Ingot Brokers Review 2026

Ingot Brokers is a CFD and forex trading brokerage headquartered in Amman, Jordan. The brand operates globally with its subsidiary, Ingot Global, accepting UK clients. This 2026 review will lift the lid on the broker’s offering, from minimum deposits and accepted payment methods to leverage, account types and customer service. Find out what our expert team thought of Ingot Brokers.

Ingot Brokers offers trading in eight asset classes with 24/5 customer support and copy trading. The brokerage is not regulated by the UK’s FCA but it is registered with multiple regulators in the Asia-Pacific region, including the ASIC. On the downside, GBP is not a supported base currency and deposit options for UK traders are limited.

Company History & Overview

Ingot Brokers was founded in 2006 and operates globally through multiple entities, including Ingot Brokers Australia (PTY) Ltd, Ingot Global, and Ingot Africa. The company also has a large presence in Asia through Ingot Financial Brokerage Limited.

The multi-regulated brokerage offers a full range of instruments with user-friendly trading tools, insights into market trends and alerts, plus various account options including a MAM Pro solution.

The trading brand has also partnered with Brazilian footballer, Thiago Silva and French player, Raphael Varane as part of its recent marketing campaign encouraging clients to ‘trade with the champions!’

Markets & Instruments

Ingot Brokers offers online trading on a good selection of global markets, including UK equities and the VIX. Supported instruments include:

- Metals – Gold, Silver, Copper and Platinum, available as both futures and spot

- Energies – Brent Oil, Crude Oil, and Natural Gas, available as both futures and spot

- Agriculture – Three soft commodities (coffee, cocoa, sugar), four grain commodities (corn, wheat, soymeal, soybean)

- ETFs – A strong selection of ETFs from big names such as iShares, Vanguard, and Invesco

- Indices – Eight indices, including FTSE 100, Dow Jones 30, S&P 500, NASDAQ, DAX 40 and VIX

- Forex – Most major currency pairs, plus some minors, including AUD/CHF, CAD/JPY, and AUD/NZD

- Cryptocurrencies – The top coins, such as Bitcoin, Ethereum, Ripple, and Cardano, plus a good range of lesser-known cryptos

- Stocks – A wide selection of US, European and UK stocks and shares, including Tesla, Netflix, Apple, Rolls-Royce, Sainsburys, and other household names

Leverage

While using Ingot Brokers, our experts found that leverage varies by account. On the Standard, Standard Plus and Prime accounts, UK traders can access up to 1:30 leverage. This level can be adjusted in your Ingot Brokers portal.

Professional accounts benefit from much higher leverage up to 1:500. It is not clear what thresholds a trader must meet to qualify for the professional account, but often with these accounts, you forego many of the standard protectionist measures, such as negative balance protection. Therefore, we would advise caution when opening a professional account unless you have demonstrable experience in the field.

Ingot Brokers Platforms

Ingot Brokers provides the reliable MetaTrader 4 (MT4) and Meta Trader 5 (MT5) platforms. These are available for desktop, iOS and Android download, plus as a web trader.

MetaTrader 4 is a tried and trusted platform for forex traders. But increasingly, as traders are looking to diversify their portfolios – and brokers are offering a wider range of assets – it’s falling behind the curve. MetaTrader 5 is superseding MT4, not only for its wider range of charting capabilities but because it facilitates multi-asset trading.

MetaTrader 4

- Forex trading

- 2 market orders

- 4 pending order types

- 2 stop orders plus a trailing stop

- 9 timeframes

- 23 analytical objects

- 30 technical indicators

MetaTrader 5

- Multi-asset platform

- Advanced charting tools

- 21 timeframes

- 6 pending order types

- One-click trading

- 80 technical indicators

How To Use The Platform

- Open an account with Ingot Brokers

- Select which MetaTrader platform you would like to use

- To get started quickly, open the web trader platform, or for the full suite of features, download the desktop version

- Once you are on the platform, enter your login details and select the IngotBrokers-Server

- Use the Market Watch window to zero in on a particular asset, such as EUR/GBP

- Enable one-click trading to open positions directly from the chart

- Use the ‘New Order’ icon (white page) to enter full trade details, including order type, volume in lots, plus any risk management parameters

- Click ‘Buy’ or ‘Sell’ to confirm the trade

MetaTrader 5

Fees & Charges

Ingot Brokers does not charge a commission on most account types. Instead, there are variable spreads on each trade. Spreads start from 1 pip on the Standard, Standard Plus and Prime accounts. Prime Raw accounts are subject to a $7 commission on trades but benefit from spreads starting at 0.0.

There are other charges to be aware of on Ingot Brokers, in particular, rollover fees will be applied to any CFD positions held outside of trading times (overnight or during weekends). These fees are standard for CFD positions with most brokers.

Overall, the trading fees are competitive, especially compared to other starter accounts. The Prime Raw profile is the best option for active investors and intraday traders looking to keep costs down.

Payment Methods

Deposits

Ingot Brokers offers a solid selection of deposit methods, including cryptocurrencies. However, options are limited for UK traders as debit card deposits are not possible in GBP. This is disappointing to see as the alternative payment option, wire transfer, has a higher minimum deposit, increasing the barrier to entry.

Additionally, whilst you can deposit in GBP, wallet currencies are USD, AUD and EUR only.

Wire Transfer

- GBP deposits available

- Minimum deposit of $100 or GBP equivalent

- No maximum deposit

- Processing time is instant upon Ingot Brokers receiving the payment

Apple Pay

- $10 or equivalent minimum

- Not possible to deposit in GBP, must be USD, JOD, or ZAR

- Instant processing

Credit/Debit Card

- $10 or equivalent minimum

- Not possible to deposit in GBP, must be USD, JOD, or ZAR

- Instant processing

Cryptocurrency

- Bitcoin, Ethereum and Tether deposits are available

- $50 or equivalent minimum for BTC and ETH

- $10 minimum for USDT

- No fees on any currency

- Instant deposits for ETH and USDT

- BTC deposit time is 30 minutes

Withdrawals

Similar to deposits, the Ingot Brokers’ withdrawal methods are more suited to traders operating from Africa or America. UK traders will be disappointed to find that the only GBP method available, wire transfer, has a steep charge attached to withdrawals below $500.

There also aren’t any other options available unless you are happy to withdraw in crypto as credit/debit card and Apple Pay withdrawals are not possible.

Wire Transfer

- Available to withdraw in GBP

- Minimum $100 withdrawal

- No fees, however a charge of 25 USD applies to withdrawals lower than 500 USD or equivalent

- 1 – 5 business days processing time

Cryptocurrency

- 1 – 12 hour processing time

- $25 minimum withdrawal

- 1% fee

Cellulant

- A withdrawal method designed for making payments within Africa

- Accepts a selection of African currencies and USD. Not suitable for GBP withdrawals

Account Types

Ingot Brokers has six different account types with different features. They mostly vary by the asset class available and the stop out level, making them suitable for different strategies, such as scalping.

Standard

- Spreads from 1 pip

- $100 minimum deposit

- No commission

- Only forex and energy assets available

- 0.01 minimum lot

- 1:30 leverage

- Negative balance protection

- Hedging is permitted

- EAs are not permitted

- Stop out level 100%

- This is not a swap-free account

Standard Plus

- Spreads from 1 pip

- No commission

- $100 minimum deposit

- Most stocks, forex, and commodities available for trading

- 0.01 minimum lot

- 1:30 leverage

- Negative balance protection

- Hedging is permitted

- EAs are permitted

- Stop out level 75%

- This is not a swap-free account

Prime

- Spreads from 1 pip

- No commission

- $100 minimum deposit

- All assets including crypto, indices, ETFs, commodities, forex, stocks

- 0.01 minimum lot

- 1:30 leverage

- Negative balance protection

- Hedging is permitted

- EAs are not permitted

- Stop out level 50%

- This is not a swap-free account

Prime Raw

- Similar features to the Prime account but with 0 spreads on some trades

- Trading on forex, crypto, indices, energies, spot metals

- Stop out level of 50%

- Commission of $7 is charged on RAW accounts

Professional

- Spreads are floating

- All asset classes available including cryptos, indices, ETFs, forex, stocks

- Leverage of 1:500

- Stop out at 25%

- Swap-free

- No negative balance protection

- Minimum deposit of $100

Professional Raw

- Spreads are floating

- All asset classes available including cryptos, indices, ETFs, forex, stocks

- Leverage of 1:200

- Stop out at 25%

- Swap-free

- No negative balance protection

- Minimum deposit of $100

- Commission of $7 is charged on RAW accounts

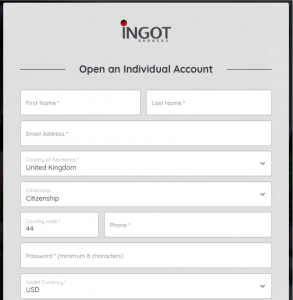

How To Register For A Real Account

- Click on the ‘Visit’ button at the top or bottom of this Ingot Brokers Review

- Fill in your details and select your wallet currency from USD, AUD or EUR. You can change this at any time through your Ingot Brokers dashboard (note UK traders may have to pay a currency conversion fee)

- Now that you have set up an account, verify your profile by adding a few more details such as your date of birth and the source of your income

- Upload ID documents using the ID-wise portal to verify your identity

- Add funds to your Ingot Brokers trading account

- Visit MetaTrader and login using the IngotBrokers-Server to get trading

How To Open A Demo Account

- Create an Ingot Brokers login the same as you would for a real account

- Navigate to the ‘Accounts’ section using the left-hand sidebar

- Click ‘+ Open a Demo Account’

Bonuses & Promos

Ingot Brokers does not provide any promotions or bonuses for joining. While this may disappoint some new traders, this is standard practice now for brokers who are regulated by legitimate regulatory authorities.

There is, however, a referral programme where you can earn money by referring friends to the platform. You will receive a commission on whatever money they spend on the platform, and there are no limits on how much you can earn. However, there are no specifics on what percentage commission is made and if there are any thresholds to be met.

UK Regulation

Ingot Brokers is regulated by the Financial Services Authority of Seychelles (FSA), Securities Dealer License number SD117. It is worth highlighting that this is not a highly-regarded regulator with fairly lax joining requirements for new members. Other entities within the global brokerage group are registered with trusted financial authorities, including the Australian Securities & Investments Commission (ASIC).

Importantly, Ingot Brokers is not licensed by the UK’s Financial Conduct Authority (FCA). Whilst many of the major protections that the FCA mandates are provided by Ingot Brokers (such as negative balance protection, limited leverage on non-professional accounts, and segregated client funds), those trading with a non-UK regulated broker do so at their own risk.

Extra Tools & Features

Ingot Brokers is fairly well-equipped with extra features. Most notable are its MAM Pro Tools and CopyTrader functions.

MAM Pro

The Ingot Brokers MAM Pro Tool is designed for money managers to allocate trades by equity, balance, lot, and a range of other cash-based rules for sub-accounts that follow you.

It is designed to work with MT4 and allows MAMs to adjust the risk factor for each sub-account to allow for different trading strategies. Plus, the ‘High Water Mark’ functionality means money managers can charge a fee for their services.

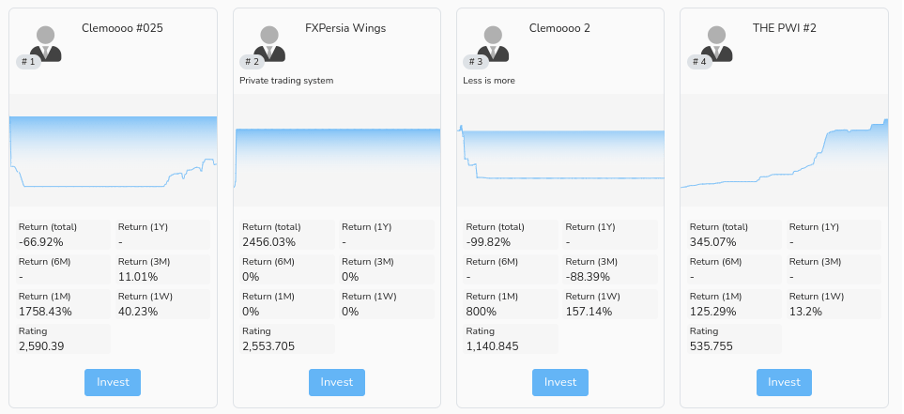

Copy Trader

On the Ingot Brokers portal, you will find a copy trading section that allows you to view other traders’ performances. From here you can select one to copy, meaning you can mirror whatever trades they make.

This can be a good option for busy traders or beginners who are looking to learn from others. However, it is not a route to guaranteed profit so assess your money management strategy before investing and ensure you stick to it.

Copy Trader Leaderboard

Education

Ingot Brokers also provides strong educational resources, with videos and tutorials to teach the basics of online trading. This is useful for beginners who need to get up-to-speed with some of the lingo. Plus, on the portal itself, there are platform tutorials for some of the most frequently asked questions. There are also basic trading calculators and currency converters, as well as a stocks heatmap and screener.

The Ingot Brokers market analysis is less impressive. While there has been an attempt to provide news updates in the past, there have not been any recent publications, making it an unreliable source of knowledge.

Customer Service

The Ingot Brokers customer service team is available 24 hours a day on weekdays only, when the markets are open. There is also a live chat function where you can receive instant support when needed.

When we used Ingot Brokers, we found customer service agents helpful and knowledgeable about the tools and products.

- For general enquiries: info@ingotbrokers.com

- For help and issues: customerservice@ingotbrokers.com

- Alternatively, call their hotline on 002484345580

Client Security

Ingot Brokers reassures clients that it keeps funds segregated to protect their wealth in the event of broker liquidation. This is an important security measure that is required of all regulated brokers and a positive indication of a secure broker.

Should You Trade With Ingot Brokers?

Ingot Brokers has many strong attributes, such as low spreads, links with MT4 and MT5, and a wide selection of assets. It also adheres to most of the recommended measures to protect traders, such as negative balance protection and segregated client funds.

However, the service is more suited to traders in Africa and the US due to its deposit and withdrawal policies that don’t support GBP in most instances. Plus, as a firm that is not regulated in the UK, investors do not benefit from the peace of mind they would with an FCA-regulated broker.

FAQ

Is Ingot Brokers Legit Or A Scam?

Ingot Brokers is a legitimate financial service brokerage offering fair and transparent trading opportunities. It is regulated by the Financial Services Authority of Seychelles (FSA), along with oversight from other trusted financial agencies, including the Australian Securities & Investments Commission (ASIC).

Is Ingot Brokers Good For Stock Investing?

Ingot Brokers offers CFDs on a good selection of stocks from the UK, EU and US. Some of the best British household names, such as J Sainsburys, BAE systems and Taylor Wimpey, are available. However, rollover fees are charged on overnight positions, so the broker is more suited to day trading than long-term investing.

Is Ingot Brokers Regulated In The UK?

Ingot Brokers is regulated by the Financial Services Authority of Seychelles (FSA). However, brokers operating in the UK and offering services to UK traders should be regulated by the Financial Conduct Authority (FCA), which Ingot Brokers is not.

Where Is Ingot Brokers Based?

Ingot Brokers is headquartered in Amman, Jordan. It is well-equipped for Asian and African traders but falls short on withdrawal methods for GBP-centred traders. We hope to see more from Ingot Brokers in the future to support UK traders and investors.

Top 3 Ingot Brokers Alternatives

These brokers are the most similar to Ingot Brokers:

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- GO Markets - Founded in 2006, GO Markets is a well-regarded CFD broker, providing various accounts, pricing models, and dependable execution for traders. Their consistent product enhancements, including MT5, TradingView, new stock CFDs, a PAMM service, and convenient local payment methods for Latin American traders, have been noteworthy.

- Vantage FX - Established in 2009, Vantage provides trading on more than 1,000 short-term CFD products to over 900,000 clients. Forex CFDs are available from 0.0 pips on the RAW account via TradingView, MT4, or MT5. Regulated by ASIC, Vantage ensures that client funds are kept in separate accounts. Traders looking to copy strategies will benefit from a wide array of social trading tools.

Ingot Brokers Feature Comparison

| Ingot Brokers | Pepperstone | GO Markets | Vantage FX | |

|---|---|---|---|---|

| Rating | 4.3 | 4.8 | 4.6 | 4.7 |

| Markets | CFDs, Commodities, Stocks, Indices, ETFs, Forex, Cryptocurrencies | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Spread betting |

| Minimum Deposit | $10 | $0 | $0 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | ASIC, FSCA, JSC, FSA, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSC, FSA | FCA, ASIC, FSCA, VFSC |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:500 (Pro) | 1:500 | 1:30 |

| Visit | 72% of retail investor accounts lose money when trading CFDs |

|||

| Review | Ingot Brokers Review |

Pepperstone Review |

GO Markets Review |

Vantage FX Review |

Trading Instruments Comparison

| Ingot Brokers | Pepperstone | GO Markets | Vantage FX | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | Yes | Yes | No | No |

| Futures | Yes | No | Yes | Yes |

| Options | No | No | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | Yes | Yes | Yes | Yes |

Ingot Brokers vs Other Brokers

Compare Ingot Brokers with any other broker by selecting the other broker below.

Popular Ingot Brokers comparisons:

|

|

Ingot Brokers is #17 in our rankings of CFD brokers. |

| Top 3 alternatives to Ingot Brokers |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Commodities, Stocks, Indices, ETFs, Forex, Cryptocurrencies |

| Demo Account | Yes |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Regulated By | ASIC, FSCA, JSC, FSA, CMA |

| Trading Platforms | MT4, MT5 |

| Leverage | 1:500 |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Card, Debit Card, Mastercard, Neteller, PayPal, Skrill, Visa, Wire Transfer |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | Yes |

| Commodities | Cocoa, Coffee, Corn, Gold, Natural Gas, Oil, Platinum, Silver, Soybeans, Sugar, Wheat |

| CFD FTSE Spread | From 0 pip |

| CFD GBPUSD Spread | From 0 pip |

| CFD Oil Spread | From 0 pip |

| CFD Stocks Spread | From 0 pip |

| GBPUSD Spread | From 0 pip |

| EURUSD Spread | From 0 pip |

| GBPEUR Spread | From 0 pip |

| Assets | 30+ |

| Crypto Coins | AAVE, ADA, ATOM, AVX, BCH, BNB, BTC, DASH, DOGE, DOT, ENJ, EOS, ETH, FTM, LNK, LTC, MATIC, SNX, SOL, WAVE, XLM, XMR, XRP, XTZ, YFI |

| Crypto Spreads | From 0 pip |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |