Axofa Review 2024

|

|

Axofa is #56 in our rankings of CFD brokers. |

| Top 3 alternatives to Axofa |

| Axofa Facts & Figures |

|---|

Axofa is a forex and CFD broker registered in St Vincent and the Grenadines. The broker offers three account types with access to forex, commodities and indices. With ECN processing, low minimum deposits and no commissions, Axofa remains an attractive option, although the broker does not hold a reputable license. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, Stocks, Indices, Commodities |

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | SVGFSA |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities |

|

| CFDs | CFDs are available on popular asset classes with a competitive $1 minimum deposit. The MT5 integration will allow serious short-term traders to utilize the vast library of technical tools, bots and indicators, but the lack of any CFD trading education puts the broker behind many alternatives. |

| Leverage | 1:1000 |

| FTSE Spread | NA |

| GBPUSD Spread | From 1.6 pips |

| Oil Spread | From 1.6 pips |

| Stocks Spread | NA |

| Forex | Axofa offers a decent range of 50+ forex pairs with raw spreads from 0.0 pips. Very high leverage up to 1:1000 and commission-free forex trading is available. With that said, the broker is not particularly transparent when it comes to account conditions and fees. |

| GBPUSD Spread | From 1.6 pips |

| EURUSD Spread | From 1.6 pips |

| GBPEUR Spread | From 1.6 pips |

| Assets | 10+ |

| Stocks | A small selection of 100+ popular international stocks is available. Trading is available on the MT5 platform, which delivers reliable stock market news straight to your dashboard. That said, it’s disappointing that the broker doesn’t provide any additional research tools. |

Axofa is an offshore forex brokerage offering the MT5 platform and access to a proprietary copy trading function. This review will unpack our opinion on Axofa’s trading fees, security features, accepted payment methods, and more. We also give our verdict on whether we trust this broker.

Our Take

- Axofa offers STP and ECN execution on a decent range of markets and high leverage up to 1:1000

- The broker offers trading on MetaTrader 5, plus a proprietary copy trading solution

- The absence of a regulatory license and misleading information on the website is concerning

- The lack of pricing transparency and verifiable company information is also a red flag

Market Access

Axofa offers 400+ instruments across 5 asset classes, comparable with other brokers. I found the broker’s selection of cryptocurrency assets particularly competitive, with over 100 instruments to choose from.

- Indices – 12 major global stock indices such as the FTSE 100, S&P 500, and ASX 200

- Forex – 50+ major, minor, and exotic currency pairs including GBP/AUD, USD/SGD, and EUR/GBP

- Cryptocurrency – 100+ digital currency coins and fiat pairs such as BTC/GBP, LTC/EUR, and XRP/GBP

- Shares – 100+ European, US, and Asian company stocks including Nestle, Unilever, Shell, and Coca-Cola

- Commodities – 8 precious metals and energy commodities, such as gold, silver, natural gas, and Brent Crude Oil

Fees

Unfortunately, Axofa is not transparent when it comes to its trading and non-trading fees. When testing the platform, we struggled to find any instrument-specific trading costs or details of inactivity charges or rollover fees.

This is very disappointing and means you may come across unexpected charges once your live account is open. We do know, however, that the minimum deposit requirement is just $1.

The Pelow profile is aimed at high-frequency traders, with spreads from 0.0 pips and low commissions. Having said that, the spreads on the two lowest-tier accounts do not compete with the likes of XTB and Pepperstone.

- Cent – Spreads from 3 pips, no commission

- Bimax – Spreads from 1.6 pips, no commission

- Pelow – Spreads from 0 pips, £3.50 commission per side

Account Types

Axofa offers three live account options: Cent, Bimax, and Pelow. Aside from the pricing structure outlined above, all provide the same trading conditions. This includes the initial deposit of $1, leverage up to 1:1000, and access to all instruments.

There is no clear difference between the Cent Profile and Bimax accounts, other than tighter spreads in the Bimax account. Overall, I didn’t find any attractive additional features in any of the accounts, which is disappointing.

How To Open An Axofa Account

- Click the ‘Sign Up’ icon found on the top right of the broker’s website

- Complete the online registration form (name, DOB, email, phone number, and address)

- Create a password and agree to the terms & conditions by selecting the tickbox

- Click ‘Continue’

- Add the six-digit code sent to your registered email address

- Automatic redirection to the client dashboard will be granted

Payment Methods

Axofa is misleading when it comes to accepted deposit methods. The brand supposedly accepts credit/debit cards including Visa and Mastercard, plus cryptocurrencies and international payment methods.

However, when I tried to deposit funds, I was only offered CIMB NIAGA bank wire transfers or cryptocurrency/altcoins which is a shady move from the broker.

Deposits

Processing times are between 1 and 3 working days, however, you are required to upload payment confirmation once the transaction has been requested.

It was also disappointing to see that USD is the only accepted fiat currency meaning UK traders may be liable for a currency conversion fee. Accepted crypto coins include Bitcoin, Ethereum, Litecoin, and Ripple, with varying processing times.

You will need to comply with the account verification requirements before withdrawals are permitted back to the original payment method. Unfortunately, no details are provided for processing times, though bank wire transfers typically take up to 5 working days for funds to clear.

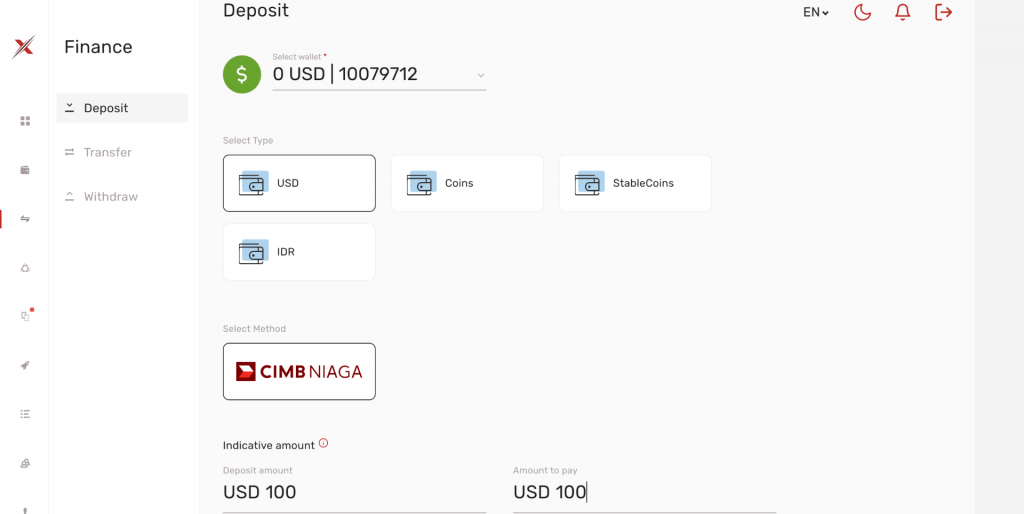

How To Make A Deposit Via Bank Wire Transfer

- Login to the Axofa client portal

- Select ‘Finance’ from the side menu and then ‘Deposit’

- Choose the account to add funds using the dropdown menu at the top

- Select an account funding option using the logos and add the amount to deposit in USD under the ‘Indicative Amount’ section

- Scroll down to view bank details and initiate the payment via your online banking portal

- Upload a proof of payment by clicking on the ‘File’ logo under ‘Bank Slip’

- Select ‘Proceed’ to approve the deposit

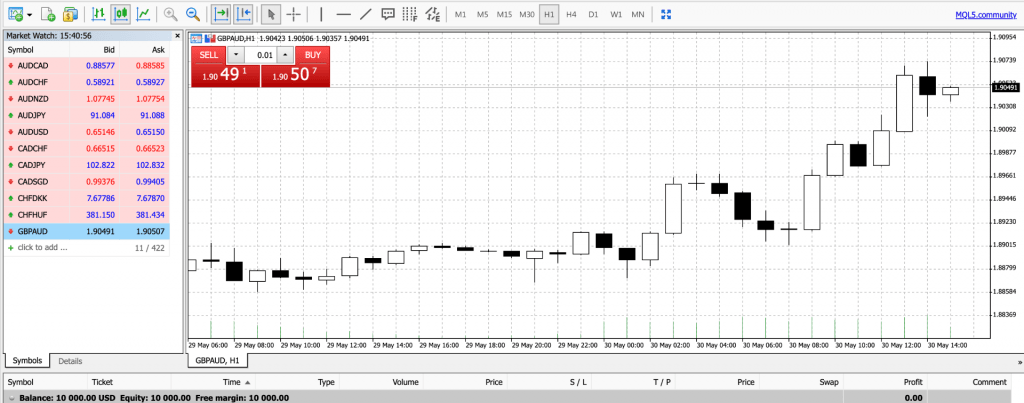

Trading Platforms

Axofa does offer the reputable MetaTrader 5 (MT5), which is a trusted multi-asset platform with best-in-class analysis features.

We typically recommend the platform to experienced investors looking for a powerful yet fully customisable interface. The sophisticated MT5 platform offers decent visual displays, technical analysis tools, clear price data, and a superior automated expert advisor (EA) function.

MetaTrader 5

With that said, a reputable trading platform is not an indicator of a trustworthy broker. If you’re looking to trade with peace of mind on MT5, we recommended sticking to well-established or regulated brands such as IC Markets or FxPro.

Some of our favourite MT5 features are:

- Hedging and netting permitted on relevant markets

- 80+ in-built technical indicators and analytical objects

- Live financial news streams and integrated economic calendar

- Advanced Market Depth with time and sales information and a tick chart

- MQL5 programming language to create bespoke indicators and robots for automated trading

- Six pending order types; buy stop, sell stop, buy limit, sell limit, buy stop limit, and sell stop limit

- Up to 100 charts can be open at any time with 21 timeframes available from one minute to one month

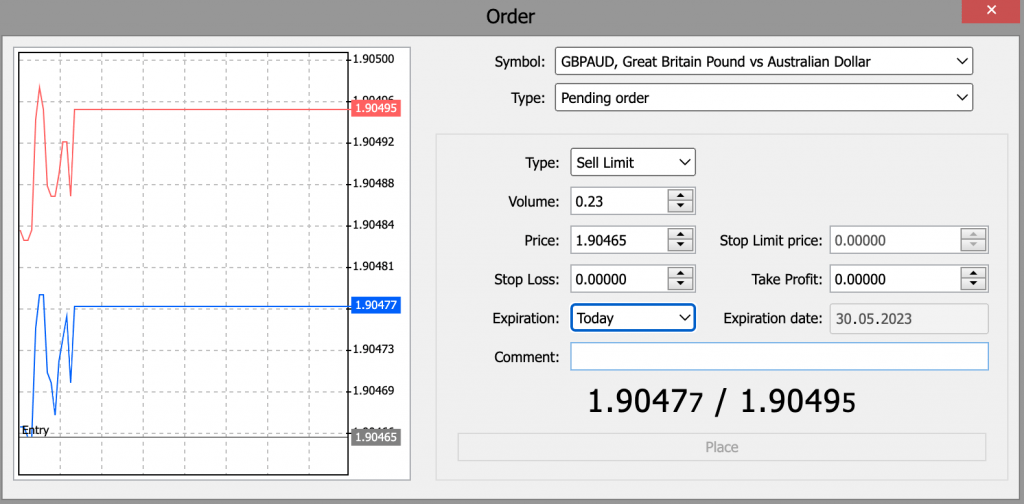

How To Place A Trade

The ‘New Order’ window is simple to use, with dropdown icons and arrow toggles indicating where information is required or choices can be made.

- Double-click or right-click on an instrument in the ‘Market Watch’ window

- Choose an order type from the first menu (market order or pending order). In this example, we will choose a pending order

- Choose the pending order type from the following dropdown menu

- Add the volume to trade

- Set a stop loss or take profit parameter using the arrow toggles (optional)

- Select an expiration style from the next menu

- Add a comment (optional)

- Execute the position

Mobile App

The broker does provide a proprietary mobile application, though we found this is only available to customers in Indonesia.

Instead, UK investors can download the MetaTrader 5 mobile app to iOS and Android (APK) devices for no fee. You can sign in using your existing Axofa login credentials and trade on the go. I like that the MT5 mobile terminal offers all the advanced functions of the desktop version including access to analysis tools and custom charting.

I find the MT5 mobile app stable, and somewhat less overwhelming than the PC version. The bottom menu makes it easy to switch between screens and the zoom/scroll functionality of the graphs is suitable to analyse price shifts from smaller displays.

Execution

Our experts found that Axofa offers both STP and ECN order execution. The Pelow account benefits from raw spreads as low as 0.0 pips thanks to order processing directly through liquidity providers. The Cent and Bimax accounts operate with straight-through processing, with no dealing desk intervention.

Leverage

As an offshore brokerage, you can trade with much higher leverage than the 1:30 imposed by leading authorities such as the FCA and CySEC.

Axofa allows you to trade with leverage up to 1:1000 meaning for every £1 investment, you can access £1,000 purchasing power. However, traders should be very cautious when gaining this kind of exposure to positions – there is a reason that such high limits are restricted in many jurisdictions.

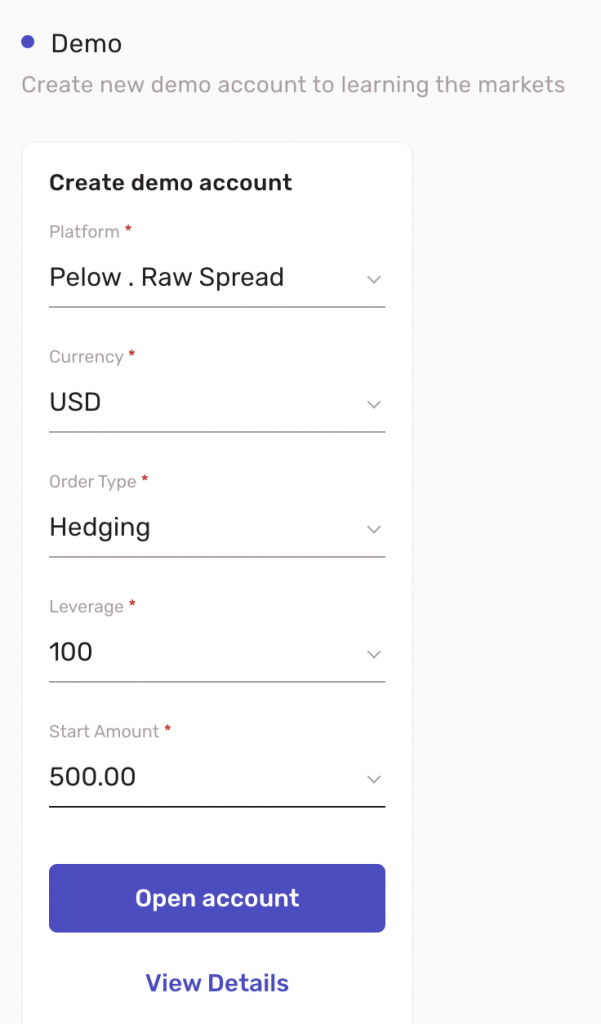

Demo Account

Our team did find a free demo account so you can practise trading with leverage up to 1:1000 and virtual money up to $1,000,000.

However, we were not offered a choice of account base currency and only the raw spread Pelow profile was available. It is concerning that you can’t practise trading with the different pricing conditions of all three accounts.

Demo Account

How To Open A Demo Account

You will need to register for an Axofa account first before you can get started with a demo profile. Follow the account registration steps above and then the below once you are logged in to the client dashboard:

- Select ‘MT5’ from the side menu

- Complete the application form under the ‘Demo’ header. You will need to choose a platform, currency, and order type (no choices) plus leverage and virtual currency value

- Click ‘Open Account’

Is Axofa Regulated?

Axofa Markets LLC is registered in the offshore jurisdiction of Saint Vincent and the Grenadines under the Financial Services Authority (SVGFSA), registration number 1976.

This authority does not regulate forex brokerage activities and therefore does not provide many of the protective measures offered by the Financial Conduct Authority. We found no evidence of suitable financial safeguarding such as segregated client funds. A customer service representative also confirmed that the brand does not provide negative balance protection.

The only customer due diligence we came across was compliance with anti-money laundering (AML). We also considered other user reviews and many refer to issues with scams and financial losses, which is concerning. We are not assured the broker is safe or operates with customer safety in mind.

Bonuses

We weren’t surprised to see a range of bonuses and promotions available at Axofa, a common feature among offshore brokers. For example, I was offered a 10% deposit bonus for each transaction. However, the broker cancels any rewards if you attempt to withdraw. This is a common trick used by scam brokers, so we recommend steering clear of any shady bonuses that discourage you from cashing out.

Extra Tools & Features

At a minimum, our team were expecting to find some basic trading guides or tutorials for beginners, however, the broker doesn’t offer any kind of educational content. If you’re looking for top-notch learning materials, forex tutorials and market analysis at IG Index and AvaTrade are excellent examples to consider.

Whilst there are also no additional trading tools, I did find a copy trading service where followers can copy positions from master traders in real-time. Followers can pause and stop copying when needed, and set limits and automatic stops for risk management.

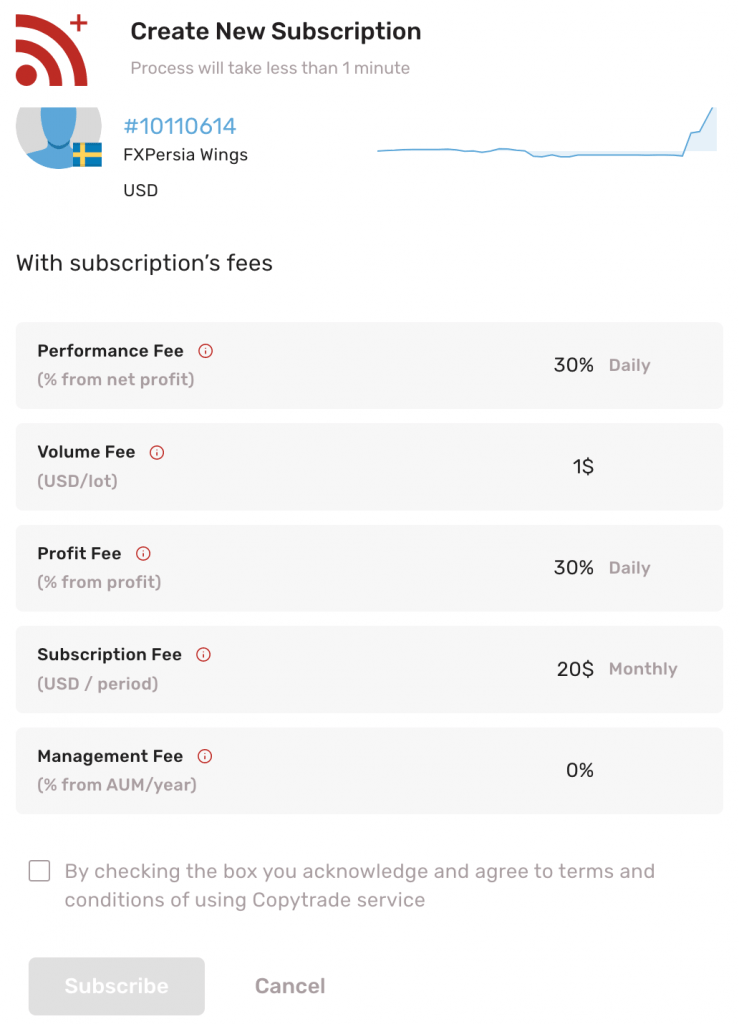

However, if you are signing up as a master, be aware that the broker charges various fees including a monthly subscription, a ‘periodic’ management fee, plus charges based on performance and volume.

Master Trader Fees

Customer Service

Axofa customer support is adequate, and available 24/5. Contact methods include a UK mobile number, email address, and live chat function.

We found the live chat response times commendable, with a human advisor available within three minutes. There is also a ‘search’ tool available in the live chat box, which is designed for self-help, though when we tried on multiple occasions, no information was obtained.

- Email – support@axofa.com

- Telephone – +447308813444

- Live Chat – Icon located bottom right of the broker’s website

Overall, with no FAQ page and very limited information on the Axofa website, our team found it difficult to source key company information. There are no step-by-step user guides, account creation support, or deposit and withdrawal help.

Company History

Axofa Markets LLC is registered in St. Vincent and the Grenadines. There is a significant lack of information available on the company and its history, which does raise concerns about legitimacy. We do know the brand is registered offshore by Saint Vincent and the Grenadines Financial Services Authority (SVGFSA).

When we researched the broker, our team found no information regarding its history, office presence, accreditations or company statistics. The website is also poorly presented with multiple spelling and grammar mistakes throughout, which is another red flag for us.

Trading Hours

Axofa trading platform is available to trade between Sunday at 10:05 pm (GMT) and Friday at 9:50 pm (GMT). Within this, trading hours will vary by instrument.

The forex market, for instance, is open 24 hours a day, from Sunday evening to Friday night. Indices on the other hand will be available to trade during their registered stock exchange opening hours. The London Stock Exchange for example is open from 8:00 am to 4:30 pm (GMT).

We were disappointed to find that the broker isn’t transparent about market closures and upcoming holiday dates.

Should You Trade With Axofa?

On the surface, Axofa appears to offer some competitive features, with a social trading platform, a decent selection of assets and a free demo account aimed at all experience levels.

However, the lack of transparency around trading conditions and pricing is alarming. When testing the services, we uncovered numerous red flags which are consistent with a scam, making it very difficult for us to recommend this brand.

FAQ

Is Axofa Legit Or A Scam?

We are not convinced that Axofa is legit. The broker is not regulated and there are limited financial protection measures in place. Other reviews are not particularly positive, indicating difficulty with profit withdrawal, and the website displays traits that are consistent with a scam broker. We would not recommend this brand.

Can I Trust Axofa?

We don’t think Axofa is a trustworthy broker. There is very limited company information available to new clients, and the brand is not transparent when it comes to trading fees and operations. We are not convinced the brokerage operates with customer safety in mind.

Does Axofa Have A Mobile App?

Axofa does have a proprietary mobile app but it is not available to UK traders. Having said that, MetaTrader 5 (MT5) does have a mobile application, providing top-tier analysis features and powerful charting functionality for iOS and Android devices.

Is Axofa Good For Beginners?

We would not recommend Axofa for beginners. Despite a demo account being offered and a low minimum deposit requirement, we were disappointed with the lack of educational content available to novice investors. This, alongside no negative balance protection and limited help on the website, does not make it a worthy contender.

Are Axofa Trading Fees Competitive?

Axofa trading fees are not competitive for accounts with STP execution. Spreads in the Bimax and Cent profiles are high, from 1.6 pips and 3 pips, respectively. The Pelow account, however, offers raw spreads from 0 pips, with a £3.50 commission per side. It’s worth noting that the brand is not transparent with specific trading fees per instrument.

Article Sources

SVGFSA List of Registered Companies

Top 3 Axofa Alternatives

These brokers are the most similar to Axofa:

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- INFINOX - Infinox is a UK-based and FCA-regulated broker that offers diverse trading products thanks to its STP and ECN account types and support for MetaTrader 4, MetaTrader 5 and a proprietary platform. Clients can also benefit from a free VPS that can support automated strategies and a social trading platform, catering to both beginner and seasoned traders.

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

Axofa Feature Comparison

| Axofa | Swissquote | INFINOX | FXPrimus | |

|---|---|---|---|---|

| Rating | 3 | 4 | 3.4 | 2.3 |

| Markets | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $1 | $1000 | £1 | $15 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SVGFSA | FCA, FINMA, DFSA, SFC | FCA, SCB, FSCA | CYSEC, MIFID, ICF, FCA, BaFin, VFSC |

| Bonus | - | - | - | - |

| Education | No | No | No | No |

| Platforms | MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 | 1:30 (UK), 1:200 (Global) | 1:1000 |

| Visit | ||||

| Review | Axofa Review |

Swissquote Review |

INFINOX Review |

FXPrimus Review |

Trading Instruments Comparison

| Axofa | Swissquote | INFINOX | FXPrimus | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | No | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | No | No |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Axofa vs Other Brokers

Compare Axofa with any other broker by selecting the other broker below.

Popular Axofa comparisons: