Trading212 Review 2024

|

|

Trading212 is #94 in our rankings of CFD brokers. |

| Top 3 alternatives to Trading212 |

| Trading212 Facts & Figures |

|---|

Trading 212 is a European and UK-regulated CFD broker that also offers stock investing and ISAs. It’s best known for its commission-free trading model and beginner-friendly app, which has helped it attract 2.5 million users and £3.5 billion in client assets. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs |

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

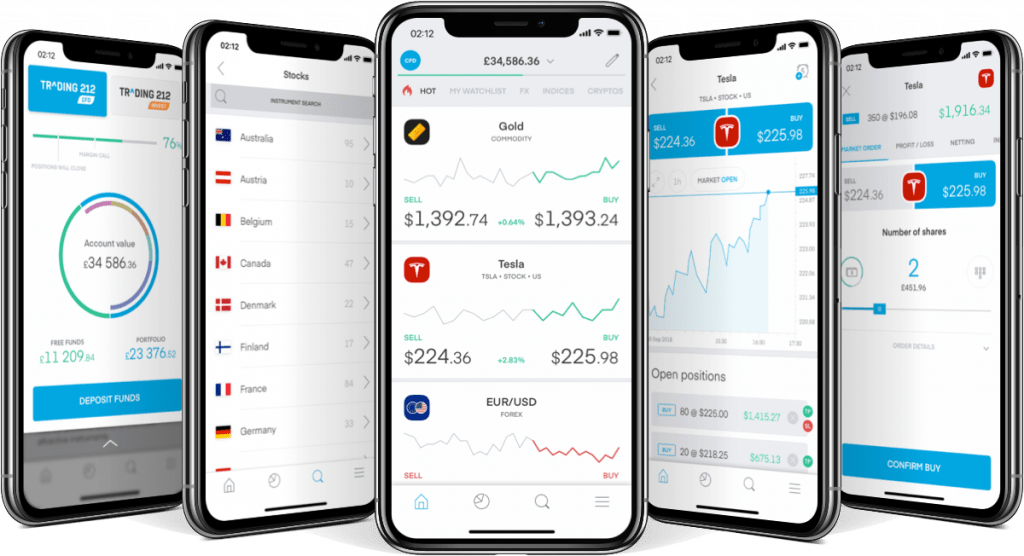

| Trading App |

Trading212 have positioned themselves at the front of the mobile trading movement. Their platform is based on a ‘mobile-first’ model, so they prioritize this type of trader. The app offers 1800+ instruments, zero commissions and a free practise account. Download the app risk free and try it out.

|

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FCA, CySEC, FSC |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | No |

| Auto Trading | AutoInvest Portfolio |

| Islamic Account | No |

| Commodities |

|

| CFDs | Engage in leveraged CFD trading across a wide array of instruments, encompassing forex, stocks, commodities, and indices. Yet while the selection of asset classes is satisfactory, the charting software and floating spreads for short-term traders fall behind that of competitors. |

| Leverage | 1:30 |

| FTSE Spread | 2.5 |

| GBPUSD Spread | 0.00028 |

| Oil Spread | 0.4 |

| Stocks Spread | 0.2% Var |

| Forex | Trade over 180 major, minor, and exotic forex pairs on the Trading 212 platform, featuring floating spreads and leverage up to 1:30. It’s important to note, though, that the forex broker has a history of adjusting margin requirements without providing adequate notice. As a result, CMC Markets is a better pick for forex traders with more currency pairs and a cleaner record. |

| GBPUSD Spread | 0.00028 |

| EURUSD Spread | 0.00015 |

| GBPEUR Spread | 0.00044 |

| Assets | 180+ |

| Currency Indices |

|

| Stocks | Traders can take positions on thousands of stock CFDs sourced from various global markets, including the US, UK, EU, China, and Japan. For longer-term investors, Trading 212 facilitates direct share dealing on more than 8,500 global stocks within investment accounts and tax-efficient ISAs for UK customers. The key selling point is the zero commissions on equities. |

Trading 212 is an online broker offering stocks, CFDs and ISAs. In this guide, we review the broker’s mobile app, commission structure and usability. We also evaluate the pros and cons of opening an account with the UK firm and answer popular questions.

About Trading 212

Trading 212 was founded in 2004 in Bulgaria. Today, it is a globally registered entity with a head office in London. It is run by Borislav Nedialkov, who was appointed Director in March 2021. The trading app has had over 15 million downloads in the UK and beyond.

In 2021, the broker made news headlines as one of the leading trading websites used by GameStop (GME) investors. As a result, Trading 212 became the most downloaded app in the UK. The firm temporarily paused sign-up to manage the unprecedented demand, leading to a one-month waiting list. Trading 212 also placed restrictions on a selection of illiquid US penny stocks.

Trading 212 boasts zero commissions on stocks, which is one of the reasons for its popularity. With that said, the introduction of exchange rate fees and an increase in margin requirements to 50% in December 2020 proved controversial.

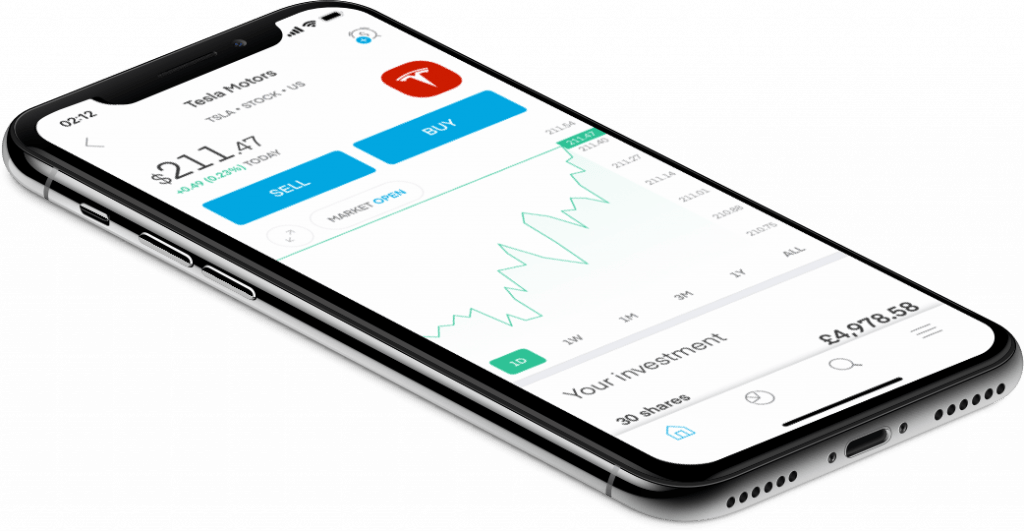

Trading Platform

Trading 212 provides its proprietary software on a mobile app. The app is intuitive, with a sleek design that makes it perfect for beginners. Charts are easy-to-use and indicators can be added from a drop-down list. Traders can choose from stocks on the Trading 212 hotlist, or browse and save to their own watchlist.

Trading212 platform

Despite the positives, those used to the flexibility and functionality of MetaTrader 4 or equivalent platforms may find it lacking. For example, clients cannot code their own EAs and the list of technical indicators is fixed.

The app is available for download on both Android and iOS devices. There is currently no desktop app for Apple Mac as the firm has focused on trading on-the-go.

Markets

Trading 212 offers the ability to invest in over 10,000 fractional stocks, shares and ETFs. This includes popular equities such as Deliveroo (ROO), Zoom (ZM) and Airbnb (ABNB), as well as managed funds. The list of stocks covers most notable indexes, including the NASDAQ, London Stock Exchange (LSE) and the S&P 500. New stocks are added as the broker introduces exchanges from around the world to the platform.

Trading 212 also offers CFDs on the following assets:

- Commodities – Over 100 commodities including gold, coffee and cocoa

- Forex – Over 200 forex pairs including majors plus a mixture of crosses and exotics

- Stocks – Thousands of stocks including Tesla (TSLA), Apple (AAPL) and Amazon (AMZN)

- Indices – Over 30 major and less-known markets including the US 30, Japan 225 and UK 100

Trading 212 CFDs Vs Invest Vs ISA

There are a few options for trading stocks with Trading 212. The Invest option allows traders to own equity in the stock. This means you’ll own a stake in the company and can be paid dividends. Similarly, with the ISA account, you’ll also own the stock but it is packaged within a tax-efficient account and has limits on how much you can invest annually.

CFDs allow traders to speculate on future price movements of the stock. CFDs are the option used by day traders who are looking to profit from price movements with leveraged assets.

As of November 2020, Trading 212 no longer offers CFDs on cryptos such as Bitcoin (BTC), Ripple (XRP), Ethereum (ETH) or Stellar (XLM). This is due to changes in FCA regulations that prevent exchange-traded products (ETPs) on cryptos.

Trading Fees

Trading 212 charges zero commissions on stocks, ETFs and CFDs, making the broker an attractive place for investors. It also promises tight spreads on CFDs. All spreads are variable and move depending on market conditions.

For Invest accounts, an exchange rate fee of 0.15% is placed on all stocks or ETFs traded in currencies other than the account’s base currency. For CFD accounts, this is 0.5%. There is no inactivity fee on any account.

For those with a CFD account, overnight fees are charged in the form of a daily interest swap. This charge does not apply to Invest or ISA accounts.

In general, Trading 212 fees are low compared to alternatives.

Leverage Review

With Trading 212, leverage is only available on the CFD account. Retail traders can benefit from leverage up to 1:30 on all assets. This is increased to 1:500 for professional accounts. However, there are stringent requirements on these, including a minimum portfolio size of 500,000 GBP, making it inaccessible to most traders.

Trading 212 margin requirements vary depending on the tradeable asset:

- Forex – 3.33% on majors, 5% on all other currency pairs

- Commodities – 5% on gold, 10% on all other commodities

- Indices – 5% on base indices, 10% on all other non-major indices

- Stocks – 20% flat margin requirement across all stocks

Note in December 2020, Trading 212 lifted margin requirements to 50% for all CFDs on stocks. This move proved controversial in the trading community, with some portfolios crippled by the change. Trading 212 stated extreme market volatility and a need to protect its client base as the reason. It’s unclear when this will be reduced back to normal levels.

Mobile Apps

The Trading 212 mobile app was traditionally one of the biggest selling points of the broker. With over 15 million downloads on iOS and more than 10 million on Android, customers praised its user-friendly interface. Full functionality is available through the app, including the ability to place pending orders, add stop loss and take profit limits, and withdraw funds. Traders can also engage in technical analysis using the charting tools available.

Trading212 mobile trading

However, since the GME saga, there have been complaints of a lagging app with slow processing on pending orders. It’s possible that the surge in demand could be to blame. Moreover, the broker temporarily suspended the onboarding of clients, rendering the app download futile for new traders.

Deposits

Trading 212 offers a selection of payment methods to choose from. These include bank wire transfer, credit or debit card, Google Pay, Apple Pay, PayPal and Skrill. Deposit and withdrawal fees vary depending on your account type and payment method.

- Invest account – Zero fees for bank transfers. For all other payment methods, there is no fee until you deposit a total of 2,000 GBP. From then on you’ll pay 0.7% to deposit funds. There are no withdrawal fees

- ISA account – The same fee structure as the Invest account applies

- CFD account – There are no deposit or withdrawal fees with this account

For ISA and Invest accounts, the minimum deposit and withdrawal amount is just 1 GBP. However, this is dependent on your payment method. If you’re depositing funds via bank wire, the minimum transfer is 10 GBP.

For CFD accounts, the minimum deposit and withdrawal is 10 GBP.

Trading 212 allows up to 2 working days to process withdrawals. If you’ve not received funds after this time, the delay is likely with your bank instead. You can contact the Trading 212 help centre who will be able to advise the exact time that the transaction was processed on their end.

Demo Account

Trading 212 offers a practice mode that allows you to trade with up to £50k. However, if you end up losing these pretend funds, you have the option to reset your account and start again. When you open an account you’ll have the option to register for a demo solution.

Trading 212 Bonuses

Trading 212 is well-known for its free share referral scheme. UK customers who refer a friend to join Trading 212 get a joining bonus of a free share worth up to 100 GBP. The friend also receives a free share. This offer is only available to those who recommend new customers. The referee must use the invite link and promo code provided to activate an account and fund it with the minimum deposit amount. As of 2021, no new invite links will be provided, but the promotion remains open to existing participants.

Regulation Review

Trading 212 UK Ltd is regulated by the Financial Conduct Authority (FCA) – one of the most stringent regulators worldwide. This means that UK traders can have sufficient confidence in the firm. In line with regulation, negative balance protection is provided for all accounts, meaning that Trading 212 will send a margin call when the funds in your account drop below a certain level.

For those concerned about the firm going bust, customer assets up to the value of 85,000 GBP are protected by the Financial Services Compensation Scheme.

Additional Features

- The Trading 212 Hotlist shows how many T212 users own stock in each company. Some of the most popular stocks on the list include Tesla (TSLA), Healthier Choices Management Corp (HCMC) and Amazon (AMZN). Note, it is not a list of the best stocks, but those most popular with T212 clients.

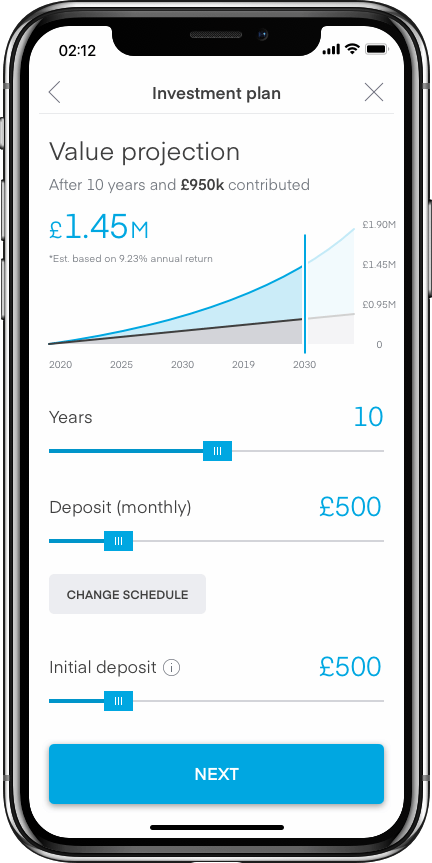

- AutoInvest allows you to create your own investment plan that matches your goals. Using the fully automated feature you can add funds, rebalance your portfolio and reinvest dividends to grow your Pie. You can adjust your plan via the mobile app, maintaining full flexibility. It will provide you with useful analysis including an upcoming earnings projection and a yearly statement.

- Hedging and aggregating modes allow you to switch between strategies. The hedging mode allows you to hold multiple separate positions on a single asset. For example, going long and short to manage your risk. The aggregating mode allows only one position which is added to and averaged with each change.

- In the Trading 212 Learn section, you’ll find a selection of video tutorials, ‘how to’ user guides, tips and a glossary to help you get to grips with trading analysis and terminology. In this section, complex trading terms such as key ratios, trailing stops and limit orders are explained.

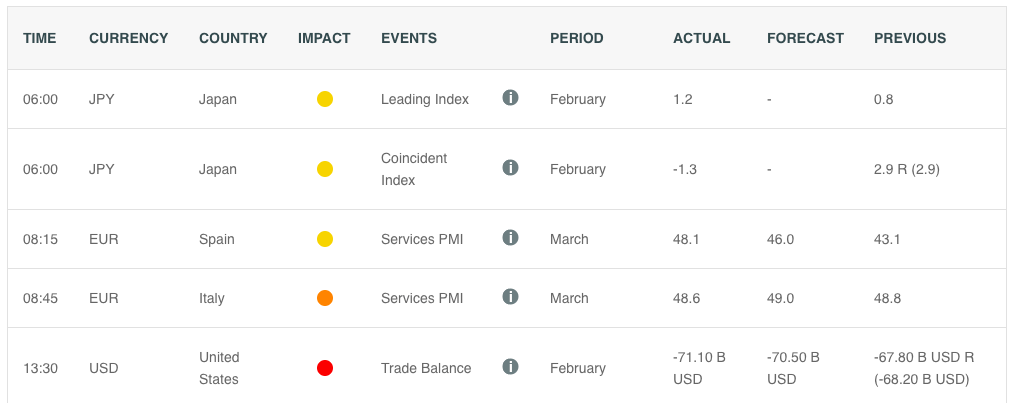

- Other additional features include an economic calendar, a news section and a community forum.

Economic calendar

Trading 212 Accounts

Trading 212 has three account types to choose from: Invest, ISA or CFD:

- Invest – The Invest account allows you to own equities in over 10,000 shares and ETFs. It is a standard investment account and therefore you will be taxed on capital gains above £12,000 and dividends above £2,000

- ISA – The ISA account gives you the ability to invest up to £20,000 per year while keeping your profits tax-free in the UK. There are zero admin charges, commissions and dividend reinvestment fees vs alternative stocks and shares ISA providers such as Hargreaves Lansdown (HL) and Vanguard which both charge for their services

- CFDs – The Trading 212 CFD account is the only option that allows you to trade using leverage, making it the preferred option for day traders. The benefits of this account include stop loss and take profit options, negative balance protection and instant execution

Trading 212 does not offer a joint account for spouses or partners.

Benefits

Trading 212 has a number of benefits vs competitor brokers such as Freetrade, Plus500 or eToro. We’ve noted the top reasons for choosing Trading 212 below.

- Commission-free trading – There is zero commission placed on any T212 trading account giving it an advantage vs Interactive Brokers

- Tax-efficient – The addition of an ISA account gives a tax-efficient option to UK traders

- User-friendly – The proprietary software is intuitive to use, making it great for beginners

- Portfolio management options – The introduction of the Autoinvest feature provides traders with new portfolio management opportunities

- FSCS guarantee – A portfolio size up to 85k GBP is protected by the FSCS against Trading 212 liquidity issues. But even if you have a portfolio over this size, customer funds are segregated to protect it from business losses.

- Transaction speeds – Compared with paper-based brokers like Hargreaves Lansdown, Trading 212’s fin-tech culture means that technology and processing speeds are put first.

Autoinvest

Drawbacks

Trading 212 does have disadvantages vs more technically advanced brokers and platforms such as MetaTrader 4 or MetaTrader 5:

- Lack of advanced functionality – For those that are looking to write their own EA codes, T212 does not currently offer API support. Traders looking to automate trading on their own algorithms will find T212 lacking in this area vs competitors such as XM or IG.

- Exchange rate fees – The introduction of exchange rate fees on the Invest account has been controversial for a platform that claims to be commission-free.

- Mobile-focussed – Trading 212’s proprietary software is designed to be used on mobiles. For those who prefer a desktop experience to enable deep analysis, this might take some getting used to.

- Lack of crypto products – Trading 212 does not offer crypto products or currency trading. This is a drawback vs alternatives such as Robinhood and Revolut.

Trading Hours

Trading 212 opening hours vary depending on the asset. Forex markets are open 24/5 from Sunday evening to Friday. Stock trading times depend on the exchange they’re traded on. For example, the NASDAQ opens 2:30am to 9pm GMT, whereas the LSE is open 8:30am to 4:30pm GMT.

At Trading 212, pre-market and after-hours trading (i.e outside the regular hours of a stock exchange) is only available on the most liquid US stocks.

Customer Support

Trading 212 has an excellent customer support network available through their Help Centre and Community Forum. Here you can post your technical questions and a community leader will assist you. Customers’ previous issues are listed in the Help Centre as an FAQ-style guide. Common problems include if an order was rejected, your account is showing as not eligible, or your funds are blocked for pending orders.

If you’re having issues with your account, the software keeps crashing or it is just not working, you can also submit a problem via their ‘Contact us’ page or reach out via live chat, email or telephone number.

Client Safety

Trading 212 is a legitimate financial services company. Being regulated by the FCA means that they’re bound by its regulatory framework and must offer certain protections to retail investors. This includes negative balance protection, Know Your Customer (KYC) identity verification and segregation of customer funds from the business’. T212’s participation in the Financial Services Compensation Scheme (FSCS) also means that investors are entitled to compensation up to 85,000 GBP should the business face insolvency.

Your information is also protected by thorough security measures including 2 Factor Authentication (2FA), IT systems audited by Grant Thornton and a dedicated 24/7 security operations centre.

Trading 212 Verdict

Overall, Trading 212 is a good choice for those looking to invest in a portfolio of stocks and ETFs. It offers similar functionality to the likes of Hargreaves Lansdown, particularly with the introduction of its ISA account – but is entirely commission-free. However, CFD traders may be disappointed with the lack of advanced functionality on their proprietary software.

FAQ

How Long Does It Take To Withdraw Funds From Trading 212?

Trading 212 allows 2 working days to process a withdrawal request. If your request is taking longer than this, it could be sitting with your bank instead. You can contact Trading 212 through the ‘Contact Us’ page on their website to check where your funds are.

What Is A Trading 212 Invest Account?

A Trading 212 Invest account allows you to buy equities in stocks, shares and ETFs. You own the asset and are entitled to dividends as a shareholder. This is different from a CFD account where you own a contract for the difference in price between when you buy and sell.

What Is A Trading 212 Pie?

The Trading 212 Pie allows you to build your own portfolio mix of ETFs and stocks. Traders set the percentage they’d like to allocate to each asset and the duration of their investment period. You’ll see a forecast for your earnings and how your account is tracking against this.

Why Can’t I Open A Trading 212 Account?

Trading 212 suspended new account registrations due to unprecedented demand. There may still be a waiting list for new customers. Head to the broker’s website to register for a live account.

Can I Have 2 Trading 212 Accounts?

You can hold any combination of Invest, CFD and ISA accounts under the same email address and login details, but you cannot create two separate accounts. If you want to open a second account to hedge your positions, you can do this within a single account by switching from aggregate mode to hedging.

Top 3 Trading212 Alternatives

These brokers are the most similar to Trading212:

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Trading212 Feature Comparison

| Trading212 | IG Index | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4.8 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $1 | $0 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FCA, CySEC, FSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4 | - | MT4, MT5, cTrader |

| Leverage | 1:30 | 1:30 (Retail), 1:222 (Pro) | 1:50 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

74-89 % of retail investor accounts lose money when trading CFDs |

||

| Review | Trading212 Review |

IG Index Review |

Interactive Brokers Review |

Pepperstone Review |

Trading Instruments Comparison

| Trading212 | IG Index | Interactive Brokers | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | No | Yes |

Trading212 vs Other Brokers

Compare Trading212 with any other broker by selecting the other broker below.

Popular Trading212 comparisons: