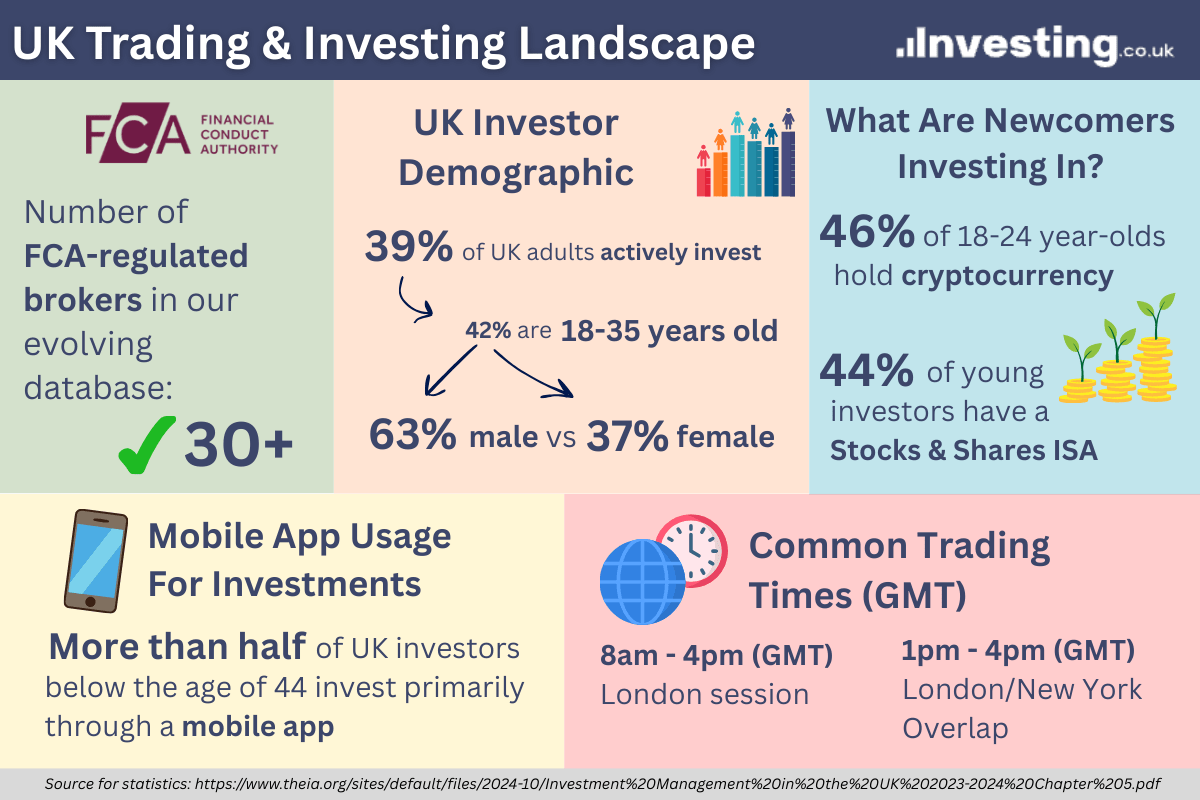

Investing.co.uk is the leading trading tutorial and investment comparison site for both beginners and experienced traders since 1996. We compare all top brokers and trading products on the market and provide detailed reviews. Join all the traders who got their financial education on investing.co.uk.

Quick Search

We have expert reviews of the best trading platforms and brokers in the UK and if you want to trade derivatives like CFDs, or forex and stocks – our tutorials will highlight the best brokers based on criteria like trading costs, customer service and the quality of trading apps.

Top 3 Brokers in the UK

Best UK Brokers and Trading Platforms

Popular Topics

Trading Tutorials

Popular online trading tutorials:

CFDs

Forex

Bitcoin

Stocks

Copy Trading

Day Trading