FXPrimus Review 2024

|

|

FXPrimus is #88 in our rankings of CFD brokers. |

| Top 3 alternatives to FXPrimus |

| FXPrimus Facts & Figures |

|---|

FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities, Bonds |

| Demo Account | Yes |

| Min. Deposit | $15 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | CYSEC, MIFID, ICF, FCA, BaFin, VFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, metals, energies, cryptos and indices with high leverage up to 1:1000 on major currency pairs, 1:200 on metals, 1:100 on indices, 1:33 on stocks and energies, and 1:5 on cryptocurrencies. The range of 200+ instruments is not the biggest on the market, but the variety of asset classes provides flexible trading options for most traders. |

| Leverage | 1:1000 |

| FTSE Spread | From 0.1 |

| GBPUSD Spread | From 0.1 |

| Oil Spread | From 0.1 |

| Stocks Spread | Variable |

| Forex | Trade on 45+ majors, minors, crosses and exotics, with competitive pricing, ultra-fast execution and no requotes. Newer traders can access zero-commission trading. Experienced forex traders can operate with no trading restrictions and benefit from an ECN account and a VPS service. |

| GBPUSD Spread | From 0.1 |

| EURUSD Spread | From 0.1 |

| GBPEUR Spread | From 0.1 |

| Assets | 45 |

| Stocks | Traders can speculate on stock market movements through CFDs on dozens of individual equities. This is less than many rival brokers, but traders can also place bets on broad market movements through 15 indices covering diverse global markets including the US, China, UK, Spain and Germany. |

| Cryptocurrency | Trade a small selection of CFDs on crypto tokens in USD pairs. While the selection of cryptocurrencies is very limited, the 1:5 maximum leverage is higher than many similar brokers, making this a decent option for forex traders to dip into if not for dedicated crypto traders. |

| Coins |

|

| Spreads | Floating |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

FXPrimus, a popular CFD & PAMM broker, offers a diverse range of asset types and investment vehicles. This 2024 broker review will provide you with an overview of the most important features, such as minimum deposit and withdrawal requirements, safety and regulation, trading fees, platforms and more. Read on to find out if you should create an FXPrimus account today.

About FXPrimus

A subsidiary of the larger, Vanuatu-based FXPrimus Group, the broker serves a global client base of over 300,000 active traders from its head office in Limassol, Cyprus. The company’s owner and CEO, Terry Thompson, is a former Wall Street trader and hedge fund owner with over two decades of experience in the global financial markets.

FXPrimus has expanded significantly in its 13-year history and now offers customers a range of accounts and trading platforms. Regulation is provided by Cyprus’ leading financial authority, CySEC, while the VFSC oversees the group at large.

Markets

FXPrimus boasts more than 200 instruments from within the forex, index, commodity, stock futures and crypto markets.

Forex

Several major, minor and exotic CFDs on currency pairs are supported, with spreads starting from 0.0 pips through the PrimusZero ECN account and 1.5 pips on zero commission accounts.

Indices

The broker supports index CFDs from many major exchanges in the US, Europe and Asia, such as the Nasdaq 100, Japan 225 and FTSE 100. However, the Dow Jones US30 index is notably absent.

Commodities

Though FXPrimus offers a good range of metals and energy markets, the firm does not provide any soft commodities investment options. Several energies are supported, with spot and futures assets to allow for more diverse trading opportunities. However, metals markets such as gold and silver are spots only.

Equities

The broker supports a small selection of stock CFDs from the major US and European exchanges, with some stocks available to trade as futures CFDs.

Cryptocurrencies

As a non-FCA regulated broker, FXPrimus is free to offer cryptocurrency CFDs to UK clients. Instruments on popular tokens such as Bitcoin (BTC) and Ethereum (ETH) feature, as well as several altcoin offerings.

Leverage

FXPrimus is not restricted by leverage limits required as part of regulation from bodies such as ESMA or the FCA. As a result, the broker can offer leverage rates of up to 1:1,000, depending on the specific instrument and account type.

- Up to 1:1,000 on forex pairs (1:500 with a PrimusZero ECN or PrimusClassic MT4 accounts)

- Between 1:250 and 1:20 on commodities markets

- Between 1:100 and 1:20 on indices

- Up to 1:33 on equites

- Up to 1:5 on cryptos

The margin call level for leveraged positions is 100%, while the stop-out level on trades is 20%.

Account Types

FXPrimus offers a range of different account types, providing something to suit every trading need and investing style. accounts differ in execution model, commission charges, minimum deposits and platform support.

A swap-free Islamic account is available for the PrimusClassic, PrimusCent and PrimusPro accounts.

PrimusClassic

The PrimusClassic account is tailored to low-stakes and beginner traders, utilising the STP execution type for variable spread, zero-commission trading. The minimum deposit to open this live account is £12, while users can choose between all three supported trading platforms.

Spreads start from 1.5 pips and maximum leverage is 1:1,000 when using the MetaTrader 5 platform or 1:500 on MT4. Base currency options include GBP plus four other major global currencies.

Those who open a Primus Classic account can also take advantage of copy trading support, a feature not available with any other account type.

PrimusCent

FXPrimus also offers a cent account to clients who want to trade with ultra-low stakes in a zero commission environment.

As with the classic account, spreads start at 1.5 pips and a minimum deposit of £12 is required. However, this account is restricted to USDcents as its only supported base currency. Additionally, PrimusCent users are only able to use the MT4 trading platform.

PrimusPro

The first of the ECN variable spread accounts is the FXPrimus Pro variant. With this account, traders forfeit zero commission to gain access to tighter spreads, starting from 0.3 pips. There are five base currency options available, including GBP.

A £400 initial minimum deposit amount means the Pro account is more suited to mid-to-high-capital investors. The maximum leverage rate supported is 1:1,000 and traders can use both the MetaTrader 4 and 5 platforms.

A substantial trading commission of £8 per round traded lot is levied on MT4 users, though MT5 traders pay a more competitive rate of £6.50 per round traded lot.

PrimusZero

Clients who desire the most optimal trading conditions can utilise the FXPrimus Zero account, named for its zero spread capabilities on supported assets. As well as tighter spreads than the Pro account, the commission rate is slashed to £4 per round traded lot.

However, traders can only use the MT4 platform and face a substantial initial minimum deposit requirement of £800. In addition, leverage is curtailed to a maximum of 1:500 and only three base currencies are supported, including GBP.

PrimusDemo

FXPrimus allows prospective clients to open a demo account before committing to a live account to trial the broker’s trading conditions. This account mirrors the specifications of the PrimusClassic account, with spreads from 1.5 pips and leverage rates of up to 1:500. However, MT4 is the only platform supported by the demo account.

Trading Platforms

Three trading platforms are available to FXPrimus clients: MetaTrader 4, MetaTrader 5 and cTrader.

MetaTrader 4

Created in 2005, MT4 remains the most popular retail forex trading platform over 15 years after its initial release.

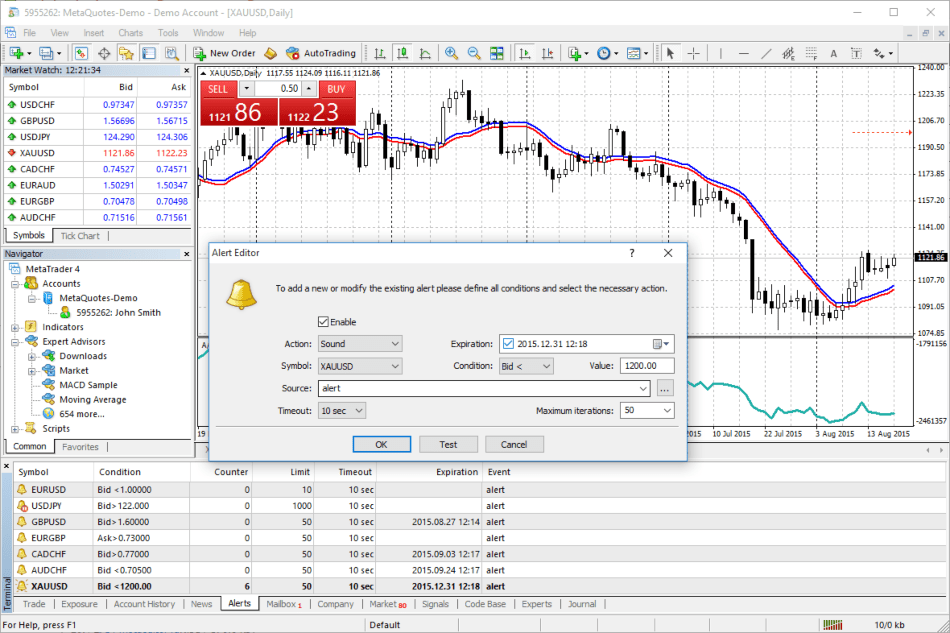

The MetaTrader 4 platform has become widely popular for forex and CFD speculation thanks to its customisable yet straightforward interface and seamless expert advisor integration capabilities. In addition, users can take advantage of features such as custom alerts, programmable hotkeys, one-click trading and strategy backtesting using historical market data.

MetaTrader 4

The platform offers nine order types, nine timeframes, 30 indicators and 31 graphical objects as standard. However, MT4 users can choose from thousands of free and paid additional tools and indicators to download through the integrated MQL4 marketplace.

MetaTrader 4 is available on Windows, Linux, Mac and as a mobile application to download for Android and iOS. The platform is regularly updated on all supported devices.

MetaTrader 5

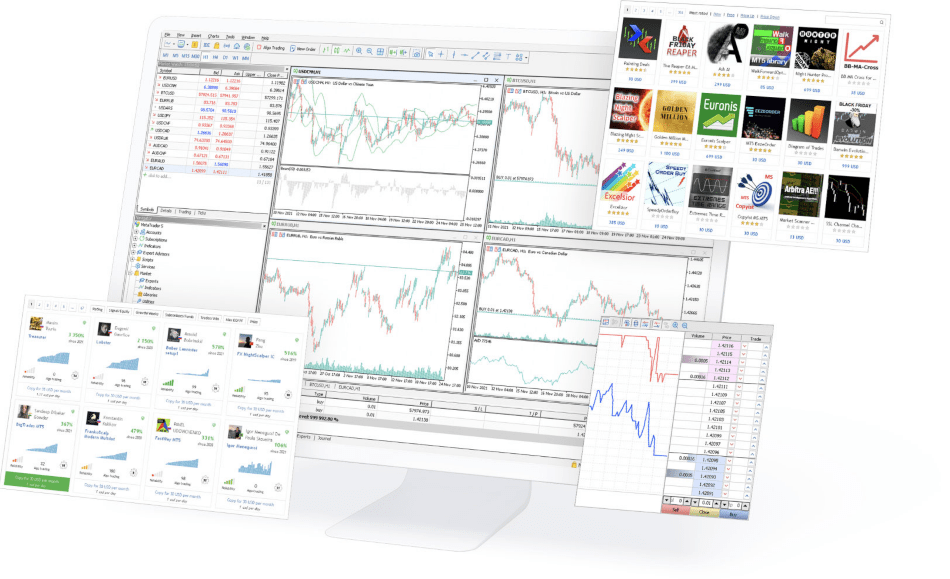

MetaTrader 5 was launched in 2010 as a successor to MT4 with support for additional markets and instruments, as well as new and updated core features.

An updated MQL5 coding language enables better EA and custom indicator integration, while support for netting, depth of market data and a built-in economic calendar featuring up-to-date market news are among the new additions to the platform.

MetaTrader 5

Additionally, MT5 offers upgraded, hardware-accelerated strategy backtesting, 38 technical indicators, 44 graphical objects, 21 timeframes and two more pending order types.

This FXPrimus platform is free on Windows, Mac, Linux and as a browser-based WebTrader variant. An MT5 app is also available on iOS and Android devices.

cTrader

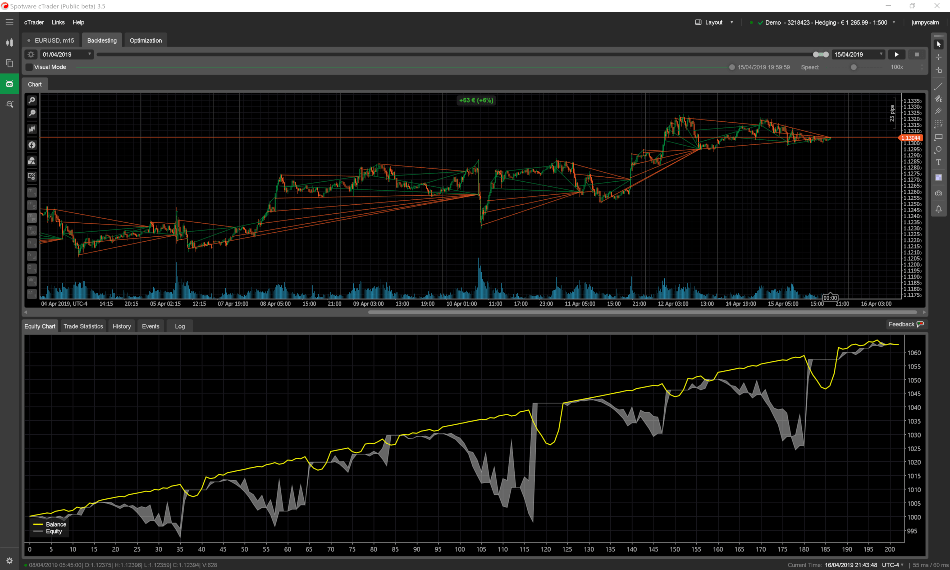

The final trading platform for FXPrimus clients is cTrader, a system launched in 2011 that provides a modern and clean interface to users on Windows, Mac, Linux and mobile devices.

The platform boasts an industry-leading 26 timeframes and six charting types in addition to 70 stock indicators for expert technical analysis. A number of tools are offered to make trading easier, such as custom hotkey support, economic calendar integration and fully automated trading capabilities.

cTrader

It is worth mentioning that the cTrader platform can only be used by PrimusStandard account holders.

Payment Methods

FXPrimus supports several funding methods for secure deposits and withdrawals, including bank wire transfers, credit cards, BitPay for Bitcoin transfers and leading e-wallets such as Neteller and Skrill. Clients can add and withdraw funds in GBP, which is a significant plus for UK traders.

Processing times on bank wire transfers are 2-5 working days, while credit card and e-wallet funding methods take up to 5 minutes to clear deposits and slightly longer for withdrawals.

Each account has different minimum requirements for initial funding, though subsequent deposits are not subject to these limits. The minimum withdrawal amount for all methods is ~£80, depending on the current exchange rate.

Deposit & Withdrawal Fees

FXPrimus covers all fees on methods other than international wire transfers, which require separate bank fees, usually upwards of £20 per transaction. Likewise, transfers made in Bitcoin using BitPay may be subject to additional wallet fees outside the broker’s control.

Trading Fees

The commissions and fees levied by a broker will often significantly impact a trader’s decision to open an account with a firm.

FXPrimus charges a commission on ECN accounts, though this varies significantly depending on the account type and trading platform. A substantial commission of £8 per round traded lot is imposed on PrimusPro MT4 traders, though rates are slightly more competitive on MT5 at £6.50 per round traded lot.

For the best value, FXPrimus traders require a PrimusZero ECN account, with an ultra-low commission of £4 per round traded lot. However, this account comes with a high initial minimum deposit and is MT4-only.

Sporadic speculators will be pleased to learn that the broker does not have any inactivity fees for dormant accounts. Longer-term investors or swing traders should check their trading platform for more details on overnight charges.

Security & Regulation

For maximum protection of personal details and funds, we advise that traders do their due diligence before signing up with a broker. Well-regulated firms often provide the most comprehensive security measures at the cost of reduced leverage rates and restrictions on promotions.

To this end, FXPrimus Group receives regulation from Cyprus-based CySEC and Vanutatu’s VFSC. While being a multi-jurisdiction licensed broker may appear impressive, these organisations do not provide the same benefits as bodies such as the FCA or ASIC.

However, the firm offers several security measures that make up for the lack of a top-tier regulator. For example, the broker employs negative balance protection and investor funds are held in segregated bank accounts. Additionally, an insurance policy underwritten by Lloyd’s of London covers balances up to £4.2 million in case of company insolvency.

An equally important element of a broker’s security is login protection. FXPrimus utilises two-factor authentication (2FA) to give maximum security to its member area.

Customer Support

FXPrimus provides several options for contacting its customer support team. The broker employs a global support staff to ensure that queries can be resolved 24/5, which can be crucial when facing registration or client area login issues.

Unfortunately, there is no UK phone number – investors need to make an international call to the broker’s head office in Cyprus for phone support. However, the firm provides a dedicated support email address and a live chat feature accessible from the FXPrimus homepage.

- Email Address: support@fxprimus.com

- Phone Number: (+357) 25 26 20 84

Registered clients can also access support via third-party apps, including WhatsApp, Telegram and Facebook messenger.

Educational Content

FXPrimus provides both articles and video-based educational content to help traders set up a new account and learn about the specific trading markets. This content covers essential information such as holiday trading schedule updates, upcoming stock splits and new platform features.

Advantages Of FXPrimus

- Copy trading

- GBP accounts

- Crypto trading

- Reputable firm

- High leverage rates

- No transaction fees

- ECN & STP accounts

- Decent security measures

- Range of platforms and account types

Disadvantages Of FXPrimus

- Not FCA-regulated

- High commission rates

- Some asset classes limited

- £80 minimum withdrawals

- No UK-based phone support

Promotions

Many brokers offer free bonuses and promotional contest schemes to encourage new clients to sign up for their services, often with high wagering requirements and stringent terms and conditions.

While FXPrmius has offered bonus programmes such as a no deposit bonus, global live trading competition and fee rebates in the past, there are currently no promotions available to UK traders.

Additional Features

The best trading firms offer a wide array of additional features to help their users succeed on the markets, such as VIP signals, access to a free VPS server and copy trading support.

The FXPrimus website features several calculators to work out margin requirements and preview potential trades and currency conversions. Additionally, an economic calendar with market news and upcoming events is provided by the broker to all.

Clients can also register for a PAMM login or use the integrated cTrader copytrade capabilities. Unfortunately, the broker no longer offers a free VPS server to clients, leaving the firm trailing behind the competition in this aspect.

Trading Hours

FXPrimus follows the standard forex and CFD market hours, trading 24/5. However, stock CFDs and indices will follow local exchange hours – you can check the broker’s website for a comprehensive breakdown.

Clients can login to their dashboard and make deposits and withdrawals 24/7, though assistance from customer support is not available on weekends.

FXPrimus Verdict

FXPrimus is both a reputable and competitive forex and CFD broker with plenty of favourable ratings and good reviews online and a quick sign-up process. The firm offers a good selection of assets (notably including crypto CFDs), six account types and three top trading platforms. As a bonus, no deposit fees or withdrawal charges are levied by the broker. However, the company’s regulation may not be up to the standards of the most cautious traders and a high minimum withdrawal requirement might put low-stakes investors off.

FAQ

What Is FXPrimus’ Minimum Withdrawal Amount?

FXPrimus has a minimum withdrawal requirement of £80 or greater. While this is high, the lack of broker deposit and withdrawal fees may counteract this disadvantage for some traders.

Which Indices Are Offered By FXPrimus?

FXPrimus has more than ten major global indices, including the US Nasdaq 100, S&P 500, German DAX 40, AUS 200, JP 225 and UK FTSE 100.

Where Is The FXPrimus Head Office?

FXPrimus has a headquarters in Cyprus, where its customer support team is based.

Is FXPrimus A Good Broker?

FXPrimus has many positive ratings for features such as crypto CFD support, free deposits and withdrawals and high client fund insurance coverage.

Does FXPrimus Offer A Joint Account?

While FXPrimus traders can take advantage of a PAMM login, there is currently no provision for a joint account.

Top 3 FXPrimus Alternatives

These brokers are the most similar to FXPrimus:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

FXPrimus Feature Comparison

| FXPrimus | IC Markets | FP Markets | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.3 | 4.8 | 4 | 4.8 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $15 | $200 | $40 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CYSEC, MIFID, ICF, FCA, BaFin, VFSC | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (UK), 1:500 (Global) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 74-89 % of retail investor accounts lose money when trading CFDs |

|||

| Review | FXPrimus Review |

IC Markets Review |

FP Markets Review |

Pepperstone Review |

Trading Instruments Comparison

| FXPrimus | IC Markets | FP Markets | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | Yes | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

FXPrimus vs Other Brokers

Compare FXPrimus with any other broker by selecting the other broker below.

Popular FXPrimus comparisons: