Coinmama Review 2024

|

|

Coinmama is #81 in our rankings of crypto brokers. |

| Top 3 alternatives to Coinmama |

| Coinmama Facts & Figures |

|---|

Coinmama is a popular cryptocurrency exchange that aims to provide streamlined and user-friendly cryptocurrency trading options to the retail market. Traders can buy a range of tokens via a fiat on-ramp, store their tokens in a third-party wallet and earn loyalty bonuses for trading with Coinmama. Millions of clients from over 180 countries have signed up to the firm. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Cryptos |

| Demo Account | No |

| Min. Deposit | $30 |

| Mobile Apps | Android only |

| Payments | |

| Min. Trade | $30 to buy, $100 to sell |

| Regulated By | FinCEN, FINTRAC |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Cryptocurrency | Buy, hold and sell 16 crypto tokens including major players like BTC and ETH and lesser-known tokens such as LRC. Use a range of fiat currencies to buy the digital assets, including USD. Cryptos are stored in third-party wallets. |

| Coins |

|

| Spreads | From 2.93% to 3.90%. Express fees of 0-5.00% also apply. |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

Coinmama provides a simple, accessible way to capitalise on the rising interest in cryptocurrency trading and DeFi investments. The firm is a centralised exchange with a bespoke platform, a wide range of market analysis and strong educational services. This 2024 broker review will explore the pros and cons of Coinmama, including trading fees, available tokens, payment methods, wallet app and account verification process.

Coinmama offers an intuitive trading platform, integrated wallet services and access to Into The Block, an advanced market insight tool that provides both fundamental and technical analysis data. Despite a limited coin list and somewhat high fees, Coinmama’s sophisticated functionality sets it apart.

Company Details

Coinmama is a global, online cryptocurrency marketplace based in Dublin, Ireland that was founded in 2013. Co-CEOs and founders Nimrod and Laurence built the company to make buying, selling and holding cryptocurrencies as easy as possible for the masses.

The company aims to be a fast, safe and open platform for traders to buy digital cryptocurrency, offering its services to millions of users from more than 200 different countries.

Trading Platform

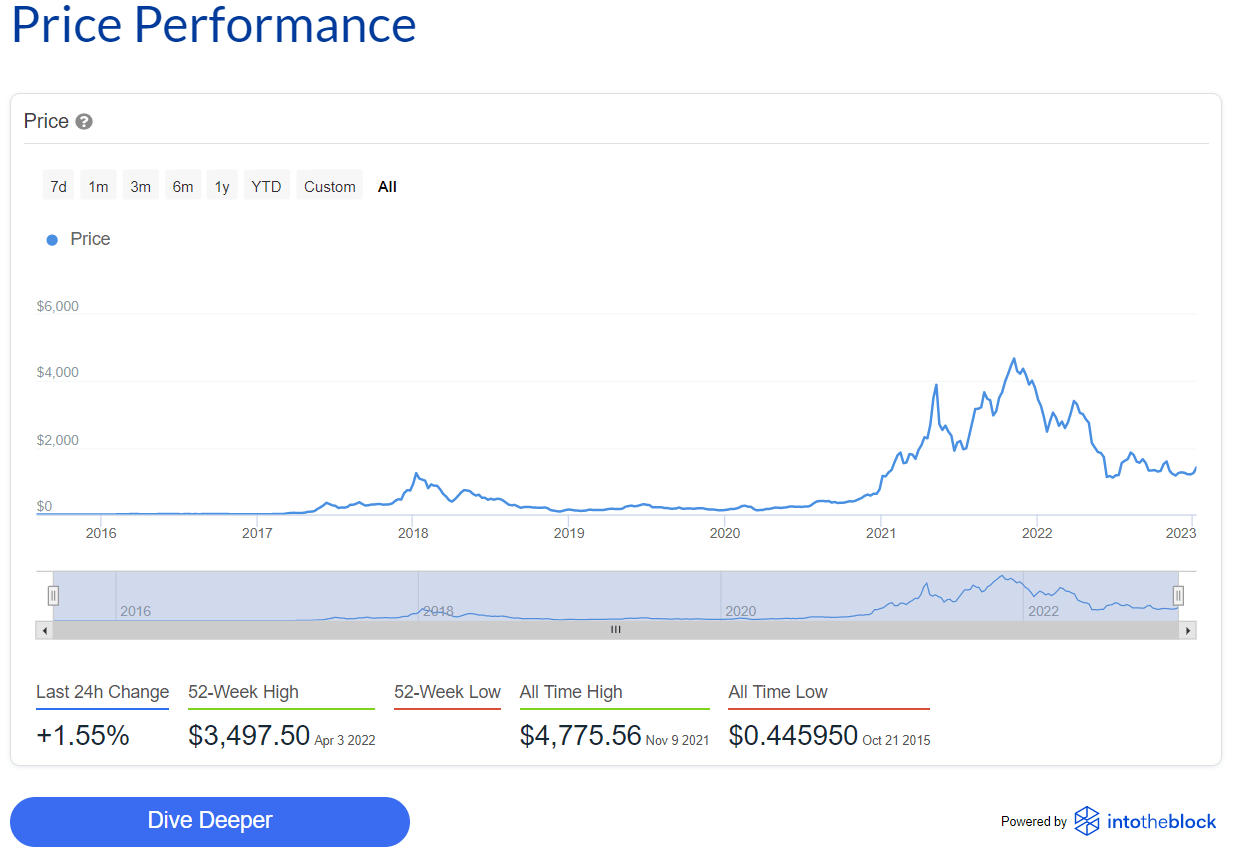

Coinmama has a bespoke Into The Block trading platform built around ease of use and simplicity. The platform allows clients to easily buy and sell any of the supported cryptocurrencies. The platform also includes a charting functionality with custom timeframes and key details, such as 24h change, all-time high and yearly low.

For those that desire additional information to inform their positions, you have the option to “dive deeper”, which takes you to a crypto analytics report page. Here, you can view extra information on each crypto, including whale concentration, 30-day volatility, market cap, breakeven prices and Bitcoin corrections. The same data is also provided for a wide range of coins not offered by the company.

Into The Block Charting

The Coinmama platform can be integrated automatically with an existing crypto wallet for token storage. Alternatively, the firm offers a local, non-custodial wallet for instant transactions, 24/7 customer support, advanced security measures and mobile app support.

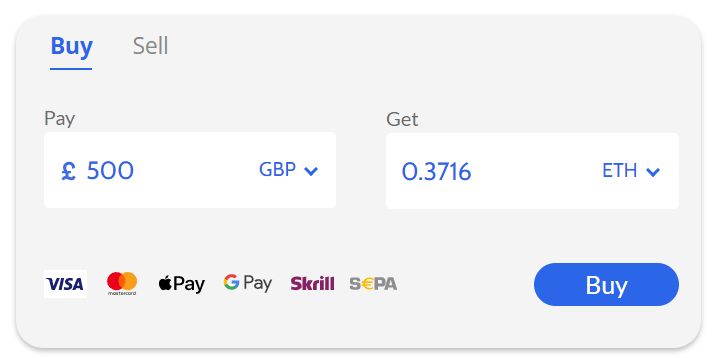

How To Buy Crypto With Coinmama

- From anywhere on the broker’s website, click the buy button on the header

- On the next screen, select your desired currency from the drop-down list

- Select the currency you wish to pay with from the other drop-down list

- Input how much you would like to pay or how much to buy, the broker will automatically calculate the rest

- Click the blue “Buy” button

- Input your desired wallet address and payment details

- Authenticate and submit the payment

Mobile App

The Coinmama Wallet is accessible through a free mobile app, which doubles as a mobile trading platform and is available on the Apple iOS App Store and Android Google Play Store. This application allows you to send, receive, buy and sell cryptocurrencies. It offers instant Bitcoin and Ethereum transactions, “bulletproof” security and 24/7 customer support. However, the wallet only supports Bitcoin and Ethereum (at the time of writing).

How To Open A Coinmama Wallet

- Download the Coinmama mobile app

- Login to your account or register for a new one

- Follow the on-screen instructions to set up your wallet recovery keyphrase

- Transfer existing crypto to this wallet or purchase some new tokens from the broker

Assets & Tokens

Coinmama exclusively offers cryptocurrencies, listing a slightly disappointing 18 coins available to trade.

While this includes major players like Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Dogecoin (DOGE) and Ripple (XRP), this is a very limited selection compared to other crypto exchanges and even generic CFD brokerages.

Fees & Charges

Coinmama charges a commission fee on each transaction placed. These fees range between 0.99% and 3.9%, depending on factors like the user’s loyalty level, the order size and local market conditions. The firm also incorporates a spread into each position, in place to offset the inherent volatility of cryptocurrencies.

An “Express Fee” is also charged when using certain payment methods, including credit/debit cards, Google Pay, Apple Pay, Skrill and Neteller.

Loyalty Program Fees

The Coinmama exchange has three client loyalty levels: Crypto Curious, Crypto Enthusiast and Crypto Believer. The Crypto Curious level has no discount on commission fees (base level of commission), while the Crypto Enthusiast level has a 12.5% discount and the Crypto Believer level has a 25% commission discount.

Fees with Coinmama are relatively high compared to other, similar crypto brokers.

Coinmama Payment Methods

Coinmama has several different payment methods available to users, with a differing number available depending on whether you are buying or selling tokens.

Selling (Withdrawal) Methods

Coinmama only offers a single payment method for withdrawals. For this, you will need a European bank account that supports SEPA transfers. Even after Brexit, the UK is still a member of SEPA (the Single Euro Payments Area). As such, UK traders can still withdraw from their accounts with the broker.

SEPA transfers are managed in EUR and come with 0% fees and an average verification time of 12 hours. To withdraw, you must first translate all your desired crypto into Bitcoin as the firm does not support withdrawals directly from another coin. The minimum amount you can sell to Coinmama is £200.

Buying (Deposit) Methods

There are several deposit methods available in a variety of fiat currencies (including GBP).

Instant Bank Transfer

- Fees – 0%

- Currencies – EUR, GBP

- Average Delivery – One hour

- Minimum Amount – £25 for the first order, £40 for subsequent orders

Credit/Debit Card

- Fees – 4.99%

- Average Delivery – One hour

- Currencies – EUR, GBP, USD, CAD, AUD

- Minimum Amount – £25 for the first order, £40 for subsequent orders

Apple Pay

- Fees – 4.99%

- Average Delivery – One hour

- Currencies – EUR, GBP, USD, CAD, AUD,

- Minimum Amount – £25 for the first order, £40 for subsequent orders

Google Pay

- Fees – 4.99%

- Average Delivery – One hour

- Currencies – EUR, GBP, USD, CAD, AUD

- Minimum Amount – £25 for the first order, £40 for subsequent orders

ACH Wire Transfer

- Fees – 0%

- Currencies – USD

- Minimum Amount – £40

- Average Delivery – Three business days

Fedwire

- Fees – 0%

- Currencies – USD

- Minimum Amount – £410

- Average Delivery – Two business days

SEPA

- Fees – 0%

- Currencies – EUR

- Average Delivery – 12 hours

- Minimum Amount – £25 for the first order, £40 for subsequent orders

SEPA Instant

- Fees – 0%

- Currencies – EUR

- Average Delivery – One hour

- Minimum Amount – £25 for the first order, £40 for subsequent orders

SWIFT

- Fees – 0%

- Currencies – USD

- Minimum Amount – $£200

- Average Delivery – Three to five business days

Skrill & Neteller

- Fees – 2.5%

- Currencies – EUR

- Average Delivery – One hour

- Minimum Amount – £25 for the first order, £40 for subsequent orders

Deals & Promotions

Coinmama does not offer any deals or promotions but it does offer a loyalty program.

Loyalty Program

The Coinmama loyalty program gives users discounted commission fees and faster support as their loyalty level increases. There are three available levels, Crypto Curious, Crypto Enthusiast and Crypto Believer.

Users are automatically enrolled in the loyalty program when they sign up, starting at the base level of Crypto Curious. Over a rolling 90-day period, the firm tracks how much you have traded. Users that buy more crypto through Coinmama in each 90-day period are given a higher loyalty level.

- Crypto Curious – No discount on commission fees. No minimum purchase level. No faster support

- Crypto Enthusiast – 12.5% discount on commission fees. £5,000 minimum spend over 90 days. Faster support

- Crypto Believer – 25% discount on commission fees. £18,000 minimum spend over 90 days or £50,000 spend over lifetime. Status acquired only after purchasing with Cryptomama for more than 30 days. Faster support

Regulation & Licensing

Coinmama’s platform is operated by Cmama Ltd., which was established and registered in Ireland. The exchange is a property of New Bit Ventures Ltd. All of these follow regulatory know-your-customer (KYC) and anti-money laundering (AML) procedures. Coinmama Ltd is registered as a money services business with FinCEN. However, the broker is not licensed or regulated in the UK by the Financial Conduct Authority.

Security & Safety

Along with KYC and AML protocols, the firm employs 3D and two-factor authentication (2FA) processes for additional account security. Signing up for an account requires providing evidence of a government-issued ID as a form of authentication.

Coinmama Additional Features

Education

The exchange hosts a blog that offers educational resources to those looking to get started with cryptocurrency investing. The blog covers a wide range of crypto topics, including basics, how-to guides, general knowledge, altcoin information, Bitcoin news and Coinmama tutorials.

There is also the Coinmama Academy, which offers basic information about relevant topics, including data about each coin, how cryptocurrencies work, important crypto terms and more. This is a great place to start learning about investing in DeFi as there are articles that cover lots of different aspects of the field.

Market Insights

Coinmama also has an extensive market analysis area. This portion of the website includes detailed pricing and statistical information on a range of cryptos that extends beyond those offered by the company. Moreover, there is a suite of charts to map crypto performance against global index, stocks, commodity and ETF performance. This section measures historical correlation and even provides volatility, intra-day move, Sharpe Ratio and Sortino Ratio analyses of all these assets.

A similar depth of insight is provided in the decentralised finance (DeFi) world, covering the adoption of DeFi tokens and the Ethereum blockchain across the world, lending protocols, NFTs and decentralised exchanges (DEXs). Metrics include value locks, token supplies, top traded coins, gas costs and active addresses.

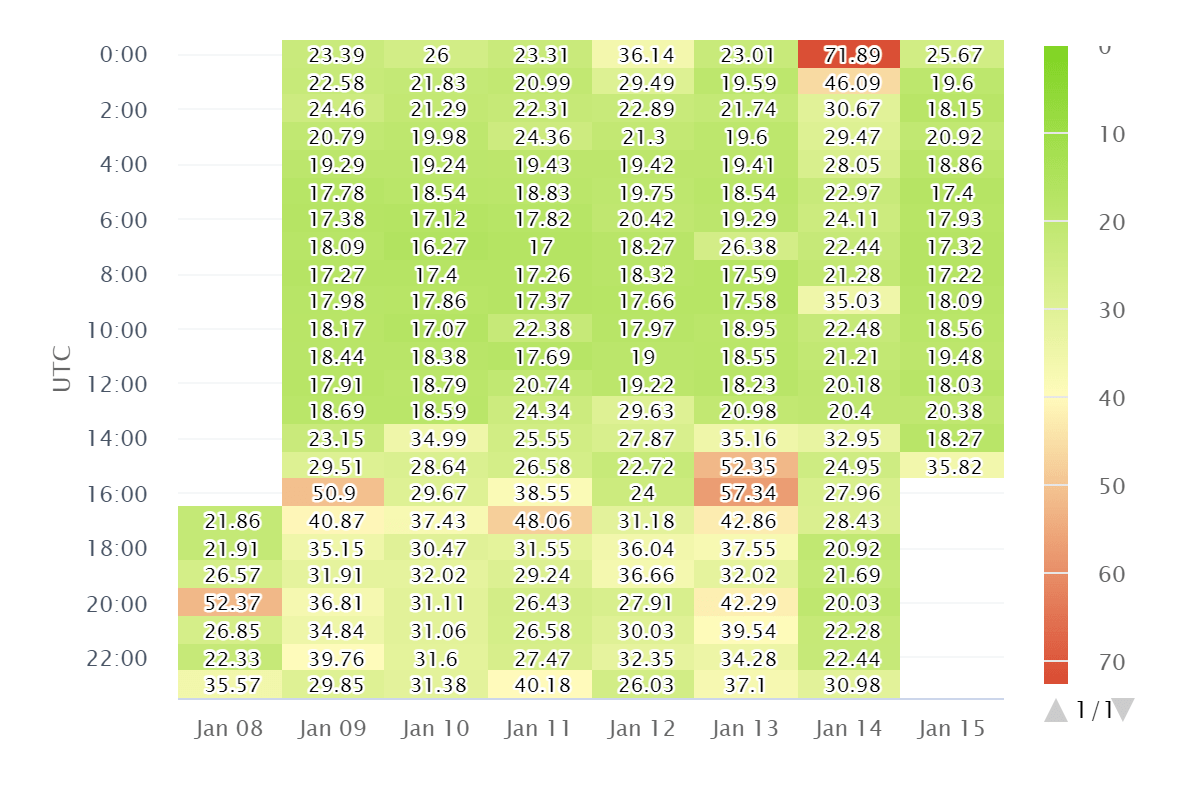

Gas Cost Heatmap

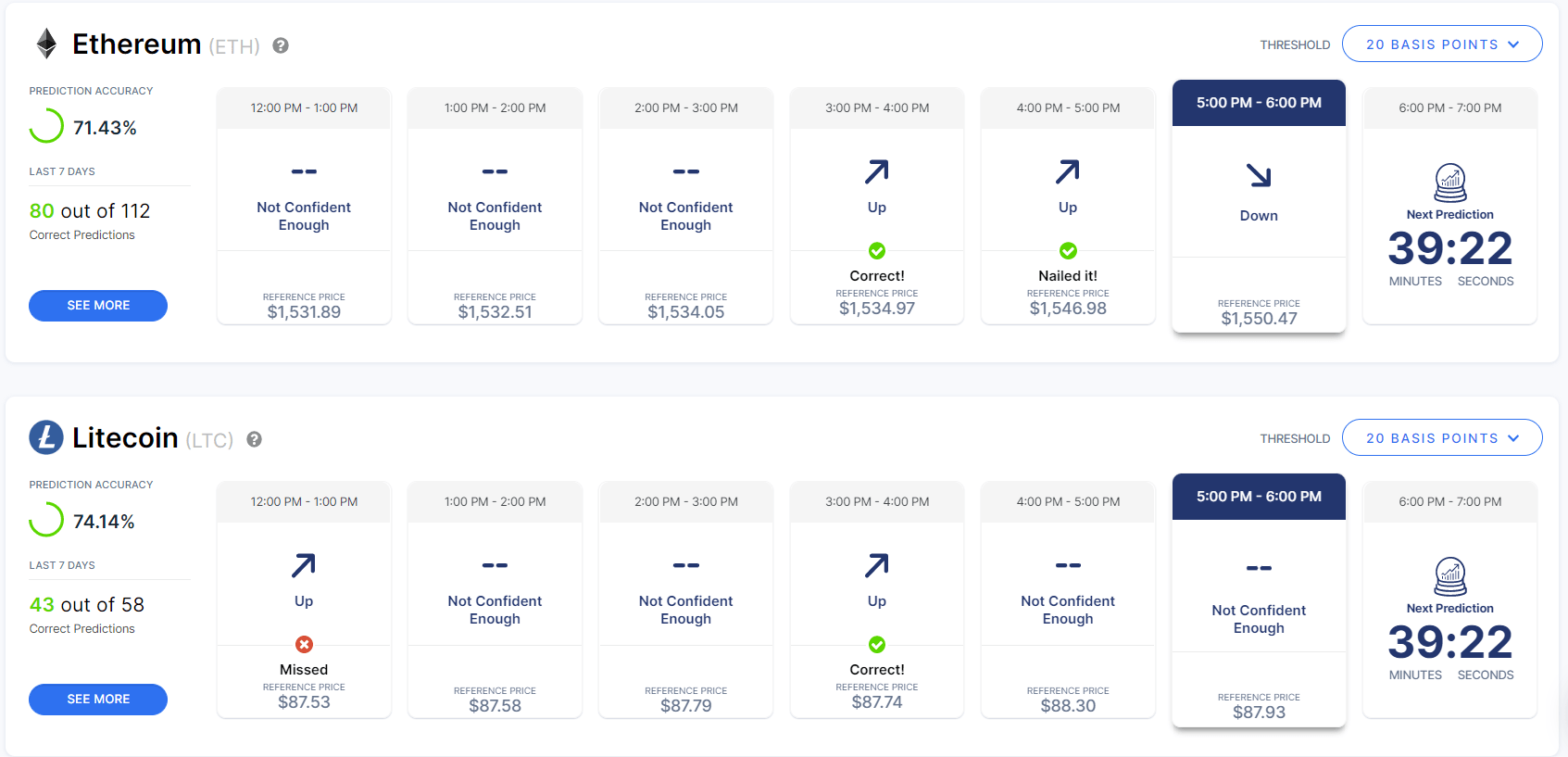

The vast wealth of addition does not stop here, with hourly price predictions proffered by the broker on all major cryptos, showing prediction confidence and success history. Moreover, if the company’s algorithms are not confident enough, no prediction will be given, reducing the risk of failure to its clients.

Coinmama Price Predictions

This is a huge amount of additional content that many competitors do not even approach, showing Coinmama to be a top-tier centralised exchange with its clients at the heart of its endeavours.

Account Types

Coinmama offers a regular account and a personalised over-the-counter investing account. Most clients will use the standard account, giving access to all 18 coins and the loyalty program. The OTC account is targeted towards institutions and high-net-worth individuals. This account type ensures instant execution and settlement services will be provided securely and professionally, no matter the volume.

Account Limits

While there are only the regular and VIP account types available, the regular account type comes with three verification levels. Each level increases the order limits available to the account.

Level 1

The level 1 account type simply requires the user to input basic details when signing up for Coinmama. This is the first account type traders will have access to when opening a regular account. At this level, daily, monthly and total volume limits are set. Daily, bankcards can only place a maximum order of £5,000, with a max quantity of 5 orders and wire transfers can order up to £15,000 with 10 orders at a maximum. Monthly, bankcards can place a max order of £15,000 with 20 orders and wire transfers can order £15,000, with up to 50 orders. The total maximum order amount is £15,000 with both payment methods.

Level 2

The level 2 account requires you to spend £2,400 on your Coinmama account and provide further documentation (a second government-issued ID, a utility bill and a completed KYC questionnaire). Daily order quantity limits are the same but order sizes rise to £10,000 and £35,000 for bankcards and wire transfers, respectively. The monthly order quantities for bankcards rise to 30 while wire transfers stay the same at 50. The order sizes also rise to £30,000 and £50,000, respectively. The total maximum order sizes rise to £50,000 for both methods.

Level 3

The level 3 account requires you to be near the £50,000 account limit of the level 2 account and fill out an updated KYC questionnaire. After this gets verified, the account gets upgraded. Both the daily and monthly max order quantities stay the same as for level 2, though daily order amounts for bankcards and wire transfers rise to £20,000 and £50,000 respectively. Monthly buy limit sizes rise to £40,000 and £100,000, while total order limits rise to £1,000,000 for both methods. Those looking to order more will need to open a VIP account.

How To Open A Coinmama Account

- Either click the “sign up” button on the header or follow the instructions above to purchase some crypto

- Fill in the prompted account details

- Confirm your email address

- Provide your personal information, including address and phone number

- Provide evidence of government-issued identification for authentication

- Begin trading with Coinmama

Trading Hours

Cryptocurrency markets are delocalised and thus are available 24/7. This extends to weekends and public holidays, so there will never be any interruptions to your ability to invest in crypto.

Customer Service

Coinmama offers an online chatbot, help centre, FAQs, online contact support form and mobile phone number as their customer service channels. The chatbot can be accessed by clicking the chat icon at the lower right side of the website, while the help centre and FAQs sit in the “Support” section of the site, alongside the contact form.

- Phone Number: +1 (650) 600-9939

Should You Trade With Coinmama?

Coinmama offers a simple crypto trading solution for some of the most popular coins and tokens in the world. The broker boasts an excellent set of educational features and market analysis functionality, including detailed crypto statistics and even AI-powered price predictions. Moreover, fast transaction speeds, an integrated wallet application and a range of wide payment methods bring it further ahead of the competition. However, the firm is held back by a limited 18-strong list of coins, as well as quite significant trading fees.

FAQ

Is Coinmama Legitimate?

Coinmama has millions of users from over 200 different countries. It is registered with FinCEN, demonstrating its legitimacy. The firm uses 3D authentication and 2FA to authenticate users. Moreover, it has been featured in articles by Bloomberg, Business Insider, Investopedia, Forbes, and Yahoo! Finance, further demonstrating its security and legitimacy.

Does Coinmama Offer A Good Range Of Cryptos?

Coinmama offers 18 popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Polygon and Dai. This is notable less than many competitors.

Is Coinmama Cheap?

Coinmama charges commission fees (ranging from 0.99% and 3.9%) that differ depending on your loyalty level. The company also charges express fees on some payment methods and a spread. As a result, overall trading and non-trading fees are higher than some alternatives.

Does Coinmama Have A Trading App?

Coinmama does have an app available on the Apple iOS App Store and Android Google Play Store (Coinmama Wallet). The app allows you to buy, sell, send and receive crypto coins and tokens, with instant BTC and ETH transactions.

Is Coinmama A Bitcoin Wallet?

Coinmama offers its own crypto wallet, capable of holding BTC and ETH. However, the service for buying and selling cryptocurrencies does not require a Coinmama Wallet, you can simply link up another wallet.

Top 3 Coinmama Alternatives

These brokers are the most similar to Coinmama:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, from CFDs to AvaOptions and now AvaFutures, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Coinmama Feature Comparison

| Coinmama | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 2.9 | 4.9 | 4.8 | 4.7 |

| Markets | Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $30 | $100 | $0 | $0 |

| Minimum Trade | $30 to buy, $100 to sell | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | No | Yes | Yes | Yes |

| Regulators | FinCEN, FINTRAC | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | - | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | 69% of retail CFD accounts lose money. |

|||

| Review | Coinmama Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Coinmama | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | No | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Coinmama vs Other Brokers

Compare Coinmama with any other broker by selecting the other broker below.

Popular Coinmama comparisons: