Forex Live Trading

Forex live trading allows you to access real-time charts and signals using the many platforms on the market, including MetaTrader 4 (MT4). UK investors can also utilise other tools and third-party resources to boost their knowledge, such as a live trading room or mobile app.

If you want to start online forex trading on live charts, read on to learn more about some of the top strategies and analysis techniques.

Live Forex Brokers In The UK

-

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist -

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Vantage provides over 55 currency pairs, exceeding the industry norm, giving traders ample opportunities. With a robust liquidity pool, forex spreads start at 0.0 pips on the ECN account, often beating other options. Additionally, there are no commissions, deposit fees, or hidden charges.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.5 0.0 0.5 Total Assets FCA Regulated Platforms 55+ Yes ProTrader, MT4, MT5, TradingView, DupliTrade -

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView -

Eightcap provides over 50 currency pairs, matching the industry norm but falling short of leaders like CMC Markets, which offers more than 300. Nonetheless, Eightcap distinguishes itself with institutional-quality spreads starting from 0.0 pips on major pairs such as EUR/USD. The broker's competitively low commissions at $3.50 per side further enhance its appeal. Eightcap also equips traders with comprehensive forex data, including essential fundamentals, bullish and bearish signals, and a calendar monitoring significant foreign exchange market events.

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.1 0.0 0.1 Total Assets FCA Regulated Platforms 50+ Yes MT4, MT5, TradingView

Safety Comparison

Compare how safe the Forex Live Trading are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Vantage FX | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Forex Live Trading support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Vantage FX | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Forex Live Trading at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Vantage FX | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ | ||

| Eightcap | iOS & Android | ✘ |

Beginners Comparison

Are the Forex Live Trading good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Vantage FX | ✔ | $50 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots | ||

| Eightcap | ✔ | £100 | 0.01 Lots |

Advanced Trading Comparison

Do the Forex Live Trading offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Vantage FX | Myfxbook AutoTrade, Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✘ | ✘ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Forex Live Trading.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Interactive Brokers | |||||||||

| Vantage FX | |||||||||

| Forex.com | |||||||||

| Eightcap |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone offers rapid execution speeds of approximately 30ms, enabling swift order processing and execution, making it ideal for traders.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- The xStation platform stands out with its user-friendly design and intuitive tools, such as adaptable news feeds, sentiment heatmaps, and a trader calculator. These features streamline the learning process for new traders.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

Cons

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- The research tools at XTB are commendable but have the potential to excel further. Enhancing them with access to top-tier third-party services like Autochartist, Trading Central, and TipRanks would significantly elevate their offering.

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- IG imposes a monthly inactivity fee of $12 after two years, discouraging occasional traders.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- IBKR offers an economical environment for traders, featuring low commissions, narrow spreads, and a clear fee structure.

Cons

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

Our Take On Vantage FX

"Vantage is an ideal choice for CFD traders looking for a well-regulated broker with access to the dependable MetaTrader platforms. With a swift sign-up process and a minimum deposit of $50, starting trading is simple and fast."

Pros

- With a minimal deposit requirement of just $50 and no funding fees, this broker stands out as an excellent option for novice traders.

- The trading software suite is outstanding, featuring the acclaimed MT4 and MT5 platforms.

- ECN accounts offer competitive terms, featuring spreads starting at 0.0 pips and a commission of $1.50 per trade side.

Cons

- Based on tests, average execution speeds of 100ms to 250ms are slower compared to other options.

- To access optimal trading conditions, a substantial deposit of $10,000 is required. This includes a commission of $1.50 per transaction per side.

- Regrettably, cryptocurrencies are accessible solely to clients in Australia.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- The in-house Web Trader remains a top-tier platform for budding traders, featuring an elegant design and more than 80 technical indicators for market analysis.

Cons

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

Introduction To Forex Live Trading

Live forex trading involves using real-time services for the intraday and long-term trading of the financial markets. Traders typically have 24/7 access to a live stream of data, with the ability to execute various strategies and analysis techniques.

Live trading in forex markets also involves using tools, resources and educational content which can supplement investing platforms. Such services are offered by brokerages, which act as intermediaries between traders and the interbank system.

As such, a brokerage will buy and sell FX assets for a commission and often make their money through the difference in live bid and ask prices. Live forex brokers also ideally offer rapid trade execution, an essential feature of effective trading.

Platforms & Apps

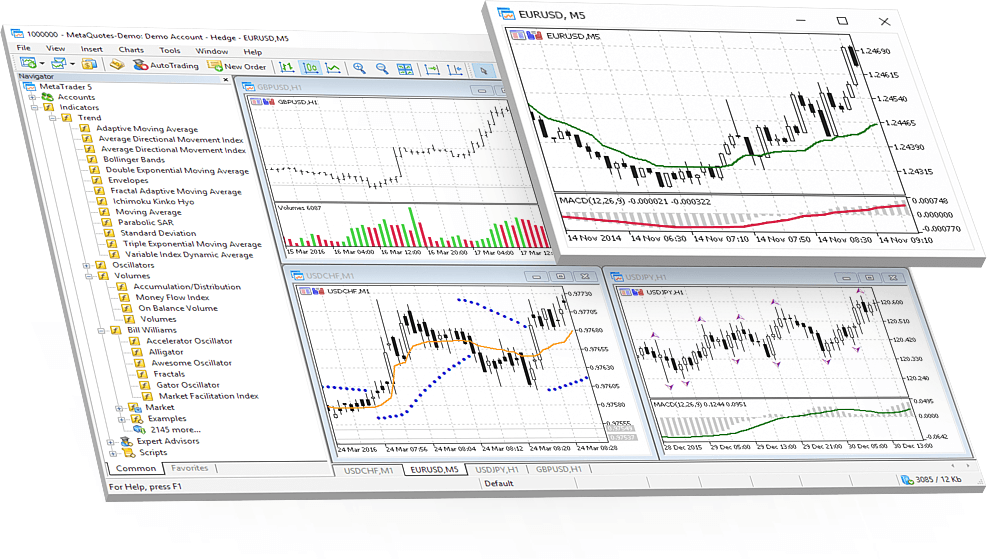

If you want to start live forex trading today, you will need a robust and reliable platform. The most popular platforms offered by forex brokers include the MetaTrader suite (MT4 or MT5).

The platforms include advanced forex trading features where you can analyse price data using technical indicators and charting tools, all on one live screen. Note that the trading times available within the platform are based on the broker’s server timezone, so make sure you choose wisely.

Some platforms also offer automated trading using robots, or expert advisors (EAs), which are programmed to execute currency trading at optimum market conditions. A forex live trading robot can be an excellent tool for any investor, though finding one that works best for you may take some trial and error.

It’s also worth looking out for brokers who offer their services via a live forex trading mobile app. The MetaTrader suite is typically available for download onto most smart devices, but some brokers such as Forex.com, have also developed their own proprietary apps.

Live Forex Trading Accounts

When you sign up to a live forex broker, they will usually offer several trading account types, catering to both beginners and experienced traders. Some accounts focus on offering tight spreads and low commissions, whilst others offer additional features.

Most account types require a minimum deposit, though some are free. Live accounts also typically require ID verification during the registration process, which can be lengthy.

A good forex broker will also offer a free trading simulator or live demo account, which are much quicker to open. More importantly, demo accounts are a useful tool for traders who want to test out the trading platform in real-time conditions, without risking any real money.

For guidance on how to open a live forex trading account with your broker, simply head to their website and follow the account registration instructions.

Forex Live Trading Analysis

To analyse prices and predict future trends, it’s important to understand the different forex analysis techniques involved.

Technical Analysis

Technical analysis involves studying historical forex price data to determine the probability of future price movements. This is achieved by using technical indicators and graphical objects, which are designed to identify live trading patterns on a range of charts and timeframes.

Live price quotes are usually presented on candlestick graphs, which indicate the entry and exit points in the market. These points represent upwards and downwards trends (bullish and bearish signals) which are usually red or green.

Technical studies are free to use and are included in your trading platform, though the range of indicators offered varies from broker to broker. Some of the most popular technical studies used by traders include Bollinger Bands, moving averages and Fibonacci curves.

Fundamental Analysis

Fundamental analysis involves looking at economic, social and political factors that could affect daily currency prices. This strategy is based on the idea that live forex prices will respond positively if a country’s economic outlook is strong.

For this kind of analysis, forex traders use various resources such as daily trading reports and live news headlines. Therefore, although fundamental analysis doesn’t involve looking online at forex trading data and live charts, it does require a good understanding of macroeconomics and geopolitics.

Using a combination of forex news data, technical analysis and other trading tools will create a strong formula for effective trading, though perfecting your techniques will take time. Note also that whilst most technical analysis tools and charts are usually free with your platform, other third-party tools may come at a cost.

Strategies

There are numerous live forex trading strategies that you can employ to enhance your skills and discipline. Forex trading strategies help to uncover live entry signals in the market, taking into account position sizing and risk management. However, not every winning forex trading strategy is easy to acquire and it will take practice to implement them effectively.

A lot of live forex trading strategies are based on whether you are operating within a short time frame or a longer time frame. Here are some examples:

- Scalping – This short-term style of trading only holds trades for a few minutes, whereby the investor aims to skim a few pips of profit before exiting the trade. The MetaTrader package offers excellent indicators for scalping strategies.

- Daily charts – Compared to strategies with tighter time frames, daily charts offer more reliable signals and require navigating the larger intraday swings in the market.

- 1-hour Strategy – By using the 60-minute time frame, traders can, for example, take advantage of the Moving Average Convergence Divergence (MACD) indicator, which map out average hourly trends. Other techniques suit varying live forex trading hours.

Education & Tools

With forex live trading, there are many tools, groups and resources available at your disposal to enhance your trading experience and skills. Most brokers offer forex training resources, for example, in the form of live day trading webinars, tutorials, contests and videos.

You can also find various forex live tips, news, courses and advice on blogs or downloadable newsletters. It’s also worth looking out for any networking features like a live community chat or forum where traders share their best trade ideas.

If you’re looking for other third-party tools, some forex traders sign up to a live trading room which allows you to interact and share ideas. Education can also be offered in the form of talks or training sessions, where traders can watch live forex day trading strategies in action, such as scalping. There are also live forex trade calls where experienced pros discuss market news.

However, forex traders should be cautious if considering signing up to live trading rooms, as they are not always free and some website are scams. Make sure to thoroughly check online reviews and look out for any notable red flags.

Final Word On Forex Live Trading

If you’re thinking about live forex trading today, you should now have a good understanding of what a brokerage can offer you in terms of tools and resources. It’s important to consider what trading platform will be available to you, which will impact your overall experience. Traders should always utilise any demo accounts on offer, before you go ahead and sign up to a live forex trading account.

FAQ

What Is Live Forex Trading?

Trading forex live means using online services which facilitate real-time data analysis and forex education. Intraday and long-term traders will trade forex live using various types of analysis and strategies.

Where Can I Trade Forex Live?

You can trade forex live at online brokerages, where you will get access to FX platforms or apps, training resources and occasionally, other third-party tools. You will need to sign up for a demo or live account to use the broker’s services.

How Do I Trade Forex Live?

Live forex traders analyse forex charts and graphs using technical indicators, automated trading, signals and other tools to help them predict future price action. This can be done through a forex trading platform, such as MetaTrader 4.

How Do I Analyse Live Forex Prices?

Most forex traders employ various day trading strategies to analyse live rates on different time frames. These allow you to follow previous trends in order to map out the probability of future trends. The 1-minute time frame, for example, is often used for forex scalping.

What Is A Live Forex Trading Room?

A forex trading room allows traders to interact with each other online, to share trade ideas and advice. Trading rooms often come with online chat rooms or forums and will grant access to training resources.