RoboMarkets Review 2024

See the top 3 alternatives to RoboMarkets or the best UK brokers list for options.

|

|

RoboMarkets is #67 in our rankings of CFD brokers. |

| Top 3 alternatives to RoboMarkets |

| RoboMarkets Facts & Figures |

|---|

RoboMarkets is a Cyprus-based forex, CFD and stock broker aimed at traders from Europe. The broker offers thousands of instruments across six asset classes and provides access to four leading platforms, including MetaTrader 4. With ECN pricing, Cent accounts and algorithmic trading tools, RoboMarkets caters to a range of trading strategies and investing styles. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, CFDs, indices, shares, commodities, ETFs |

| Demo Account | Yes |

| Min. Deposit | $100 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CySEC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade all markets via CFDs, with retail leverage up to 1:30. With the RStocks Trader account, clients can access over 12,000 CFDs with algorithmic analysis tools and intuitive charts. |

| Leverage | 1:30 (Retail), 1:300 (Pro) |

| FTSE Spread | 0.5 |

| GBPUSD Spread | 2.0 |

| Oil Spread | 4.4 |

| Stocks Spread | Variable |

| Forex | Start trading on dozens of currencies at RoboMarkets with powerful analysis tools and pattern recognition technology. 35+ currency pairs are available with tight spreads from 0 pips and rapid market execution. You can also utilise the broker's forex news alerts and economic calendar. |

| GBPUSD Spread | 2.0 |

| EURUSD Spread | 1.4 |

| GBPEUR Spread | 1.6 |

| Assets | 35+ |

| Stocks | Invest in thousands of stocks and ETFs with no commissions or overnight fees. You can also make use of the broker's blog which publishes frequent stock market updates and investment ideas. |

Robomarkets is a multi-award-winning investing broker, offering markets such as forex, crypto, indices, commodities, shares and more. With a wide user base, the brokerage is one of the most popular trading sites in Europe. This 2024 review will explore all the key features you will want to know about Robomarkets, detailing its different trading platforms, regulation, customer support and various other bits of useful information.

Robomarkets Company Details

Receiving its licence as a European trader in 2013 and so having 9 years of experience in the industry, Robomarkets Ltd currently operates out of Limassol, Cyprus and is regulated by the CySEC. It currently has more than 250,000 trading accounts open on its websites, with users registered across 29 different countries. The firm offers investing services on a variety of stocks, forex, indices, CFDs, and ETFs, as such providing something for almost any type of trader, regardless of their area of expertise.

Trading Platforms

Our experts found Robomarkets to offer a competitive array of trading platforms, covering specialisms in CFDs, automated trading, stocks investing and mobile accessibility. The platforms on offer are MetaTrader 4 (MT4), MetaTrader 5 (MT5), R WebTrader and R StocksTrader.

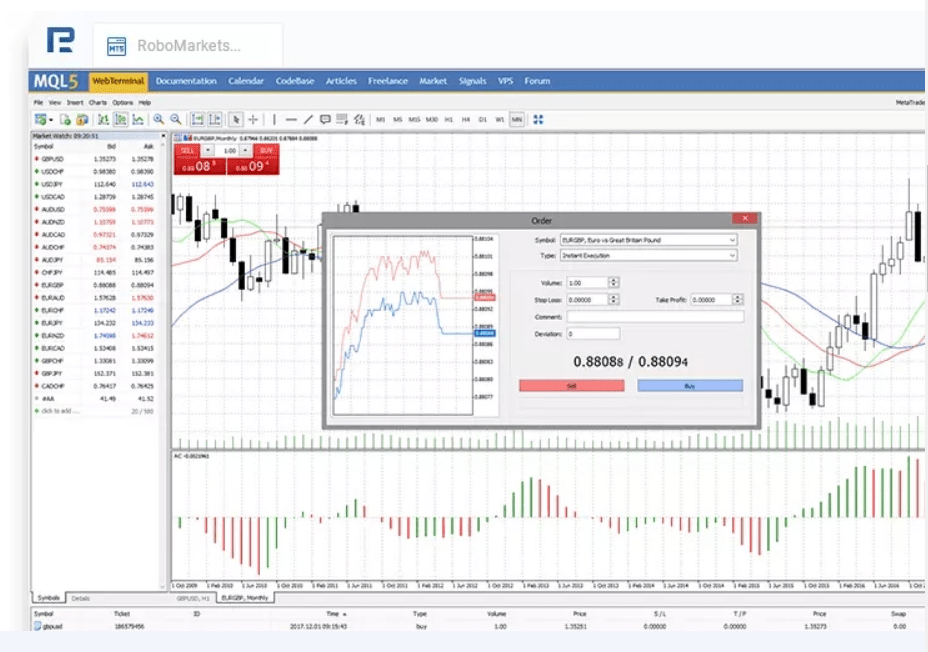

Often thought of as the most popular forex trading platform, MT4 offers a wide range of useful tools and functions, such as trading robots and indicators. Key features include:

- Price signals

- Four order types

- Nine timeframes

- One-click trading

- MQL4 automation

- Backdated price data

- 30 built-in indicators

- Interfaces over multiple screens

- Integrated and frequently updated daily news reports

MetaTrader 4

MT5 is the younger, faster, sleeker brother of MT4. Building on the success of its predecessor, this platform upgrades the automation systems, execution efficiency and customisation options. Key features include:

- Price signals

- 21 timeframes

- Six order types

- Stop-loss alerts

- One-click trading

- MQL5 automation

- Backdated price data

- 38 built-in indicators

- Customisable interfaces

- Integrated and frequently updated daily news reports

MetaTrader 5

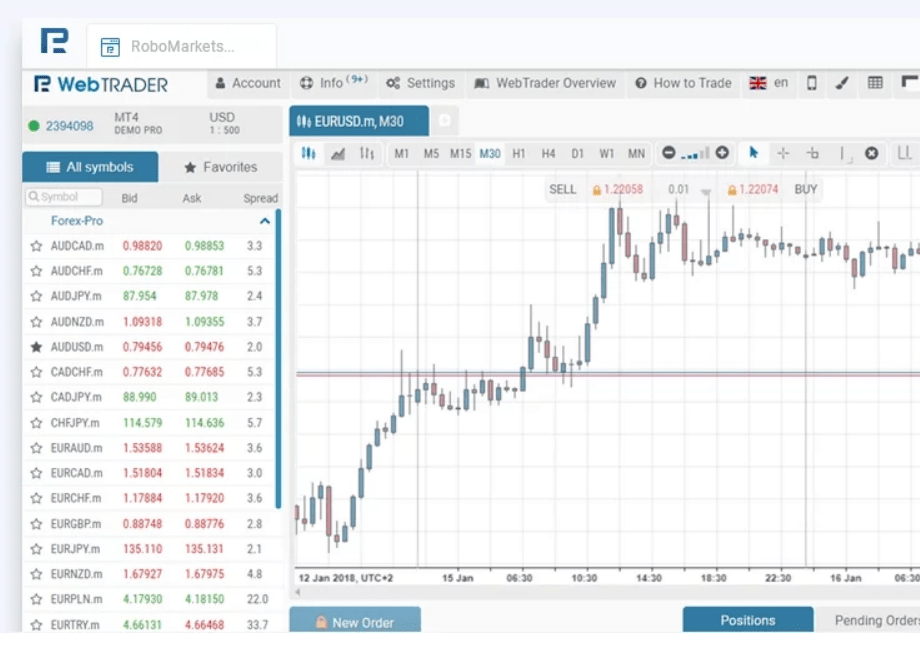

R WebTrader is Robomarkets’ proprietary CFD investing platform, boasting a slick design that is intuitive for newer traders but contains advanced analysis functionality. This programme can be accessed directly from your web browser and does not require a download. Key features include:

- One-click trading

- Exclusive analytics

- 13 built-in indicators

- Backdated trading data

- Nine graphical analysis tools

- MT4 & MT5 account integration

- Instant quote updates & monitoring

R WebTrader

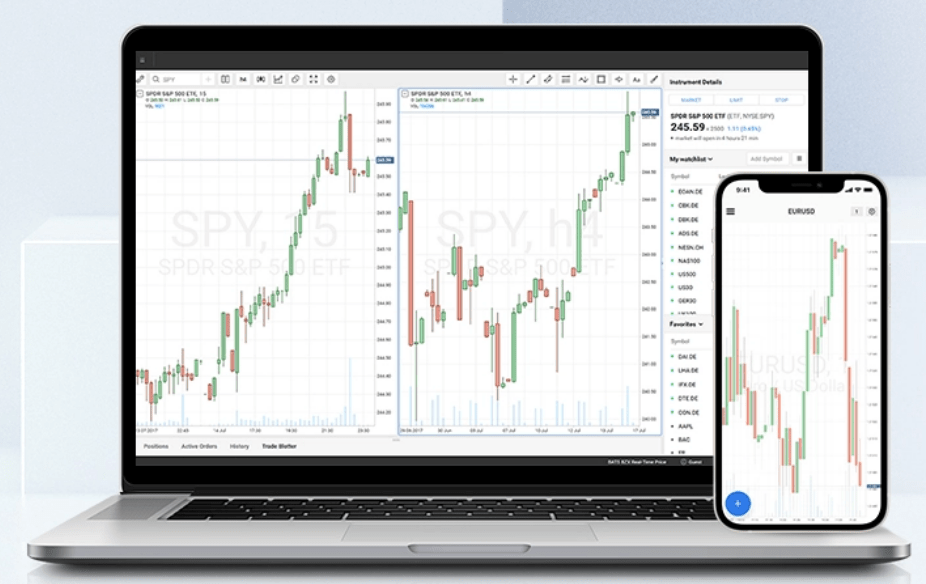

The fourth platform on offer is R StocksTrader. This platform is only available with the associated account type and provides access to the full range of equities offered by the broker. These 12,000+ instruments are sourced from major exchanges in Europe, the Americas, Asia and Africa. R StocksTrader can be accessed directly from your web browser, with no download required. Key features include:

- One-click trading

- Custom watchlists

- Level 2 market depth

- Easy-to-use interface

- Customisable interface

- In-built leverage systems

- Free trading robot builder

- Hedging and netting support

- Automated dividend payments

R StocksTrader

Assets

When we used Robomarkets, we found clients to have access to a strong variety of markets. The firm offers the following instruments to UK customers:

- 9 indices, including FTSE 100

- 2 energies, including Brent oil

- 2 metals, including gold (XAU)

- 36 forex pairs, including GBP/USD

- ETFs on commodities, including gas

- 12,000+ stocks, including Gamestop (GME)

- 22 cryptocurrencies, including Bitcoin (BTC)

Spreads & Commissions

The commission on Robomarkets varies for different account types but ranges from £10 per million on Prime accounts to £20 per million on ECN accounts. These two accounts also benefit from very low raw spreads, starting at 0.0 pips. However, there are no commissions on Pro and ProCent accounts, whose CFD spreads are floating, varying with liquidity and volatility, though typical values are as below for major instruments on the STP account types.

- GBP/USD Spread: 2.0 pips

- EUR/USD Spread: 1.4 pips

- EUR/GBP Spread: 1.6 pips

- Oil Spread: 4.4 pips

Leverage

Following the restrictive ESMA regulations in Europe, 1:30 is the max leverage rate available for forex instruments on Robomarkets. Other leverage values are 1:20 on minor forex pairs, major indices and gold, while stocks can offer a maximum of 1:5 leverage. Professional clients can access a much better maximum rate of 1:500.

Mobile Apps

All of the Robomarkets trading platforms have associated, optimised mobile versions available. Each of these can be downloaded for both Apple and Android mobile devices via the App and Google Play stores, respectively. These applications are a great way to monitor existing positions while away from a desktop computer or laptop. Moreover, they can be used for on-the-fly order closing, technical analysis, account management and order placing to ensure that you never miss a viable opportunity.

Payment Methods

Offering a large range of deposit and withdrawal methods, Robomarkets should be accessible to most prospective traders. The methods supported are:

- Visa

- Skrill

- PayPal

- Neteller

- Mastercard

- WebMoney

- Wire Transfer

- Rapid Transfer

On all account types, the minimum deposit is £100 for UK users. However, if you wish to trade on US stocks pro, this goes up to £10,000.

Demo Account

Investing with virtual cash on a demo account is a fantastic way to test new trading methods or strategies in live market situations without putting your actual money at risk. The conditions for Robomarkets’ demo accounts are the same as those for its live accounts and a paper trading account is free to set up and use.

While using the broker, our experts found that Robomarkets’ demo accounts offer the same variety of markets as the live accounts, so you can test your investing strategies on anything from stocks and metals to forex and indices. There is a wide range of different demo account types offered by the firm, including the Demo Pro, Demo and Demo R accounts. All of these can be used alongside each of the three platforms offered on the site.

Regulation & Licensing

Robomarkets is one of the most thoroughly regulated sites operating in Europe and the UK, being regulated across 29 different countries. Importantly for UK readers, the site falls under the regulation of the FCA (Financial Conduct Authority), so UK-based traders can be sure that their capital is adequately protected.

Additional Features

There are several features beyond simple CFD speculation offered by the broker, including:

- Blogs

- Webinars

- Expert advisors

- Financial charts

- Expert trading tips

- Economic calendar

- Trading calculators

- Currency analysis and forecasts

Account Types

Robomarkets offers several account types, catering to the needs of almost all investors. The minimum deposit for all accounts is £100.

Prime Account

This is Robomarkets’ premium account, which incorporates the best possible investing conditions. Designed for use by experienced traders, this account can be accessed online or via Apple or Android phones and offers a large variety of instruments and trading products, with 28 forex CFDs, alongside US stocks, indices, oil and crypto. Spreads are floating from 0.0 pips, commission sits at £10 and maximum leverage is determined upon registration from the individual user’s knowledge and experience. Prime account holders can use the MT4, MT5 or Robomarkets WebTrader platforms.

ECN Account

An ECN account offers raw spreads and rapid execution, following a different technological model. These accounts are often favoured by experienced investors and traders that use lots of technical analysis and advanced strategies. The instruments offered on this account include 38 forex CFDs, alongside metals, indices, oil, cryptos and US stocks. Spreads are floating from 0.0 pips, commission sits at £20 and maximum leverage for professional clients is up to 1:500 and determined upon registration. ECN account holders can use the MT4, MT5 or Robomarkets WebTrader platforms.

R StocksTrader Account

This specialised account allows access to stocks investing through the R StocksTrader platform. This provides access to every significant global financial market from one easy place. More than 12,000 stocks are available, alongside CFDs on forex, metals, ETFs, oil and cryptos. Spreads start from £0.01 and there is no leverage available.

Pro Account

This is the most widely used account on Robomarkets and can be used by an investor of any experience level. Users can invest via 36 forex CFDs, alongside derivatives on metals, US stocks, indices, oil and cryptocurrencies. Spreads are floating from 1.3 pips and there are no commission charges.

ProCent Account

This account works similarly to the Pro account but its base currency is cents (or pennies for UK clients), rather than dollars or pounds. This means that lower-capital users can make smaller trades and risk less money at a time. ProCent instruments include 36 forex CFDs, alongside metals and cryptocurrencies only. Spreads start from 1.3 pips and there are no commission charges.

Guide To Getting Started With Robomarkets

To get started on Robomarkets, you simply need to visit the member’s area of the website and register for a trading account. You will then be presented with a selection of different accounts to sign up for, as detailed above. Once you are registered, you can set account parameters, such as leverage, as you desire. The Robomarkets website offers a very helpful instruction video for this.

If you opt for a Pro, ECN, Prime or ProCent account, you will be allowed to choose which trading platform you would like to use, which will consist of MT4, MT5 and R WebTrader. However, you will not be locked into this decision and you can try all platforms at will.

Once you have access to a platform, whether that be on the R WebTrader or by downloading MT4 or MT5, you can pick an asset from the list and open a position.

Trading Hours

Robomarkets is open 24/7 for account management and cryptocurrency speculation. Any other instruments will have reduced trading hours due to their underlying markets. For example, forex runs 24/5, while stocks, ETFs and indices will follow the opening hours of the exchanges upon which they trade. For those setting up APIs and automated investing systems, the broker’s server time is set to EET (GMT + 2).

Customer Support

Robomarkets’ customer service team can be contacted via a form on the broker’s website, live chat widget or telephone call.

- Phone Number: +35725123275

Safety & Security

As it is heavily regulated, Robomarkets offers several features that are designed to give maximum protection to its client funds. These include negative balance protection, which ensures you cannot lose more than is in your account, and a two-step authentication process (2FA), which provides accounts with enhanced login security protection in a dependable and easy-to-use way.

Robomarkets Verdict

Robomarkets is a very popular choice with traders across Europe due to the well-thought-out website, financial services provision and user experience. Retail and professional investors will benefit from the impressive choice between the MT4, MT5 and the broker’s own RoboMarkets WebTrader and R StocksTrader platforms upon which to trade more than 12,000 global instruments. Moreover, Robomarkets has plenty of account options, including ECN & cent accounts, alongside rigorous regulation and a wide range of payment options.

FAQ

Where Is Robomarkets Regulated?

Robomarkets’ main regulator is the CySEC in Cyprus, which means it is also regulated across 28 other European countries. Moreover, the company is regulated by the FCA in the UK, which is a rigorous financial watchdog.

Does Robomarkets Offer A Demo Account?

Yes, Robomarkets offers a demo version of all its account types. This a great way for inexperienced or uncertain traders to get an idea of how the brokerage works or practise new strategies without risking hard-earned money.

What Is The Minimum Deposit On Robomarkets?

The minimum deposit limit for a Robomarkets account in the UK is £100.

Is Robomarkets A Good Broker?

Robomarkets is a respected brokerage with a large user base across Europe. This is reflected in the large number of awards it has won since its inception in 2013.

Is Robomarkets A Trustworthy Broker?

Robomarkets has taken several steps to ensure the security of its users’ funds and is regulated across 29 countries, ensuring that it acts accordingly with the relevant laws.

Top 3 RoboMarkets Alternatives

These brokers are the most similar to RoboMarkets:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

RoboMarkets Feature Comparison

| RoboMarkets | AvaTrade | RoboForex | FP Markets | |

|---|---|---|---|---|

| Rating | 3 | 4.9 | 4.5 | 4 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $100 | $100 | $10 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | IFSC | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:300 (Pro) | 1:30 (Retail) 1:400 (Pro) | 1:2000 | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | RoboMarkets Review |

AvaTrade Review |

RoboForex Review |

FP Markets Review |

Trading Instruments Comparison

| RoboMarkets | AvaTrade | RoboForex | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

RoboMarkets vs Other Brokers

Compare RoboMarkets with any other broker by selecting the other broker below.

Popular RoboMarkets comparisons: