LonghornFX Review 2025

LonghornFX offers a wide variety of assets, leverage rates of up to 1:500, access to MetaTrader 4 and narrow spreads, making it a competitive online broker for CFD traders and longer-term investors. In this 2025 broker review, we will detail who LonghornFX is, minimum deposits, withdrawal fees, trading apps, regulations, and more.

About LonghornFX

LonghornFX is an ECN and STP broker founded in 2020 in Kingstown, Saint Vincent and the Grenadines. The brokerage aims to provide fast, reliable investing via straight-through processing.

The firm also offers high leverage rates, tight spreads and low commissions, along with access to over 180 assets.

Trading Platforms

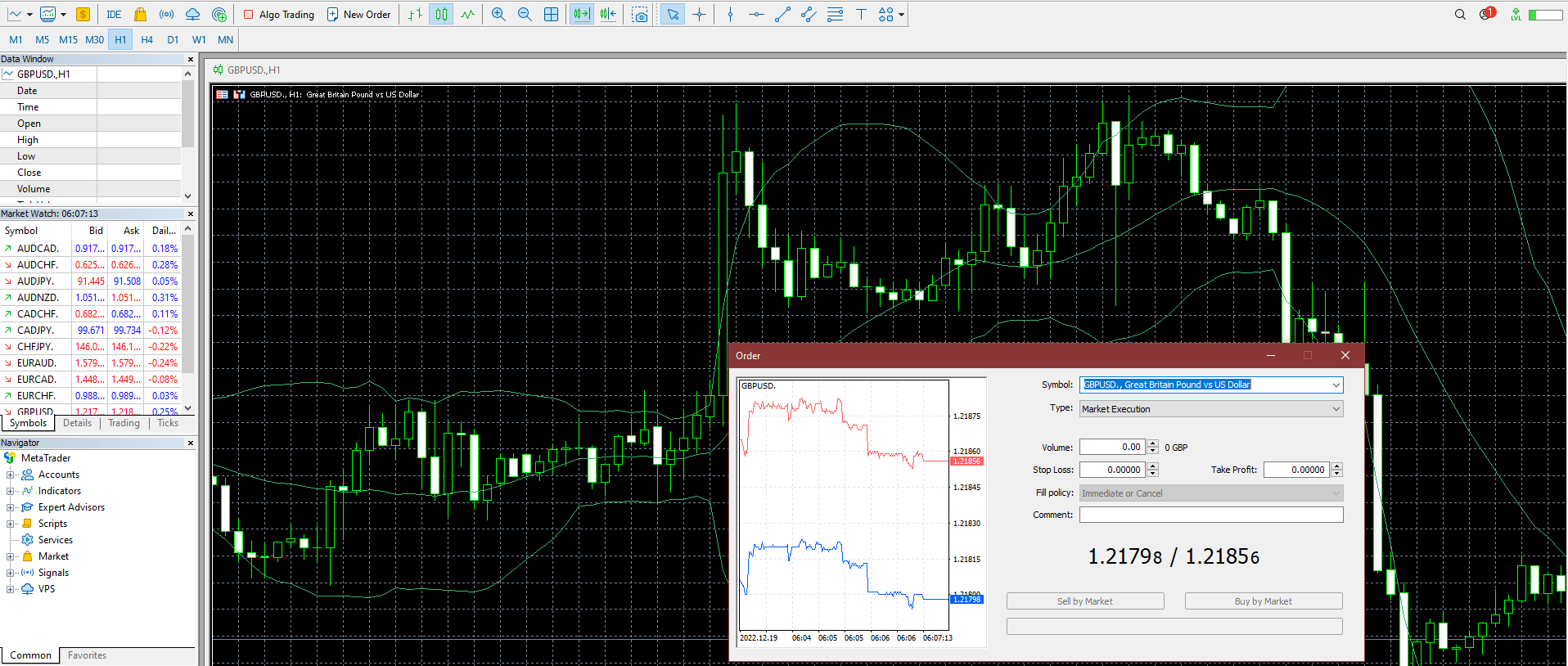

While using LonghornFX, we found it to offer the MetaTrader 4 platform as its only trading platform. This is a powerful, widely-used system that gives experienced traders the freedom to implement their strategies with ease. MT4 is an advanced platform that offers versatile tools and an intuitive interface. Key features include:

- VPS hosting

- Copytrading

- Nine timeframes

- One-click trading

- Hedging & scalping

- Customisable signals

- AI-based automation

- 30 technical indicators

MT4 also offers much more via its news, history, articles, code base and experts tabs, making it perfect for those with or without experience.

LonghornFX clients can make use of the web version of MetaTrader 4 if they prefer working in-browser or are unable to download the application to their computer.

MetaTrader 4

Assets & Markets

LonghornFX provides traders and investors access to over 183 instruments. This consists of 36+ crypto pairs, 55+ forex pairs, 73+ stocks and 10+ indices. Popular assets include:

- Indices – NAS 100 (Nasdaq), UK 100 (FTSE), GER 40 (DAX)

- Cryptocurrency Pairs – LTC/BTC, XRP/USD, ETH/BTC

- Forex Pairs – EUR/USD, GBP/USD, GBP/JPY

- Commodities – UKOil (Brent), USOil (WTI)

- Metals – XAG/USD, XAU/EUR, XPT/USD

- Futures – DOLLAR

Fees & Charges

LonghornFX charges a commission fee per lot traded, as well as a spread on each asset. The standard commission rate is £6 per lot. Micro lots (e.g. a 0.5 lot) incur lower commissions proportional to the lot size (e.g. £3 for a 0.5 lot traded).

The broker also charges floating spreads, which means they change with liquidity, market volume and volatility. Typical spreads are 1.4 pips for GBP/USD, 0.9 pips for Brent oil and 7.7 pips for the FTSE 100.

There are also swap charges (or administration costs on the Islamic account) to keep an eye out for, though the fee structure is not openly provided.

While deposit and withdrawal fees are not charged, Bitcoin transactions are subject to the blockchain network and miner fees (a flat 0.0005 BTC).

Leverage & Margin Rates

LonghornFX offers different maximum leverage levels for each asset class, ranging from a maximum of 1:20 on stocks to a maximum of 1:500 on forex pairs. Margin rates also differ per asset class. The Leverage and margin rates are given below:

- Indices: 1:200 leverage – 0.5% margin

- Energy: 1:200 leverage – 0.5% margin

- Metals: 1:500 leverage – 0.2% margin

- Forex: 1:500 leverage – 0.2% margin

- Crypto: 1:100 leverage – 1% margin

- Stocks: 1:20 leverage – 5% margin

Furthermore, there are margin rules to consider. The margin call is at 100% and the stop-out is at 70%.

LonghornFX Payment Methods

When we used LonghornFX, we discovered it has somewhat limited deposit and withdrawal methods.

Deposits

To fund your LonghornFX account, you must deposit using a debit/credit card or Bitcoin via Instacoins.

The third-party financial service provider, Instacoins, allows you to purchase Bitcoin and then deposit it into your LonghornFX account. This can take up to 6 hours and incurs the 0.0005 BTC network fee. The minimum deposit into your Longhornfx account is £50.

Visa and Mastercard payment cards are supported by the firm in GBP, EUR, USD or BIT. Minimum credit and debit card deposits are £10.

Withdrawal

The only method supported for withdrawals is Bitcoin. You can retrieve your account capital via Bitcoin into a personal crypto hot or cold wallet. There are no withdrawal fees, except the 0.0005 BTC Bitcoin Network gas charge. The minimum withdrawal limit is $10.

Demo Account

LonghornFX offers as many free demo paper trading accounts as you want in conjunction with its MetaTrader 4 trading platform. All you need to do is sign up to the firm, provide your name, age and email address and create a password.

After signing in, you can enter the Web Trader platform, choose the File option, click Open a Demo Account and input the parameters you desire.

For MT4 Desktop, you will need to choose File, Open an Account, select the LonghornFX-Demo server, select New Demo Account, fill in the account parameters and the account will open.

Deals & Promotions

LonghornFX does not provide any bonuses, deals or promotions to new or existing customers. The company states that it provides tighter spreads and lower commissions instead.

Regulation & Licensing

LonghornFX is an unlicensed, unregulated broker. This makes investing with the company risky as there is no guarantee of protection from financial malpractice. If the firm were to go under, there would be no guarantee of compensation for your funds nor any viable avenue for legal recourse.

LonghornFX Additional Features

Our experts found that LonghornFX has a Resources page that provides numerous tutorials and guides, covering a wide range of topics. These include how to sign up and get going with your LonghornFX account and deposit and withdrawal guides.

The broker offers a minimal educational section that covers the basics of understanding trading, with articles on the bid/ask spread, measuring trades in lots and increasing earning potential with leverage.

The company also seems to have offered daily forex and crypto pair technical analysis in the past but the latest dated articles were released at the beginning of 2022.

The educational resources are not sufficient to provide new clients with the know-how to trade effectively but they do provide a basic understanding of terms and concepts. We would recommend newer financial speculators look elsewhere for more informative and useful educational material.

Account Types

LonghornFX offers two main account types, a regular account and an Islamic account. The Islamic account differs by not incurring the swap fee, though it does pay administration fees. Both accounts have access to the MT4 terminal and all the listed assets. All other fees and spreads are the same.

Clients can create as many accounts as they want and set each with their own leverage settings and baseline currencies (GBP, BIT, USD or EUR).

How To Invest With LonghornFX

1) Open An Account

To get started, navigate to the LonghornFX website and click Sign Up. Fill in the required information (name, email address, date of birth and gender), choose a password and submit your application. Alternatively, you can speed up the registration and login process by auto-filling information via Facebook or Gmail.

2) Deposit Funds

To deposit, you need to go to the Deposit Funds option within the Transactions area of the account dashboard. You will then receive a ‘one-time-use’ Bitcoin Wallet address. Any funds sent to that address will appear in your account. The address is only valid for 15 minutes from when it is provided and new addresses will be given for any future deposits.

3) Place A Trade

Placing a trade on Longhorn’s MetaTrader 4 terminal is simple. Simply select the desired asset from the drop-down list. Once the right chart is open, select the order type you wish to use (market execution or pending order), input the volume parameters and specify any necessary pricing information. Next, choose whether you want to go long (buy) or short (sell) the market and initiate the trade. You can also set up automatic stop-loss and take-profit orders, which will close the position for you once the market meets predefined criteria.

LonghornFX Pros & Cons

Pros

- MT4 access

- Islamic accounts

- Free demo account

- High leverage rates

- No deposit & withdrawal fees

- Quick and easy account setup

Cons

- Unregulated & unlicensed

- Limited deposit methods

- Abstract fee structure

- Limited commodities

- High trading fees

- No promotions

Trading Hours

Trading hours vary depending on the asset in question. Some assets, like cryptocurrencies, can be traded 24/7, while others will depend on underlying exchanges and general market times.

Customer Service

LonghornFX offers 24/7 support services through its online live chat and email support channels. You can also request a call from a support agent at a specified time through the website.

- Email Address: help@longhornfx.com

LonghornFX Verdict

LonghornFX provides traders with quick and easy access to a versatile trading platform and over 180 speculative instruments. The company offers moderate floating spreads and reasonably low commission rates, as well as high leverage capabilities and free demo accounts. Unfortunately, the broker is unlicensed and unregulated, creating a real risk for any unwary clients. The limited deposit and withdrawal options can also be off-putting to some traders. Summarily, LonghornFX looks to be a broker that could appeal to retail traders looking to take advantage of the additional features and leverage rates that come with unregulated brokers to maximise profits.

FAQ

What Trading Platforms Does LonghornFX offer?

LonghornFX offers the popular MetaTrader 4 trading platform. This a versatile system that is perfect for experienced traders looking to implement complex trading strategies and automate trading. However, the desktop tool also maintains an intuitive interface that is great for beginners.

What Deposit And Withdrawal Options Does LonghornFX Offer?

LonghornFX only supports deposits via Visa and Mastercard debit or credit cards and Bitcoin via a third party. For withdrawals, clients are limited to Bitcoin.

Does LonghornFX Have Any Deposit Or Withdrawal Fees?

LonghornFX does not charge any deposit or withdrawal fees. However, transferring Bitcoin does incur a flat 0.0005 BTC Bitcoin Network Fee.

What Are LonghornFX’s Trading Fees?

LonghornFX charges a £6 commission per lot traded (this is reduced proportionally for smaller positions). Spreads are floating and sit at around 1.4 pips for GBP/USD.

Is LonghornFX A Licensed Or Regulated Broker?

LonghornFX is neither licensed nor regulated by any independent regulatory body or authority.

Top 3 LonghornFX Alternatives

These brokers are the most similar to LonghornFX:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- FXPro - Founded in 2006, FxPro has built a reputation as a reliable non-dealing desk (NDD) broker, providing trading access across more than 2,100 markets to over 2 million clients globally. It has received over 100 industry awards, reflecting its favourable conditions for active traders.

LonghornFX Feature Comparison

| LonghornFX | Pepperstone | Swissquote | FXPro | |

|---|---|---|---|---|

| Rating | 3 | 4.8 | 4 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Futures, Spread Betting |

| Minimum Deposit | $0 | $0 | $1,000 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | - | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, CySEC, FSCA, SCB, FSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4 | MT4, MT5, cTrader | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | LonghornFX Review |

Pepperstone Review |

Swissquote Review |

FXPro Review |

Trading Instruments Comparison

| LonghornFX | Pepperstone | Swissquote | FXPro | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | Yes | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | No | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | No |

LonghornFX vs Other Brokers

Compare LonghornFX with any other broker by selecting the other broker below.

Popular LonghornFX comparisons:

|

|

LonghornFX is #49 in our rankings of CFD brokers. |

| Top 3 alternatives to LonghornFX |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Demo Account | Yes |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Trading Platforms | MT4 |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Debit Card, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities | Gold, Natural Gas, Oil, Palladium, Platinum, Silver |

| CFD FTSE Spread | 7.7 |

| CFD GBPUSD Spread | 1.4 |

| CFD Oil Spread | 0.8 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 1.4 |

| EURUSD Spread | 0.6 |

| GBPEUR Spread | 1.5 |

| Assets | 55+ |

| Crypto Coins | BCH, BTC, DASH, ETH, IOTA, LTC, NEO, XRP |

| Crypto Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |