Spectre.ai Review 2024

|

|

Spectre.ai is #11 in our rankings of binary options brokers. |

| Spectre.ai Facts & Figures |

|---|

Spectre.ai is a binary options trading platform that offers an innovative blockchain-based system and proprietary products with payouts up to 400%. Spectre sources liquidity directly from traders with no middleman, and offers a transparent trading environment with all transactions visible on a verified ledger. The broker offers contracts on crypto and forex pairs with flexible expiry times and instant payouts on an easy-to-use bespoke platform and mobile app. |

| Pros |

|

|---|---|

| Cons |

|

| Instruments | Shares, Reverse Futures, Crypto, Forex, Commodities, Binary options, EPIC, CFD |

| Demo Account | Yes |

| Min. Deposit | $0 |

| Mobile Apps | Yes |

| Payments | |

| Min. Trade | $1 |

| Regulated By | St. Vincent and the Grenadines |

| MetaTrader 4 | No |

| MetaTrader 5 | No |

| cTrader | No |

| DMA Account | No |

| ECN Account | No |

| Social Trading | No |

| Copy Trading | No |

| Auto Trading | Yes - through APIs |

| Islamic Account | Yes |

| Commodities |

|

| Forex | Trade binary options on 18 forex pairs, including a selection of majors, minors and cross pairs such as GBP/USD, EUR/USD and AUD/JPY. Gold and silver binary options are also available paired with USD. |

| GBPUSD Spread | 0.90 |

| EURUSD Spread | 0.58 |

| GBPEUR Spread | 0.90 |

| Assets | 20 |

| Stocks | Stock binary options are available on US equities to qualifying registered members who complete an application form. 20 blue chip stocks are available to aspiring traders. |

| Cryptocurrency | Trade some of the most well-known cryptos, including Bitcoin, Ethereum, and Litecoin. Users just have to decide if the price of the digital token will rise or fall over an agreed timeframe. |

| Coins |

|

| Spreads | Variable |

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Auto Market Maker | No |

| Binary Options | Spectre.ai offers binary options trading on multiple markets with a $0 starting deposit and payouts up to 400%. No other binary brands match Spectre in terms of payouts. |

| Expiry Times | 1 second - 1 day |

| Payout Percent | 400% |

| Ladder Options | No |

| Boundary Options | No |

Spectre.ai is an online platform that offers blockchain-based trading. Interestingly, Spectre adopts a broker-less model, utilising crowd-sourced technology to provide a flexible, secure trading experience. In this review, we explore what Spectre.ai has to offer UK traders, from the fee structure and minimum deposit to binary options trading, mobile apps, withdrawals, and security.

Spectre.ai offers over 100 assets, including bespoke instruments with payouts of up to 400%. The beginner-friendly web-based platform and app are also easy to pick up. On the downside, Spectre.ai is not regulated by the UK’s FCA.

Differentiators

There are a number of features that separate Spectre.ai from alternatives:

- A Broker-less Model – Trades are made directly against Spectre’s liquidity pool, or other traders. All trades are audited on a fully transparent digital ledger. Cutting out the middleman allows for greater flexibility, faster execution and lower fees.

- No Deposits – Spectre.ai takes an innovative approach to deposits, allowing clients to trade directly from their digital wallet. There is no upfront deposit required and the company does not hold onto client funds at any stage. Instead, the platform takes a percentage based on the volume traded.

- Verification – Spectre.ai offers a global audit trade. Every trade is verified on a digital ledger which is then sent to a public digital ledger for verification. Over 20,000 nodes from around the world will process the trades. The company was one of the first to implement a global audit system.

- Gamified Trading – Trader’s Bay is an online store built into the Spectre.ai platform itself. A unification between the world of trading and gaming. In exchange for a small daily fee, clients can subscribe to a range of upgrades or trading privileges designed to enhance the investing experience.

Company History & Overview

Spectre.ai, full name, Speculative Tokenized Trading Exchange, came onto the scene in the early 2000s. First making a name for itself in Asia, the brand’s popularity quickly grew thanks to its interest in making investing transparent, flexible and secure. The firm now has over two decades of experience serving traders globally, including in the UK.

Spectre’s pioneering approach is centred around a decentralised, autonomous liquidity pool (DALP) built on the Ethereum blockchain. It essentially follows a broker-less model, allowing payments to be processed directly to and from client wallets.

The company is owned by Spectre Trading Ltd which is registered in St. Vincent and the Grenadines.

Markets & Instruments

Traders can choose from 100+ trading instruments across multiple asset classes. Assets are split into two key categories: digital options and Spectre’s Epochal Price Index Composite (EPIC).

The key difference between the two is that digital contracts offer near-instant verification, payouts of up to 400% and can be traded in various live markets. In contrast, EPIC contracts are the firm’s own trading vehicles based on historical market data.

The firm’s EPIC products are unique and help separate Spectre.ai from traditional providers of CFDs and binary options.

Available assets:

- Forex – trade 18 major and minor currencies pairs, including GBP/USD

- Commodities – diversify your portfolio with silver and gold trading

- Crypto – 23 of the biggest names in crypto including Bitcoin, Ethereum, Dash, Chainlink and more. Available to trade 24/7

- Equities – 10 digital contracts and covered CFDs on popular global names such as Apple, Netflix, Walmart and Tesla

- EPICs – Spectre.ai’s benchmark index of Euro-based currencies

- Reverse Futures – Spectre.ai’s digital contracts on past global equities

The list of assets is also continuously growing as new cryptocurrencies and DeFi coins are added. New tokens are often first introduced via the demo account, available with up to 90% returns.

Platform

Spectre.ai offers a proprietary, web-based platform. The system offers all of the standard features including interactive charting, fast processing and 30+ technical indicators. When we used Spectre.ai’s platform, we found it user-friendly and easy to navigate.

The platform also underwent an extensive upgrade in 2022, and now offers a faster and more reliable trading experience, however it still lacks some of the advanced tools and features offered by third-party terminals, such as MetaTrader 4 and MetaTrader 5.

The good news is that integration with MT4/MT5 is in the pipeline so clients should have access to enhanced features in the near future.

The platform does support APIs, allowing traders to utilise automated robots. Automated trading is also available on the demo account.

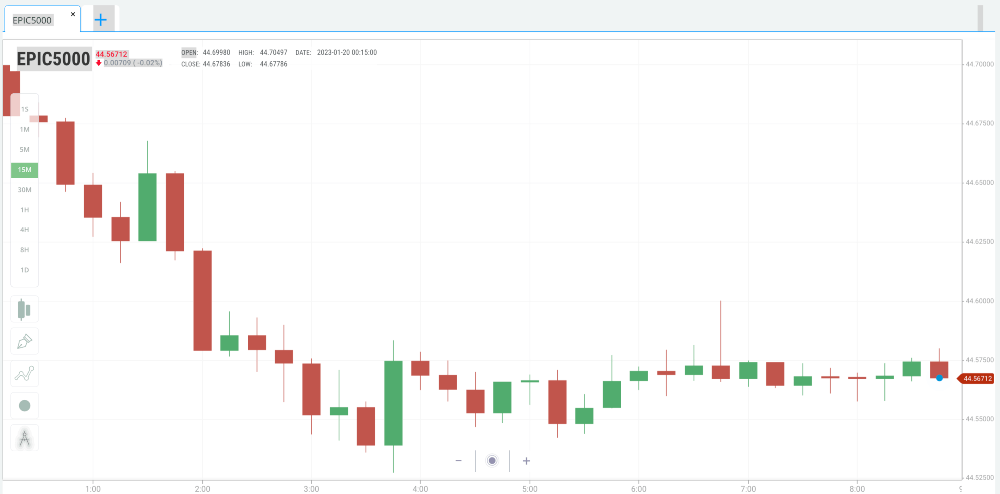

EPIC Trading

Mobile App

Spectre.ai offers mobile trading through its proprietary app. The APK application can be downloaded free of charge directly from the Spectre.ai website. It is not currently available on the Google Play or Apple App Store, but it is compatible with iOS and Android devices.

The mobile app supports most of the features available on the desktop version. The user experience is sleek and provides investors with the added flexibility of being able to trade on the go.

To improve its mobile trading rating, it would be good to see Spectre.ai release official download links via the relevant app stores.

Trading Tutorial

It’s quick and easy to start trading on Spectre.ai once you have registered for an account:

- Open the web platform from the broker’s official site

- Use the ‘+’ icon and drop-down menu to find an asset to trade

- A price chart will then open which you can customise with drawing tools, indicators and technical overlays

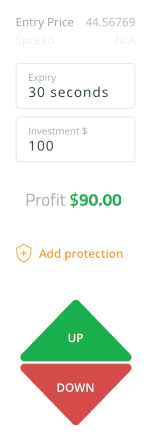

- In the widget on the right you will find a ‘Digital Contracts’ view

- Choose an expiry time (10 seconds to 1 hour)

- Select the investment amount (£5+)

- Decide whether you want to ‘Add Protection’ (loss insurance for a fee)

- Review the potential payout, displayed as a percentage underneath

- Click on ‘Up’ or ‘Down’ to open the position

- Monitor the trade and wait for the expiry

Fees & Charges

For Wallet account holders, there is no minimum deposit and the minimum trade size is £50.

For Regular account holders, there is a £10 minimum deposit and a £1.00 minimum trade size.

Withdrawals are free for all account holders. However, third parties such as Uphold and other payment processing intermediaries may have their own associated fees.

There are no inactivity fees or commission charges.

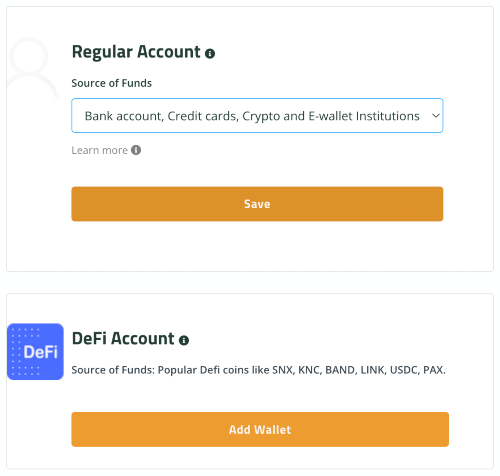

Account Types

Spectre.ai does not offer a range of account options. Instead, clients can choose between two trading solutions:

- Wallet – allows clients to trade directly from their crypto wallet. Removing the middleman means that transactions are processed quickly and there are no fees.

- Regular – essentially a private escrowed Ether wallet. Returns are deposited directly into the escrowed wallet which can subsequently be withdrawn into a private e-wallet. There is a minimum deposit of £10.

There is also an Islamic account available upon request. For more information, get in touch with the Spectre.ai support team (details below).

Demo Account

Spectre.ai offers all prospective clients the opportunity to try before they buy with their demo account.

It supports most of the features of the live account, including APIs. It is also the first place new DeFi coins are released.

A demo account can be upgraded to a live account quickly and easily. Simply log in to the client portal and navigate to the live account registration section.

Payment Methods

Spectre.ai offers a good selection of payment methods for both fiat and digital currencies:

- E-wallets including Neteller and Skrill

- Credit/debit card

- Bank transfer

- PaySafeCard

- Uphold

Clients also have the option to make a deposit or withdrawal using a DeFi wallet. Supported coins include SNX, KNC, BAND, LINK, USDC and PAX. There are talks of adding proprietary coins, SXDT and SXUT, in the future.

Allow up to 48 hours for transfers to be processed, though this may vary according to the processing method used. Wire transfers may take a few days. On the downside, this is fairly slow vs popular brokers.

How To Make A Deposit

- Login to the Spectre.ai members’ area with your registered credentials

- In the top right corner select the green ‘Deposit’ button

- Choose how you would like to make a payment (fiat vs digital currency)

- Choose the specific payment method from the drop-down menu

- Follow the on-screen instructions, including entering the amount and currency

- Enter any security code via 2FA depending on the payment method

- Check your live account for the updated balance

Note, you cannot make a deposit until you have completed the KYC process.

UK Regulation

Spectre.ai is owned and operated by Spectre Trading Ltd which is based in St. Vincent & the Grenadines under registration number 25113 IBC 2018.

Importantly, the company is unregulated in the UK. This means that it operates independently from government regulations or standards. Prospective users should note that trading with an unregulated broker carries greater risk.

Address: Suite 305, Griffith Corporate Centre, PO Box 1510, Beachmont, Kingstown, St.Vincent and the Grenadines.

Leverage

Forex is the only asset that can be traded with leverage at Spectre.ai where it is available up to 1:40.

For traders with less capital, this might be disappointing. However, leverage trading is a risky strategy that can lead to greater losses as well as returns.

Bonuses & Promotions

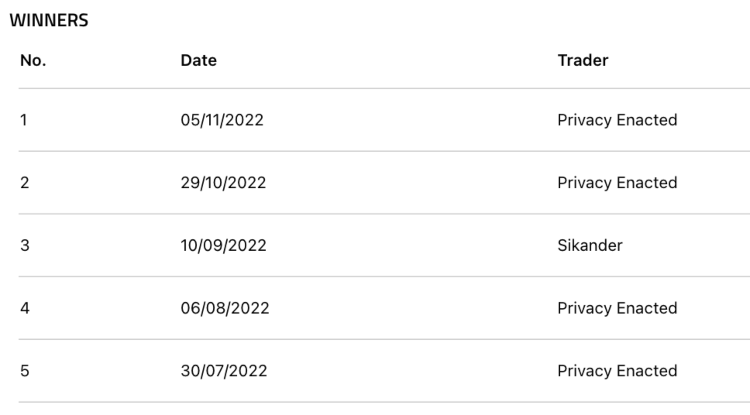

Spectre.ai does not offer any welcome bonuses or ad hoc promotional offers. It does, however, run weekly and annual trading competitions known as Incentive Challenges. They are open to all live account holders and winners can receive up to $100,000.

Spectre.ai also offers U-Token rewards which is an internal dividend reward utility token (SXDT) that grants clients access to more assets, increased trade sizes and higher payouts. They can be stored in a digital wallet and are not a feature found at competitors. Head to the rewards portal to view your perks.

Incentive Challenge Winners

Opening Hours

Trading is supported 24/7, however, some markets may follow set schedules. Trading outside of these hours may result in less competitive spreads and slower processing times.

Forex and stocks are only available during the week. Cryptos can be traded on weekdays and weekends.

For detailed trading times broken down by asset, visit the official Spectre website.

Customer Service

While using Spectre.ai, our traders found the firm offers typical support channels and reliable assistance.

To get in touch with the customer support team, visit the Spectre.ai website and navigate to the ‘Contact Us’ tab. There you will find an option to submit a ticket. Alternatively, email support@spectre.ai or speak to a representative directly through the live chat feature.

The Spectre.ai platform is also available in multiple languages, including English, Japanese, Chinese, Spanish and Turkish. For the full list visit ‘Account Settings’.

For news and the latest updates, follow Spectre.ai on Facebook, Twitter or Medium.

Client Safety

Security is a priority for Spectre.ai. Every transaction is either mined and settled on a fully transparent digital ledger, or verified on a public ledger (aggregated every 24 hours). A network of 20,000+ nodes from around the world will verify the parameters of the trade. The company was one of the first to adopt a global audit trail of this nature.

There are also a number of verification checks prior to opening an account. Users will need to supply proof of identity and address as well as a recent picture in line with KYC requirements.

Should You Trade With Spectre.ai?

Spectre.ai offers a fairly unique trading experience. Based on a fully transparent blockchain, with an EPIC contract class, no minimum deposits and no broker, it is not hard to see why Spectre.ai receives a lot of interest.

For investors seeking a flexible, innovative and transparent online trading system, Spectre.ai is worth considering.

FAQ

Is Spectre.ai A Scam?

No, Spectre.ai is not a scam. It is an established online platform that facilitates trading across multiple asset classes and markets. It is, however, unregulated. Trading with an unregulated broker or exchange always carries greater risks.

How Do I Use Spectre.ai?

Spectre offers little in terms of educational resources or materials. This is a serious drawback vs alternative trading firms and may worry beginners. Fortunately, there is a demo account which allows traders to get to grips with the platform risk-free.

Alternatively, see our full Spectre.ai review for tips on using the platform and trading app.

Is Spectre.ai Good For Online Trading?

User reviews of the Spectre.ai platform are generally positive. Low deposits, reasonable spreads and no middleman also make for a competitive trading experience.

Note, Spectre.ai is not a broker – it is an exchange platform.

Is Spectre.ai Available On The Android Store?

No, the firm’s mobile app is only available to download directly from the Spectre.ai website. It is, however, compatible with Android devices.

When Was Spectre.ai’s ICO?

Spectre.ai had a successful Initial Coin Offering (ICO) in 2017. It was open to prospective investors who were actively encouraged to participate. The firm released a roadmap on popular trading forums.

Compare Spectre.ai with Other Brokers

These brokers are the most similar to Spectre.ai:

- AvaTrade - AvaTrade is a leading forex and CFD broker, established in 2006 and regulated across 9 jurisdictions. Over 400,000 users have signed up with the broker which processes over 2 million trades each month. The firm offers multiple trading platforms, including MT4, MT5, and a proprietary WebTrader. 1250+ financial instruments are available for trading, alongside a comprehensive education center and multilingual customer support.

- XTB - Founded in 2002 in Poland, XTB now serves more than 935,000 clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of 5,600+ assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring traders.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

Spectre.ai Feature Comparison

| Spectre.ai | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4.9 | 4.8 | 4.7 |

| Markets | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities | Forex, Stocks, Commodities, Crypto | Forex, Stocks, Commodities |

| Minimum Deposit | $0 | $100 | $0 | $0 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Demo Account | Yes | Yes | Yes | Yes |

| Regulators | St. Vincent and the Grenadines | ASIC, CySEC, FSCA, ISA, CBol, FSA, FSRA, BVI, ADGM | FCA, CySEC, KNF, CNMV, DFSA, FSC | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Bonus | - | - | - | - |

| Education | No | Yes | Yes | Yes |

| Platforms | - | MT4, MT5 | - | MT4 |

| Leverage | 1:40 | 1:30 (Retail) 1:400 (Pro) | 1:30 | 1:30 (Retail), 1:500 (Pro) |

| Visit | ||||

| Review | Spectre.ai Review |

AvaTrade Review |

XTB Review |

CMC Markets Review |

Trading Instruments Comparison

| Spectre.ai | AvaTrade | XTB | CMC Markets | |

|---|---|---|---|---|

| Binary Options | Yes | No | No | No |

| Ladder Options | No | No | No | No |

| Boundary Options | No | No | No | No |

| CFD | No | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | Yes | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | Yes | No |

| Futures | No | No | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | Yes |

| Volatility Index | No | Yes | Yes | Yes |

Spectre.ai vs Other Brokers

Compare Spectre.ai with any other broker by selecting the other broker below.

Popular Spectre.ai comparisons: