Libertex Review 2024

|

|

Libertex is #95 in our rankings of CFD brokers. |

| Top 3 alternatives to Libertex |

| Libertex Facts & Figures |

|---|

Libertex is a well-known broker, established in 2012. The regulated brand has served numerous clients and is regulated by the Cyprus Securities and Exchange Commission with license number 164/12. Libertex offers CFD trading on 250+ underlying assets, including through an innovative and user-friendly proprietary web trader platform. Choose between CFDs on forex, cryptocurrencies, commodities, stocks, indices and ETFs, which are available with tight spreads and low commissions. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs on Forex, Cryptocurrencies, Metals, Indices, Stocks, Oil & Gas, Agriculture, ETFs |

| Demo Account | Yes |

| Min. Deposit | €100 |

| Mobile Apps | iOS, Android + Browser |

| Trading App |

Libertex offers an iOS and Android-compatible mobile app with advanced features and trading tools. Users can make deposits, execute positions and analyze the markets in a few swipes. Traders can also flick between live and demo mode with one tap. |

| Payments | |

| Min. Trade | €20 |

| Regulated By | CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Commodities |

|

| CFDs | Libertex's list of CFDs covers a decent range of tradeable underlying assets, but there isn't much depth with only around 250 in total. Leverage up to 1:30 for retail clients is available in accordance with CySEC regulations, and traders can choose between three excellent trading platforms. Best of all are the tight spreads available on all markets and the zero commissions on investments in stocks. |

| Leverage | Up to 1:30 (Retail) |

| FTSE Spread | Variable |

| GBPUSD Spread | Variable |

| Oil Spread | Variable |

| Stocks Spread | Variable |

| Forex | Libertex offers CFD trading on 50+ forex pairs, offering long and short opportunities. Its strength comes in its tight spreads – we were offered 0.2 pips for EUR/USD. |

| GBPUSD Spread | From 0.2 |

| EURUSD Spread | From 0.2 |

| GBPEUR Spread | From 0.2 |

| Assets | 50+ |

| Currency Indices |

|

| Stocks | Libertex offers CFDs on 100+ stocks as well as 10 stock indices. Clients can also invest in real stocks directly on the Libertex platform and mobile app. |

| Cryptocurrency | With 70+ cryptocurrencies available to trade via CFDs with tight spreads, low commissions and overnight swap fees, Libertex is a great option for crypto CFD traders. The list of crypto CFDs includes the usual major players like Bitcoin and a good variety of lesser-known cryptos such as Tezos. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Libertex is an award-winning online broker that provides traditional investing services and CFD speculation to clients in the UK, Europe and Asia. The broker has been operating for 25 years and offers over 250 tradable assets through several trading platforms. This 2024 Libertex review will delve into its services, covering essential features like fees, leverage, trading apps and regulation.

About Libertex

Established in 1997, the Libertex Group has operated in the online trading market for 25 years and accumulated over 40 awards from reviewers. The company is based in Cyprus and holds a licence with regional regulator CySEC.

A well-established firm in the CFD space, Libertex provides services to retail and professional traders worldwide, promising tight spreads and a significant range of trading assets. Moreover, the firm has recently expanded into investing, launching its Invest platform for non-derivative stock trading.

Account Types

The Libertex firm supports several types of trading accounts based on clients’ specific goals, funds and trading volume.

Standard Account

The first of these accounts is the retail trader CFD account. Any verified trader over 18 in a supported jurisdiction can open this account, which facilitates CFD trading with maximum leverage of 1:30. The minimum trade limit is £20.

Professional Account

Traders that meet specific criteria can apply for a professional trading account, unlocking higher leverage rates of up to 1:500. To qualify for a pro account, you must have over one year of experience in a professional role within the finical services industry, a demonstrable minimum trading frequency of 10 lots per quarter and a total financial portfolio exceeding £500,000.

Libertex Invest

Libertex has recently launched an investment platform for zero-commission stock trading. As a result, you can create an investment portfolio of real stocks and ETFs and receive cash dividends on your investments.

Hundreds of stocks are available across several US exchanges, though shares from non-US markets are not supported at this time. Additionally, the Invest facility does not support fractional share trading, although it is in development.

Demo Account

The broker also provides a demo account for those that want to gain risk-free experience trading through Libertex. This paper trading account is funded with up to £50,000 and supports speculation on CFDs like gold, Bitcoin and Tesla without depositing real capital.

This demo account is only available for forex and CFD trading, with no provision for Libertex Invest. However, you can trial three platforms: the proprietary platform, MetaTrader 4 and MetaTrader 5.

Trading Platforms

There are three online trading platforms supported by Libertex: a proprietary platform, MetaTrader 4 and MetaTrader 5. All three of these platforms have a mobile app available on iOS and Android for on-the-go trading.

Libertex Trading Platform

The Libertex proprietary online trading platform is an award-winning browser-based forex and CFD trading system. The tool provides a simple, user-friendly interface that features built-in market sentiment signals indicators on every trading asset and a dedicated news section.

Libertex Platform

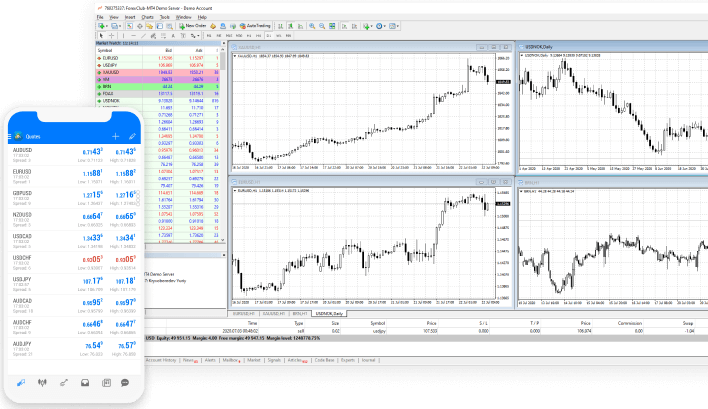

MetaTrader 4

The broker also provides access to the most popular global trading platform: MetaTrader 4 (MT4). MT4 is a standalone program that has been used by traders worldwide for access to forex and CFD markets for over 15 years. Boasting advanced charting tools, automated trading facilities and custom indicator support, Libertex caters for more experienced traders by offering MetaTrader 4.

MetaTrader 4

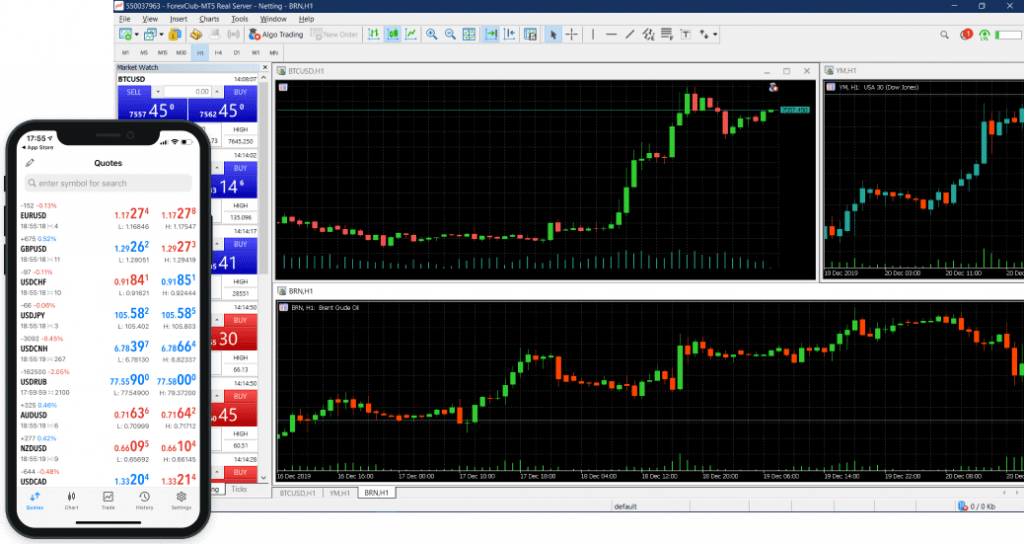

MetaTrader 5

MetaTrader 5 (MT5) is the most recent creation from MetaQuotes. While this platform is not a direct replacement for MetaTrader 4, clients can benefit from additional time frames, a broader range of stock indicators and an updated programming language. MetaTrader 5 is also available as a web platform, while MT4 is no longer supported.

MetaTrader 5

Markets & Assets

Libertex offers more than 250 CFD assets from various markets:

Forex CFDs

Clients can trade more than 50 forex pairs, including seven majors, 23 minors and 21 exotics.

Stock & ETF CFDs

CFDs are available on 140+ shares and ETFs, including leading US tech stocks and the most prevalent offerings from Europe and Latin America. Moreover, these can be sorted into numerous industries, including energy, healthcare and finance, providing you with great options for speculation on specific markets.

Index CFDs

For traders that want to speculate on the overall health of a particular sector or regional economy, Libertex provides more than 25 index CFDs to choose from. Clients can choose between cash and futures markets with various expiration dates.

Commodities CFDs

Libertex offers contracts for difference on over 15 precious metals, agricultural commodities and energies. Most commodity CFDs are based on futures markets, though spot speculation is available on gold, silver and Brent crude oil.

Options Contracts

In addition to its CFD markets, Libertex also offers options contracts on various markets, including Bitcoin, the S&P 500 index and Brent crude oil.

Commissions & Fees

Libertex maintains a competitive edge when it comes to commissions. Charges start at just 0.0006% per trade, with 0.0003% commission charged at entry and exit. However, these commission rates are subject to the selected leverage multiplier.

For other markets, overnight swap fees vary from asset to asset, with the trading position (long or short), asset class and interbank interest rate all playing a part. Wednesday night forex and Friday night CFD swaps are charged triple, as is standard market practice.

In terms of other account charges, an inactivity fee of £10 per month is levied on accounts that have not made an active trade in 180 days. However, this only applies to accounts with a balance of under £5,000.

Margin & Leverage

Libertex offers the maximum possible leverage on each asset class under ESMA regulations for retail clients. These margin levels will be familiar to UK clients as they mirror FCA regulations.

Retail traders can utilise leverage rates of 1:30 on major forex pairs, 1:20 on minor and exotic currency pairs, gold and major global indices, 1:10 on minor indices and other commodities and 1:5 on stocks and ETFs.

Professional traders are not subject to these restrictions and are free to utilise leverage rates of up to 1:500 on all CFD trades.

Payment Methods

Funding a Libertex account can be done via bank wire transfer, debit card, credit card, Skrill, Neteller or PayPal. Transfer times range from instant for PayPal to five working days for wire transfers.

Bank transfers have no minimum limits, though PayPal payments must exceed £10 and other methods have a minimum deposit of £100. Libertex also charges a 1.9% commission on Skrill deposits, though other methods are free.

Withdrawals are supported via all the same methods, except credit cards. Processing times range from one to five working days for card and bank transfers. There is a minimum withdrawal limit of £10. Bank transfers are subject to a 0.2% commission charge that is capped at £10, while Neteller withdrawals incur a 1% fee and card withdrawals cost £1.

GBP withdrawals are only available through PayPal.

Pros Of Libertex

- MT4 & MT5

- Demo trading

- Equities, CFDs and options

- Competitive commission rates

- Retail and professional support

Cons Of Libertex

- No fractional shares

- Limited customer support

- Several regulatory infractions

- Deposit and withdrawal charges

Security & Regulation

Libertex takes significant measures to protect its clients’ accounts from fraud and information theft. A dedicated anti-fraud team actively monitors accounts and trades for suspicious activity, while strong encryptions protect personal information on the Libertex.com site and trading platforms. Additionally, client funds are held in segregated bank accounts and separate login information for the MetaTrader 4 and 5 platforms adds an extra level of account security.

Libertex is licensed and regulated by CySEC to operate as a forex and CFD brokerage firm in Europe.

Controversies

Libertex has fallen foul of CySEC regulations twice in recent years. In mid-2020, CySEC ordered the broker to pay €160,000 in fines for numerous violations, including offering leverage greater than the maximum 1:30 EU limits to clients and executing trades on non-favourable terms.

After resolving these issues, Libertex was sanctioned by CySEC a second time in 2021, this time having its licence briefly suspended by the regulator. This infraction concerned reduced commission rates for clients in specific jurisdictions and promotional material pertaining to banned giveaways.

The broker has addressed these problems and is currently in good standing with CySEC.

Customer Support

When running into an issue on a trading platform, traders often have two avenues to explore for help: a website’s help section or direct customer service.

Libertex offers support through a help desk with sections on the Invest service, deposits and withdrawals, verification (KYC) protocols and information for trading beginners. However, the platform is not as transparent as other brokers, with information such as the inactivity fees and trading commissions not mentioned here.

Furthermore, the broker does not operate a live chat service, again lacking compared to many competitors. Instead, traders must fill out an email form to the broker’s support team or pay for an international call to the company headquarters in Cyprus.

Educational Resources

There is a section dedicated to trader education on the Libertex website, featuring a beginner’s trading course, several webinars and specific articles on the uses of CFDs. In addition, clients can learn the basics of leverage, using a stop loss or take profit and how to use the Invest platform.

The platform has also recently created a research and market news section and an economic calendar to analyse the markets further.

Trading Hours

The Libertex proprietary platform, MT4 and MT5 operate 24/5, with forex and selected commodities available continually throughout the week. Assets such as stocks, ETFs and indices can be traded during local market hours, depending on their exchanges’ locations.

Libertex Verdict

Libertex is an internationally renowned broker, primarily offering forex and CFD trading with a competitive range of assets. Recent forays into options and stock equities trading have expanded the firm’s repertoire, while zero commission policies on crypto CFDs ensure that the broker is staying up to date with the most recent financial trends. However, a lack of transparency on some aspects, such as account fees, and recent regulatory infractions may leave some traders wary of Libertex.

FAQ

What Platforms Does Libertex Support?

Libertex has an award-winning proprietary trading platform and supports industry favourites MetaTrader 4 and 5.

Does Libertex Offer An Islamic Account?

Unfortunately, Libertex does not provide a swap-free account for Islamic traders.

Is There A Libertex App?

Yes, Libertex has a mobile app for both Android and iOS devices, in addition to MT4 & MT5 mobile apps for on-the-go trading.

Does Libertex Charge Withdrawal Fees?

Traders can make commission-free withdrawals using Skrill or PayPal but bank transfers, card withdrawals and Neteller transactions are not free.

Is There A Libertex Demo Account?

Libertex boasts a demo trading account stocked with 50,000 of a traders’ preferred currency for risk-free practice trading.

Top 3 Libertex Alternatives

These brokers are the most similar to Libertex:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Libertex Feature Comparison

| Libertex | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.6 | 4.9 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | €100 | $100 | $0 | $0 |

| Minimum Trade | €20 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | - | MT4 |

| Leverage | Up to 1:30 (Retail) | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 78.31% of retail investor accounts lose money when trading CFDs with this provider. |

69% of retail CFD accounts lose money. |

||

| Review | Libertex Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Libertex | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | Yes | No |

| Futures | No | Yes | No | No |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Libertex vs Other Brokers

Compare Libertex with any other broker by selecting the other broker below.

Popular Libertex comparisons: