Webull Review 2024

|

|

Webull is #45 in our rankings of UK brokers. |

| Top 3 alternatives to Webull |

| Webull Facts & Figures |

|---|

Webull is a multi-regulated trading app that offers stocks, options, forex, cryptos, ETFs, fractional shares and more. The firm is authorized by the SEC, FINRA and FCA and continues to uphold a strong trust rating. Low fees, no minimum investment and generous welcome bonuses have made the discount broker popular with online investors. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Stocks, ETFs, ADRs, OTCs, options, cryptos, forex, fractional shares |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | iOS & Android |

| Payments | |

| Min. Trade | 0.00001 (Fractional Share) |

| Regulated By | SEC, FINRA, FCA |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Islamic Account | No |

| Stocks | You can trade an excellent suite of 2000+ US stocks, fractional shares, options, ETFs, OTC and ADRs. There are no commissions on most assets. Additionally, extended hours trading is offered as well as optimized screeners and custom watchlists to aid investment decisions. |

Webull is a Chinese-owned stock broker that extended its services to UK investors in 2023. This Webull review takes a balanced look at the broker’s usability and features to see if it’s a good option for British investors, drawing on first-hand trading insights.

Our Take

- Webull is regulated by the FCA, ensuring a secure environment for investors in the UK, however there is no GBP account.

- The broker offers low-cost trading on around 5000 US stocks, but there are small commissions for trading and currency conversion fees.

- The platform provides an excellent range of tools and research, notably stock-specific news feeds, market analysis, and company fundamentals.

- Webull provides no ability to invest in UK and global shares, a notable drawback compared to IG with its 17,000+ markets.

- Unlike a growing list of UK brokers, including XTB, Webull does not offer interest on idle cash balances.

Is Webull Regulated In The UK?

Founded in 2021 as part of the global Webull Group, Webull Securities (UK) Ltd was established to offer low-cost trading for UK investors.

In addition to having the financial backing of the company in the US, Webull Securities (UK) Ltd is regulated by the Financial Conduct Authority (FCA), so has to adhere to regulatory standards to ensure the safety of your investments.

It also offers protection through the Financial Services Compensation Scheme (FSCS), ensuring deposits of up to £85,000 are safeguarded in the event of Webull’s insolvency.

While FSCS protection provides coverage for deposits, it does not extend to losses incurred from a decrease in the value of investments. Your capital is always at risk.

Accounts

Live Accounts

Whether you choose to open an account through the website or the Webull mobile app, you’ll only have access to a General Investment Account (GIA).

While this account offers flexibility in terms of investment amounts, it lacks the unique benefits and tax-efficient features found in accounts like Stocks and Shares ISAs or Self-Invested Personal Pensions (SIPPs). This limitation makes it one of the most restricted platforms for long-term investing.

Also, Webull isn’t specifically designed for active trading. This means there are no account options for spread betting or CFDs, which suit short-term traders.

On a lighter note, I appreciate the freedom to invest as much as I desire, though you should keep in mind that any gains may be subject to taxes from HMRC.

Demo Account

The paper trading environment is impressive for simulating trades and familiarising yourself with platform features before committing to a live account.

The demo account also offers unlimited virtual funding, which will be invaluable for new investors looking to gain experience.

Accessing the demo account is straightforward; simply follow the same steps as signing up for a live account and then navigate to the ‘Paper Trading’ icon in the left-hand menu.

I find it convenient to switch seamlessly between live and demo modes on Webull, allowing for easy testing of strategies from a single dashboard. Also, unlike some UK brokers, I appreciate that the paper trading account isn’t time-restricted.

Funding Options

Deposits

Webull has no minimum deposit or withdrawal requirements, making it an accessible option for beginners and those with limited starting capital.

However, it’s surprising that deposits and withdrawals are limited to bank transfers. Unlike other platforms, such as highly-rated Pepperstone, that offer various funding options like credit/debit cards or e-wallets (like PayPal, Skrill, Neteller, etc.), Webull solely relies on bank transfers.

Deposits made through the app using the faster payments system appeared in my account within 10 minutes, but bank wires can take up to 3 business days.

Another drawback is the limitation to only one base currency, which is USD. This will be inconvenient for many British investors who prefer trading in GBP. Leading alternatives like AvaTrade offer the choice between GBP or USD accounts, as well as EUR, AUD and CAD.

Withdrawals

Withdrawal times are reasonable, typically ranging from 2 to 5 days. It’s worth noting, however, that before I initiated a withdrawal I had to ensure that I had linked my bank account details for the transfer.

This is because Webull does not accept third-party bank accounts or third-party payment platforms, so withdrawals must be made to your own individual bank account.

Market Access

Webull’s product portfolio is limited to around 5000 US, Hong Kong and China stocks, leaving out popular asset types such as FTSE shares, forex, funds, bonds, commodities, and ETFs.

In the US, the broker offers additional products such as ETFs, treasuries, and alternatives. While these may potentially become available in future releases in the UK, currently, British clients are limited to building a stock portfolio from US equities.

On the plus side, Webull allows investing in fractional shares, which is beneficial for more conservative trading approaches. With a minimum deposit requirement of just £1 and the opportunity to purchase fractional shares starting from as little as £5 (the minimum fractional amount of shares for a single trade is 0.00001), Webull is worth considering for those interested in trading US stocks from the UK with small amounts.

British traders are restricted from trading cryptocurrency due to regulations imposed by the Financial Conduct Authority (FCA).

Leverage

Webull UK does not offer leverage – even for professional investors.

Leveraging stocks can offer the potential for amplified returns and diversification opportunities, but it also comes with increased risk, potential interest costs, and the possibility of margin calls if investments don’t perform as expected.

If you want to trade stocks with leverage, consider a top-rated CFD broker like CMC Markets.

Pricing

While Webull offers competitive fees, there is a commission applied to stock transactions, unlike its US entity. Although this fee is exceptionally low, it’s not as competitive as leading commission-free brokerages such as Freetrade.

The platform charges a small commission for trading stocks, 2.5 basis points, equating to approximately 0.025% of your trade value. For example, if you were to purchase £200 worth of stock, the fee would amount to £0.06 (rounded up). While not exorbitant, it’s worth noting that it’s not entirely free either.

Apart from these nominal investing commissions, Webull imposes a few other fees. Account opening and maintenance are free of charge, and there are no fees for depositing or withdrawing funds.

Additionally, there is no platform or inactivity fee, allowing users to access the platform’s analysis and dashboards for free.

However, a notable limitation of investing solely in US stocks is encountering currency conversion fees with each deposit (not per investment). Similar to investing on eToro, there are no workarounds, as all deposits must be made in GBP and subsequently converted to USD. Unfortunately, this setup does not create ideal conditions for UK investors.

Trading Platform

Webull offers its proprietary trading platform, which can be accessed via desktop download, web browser, or mobile app.

All platforms provide a diverse selection of technical indicators and charting styles, making investing relatively straightforward. However, compared to platforms like eToro and Trading212, Webull’s interface is less intuitive or pleasurable for casual investors.

Another notable drawback is the lack of support for sophisticated third-party platforms such as MetaTrader, cTrader, or TradingView, which may be disappointing for experienced investors seeking robust charting software and algorithmic trading capabilities. That said, it’s worth noting that Webull isn’t primarily designed for active traders.

Importantly, the proprietary platform does offer a fully customisable experience, providing more advanced charting and analysis tools compared to many competitors.

I particularly appreciate the real-time alerts feature, which allows me to set custom alerts based on various parameters like price movements, news updates, or technical signals.

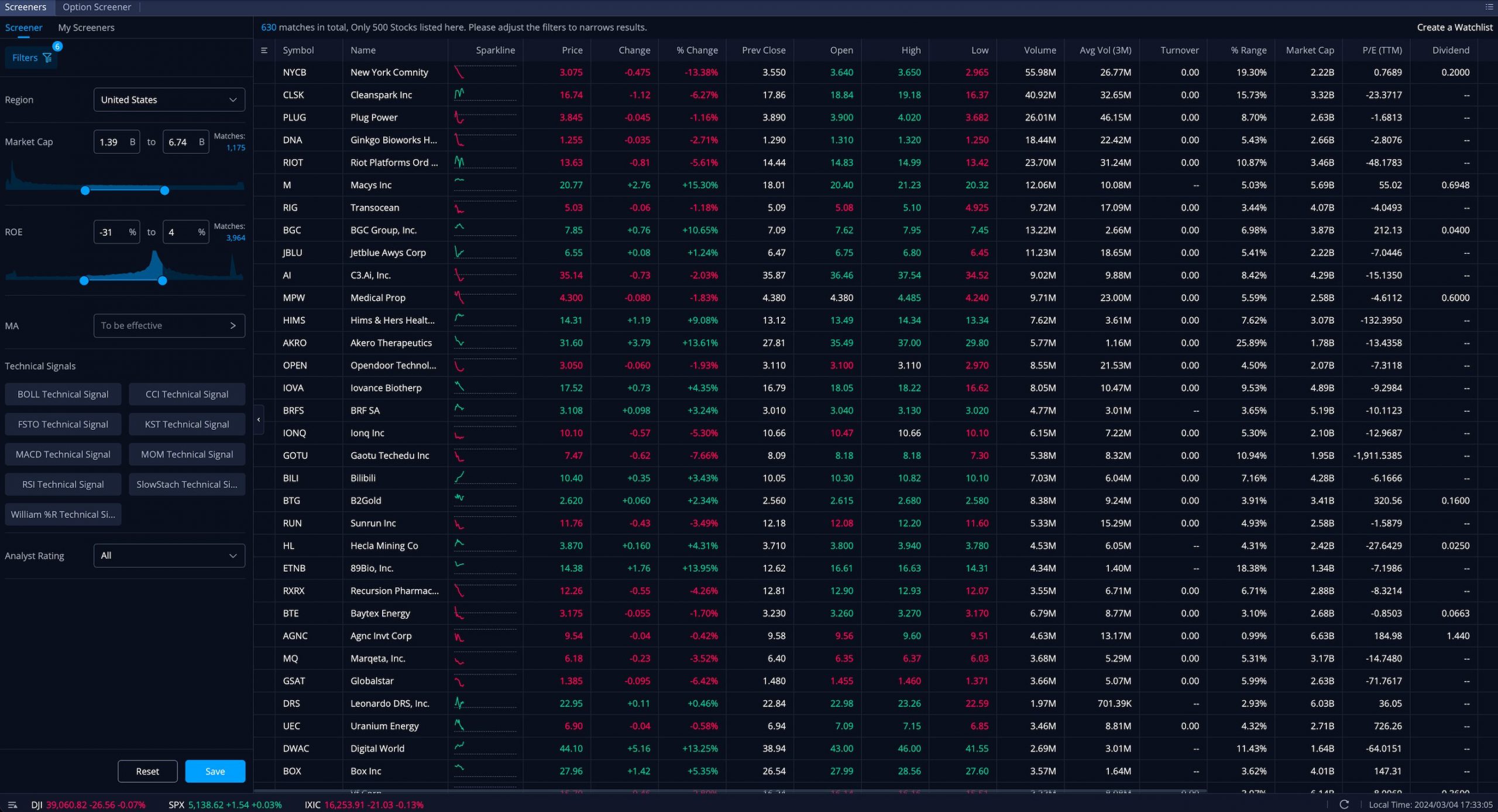

One of Webull’s best features is the optimised screeners that let me filter stocks based on over 40 indicators to track top gainers, losers, and best-performing industries to identify potential investment opportunities.

The market analysis section, containing detailed global market data including top gainers and losers feed, along with best-performing industries, is also impressive. I find the ‘VS feature’ especially useful for quickly comparing two stocks on the same chart.

However, I did find that the platform required some time to familiarise myself with the layout. Despite the tab-based layout appearing simple, each tab contains a plethora of information, making navigation challenging. Additionally, I find the process of opening and closing widgets to be unintuitive.

Furthermore, finding and purchasing a stock felt somewhat disorganised and not straightforward. Considering Webull is aimed at beginner investors, the platform could benefit from being more user-friendly and intuitive.

Extra Tools

Webull offers a commendable suite of market research and analysis tools. The News Center provides market and stock updates from reputable sources like Reuters, Bending and Seeking Alpha, along with an IPO hub offering insights into recent filings, earnings, and dividends per share.

The News Center and IPO hub are excellent resources for updates on market trends, stock filings, and earnings reports, and can help you to stay ahead of the curve.

Live account holders also gain access to WSJ’s business news and market analysis and the option to subscribe to Level 2 data at an additional cost.

While these resources are valuable for novice investors, seasoned investors may find more advanced tools and expert insights at other brokerage firms, notably category leaders like IG.

Still, Webull excels in its educational offerings. The platform provides comprehensive video tutorials, articles, and trading courses suitable for investors of all experience levels.

Covering popular topics such as short selling and technical analysis, these well-presented resources compare favourably to those available on other platforms such as Trading212.

On the downside, there are no free trading signals, seminars, webinars, or podcasts. I’d also like to see more structured courses that can be filtered based on personal investing experience.

There’s no copy trading functionality, either, which is a big limitation for beginners looking to copy the investments of more experienced users. IC Markets is an excellent option for copy traders.

Customer Service

While Webull’s customer service is satisfactory, it lacks the immediate responsiveness found on some other platforms.

For example, although support is supposed to be available around the clock through the in-app chat function, it has taken me at least 30 minutes to connect to a live agent during the European trading session on a few occasions.

Fortunately, there are alternative options for direct assistance. You can call support on a landline from 9 am to 6 pm on weekdays in UK time, or email if your query is less urgent.

Additionally, the broker maintains a comprehensive help portal covering various topics, including account management and platform support, which can be helpful for addressing non-urgent issues.

Should You Invest With Webull?

Webull is a reputable broker with headquarters in the US and regulation in the UK. It offers several advantages for novice investors, including no minimum deposit or withdrawal requirements, access to unlimited demo trading, and valuable educational resources.

However, I find the proprietary platform confusing to navigate (both desktop and mobile versions), and it lacks some of the advanced analysis tools available on other platforms. Additionally, investment offerings are limited, lacking popular products including UK stocks or ISAs.

Ultimately, while Webull is suitable for those seeking low-cost US stock trading, its lack of account and market variety may limit its appeal. To stand out among the the best commission-free brokers in the UK, Webull needs to enhance its overall offering.

FAQ

Is Webull Good For UK Investors?

Webull is a viable option for UK traders, particularly those interested in accessing US stocks.

However, it is quite restrictive in most aspects, notably its account options and market access, while the proprietary platform trails those of the best brokers in the UK.

Can You Invest In GBP With Webull?

Webull primarily facilitates trading in USD. Therefore, if you are trading from the UK, your account balance will be converted to USD.

Conversion fees are applied at the time of execution, utilising bid and offer exchange rates provided by Webull’s banking partner, along with a spread of 0.35%.

Is Webull Safe?

Webull is generally considered safe as Webull Securities (UK) Limited is authorised by the Financial Conduct Authority (FCA) in the UK.

Additionally, client assets are safeguarded under the Financial Services Compensation Scheme (FSCS).

Does Webull Offer A Mobile Investing App?

Webull offers trading platforms for desktop and mobile devices. The desktop platform is available as a downloadable application or via a web browser. Also, the broker provides a mobile app, allowing you to access the platform on the go.

Can You Invest In Cryptocurrency With Webull In The UK?

At present, Webull does not offer cryptocurrency trading services for UK investors. This distinguishes it from several of its key competitors, such as OANDA, which facilitates the buying and selling of popular digital currencies including Bitcoin and Ethereum.

Article Sources

Webull Securities (UK) Ltd – FCA Licence

Top 3 Webull Alternatives

These brokers are the most similar to Webull:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG Index - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Swissquote - Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Webull Feature Comparison

| Webull | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| Rating | 4.4 | 4.3 | 4.7 | 4 |

| Markets | Stocks | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities |

| Minimum Deposit | $0 | $0 | $0 | $1000 |

| Minimum Trade | 0.00001 (Fractional Share) | $100 | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | SEC, FINRA, FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM | FCA, FINMA, DFSA, SFC, AFM |

| Bonus | - | - | - | - |

| Education | Yes | Yes | Yes | No |

| Platforms | - | - | MT4 | MT4, MT5 |

| Leverage | 1:4 | 1:50 | 1:30 (Retail), 1:222 (Pro) | 1:30 |

| Visit | 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

|||

| Review | Webull Review |

Interactive Brokers Review |

IG Index Review |

Swissquote Review |

Trading Instruments Comparison

| Webull | Interactive Brokers | IG Index | Swissquote | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | No | Yes | No | No |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Webull vs Other Brokers

Compare Webull with any other broker by selecting the other broker below.

Popular Webull comparisons: