Vault Markets Review 2024

|

|

Vault Markets is #91 in our rankings of CFD brokers. |

| Top 3 alternatives to Vault Markets |

| Vault Markets Facts & Figures |

|---|

Vault Markets is an award-winning brokerage headquartered in Namibia. It is an accessible direct-market-access CFD broker with affordable minimum deposits, flexible funding methods and high leverage. This broker offers a very large range of forex pairs as well as commodities and indices through MetaTrader 4 or MetaTrader 5. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Demo Account | No |

| Min. Deposit | $5 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | Yes |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, commodities, indices and crypto assets. With spreads from 0 pips and generous incentives and bonus offers setting Vault Markets apart from competitors, this Namibian broker will appeal to aspiring traders. |

| Leverage | 1:1000 |

| FTSE Spread | From 1 pip |

| GBPUSD Spread | From 1 pip |

| Oil Spread | From 1 pip |

| Stocks Spread | From 1 pip |

| Forex | Trade 200 CFD forex pairs with DMA pricing and tight spreads, ultra low latency and high leverage up to 1:1000. The range of forex pairs available and pricing model are among the most attractive in the African market. |

| GBPUSD Spread | From 1 pip |

| EURUSD Spread | From 1 pip |

| GBPEUR Spread | From 1 pip |

| Assets | 200 |

| Stocks | Take positions on major brands in multiple industries, from finance to manufacturing and technology. Popular indices like the Dow Jones also offer more diverse access to popular markets. |

| Cryptocurrency | Trade five crypto pairs via leveraged CFDs. This is too small a range to satisfy dedicated crypto traders, but the digital tokens do have the advantages of ultra-fast execution and pure direct market access. |

| Coins |

|

| Spreads | From 1 pip |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Vault Markets is a CFD broker that provides investing via forex, stocks, indices, commodities, cryptocurrencies and bonds. This user review will examine Vault Markets in more detail, including its trading platform, registration process, fees, as well as minimum deposit and demo account options. Find out if you should sign up with Vault Markets.

About Vault Markets

Vault Markets is a fairly new broker that was only established in July 2021. However, it has grown fast and now has over 350,000 clients, in addition to having received multiple awards, including the Most Innovative Broker 2022 – South Africa (International Investor Awards 2022). The firm’s objective is to develop and empower African forex markets, although traders from the UK are accepted.

The owner of Vault Markets is 1st Fintech Capital (Pty) Ltd. One of its offices is in South Africa and it is regulated by South Africa’s Financial Sector Conduct Authority (FSCA).

Derivatives on the platform are issued by Karibu FX Financial Consultant Services Pty Ltd, a company that operates from Namibia but that does not hold a reputable regulatory license. In addition to offices in South Africa and Namibia, this brokerage has one in Tanzania.

Assets & Markets

Vault Markets provide a wide range of CFDs across several markets:

- Commodities – including gold and crude oil

- Forex Pairs – 200+ including majors and minors

- Bonds – including the Euro-Bund and the Euro-BTP

- Crypto Pairs – five+ including Bitcoin and Ethereum

- Indices – including the UK FTSE 100, US 30 and Nasdaq 100

- Stocks – take a long or short position on numerous established global companies

Overall, the range of instruments is competitive vs alternatives.

Leverage

When we used Vault Markets, we found the maximum leverage rate available to be a competitive 1:1000, although some account types limit leverage to 1:500.

Traders have a degree of choice on the leverage availability when they open a live account, so remember that you do not need to opt for the maximum.

Importantly, these maximum leverage ratios are high when compared with UK and European-regulated brokers.

Fees Review

Spreads vary on Vault Markets depending on the account type, though they tend to stay quite competitive. The lowest spreads are on the Zero Spread account, which starts from zero pips, as the name indicates. Spreads on other accounts generally start from 1.0 pips, which is around average.

Commissions may be applicable on the Zero Spread account. The rates depend on the lot size but traders may find a commission in the region of £50 for 0.01 lots.

Swap rates may be charged on positions held overnight, although these can be positive and represent a credit to your trading account; it depends on the position type and market conditions at the time whether swaps are positive or negative.

Our experts found that Vault Markets also has a feature called Tradebacks that allows investors to earn commission from their trades. This is a notable benefit vs alternative brokers and a good way to reduce trading fees.

Trading Platform

MetaTrader 4 (MT4) is the only desktop trading terminal offered by Vault Markets. The toolset is available for download on PC, mobile and tablet but can also be run on a web browser. MetaTrader 5 (MT5) is promised by the broker, although no timetable has yet been given for the integration of this trading platform.

Our experts found the following features on MT4:

- Copy trading

- Trading signals

- Nine timeframes

- 23 analytical objects

- 30 built-in technical indicators

- Range of market and pending orders

- Algorithmic trading using expert advisors (EAs)

The broker promises fast execution speeds, though bear in mind that scalping is not permissible.

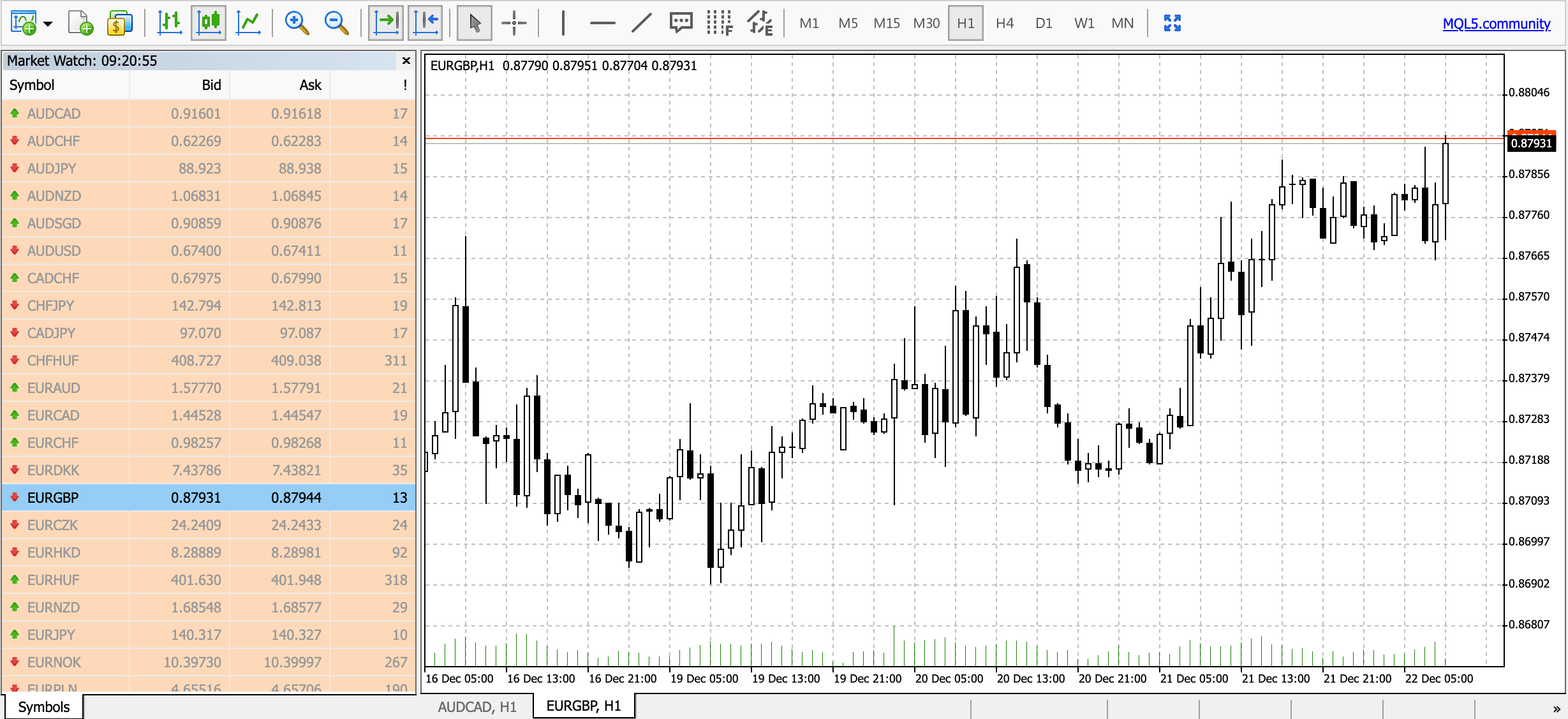

MetaTrader 4

Vault Markets Account Types

The best account type to open with Vault Markets depends on your financial circumstances and risk preference. The live accounts are detailed below.

50% Bonus Account

- MT4 platform

- 1:500 leverage

- 1.0 pip spreads

- £5 minimum deposit

- Forex, shares, indices and cryptocurrencies

100% Bonus Account

- MT4 platform

- 1:500 leverage

- 1.0 pip spreads

- £5 minimum deposit

- Forex, shares, indices and cryptocurrencies

200% Bonus Account

- MT4 platform

- 1:500 leverage

- 1.0 pip spreads

- $5 minimum deposit

- Forex, shares, indices and cryptocurrencies

Islamic/Swap-Free Account

- MT4 platform

- 1:500 leverage

- Spreads from 1.0 pip

- £100 minimum deposit

- Forex, shares, indices and cryptocurrencies

Zero Spread Account

- MT4 platform

- 1:500 leverage

- Spreads from 0.0 pips

- £100 minimum deposit

- Forex, shares, indices and cryptocurrencies

No Bonus Account

- MT4 platform

- 1:500 leverage

- £5 minimum deposit

- Spreads from 1.0 pip

- Forex, shares, indices and cryptocurrencies

USD Cent Based Account

- MT4 platform

- 1:500 leverage

- $5 minimum deposit

- Spreads from 1.0 pip

- Forex, shares, indices and cryptocurrencies

1:1000 Leverage Account

- MT4 platform

- 1:1,000 leverage

- Spreads from 1.0 pip

- £100 minimum deposit

- Forex, shares, indices and cryptocurrencies

Vault 24/7 Account

- VIX 75 and VIX 100

- £5 minimum deposit

- Forex, shares and indices

Vault Micro Account

- MT4 platform

- £10 minimum deposit

- Forex, shares and indices

Note that two types of accounts (the 50% Bonus account and the Vault 24/7 account) are not currently available but will be provided soon.

Demo Account

We were disappointed that there was not a Vault Markets demo or practice account available to open with the broker or through MT4.

This would be useful for beginners to sign up for so that they can improve their understanding of the markets using virtual funds and also to provide a forum for more experienced investors to practise new trading strategies.

How To Open A Real Account & Start Investing

1) Register For An Account

The initial registration process to create an account on Vault Markets usually takes around 30 seconds. Login details will be sent to your email address once the initial request is complete.

You will then need to complete the account registration process in the client portal, including KYC checks, which require customers to upload documents showing proof of ID, residency and a bank statement.

KYC and document upload is a prerequisite for withdrawals, although investors can deposit and trade without having completed their account verification.

2) Deposit Funds

The minimum deposit amount depends on the account type chosen. Deposits on Vault Markets can be made through the online client portal or mobile app.

As we found no details of an insurance scheme for customer deposits, we recommend making deposits in moderation and not keeping funds unnecessarily in your trading account.

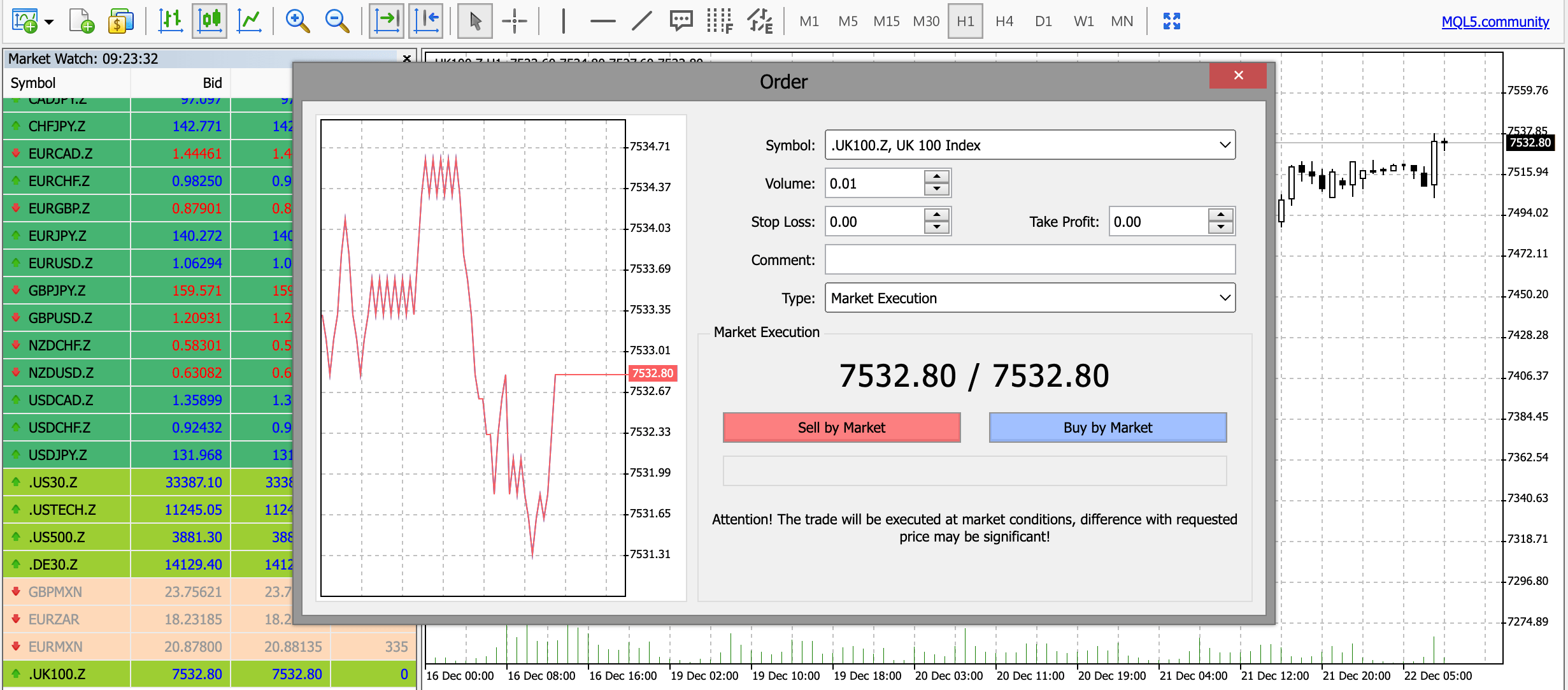

3) Open A Position

MT4 has a range of technical and fundamental analysis tools for traders on Vault Markets, including indicators, charts and real-time financial news. These tools help investors time the market, rather than simply gambling on when best to make a trade.

Investors opening and closing positions frequently on their accounts will likely use more technical analysis, whereas those with longer-term positions should incorporate a greater level of fundamental analysis into their strategies.

MT4 Order Screen

Vault Markets Mobile Trading

Vault Markets has its own mobile app, which can be downloaded from the Google Play Store for Android (APK) and the Apple App Store for iOS. It will also be available to download soon from the Huawei AppGallery. Clients can use the mobile app to deposit, withdraw, transfer funds internally and check their investing history, all whilst on the go.

In addition to the broker’s own mobile app, investors have access to MT4’s mobile app, although this is not currently available from the App Store. The mobile application includes all the main features from the browser and desktop versions, including multiple timeframes, charts and indicators.

Payment Methods

Deposits

Although there is technically no minimum deposit limit on Vault Markets, individual accounts do have their own, and sometimes different, minimum first deposits. Some of these, such as the No Bonus account, have a £5 minimum deposit, whereas others like the Zero Spread account have a minimum of £100.

The account base currencies are ZAR, USD and TZS. Unfortunately, this means UK clients may need to pay a fee to fund accounts in GBP – a drawback vs competitors.

Deposit methods:

- Ozow

- Airtel

- Paxful

- MPesa

- PayFast

- Alphapo

- Tigopesa

- Wire Transfer

- Visa/Mastercard

- Cryptocurrencies (Bitcoin and Tether)

Deposits on Vault Markets can be made from the main client/members’ area. Processing times are almost instant.

How To Withdraw From Vault Markets

Withdrawal options are limited to wire transfers.

Although withdrawals at Vault Markets are processed almost instantly, bank processing times may lengthen the withdrawal time.

While using the platform, we found that there were no minimum or maximum withdrawal limits. There is also no withdrawal fee charged by the broker.

Customer Support

In addition to a comprehensive FAQ section that provides answers to most standard queries, 24/7 customer support is available on Vault Markets (so there are no specified office hours). This can be helpful for queries like understanding how to change the leverage on your account or how to upload documents for KYC verification.

Contact Details:

- Live Chat

- Online Contact Form

- Email: help@vaultmarkets.trade

- WhatsApp/Phone Number: +27 74 024 6890

- South Africa Phone Number: +27(0) 10 449 6045

Unfortunately, there is no international contact number or helpline. Traders may need to scan a QR code to access WhatsApp.

We tested the live chat feature and received a response within minutes during normal business hours. However, one response we received was simply to contact the customer support email address instead.

Vault Markets also has several social media accounts on various sites including Twitter, Facebook, Instagram and YouTube.

Security

Vault Markets uses segregated bank accounts to separate funds belonging to clients from those belonging to the broker. Personal account security can be enhanced by enabling two-factor authentication (2FA).

Moreover, MT4 is a trusted trading platform used by investors and traders around the world. It has its own security, including advanced encryption technology to protect customer and broker data being transferred to the server.

Traders should note that there are some poor ratings of Vault Markets online, including some complaints regarding withdrawals not being processed. This is a concern and not an issue normally found with FCA-regulated brokers.

Bonuses & Promotions

The main promotions on Vault Markets are the deposit welcome bonuses linked to particular accounts. Not all accounts have them but the profiles that do have bonuses range from 50% to 200%.

Always check the terms and conditions carefully to ensure bonus funds can be easily withdrawn and to see what the maximum bonus amount is.

UK Regulation

Although 1st Fintech Capital (Pty) Ltd is regulated by the FSCA (FSP number 51478), derivatives on the Vault Markets platform are issued by Karibu FX Financial Consultant Services Pty Ltd. Our experts could not find any details of this company’s regulation.

New customers should therefore be cautious if they choose to sign up as it is likely this broker will not be subject to the same monitoring and supervision requirements as a broker regulated by the FCA.

Additional Features

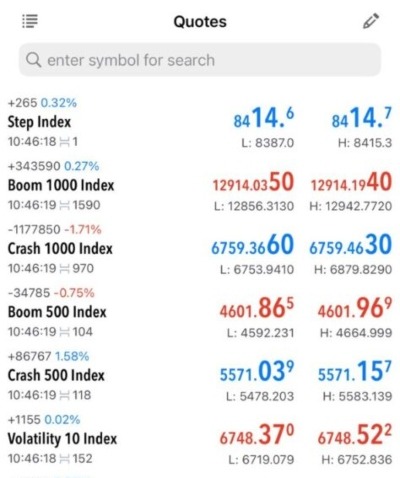

Vault 24/7 is Vault Markets’ synthetic indices feature that allows traders to speculate on markets that are unaffected by real events where the value of the indices is altered by random number generators. These can be traded 24/7.

Synthetic Indices

Examples of educational and other resources available include trading courses, webinars, free e-books and podcasts. There are also some integrated YouTube videos on the Vault Markets website that show you how to perform certain account activities, such as the withdrawal of funds. We found no economic calendar or pip calculator at this broker, which is a drawback vs alternatives.

Trading Hours

The general rule for trading hours on Vault Markets is that markets close on Friday at 23:00 (GMT+2) and open on Sunday at 23:00 (GMT+2). However, this depends on market conditions, international public holidays and the instrument being traded.

Should You Trade With Vault Markets?

Although Vault Markets is tailored more to African clients rather than UK traders, it provides a decent range of instruments with tight spreads and a low minimum deposit limit. The reliable MetaTrader 4 platform will also help you undertake the analysis necessary for sophisticated investing strategies.

However, our experts recommend that registered traders deposit funds in moderation with Vault Markets given the limited regulatory oversight. The lack of a GBP-denominated trading account may also lead to conversion fees that can be avoided by signing up with one of the alternative firms listed below.

FAQ

Is Vault Markets A Good, Safe & Legit Broker?

Vault Markets is a relatively new broker having only been established in 2021. Its derivatives issuer also appears to be unregulated and there are some poor customer reviews online. That said, the broker does offer low-cost trading as well as free deposits and withdrawals.

Is Vault Markets Regulated?

1st Fintech Capital (Pty) Ltd (the owner of Vault Markets) is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. However, there is no mention of a license held by its derivatives issuer based in Namibia. Note, the broker is not licensed by the Financial Conduct Authority (FCA) in the UK.

Does Vault Markets Have A Demo Account?

No. There is no demo account at this broker. This is a serious downside vs competitor brands.

Does Vault Markets Have NAS100?

Yes. You can trade NAS100 at Vault Markets. The UK FTSE is also available.

Who Owns Vault Markets?

1st Fintech Capital (Pty) Ltd is the owner of Vault Markets.

Does Vault Markets Have MT5?

MT5 is not currently on Vault Markets, although the platform could be available soon. Instead, clients can trade on the MT4 terminal.

What Is The Minimum Deposit For Vault Markets?

There is no official minimum deposit, although individual account types have their own minimum deposits, which are usually either R10, $5 or $100.

Does Vault Markets Have A Deposit Bonus Promotion?

This broker does have some account types that offer bonuses on deposits up to a limit. There are 50%, 100% and 200% bonus accounts.

How Long Does It Take For Withdrawals On Vault Markets?

Withdrawals are processed almost instantly and payouts are generally received by traders within a few working hours. There may be delays with withdrawals at weekends and during public holidays.

Top 3 Vault Markets Alternatives

These brokers are the most similar to Vault Markets:

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

Vault Markets Feature Comparison

| Vault Markets | IC Markets | IG Index | Pepperstone | |

|---|---|---|---|---|

| Rating | 2.5 | 4.8 | 4.4 | 4.8 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $5 | $200 | $0 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FSCA | ASIC, CySEC, FSA, CMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4 | MT4, MT5, cTrader |

| Leverage | 1:1000 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | 1:30 (Retail), 1:222 (Pro) | 1:30 (Retail), 1:500 (Pro) |

| Visit | 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

74-89 % of retail investor accounts lose money when trading CFDs |

||

| Review | Vault Markets Review |

IC Markets Review |

IG Index Review |

Pepperstone Review |

Trading Instruments Comparison

| Vault Markets | IC Markets | IG Index | Pepperstone | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Vault Markets vs Other Brokers

Compare Vault Markets with any other broker by selecting the other broker below.

Popular Vault Markets comparisons: