GoFX Review 2024

|

|

GoFX is #55 in our rankings of CFD brokers. |

| Top 3 alternatives to GoFX |

| GoFX Facts & Figures |

|---|

GoFX is an unregulated CFD and forex broker that covers instruments from currency, stock, index, commodity and crypto markets. Traders can sign up to a variety of account types with deposits as low as $1 and will trade using the popular MetaTrader 4 platform. Exceptionally high leverage up to 1:3000 is offered on the standard account, while traders with the low-spread account can access leverage up to 1:1000. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, Cryptos, CFDs on Stocks, Indices & Commodities |

| Demo Account | Yes |

| Min. Deposit | $1 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | FSA |

| MetaTrader 4 | Yes |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | Yes (via MT4) |

| Islamic Account | Yes |

| Commodities |

|

| CFDs | Trade CFDs on forex, indices, stocks, commodities and cryptocurrencies with leverage up to 1:3000. Swap-free trading is available, and all account types trade with competitive spreads and are commission-free except the Go Pro account, which charges a $7 round-turn commission. |

| Leverage | 1:3000 |

| FTSE Spread | 0.01 |

| GBPUSD Spread | 0.00001 |

| Oil Spread | 0.01 |

| Stocks Spread | Variable |

| Forex | Trade a small selection of 25 major and minor pairs. Spreads from zero on the pro account, micro-lot trading, and very high leverage make up for the limited range of currencies. The MetaTrader software is also a well-regarded platform for forex trading. |

| GBPUSD Spread | 0.00001 |

| EURUSD Spread | 0.00001 |

| GBPEUR Spread | 0.00001 |

| Assets | 28 |

| Stocks | Trade CFDs on 25 global stocks including Alibaba, Netflix and Tesla. This is a very limited selection, but traders can also make highly leveraged bets on 18 indices covering a wide range of global countries and regions including the US, Europe, Russia, China and Japan. |

| Cryptocurrency | Trade tight-spread CFDs on BTC, LTC, ETH, DOGE, ADA and XRP paired with USD. This may be too small a range to satisfy many crypto traders, but it is a comparable offering to similar brokers. |

| Coins |

|

| Spreads | 0.0001 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

GOFX is a CFD and forex broker that offers high leverage rates, low minimum deposits and an enticing loyalty program. However, the answer to whether UK traders should look to open an account with the firm is up for debate.

In this 2024 broker review, we will cover who GOFX is, what trading platforms it offers, what assets you can speculate with, any deals and promotions available and more. Find out if our experts recommend trading with GOFX.

About GOFX

GOFX was established in 2020 and is owned and operated by GOFX Limited. The firm is registered in St. Vincent and the Grenadines and licensed by the Seychelles Financial Services Authority (FSA).

The broker was formed by a team experienced in both software development and financial development. The firm offers several account types, access to a globally popular investing platform and a wide variety of tradable instruments.

Assets & Markets

While using GOFX, we found it offers six different asset classes: forex CFDs, precious metal CFDs, stock CFDs, energy CFDs, index CFDs and cryptocurrencies. While this range of asset types is good to see, the number of instruments and speculative products within each category is not high compared to some of the broker’s competitors.

- 25+ forex pairs, including GBP/USD & EUR/GBP

- 20+ stock indices, including the FTSE 100 and S&P 500

- 25+ stock CFDs, including Nike, Ferrari, Microsoft and Tesla

- Six cryptocurrency pairs, including BTC/USD, ETH/USD and DOGE/USD

- Two precious metals, two energies and five commodities, including copper, Brent crude oil and wheat

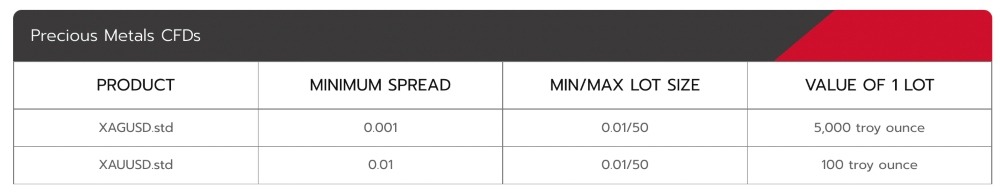

Precious Metal Trading Conditions

Margin Rates & Leverage

Each account type has a different level of available leverage. The Standard and Mini accounts reach very high leverage rates of up to 1:3000, while the Low-Spread account is limited to 1:999. The Pro and Inter accounts reach leverage rates of up to a competitive 1:100.

Leverage limits also depend on position sizes and volumes:

- Below $999 (Roughly £830) – 1:3000

- $1,000 to $1999 (Roughly £1,660) – 1:2000

- $2,000 to $9,999 (Roughly £8,280) – 1:999

- $10,000 to $19,999 (Roughly £16,570) – 1:500

- $20,000 to $49,999 (Roughly £41,420) – 1:400

- $50,000 to $199,999 (Roughly £165,690) – 1:200

- $200,000+ (Roughly £165,690+) – 1:100

Importantly, the leverage offered by GOFX is significantly higher than the margin trading opportunities provided by FCA-regulated brokers, which typically have a 1:30 cap.

Commissions & Spreads

When we used a GOFX account, we found that the spreads and commissions are dependent on the account type you have but are generally quite low vs competitors.

On the GO Standard and GO Mini accounts, spreads start from 1.0 pips. The GO Low account spreads start from 0.6 pips and the Go Pro account’s begin at 0.2 pips. The GO Inter account allows for investing with the raw market spreads, which can be as low as 0.0 pips.

Only the Pro account charges a commission, at (£3.50) per lot traded, which is fairly high.

Swap fees also apply to non-Islamic accounts and will vary based on asset price and break period.

Account Types

GOFX offers a competitive five different account types: GO Mini, GO Standard, GO Low-Spread, GO Pro and GO Inter. All accounts have a minimum deposit of $5 (roughly £4.10) and a maximum number of open positions of 1,000.

All account types can be opened as halal, Islamic profiles with no swap fees. No accounts permit hedging.

Besides the spreads and leverage rates mentioned above, each account differs in minimum and maximum trade size limits.

- GO Mini: Min 0.01 lot – Max 100 lots

- GO Standard: Min 0.01 lot – Max 50 lots

- GO Low Spread: Min 0.01 lot – Max 50 lots

- GO Pro: Min 0.1 lot – Max 50 lots

- GO Inter: Min 1 lot – Max 50 lots

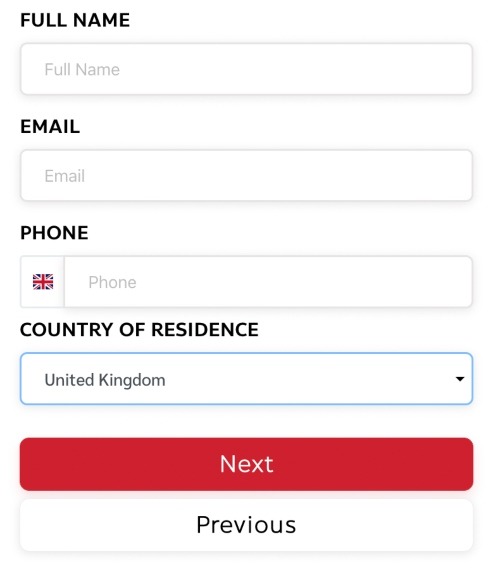

Opening A GOFX Investing Account

Opening an account is easy and simply requires you to click the Subscribe button at the top of the broker’s website. You will then need to complete the form that pops up, including your email address, phone number and name.

Once you have verified your email address, you can then login to the client portal and verify your profile.

Next, you can get started with GOFX trading by depositing some capital and opening a live account.

Account Registration

Demo Account

GOFX offers demo accounts to all clients, which is a great opportunity for traders to become accustomed to the platform and practise implementing their investing strategies without risking real capital.

Setting up a demo account is simple. Once you have opened a live account, simply go to the Open New Account section in the client portal. Choose the Demo Account option and choose the parameters you desire. The firm will then send you the details to input in MetaTrader 4 to access your paper trading profile.

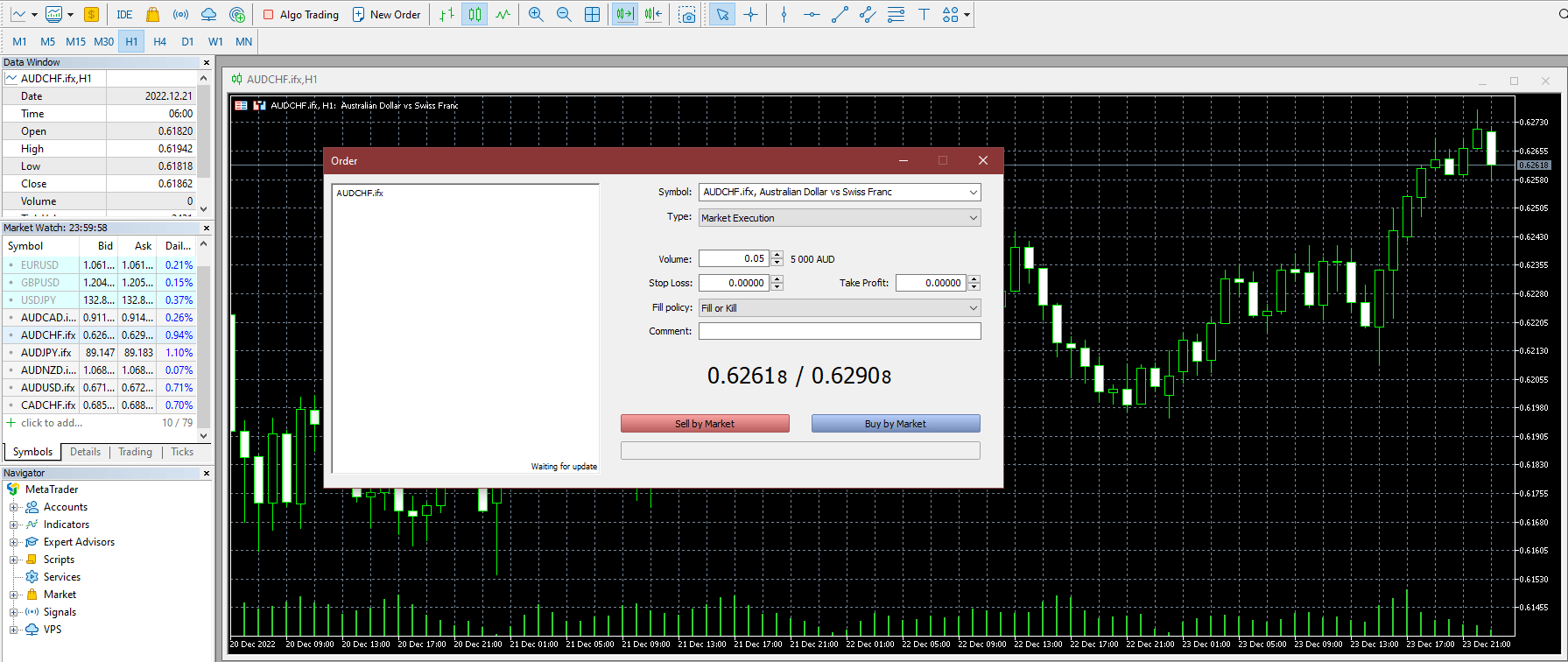

Trading Platform

GOFX offers free access to the MetaTrader 4 (MT4) platform for all its account holders. This is one of the most popular online platform technologies, known for its advanced technical analysis tools, customisability and online marketplace.

Key features include:

- Nine timeframes

- One-click trading

- 30 built-in indicators

- Layout customisation

- Range of graphical objects

- MQL4 programming language

- Online indicator and EA marketplace

- Algorithmic investing via expert advisors

MetaTrader 4

Because of MT4’s wide use, there are large amounts of free educational resources available across the web to help traders customise and tune their investing experience. This includes free code for indicators, copy trading opportunities and automated trading EAs.

Mobile App

While GOFX does not have a bespoke platform or app, the MetaTrader 4 terminal is accessible via mobile and tablet devices. Both the Android Google Play Store and Apple iOS App Store have the MetaTrader 4 application available for download.

The app offers many features available on the base MT4 desktop application. This includes charting, placing orders, using EAs and account management.

Unfortunately, other leading brokers do offer a proprietary app with additional market insights, signals and account management functionality, so GOFX falls short in the mobile trading area.

GOFX Payment Options

Payment methods for international traders are limited to bank wire transfers, debit and credit cards, Bitcoin and the Skrill e-wallet, which is quite disappointing vs alternative brokers.

While Bitcoin and Skrill can be quick, even instant, wire transfers can take up to five business days to complete.

You can also link your bank account to your GOFX account by inputting the broker’s bank details and SWIFT code.

Customer Service

GOFX boasts 24/7 customer support through its live chat and telephone service. The company also offers step-by-step guides in its help centre and clients have access to a personal account manager that can be contacted 24 hours a day.

- Telephone Number: 02-026-6559

In addition, there are several active social media channels, including Twitter, Facebook, and Instagram.

Security & Safety

GOFX offers two-factor authentication (2FA) through SMS and email when logging into the client portal.

However, our experts found no additional safety features specified, which suggests there is limited client protection.

Deals & Promotions

While using GOFX, we found the firm offers various promotions and deals to its customers. One such deal is a welcome bonus £50 upon opening a live promotion account.

Loyalty Bonus Program

The broker also offers a loyalty program for existing investors which is a key selling point. This works via a point system, where points are received directly for speculating. Four loyalty tiers are available, with prizes ranging from headphones to cars.

The requirements for each tier are:

GO Trader

- Points Required: 0 to 1,800

- Points per lot: 10

Advanced Trader

- Points Required: 1,801 to 105,000

- Points per lot: 12

Expert Trader

- Points Required: 105,001 to 540,000

- Points per lot: 15

Master Trader

- Points Required: 540,001+

- Ponts per lot: 20

UK Regulation & Licensing

GOFX is registered in Saint Vincent and the Grenadines and regulated by the FSA of Seychelles.

While it is good that the firm has regulation in place, the FSA is not as strict in protecting traders as what is expected in the UK from the FCA. UK traders should, therefore, be wary as the broker does not need to offer key safety features, such as negative balance protection, segregated accounts or compensation funds.

GOFX Additional Features

GOFX offers some articles on its webpage informing traders on how to set up and use MT4, how to deposit and withdraw capital, how to search for assets, how to count lots and much more. The firm also hosts a blog that provides up-to-date insight on several relevant topics for its clients.

However, it’s worth noting that GOFX offers a fairly narrow selection of educational resources vs other brokers, especially for beginners. As a result, aspiring traders may prefer to sign up with an alternative provider.

Trading Hours

The instruments available through GOFX have different open trading hours. For example, indices will trade when their respective markets are open, while cryptocurrencies are available 24/7.

Should You Trade With GOFX?

GOFX offers access to the MT4 platform, high leverage rates, customisable account options and a wide range of tradable assets and promotional deals. However, the lack of a strong, reputable regulatory body and client financial safety information are causes for concern.

Overall, savvy UK investors willing to risk their capital may be able to make use of the high-leverage rates and low trading fees to make the most of the less-regulated conditions.

FAQ

What Platform Does GOFX Offer?

GOFX offers the popular MetaTrader 4 platform. This trading tool gives clients the freedom to implement high-level investing strategies, incorporating a range of indicators, assets and automation options, to maximise their potential profits.

Does GOFX Offer Demo Accounts?

Yes. You can open demo paper trading accounts on the MetaTrader 4 platform. This can done from the GOFX client portal.

Is GOFX Regulated?

GOFX is licensed in Saint Vincent and the Grenadines and regulated by the Seychelles FSA. Importantly, the broker does not a hold a license with the UK’s FCA.

Does GOFX Offer A Welcome Bonus?

Yes, GOFX often has promotional deals available. These include welcome and no deposit bonus deals that provide financial incentives to opening an account with the firm.

What Assets Can You Trade With GOFX?

GOFX gives traders access to a range of forex pairs, stock CFDs, index CFDs, commodity CFDs and cryptocurrency pairs.

Top 3 GoFX Alternatives

These brokers are the most similar to GoFX:

- Admiral Markets - Admirals is a multi-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

- FP Markets - Established in 2005 in Australia, FP Markets is an ASIC- and CySEC-regulated broker boasting an extensive suite of tradable assets. Its Standard and Raw accounts cater to traders at every level, while it packs a punch in the tooling department, from the MetaTrader suite and intuitive TradingView to actionable trading ideas from Trading Central and AutoChartist.

GoFX Feature Comparison

| GoFX | Admiral Markets | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 3.4 | 3.6 | 4 | 4 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $1 | $100 | $1000 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | FSA | FCA, CySEC, ASIC, JSC, CMA | FCA, FINMA, DFSA, SFC | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | No | Yes |

| Platforms | MT4 | MT4, MT5 | MT4, MT5 | MT4, MT5, cTrader |

| Leverage | 1:3000 | 1:30 (EU), 1:500 (Global) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Visit | ||||

| Review | GoFX Review |

Admiral Markets Review |

Swissquote Review |

FP Markets Review |

Trading Instruments Comparison

| GoFX | Admiral Markets | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | No | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | Yes |

GoFX vs Other Brokers

Compare GoFX with any other broker by selecting the other broker below.

Popular GoFX comparisons: