Best Forex Trading Apps 2026

We’ve identified the best forex trading apps for UK investors, featuring user-friendly designs, mobile-optimised features, and an excellent selection of currency pairs like GBP/USD with low fees.

List of Best Forex Trading Apps

-

Pepperstone shines with top-tier integration with MT4, MT5, cTrader, and TradingView, ideal for traders using these major platforms. They offer stable mobile trading, boosted by Pepperstone's rapid execution speeds and extensive asset variety. It recently achieved second place in DayTrading.com's 2025 'Best Trading App' award.

Pepperstone provides forex spreads on the EUR/USD averaging just 0.12 pips with their Razor account. This is highly competitive. Their extensive portfolio includes over 100 currency pairs, which exceeds what most rivals offer. Furthermore, Pepperstone stands out by offering three unique currency indices: USDX, EURX, and JPYX, which are rare on other platforms. They have been recognised with our 'Best Forex Broker' award twice.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.4 0.1 0.4 Total Assets FCA Regulated Platforms 100+ Yes Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist -

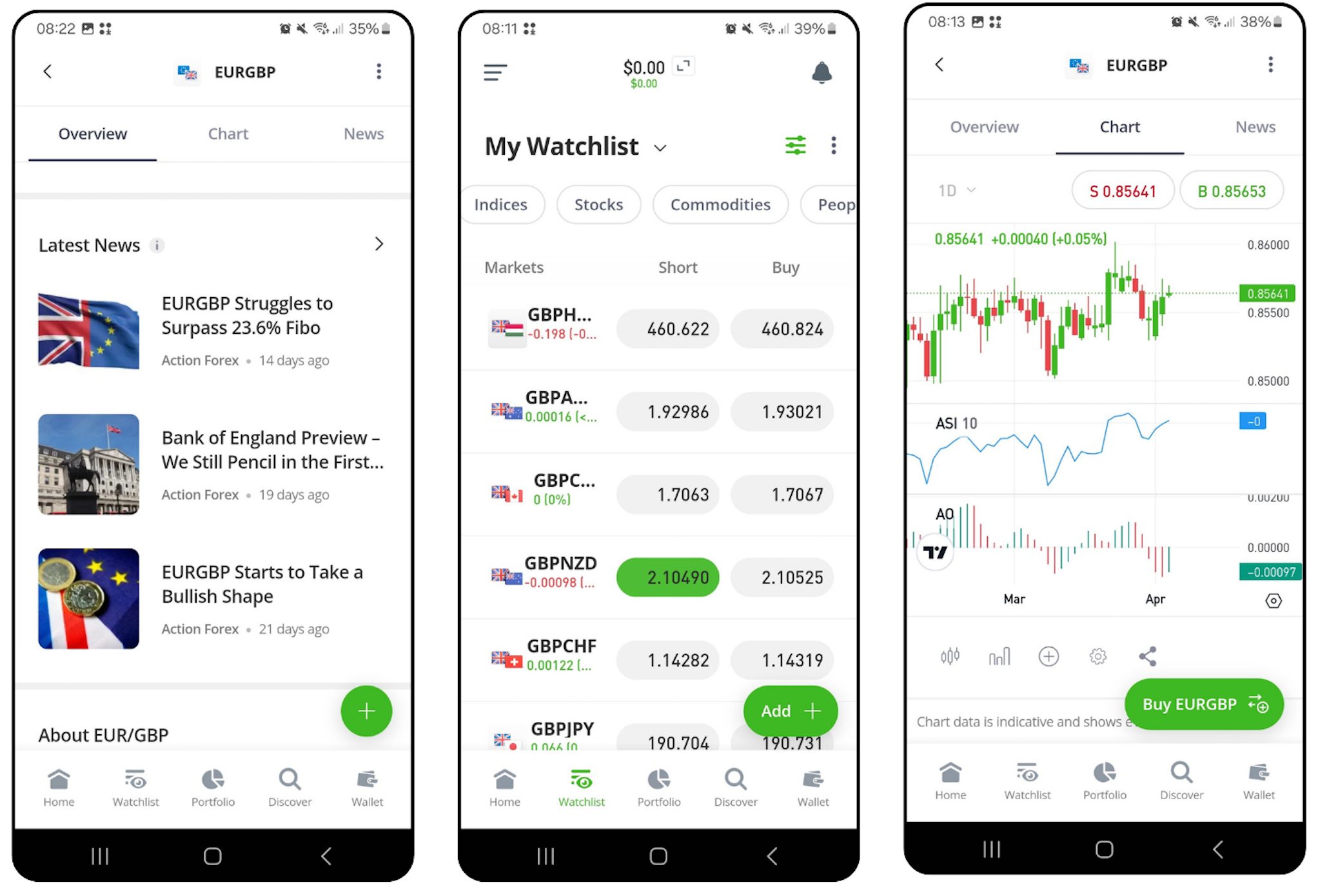

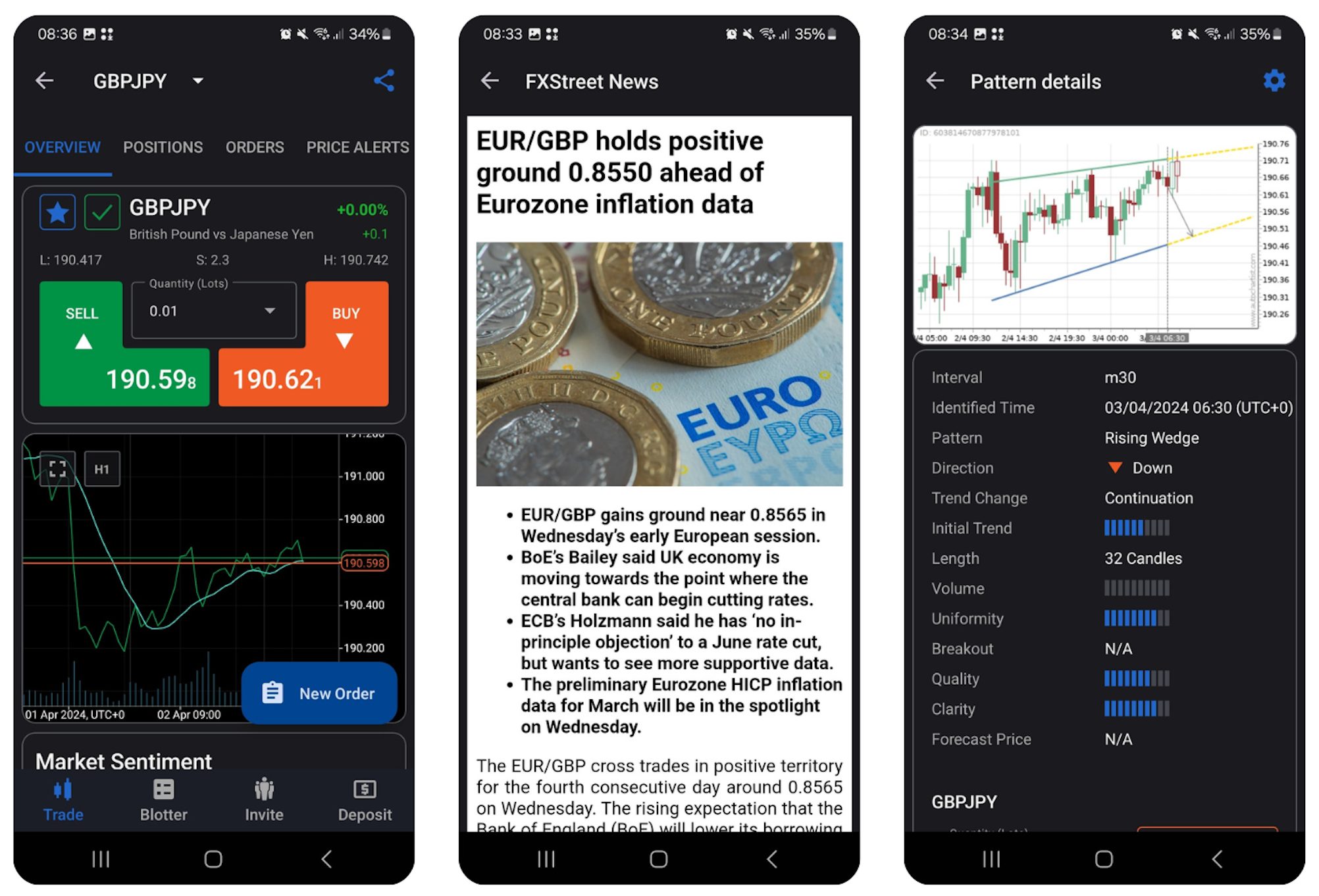

Each year, XTB's app impresses with its sleek design and clear interface. It's fast, responsive, and full of practical features like integrated sentiment data, market news, economic calendars, and educational content. The intuitive order panel below the chart simplifies trade execution, including take profit and stop loss settings.

XTB offers over 60 currency pairs with competitive spreads, averaging 1 pip on major pairs. The xStation platform is user-friendly, featuring over 30 indicators in its charting package and a variety of order types, supporting diverse trading strategies and risk management.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.4 1.0 1.4 Total Assets FCA Regulated Platforms 70+ Yes xStation -

IG provides an excellent trading app. As a mobile trading pioneer, it has evolved over the years into a top-tier app. Expect swift responses, an intuitive interface, comprehensive charting, and dependable performance. Additionally, it includes guaranteed stops, a crucial risk management feature absent in many apps we've evaluated.

IG provides an extensive selection of over 80 currency pairs through its own web platform, mobile app, or MetaTrader 4. For advanced charting and forex analysis, the ProRealTime software is available. Testing shows forex spreads are competitive, beginning at 0.1 pips on major pairs such as EUR/USD.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.9 0.8 0.9 Total Assets FCA Regulated Platforms 80+ Yes Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime -

Trade Nation provides more than 30 popular forex pairs with variable spreads. Traders can choose between a user-friendly proprietary platform and MetaTrader 4. Real-time forex market updates and insights are available through 'Smart News'.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread Variable Variable Variable Total Assets FCA Regulated Platforms 33 Yes TN Trader, MT4 -

The IBKR Mobile app, for iOS and Android, transforms your phone into a robust portal to access your IBKR accounts. It allows users to monitor portfolios, execute trades, view real-time quotes and charts, and manage account activities seamlessly. With its intuitive design, the app is particularly user-friendly for novices, offering a simpler experience compared to the advanced TWS platform.

IBKR offers a vast range of over 100 forex pairs, including major, minor, and exotic currencies, outstripping most competitors except CMC Markets. Trading is available across multiple platforms with institutional-grade spreads beginning at 0.1 pips. There are also 20 sophisticated order types, such as brackets, scale, and one-cancels-all (OCA) orders, enhancing trading strategies.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value 0.08-0.20 bps x trade value Total Assets FCA Regulated Platforms 100+ Yes Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower -

Eightcap offers MT4, MT5, and TradingView apps, being the sole FCA-regulated broker with TradingView, ideal for mobile traders seeking advanced charting. Although MetaTrader's design feels dated, its numerous technical indicators, drawing tools, diverse chart styles, and simple horizontal overlays are impressive. Push notifications and an active social network on TradingView are beneficial for traders, with Eightcap providing guidance videos on linking TradingView to iOS and Android.

Eightcap provides over 50 currency pairs, matching the industry norm but falling short of leaders like CMC Markets, which offers more than 300. Nonetheless, Eightcap distinguishes itself with institutional-quality spreads starting from 0.0 pips on major pairs such as EUR/USD. The broker's competitively low commissions at $3.50 per side further enhance its appeal. Eightcap also equips traders with comprehensive forex data, including essential fundamentals, bullish and bearish signals, and a calendar monitoring significant foreign exchange market events.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread 0.1 0.0 0.1 Total Assets FCA Regulated Platforms 50+ Yes MT4, MT5, TradingView -

Alongside the MT4 and Web Trader platforms, the FOREX.com app provides comprehensive trading features in a user-friendly, compact package. With integrated news, analysis, and real-time alerts, it excels on mobile. It surpasses MT4 in mobile charting, offering over 80 indicators and 11 chart types, alongside a more streamlined design.

FOREX.com remains a leading FX broker, providing 80 currency pairs with highly competitive fees. EUR/USD spreads can reach as low as 0.0, with a $7 commission per $100k, making it a standout choice.

iOS App Rating

Android App Rating

GBPUSD Spread EURUSD Spread GBPEUR Spread 1.3 1.2 1.4 Total Assets FCA Regulated Platforms 84 Yes WebTrader, Mobile, MT4, MT5, TradingView

Safety Comparison

Compare how safe the Best Forex Trading Apps 2026 are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Forex Trading Apps 2026 support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Forex Trading Apps 2026 at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Forex Trading Apps 2026 good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Forex Trading Apps 2026 offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Forex Trading Apps 2026.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- Pepperstone presents itself as an economical choice for traders, offering spreads as low as 0.0 in its Razor account. The Active Trader programme provides rebates up to 30% on indices and commodities, plus $3 per lot on forex.

- The award-winning customer support can be accessed through phone, email, or live chat. During tests, response times have consistently been under 5 minutes.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

- XTB offers a diverse array of instruments, including CFDs on shares, indices, ETFs, commodities, forex, crypto, real shares, real ETFs, and share dealing, along with newly introduced Investment Plans. This allows XTB to serve both short-term traders and long-term investors efficiently.

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

Cons

- It is frustrating that XTB products do not allow traders to modify the default leverage level. Manually adjusting leverage can greatly reduce risk in forex and CFD trading.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- The ProRealTime advanced charting platform remains free, provided traders meet modest monthly activity requirements.

- The IG app provides an excellent mobile trading experience with an intuitive design, earning it the Runner Up position in our 'Best Trading App' award.

Cons

- Based on tests, stock and CFD spreads remain less competitive than the lowest-cost brokers, such as CMC Markets.

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- Access a comprehensive selection of investments through leveraged CFDs, enabling both long and short strategies.

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Beginners benefit from a modest initial deposit.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- The new IBKR Desktop platform combines the top features of TWS with customised tools such as Option Lattice and MultiSort Screeners, providing an impressive trading experience for traders of all skill levels.

- Interactive Brokers has been awarded Best US Broker for 2025 by DayTrading.com. This accolade highlights its dedication to traders in the US, offering exceptionally low margin rates and access to global markets at minimal expense.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

- The learning curve for TWS is quite steep, making it tough for novice traders to navigate and grasp all its features. In contrast, Plus500's web platform is far more accessible for those new to trading.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2021, Eightcap enhanced its lineup, now providing an extensive range of cryptocurrency CFDs. It offers crypto/fiat and crypto/crypto pairs, along with crypto indices for comprehensive market exposure.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- The demo account is available for 30 days, after which it requires a request for extension. This is less convenient than XM's offering, which provides an unlimited demo mode.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

Cons

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

What Is A Good Forex Trading App

We’ve been following the trend towards mobile forex trading in recent years, and drawing on our industry observations and hands-on tests, look for several qualities in an app:

Enjoyable To Use With A User-Friendly Design

Trading currencies from your mobile should be intuitive. We’ve selected apps based on the interface design and how quickly we feel forex traders will get the hang of the platform.

We tested the findability of key features, like locating GBP currency pairs, placing trades, navigating integrated research, and reviewing account information.

Increasingly, proprietary mobile platforms are doing well in this area, as we’ve seen a shift in focus across the industry to prioritising mobile user experience over desktop software.

This has been driven by the likes of eToro, which is leading the way with its app that caters to aspiring traders, sporting a unique and uncluttered mobile interface with currencies available through the ‘Discover’ button in the bottom menu.

eToro Forex App

In comparison, while feature-rich, forex brokers only offering the classic MetaTrader 4 or MetaTrader 5 apps, such as ForexChief, feel like they are primarily designed for advanced traders, missing the needs of newer investors with an increasingly outdated look and feel.

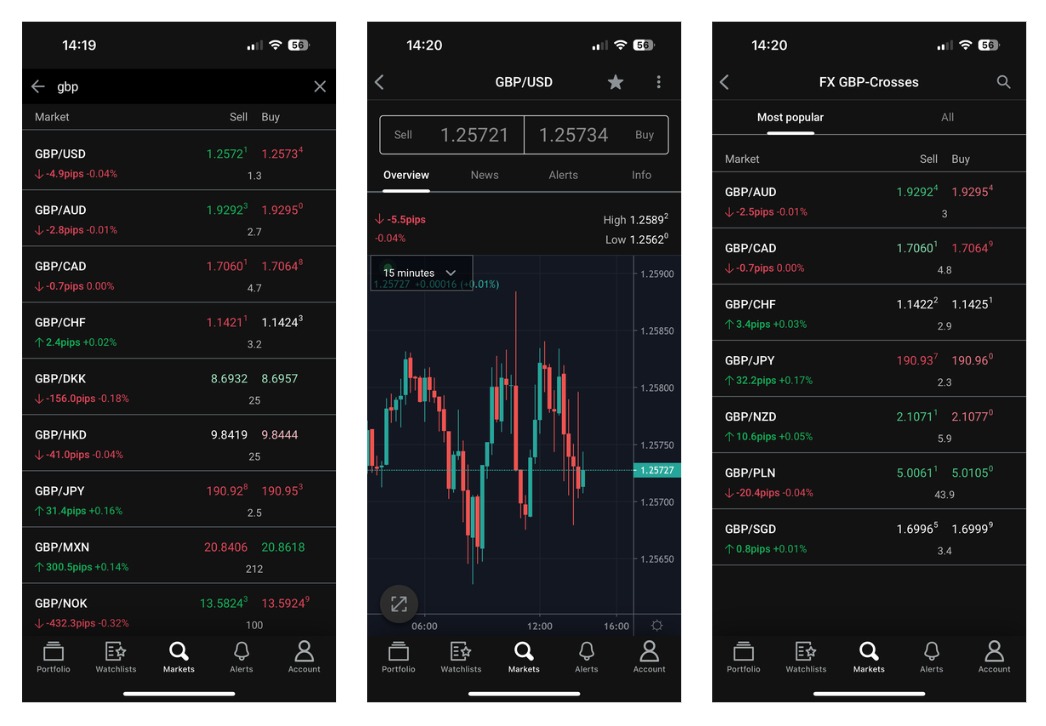

Great Range Of Currency Pairs And Trading Vehicles

Our analysis shows the top forex apps offer upwards of 50 currency pairs, providing a range of trading opportunities, from majors like the GBP/USD to GBP crosses, such as the GBP/AUD and GBP/JPY, which typically exhibit high levels of volatility, opening up opportunities for skilled traders.

Some apps, such as CMC Markets, also stand out by offering currency indices, notably the GBP index, which is comprised of a basket of currency pairs that all share the British pound as the base, providing exposure to the international value of the sterling.

We also favour forex apps that cater to a broad range of investors by providing different trading vehicles. The most popular in the UK include:

- Spot forex – Allows you to buy one currency, such as GBP, while simultaneously selling another, such as USD, at their current price, with the exchange occurring on the spot, allowing you to take advantage of price fluctuations.

- Forex CFDs – Allows you to trade on the price movements of currency pairs without owning the underlying currencies, profiting from price differences. Leverage can be used to multiply trading results.

- Forex spread betting – Allows you to make a bet on the direction in which a currency pair’s price will move, with profits or losses determined by the accuracy of your prediction and the size of the movement.

Profits from spread betting are tax-free in the UK. Spread bets on currencies are free from both Stamp Duty and Capital Gains Tax.

Excellent Charting And Trading Tools

The best forex apps offer excellent charting tools for serious traders, optimised for mobile devices with horizontal views, dynamic graphs, plus drag and drop drawing features.

For example, the IBKR app from Interactive Brokers is best-in-class, with 3 chart types, 10 timeframes and 70 indicators. You can also conduct charting analysis in a responsive horizontal mode and amend the size of currency charts for an optimal mobile trading experience.

Economic news and research are also important for many forex traders. For instance, you may believe that the Bank of England (BoE) is about to announce a reduction in interest rates, which could cause the value of GBP to fall. Having third-party resources, such as insights from Reuters or Autochartist may help you anticipate this ahead of the formal BoE announcement.

Pepperstone is particularly strong in this area, with Autochartist signals provided directly through the app, a news stream from FXStreet, plus price alerts with pop-ups.

Pepperstone Forex App

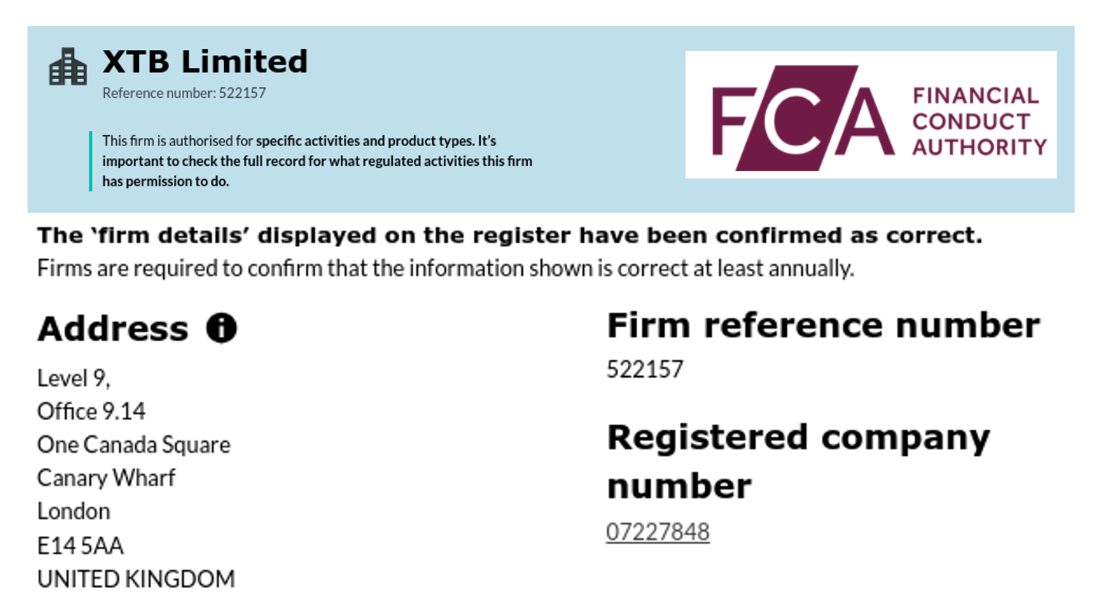

Trusted With Excellent Regulatory Credentials

Trading currencies online, whether on a mobile or desktop device, can be risky due to volatile market conditions and leveraged products. However, one area where you need certainty is choosing a trustworthy firm.

That’s why we only recommended forex trading apps that are regulated by a credible authority, such as the UK’s Financial Conduct Authority (FCA).

XTB Limited – FCA License

The FCA’s purpose is to protect customers and increase competition within the financial services industry, including currency trading. Some of the key measures they’ve introduced to help protect retail forex traders are:

- Financial Services Compensation Scheme – If your forex trading app provider goes out of business, this program can protect your investments up to a value of £85,000.

- Limits on leverage – It’s common to see offshore brokers with leveraged forex trading up to 1:500, greatly increasing the size of potential losses, especially for beginners. The FCA limits leverage on currency pairs, such as the GBP/USD, to 1:30.

- Risk warnings – FCA-regulated forex platforms must display suitable risk warnings, including the percentage of losing traders if providing forex CFD trading.

If you use our ‘Visit’ buttons, you’ll be taken directly to the relevant forex broker’s website where you can download the app, helping to mitigate the risk of clone firms, a scam the FCA has warned against.

Competitive Pricing With Tight Forex Spreads

Forex trading often comes down to the bottom line. Therefore, traders will need apps that offer opportunities to profit via tight spreads and low/no commissions.

We’ve validated over 50 apps for those that offer GBP accounts (to reduce conversion fees), low/no inactivity fees, and measuring spreads on key currency pairs, including the GBP/USD and GBP/EUR at the most liquid times of day (between 2:30 pm and 4:40 pm GMT).

FOREX.com is a strong player here with consistently low fees, especially if you opt for its ‘Raw Spread’ account with spreads from 0.0 on majors like the GBP/USD, a $5 commission per $100K, plus rebates up to 15% through the Active Trader program. The broker also offers a GBP account for convenient payments in the UK.

FOREX.com App

Smooth Account Management With GBP Deposits

The best apps for trading forex enable you to deposit and withdraw quickly, easily and with low costs. That’s why we look for apps with popular payment methods in the UK, alongside affordable minimum deposits, typically <£250.

That said, many of our recommended forex apps have no minimum deposit, including IG, which also offers four of the top payment methods in the UK: bank transfer, credit/debit cards, PayPal and Apple Pay, with no deposit or withdrawal fees.

We also look for reliable in-app support for any transfer issues. Unfortunately, this is an area where many firms could step up their offering. We’re seeing an increasing number of forex apps moving to chatbot services in place of live agents, to the detriment of the user, with Trading 212 sporting a particularly frustrating chatbot during testing.

In contrast, an example of best-in-class functionality is XTB’s live chat service, all available via the mobile platform with our UK forex traders connected within seconds, even during peak hours.

The choice of forex trading app is ultimately a personal decision. That’s why I recommend using a demo account to test-drive an app before investing real money. You can place simulated trades on currency pairs like the EUR/GBP.

Methodology

To identify the top forex trading apps, we started by identifying all those available on the Apple App Store and Google Play Store in the UK.

We then ranked them based on a comprehensive rating that includes qualitative and quantitative factors, notably the number of currency pairs, GBP/USD and EUR/GBP spreads, FCA authorisation, and insights from hands-on testing on iPhone and Samsung devices by our UK experts.

This approach allowed us to pinpoint those forex apps that best serve British investors of all experience levels, budgets and trading preferences.

FAQ

What Is The Best Forex Trading App In The UK?

Use our list of the best forex trading apps for UK traders to find the right mobile platform for your needs.

Our top-rated forex apps excel for their mobile-optimised tools, excellent range of currency pairs, competitive pricing, strong regulatory credentials, and hassle-free deposits for British investors.

What Is The Best Forex Trading App For Beginners?

Use our rankings of the best forex trading apps, where we collate those that are intuitive and easy-to-use for beginners.

New traders may also want to start with a social trading app, such as eToro, that will enable you to learn from a community of seasoned forex traders.

Which Apps Are Used For Forex Trading?

The most popular apps for forex trading in the UK include Plus500, MetaTrader 4 and MetaTrader 5 with over 10 millions downloads each on the Play Store alone.

MT4 and MT5 are third-party forex trading applications that are offered by the vast majority of online brokerages, despite increasing competition from applications like TradingView and in-house solutions.