N1CM Review 2024

|

|

N1CM is #97 in our rankings of CFD brokers. |

| N1CM Facts & Figures |

|---|

N1CM is an offshore forex and CFD broker launched in 2017 and based in Vanuatu. The brand offers highly leveraged trading on nearly 100 instruments via the MetaTrader 4 and MetaTrader 5 platforms. The brokerage also offers a range of account types including a raw spread account with low commission fees, which will appeal to active forex traders. |

| Pros |

|

|---|---|

| Cons |

|

| Awards |

|

| Instruments | Forex, Indices, Commodities, Shares, Cryptocurrencies, Metals |

| Demo Account | Yes |

| Min. Deposit | $5 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.01 Lots |

| Regulated By | VFSC |

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | No |

| DMA Account | No |

| ECN Account | Yes |

| Social Trading | No |

| Copy Trading | Yes |

| Auto Trading | Expert Advisors (EAs) on MetaTrader |

| Signals Service | MT4 & MT5 |

| Islamic Account | No |

| Commodities |

|

| CFDs | Trade CFDs on forex, stocks, commodities, indices and cryptos with leverage ranging from 1:25 to 1:1000. The average 211ms execution speeds are not as fast as our top-rated options, but the broker does provide deep liquidity and features such as negative balance protection. |

| Leverage | 1:1000 |

| FTSE Spread | From 0.5 pips |

| GBPUSD Spread | From 0.5 pips |

| Oil Spread | From 0.5 pips |

| Stocks Spread | From 0.5 pips |

| Forex | Trade 50 major, minor and exotic forex pairs including EUR/GBP and USD/JPY. While not the widest selection of currencies, forex traders benefit from tighter-than-average floating spreads from 0.3 pips. |

| GBPUSD Spread | 1.1 average |

| EURUSD Spread | 0.9 average |

| GBPEUR Spread | 1.1 average |

| Assets | 50+ |

| Stocks | Trade CFDs on 26 US and European shares including Tesla, Google and Ferrari. This is only a small selection compared to most competitors, though traders can also make leveraged bets on broad market movements through nine indices including the Dow Jones and S&P 500. |

| Cryptocurrency | Trade leveraged CFDs on BTC, BCH, ETH, XRP and LTC in pairs with USD. The small selection does not offer much to traders who favor crypto, but there is enough for traders to dip into the sector's volatility. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Number One Capital Markets, N1CM, is an ECN/STP multi-asset brokerage offering high leverage up to 1:1000 and a minimum deposit requirement of just $1. In this review, we will examine the services offered by N1CM. This includes trading fees, account types, bonus rewards, and more. We also provide step-by-step guides on how to register for an account and trade on the platform.

Our Take

- N1CM is a decent choice for novices looking for Cent account conditions on the MT4 platform, or experienced investors seeking competitive pricing on the MT5 platform

- The broker offers fast deposits and withdrawals with a good range of crypto methods

- UK traders will be disappointed by the lack of GBP accounts and GBP-supported payment methods

- The offshore regulatory status and lack of fund protection are also key drawbacks

Market Access

N1CM offers 200+ instruments, which we thought was a decent offering, covering multiple asset classes. With that said, it’s not the widest selection compared to that of CMC Markets or Eightcap, for example.

- 3 energies including UK Oil

- 7 indices such as DAX40 and AU200

- 50+ currency pairs including EUR/GBP and GBP/JPY

- 5 precious metals including gold, silver, and palladium

- 3 cryptocurrencies to trade against the USD including Bitcoin and Litecoin

- 25+ European and US company stocks such as Amazon, BMW, and Google

Fees

Trading fees vary by account type and product but we felt reassured that N1CM is relatively transparent with costs. The Cent and Standard accounts both offer commission-free trading.

Spreads start from 0.9 pips on the Cent profile and 0.8 pips on the Standard account. The ECN account offers the tightest spreads from 0.5 pips, though commission fees apply from $2.50 per side (varies by asset class). This is the best pick for active day traders.

To demonstrate, we were offered the following spreads on the GBP/USD currency pair:

- 1.2 pips on the Cent account

- 1 pip on the Standard account

- 0.7 pips on the ECN account plus a $4 commission fee

Overall, we found the ECN and Cent account fees match up well with popular brands like Pepperstone and RoboForex.

Swap rates will also apply for positions held overnight. This is standard for the majority of brokerage firms. This includes a triple charge on Wednesday nights for currency pairs.

Accounts

We were satisfied to see three live account types, suited for different trading styles and experience levels: Cent Account, Standard Account, and the ECN Account. All three profiles have a 0.01 lot minimum trade size. The ECN account also benefits from access to additional features such as a dedicated account manager.

The Cent account offers the lowest minimum deposit requirement of just $1, however, we would recommend the Standard profile as trading conditions are the same, but spreads are slightly tighter. The minimum deposit is only marginally higher at $10.

We were not offered an Islamic profile, which is disappointing.

Cent Account

- Commission-free

- Spreads from 0.9 pips

- $1 minimum deposit requirement

- Free e-books and access to education

Standard Account

- Commission-free

- Spreads from 0.8 pips

- $10 minimum deposit requirement

- Free e-books, access to education and market analysis

ECN Account

- Spreads from 0.5 pips

- Commissions from $2.50 per side

- $10 minimum deposit requirement

- Free e-books, access to education, dedicated account manager, one on one training, and market analysis

How To Open A N1CM Account (Demo And Live)

We thought the account registration process was very lengthy in comparison to most other brokers. You will need to complete the same steps for both a demo and a live profile.

- Select ‘Accounts’ from the top menu or the broker’s website and then ‘Demo Account’

- Scroll down the page and click on the ‘Join Now’ icon

- Add your name, email address, and telephone number to the application form and create a password

- Select ‘Join Now’

- Sign in to your email account and authenticate the registration by selecting ‘Confirm Your Email’

- Account login credentials will be sent in a new email to your registered email address

- Select the ‘Login To Client Area Now!’ icon within the email

- Log in with your email address and auto-generated password

- Click ‘Products’ from the side menu and then ‘Accounts’

- Highlight either Real Accounts or Demo Accounts and then choose ‘Create Account’ on the right-hand side

- Complete the five pages of personal information including your employment status, tax declarations, and new account conditions

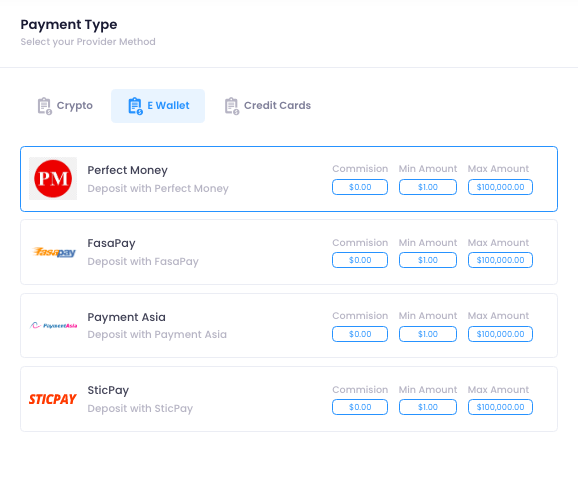

Funding Methods

The good news is, N1CM does not charge any fees to deposit or withdraw from a live trading account.

We were pleased with the number of payment methods, however, only credit/debit cards accept GBP funding, whilst most other methods required USD only. This is a shame since many leading brokers like IC Markets offer an excellent range of payment methods in multiple currencies, including GBP.

With that said, it is good to see a large number of cryptocurrency tokens accepted as payment, including Bitcoin, Ethereum, and Litecoin. The brand states that all funds are processed instantly, however, we know blockchain confirmation times can cause delays.

We found that all payment methods have a minimum funding amount, ranging from $1 to $25 vs the broker’s minimum initial deposit requirement of $5. This is still competitive and means no significant upfront capital is needed.

Supported deposit options:

- Tether

- SticPay

- Fasapay

- PerfectMoney

- Credit/Debit Card

- Bitcoin, Ethereum, Litecoin, USD Coin, Bitcoin Cash, Shiba Inu, ApeCoin, BNB, Dogecoin, Ripple, Dash and Tron

We were pleased to see N1CM aims to process withdrawal requests within three hours and there are no fees. This is much quicker than the average several days we typically wait when using other brokers. You must, however, have submitted identity verification documents.

Worth noting, all withdrawals are processed in USD, so you will need to convert your money back to GBP once received.

The minimum withdrawal amounts are very reasonable, varying from $1 to $10.

How To Make A Deposit Or Withdrawal

When we used N1CM, we didn’t encounter any issues with the payment process. Simply follow these steps:

- Sign in to the client portal

- Select ‘Finance’ from the side menu and then ‘Deposit’ or ‘Withdraw’

- Choose the payment method by selecting the icon

- Add the monetary value to deposit or withdraw

- Select ‘Create’ to confirm the transactions

Trading Platforms

N1CM offers third-party terminals only, with no proprietary platform. You can trade on MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are available for download to desktop devices or used as a WebTrader.

Both platforms, created by MetaQuotes, are industry-leading multi-asset terminals. We found them both easy to use, yet intuitive and powerful. There are plenty of customisable features so you can navigate the interface with ease.

MT4 and MT5 are renowned for their automated trading functions, with expert advisors (EAs) available to create custom indicators, scripts, and signals. You can use bots to identify trade opportunities based on your pre-defined parameters. Positions can be programmed to open automatically. Other useful features include:

MetaTrader 4

- Nine timeframes

- 31 graphical objects

- Four pending order types

- Single-thread strategy testing

- 30+ integrated technical indicators

MetaTrader 5

- 21 timeframes

- 44 graphical objects

- Six pending order types

- Double-threaded strategy testing

- 38+ integrated technical indicators

How To Place A Trade

We found it simple to open a new trade on the MetaTrader terminals. To place a trade:

- Open the MetaTrader web trader or download the platform to a desktop device

- Log in with your registered credentials

- Double-click on the instrument to trade from the ‘Market Watch’ window

- Add the new trade details including order volume, order type, stop loss/take profit price, and a comment

- Select ‘Buy’ or ‘Sell’ to open the position

Mobile App

N1CM does not offer a proprietary mobile app. That being said, MT4 and MT5 provide mobile compatibility, and customers can download the apps for free to iOS and Android devices.

We found the applications imitate the desktop trading experiences, whilst offering stable mobile-optimised features such as charting, with small screen zoom and scroll compatibility.

You can set customised price alerts which provide real-time market movement data. A major advantage of the mobile app is that one-click trading is also permitted, plus all order types and execution modes.

Execution

N1CM offers both an ECN and STP pricing model. The broker provides low pricing which is sourced directly through tier-one financial institutions and liquidity providers. On the downside, execution speeds are mediocre with an average of 211 ms per order – we judge anything below 100ms fast.

We did not find any trading restrictions, with hedging and scalping strategies permitted.

Leverage

You can trade with very high leverage up to 1:1000 while using the N1CM platform. This is sizeable, meaning for every £1 invested, you can trade with £1000 of borrowed funds.

However, trading with such high leverage can cause devastating losses without proper risk management.

Note, the maximum leverage ratio is offered on account balances up to $999 only. The broker uses a tier-based leverage system meaning those with higher account balances will not be able to access such significant funding.

- Account Balance $0 to $999 – 1:1000

- Account Balance $1000 to $1999 – 1:800

- Account Balance $2000 to $9999 – 1:500

- Account Balance $10,000 to $29,999 – 1:400

- Account Balance $30,000 to $49,999 – 1:300

- Account Balance $50,000 to $79,999 – 1:200

- Account Balance $80,000+ – 1:100

All accounts have a 30% stop-out level.

Demo Account

You can practise trading on the MT4 and MT5 platforms via the N1CM demo account. You can access all trading instruments and invest without having to deposit your own money.

We were pleased to see that the demo profile mirrors the trading conditions and live pricing of a real account. There is also no expiration time and unlimited virtual funds which is a huge advantage over alternatives.

You will need to register for an NC1M account before you can open a demo profile. We were disappointed that all the mandatory and lengthy requirements to open a live profile apply to the demo account too. You will need to provide personal financial information and proof of residency documents just to practise trading.

Regulation

N1CM is not regulated by a reputable financial watchdog. UK traders will not find any oversight from the Financial Conduct Authority (FCA) which is a shame. Instead, the broker is authorised by the Vanuatu Financial Services Commission (VFSC), company number 15035.

Though this is not a top-tier authorisation, you can be assured of negative balance protection. You will however be limited when it comes to financial compensation initiatives such as access to the FSCS. We also did not find any information regarding fund segregation, which is a concern if the brand were to face financial issues.

Bonus Deals

When we tested N1CM, we were offered two bonus schemes; a first deposit bonus and a redeposit bonus. This is an attractive feature of investing with a non-FCA-regulated brand, as UK-registered brokers are not permitted to use financial incentives to encourage trading activity. With that said, traders should read the terms and conditions carefully and we don’t recommend choosing a brokerage based on their promotions alone.

The first deposit bonus scheme offers a 35% reward on initial account funding, with a minimum requirement of $100. This means if you deposit $1000, you will be entitled to a $350 bonus. There is a maximum bonus cap of $5000. The redeposit programme offers a 25% reward for account funding after an initial payment.

On the downside, when our team reviewed the terms and conditions, we found that Cent account holders are not permitted to access any bonus rewards which is a shame.

Extra Tools & Features

Education

We were disappointed with N1CM’s educational content. There is no online learning academy or materials such as podcasts or user guides. The broker does, however, offer a free e-book that can be downloaded to a computer, though the information is suitable for beginners only.

A glossary of key terms is also available on the website. Experienced traders and even beginners will feel unsupported when it comes to expanding financial market knowledge and creating advanced strategies.

Tools

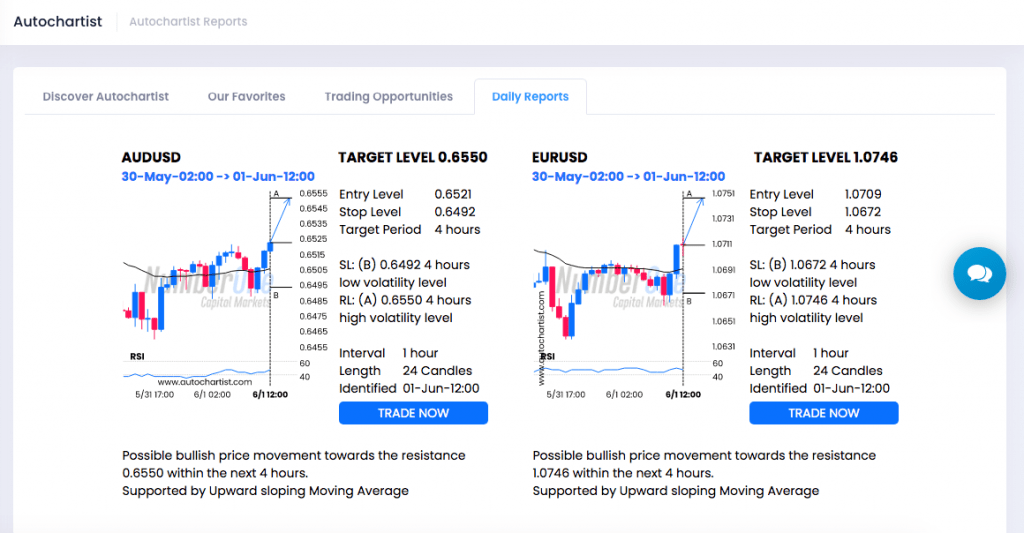

Similar to N1CM’s education, additional tools are very limited. The broker’s market news page is not updated with the latest financial data. You can however use an integrated economic calendar hosted by TradingView, which is reliable.

We were pleased to see that N1CM has partnered with Autochartist offering free access to market analysis tools. You can use the tool to identify potential trades and access trade set-up guidance.

The terminal is ideal to take the pressure off constant market scanning, meaning you can spend time executing positions and monitoring your portfolio. Some of the most well-known price patterns available include consecutive candles, key levels, and volatility.

Customer Service

We were impressed with N1CM’s customer support options. Several contact methods are provided including a telephone number, email address, and live chat tool. We also liked the option of using WhatsApp or Skype to speak to a customer service representative.

Response times are fast. We received a reply to our query within two minutes, using the online chat function.

On the negative front, we did find that support is only available during business hours, and due to international time zones, this means limited afternoon help. UK traders can speak to an agent between 6:00 am and 3:00 pm (GMT), Monday to Friday.

You can also use the broker’s detailed FAQ section, with plenty of information categorised into key topics. You can find information relating to deposits and withdrawals, trading conditions, MT4/MT5 platform queries and more.

- Email – info@n1cm.com

- Telephone – +442045259759

- Live Chat – Blue icon, middle right of the broker’s website

- Email/Online Assistance Contact Form – Via the ‘Contact Us’ webpage

- Skype/WhatsApp – Icons available bottom right of the broker’s website

Company Details & History

Number One Capital Markets, referred to as N1CM, was established in 2017. The brokerage is authorised and regulated by the Vanuatu Financial Services Commission (VFSC).

The global CFD broker offers services in 80+ countries including the UK and the US with head office presence in London and Istanbul. N1CM has over 20,000 registered customers.

The brand has been recognised with several industry awards including the Best Forex & CFD Trading Platform at the 2020 FNC London Awards and The Best Customer Service at the 2021 Finance Magnums Awards.

Trading Hours

N1CM trading hours are Sunday 1:00 am (GMT+3) to Friday 12:55 am (GMT+3). Instrument-specific opening hours will vary within these times. This includes the forex market open 24/5 and the crypto market 24/7.

You can view trading hours by instrument on the broker’s website and these timings are reflected in the MT4/MT5 terminals. We liked that the broker provides traders access to an integrated TradingView economic calendar, with details of financial news broadcasts and upcoming events such as public holidays that may impact the market.

Should You Trade With N1CM?

N1CM is a suitable multi-asset broker for UK traders, though services are quite basic. If you aren’t looking for access to a catalogue of educational content or additional analysis you will be satisfied. The minimum deposit requirement is low, and a choice of account type on the MetaTrader terminals will serve you well.

With that said, the weak regulation and lack of security features are the main disadvantages of trading with this brand. As a result, the brokerage does not stack up against leading alternatives.

FAQ

Is N1CM Legit?

N1CM is a legitimate broker-dealer, registered offshore in Vanuatu with company number 15035. The broker is transparent with its VFSC license but we do recommend caution since this kind of regulatory oversight is much less stringent vs FCA-regulated brokers.

Is N1CM Trustworthy?

N1CM’s weak regulatory status makes the brand less trustworthy and reliable than brokers with top-tier licenses. Traders will not benefit from any compensation, should the broker get into financial difficulty. With that said, the availability of negative balance protection is reassuring to a degree.

Is N1CM Good For UK Investors?

N1CM could be a good choice for UK traders, with a small selection of UK assets to trade including the FTSE 100, UK oil and cryptocurrencies. Beginners and experienced investors have a good choice of accounts with low entry requirements.

However, the lack of GBP-supported payment methods and FCA regulation is a key drawback for UK clients.

Are N1CM Trading Fees Competitive?

N1CM trading fees are generally quite competitive, though average spreads are not the tightest vs alternative brokers. You can trade commission-free on the Standard or Cent account with spreads from 0.8 pips and 0.9 pips respectively. The ECN profile offers the tightest spreads from 0.5 pips, but a commission fee of $2.50 applies per side.

Does N1CM Offer Good Trading Software?

N1CM customers can trade on either the MetaTrader 4 or MetaTrader 5 terminals. The broker does not provide any proprietary software, however, these third-party platforms are industry-leading and provide a wealth of advanced features such as integrated technical indicators and customisable charting. Beginners and experienced investors should be well-catered for.

Article Sources

Compare N1CM with Other Brokers

These brokers are the most similar to N1CM:

- FXPrimus - FXPrimus is an award-winning CySEC-regulated brokerage offering CFD trading on 200+ instruments via the MetaTrader 4, MetaTrader 5 and cTrader platforms. The choice between a competitive commission-free account and two affordable raw spread options make this an accessible broker for anyone seeking forex, stocks, indices and commodities with high leverage.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for traders at all levels.

- Admiral Markets - Admirals is an FCA- and ASIC-regulated broker with an excellent range of leveraged instruments, including forex, stocks, indices, ETFs, commodities, cryptos and more. The broker supports the MetaTrader 4, MetaTrader 5 and TradingCentral platforms. With both spread betting and CFDs available and thousands of instruments, this broker provides more flexibility than most rivals.

N1CM Feature Comparison

| N1CM | FXPrimus | Pepperstone | Admiral Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4 | 4.8 | 3.5 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities, Crypto |

| Minimum Deposit | $5 | $15 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | VFSC | CYSEC, MIFID, ICF, FCA, BaFin, VFSC | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, CySEC, ASIC, JSC |

| Bonus | - | - | - | - |

| Education | No | No | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader | MT4, MT5, cTrader | MT4, MT5 |

| Leverage | 1:1000 | 1:1000 | 1:30 (Retail), 1:500 (Pro) | 1:30 (EU), 1:500 (Global) |

| Visit | ||||

| Review | N1CM Review |

FXPrimus Review |

Pepperstone Review |

Admiral Markets Review |

Trading Instruments Comparison

| N1CM | FXPrimus | Pepperstone | Admiral Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | No | Yes | No |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | No | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | Yes | Yes |

| Volatility Index | No | No | Yes | Yes |

N1CM vs Other Brokers

Compare N1CM with any other broker by selecting the other broker below.

Popular N1CM comparisons: