TMGM Review 2025

TMGM is an online forex and CFD trading service that specialises in high leverage speculation via the MetaTrader 4 and 5 trading platforms. This 2025 broker review will detail all the information that prospective clients need to know before they register with TMGM, including minimum deposit requirements, withdrawal fees, account types and sign-up bonus schemes. Read on to learn whether this broker is right for you.

About TMGM

TMGM has been operating since 2013 with a focus on top-tier customer service and support for all of its global clients. Based in Australia, the firm operates multiple offices worldwide, including Melbourne, Sydney and Limassol, Cyprus.

Founder and CEO Lee Yu has overseen the expansion of the company. Due to several high-profile promotion campaigns, including sponsoring the Australian Open tennis competition, and prominent partners like former Juventus goalkeeper Gianluigi Buffon, the company is well known across its native Australia.

The broker is regulated by three bodies across its jurisdictions, including the ASIC. However, the less reputable VFSC licences the arm of TMGM serving UK clients.

Markets

More than 12,000 instruments are supported by TMGM, primarily spanning the forex and CFD markets.

Forex

Over 50 major, minor and exotic forex pairs are available. The broker offers competitive spreads from 0.0 pips on the ECN Edge account and 1.0 pips on the commission-free Classic account.

Indices

Twelve spot indices instruments, including the UK FTSE 100, US S&P 500 and ASX 200 from Australia are supported by the firm for country and industry-based speculation.

Commodities

Disappointingly, TMGM only supports five commodities products, made up of three metals and two energies instruments. As a result, clients can speculate on gold, silver, platinum, Brent crude and WTI crude oil, though soft commodities are absent.

Spreads start from 0.2 pips on energies and 0.0 pips on metals through the low-spread Edge account.

Shares & ETFs

Over 12,000 shares and ETFs are available for CFD speculation through the broker. Equities from the NYSE, Nasdaq, Hong Kong exchange and the ASX make up this offering, featuring competitive pricing and instant execution.

Cryptocurrency

Twelve cryptocurrency pairs are provided, including primary tokens such as Bitcoin and Ethereum as well as altcoins such as Chainlink, Polkadot and Uniswap. These assets are available to trade seven days a week, 24 hours a day with tight, variable spreads.

Leverage

TMGM offers leverage rates of up to 1:500, which is significantly higher than its FCA and ESMA regulated competition. The maximum leverage on each market is as follows:

- Up to 1:500 on forex pairs

- Up to 1:400 on gold

- Up to 1:100 on indices and other commodities

- Up to 1:20 on crypto and share CFDs using MT4 and MT5.

- Up to 1:10 with share CFDs on IRESS Viewpoint

The broker enforces a stop-out on leveraged positions at 40% margin, closing the position.

Account Types

There are two MetaTrader compatible account types available from TMGM: the Standard and Edge variants.

Both pass on trades to liquidity providers using an ECN execution style. However, the Standard variant mirrors the trading conditions of an STP account.

These accounts are also available as swap-free Islamic variants designed for clients that cannot pay interest due to religious reasons.

Additionally, the broker supports three IRESS account types – the Standard, Premium and Gold variants.

MetaTrader Standard Account

The MetaTrader Standard account offers zero commission trading with spreads from 1.0 pips and 1:500 maximum leverage. There is a £100 minimum deposit requirement to open a Classic account and GBP is a supported base currency.

MetaTrader Edge Account

The TMGM Edge account offers the full ECN trading experience, with tight spreads as low as 0.0 pips. Commissions stand at £6 per round traded lot and there is an £85 initial minimum deposit requirement.

UK clients can open an account using GBP as a base currency and utilise leverage of up to 1:500.

IRESS Standard Account

For investors who favour the IRESS Viewpoint platform, this standard account is available for a hefty £4,200 initial minimum deposit.

A standard £30 platform fee is waived if ten or more trades are made per month and a commission of 0.08% is levied on positions (£10 minimum fee). Clients can trade in GBP.

IRESS Premium Account

The second TMGM IRESS account is the Premium variant, which eliminates the platform fee on active accounts and reduces commission to 0.07% (no minimum fee).

This account gives free access to a full complement of global exchange data feeds for those who make over ten monthly trades. However, an even higher initial minimum deposit of £8,300 is required to open an IRESS Premium account.

IRESS Gold Account

The highest tier of IRESS-compatible accounts is the Gold variant, which mirrors the trading conditions of the Premium account but reduces commissions to 0.06% (no minimum fee). However, traders will want to review whether this discount is worth the £41,500 initial minimum deposit.

Demo Account

Whether you wish to practise trading with a new tool or explore new markets, a demo account is an excellent weapon in your arsenal. To this end, clients can trial the TMGM brokerage through a risk-free demo account available for the MetaTrader 4 and 5 platform accounts.

Trading Platforms

Three trading platforms are available to TMGM users- MetaTrader 4, MT5 and IRESS Viewpoint.

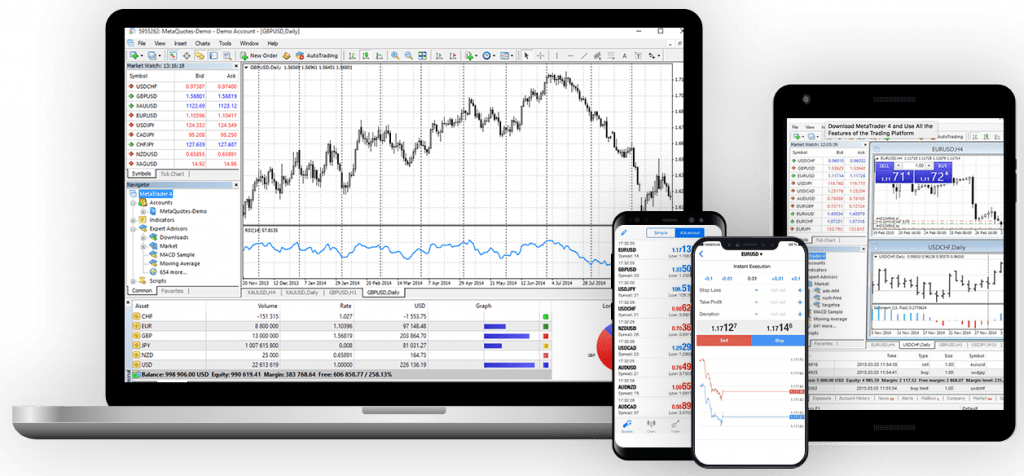

MetaTrader 4

MetaTrader 4 is the first platform available to TMGM clients. Created in 2005, MT4 features 20 indicators, 31 graphical objects and nine time frames, as well as nine order types.

Users can add custom indicators and expert advisors (EA) from the well-populated MQL4 marketplace or create custom alerts and hotkeys for rapid market monitoring and trading.

MetaTrader 4

TMGM customers can download MetaTrader 4 for Windows, Mac and Linux or trade via the WebTrader browser-based platform. In addition, the MT4 mobile app is available to download for Android and iOS devices.

MetaTrader 5

Launched in 2010 to provide greater choice to clients, MT5 adds several key features and multiple asset classes such as stocks and ETFs to the options in MetaTrader 4.

An integrated economic calendar with market news and events, 38 indicators, 44 graphical objects and 21 time frames makes technical analysis a breeze. In addition, enhanced strategy backtesting and an updated MQL5 coding language mean that users can devise more accurate trading strategies.

Clients can download MT5 for Windows, Linux and Mac computers, as well as an app for iOS and Android mobile devices. The browser-based WebTrader platform is another option for those on the go.

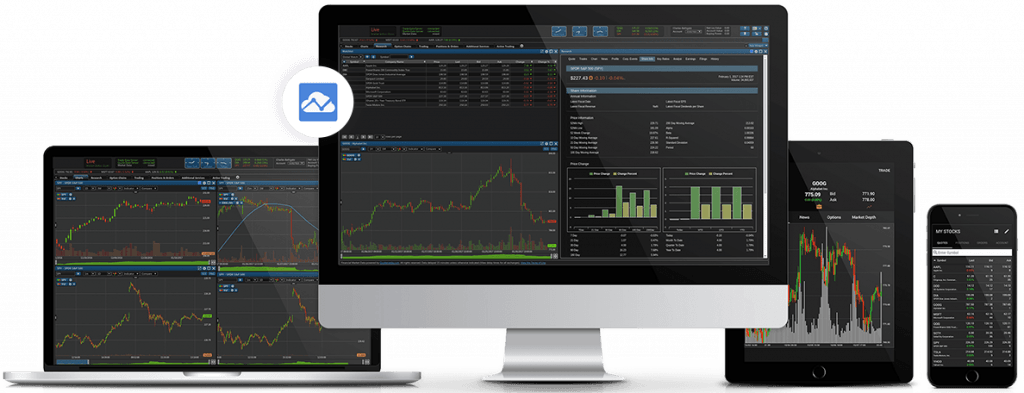

IRESS ViewPoint

The final software package offered by TMGM is IRESS Viewpoint. This direct market access platform allows clients to trade stock CFDs with over 50 charting instruments, 59 indicators and advanced market depth data support.

IRESS Viewpoint

Clients must open one of the firm’s three specific IRESS accounts to use this platform. IRESS Viewpoint is available on Windows and Mac devices and through the IRESS Mobile app for Android and iOS.

Payment Methods

There are several payment methods available to TMGM traders, many of which support GBP deposits and withdrawals. These are Visa and MasterCard credit and debit cards, Revolut, Wise, Neteller and bank wire transfers. Skrill is also supported but only available in USD.

Deposits clear between instantly and 3 working days depending on the specific method, though a universal £100 minimum deposit requirement applies across all forms. Withdrawals take one working day to process and also must exceed £100.

Deposit & Withdrawal Fees

There are no deposit or withdrawal fees levied on any payment method by TMGM. However, intermediary bank charges may apply for wire transfers.

Trading Fees

TMGM is transparent when it comes to trading fees, with no charges for deposits or withdrawals. There is no inactivity fee when using a MetaTrader account. However, IRESS accounts come with a £30 per month platform fee if a specific trading volume is not met.

IRESS commissions range from 0.06% to 0.08%, while the Edge account has a £6 per round traded lot charge. Swap fees for maintaining a leveraged position overnight vary from asset to asset but there is a lower financing fee available for higher-level IRESS accounts.

Security & Regulation

Staying safe from scams when investing online is a priority for all serious investors and choosing a well-licenced broker is an excellent step towards this. While overseen by the ASIC in its domestic region, the TMGM global arm is regulated by the VFSC, a less rigorous body.

This being said, the company uses several security measures to protect clients, such as holding capital in tier-one banks and ensuring client funds are insured for up to £2.8 million per customer.

Unfortunately, the broker’s secure login portal does not support two-factor authentication (2FA), which would offer enhanced sign-in protection to users.

Customer Support

There are several 24/7 options to contact the support team. These include a live chat feature and direct messaging via Facebook Messenger, WhatsApp and Telegram.

- Phone Number: +61 2 8036 8388

- Email Address: support@tmgm.com

The broker also has a solid social media presence and users can find help via its Twitter, Facebook and Instagram pages.

Educational Content

While many brokers provide proprietary educational material to clients with varying degrees of success, this broker has left education to the pros.

Access to Trading Central is permitted via the TMGM Academy section of its website- investors can take advantage of a free newsletter, feature idea segments and analyst view pieces.

Advantages Of TMGM

- No transaction fees

- High leverage rates

- Competitive spreads

- Several account types

- 24/7 customer support

- Several trading platforms

- Great range of global shares and ETFs

Disadvantages Of TMGM

- No UK phone number

- No promotions or bonuses

- High minimum deposit amount

- Limited commodities instruments

- IRESS accounts have high minimum deposits

Promotions

Many brokers offer sign-up bonus promotions, demo trading competitions or fee rebates to tempt new clients to their service. TMGM used to provide a £50 no deposit bonus to new users but has discounted this promotion.

Additional Features

TMGM boasts several trading tools to enhance investors’ chances of predicting and taking advantage of market movements. These include a real-time economic calendar for keeping track of the latest news and upcoming market events, the “Market Buzz” sentiment detection tool and free access to a VPS for active clients.

Trading Hours

The broker’s platforms are available 24/7 to keep up with the crypto markets supported by the broker, though forex and non-crypto CFD instruments only trade during weekdays.

Investors can access the client portal and make deposits and withdrawals at any time.

TMGM Verdict

This investing review has found TMGM to be a high-ranking choice for forex and CFD traders due to its lack of deposit and withdrawal fees, robust range of products across most markets and high maximum leverage. The company also earns points for 24/7 customer support and supporting several trading platforms. However, high minimum deposit requirements and a lack of oversight from a leading regulator for its global operations go against the firm.

FAQ

Is TMGM A Scam?

TMGM has been operating globally for almost ten years without scandal and holds a licence in its home region from the reputable regulator ASIC.

Does TMGM Offer A No Deposit Bonus?

Unfortunately, the no deposit bonus promotion run by TMGM has been discontinued.

Is TMGM Regulated?

UK clients that sign up to TMGM benefit from VFSC oversight.

How Many Account Types Does TMGM Offer?

TMGM provides prospective clients with five options when signing up for an account. The Standard and Edge accounts allow traders access to the MT4 and MT5 platforms, while three variants serve IRESS Viewpoint.

The MetaTrader compatible accounts are available as swap-free Islamic variants.

What Is The TMGM Minimum Deposit Amount?

There is a £100 minimum deposit requirement when adding funds to a TMGM account using any supported method.

Top 3 TMGM Alternatives

These brokers are the most similar to TMGM:

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

- IC Markets - IC Markets is an internationally acclaimed forex and CFD broker, admired for its competitive pricing, diverse trading instruments, and superior technology. Established in 2007 and based in Australia, the firm is under the regulation of ASIC, CySEC, and FSA. It has successfully drawn over 180,000 clients from more than 200 nations.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

TMGM Feature Comparison

| TMGM | FP Markets | IC Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 3.4 | 4 | 4.8 | 4.8 |

| Markets | CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting |

| Minimum Deposit | $100 | $40 | $200 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FMA, VFSC | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (UK), 1:500 (Global) | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | TMGM Review |

FP Markets Review |

IC Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| TMGM | FP Markets | IC Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

TMGM vs Other Brokers

Compare TMGM with any other broker by selecting the other broker below.

Popular TMGM comparisons:

|

|

TMGM is #49 in our rankings of CFD brokers. |

| Top 3 alternatives to TMGM |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Stocks, Energies, Indices, Metals, Cryptos, Forex |

| Demo Account | Yes |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC, FMA, VFSC |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Alipay, Credit Cards, Debit Card, FasaPay, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Yes |

| Signals Service | MT4 Expert Advisors (EAs) |

| Islamic Account | Yes |

| Commodities | Gold, Natural Gas, Oil, Platinum, Silver |

| CFD FTSE Spread | 4.0 |

| CFD GBPUSD Spread | 1.4 |

| CFD Oil Spread | 0.0 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 1.4 |

| EURUSD Spread | 0.3 |

| GBPEUR Spread | 0.2 |

| Assets | 50+ |

| Crypto Coins | BCH, BNB, BTC, DOT, EOS, ETH, LINK, LTC, UNI, XLM, XRP, XTZ |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |