Forex Demo Accounts

Forex demo accounts are a safe and convenient way to practise online trading. The best paper trading accounts will replicate the conditions of a real-money account with access to platform features and live pricing. In this guide, we cover how FX demo accounts work and how to get the most out of simulated profiles. We have also compiled a list of the top forex demo accounts in 2026.

Best Forex Demo Accounts UK

-

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

In our recent tests, Pepperstone’s demo reflected live spreads—EUR/USD averaged 0.1–0.3 pips with Razor accounts. Execution proved swift, with little slippage and over 1,000 assets available. The interface precisely mimicked the real trading environment. No personal information was needed, offering a 30-day trial with up to $50,000 virtual funds.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist -

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

In our assessments, XTB’s demo accurately replicated its live xStation 5 platform, featuring over 5,000 assets like forex, indices, commodities, stocks, and crypto. Execution was rapid through CEC liquidity, with EUR/USD spreads starting at approximately 0.6 pips and minimal slippage. Setup required only an email, provided a $100,000 virtual balance, and the demo had no expiration.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

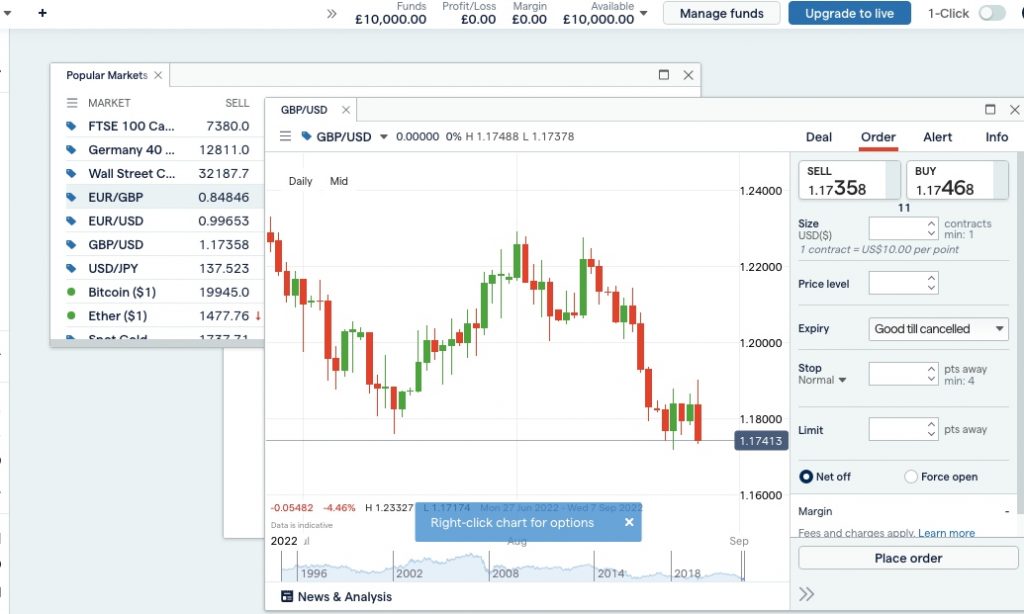

In our assessment, IG's demo account provided a $10,000 virtual fund. Execution was dependable with minimal slippage, and real-time market data was accessible. There is no time restriction. Setup required just an email, and users can replenish their virtual funds anytime. The platform is available via MT4, ProRealTime, L2 Dealer, and WebTrader. IG Academy also offered superb educational resources.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

Using Interactive Brokers' demo mirrored the live TWS platform, featuring global market access and advanced order types. Execution speed felt genuine, although fast-moving assets experienced slight slippage. Basic details were needed for setup. With a virtual balance of $1M, paper trading started post-account approval.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Vantage provides over 55 currency pairs, exceeding the industry norm, giving traders ample opportunities. With a robust liquidity pool, forex spreads start at 0.0 pips on the ECN account, often beating other options. Additionally, there are no commissions, deposit fees, or hidden charges.

In our tests, Vantage's demo provided real-market ECN conditions through MT4/MT5/cTrader. EUR/USD spreads were between 0.0 and 0.2 pips, with a $3 round-trip commission. Execution was fast with minimal slippage. Setup required just an email, offered up to $500K in virtual funds, and never expired—ideal for realistic strategy development.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.0 0.5 Total Assets FCA Regulated Platforms 55+ Yes ProTrader, MT4, MT5, TradingView, DupliTrade -

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

While testing FOREX.com's demo account, we accessed over 80 currency pairs alongside crypto, commodities, and indices. Execution speed during trades was reliable, with EUR/USD spreads averaging 1.2 pips on standard accounts, closely mirroring live conditions. No personal information was required, and the $50,000 demo lasted for 30 days.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView -

Eightcap provides over 50 currency pairs, matching the industry norm but falling short of leaders like CMC Markets, which offers more than 300. Nonetheless, Eightcap distinguishes itself with institutional-quality spreads starting from 0.0 pips on major pairs such as EUR/USD. The broker's competitively low commissions at $3.50 per side further enhance its appeal. Eightcap also equips traders with comprehensive forex data, including essential fundamentals, bullish and bearish signals, and a calendar monitoring significant foreign exchange market events.

In our tests, Eightcap's demo account matched actual trading conditions with live pricing and execution. Accessible via MT4, MT5, and TradingView, it offers over 1,000 instruments like forex, indices, commodities, stocks, and crypto. Setup merely required an email, offering a $5,000,000 virtual balance for 30 days, extendable on request. Perfect for both novice and experienced traders seeking realistic practice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.1 0.0 0.1 Total Assets FCA Regulated Platforms 50+ Yes MT4, MT5, TradingView

Safety Comparison

Compare how safe the Forex Demo Accounts are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Forex Demo Accounts support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Forex Demo Accounts at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Forex Demo Accounts good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Forex Demo Accounts offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Forex Demo Accounts.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| Vantage FX | |||||||||

| Forex.com | |||||||||

| Eightcap |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- Over the years, Pepperstone has consistently garnered recognition from DayTrading.com’s annual awards. Recently, it was honoured as the 'Best Overall Broker' in 2025 and was the 'Best Forex Broker' runner-up the same year.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB offers a superb array of educational resources, such as training videos and articles, embedded within the platform to assist traders of all experience levels.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- Trading fees are competitive, with average EUR/USD spreads of about 1 pip. However, they are not as low as the most affordable brokers, such as IC Markets. Additionally, an inactivity fee applies after a year.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

- IBKR consistently offers unparalleled access to global equities, with thousands of shares available across over 100 market centres in 24 countries, including the recently added Saudi Stock Exchange.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

- Vantage upholds a high trust score through its solid reputation, backed by premier regulation from the FCA and ASIC.

- Opening a live account is both straightforward and swift, requiring under 5 minutes to complete.

Cons

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

- It's unfortunate that some clients must register with the offshore firm, which provides reduced regulatory safeguards.

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

Cons

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

How Does A Forex Demo Account Work?

Forex demo trading accounts came to light in the early 2000s, following an explosion in the online investment landscape facilitated by high-speed internet services.

Paper trading profiles essentially simulate real market conditions. They are offered by online brokers to give prospective users insights into how their trading platforms, tools and products work. The aim is to recreate the experience of live forex trading.

Pre-determined or flexible virtual balances are provided so clients don’t have to practise with personal capital. The top apps and platforms offer an unlimited virtual balance with no expiry. With that said, some paper trading profiles are only available for a set period, for example, 30 days.

Ultimately, paper trading accounts offer a safe space to practise investing, learn platform features or test a new forex strategy without risking real cash. Popular with beginners, in particular, many of the best brokers in the UK offer a free forex demo trading account.

Pepperstone forex demo account

Differences Between Demo Accounts & Live Accounts

There are some key differences between forex demo trading accounts and real-money profiles:

- Execution – In a demo account environment, investors do not have to contend with broker liquidity and volume differentials. In a live forex account, trades must be ‘filled’, which can lead to delays in fast-moving, highly volatile markets. However, trades made in a simulated environment are normally executed instantly.

- Fees – Forex demo accounts are free. There is no minimum deposit requirement or charge to use platform features, including advanced charting, technical indicators or news feeds.

- Pricing – A demo feed may be based on a live feed, however there may be delays in the reflection of prevailing market prices. These can range from a few seconds to several minutes.

Pros Of Forex Demo Account

- Risk-Free – Forex trading demo accounts are a great way to practise a new strategy or make risky decisions without the possibility of losing real money.

- Learn – Opening a forex practice account essentially provides access to free training. Alongside a demo account, the top brokers also provide educational content and resources such as tutorials, webinars and online glossaries,

- Practise – Learn how to open and close forex trades, plus use risk management tools like stop-loss and take-profit orders. Demo accounts also offer a good opportunity to test strategies on more volatile, exotic forex pairs.

- Manage Emotions – Being rewarded with a hypothetical profit can build confidence. Experiencing failure can also finesse tighter risk management strategies when it comes to live forex trading.

Cons Of Forex Demo Accounts

- Access To Features – Some forex exchanges do not provide retail traders with access to all trading platforms, tools or apps in the demo account setting. This can include access to historical pricing, advanced charting tools or third-party strategy bots.

- Unrealistic Expectations – The experience and results when trading on a demo account don’t always accurately reflect the real-money trading environment. An unlimited bankroll and no slippage can give a false sense of confidence.

- Emotional Disconnect – The comfort of trading forex currency pairs in a virtual environment does not allow you to experience the psychological emotions of trading with your own money. It is easy to become overconfident and take greater risks when your personal funds aren’t on the line.

How To Compare Forex Demo Accounts

Free Services

Most UK brokers offer completely free forex demo accounts. Nevertheless, look out for brokerages that require funding to a live account before being able to access paper trading services.

IG and FXCM are examples of brokers with demo profiles available at no cost.

Educational Content

Some platforms provide access to free educational resources alongside their demo account. This is particularly useful for forex beginners.

Admiral Markets, for example, offers a forex 101 online trading course that can be used alongside its demo account. The free course is separated into nine modules, with access to professional guidance, glossaries and integrated tutorial support.

Time Limit

The best forex demo trading accounts will have no time limit or expiry. This means you can always return to the paper trading environment to test or refine a new strategy or investing system.

City Index provides a free demo account service. Retail traders can trial advanced features including TradingView charts, Trading Central analysis and more. However, a 12-week time limit applies which may deter some beginners.

Competitions

Some brokers also offer forex demo contests and competitions. Online tournaments usually require participants to generate the most profit with virtual funds.

As well as a great way to test your skills against other traders, some platforms and apps offer real cash prizes with capital that can be used in the real-money environment.

Note, rules, terms and conditions, plus eligibility vary by broker and contest.

Platforms & Apps

The best forex demo accounts provide access to leading trading platforms and apps. Whether it’s a proprietary terminal or the industry-established MetaTrader 4 (MT4) and MetaTrader 5 (MT5), check user-friendly and reliable trading applications are available.

Design, functionality and ease of use will differ between terminals. The MT4 forex demo account, for example, facilitates copy trading via signals and automated strategies through Expert Advisors (EAs).

It is also worth looking for mobile-compatible forex trading apps. This means you can extend your practice sessions while on the go.

Forex trading demo accounts are becoming increasingly popular on mobile devices thanks to the integration of intuitive designs, consolidated charting and slick navigation features. Simply check for iPhone (iOS) and Android (APK) compatibility.

The Best Forex Demo Accounts For UK Investors

We have compared some of the top forex demo trading accounts for UK investors based on our detailed reviews:

- EasyMarkets – The EasyMarkets forex demo account is free to download and is available on MT4 and the broker’s proprietary terminal. Investors can test out intuitive features such as Deal Cancellation and Freeze Rate across all 103 currency pairs. The broker also has a comprehensive education platform – Learn Centre. Here, traders can access articles, videos and ebooks with topics including risk management, forex trading strategies and investing psychology.

- IG – Develop your trading skills on one of the top forex demo accounts for beginners. Practise trading with £10,000 in virtual funds, gain exclusive access to educational content with the IG academy and test strategies risk-free via the mobile app. Practise accounts are available on MT4 or the proprietary IG platform. The broker is also authorised and regulated by the Financial Conduct Authority (FCA).

- Pepperstone – A free forex demo account profile with trading opportunities on 80+ currency pairs. Practise profiles can be opened on the MT4, MT5 or cTrader platforms. UK investors can access up to £500,000 in virtual funds. The only downside is the time limit of 30 days. Complete the online application form on the broker’s site with your name, email address and phone number to get started.

IG forex demo account

Getting The Most Out Of Your Forex Demo Account

Below are some top tips to get the most out of your forex demo account from the first login:

Create A Plan

The first step is to develop a trading strategy that you can replicate in a live forex trading account. While you may be trialling a demo account as a complete beginner, it is still worth having the basics planned out from the first sign-in.

Your plan could include the currency pairs you are interested in trading, the time of day that you will be dealing and the strategy you intend to use to inform entries and exits.

Create Goals

Create a checklist of objectives you will meet before switching to a real-money account.

Examples of goals could include executing 25 trades, achieving three months of profitable trading, or making 20% of your initial virtual balance back.

Log Results

A log or journal can be used to document successes and failures. This can help you pinpoint errors and improve trading strategies and systems. It is also good practice to get into before you start trading forex with real money.

Bottom Line On Forex Demo Accounts

The best forex demo accounts for beginners and novice investors will provide access to live trading conditions. Look out for the terms and sign-up requirements, including the size of the virtual bankroll and any expiry period. Also check for free registration and compatibility with a downloadable mobile app.

Use our list of the best forex demo accounts in 2026 to get started.

FAQs

What Is A Forex Demo Account?

A forex demo trading account is a virtual investing profile offered by online brokers. The aim is to recreate the experience of ‘live’ trading but with virtual funds. This means users can place trades, practise strategies or learn platform features in a risk-free environment.

Are Forex Demo Accounts Accurate?

The majority of forex demo accounts offered by the top UK brokers fairly accurately mimic ‘live’ conditions. This means providing real-time pricing that reflects current market conditions, including volume and volatility.

Which Brokers Offer A Free Forex Demo Account On MT4?

Some of the best brokers that offer unlimited access to a forex demo account on the MT4 platform include IG and EasyMarkets. Pepperstone does provide a free demo profile, however, access is restricted after 30 days.

What Should I Consider When Comparing Demo FX Accounts Online?

Before you open a forex demo trading account, decide what you want to achieve from your practice profile. Do you want to test a new strategy, learn how to trade on charts, or trial risk management alerts and tools? Also look at the size of the virtual balance provided and any time limits.

Are Forex Demo Accounts Rigged?

No – forex demo accounts are not rigged and the majority of profiles mirror real trading conditions. With that said, paper trading profiles do not always take into account slippage, requotes and the psychological pressures that come with live forex trading.