Best Forex Brokers 2024

We review the best UK forex brokers in 2024 in our annual test. In our comparison of forex trading platforms, we look at key platform features, from low ECN spreads, fees and leverage, to safety, available currency pairs and forex trading apps.

Top Forex Brokers

-

XTB provides access to 70+ currency pairs with low spreads averaging around 1 pip on majors. The xStation platform offers an intuitive environment for forex traders with an excellent charting package encompassing 30+ indicators, plus a range of order types, catering to various strategies and risk management techniques.

-

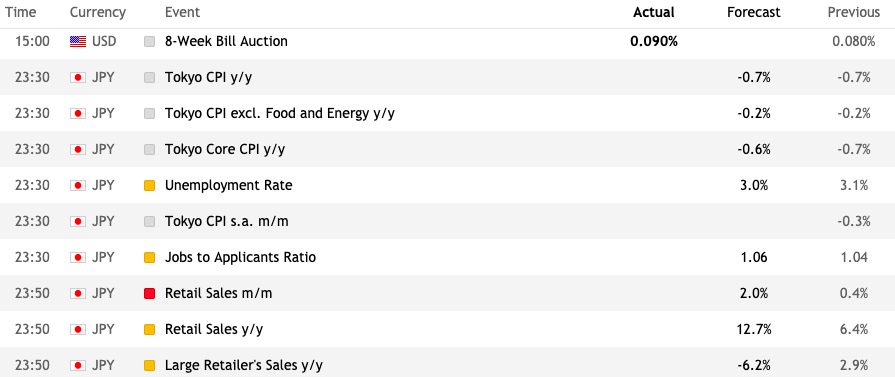

Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

-

FXCC's key selling point is its forex trading conditions. ECN spreads come in as low as 0.0 pips during peak trading hours, while it supports a wider range of currency pairs than the majority of rivals with over 70 forex assets. Additionally, you have access to MT4, which was built specifically for forex trading and excels for its charting tools.

-

Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

-

IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

-

XM offers ultra low spreads across a wide range of forex assets with no re-quotes or hidden charges. Over 50 currency pairs are available, which is above the market average and is in line with one of our top award-winners, AvaTrade.

-

OANDA offers 68 currency pairs, which is above the industry average. You can speculate on majors, minors and exotics, with spreads from 0.8 pips on popular pairs. There are no commissions and leverage is available up to 1:200. Average execution speeds are fast based on tests, at 12 milliseconds.

-

IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

-

FxPro offers 70+ currency pairs with ultra-fast execution speeds and tight spreads from 0.46 pips on EUR/USD. The range of forex assets outranks many rivals, including our award winner, AvaTrade. Various short-term forex strategies are permitted, including EA trading and hedging.

-

Plus500 provides forex trading through CFDs, featuring narrow spreads across an impressive selection of over 60 currency pairs. During testing, spreads came in as tight as 0.6 pips on the EUR/USD, which is notably lower than many alternatives.

-

Markets.com offers 43 major, minor and exotic currency pairs. The range is around the industry average, though spreads are fairly competitive, starting from 0.6 pips for EUR/USD. There’s also an excellent range of tools and education, including forex calculators and trading videos.

-

NinjaTraders supports the trading of popular currencies including the EUR/USD. The software also offers advanced features to streamline the trading experience, including complex order types like market if touched (MIT) and one cancels other (OCO).

-

Axi continues to offer a strong selection of 70+ currency pairs - more than many top brokers including award-winner AvaTrade, with only 50+. There are no restrictions on trading strategies including algo trading and scalping, which will serve both short-term and long-term traders.

-

Trade 35 major, minor and exotic forex pairs through CFDs with floating spreads from 0.1 pips. Alternatively, binary options allow you to speculate on rising and falling prices with a fixed stake and payout.

-

Focus Option offers 22 forex pairs tradeable via binary options, including a selection of majors and minors. FX pairs are also available to trade with margin on Focus Option's mobile app, which offers high leverage up to 1:50 and spreads from 1 pip.

-

Global Prime traders can access 48 forex pairs including majors, minors and exotics with tight spreads from 0.9 with no commission or from 0 with a $7 round turn. Forex is traded via the leading MT4 platform, micro lots are available and latency is low via a New York-based server.

-

Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

-

IC Markets maintains its commitment to providing exceptionally tight 0.0-pip forex spreads on major currency pairs such as EUR/USD. This makes it an excellent option if you are seeking superior execution, with an average of 35 milliseconds. Additionally, if you are a high-volume trader, you can benefit from rebates of up to $2.50 per forex lot.

-

AvaTrade offers 50+ currency pairs with competitive spreads from 0.9 pips and zero commissions. You can trade majors, minors and exotics around the clock on industry-leading platforms, including MT4 and MT5. Traders can also access beginner-friendly trading tools and comprehensive forex education.

-

FOREX.com continues to uphold its stature as a premier FX broker, offering over 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $5 commission per $100k, it stands out. Moreover, its SMART Signals help to identify price behaviors across numerous major currency markets.

-

PrimeXBT offers 50 forex pairs, which is above the industry average and covers a good range of majors, minors and exotics. Traders can enjoy trading via margin with zero commissions. Additionally, the broker’s copy trading service allows you to explore various currency trading strategies.

-

An above-average selection of 55 currencies are available with reasonable spreads averaging 0.9 pips on EUR/USD during peak hours. Aspiring traders can continuously hone their forex strategies by switching between demo mode and their live account any time, with full access to the broker's 100+ technical indicators.

-

DNA Markets continues to deliver an excellent environment for forex traders with 40+ currency pairs and low spreads from 0.0 pips on the EUR/USD during tests. The MetaTrader 4 platform, available on desktop, web and mobile, was also designed specifically for forex trading.

-

OspreyFX offers more than 50 major, minor and exotic currency pairs. Spreads start from just 0.1 pips on the EUR/USD and the broker provides a suite of forex trading education for beginners, including partnering with Forex Squad.

-

CloseOption offers binaries on 25+ forex pairs, including majors like EUR/USD and a few minors like AUD/JPY. Payouts vary by currency, with decent typical payouts of 75% for GBP/USD.

-

Trade 70+ major, minor and exotic forex pair CFDs with up to 1:1000 leverage, no commission fees and competitive spreads from 0.8 pips. FX trades can also be executed via the reliable and fast MetaTrader 5 software.

-

Errante traders can access 50+ forex pairs with leverage up to 1:500 (location dependant). The broker offers fast execution and tight spreads, especially to clients with VIP and Tailor-Made accounts.

-

Kwakol Markets offers a wider range of forex pairs than most competitors, with 90+ assets available. Users get fast execution speeds and competitive spreads through the ECN model. On the negative side, not all currency pairs are available on MT4.

-

Trade 70 major, minor and exotic forex pairs with ultra-low ECN spreads and fast execution via the MT4 or MT5 platforms. There are also zero SL/TP limits and automated forex trading is well catered for.

-

Ingot Brokers offers forex trading on a modest suite of 30+ currency pairs with raw spreads on the MT5 platform. There are also no restrictions on short-term trading strategies, including hedging, scalping and the use of Expert Advisors (EAs).

-

Trade a small selection of 25 major and minor pairs. Spreads from zero on the pro account, micro-lot trading, and very high leverage make up for the limited range of currencies. The MetaTrader software is also a well-regarded platform for forex trading.

-

Axofa offers a decent range of 50+ forex pairs with raw spreads from 0.0 pips. Very high leverage up to 1:1000 and commission-free forex trading is available. With that said, the broker is not particularly transparent when it comes to account conditions and fees.

-

Go long or short on over 50 currency pairs with spreads from 0.6 pips on EUR/USD. Traders can access market-leading forex tools in the MT4 platform, including customisable forex charts and algorithmic trading.

-

World Forex offers CFD and digital contract trading on 53 forex pairs, including EUR/USD and GBP/EUR. High leverage is available for CFDs, which can be accessed with competitive spreads on certain account types.

-

FinPros offers 80+ forex pairs, which is one of the more diverse offerings available. Traders benefit from ultra-low latency, MT5 support and very tight spreads and low commissions on the RAW+ account.

-

Trade 45+ major, minor and exotic pairs with deep liquidity and low latency. The ultra-tight spreads from 0.01 pips on raw accounts, competitive $7 or lower round-turn commissions and high leverage up to 1:500 will suit scalpers, who can trade without limits.

-

IQCent traders can access CFDs or binary options on 45+ forex pairs. CFD spreads start from 0.3 pips and binary options payouts are decent up to 95%. This is competitive compared to Pocket Option, for example, offering forex payouts up to only 81%.

-

Trade 50+ forex pairs including popular majors and minors with very high leverage available up to 1:1000. Gold, silver, palladium and platinum pairs with USD are also available.

-

Trade 25+ major and minor currency pairs with access to over 30 technical indicators in the broker's proprietary terminal. You can also follow and replicate other forex trades using the integrated copy trader.

-

Scope Markets offers 40+ major, minor and exotic currency pairs. Although the range is average, experienced traders can access very high leverage up to 1:2000. Additionally, the broker’s proprietary terminal delivers advanced analysis tools, including a live forex heatmap.

-

Trade 50+ forex pairs, including popular major, minor and exotic pairs. This is a decent selection, but traders will have a choice between the attractive MT4, MT5 or IRESS platforms and regulatory cover from ASIC. The VPS will also suit automated forex trading strategis.

-

Trade 49 major, minor and exotic currency pairs with fixed spreads or ECN pricing with no dealing desk intervention and a low starting deposit. You can analyze the currency markets using the broker's in-house trading platform.

-

Anzo Capital offers 45+ forex pairs including majors, minors and exotics with fast execution and spreads starting from zero. High leverage up to 1:1000 is available with a margin call at 80% and a stop out level at 50%.

-

Rock Global clients can access 50+ currency pairs via CFDs with leverage up to 1:500, world class liquidity and fast execution on the MT4 or TWS platforms. The tight spreads from 0.9 with no commission are a particularly attractive feature.

-

VT Markets offers an average selection of 40+ forex pairs with up to 1:500 leverage. Forex spreads in the ECN account are highly competitive, starting from 0.0 pips, although the 1.2-pip minimum quotes in the Standard account are a little higher than the likes of Pepperstone or IC Markets.

-

Binary and OTC options can be purchased on 40+ currency pairs, with 55+ currency pairs available if you deposit $1000. Typical payouts are reasonable at 81% and the $1 minimum trade makes the broker accessible to new forex traders. There is also access to the MT4 and MT5 platforms for experienced forex traders.

-

Exinity offers 150+ forex pairs to trade on a very competitive ECN pricing model, with spreads from zero and low commissions of $4 per round turn. Traders can access the powerful MT4 and MT5 platforms and trade with no restrictions on popular trading strategies.

-

ForexChief supports spot foreign exchange trading on all account types for 40+ major, minor and exotic currency pairs. Trading takes place on the leading MT4 and MT5 platforms, which offer dozens of in-built technical tools for short-term forex strategies.

-

PU Prime clients can trade 40+ forex pairs via the MT4 and MT5 platforms with dynamic leverage up to 1:500. Spreads start from near zero on Prime accounts, which also charge a $7 commission per lot, and a zero-commission Standard account with wider spreads is also available.

-

With 100+ currency pairs including all majors plus many minors and exotics tradeable on the MT4 platform with 1:2000 leverage, SuperForex lives up to its name as a great choice for forex traders. The ForexCopy system is also useful for newer traders.

-

AdroFx's strongest offering is its 60+ currency pairs, which can be traded with very high leverage up to 1:500. The broker also offers competitive forex spreads starting from 0.4 pips and charges no commission. Additionally, traders have access to MetaTrader 4, which was built for forex trading and offers excellent support for technical analysis and algo trading.

-

Start trading on dozens of currencies at RoboMarkets with powerful analysis tools and pattern recognition technology. 35+ currency pairs are available with tight spreads from 0 pips and rapid market execution. You can also utilise the broker's forex news alerts and economic calendar.

-

Trade 7 major, 21 minor and 29 exotic forex pairs with high leverage and a choice between STP or ECN accounts. Support is available around the clock and the TradeLocker forex software is provided.

-

Core Spreads offers trading on 34 forex pairs through spread betting and 40 currencies through CFDs, with both vehicles covering major and minor pairs. Spread betting spreads start from 0.6 for EUR/GBP; CFD spreads are variable and start from 1.2 pips on EUR/GBP.

-

M4Markets offers 45+ currencies with zero pip spreads. The low latency and 30-millisecond execution speeds makes the broker a decent choice for forex traders. Additionally, there are no restrictions on trading strategies, including scalping.

-

MultiBank FX offers trading on 50+ major, minor and exotic currency pairs. Spreads are tighter than many competitors and the broker offers higher leverage than most alternatives. Automated trading strategies are also permitted.

-

I’m happy with Tradeview’s strong range of 60+ currency pairs spanning majors, minors and exotics with competitive spreads from 0 pips in the $1000 ILC account. Traders can choose from several platforms, but I was particularly impressed with the feature-rich Currenex platform which is designed specifically for currency trading.

-

Trade Nation offers over 30 of the most popular forex pairs with variable spreads. Traders can access a slick proprietary platform or MetaTrader 4, with real-time forex market updates and insights via 'Smart News'.

-

As well as a competitive selection of 55+ forex pairs, traders can access high leverage up to 1:300. You can also enjoy advanced analysis from Trading Central with easy integration into MetaTrader 4.

-

Traders can access a decent range of 60+ major, minor and exotic forex pairs through standard and ECN accounts with tight spreads from 0.5 and 0.0, respectively. Execution speeds are also faster than most competitors at 50ms, which will appeal to active forex traders.

-

4xCube offers 60+ currency pairs with competitive trading conditions. We like that all trading strategies are permitted including scalping and hedging.

-

ActivTrades is a great broker for active forex traders with industry-low spreads from 0.5 pips and zero commissions. The forex broker also offers impressive execution quality and speeds, alongside award-winning customer service.

-

BlackBull offers 64 forex pairs with very competitive pricing through its ECN accounts, with the standard commission-free spread starting from 0.8 and spreads with commission starting from zero. The broker supports diverse trading platforms including MT4 and MT5, and provides leverage up to 1:500.

-

LQDFX offers an extensive list of 70+ currency pairs, more than most alternatives. Spreads are low, coming in at 0.2 pips for EUR/GBP during peak market hours and the low/no commission models will suit beginners and high-volume forex traders.

-

RoboForex offers trading on 30+ currency pairs, trailing category leaders like Pepperstone with its 90+ forex assets. That said, the Prime and ECN accounts feature competitive average spreads of 0.1 pips on the EUR/USD. Additionally, with a minimum investment of $100, traders can utilize the CopyFX system to replicate the strategies of seasoned currency traders.

-

Swissquote offers trading on a huge range of forex assets, covering 80+ currency pairs. Spreads start from 1.3 pips with the Premium account and there are zero commissions. Micro, mini and standard lot sizes are available plus options contracts on major currencies.

-

SimpleFX provides a comprehensive selection of around 60 currency pairs, from majors like GBP/USD to exotics like CHF/PLN. Forex trading fees are competitive, averaging 0.9 pips on EUR/USD during testing, while MetaTrader 4, available on desktop, web and mobile, was built specifically for trading currencies online.

-

You can go long or short on over 50 forex pairs from majors to exotics, with competitive spreads as low as 0.1 pips. The broker offers the leading charting software, MetaTrader 4, which delivers a host of advanced features, including 9 timeframes and over 30 indicators.

-

FXDD continues to offer a leading selection of 90+ currency pairs with ECN pricing. Spreads are decent, coming in at 0.4 pips for EUR/USD during testing. That said, these quotes aren’t as narrow as top competitors like Pepperstone.

-

Trade on 45+ majors, minors, crosses and exotics, with competitive pricing, ultra-fast execution and no requotes. Newer traders can access zero-commission trading. Experienced forex traders can operate with no trading restrictions and benefit from an ECN account and a VPS service.

-

FXTrading clients can access 70+ forex pairs with high leverage up to 1:500, fast execution averaging 80ms, excellent liquidity and spreads from zero. A good selection of minors and exotics are available as well as all the majors. New users can start trading forex in 4 easy steps.

-

With over 190 forex spot pairs, EZ Invest outperforms many rivals in terms of access to the currency markets. Users can also choose between desktop software, a webtrader plus a solid mobile app. On the negative side, spreads aren't the tightest on entry accounts.

-

Trade 50+ forex pairs via the MetaTrader 4 and MetaTrader 5 platforms with leverage up to 1:500, immediate execution, deep liquidity and tight spreads.

-

Fortrade offers 60+ currency pairs including a good selection of majors, minors and exotics. Trading takes place via MT4 or Fortrade's proprietary, low-latency terminal, and spreads on the USD/GBP pair average a reasonable 2 pips.

-

FP Markets is a good option for forex traders, with 70+ pairs covering an excellent range of currencies. Spreads are already tight on standard accounts and start from zero on raw spread accounts, and the broker offers high leverage up to 1:500 and top-tier liquidity.

-

IronFX continues to offer a strong selection of 80 currency pairs. You can trade through the market-leading MT4 platform with a range of forex market research tools. That said, commission charges in the zero-spread accounts are high, starting from $13.50 per lot.

-

Trade 80+ major, minor and exotic forex pairs. This is a very competitive range of currency pairs with 50+ exotics to choose from, and traders will benefit from fast execution and support from extra features including a pip calculator. The MetaTrader 4 software was also designed for online forex trading.

-

Libertex offers CFD trading on 50+ forex pairs, offering long and short opportunities. Its strength comes in its tight spreads – we were offered 0.2 pips for EUR/USD.

-

NordFX offers a modest range of 33 major and minor forex pairs. Disappointingly, there are no exotic pairs, though traders do benefit from tight spreads from 0.0 pips and low commissions from 0.0035% per side.

-

HYCM offers 40+ forex pairs, with most available to trade on either the MT4 or MT5 platform. The maximum leverage on offer is 1:30 in accordance with regulations, and tight spreads start from 0.2 on the Raw account and from 1.2 on the commission-free Classic account.

-

FXOpen clients can trade 50+ forex pairs (28 on micro accounts) with leverage up to 1:30. Fees are competitive with spreads starting from zero with a small commission on ECN accounts, and slightly wider spreads and no commission on STP accounts.

-

Trade 45 major, minor and exotic forex pairs. This is an average range, but the broker offers attractive and very competitive tight floating spreads from 0.3. Useful features including a news feed set the broker apart from many rivals and can help plan forex strategies.

-

Hantec Markets offers a limited range of 30+ forex pairs – less than most top brands, including Pepperstone with 100+. That said, market execution is rapid based on tests, and spreads are competitive starting at just 0.2 pips. This, combined with access to the popular MT4 platform with 30+ technical indicators, ensures a relatively complete trading experience for short-term currency traders.

-

With 60+ currency pairs available, Dukascopy offers enough majors, minors and exotics to keep most forex traders happy. The broker also offers high leverage up to 1:100 – a good amount to see from a reputable and regulated broker. Currency traders have access to excellent software, including MT4 and JForex.

-

Speculate on popular currency pairs with flexible leverage up to 1:500 and zero-pip spreads in the GO Plus account. Commission-free trading is available with micro, mini and standard forex contract sizes.

-

Tier 1 liquidity on an impressive range of 189 currency pairs and spot metals, plus 130 forwards, from 0.4 pips.

-

Trade on 60+ forex pairs with no commission and competitively tight spreads from 0.6 on major pairs such as EUR/USD. This is a good selection of forex pairs and excellent pricing for commission-free trading, well below the industry average.

-

Trade a wide selection of 80+ currency pairs with spreads from 0.5 pips and industry-favorite platforms. City Index has 40+ years experience in forex trading with liquidity from tier-one banks.

-

ThinkMarkets offers 46 currency pairs, which is around the industry average. Forex traders can benefit from tight 0.0-pip spreads for EUR/USD during peak market hours. Additionally, the ThinkTrader proprietary platform offers an impressive 125+ technical indicators - ideal for complex forex strategies.

-

CMC presents an extensive array of 300+ forex pairs characterized by tight spreads and rapid executions, surpassing the offerings of many competitors in terms of currency diversity. Forex indices also present a fairly unique and holistic way to speculate on the value of key currencies like the USD, EUR and GBP.

-

FXTM offers a strong range of 60+ currency pairs - more than many competitors including AvaTrade. There’s also 6 currency indices for traders looking to diversify their forex portfolios. The brand’s ECN account offers competitively low spreads from 0 pips, with equally low commissions up to $2 per lot.

-

Trade FX pairs with tight spreads & leverage.

-

easyMarkets continues to offer 60+ forex pairs including majors, minors and a selection of exotics, with fixed spreads from 1.8 pips or variable spreads from 0.8 pips. FX traders can access advanced trading software in MetaTrader, as well as very high leverage up to 1:2000.

-

Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

-

Trade 24 forex pairs via binary options. Such a small range of currency pairs is not that unusual among binary options brokers, and BinaryCent's high payouts up to 95% compensate for the lack of range.

-

FXCM offers an average range of 40+ currency pairs, although there are no commissions and spreads are competitive from 0.78 pips for EUR/USD. The broker also offers 3 forex baskets covering USD, Yen and emerging markets benchmarks.

-

InstaForex's range of 100+ currency pairs is among the largest we have seen. ECN spreads are also available from 0.0 pips with zero commissions. Minimum deposits start from $1 making the broker accessible for beginners. You can also access market-leading forex analysis and insights.

-

Trade 200 CFD forex pairs with DMA pricing and tight spreads, ultra low latency and high leverage up to 1:1000. The range of forex pairs available and pricing model are among the most attractive in the African market.

-

Capital.com offer a long list of forex CFD pairs for trading. All have competitive spreads. The firm also ensures negative balance protection

-

Trade over 180 major, minor, and exotic forex pairs on the Trading 212 platform, featuring floating spreads and leverage up to 1:30. It’s important to note, though, that the forex broker has a history of adjusting margin requirements without providing adequate notice. As a result, CMC Markets is a better pick for forex traders with more currency pairs and a cleaner record.

Of course, what is a good forex broker or trading platform also varies depending on individual needs, for example, access to major currency pairs, low minimum account deposits, or sign up bonuses for beginners. Even some of the best forex brokers in the world won’t be suitable for everyone. With that said, good forex brokers share similar features, and here we explain what those are so you can open an account with the forex trading platform that’s right for you.

For a detailed breakdown of individual providers, see our list of broker-specific reviews. Some established names you may already recognise, but new firms are constantly emerging, offering enticing new account features and promos.

How We Identify The Best Forex Brokers

There are two key areas we consider above others when selecting brokers:

- Competitive trading conditions – forex is the largest financial market in the world with over $6.6 trillion traded daily. As a result, brands are constantly competing for your business, offering competitive spreads, flexible leverage, greater analysis tools and powerful trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Trader safety – transparency is key when determining how safe your funds will be. This ultimately refers to regulation, reputation and security. Numerous trading scams are operating in the market today, so it’s imperative to use a reliable forex broker that can be trusted. We generally recommend FCA regulated brokers, but there are safe options that are regulated elsewhere, with a long history and proven track record.

We’ve put together a guide with other key factors we consider below, which should also inform your own choice.

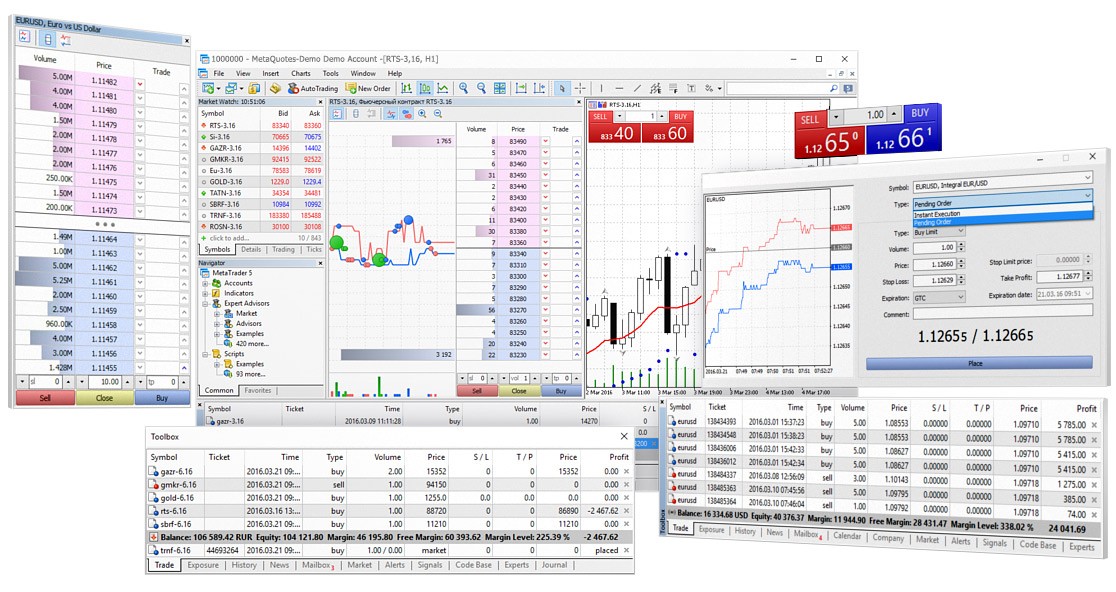

Forex Trading Platforms

As your gateway into the forex market, the trading platform offered will have a huge impact on your trading experience. Trading platforms vary in style, usability and additional features offered. The number of charts, order types, drawing tools and automated trading features can help ensure your forex trading strategy is successful.

Many of the best forex brokers today use MetaTrader 4 (MT4) and MetaTrader 5 (MT5). But whilst MetaTrader is a reliable choice, it may not be the best choice for you. There is a range of other good platforms out there, such as cTrader, as well as social and copy trading platforms such as DupliTrade.

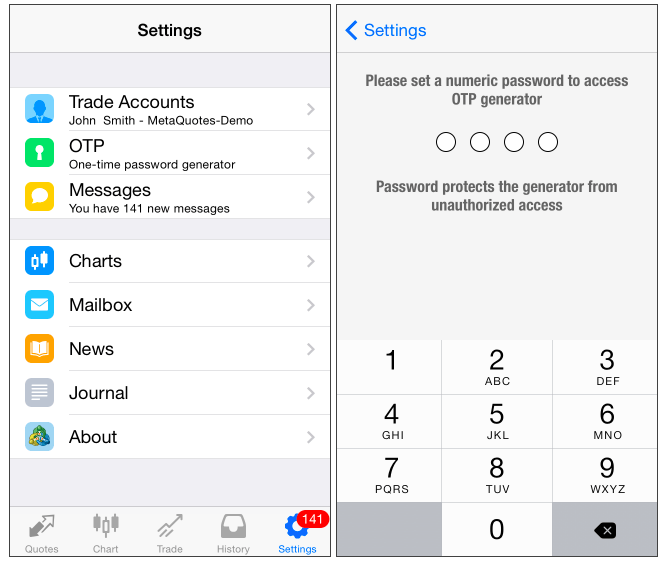

Mobile Apps

Traders who wish to monitor the markets whilst on the move should also consider the best forex brokers for mobile trading. Mobile apps allow you to manage your money, open positions and keep up with the financial markets from your iOS or Android smart device.

Some of the best forex brokers using MetaTrader also provide the user-friendly mobile application. Other top forex brokers also offer their own proprietary app.

Trade Execution

There are several operating models that the best forex brokers in the UK use. These models determine how customer orders are executed. The key models are Dealing Desk, No Dealing Desk (NDD), Electronic Communication Network (ECN) and Straight Through Processing (STP).

Dealing Desk brokers (also known as market makers) will fill both the buy and sell orders and will often sit on the other side of a client’s trade. Market makers therefore control prices and often set fixed spreads.

Conversely, No Dealing Desk (NDD) brokers do not pass orders on to a dealing desk and therefore provide direct access to the interbank market. NDD brokers typically offer variable spreads and can be subdivided into ECN and STP models:

- Electronic Communication Network (ECN) – ECN brokers offer Depth of Market, where client orders can interact with the other participants in the network (such as banks and hedge funds).

- Straight Through Processing (STP) – STP brokers route orders directly to liquidity providers, with each quoting its own bid and ask prices.

Trading Costs

Another key consideration should be the spreads and fees that the forex broker charges. These are the costs of trading and vary among online providers.

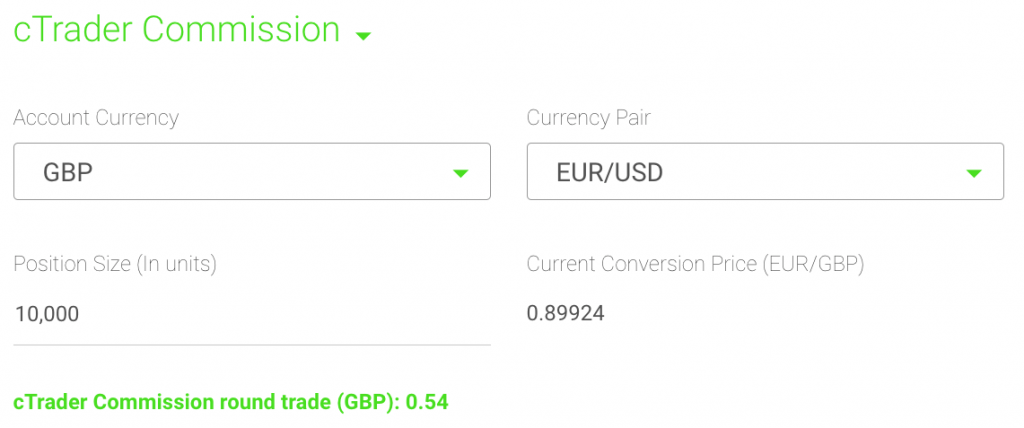

Spreads & Commission

The spread is the difference in the bid and ask price of a currency pair, which is how the broker makes money. Forex spreads can be fixed or variable and are usually presented as 4-digit or 5-digit pricing. A commission is usually charged on a per volume basis and typically varies depending on the account type.

The best forex brokers often provide spread or commission calculators so you can easily establish the cost of trading before you execute positions.

Choosing forex brokers with the lowest spreads does not necessarily guarantee you the best deal, as low spreads might be compensated elsewhere. Conversely, choosing a no commission forex broker is likely to mean higher spreads. Some ECN brokers may also offer attractive zero spread accounts, but these aren’t the best for everyone as there will often be costs elsewhere.

In fact, the main pricing structures that brokers typically use will either involve charging the spread only (with commissions rolled into the spread) or charging a lower spread with the commission on top.

Identifying the most cost-effective option for each broker will require some comparison. You can quickly compare the best forex brokers’ spreads using our individual reviews.

Additional Fees

As well as forex trading spreads, some of the best forex brokers charge additional fees that can impact returns:

- Swaps & rollover fees – A swap is interest that is either charged or paid to you when you hold a position overnight. It is best to gain a fair understanding of forex swap rates with your broker, as they are subject to change depending on market volatility.

- Payment fees – Each forex broker will have their own funding policies that determine how accounts can be funded, as well as any charges levied on deposits and withdrawals. Make sure to find out what fees are charged, as these can have a significant impact on your overall trading costs.

- Inactivity fees – Some brokers charge a monthly inactivity fee on accounts that have had no trading activity for a certain period. Again, the size of this fee will vary between the best forex brokers, so make sure you check this before you open an account.

Getting to know all the different costs can be overwhelming. A good thing to do is to note down any fees from brokers’ websites or see our breakdowns in individual brand reviews. The best forex brokers will be transparent with their costs and some even publish a comprehensive PDF with contract specifications.

If basic pricing details are not readily available on a forex broker’s website, and the customer support team is reluctant to provide details, then this is a red flag and may indicate a possible scam.

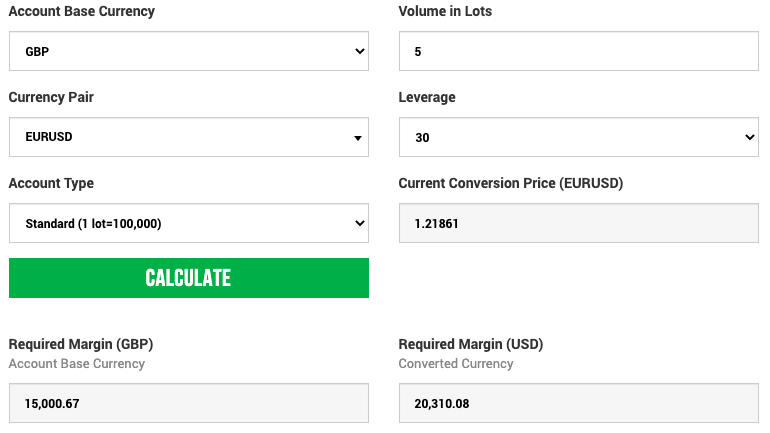

Leverage & Margin

Leverage allows you to put down a small amount of cash in order to take larger positions. The margin is how much money is required to open the leveraged position.

Whilst leveraged forex trading can lead to potential profits, it can also amplify losses. This has proven harmful when trading with unregulated forex brokers and high leverage ratios. Some brokerages even offer leverage rates as high as 1:3000.

It is for this reason that some legislators have capped retail leverage at 1:30 on major forex pairs. This is the maximum rate offered if you choose an FCA-regulated broker. Professional traders can leverage up to 1:500.

The best forex brokers usually provide a straightforward margin calculator on their website.

Note, if you wish to compare the best forex brokers with higher leverage, there are plenty of resources online.

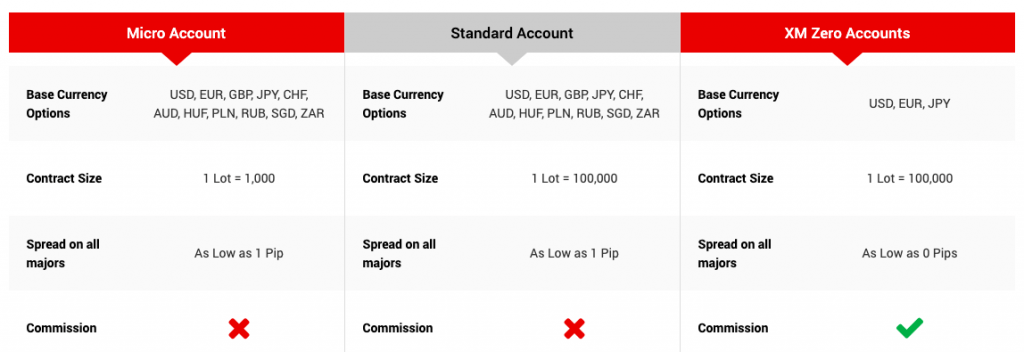

Trading Accounts

Account types vary from broker to broker and differ depending on various factors, including spreads, pricing and access to additional tools. The best combination of factors will therefore largely depend on a trader’s level of experience.

Many of the best forex brokers are now offering cent accounts for beginners, as well as trading in micro lots with micro accounts. Zero spread or ECN forex brokers provide direct access to other market participants and typically charge a premium commission.

PAMM brokers offer investor accounts that allow you to allocate funds to other traders’ accounts. Halal or Islamic accounts are also provided by some of the best forex brokers and have no swap or rollover interest fees, complying with Sharia law.

Most of the best forex brokers also offer a risk-free demo account which allows both beginners and experts to test out the service and place virtual trades in the trading platforms. Clients can then open a live, real-money trading account when they’re ready.

Forex Products

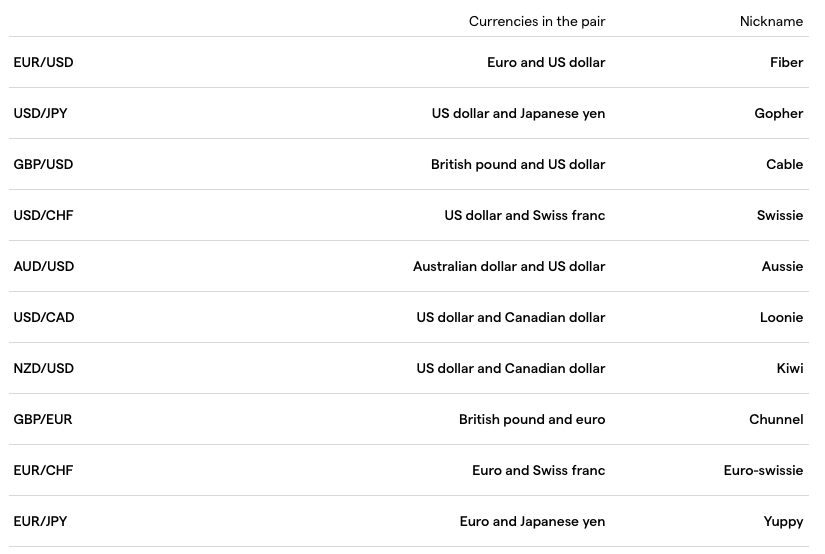

Beginners may want to start trading with stable and liquid pairs such as the EUR/USD and EUR/JPY. Putting these at the top of your list will help you choose good FX brokers with low spreads for these pairs. You may even find top forex brokers offering zero pip spreads on some majors.

For the best trading experience, you should also look for currency exchange brokers in the UK that offer a variety of other instruments to trade in the forex market. Top brokers usually offer a mix of major, minor and exotic currency pairs on spot contracts, as well as other day trading assets such as binary options or futures. Brokers that allow you to trade cryptocurrency pairs, stock market instruments or indices, such as NASDAQ, are also popular.

Deposits & Withdrawals

The best forex brokers are those accepting and offering a range of deposit and withdrawal methods, including debit cards, bank wire transfers, e-wallets, PayPal, WebMoney, Sofort, plus mobile money. Making a deposit will be the first thing you do once you open an account, so it’s important that your broker facilitates prompt and hassle-free payments. The best forex brokers also cover any processing fees so your trading capital and profits are unaffected.

Note, the best forex brokers offer close to instant deposits and process withdrawals within several working days.

Minimum Deposits

Traders usually need to pay an initial deposit when they open an account. Some top forex brokers offer a low minimum deposit (typically under £100) and some even offer no minimum payment. For beginners in particular, a low minimum account deposit can be appealing.

Customer Support

The importance of customer support can easily be overlooked, but should you encounter any urgent issues with your account or trading platform, it’s important you can get help quickly.

The best forex brokers provide good quality customer support through live chat services and 24-hour telephone hotlines, which are the best options for immediate response times. Many UK-based forex brokers have customer support offices in locations like London.

Additional Tools

Any additional tools and features offered by forex brokers are a bonus, as these can often be tailored to beginners and experts alike. Educational resources are particularly important to new traders who need to understand the basics of forex trading. Access to tutorials, webinars, economic calendars, financial news feeds or forex calculators, for example, can help to boost efficiency and enrich trading knowledge. The best forex brokers also offer more comprehensive tools for experienced traders, such as a VPS or custom add-ons to support automated trading.

It’s also worth considering trading styles or strategies that you might want to implement. For example, you could check out the best forex brokers that allow hedging and scalping.

Security At The Best Forex Brokers

The level of security provided by the best forex brokers is high, helping to ensure your funds and personal information are kept safe. If the broker uses a proprietary trading platform, they should be transparent around any measures they have in place, such as Secure Sockets Layer (SSL) encryption, two-factor authentication (2FA), or one-time passwords (OTP). Most well-known third-party trading platforms such as MetaTrader 4 or 5 use such measures.

The best forex brokers should also have fraud prevention measures in place, which will verify a new client’s identity upon registration. Traders should be cautious of forex brokers that don’t need verification at the registration stage, as this could be a sign of a scam.

The best forex brokers in several jurisdictions, including the UK, are required to use Know Your Customer (KYC) procedures. KYC is part of the wider Anti-Money Laundering (AML) financial policy and consists of several protective features, such as requesting two forms of identification from each customer.

Customer Reviews

The reputation and success of a top forex broker can easily be gleaned by the volume of daily trades executed. For example, some of the best forex brokers by transaction volume over the last few years have included popular names such as eToro, FXPro, IG, Oanda and HotForex.

Another way to get an idea of a broker’s reputation is by checking out customer feedback online, as these provide insight into other traders’ experiences. Many of the best forex brokers received a good ranking in 2024 for this reason. Bear in mind, though, that traders are more likely to post a review and a poor rating if they have had a bad experience.

In addition, there are professional best forex broker reviews and ranking tables online which can help with your comparison. Again, these shouldn’t be the basis for your decision and should not take precedence over the other key considerations.

It’s also worth checking out any community forums or social media pages that the broker offers. Being active on social media can be a good indicator of how much they value the modern customer experience. Some of the best forex brokers are on Instagram and other popular channels, such as Facebook and Twitter.

Promotions

Forex brokers that are regulated by the FCA are prohibited from offering bonuses or similar incentives to traders. These regulations are designed to protect traders from potentially harmful incentives.

If you do want access to trading bonuses, be aware that these firms are unlikely to be licensed by a top regulator, such as the FCA.

Final Word On The Best Forex Brokers

There are multiple factors to take into account when looking for the best forex brokers in the UK. Whilst we can provide insights and recommendations, the decision is ultimately down to individual requirements. So whether you’re looking for the best forex brokers with low spreads, for small accounts, or for MT4, the first step in your comparison should be listing your top priorities. From there, you can check out our individual brand reviews or our ranking list of the best forex brokers of 2024.