Best Day Trading Platforms In The UK

Ready to dive into the fast-paced world of day trading? We reveal the best day trading platforms in the UK, packed with powerful tools, fast execution, and features designed to give you an edge.

Top Day Trading Platforms in the UK

-

Founded in Australia in 2010, Pepperstone is a highly regarded broker specialising in forex and CFDs. Serving more than 400,000 clients globally, it provides access to over 1,300 financial instruments through popular platforms like MT4, MT5, cTrader, and TradingView. Its fee structure is both low and transparent. With regulation by reputable bodies such as the FCA, ASIC, and CySEC, Pepperstone guarantees a safe trading environment for traders at every level.

Minimum Deposit: $0

Reliable Execution: Yes

Charting Platforms: Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist

Regulators: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB

-

Established in Poland in 2002, XTB caters to over a million clients worldwide. This forex and CFD broker offers a robust regulatory framework, a diverse range of assets, and prioritises trader satisfaction. It provides an intuitive proprietary platform equipped with excellent tools to support aspiring traders.

Minimum Deposit: $0

Reliable Execution: Yes

Charting Platforms: xStation

Regulators: FCA, CySEC, KNF, DFSA, FSC

-

Founded in 1974, IG is a part of IG Group Holdings Plc, a publicly listed brokerage (LSE: IGG). The company provides spread betting, CFD, and forex trading, offering access to over 17,000 markets. Its platforms and investing apps are notably user-friendly. Over the past 50 years, IG has consistently been an industry leader, excelling in all essential areas for traders.

Minimum Deposit: $0

Reliable Execution: Yes

Charting Platforms: Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime

Regulators: FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA

-

Trade Nation is a leading FX and CFD broker regulated in the UK and Australia, among other places. The company provides competitively priced fixed and variable spreads on over 1,000 assets. Traders benefit from advanced platforms and comprehensive training materials. Additionally, the Signal Centre offers valuable trade ideas.

Minimum Deposit: $0

Reliable Execution: No

Charting Platforms: TN Trader, MT4

Regulators: FCA, ASIC, FSCA, SCB, FSA

-

Interactive Brokers (IBKR), a leading brokerage, offers access to 150 markets across 33 countries and provides extensive investment services. With more than 40 years of experience, this Nasdaq-listed company complies with strict regulations from the SEC, FCA, CIRO, and SFC. It is among the most reliable brokers worldwide for traders.

Minimum Deposit: $0

Reliable Execution: Yes

Charting Platforms: Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower

Regulators: FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM

-

Eightcap, an acclaimed broker regulated by the FCA, offers exceptionally low trading costs. Recognised as the top-rated brand by TradingView's vast user base of 100 million, traders can directly access the platform. UK traders can open a live account with a minimum deposit of just £100.

Minimum Deposit: £100

Reliable Execution: Yes

Charting Platforms: MT4, MT5, TradingView

Regulators: ASIC, FCA, CySEC, SCB

-

Established in 1999, FOREX.com is now integrated into StoneX, a prominent financial services entity catering to more than one million clients globally. The broker is regulated in numerous jurisdictions, including the US, UK, EU, and Australia. It offers a vast array of markets beyond forex, delivering competitive pricing on state-of-the-art trading platforms.

Minimum Deposit: $100

Reliable Execution: Yes

Charting Platforms: WebTrader, Mobile, MT4, MT5, TradingView

Regulators: NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA

Safety Comparison

Compare how safe the Best Day Trading Platforms In The UK are and what features they offer to protect traders.

| Broker | Trust Rating | FCA Regulated | Negative Balance Protection | Guaranteed Stop Loss | Segregated Accounts |

|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✘ | ✔ | |

| XTB | ✔ | ✔ | ✔ | ✔ | |

| IG | ✔ | ✔ | ✔ | ✔ | |

| Trade Nation | ✔ | ✔ | ✘ | ✔ | |

| Interactive Brokers | ✔ | ✔ | ✘ | ✔ | |

| Eightcap | ✔ | ✔ | ✘ | ✔ | |

| Forex.com | ✔ | ✔ | ✘ | ✔ |

Payments Comparison

Compare which popular payment methods the Best Day Trading Platforms In The UK support and whether they have trading accounts denominated in British Pounds (GBP).

| Broker | GBP Account | Debit Card | Credit Card | Neteller | Skrill | Apple Pay |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| XTB | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| IG | ✔ | ✔ | ✔ | ✘ | ✘ | ✘ |

| Trade Nation | ✔ | ✔ | ✔ | ✘ | ✔ | ✘ |

| Interactive Brokers | ✔ | ✔ | ✘ | ✘ | ✘ | ✘ |

| Eightcap | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

| Forex.com | ✔ | ✔ | ✔ | ✔ | ✔ | ✘ |

Mobile Trading Comparison

How good are the Best Day Trading Platforms In The UK at mobile trading using apps or other mobile interfaces.

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Pepperstone | iOS & Android | ✘ | ||

| XTB | iOS & Android | ✔ | ||

| IG | iOS & Android | ✔ | ||

| Trade Nation | iOS & Android | ✘ | ||

| Interactive Brokers | iOS & Android | ✔ | ||

| Eightcap | iOS & Android | ✘ | ||

| Forex.com | iOS & Android | ✘ |

Beginners Comparison

Are the Best Day Trading Platforms In The UK good for beginner traders, that might want an affordable setup to get started, along with good support and educational resources?

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Support Rating | Education Rating |

|---|---|---|---|---|---|

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| XTB | ✔ | $0 | 0.01 Lots | ||

| IG | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots | ||

| Interactive Brokers | ✔ | $0 | $100 | ||

| Eightcap | ✔ | £100 | 0.01 Lots | ||

| Forex.com | ✔ | $100 | 0.01 Lots |

Advanced Trading Comparison

Do the Best Day Trading Platforms In The UK offer features that allow for more advanced trading strategies?

| Broker | Automated Trading | Pro Account | Leverage | VPS | AI | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ | ✔ | ✘ |

| XTB | - | ✔ | 1:30 | ✘ | ✘ | ✔ | ✘ |

| IG | Expert Advisors (EAs) on MetaTrader, build your own on ProRealTime | ✔ | 1:30 (Retail), 1:222 (Pro) | ✔ | ✔ | ✔ | ✔ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | 1:500 (entity dependent) | ✘ | ✘ | ✘ | ✘ |

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | 1:50 | ✘ | ✔ | ✔ | ✔ |

| Eightcap | TradingView Bots | ✘ | 1:30 | ✔ | ✘ | ✔ | ✘ |

| Forex.com | Expert Advisors (EAs) on MetaTrader | ✘ | 1:30 | ✔ | ✔ | ✔ | ✘ |

Detailed Rating Comparison

Use this heatmap to compare our detailed ratings for all of the Best Day Trading Platforms In The UK.

| Broker | Trust | Platforms | Mobile | Assets | Fees | Accounts | Support | Research | Education |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | |||||||||

| XTB | |||||||||

| IG | |||||||||

| Trade Nation | |||||||||

| Interactive Brokers | |||||||||

| Eightcap | |||||||||

| Forex.com |

Our Take On Pepperstone

"Pepperstone is a premier trading platform, providing tight spreads, swift execution, and sophisticated charting tools for seasoned traders. Beginners benefit from no minimum deposit, comprehensive learning materials, and outstanding 24/7 support."

Pros

- In recent years, Pepperstone has significantly enhanced the deposit and withdrawal process. By 2025, clients can use Apple Pay and Google Pay, while 2024 saw the introduction of PIX and SPEI for customers in Brazil and Mexico.

- Support for top-tier charting platforms such as MT4, MT5, TradingView, and cTrader. These tools accommodate different short-term trading methods, including algorithmic trading.

- Pepperstone now offers spread betting via TradingView, delivering a streamlined and tax-efficient trading experience with sophisticated analytical tools.

Cons

- Pepperstone's demo accounts remain active for 60 days. This duration might be insufficient to fully explore the platforms and trial various trading strategies.

- Pepperstone doesn't offer cTrader Copy, a favoured feature for copying trades found in the cTrader platform, which is available on other platforms such as IC Markets. However, Pepperstone has launched its own user-friendly copy trading app.

- Although its market range has improved, its crypto offerings remain limited compared to brokers specialising in this sector, lacking real coin investment options.

Our Take On XTB

"XTB excels for novice traders with its superb xStation platform, minimal trading costs, no required deposit, and outstanding educational resources, many of which are fully integrated into the platform."

Pros

- XTB has raised interest rates on uninvested funds and introduced zero-fee ISAs (for ETFs and real shares, or 0.2% on trades over €100k) for UK clients, offering access to a wide array of markets.

- Top-notch customer support, available 24/5, includes a welcoming live chat with response times under two minutes during tests.

- XTB processes withdrawals swiftly, paying within 3 business days, subject to the method and amount.

Cons

- XTB lacks a raw spread account, a feature increasingly offered by competitors such as Pepperstone. This omission might not satisfy traders seeking the most competitive spreads.

- The demo account lasts only four weeks, posing a challenge for traders wanting to fully explore the xStation platform and refine short-term strategies before investing actual money.

- XTB has stopped supporting MT4, restricting traders to its own platform, xStation. This decision may discourage experienced traders accustomed to using the MetaTrader suite.

Our Take On IG

"IG offers a complete package: an easy-to-use web platform, top-tier beginner education, enhanced charting via TradingView, up-to-date data, and strong trade execution for seasoned traders."

Pros

- The web-based platform supports traders at every level, offering advanced charting tools and real-time market data vital for trading. Additionally, IG now includes TradingView integration.

- IG provides a wide range of professional and engaging educational materials, such as webinars, articles, and analyses, tailored for traders.

- IG excels with its diverse instruments, offering stocks, forex, indices, commodities, and cryptocurrencies. Additionally, it provides US-listed futures, options, and an AI Index, ensuring varied diversification opportunities.

Cons

- Beginners may find IG's fees complicated, as they vary depending on the trades or services. This could cause confusion and unexpected costs.

- In the UK and EU, negative balance protection is available. However, US clients lack account protection and guaranteed stop losses.

- IG has ended its swap-free account, diminishing its attractiveness to Islamic traders.

Our Take On Trade Nation

"Trade Nation is ideal for novice traders seeking diverse markets on an easy-to-use platform. It offers no minimum deposit, complimentary funding options, and robust educational resources."

Pros

- A variety of trading platforms and apps, such as MT4, make the brand suitable for experienced traders.

- Global traders can use accounts in various currencies.

- The trading firm provides narrow spreads and a clear pricing structure.

Cons

- Reduced legal safeguards with an offshore entity.

Our Take On Interactive Brokers

"Interactive Brokers ranks highly for seasoned traders due to its robust charting platforms, live data, and bespoke layouts via the new IBKR Desktop app. Its competitive pricing and sophisticated order choices appeal to traders, and its wide equity options are industry-leading."

Pros

- IBKR is a highly respected brokerage, regulated by top-tier authorities, ensuring the integrity and security of your trading account.

- Interactive Brokers has introduced ForecastTrader, an innovative product offering zero-commission trading with yes/no Forecast Contracts on political, economic, and climate events. It features fixed $1 contract payouts, 24/6 market access, and a 3.83% APY on positions held.

- The TWS platform is tailored for intermediate and advanced traders, featuring over 100 order types and a dependable real-time market data feed with exceptional uptime.

Cons

- Support can be sluggish and frustrating. Tests reveal that you may face challenges reaching customer service quickly, which could result in delays in issue resolution.

- You are limited to a single active session per account, meaning you cannot use both your desktop programme and mobile app at the same time. This restriction can occasionally lead to a frustrating experience for traders.

- IBKR offers a variety of research tools, but their inconsistent placement across trading platforms and the 'Account Management' webpage creates a confusing experience for users.

Our Take On Eightcap

"Eightcap excels for traders, offering diverse charting platforms, educational Labs, and AI tools. With over 120 crypto CFDs, it stands out in crypto trading and has won our 'Best Crypto Broker' award twice consecutively."

Pros

- Eightcap excels with a suite of advanced trading tools, such as MT4 and MT5, and has recently joined the 100-million-user social trading network, TradingView.

- Eightcap has excelled in all essential trading areas, surpassing all rivals to clinch our 'Best Overall Broker' award for 2024. It also earned the titles of 'Best Crypto Broker' and 'Best TradingView Broker' for 2025.

- In 2026, Eightcap integrated TradeLocker, distinguishing itself as the premier regulated broker for TradeLocker. It continues to offer ultra-fast execution and competitive fees for active traders on the charting platform.

Cons

- Eightcap must enhance its range of over 800 instruments to rival top competitors like Blackbull Markets, which offers 26,000+ assets, especially improving its limited commodities selection.

- Despite the growing range of tools available, Eightcap lacks popular industry resources such as Autochartist and Trading Central. These provide advanced charting analytics, live news, and essential market insights for traders focused on short-term strategies.

- Despite a helpful array of educational guides and e-books in Labs, Eightcap lags behind IG's extensive resources for aspiring traders. IG boasts a dedicated Academy app and features 18 diverse course categories.

Our Take On Forex.com

"FOREX.com excels in serving traders of all levels, offering more than 80 currency pairs, spreads starting at 0.0 pips, and competitive commissions. Its robust charting platforms provide over 100 technical indicators and comprehensive research tools."

Pros

- With more than two decades of expertise, strong regulatory governance, and numerous accolades, including a second-place finish in our 'Best Forex Broker' awards, FOREX.com is globally renowned as a reliable trading platform.

- An abundance of educational resources is available, such as tutorials, webinars, and an extensive YouTube channel, designed to enhance your understanding of financial markets.

- FOREX.com provides top-tier forex rates beginning at 0.0 pips, along with attractive cashback rebates up to 15% for dedicated traders.

Cons

- US clients are not protected against negative balances, which means you could end up owing more than your initial deposit.

- FOREX.com's MT4 platform provides around 600 instruments, a notable reduction compared to the more than 5,500 options on its other platforms.

- Demo accounts are typically limited to 90 days, hindering effective strategy testing.

How Did Investing.co.uk Choose The Best Brokers For Day Trading?

Our rankings are based on a rigorous methodology combining over 200 quantitative data points with hands-on testing by experienced UK-based active traders and industry experts.

We focus specifically on brokers that support short-term trading strategies, assessing key factors like execution speed, platform tools, and fee structures.

We also verify whether brokers are FCA-regulated, offer GBP-denominated accounts, and provide access to UK-specific assets such as LSE-listed stocks, FTSE 100 derivatives, and GBP currency pairs.

This ensures our top picks are not only trustworthy but also tailored to the needs of active day traders in the UK.

What To Look For In A Day Trading Platform

Comparing day trading platforms is essential for finding the right fit for your trading style. From fees and execution speed to charting tools and asset selection, each platform offers something different.

Let’s break down the key features to help you make a confident, informed choice:

Trust

Choosing a trustworthy broker is a crucial first step for any day trader. With millions lost to trading scams in recent years, protecting yourself starts with using a platform regulated by a top-tier authority.

In the UK, that means looking for brokers authorised by the Financial Conduct Authority (FCA), which provides strong protections for retail traders, including:

- Negative balance protection ensures you can’t lose more money than you deposit.

- A leverage limit of 1:30 helps reduce the risk of significant losses in volatile markets.

- The Financial Services Compensation Scheme (FSCS) covers up to £85,000 if your broker goes out of business.

Whether you’re trading GBP currency pairs, UK equities, or FTSE 100 derivatives, using an FCA-regulated platform is the best way to start safely.

You can check that a broker is authorised on the FCA’s Financial Services Register. From there, you can see how long it has been operating and whether it has provided regulated products or services without the correct authorisation.

You can check whether a broker like Plus500 is authorised and regulated to operate in the UK

Top pick for UK regulation and trust: IG continues to earn its place as our most trusted day trading broker in the UK. It’s FCA-regulated, listed on the London Stock Exchange for extra scrutiny, and has been around since 1974 – giving it one of the longest track records amongst online brokers.

IG is even used by some of our testing panel for their personal trading activities, a testament to its reliability.

Markets

It’s crucial to choose a broker that provides access to the financial markets you’re most interested in, whether it’s stocks, indices, forex, commodities, futures, ETFs, or another asset class.

It’s worth noting that the FCA banned cryptocurrency derivatives for retail traders in the UK in 2020, a position it reaffirmed in 2024. This highlights the need for UK traders to focus on more traditional and regulated markets.

For day trading beginners who may not yet know all the assets they want to trade, opting for a broker with broad market access is smart. Day traders, in particular, often look for assets with high volatility, as these present opportunities for quick, profitable trades due to significant price movements in the short term.

If you’re day trading in the UK, you may want to focus on:

- Currency pairs with a GBP component: Pairs like GBP/USD and GBP/JPY have shown significant volatility in recent years, driven by events such as the Brexit referendum and changes in government leadership.

- Stocks listed on the London Stock Exchange (LSE): If you’re interested in the banking sector you can look to high-volume stocks like Lloyds and Barclays, two of the most frequently traded UK stocks.

- The FTSE 100 index: The largest publicly traded companies in the UK offer an excellent option if you seek stability. Alternatively, the Alternative Investment Market (AIM), which lists smaller, more volatile companies, is attractive if you desire higher risk and reward.

Top pick for market access: With access to over 12,000 markets, UK-regulated CMC-Markets provides one of the most comprehensive selections for UK traders and investors that we’ve seen.

From major and minor forex pairs to UK and international stocks, popular commodities like gold and oil, and a wide range of global indices—including the FTSE 100—you’ll have everything you need to diversify your portfolio, manage risk, and take advantage of daily market opportunities.

Pricing

When day trading, there are a few key charges you need to be aware of. These costs can eat into your profits if you’re not careful, so understanding them upfront is essential:

Spread and Commission

Most brokers charge either a low spread—the difference between the buy and sell price—or a commission per trade.

For example, if you’re trading popular UK assets like FTSE 100 stocks or GBP/USD, you’ll notice brokers often offer tight spreads due to high liquidity.

However, some platforms may add a fixed or percentage-based commission on top, especially for stock trading. Depending on the broker, this can be around £3–£8 per trade for UK-listed stocks.

Overnight Financing Fees (Swap/Rollover)

You may incur a financing charge overnight if you hold a leveraged position, common in CFDs or spread betting. Since day traders typically close positions before the market closes, you can often avoid this, but it’s still important to understand.

For example, holding a position on an FTSE 100 CFD past 22:00 may result in a small daily charge, depending on market rates.

Platform and Inactivity Fees

Some brokers charge a monthly fee for access to advanced trading platforms or charting tools. Others may apply an inactivity fee if your account remains idle for several months.

Read the fine print so you don’t get caught off guard.

Funding and Withdrawal Costs

Most UK day trading brokers we’ve tested offer free deposits via bank transfer or debit card, but charges may apply for specific payment methods like credit card or e-wallets.

Withdrawal fees can also vary—some brokers offer one free monthly withdrawal. In contrast, others may charge a flat fee or apply currency conversion costs if you withdraw in GBP from a multi-currency account.

Top pick for day trading pricing: Pepperstone is one of my go-to choices for day trading thanks to its consistently competitive pricing. Its Razor account offers ultra-tight spreads from 0.0 pips on GBP/USD, a low £2.25 commission per side, and even 25% or more rebates when I trade high volumes.

Add in execution speeds as fast as 30 milliseconds, and it’s a solid choice for day trading.

Charting

Choosing a broker with robust charting tools is essential for day trading, especially if you rely on technical analysis to capitalise on short-term market movements.

Whether you’re trading stocks, commodities, currency pairs, or ETFs, precise, real-time data and responsive charts make all the difference.

Over the years, I’ve used all the main charting platforms, from MT4 and MT5 to modern alternatives like cTrader and the sleek, intuitive TradingView.

As mobile trading continues to rise, I’ve also seen a substantial shift toward platforms offering fully optimised charting apps for on-the-go analysis.

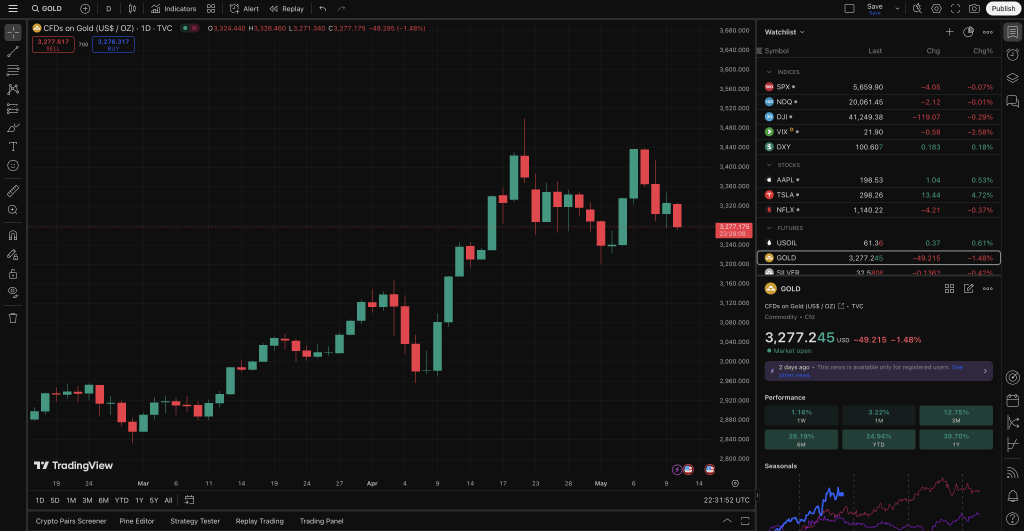

TradingView stands out for its sleek interface and powerful charting tools

Most well-known third-party tools, along with proprietary platforms from UK brokers, offer the essentials: multiple chart types (like candlestick, bar, or line), minute-level intervals for scalping, and a wide range of indicators and drawing tools, such as the MACD, RSI, and EMA.

However, the real difference often comes down to user experience. While MetaTrader remains powerful, I think its interface is outdated and can feel clunky, especially compared to the polished, highly customisable layouts offered by platforms like TradingView.

When choosing a charting platform, I always look beyond the technical tools—most platforms have the basics. What matters is how intuitive and responsive the interface feels during fast-paced trading.If I can’t confidently make quick decisions, it’s not the right platform for me.

Top pick for short-term trading charts: From years of hands-on testing across platforms, we’ve found FOREX.com offers the most complete charting suite, combining robust proprietary software with direct access to TradingView, MT4, MT5, AutoChartist, and Trading Central.

Whether day trading from desktop, mobile, or web, we consistently found their tools to be highly customisable, responsive, and well-suited to both technical analysis and real-time trading needs.

Funding

Day traders need brokers that offer fast, secure, and low-cost deposit options. The ability to fund your account quickly can be the difference between catching and missing a short-term opportunity.

In the UK, debit cards remain the go-to method for most traders, and nearly all platforms support them. However, we’re also seeing many brokers integrating mobile-friendly options like Apple Pay, Google Pay, and PayPal, which complement the rise of app-based trading.

Brokers with GBP accounts are especially valuable, as they eliminate currency conversion fees and make deposits, withdrawals, and trades smoother for UK-based traders.

Most UK brokers have a typical minimum deposit of £0 to £250, while minimum withdrawals, depending on the payment method used, often start from as little as £10.

For me, a good trading platform isn’t just about tight spreads or advanced charting tools—it’s about how easily and reliably I can move my money. Quick, hassle-free deposits are great, but if withdrawals take days or come with hidden fees, it tells me a lot about how the broker treats its clients.Speed and transparency on both ends are non-negotiable.

Top pick for fast account funding: FxPro stands out from our tests when it comes to fast, secure and low-cost account funding for active traders in the UK. GBP account? Tick. Popular payment methods with British traders like wire transfer, bank cards, PayPal, Skrill, and Neteller? Tick again.

Support

Reliable customer support is crucial for day traders, especially when quick resolutions are needed during volatile market conditions. A slight delay can turn a minor issue into a costly mistake.

The top brokers typically offer locally based support with English-speaking teams and a UK phone line, which adds an extra layer of trust and accessibility. Live chat is also standard, and the best platforms embed it directly into their web or mobile apps for seamless access.

However, one trend I’ve found increasingly frustrating is the growing reliance on automated chatbots. While they can handle basic queries, they often fall short when real-time answers are needed, especially during trading hours.

The best brokers still make it easy to reach a human quickly without jumping through endless hoops or using generic chatbot scripts.

I don’t have time to argue with a chatbot in fast-moving markets—I need answers, not automation.The brokers I trust are the ones where I can speak to a real person within minutes, especially when a trade or platform issue could cost me real money

Top pick for day trading support: IC Markets has consistently provided fast and reliable customer support in our UK-based testing over several years, especially when handling account and funding queries relevant to British traders.

While live chat agents occasionally lack deeper technical knowledge, the prompt assistance—often within minutes—and the reassurance of having real-time human support during UK trading hours make it one of the most dependable broker support teams we’ve used.

Bottom Line

Choosing the right day trading platform and broker is essential for success. Speed, stability, and user-friendly tools are a must, especially when trading fast-moving UK assets like FTSE 100 stocks or GBP currency pairs.

Look for platforms with low-latency execution, advanced charting, and real-time data.

Cost matters too—compare trading fees, minimum deposits, and withdrawal policies. Transparent pricing with no hidden charges is key to protecting your profits.

Easy funding and withdrawals are vital, so choose brokers that support popular UK payment methods and offer fast processing times.

Finally, responsive customer support, ideally UK-based, can make a huge difference, especially in critical trading moments.

See our list of recommended day trading brokers to start trading today.

FAQs

Which Is The Best Day Trading Platform In The UK?

After thorough testing in 2026, we’ve compiled a list of the best day trading platforms in the UK.

Many of our top picks are tailored to UK traders, with FCA authorisation, GBP-based accounts, and seamless access to British financial markets—from stocks to currency pairs.

Check out our rankings to find the platform that best suits your trading needs.

Who Regulates Day Trading Brokers In The UK?

The Financial Conduct Authority (FCA) oversees brokers offering day trading services in the UK, ensuring they meet strict regulatory standards.

Choosing an FCA-regulated broker gives British traders some of the strongest protections, including secure fund handling and clear trading practices.

However, it’s important to remember that day trading carries significant risk, regardless of your platform. Most traders lose money, so always trade with funds you can afford to lose.

How Much Capital Do I Need To Start Day Trading In The UK?

The amount of capital you need to start day trading in the UK depends on your strategy and the markets you plan to trade.

Most brokers we’ve tested let you open an account with as little as £100, but most traders start with at least £1,000–£5,000 for meaningful returns and proper risk management.

If you’re using leverage—common in forex or CFD trading—you can control larger positions with less capital, which also increases risk.