Baxia Markets Review 2024

|

|

Baxia Markets is #61 in our rankings of CFD brokers. |

| Top 3 alternatives to Baxia Markets |

| Baxia Markets Facts & Figures |

|---|

Baxia Markets is an offshore CFD broker that offers trading on forex, commodities and indices with tight spreads on a straight-through processing model with ultra-low latency. Trade on MetaTrader 4 or MetaTrader 5 with leverage up to 1:500 and no restrictions to scalping or hedging strategies. Users also benefit from third-party copy trading services. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs on Forex, Commodities, Cryptos & Indices |

| Demo Account | Yes |

| Min. Deposit | $50 |

| Mobile Apps | MT4 & MT5 iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SCB, FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | Yes |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on 75+ instruments, including forex, energies, metals, and indices with variable leverage up to 1:500 on major pairs, 1:200 on minors and exotics and 1:100 on commodities and energies. |

| Leverage | 1:500 |

| FTSE Spread | From 1.0 |

| GBPUSD Spread | From 0.0 |

| Oil Spread | From 1.0 |

| Stocks Spread | N/A |

| Forex | Trade 45+ major, minor and exotic pairs with deep liquidity and low latency. The ultra-tight spreads from 0.01 pips on raw accounts, competitive $7 or lower round-turn commissions and high leverage up to 1:500 will suit scalpers, who can trade without limits. |

| GBPUSD Spread | From 0.0 |

| EURUSD Spread | From 0.0 |

| GBPEUR Spread | From 0.0 |

| Assets | 56 |

| Stocks | Traders can speculate on broad stock market movements by trading on 14 major indices, including the FTSE 100, S&P 500 and Dax 30. Clients can analyze stock market movements on leading trading software from MetaQuotes. |

| Cryptocurrency | Trade popular crypto-fiat crosses with low spreads. Clients can speculate on short-term price fluctuations with powerful trading tools, low fees and reliable risk management features. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Baxia Markets is an online CFD broker with a UK presence. Through the MetaTrader 4 and MetaTrader 5 platforms, customers can trade leveraged CFDs on a range of forex pairs, commodities and indices. This review will provide UK investors with details about using Baxia Markets in 2024, from the list of tradeable markets to live account options, pros, cons and more.

About Baxia Markets

Baxia Markets launched in 2020, providing trading opportunities to clients around the world through its data centres in London, UK and New York, USA.

The broker is licensed with the regulatory authorities of the Seychelles and the Bahamas with branches located in both countries. These trading entities are registered under the names Baxia Global Limited and Baxia Limited, respectively.

Live account holders benefit from ultra-low latency of ~30 ms, 24/5 customer support, plus a free demo account and educational resources for beginners.

Instruments

Baxia Markets offers CFD trading on a range of worldwide assets:

- Indices: 14 indices including the FTSE 100

- Metals: Seven assets including gold and silver

- Energy: West Texas Intermediate crude oil, Brent crude oil and natural gas

- Forex: 56 major, minor, cross and exotic currency pairs, including eight with GBP as either the base or quote currency

Our experts were disappointed to see that trading on shares and cryptocurrencies is not available.

Fees

For BxStandard accounts, fees are paid in the form of bid-ask spreads, which start at 1 pip. Clients with BxZero accounts pay a commission on forex trades, however, they benefit from ultra-tight spreads from 0.0 pips. The UK FTSE can be traded from 1.0 point and the GBP/USD forex pair is available from zero pips.

While there are no inactivity fees, our experts found that Baxia Markets does charge swap fees on overnight forex positions. The exact amount depends on the current swap rate, trade volume, number of nights and whether you are going short or long.

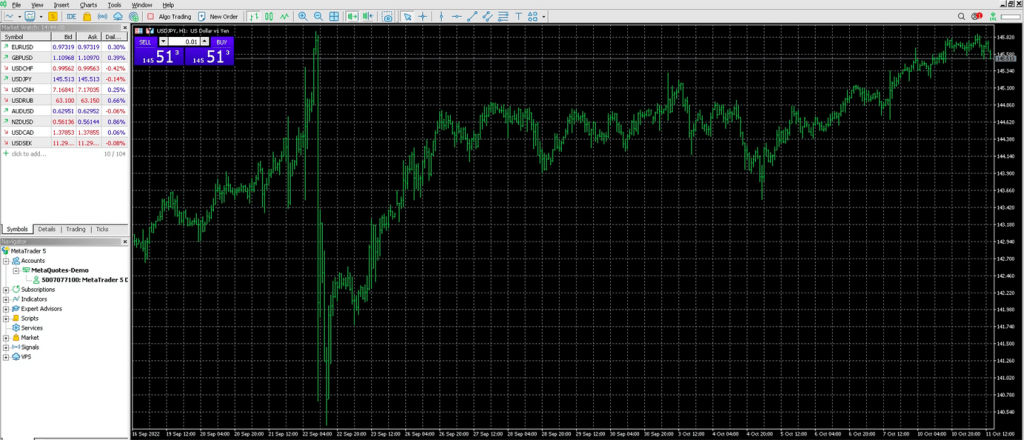

Trading Platforms

Baxia Markets clients have a choice of either MetaTrader 4 or MetaTrader 5 to conduct trading activities.

To trade on your computer, you can either download the desktop software or use the web trader terminal on all major internet browsers. Both platforms also have mobile apps available on iOS and Android devices. Download links via the Apple App Store and Google Play can be found on the broker’s website.

Below we outline some of the key features available having tested both platforms.

MetaTrader 4

MetaTrader 4 is a world-leading platform developed by MetaQuotes that provides live price quotes for planning and executing trades. The platform comes with 30 indicators, useful for technical analysis, in addition to two thousand more that you can download.

Through the MT4 platform, you can set up signals and copy trading, as well as use the MQL4 scripting language to design your own expert advisors. From here, you can use the strategy testing tool to input the parameters for your trading bot and find the profit or loss the EA would generate over a chosen period.

MetaTrader 5

MetaTrader 5 is the more powerful successor to MetaTrader 4. Launched five years after MT4, this platform is much faster, adopting 64-bit processing rather than 32-bit. Moreover, it comes with an additional eight technical indicators as well as 21-time frames ranging from one minute up to one month.

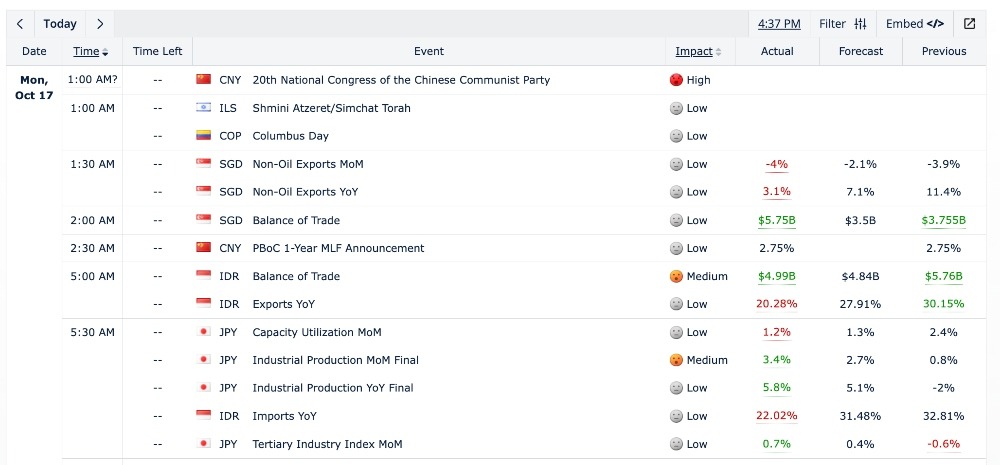

Other key benefits of using MT5 include the integration of an economic calendar, the provision of one-click trading and access to depth of market data.

MetaTrader 5

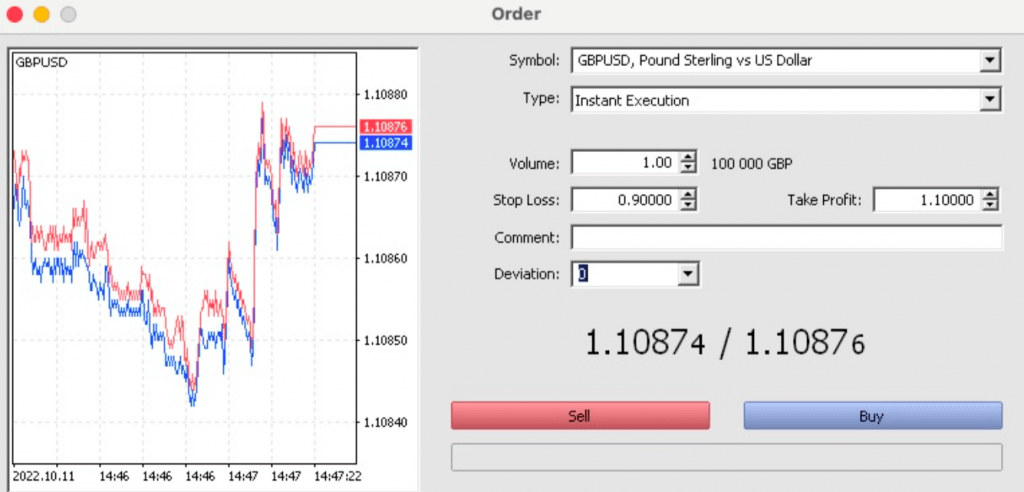

Placing A Trade With Baxia Markets

- Click the ‘New Order’ button above the price history chart on your trading platform

- Select the asset from the drop-down list, for example, EUR/GBP

- Choose either instant or pending order

- Customise your order by inputting the trade volume and any stop loss or take profit orders

- If you have selected a pending order you will also need to choose from buy/sell limit, buy/sell stop or buy/sell stop limit, input the trigger price and expiration

- Click ‘Buy’ or ‘Sell’ to complete the order

Order Window

Account Types

Baxia Markets offers two live trading accounts. Both profiles offer access to the same features such as expert advisors, strategy back-testing and various platform accessibility options. The only difference between the two accounts is how clients pay for the broker’s services.

BxStandard

- No trade commission charged

- Floating spreads from 1 pip

BxZero

- Tight spreads as low as zero pips

- Commission of $7 per lot round turn for forex

- No commission is charged on indices, metals and energies

Demo Account

Clients who want to practise trading risk-free also have the option to register for a Baxia Markets demo account.

When we used Baxia Markets’ paper trading profile, we were only offered the MT5 BxStandard demo account for forex trading. Nonetheless, it was free to access and you can choose the leverage and initial virtual balance.

Leverage Review

Baxia Markets is not regulated by the FCA and so it does not adopt the same leverage limits that UK-based brokers follow. When using Baxia Markets, investors can access maximum leverage of up to 1:500 with a margin call of 90%.

Remember, leveraged trading can increase profits, but may also increase losses. Because of this, make sure you implement a suitable approach to risk management.

Payments

Funding

To deposit funds into your Baxia Markets live trading account, you can use four methods. These include Visa and Mastercard debit and credit cards, e-wallets Sticpay and Astropay, plus bank wire transfers.

There are no fees and the minimum deposit for all methods is £50. Note, when you first open an account, you need to deposit at least £200.

All payment methods take 30 minutes to an hour for funds to clear, except bank transfers which can take between two to five business days.

Withdrawals

Withdrawing funds from Baxia Markets can be done using the same methods as deposits. The only difference is that processing times are usually longer.

Debit and credit card withdrawals can take up to five business days for funds to clear. E-wallet payments take one to three business days and incur a fee of £1. Bank transfers take three to five business days and incur a fee of £20.

UK Regulation

Baxia Markets holds licenses with two regulators; the Financial Services Authority of The Seychelles and The Securities Commission of The Bahamas. The license numbers are SD104 and SIA-F234, respectively.

Baxia Markets is not regulated by the UK Financial Conduct Authority, meaning you may not be entitled to the same fund protections as you would when trading with an FCA-licensed broker.

We also found limited information about client protection schemes, the segregation of traders’ funds and negative balance protection.

Getting Started

Baxia Markets requires users to complete an account verification process. This involves uploading a government-issued ID and proof of address as well as completing appropriateness and suitability tests. The appropriateness test asks questions regarding fund sources and experience level. The suitability test asks about your plans for trading, for example, how much you plan to invest and what you plan to invest in.

Once you have completed this process, you can open a live account.

Customer Support

Issues may arise when trading CFDs online. If you are having problems while using Baxia Markets, you can seek help by contacting the support team via:

- Read their FAQs

- Phone call to +44 1392 58 0012

- Contact form with a response via email

- Live chat, available to traders with a live account

- Message the broker’s social media accounts on Twitter, Facebook, Instagram and LinkedIn (you can also follow these accounts to keep up to date with any news, marketing and events)

Opening Hours

Trading hours at Baxia Markets are dependent on the asset. The majority of forex pairs and indices, including the FTSE100, can be traded 24/5. All commodities except Brent crude oil can be traded between 1 AM and midnight (GMT+2) Monday to Friday. Brent opens two hours later but ends at the same time.

For a full breakdown of the trading hours across all assets, see the Baxia Markets website.

Promotions

Baxia Markets runs a friend referral scheme whereby each user is given a unique link they can send to colleagues, friends and family. If someone uses your link to sign up and meets the minimum deposit and trade requirements, both of you will receive a £50 bonus.

Demo competitions are also occasionally offered, with rewards based on trading performance within a simulated environment.

Benefits Of Trading With Baxia Markets

- Deposit and hold funds in GBP

- Two-factor authentication available

- Access to MT4 or MT5 trading platforms

- Trade on margin with up to 1:500 leverage

- London data centre to improve latency for UK-based traders

- Reduced slippage as a straight-through processing (STP) broker

- Additional trading tools including an economic calendar and forex calculators

Drawbacks Of Trading With Baxia Markets

- Not FCA regulated

- Complex verification process

- No stock or cryptocurrency trading

- High fees for bank transfer withdrawals

- Limited account features until verification is complete

Economic Calendar

Should You Trade With Baxia Markets?

For UK investors looking to invest in and speculate on a decent range of different assets, Baxia Markets is a viable option. The maximum leverage of 1:500 will also make this broker attractive to some investors. Additionally, the choice of pricing models and MetaTrader platforms mean traders of all experience levels are accommodated.

At the same time, Baxia Markets is not FCA-regulated and traders wishing to speculate on stocks and cryptos will need to consider an alternative broker.

FAQ

Can UK Traders Register An Account With Baxia Markets?

Yes, Baxia Markets accepts UK-based investors. The broker also has a data centre in London that helps to improve latency and reduce slippage.

Is Baxia Markets A Legit Or Scam Broker?

Baxia Markets Ltd is a legitimate broker that you can trust. While it is not licensed by the UK Financial Conduct Authority, it is regulated by the FSA of Seychelles and the SCB of The Bahamas. We would, however, be cautious due to the limited information about client protection, including segregated funds and negative balance protection.

What Deposit Methods Can I Use With Baxia Markets?

Clients can make deposits to their accounts using debit and credit cards issued by Mastercard and Visa, Astropay, Sticpay, or bank transfer. Bank transfers take between two and five days, while all other methods take less than an hour.

Is Baxia Markets Down Today?

If one of the trading platforms or the Baxia Markets website does not work then contact the support team. Alternatively, you can use third-party websites such as downdetector.com to see if other traders are reporting similar issues.

What Is The Best Strategy For Trading With Baxia Markets?

To determine which strategy is best for your financial goals, risk appetite and experience, you may want to try the Baxia Markets demo account. Alternatively, if you need trade ideas, use online resources such as PDF guides and the regular newsletters and articles published by Baxia Markets, which offer advice on using certain indicators and trading technology. Additionally, the wider trading community can be helpful, for example, you can watch trading videos via established YouTube channels.

Is Baxia Markets Open For Trading Today?

You can trade on a live account, process deposits and withdrawals, and contact the Baxia Markets support team 24 hours a day, Monday through to Friday. On Saturday and Sunday, however, you can only use the brand’s demo accounts.

Top 3 Baxia Markets Alternatives

These brokers are the most similar to Baxia Markets:

- FXOpen - FXOpen is a multi-asset broker with regulation from several trustworthy bodies including the UK's FCA. The broker offers CFD trading on forex, stocks, commodities, indices, cryptocurrencies and ETFs via the MetaTrader 4 & 5 and TradingView platforms.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

- GO Markets - GO Markets is an established forex and CFD broker with multiple industry awards and accolades. The ECN/STP broker is popular with budding traders, offering competitive accounts in multiple base currencies and a range of flexible payment methods. With top-tier regulation from CySEC and ASIC, GO Markets is a trusted broker.

Baxia Markets Feature Comparison

| Baxia Markets | FXOpen | FP Markets | GO Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 3.7 | 4 | 3.9 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $50 | £300 | $40 | $200 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SCB, FSA | FCA, CySEC, ASIC, AFM | ASIC, CySEC, FSA, CMA | ASIC, CySEC, FSC of Mauritius |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (EU), 1:500 (Global) | 1:30 (UK), 1:500 (Global) | 1:500 |

| Visit | ||||

| Review | Baxia Markets Review |

FXOpen Review |

FP Markets Review |

GO Markets Review |

Trading Instruments Comparison

| Baxia Markets | FXOpen | FP Markets | GO Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | No | No | Yes |

| Options | No | No | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | No |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Baxia Markets vs Other Brokers

Compare Baxia Markets with any other broker by selecting the other broker below.

Popular Baxia Markets comparisons: