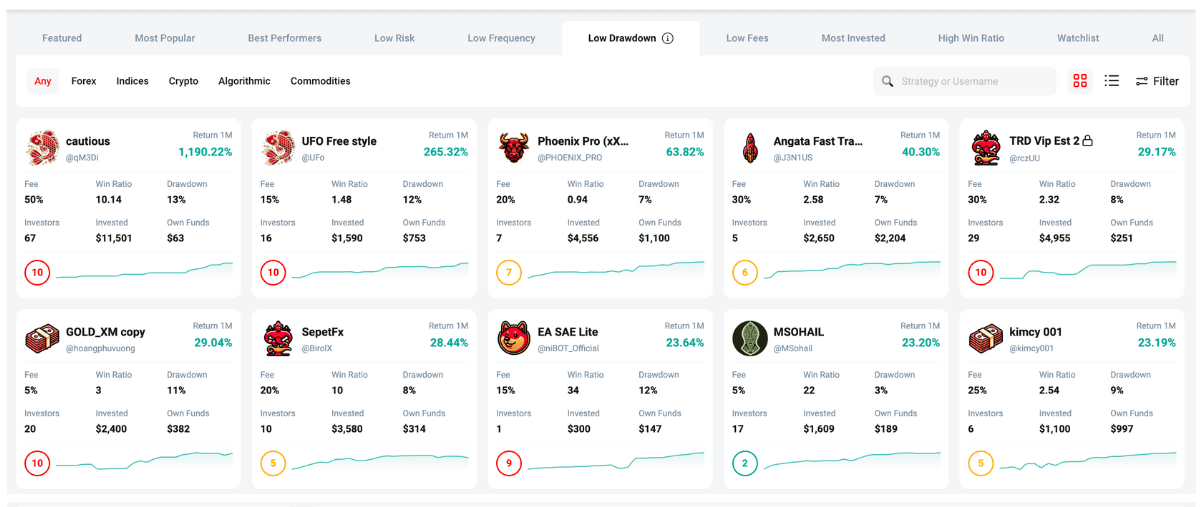

You can also access a proprietary copy trading feature, allowing you to emulate the strategies of other traders.

Copy Trading

One notable drawback, however, is the cost of VPS hosting, priced at $28 per month. This is higher than other brokers that offer it for free to active traders.

For example, RoboForex offers a free VPS service to UK clients who maintain at least $300 account equity and can trade a minimum of 3 standard lots per month.

Customer Service

XM offers multilingual support in over 30 languages, notably English, and is available around the clock via telephone, email, and live chat.

However, it’s a shame that UK clients don’t have access to a local phone number, or a dedicated account manager. This can add a layer of support for newer traders, making for a smoother entry into online trading.

eToro scores much better here, with account managers I’ve primarily had positive interactions with.

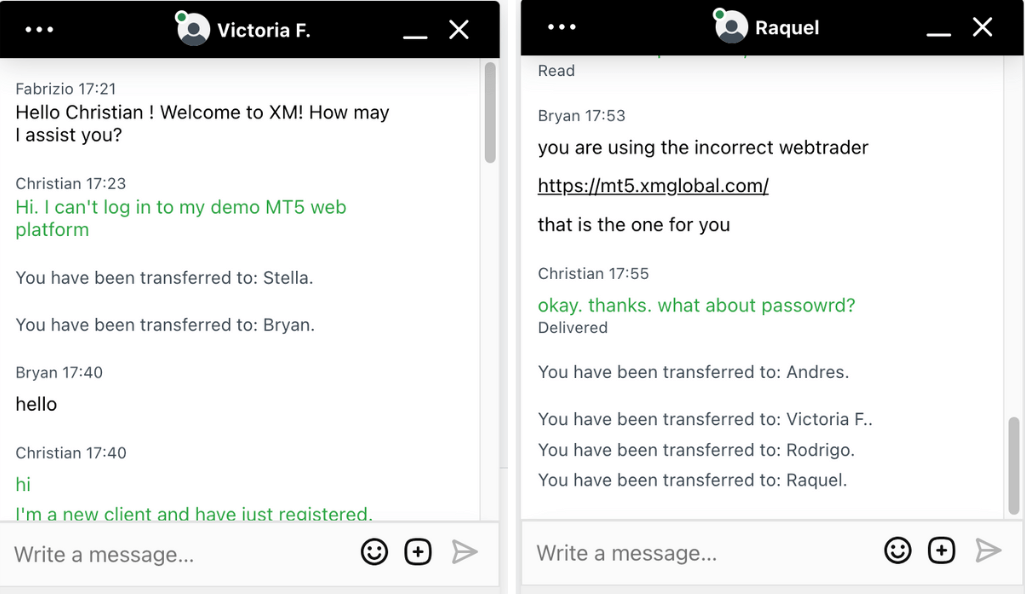

Live Chat

In my time using XM’s MetaTrader platforms (desktop and web), I also encountered a few issues and had to contact live chat for help. Disappointingly, the service was slower than most leading alternatives, taking a minimum of 10 minutes to connect.

Additionally, despite being transferred to different agents at least 5 times in one instance, my enquiry was still not resolved.

Due to my poor experience with XM’s support services, I find it difficult to recommend the broker to UK residents if you’re looking for a trading partner that is easy to reach in times of urgency.

Should You Invest With XM?

XM stands out for its comprehensive educational resources and insightful market research. The flexible account options also suit various trading styles and budgets.

However, limiting platform availability to just MetaTrader may reduce its appeal to newer traders. XM also trails leading UK brokers like CMC Markets in terms of market variety.

Finally, with no reliable customer service presence in the UK and the lack of an FCA license, there are safer choices out there for UK investors, especially IG.

FAQ

Is XM Good For UK Investors?

XM is a good broker for British investors, but not the best. UK clients benefit from GBP accounts and accessible payment methods. There’s also a strong range of UK assets.

However, the biggest downsides are the lack of platform options, disappointing customer service for UK traders, and no FCA oversight.

Can You Trade In GBP With XM?

Yes, you can trade in GBP with XM. The broker offers GBP as one of many base currencies, allowing you to fund your accounts, make trades, and withdraw funds in the British pound.

Is XM Safe?

XM is a relatively trusted broker. Despite being regulated by fewer top-tier authorities than alternatives, with no FCA authorisation, XM does offer important safeguards like negative balance protection and has a strong track record dating back to 2009.

Can You Trade Cryptocurrency With XM In The UK?

XM does not provide cryptocurrency trading for UK clients. This sets it apart from some of its major competitors, such as eToro, which allows you to buy and sell popular digital currencies including Bitcoin and Ethereum.

Article Sources

XM Global Limited – FSC License

Top 3 XM Alternatives

These brokers are the most similar to XM:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

XM Feature Comparison

| XM | IC Markets | AvaTrade | Pepperstone | |

|---|---|---|---|---|

| Rating | 4.4 | 4.8 | 4.9 | 4.8 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $5 | $200 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, CySEC, DFSA, FSC, FSCA, CNMV, AMF | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail) 1:400 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 74-89 % of retail investor accounts lose money when trading CFDs |

|||

| Review | XM Review |

IC Markets Review |

AvaTrade Review |

Pepperstone Review |

Trading Instruments Comparison

| XM | IC Markets | AvaTrade | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | Yes | Yes | Yes |

XM vs Other Brokers

Compare XM with any other broker by selecting the other broker below.

Popular XM comparisons: