EagleFX Review 2024

|

|

EagleFX is #32 in our rankings of CFD brokers. |

| Top 3 alternatives to EagleFX |

| EagleFX Facts & Figures |

|---|

EagleFX is a forex and CFD broker, established in 2019. The broker uses STP execution on the MT4 platform, offering tight spreads and low commissions. With leverage up to 1:500 and no restrictions on hedging or scalping, EagleFX is an attractive option for short-term traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, Indices, Stocks, Commodities, Cryptocurrencies |

| Demo Account | Yes |

| Min. Deposit | $10 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payments | |

| Min. Trade | 0.01 Lots |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | The broker offers a small range of 100+ CFD instruments spanning key markets, with high leverage up to 1:500. Pricing is reasonable, with round turn commissions coming in at $6 alongside tight spreads. Multiple short-term strategies are also permitted, including hedging and scalping. |

| Leverage | 1:500 |

| FTSE Spread | 0.77 |

| GBPUSD Spread | 1.3 |

| Oil Spread | 0.09 |

| Stocks Spread | Variable |

| Forex | You can go long or short on over 50 forex pairs from majors to exotics, with competitive spreads as low as 0.1 pips. The broker offers the leading charting software, MetaTrader 4, which delivers a host of advanced features, including 9 timeframes and over 30 indicators. |

| GBPUSD Spread | 1.3 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.4 |

| Assets | 55 |

| Stocks | You can trade 70+ of the most popular global stocks including Amazon and Tesla, as well as 10+ major indices. This isn’t particularly competitive compared to the hundreds offered by most alternatives, and the lack of additional analysis tools will disappoint seasoned stock traders. |

| Cryptocurrency | A strong range of cryptocurrencies are available with 35+ tokens including popular assets like Bitcoin and Ethereum. You can also make convenient Bitcoin deposits within minutes, with no transfer fees. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

EagleFX is an online forex and CFD broker that gives its users access to the widely popular MetaTrader 4 platform for analysis and position management for CFDs in a range of markets. This 2024 EagleFX review will outline its investing products, deposit and withdrawal methods, customer support, how to create an account and sign in, key pros and cons and more.

Company History & Overview

EagleFX Ltd is a global brokerage established in 2019 that offers investing services in 188 countries – including the UK – to thousands of clients. It is an offshore and unregulated firm with the location of its registered office and headquarters sitting in The Commonwealth of Dominica. Our review team was unable to find any details of the broker’s owner, founder or CEO.

The broker prides itself on creating optimal trading conditions and fast execution using straight-through processing (STP) for a range of liquidity providers and not using requotes. The firm also claims it has access to institutional-grade liquidity, although it does not provide further details. Trading speeds can be improved further by using a virtual private server (VPS).

Trading Platform

EagleFX uses the industry-leading MetaTrader 4 (MT4) platform. This can be downloaded on Windows and Mac computers, although this may require a separate software setup. Those looking to avoid downloading software can use the WebTrader version, which operates through most major browsers. Note that the MT4 mobile app is currently only available on Android (APK download) and not on the App Store.

Our experts reviewed the main features of MT4, which are as follows:

- Nine timeframes

- One-click trading

- 24 graphical objects

- Financial news alerts

- 30 technical indicators

- Signals integration options

- Various trade execution modes

- Copy trading integration options

- Algorithmic trading using expert advisors (EAs)

MetaTrader 4

EagleFX Markets & Instruments

This broker specialises in CFD and spot forex trading. EagleFX has over 180 CFD assets to choose from:

- 73 stocks

- 10 indices

- 55 forex pairs

- Six commodities

- US Dollar futures

- 37 cryptocurrencies

Investing Fees

EagleFX uses an ECN/STP brokerage model, which means it charges commissions in return for raw market spreads. The commission is £6 per lot round turn. Spreads are variable and fluctuate based on market conditions and liquidity. However, clients can expect spreads on the most liquid forex majors of around 0.1 pips. For example, our experts found the EUR/USD spread to generally sit around 0.8 pips and the EUR/GBP at 0.9 pips. The FTSE 100 spread tends to be a respectable 1.2 pips and the Nasdaq 100 (NAS100) spread is closer to 1.1 pips.

There are no inactivity fees. Swap fees may be applied when holding a position overnight and the type of asset will have an effect on the charges applicable.

Leverage

As a broker that is not regulated, the maximum leverage rate at EagleFX is 1:500 on forex and metals, 1:200 on indices and energies and 1:100 on cryptocurrencies. The margin call activates at a 100% margin level and the stop out at a 70% margin level.

Mobile Trading

There is no in-house EagleFX mobile trading app. However, investors can use the MT4 mobile app, which is intuitive and easy to use. The mobile platform has some limited features compared to the desktop alternative, though key functions and position management systems are still in place.

While this application has historically been available on iOS, it is currently not on the App Store. Only Android users can therefore benefit, although this may be rectified in due course.

EagleFX Payment Methods

Deposits

There are no deposit fees at EagleFX. The two main deposit methods at this broker are Bitcoin (USD 10 minimum deposit) and Instacoins (USD/EUR/GBP 50 minimum deposit), which is a third-party Bitcoin provider. Investors can purchase Bitcoin through Instacoins using their credit/debit card or by bank wire transfer. The Bitcoin then gets sent directly to the investor’s account. Both deposit methods take 1-6 hours but this depends on blockchain traffic. Deposited funds appear in your vault and will then need to be internally transferred to the appropriate MT4 account.

Withdrawals

Withdrawals must be made using Bitcoin or to a Coinbase Wallet via PayPal. There are no transaction fees. EagleFX offers fast withdrawal times, with most being processed in 30 minutes or less. The minimum withdrawal amount via Bitcoin is USD/EUR/GBP 10 and there is no maximum withdrawal limit.

Demo Account

A demo account is available on MT4 with EagleFX. Prospective clients can download the desktop platform for this, though the web-based system is also suitable. The MT4 mobile app is also compatible with the demo account and investors can download this from Google Play. There are no restrictions on the demo account balance nor any time limits, which is great for new and experienced speculators alike.

Bonuses & Promotions

EagleFX does not have a no-deposit welcome bonus available for new customers. This is unusual for an unregulated broker that is not subject to the same restrictions as many European brokers. However, it may be that this broker decides to offer promotions in the future.

Regulation

This broker is unregulated, which means that its customers have fewer protections compared to traders using regulated brokers. It also means that the firm is not subject to the same level of scrutiny or monitoring requirements and that investors do not have insurance for the funds they deposit in the company should it become insolvent. Despite this, there are brokers without a license with a regulatory body where the company is not a scam but a legitimate, fair and competent financial services firm. We recommend that investors always approach unregulated brokerages like EagleFX with caution.

Account Types

Only one account type is available at EagleFX, although traders can open multiple MT4 accounts with different leverage settings. There is also the option to open an Islamic/swap-free account, where rollover charges are replaced with administrative costs to keep in line with Sharia law. Traders that want an Islamic account should contact the broker. The minimum lot size when trading is 0.01.

How To Get Started With EagleFX

1) Sign Up To Receive Your Login Details

The initial sign-up process is very quick and it takes around one minute to register a new account. Simply click on the ‘Sign Up’ button in the top-right of the EagleFX webpage and enter the details requested. Email verification is also required. No documents are needed as part of know-your-customer (KYC) regulations as these do not apply. Once complete, you can use your login details (email address and password) on the relevant page to go to the dashboard where you can perform various functions including accessing the trading platform and funding your account.

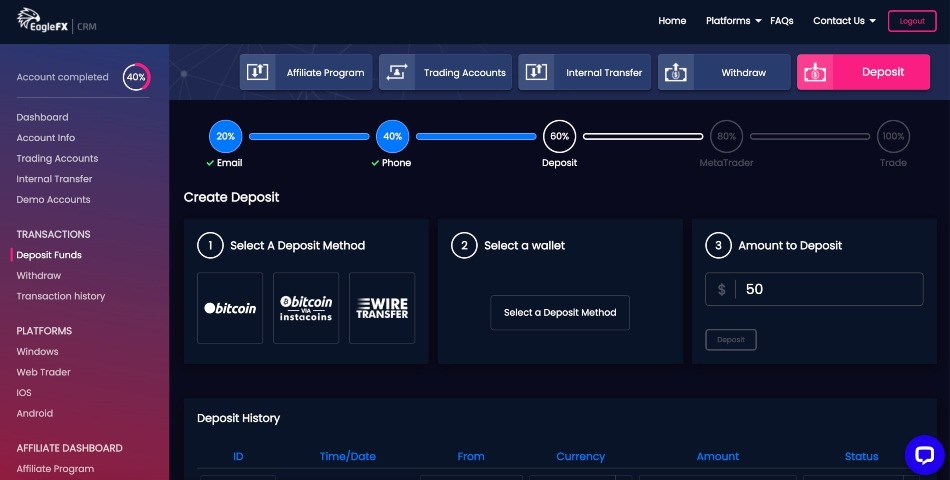

2) Open A Live Trading Account

Clients need to deposit funds to activate a real trading account and begin investing. This can be done easily from the account dashboard by selecting a deposit method, a wallet and the desired amount. Remember that the minimum deposit amount for Bitcoin is £10. When opening an account, you will also need to choose your leverage rate and the currency you want the account to display. Investors will then receive an email with their MT4 login details.

EagleFX Dashboard

3) Choose A Market

Markets have different characteristics in terms of liquidity and volatility. Choose a market that fits your risk preferences and experience. For example, EagleFX traders wanting increased risk and reward may want to explore the crypto market, where volatility is much higher. Ensure you have the required skill to invest in that market by testing your strategy on the demo account beforehand.

4) Open A Position

Opening a position at the right time requires skill and rationality. Some investors prefer to use copy trading and signals to better time their entry into the market. Others will analyse the market themselves, based on technical or fundamental analysis (or perhaps both). Indicators such as Bollinger Bands and moving averages can be useful to identify overbought/oversold assets and positive/negative trends.

Benefits Of EagleFX

- MT4 access

- Low spreads

- Crypto CFDs

- Crypto deposits

- High leverage rates

- No transaction fees

- Low minimum deposit

- ECN/STP brokerage model

- Excellent customer support

Drawbacks Of EagleFX

- Unregulated offshore broker

- Limited payment methods

- Poor educational material

- Limited market analysis

Additional Features

The EagleFX education section is limited and lacks real insight into how to speculate on the various CFD markets offered by the firm. Most of the material is focused on affiliates, rather than on how to improve as a retail trader. More expert analysis of the market would also be welcome. The broker does have various guides that help understand how to navigate the website and the MT4 platform. Our team was unable to find a margin or forex calculator to assist traders in making investment decisions.

Trading Hours

Trading hours at EagleFX vary with the market in question. The forex market runs 24/5, Monday through Friday, whereas crypto is open 24/7. The time zone for market hours with the firm is GMT+3 by default but this can be changed on the platform.

Customer Support

The EagleFX team provides the following customer service options:

- Live chat

- Email ticket

- Request a call back (no direct phone number)

Our review team found the live chat feature to be excellent with instant response times to a range of different enquiries. Submitting a ticket online has an average response time of 15 minutes and those requesting a call back will have an average wait of four hours. There is also an FAQ page for queries that do not require human input.

Safety

Although EagleFX is an unregulated broker with limited consumer protection in place, the broker does say it undertakes ongoing risk assessments and stores Bitcoin funds in cold storage where possible. It also says its crypto is hedged on global exchanges to reduce exposure to market volatility. Investors should also note that MT4 uses encryption to protect its users and is an established trading platform. In terms of personal account security, customers can use two-factor authentication (2FA).

EagleFX Verdict

Whether it is currencies or commodities, EagleFX provides a quality CFD trading experience through the MT4 platform with fast execution and a wide range of markets to choose from. High leverage rates allow for a variety of trading strategies and ECN/STP execution keeps spreads low. Offshore and unregulated brokers should be approached with caution but the responsive and helpful customer support team may help reassure investors about EagleFX.

FAQ

Is EagleFX Regulated?

No. EagleFX is an unregulated broker, which means it provides fewer protective measures to customers and is not as stringently monitored.

Is EagleFX A Good Broker?

EagleFX has many good features such as fast trade execution, free deposits and withdrawals and excellent customer support. However, its regulatory status suggests clients should approach it with caution.

Is EagleFX A Scam Or Legit?

Although EagleFX has a relatively short history operating in the online trading industry and is unregulated, the broker does have a responsive customer support team and claims to have customers around the world. The broker has also won multiple forex awards.

Which Country Is EagleFX From?

There are no details available as to where the broker was founded, however, its current registered address is in Dominica.

Does EagleFX Have The Volatility 75 Index (VIX 75)?

This broker does not offer VIX 75 speculation but does have 10 other indices to choose from, including the FTSE 100, DAX 40 and NAS 100.

Top 3 EagleFX Alternatives

These brokers are the most similar to EagleFX:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- FXPro - Founded in 2006, FxPro is an established forex, CFD and spread betting broker offering 2100+ assets to over 2 million clients worldwide. The broker is regulated in 4 jurisdictions and offers reliable 24/5 customer support, earning it a high trust and safety score. FxPro has also picked up more than 100 industry accolades for its competitive trading conditions, including fast execution and deep liquidity.

EagleFX Feature Comparison

| EagleFX | Pepperstone | FP Markets | FXPro | |

|---|---|---|---|---|

| Rating | 4.1 | 4.8 | 4 | 4.4 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $10 | $0 | $40 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA | FCA, CySEC, FSCA, SCB, FSC |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 74-89 % of retail investor accounts lose money when trading CFDs |

|||

| Review | EagleFX Review |

Pepperstone Review |

FP Markets Review |

FXPro Review |

Trading Instruments Comparison

| EagleFX | Pepperstone | FP Markets | FXPro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | Yes | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | No |

EagleFX vs Other Brokers

Compare EagleFX with any other broker by selecting the other broker below.

Popular EagleFX comparisons: