RedMars Review 2025

Established in 2020 and headquartered in Cyprus, RedMars offers a range of CFDs including forex, stocks, indices, commodities and cryptos.

This RedMars review, conducted by UK-based traders and market specialists, examines its functionality, trustworthiness, and overall trading environment to determine how well it meets the needs of British investors.

Our Take

- RedMars is regulated by CySEC, which gives us some peace of mind – but without FCA backing, UK traders might feel a little exposed. It just doesn’t offer the same home turf reassurance.

- Spreads are sharp on the top-tier accounts – we saw 0.0 pips in some tests, which is perfect for scalping and short-term plays. Standard accounts came in around 1.2 pips, which holds up well but doesn’t blow us away.

- MT5 on RedMars feels slick and powerful. Charting is spot on, timeframes load fast, and trading operations run without hiccups.

- There’s no research or learning hub, and that leaves things feeling bare. If you’re still learning the ropes or want fresh market insights, you’ll have to look elsewhere.

- No GBP account options means you have to convert funds to EUR from the get-go, which isn’t ideal. For UK traders, that extra friction – and possible currency fees – definitely stands out.

- We miss a live chat support channel. Email responses come, but not quickly based on our tests, and in fast-moving markets, that lag could be a dealbreaker if something urgent crops up.

Is RedMars Regulated In The UK?

RedMars is regulated by the Cyprus Securities and Exchange Commission (CySEC). While CySEC is considered a relatively credible regulator within the EU, it doesn’t carry the same weight as the UK’s Financial Conduct Authority (FCA), which is known for its stricter compliance requirements and stronger consumer protection measures.

For example, under FCA rules, UK brokers must offer access to the Financial Services Compensation Scheme (FSCS), which can reimburse eligible clients up to £85,000 in the event of broker insolvency.

In contrast, CySEC’s Investor Compensation Fund (ICF) offers a lower coverage of up to €20,000.

That said, RedMars has taken some steps to enhance client safety. Client funds are kept in segregated accounts with reputable European banks, which helps protect your capital in case of company insolvency.

The broker also highlights its internal and external account reconciliation processes, aiming to ensure fund accuracy and operational transparency.

Accounts

Live Accounts

RedMars provides four account options, each designed to suit different trading styles and experience levels.

The accounts vary primarily in spreads, leverage, and funding requirements.

- Micro: Tailored for beginner traders, this commission-free account requires a minimum deposit of €250. It offers lot sizes from 0.01, average spreads of 1.2 pips and leverage up to 1:30 in line with the limits set by CySEC. This makes it most suitable for traders with smaller balances prioritising regulatory-aligned risk management.

- Standard: This commission-free account requires a minimum deposit of €250. It offers lot sizes from 1.0, average spreads of around 1.2 pips and leverage capped at 1:30.

- Prime: Targeted at more experienced or higher-volume traders, this account demands a minimum deposit of €5,000. It features zero spreads on selected instruments and offers leverage up to 1:30, but trades are subject to €7 round trip commission.

- VIP: This exclusive account is available by invitation only to clients depositing €50,000 or more. Benefits include access to a dedicated account manager, premium customer support, and international sporting and entertainment event invitations. This tier caters to high-net-worth individuals looking for a personalised service.

All account types allow for scalping, hedging, and EAs and support VPS hosting, making them compatible with automated and algorithmic trading strategies.

Opening a live account was smooth and straightforward for me. Everything from registration to verification flowed easily. The only exception is the VIP account, which can’t be opened directly online and requires activation by contacting the broker.

Demo Account

RedMars offers a demo account that allows you to practice trading without risking real money. This demo account is compatible with the MT5 platform, which you can access on PC, Mac, or mobile device.

You can explore various trading instruments with the demo account, including forex pairs like GBP/USD and EUR/USD, indices such as the FTSE 100, commodities like gold and oil, and even cryptocurrencies.

This variety enables you to test different trading strategies across various markets to fully understand the implications of leveraged trading before considering a live account.

Funding Options

Deposits

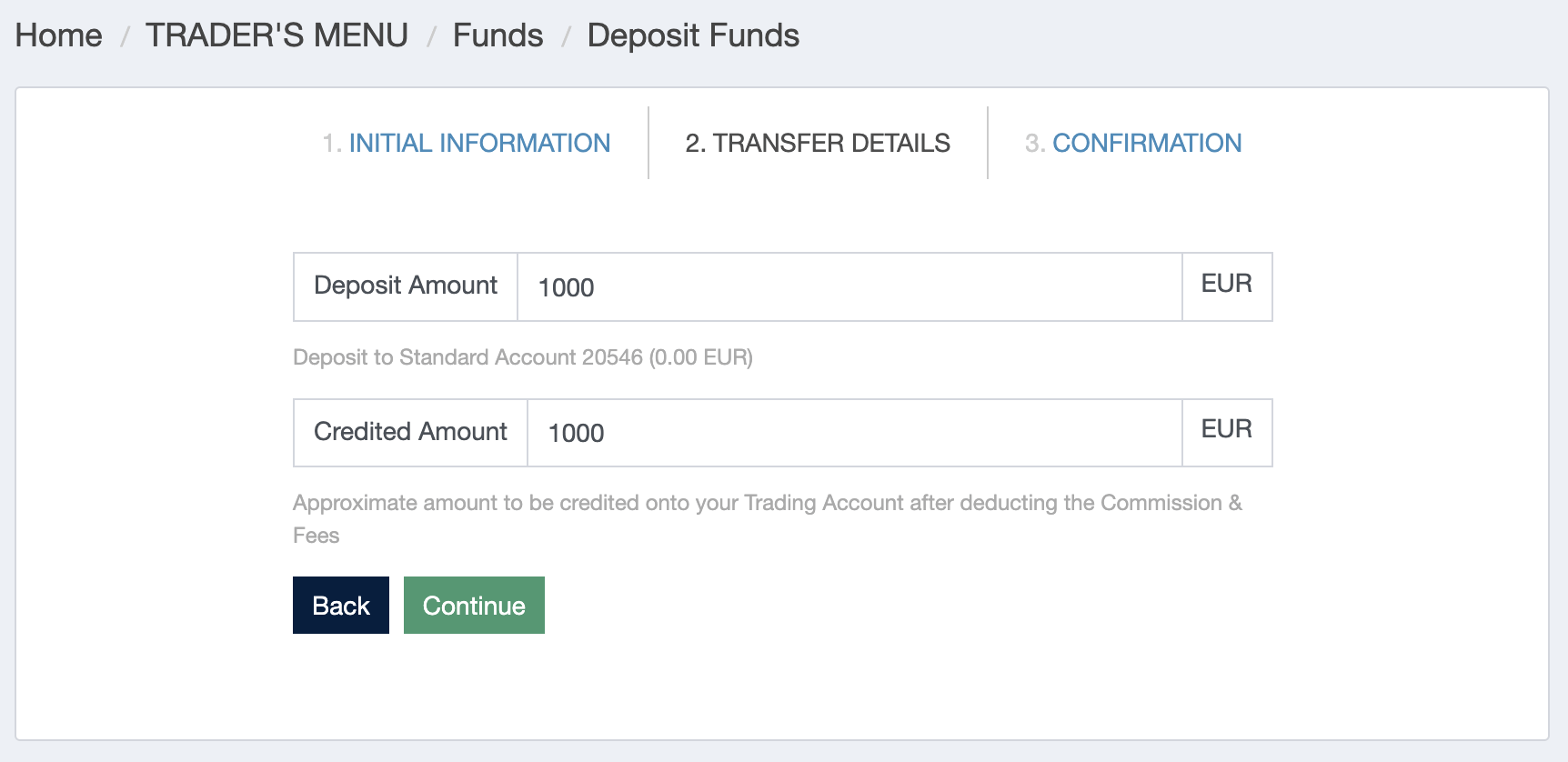

I appreciate that RedMars gives several options for funding an account.

It requires a €250 minimum deposit for its Standard account, which is higher than some FCA-regulated brokers. Minimum deposits for the Prime and VIP accounts are also relatively steep, and many brokers offer similar services with lower deposit requirements.

Compared to FCA-regulated brokers with no minimum deposit, like Axi, RedMars’ thresholds may seem limiting for traders with smaller budgets.

I usually use a standard bank transfer when moving more significant amounts, and it typically takes three to five working days for the funds to show up. For quicker access, I can deposit using my debit card or credit card, which I find more convenient.

RedMars does not support e-wallets like STICPAY or PayPal, and there’s no option to deposit via cryptocurrency.

Once money lands in my trading account, it’s instantly converted into EUR as this is the only base currency RedMars supports. As a UK trader, I would prefer having a GBP account to avoid conversion fees, but I factor that into my deposit decisions.

Withdrawals

The minimum withdrawal amount is €50 for e-wallets and bank cards and €5 for cryptocurrency withdrawals. Withdrawals must be processed using the same method as the deposit, and account verification is necessary before processing.

Compared to RedMars, many top UK brokers have lower minimum withdrawal thresholds. For instance, FP Markets has no minimum withdrawal amount, offering greater flexibility if you want to make small and frequent withdrawals.

Market Access

RedMars is mainly geared toward forex and CFD trading, offering a fairly limited range of instruments.

You can trade currency pairs, indices, commodities, stocks and cryptocurrencies, but the overall selection feels quite narrow compared to other brokers we’ve evaluated.

RedMars gives access to about 50 forex pairs, which covers most of the major and minor currencies I’d typically look to trade like GBP/USD and EUR/USD, but there are no exotic pairs like USD/ZAR or USD/MXN.

However, when I compare that to brokers like CMC Markets, which offers over 300 forex pairs, or IG and XTB with 100+ and 70+ pairs respectively, it’s clear that RedMars lags behind in terms of variety.

This strong focus on forex seems to come at the cost of other popular asset classes. You can’t trade real stocks or ETFs, and there’s no support for options trading or spread betting, something that more comprehensive UK-regulated platforms tend to offer.

Even the crypto selection is fairly basic. You can trade 13 cryptocurrencies via CFDs, but you don’t actually own the underlying coins. That’s fine for short-term speculation, but if you were looking for more diversity in digital assets, brokers like eToro, which offers access to over 110 cryptos, would be a better match.

So while RedMars covers the basics, especially for forex-focused traders, it might feel a bit restrictive if you’re after a wider range of instruments or want direct ownership of assets.

Leverage

For retail clients in the UK, the maximum leverage is capped at 1:30, which aligns with CySEC regulations aimed at protecting traders from excessive risk.

However, for those who qualify as professional clients, RedMars offers significantly higher leverage options.

For instance, professional accounts can access up to 1:500 leverage on forex trades, up to 1:100 on commodities, 1:20 on indices, 1:5 on shares, and 1:2 on cryptocurrencies.

It’s important to note that to be eligible for a professional account and access these higher leverage levels, you would need to meet at least two of the following criteria: sufficient trading activity in the last 12 months, a financial instrument portfolio exceeding €500,000, or relevant experience in the financial services sector.

Pricing

Spreads vary depending on the account type. On the Standard account, spreads for major currency pairs like EUR/USD and USD/JPY generally start from around 1.2 pips, with no added commission.

This setup works fine for longer-term strategies like swing trading, but if you’re scalping or day trading where every pip counts, you might prefer the Prime account which offers zero-pip spreads on certain currency pairs, though it does charge a commission (€3.5/lot per side commission).

One thing that caught my attention during testing was RedMars’ inactivity policy. If you leave your trading account idle for two months, a one-time €20 fee kicks in, followed by a €10 monthly fee for continued inactivity.

That said, if you have multiple accounts and keep at least one active, the broker won’t charge the inactivity fee on any of the others, which is a helpful bit of flexibility.

While RedMars’ trading fees fall within what we’d expect from the industry average, it doesn’t quite match the ultra-competitive pricing offered by some of the UK’s top-tier brokers, notably Fusion Markets.

Trading Platform

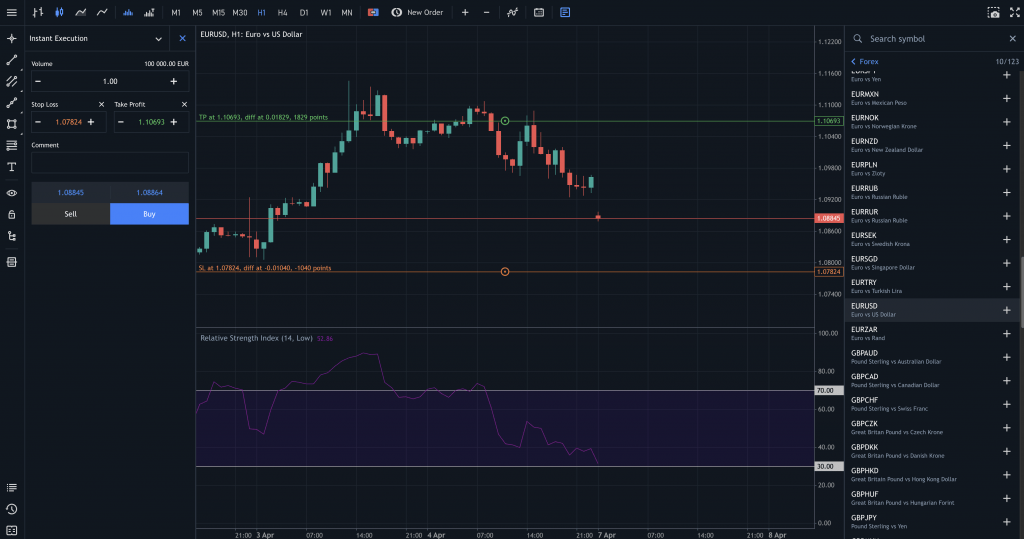

RedMars only supports MT5, and there is no access to MT4 or other widely used third-party platforms like TradingView or cTrader. Therefore, all of trading activities are confined to MT5 (desktop or mobile), which has advantages and limitations.

MT5 offers several improvements over MT4, such as access to a wider range of markets. It has more advanced charting features, with 21 timeframes and over 80 built-in technical indicators, which is helpful for detailed market analysis.

Unlike MT4, which only supports hedging, MT5 provides both netting and hedging options, offering more flexibility for experienced traders with particular trading requirements.

MT5 also supports algorithmic trading through EAs, which allows me to automate my trading strategies.

On the flip side, MT5 has some drawbacks. I find the platform’s interface complex at times, especially if you’re new to trading, and it requires some time to get used to.

Also, fewer third-party resources and support are available because the MT5 user and developer community is smaller than that of MT5.

To place a trade on MT5, I start by opening the Market Watch window, which shows me the list of available instruments. I then choose the currency pair or asset I want to trade.

After right-clicking on the selected instrument, I open the New Order window. Here, I specify the trade volume (lot size) and the order type, setting stop-loss and take-profit levels if I wish. Once everything looks good, I click Buy or Sell to execute the trade.

While MT5 offers powerful trading tools, the absence of more popular platforms like TradingView means you cannot access certain charting features and social trading options that you can find with other brokers like IC Markets.

Extra Tools

There’s a disappointing lack of research and educational resources. Unlike some brokers, such as IG, which offer access to high-quality analysis tools from well-known third-party providers like Trading Central, Autochartist and Signal Centre, RedMars doesn’t provide such tools.

This absence of research materials is a significant downside, especially for beginners. It doesn’t even provide in-house content like blogs or webinars to help traders navigate the markets.

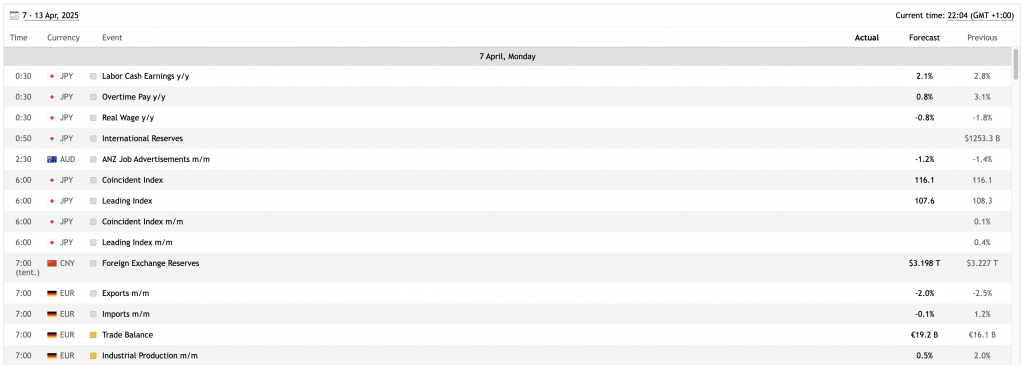

At least there’s an economic calendar in the client area, allowing me to keep track of important market events and potential trading opportunities, even if I can’t filter it to specific regions or assets.

Customer Service

RedMars’ customer support options are limited. In particular, no live chat feature is available, so you can’t get immediate assistance during trading hours.

Instead, you have to contact the broker via email or at a Cyprus-based phone number. Additionally, through the client dashboard, there’s an option to submit a support ticket under the ‘Help Desk’ section.

While these channels are available, the absence of live chat means I’ve experienced delays of up to 48 hours in getting responses, especially during peak trading times. This is a notable drawback compared to other brokers that offer more immediate support options.

Bottom Line

While RedMars offers some appealing features like tight spreads, zero-commission trading, and access to the well-regarded MT5 platform, its inexperience in the market is noticeable, especially from a UK trader’s perspective.

There’s also an apparent absence of educational content and research tools, which we’d typically expect from CySEC-regulated brokers operating in the UK.

Customer support falls short, too, especially compared to established UK brokers like Pepperstone or XTB, where response times and service quality are consistently stronger based on our tests.

Although RedMars is regulated by CySEC in the EU, it doesn’t hold an FCA license, which might be a red flag for UK traders who prioritise local oversight and FSCS protection.

RedMars feels functional but doesn’t come close to the standards set by top-tier, UK-regulated platforms.

FAQ

Can You Invest In GBP With RedMars?

The platform only supports the EUR as a base currency for trading accounts. This means you can’t hold your account balance in GBP, which is inconvenient.

You can still deposit funds in GBP, but they’ll be converted to EUR, which might incur additional fees or result in exchange rate differences.

If you’re specifically looking for accounts based in GBP, platforms like Plus500 or ActivTrades might be a more suitable choice.

Is RedMars Safe For UK Traders?

RedMars is a moderately safe choice. It is regulated within the EU and has standard fund segregation practices.

However, if you want maximum protection and oversight, you should consider an FCA-regulated broker with a longer track record and higher compensation scheme limits.

Does RedMars Offer A Mobile Trading App?

RedMars supports MT5, which is available on desktop and as a mobile app on iOS and Android. This allows you to access real-time market data and advanced charting tools and execute trades directly from your smartphone or tablet.

While RedMars doesn’t offer a proprietary mobile app, the MT5 mobile application provides a comprehensive trading experience. It supports various trading instruments and includes technical analysis tools and push notifications for price alerts.

Can You Invest In Cryptocurrency With RedMars In The UK?

You can invest in cryptocurrency through RedMars, but only via CFDs and not by owning digital coins.

This means you’re speculating on the price movements of cryptocurrencies like Bitcoin, Ethereum, and others without owning the underlying asset.

RedMars offers around 13 crypto CFDs, a limited selection compared to platforms like eToro, which provides access to over 100 cryptocurrencies.

Article Sources

Top 3 RedMars Alternatives

These brokers are the most similar to RedMars:

- Swissquote - Founded in 1996, Swissquote is a prominent Swiss bank and broker, providing online trading opportunities for an impressive portfolio of three million products, including forex, CFDs, futures, options, and bonds. Renowned for its reliability, Swissquote has earned a solid reputation through pioneering trading solutions. It was the first bank to introduce cryptocurrency trading in 2017, and has since expanded its offerings to include fractional shares and the Invest Easy service.

- Pepperstone - Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

- FP Markets - Founded in 2005 in Australia, FP Markets is a broker regulated by both ASIC and CySEC. It offers a wide range of tradable assets and provides Standard and Raw accounts suitable for traders of all levels. The platform excels in tools, featuring the MetaTrader suite, user-friendly TradingView, and practical insights from Trading Central and AutoChartist.

RedMars Feature Comparison

| RedMars | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| Rating | 3.8 | 4 | 4.8 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto (only Pro clients), Spread Betting | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Minimum Deposit | €250 | $1,000 | $0 | $40 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | CySEC, AFM | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | ASIC, CySEC, FSA, CMA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5 | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Leverage | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) | 1:30 (UK), 1:500 (Global) |

| Visit | 75.1% of retail investor accounts lose money when trading CFDs |

|||

| Review | RedMars Review |

Swissquote Review |

Pepperstone Review |

FP Markets Review |

Trading Instruments Comparison

| RedMars | Swissquote | Pepperstone | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | Yes | Yes | Yes |

RedMars vs Other Brokers

Compare RedMars with any other broker by selecting the other broker below.

|

|

RedMars is #21 in our rankings of CFD brokers. |

| Top 3 alternatives to RedMars |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Cryptos |

| Demo Account | Yes |

| Minimum Deposit | €250 |

| Minimum Trade | 0.01 Lots |

| Regulated By | CySEC, AFM |

| Trading Platforms | MT5 |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Mobile Apps | iOS & Android |

| iOS App Rating | |

| Android App Rating | |

| Payment Methods | Credit Cards, Debit Card, FasaPay, Klarna, Mastercard, Neteller, PayPal, Skrill, STICPAY, Trustly, Visa, Wire Transfer |

| Copy Trading | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Islamic Account | No |

| Commodities | Gold, Natural Gas, Oil, Palladium, Platinum, Silver |

| CFD FTSE Spread | 15 |

| CFD GBPUSD Spread | 0.7 |

| CFD Oil Spread | 15 |

| CFD Stocks Spread | Variable |

| GBPUSD Spread | 0.7 |

| EURUSD Spread | 0.7 |

| GBPEUR Spread | 1.1 |

| Assets | 50+ |

| Crypto Coins | BCH, BTC, DOT, DSH, EOS, ETH, LTC, NEO, QTM, XLM, XMR, XRP, ZEC |

| Crypto Spreads | 65 |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |