Scope Markets Review 2024

|

|

Scope Markets is #46 in our rankings of CFD brokers. |

| Top 3 alternatives to Scope Markets |

| Scope Markets Facts & Figures |

|---|

Scope Markets offers trading and investing in multiple spot and CFD instruments. The group of brokers is regulated in several locations, including Belize, Kenya and South Africa. Users get competitive trading conditions, a range of payment methods, strong support and can get started in a few straightforward steps. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Forex, CFDs, Stocks, Commodities, Indices, Futures |

| Demo Account | Yes |

| Min. Deposit | £50 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 lots |

| Regulated By | CMA, FSC, FSCA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | You can trade hundreds of CFDs on major asset classes including currencies, shares and futures. Spreads are not overly competitive starting at 0.9 pips, although the $50 minimum deposit and zero commissions will allow active traders to keep their costs down. |

| Leverage | 1:2000 |

| FTSE Spread | 0.4 |

| GBPUSD Spread | 1.0 |

| Oil Spread | 0.2 |

| Stocks Spread | Variable |

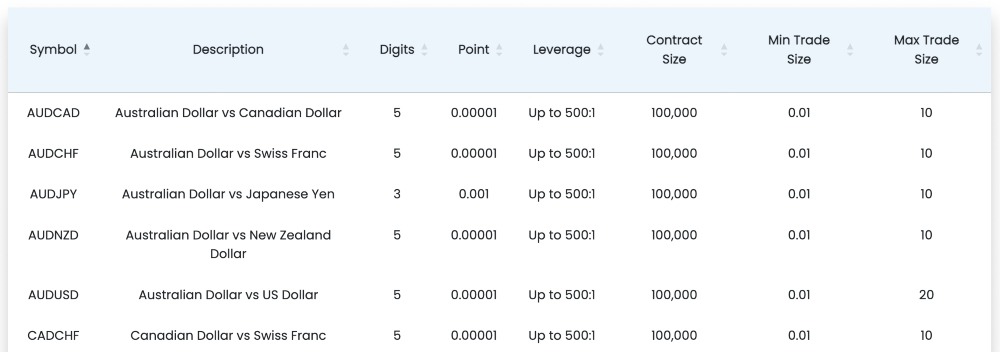

| Forex | Scope Markets offers 40+ major, minor and exotic currency pairs. Although the range is average, experienced traders can access very high leverage up to 1:2000. Additionally, the broker’s proprietary terminal delivers advanced analysis tools, including a live forex heatmap. |

| GBPUSD Spread | 1.0 |

| EURUSD Spread | 1.0 |

| GBPEUR Spread | 1.0 |

| Assets | 44 |

| Stocks | Scope Markets offers stock trading on 1500+ popular markets, as well as a decent range of cash and futures indices. Traders looking to diversify can explore some other interesting opportunities, like cannabis stocks. There are also some useful resources to help inform trading decisions, including a dividend calendar. |

| Cryptocurrency | Traders can go long or short on popular cryptos like Bitcoin, Ethereum and Ripple paired with USD. Trading is available on the MT5 platform, which offers an excellent environment for short-term crypto strategies, with 21 chart timeframes and dozens of indicators. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Scope Markets is an online broker offering multi-asset trading via the popular MT4 and MT5 platforms. The live account available gives retail and corporate investors access to competitive spreads, flexible payment options and educational resources. In this Scope Markets review, we explore the broker’s services from account types to platforms, fees, bonuses and more. Our team also share their opinion on trading with Scope Markets.

Market Access

Scope Markets is a multi-asset broker, offering a modest range of tradeable instruments across five classes:

- Indices – trade 14 indices from Europe, the US and Asia

- Precious metals – trade gold and silver

- Forex – trade 70+ forex pairs, including majors, minors and exotics

- Energies – trade natural gas, crude oil and Brent oil

- Shares – trade 50+ shares from global companies including Airbnb, Amazon and Shopify

The main shortfalls are the lack of commodity and crypto assets. Scope Markets’ list of commodities is limited – traders will find a far better selection from alternatives like CMC Markets or IG Index.

Meanwhile, clients looking to trade digital currencies such as Bitcoin, Ripple or Litecoin will need to sign up with crypto brokers.

Fees

We were disappointed to find limited information on pricing readily available, and feel it would benefit this broker to be more upfront on this point.

With that said, spreads vary according to the instrument, with an average of 0.9 pips, which is reasonable vs other brokers. There are also no commissions, so users only need to factor in spreads when trading.

On a more positive note, we rated that there are no fees for deposits or withdrawals.

Trading Account

Scope Markets merged its account types into a single option, called the ‘One Account’ – though ironically, we noticed that traders are allowed to open up to five.

The One Account offers commission-free trading on all instruments and access to both MT4 and MT5 trading platforms. We also like that you get a dedicated account manager and resources such as educational content and a signals package. 1:500 leverage is also available to all users.

The minimum deposit to open a One Account is 100, and the minimum top-up amount is 50. This is good news as it will allow those with less cash and beginners to get started without risking too much capital.

Low setup fees and a straightforward registration process also make the One Account accessible to a range of traders. However, more experienced, high-volume traders might be disappointed with such a general offering, which is less competitive than some of the more bespoke options offered by alternatives.

We were also disappointed to see that swap-free and managed portfolio accounts are not available.

How To Open A Scope Markets Account

Once you have decided to trade with Scope Markets, account set-up is straightforward:

- Register – open a Scope Markets trading account by entering your basic information

- Verify – upload personal documents to confirm your identity

- Fund – make a deposit to your live trading account

- Trade – you are ready to start trading online

Funding Methods

Our experts felt that there is room for improvement in terms of the deposit and withdrawal options available. While the broker supports popular bank cards and electronic solutions, the selection is fairly limited compared to alternatives.

- Skrill

- Neteller

- Wire Transfer

- Credit/debit card (Visa or Mastercard)

Accepted deposit methods can also be found under the ‘Deposit’ section in the client portal.

It is also possible to transfer funds between trading accounts registered under the same email address. To do so, funds must be moved to the same currency wallet. Visit the dashboard, go to ‘My Wallet’ and request an ‘Internal Transfer’.

Our team appreciated that deposits made via e-wallets or credit cards are free of charge. However, wire transfers may carry an additional charge which is up to the discretion of the bank.

The minimum withdrawal is 50, and these are usually processed within 48 hours, though bank wire or debit/credit card withdrawals may take up to five business days and international transfers can take up to eight working days.

On the downside, our experts found that Scope Markets only allows clients to make one free withdrawal per day; additional withdrawals incur a 35 fee. Although most traders will be able to get by with the one free withdrawal per day, we did find this charge to be high vs competitors.

Platforms

Scope Markets offers two reliable trading platforms, the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 and MT5 can be downloaded directly from the Scope Market website. Both trading platforms are compatible with desktop and mobile devices including Android and iOS operating systems.

We were pleased to find these widely used platforms on Scope Markets, and it was a good move by the broker to integrate MT4 in recent years.

However, it struck me that while powerful, these platforms are getting somewhat dated and are not the smoothest choice available for newer traders. I feel Scope Markets could improve on its offering with a proprietary platform or a different third-party platform that caters to less experienced clients.

MetaTrader 5

MetaTrader 4

MT4 is designed for forex trading, but it has become an extremely popular platform amongst short-term traders of numerous asset classes.

We liked that MT4 offers advanced tools for technical analysis, powerful charting and an intuitive interface, with direct market access, no dealing desk intervention and fast execution. Other key features include:

- APK

- 3 chart types

- 9 timeframes

- Historical data

- One-click trading

- 4 pending orders

- Automated trading

- 50+ technical indicators

- Multi-language interface

- Micro, mini and standard lots

MetaTrader 5

The successor of MT4 was designed to accommodate a wider range of assets and offers more advanced tools and features. Best suited to experienced traders, it is favoured for its enhanced technical analysis, custom indicators, additional timeframes and charting capabilities.

Our team particularly like that that MT5 offers:

- 6 pending orders

- 46 graphical objects

- 22 analytical objects

- 60+ technical indicators

- Access to global markets

- Agent manager for remote optimisation

- Integrated MQL forex market products for expert advisors

- Additional chart frames including M1, M2, MI3: Ghost Protocol

Demo Account

Scope Markets offers a demo account, credited with 50,000 in paper funds, and we recommend that traders make use of this feature to try before they buy. The demo account offers a realistic simulation of real market conditions without the risk of real losses.

However, I was not impressed to find that the demo account will only remain active for 14 days. Although this should be enough time to try out Scope’s services, simulator accounts are extremely useful tools for trying out new strategies and sharpening your trading skills, so we prefer brokers that offer these accounts for a longer period if not indefinitely.

Scope Markets Education

Scope Markets offers some free resources and training guides for clients, including free weekly webinars and seminars in addition to a suite of video tutorials, e-books, an economic calendar and dividends calendar, and several calculators.

Scope Markets also offers a blog. However, we were frustrated to find that this has not been updated for years – unlike the daily news updates on Scope Market’s top-ranking competitors such as Pepperstone.

Is Scope Markets Regulated In The UK?

Scope Markets is a multi-regulated broker, overseen by CySEC, CMA and the FSCA. On the downside, it is not regulated by the UK’s FCA which is a major drawback for British traders.

Scope Markets Ltd is a registered entity in Belize, registration number 145,138. Scope Markets Ltd is authorised by the Financial Services Commission of Belize with license numbers 000274/325 and 000274/324.

The limited oversight of its offshore entity means it can offer welcome bonuses, including a 50% deposit bonus up to $50,000.

Safety & Security

Platform security is robust with MT4 and MT5 platforms both offering two-factor authentication on customer login. The Scope Markets website also implements SSL (Secure Socket Layer) and payments are protected by PCI Level 1 Merchant compliant procedure.

With extra measures such as negative balance protection (offered to retail clients only), Scope Markets’ security is fairly good among online brokers.

However, our experts found some discrepancies in the information provided regarding the company itself, in terms of both the registered address and awards that the broker claims to hold.

We were also concerned to find that Scope’s website only provided limited insights into security measures and protocols. Furthermore, the company does not disclose the percentage of losses suffered by clients on its website.

With this in mind, security is a concern for our traders and we would advise clients to proceed with caution. Investors who access Scope Markets from within one of its licensed jurisdictions should also ensure they are eligible for any insurance or protection offered.

Customer Support

Reliable customer service is available for all clients 24/5, Monday – Friday. There is also a live chat feature available on the website, though this is only operational between 6:30am and 10:30pm (GMT), Monday – Friday.

We also rated that support is offered in English, Arabic, Vietnamese and Spanish, making the firm accessible to global investors.

The team can be contacted via:

- Email: customerservice@scopemarkets.com

- Phone: +44 2030 516 959

- Registered Address: 6160, Park Avenue, Buttonwood Bay, Lower Flat Office Space Front, Belize City, Belize

Company Details

Scope Markets was founded in 2007. In 2022, the company was acquired by Rostro Financials Group for an undisclosed fee. CEO and major shareholder, Jacob Plattner, remains at the helm.

Rostro operates multiple brokerage firms in addition to banking, finance and digital asset storage.

The company’s head office is located in Belize City, Belize.

Trading Times

Trading hours vary according to the asset traded, which is standard at online brokers.

Forex trading hours are Sunday 5pm – Friday 5pm. For a detailed list of trading hours for specific assets or markets, visit your MT4/MT5 account, select the instrument and then click ‘Specification’.

Note, it is not possible to trade at Scope Markets during the weekend.

Should You Invest With Scope Markets?

Scope Markets does offer access to global markets, in addition to popular trading platforms MT4 and MT5, a multilingual support hub, leveraged derivatives and competitive spreads.

However, we have some concerns regarding transparency as the broker offers limited insights into its processes and security and there are some discrepancies regarding the accuracy of the information it does provide.

There are some other highly rated options available to UK traders, so we would recommend considering alternatives.

FAQ

Is Scope Markets Legitimate Or A Scam?

Scope Markets is an established broker offering legitimate trading services to investors around the world. However, it does not hold a license with the UK’s Financial Conduct Authority (FCA), which is a key drawback for British traders.

Does Scope Markets Sponsor West Ham United?

Scope Markets is an official kit sponsor of West Ham United. The sponsorship is a multi-year deal with investment totalling 1.5m per year.

Does Scope Markets Offer A Way To Try Them?

Scope Markets offers a demo account to all prospective clients. The account is available for 14 days and is credited with 50,000. Demo accounts are a great way to try a new broker, platform or strategy, risk-free. However, we were disappointed to see that the time limit is fairly short.

Does Scope Markets Offer Good Account Conditions?

Scope Markets offers one straightforward account, though clients can open up to five live trading profiles. We liked that there are no commissions and that average spreads are reasonable at 0.9 pips. High leverage up to 1:500 is also available.

Does Scope Markets Offer Negative Balance Protection?

Yes, Scope Markets offers negative balance protection to all individual investors, but not to corporate accounts. This is reassuring as it means traders cannot lose more than the funds in their live account.

Article Sources

Top 3 Scope Markets Alternatives

These brokers are the most similar to Scope Markets:

- FXPro - Founded in 2006, FxPro is an established forex, CFD and spread betting broker offering 2100+ assets to over 2 million clients worldwide. The broker is regulated in 4 jurisdictions and offers reliable 24/5 customer support, earning it a high trust and safety score. FxPro has also picked up more than 100 industry accolades for its competitive trading conditions, including fast execution and deep liquidity.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

Scope Markets Feature Comparison

| Scope Markets | FXPro | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 4.2 | 4.4 | 4.8 | 4 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | £50 | $100 | $0 | $40 |

| Minimum Trade | 0.01 lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CMA, FSC, FSCA | FCA, CySEC, FSCA, SCB, FSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 74-89 % of retail investor accounts lose money when trading CFDs |

|||

| Review | Scope Markets Review |

FXPro Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| Scope Markets | FXPro | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | No | No | No | No |

| ETFs | Yes | No | Yes | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | Yes | No |

| Volatility Index | No | No | Yes | Yes |

Scope Markets vs Other Brokers

Compare Scope Markets with any other broker by selecting the other broker below.

Popular Scope Markets comparisons: